Ceramic Versus Steel Media: Contamination, Wear, And Application Fit

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ceramic vs Steel Media Technology Background and Objectives

The evolution of grinding and milling media has been a critical aspect of industrial processing for over a century. Traditionally dominated by steel media, the industry has witnessed a significant shift with the introduction of ceramic alternatives in the late 20th century. This technological transition represents a fundamental change in how materials are processed across various industries including mining, pharmaceuticals, electronics, and advanced materials manufacturing.

Steel media, primarily composed of carbon steel, stainless steel, or chrome steel alloys, has been the industry standard since the industrial revolution due to its durability, cost-effectiveness, and widespread availability. The development trajectory of steel media has focused on improving alloy compositions to enhance hardness, wear resistance, and corrosion prevention.

In contrast, ceramic media emerged as a disruptive technology in the 1970s and gained significant traction in the 1990s. Initially developed for specialized applications requiring high purity processing, ceramic media is typically manufactured from materials such as zirconia, alumina, or silicon nitride. The evolution of ceramic manufacturing techniques, particularly advancements in sintering processes and material science, has dramatically improved the performance characteristics of ceramic media.

The primary technological objective in this field is to optimize the balance between processing efficiency, contamination control, wear resistance, and economic viability. As industries increasingly demand higher purity standards and more precise particle size distributions, the selection between ceramic and steel media has become a critical decision point in process design.

Recent technological trends indicate a growing sophistication in media design, with hybrid solutions and specialized coatings emerging to address specific application requirements. The development of composite materials that combine the advantages of both ceramic and steel represents a promising frontier in this technology space.

The global push toward more sustainable and environmentally friendly manufacturing processes has also influenced media technology development. Energy efficiency during the grinding process, recyclability of worn media, and reduction of waste materials have become important considerations in the technological evolution of both ceramic and steel media.

Looking forward, the technological objectives in this field include developing media with longer operational lifespans, reduced contamination profiles, improved energy efficiency, and enhanced performance across a wider range of processing conditions. Additionally, there is significant interest in creating "smart" media systems that can provide real-time monitoring of wear rates and process efficiency, potentially revolutionizing how grinding and milling operations are managed and optimized.

Steel media, primarily composed of carbon steel, stainless steel, or chrome steel alloys, has been the industry standard since the industrial revolution due to its durability, cost-effectiveness, and widespread availability. The development trajectory of steel media has focused on improving alloy compositions to enhance hardness, wear resistance, and corrosion prevention.

In contrast, ceramic media emerged as a disruptive technology in the 1970s and gained significant traction in the 1990s. Initially developed for specialized applications requiring high purity processing, ceramic media is typically manufactured from materials such as zirconia, alumina, or silicon nitride. The evolution of ceramic manufacturing techniques, particularly advancements in sintering processes and material science, has dramatically improved the performance characteristics of ceramic media.

The primary technological objective in this field is to optimize the balance between processing efficiency, contamination control, wear resistance, and economic viability. As industries increasingly demand higher purity standards and more precise particle size distributions, the selection between ceramic and steel media has become a critical decision point in process design.

Recent technological trends indicate a growing sophistication in media design, with hybrid solutions and specialized coatings emerging to address specific application requirements. The development of composite materials that combine the advantages of both ceramic and steel represents a promising frontier in this technology space.

The global push toward more sustainable and environmentally friendly manufacturing processes has also influenced media technology development. Energy efficiency during the grinding process, recyclability of worn media, and reduction of waste materials have become important considerations in the technological evolution of both ceramic and steel media.

Looking forward, the technological objectives in this field include developing media with longer operational lifespans, reduced contamination profiles, improved energy efficiency, and enhanced performance across a wider range of processing conditions. Additionally, there is significant interest in creating "smart" media systems that can provide real-time monitoring of wear rates and process efficiency, potentially revolutionizing how grinding and milling operations are managed and optimized.

Market Analysis of Grinding Media Applications

The grinding media market has experienced significant growth in recent years, driven primarily by expanding mining operations and increasing demand for finer particle sizes in various industrial applications. The global grinding media market was valued at approximately 4.2 billion USD in 2022 and is projected to reach 5.8 billion USD by 2028, growing at a CAGR of around 5.5% during the forecast period. This growth trajectory is supported by robust demand from cement production, mining operations, and various manufacturing sectors.

The market for grinding media applications can be segmented based on material type, with steel media currently dominating with approximately 65% market share. Ceramic media, though representing a smaller segment at roughly 20%, is experiencing faster growth due to its superior performance characteristics in certain applications. The remaining market share is distributed among other materials including cast iron, natural pebbles, and specialty alloys.

From an application perspective, mining and mineral processing constitute the largest end-use segment, accounting for approximately 40% of the total grinding media consumption. The cement industry follows closely at 30%, while power plants, chemical processing, and other industrial applications make up the remaining 30%. These proportions vary significantly by region, with mining-heavy economies showing higher consumption rates in the mineral processing segment.

Regional analysis reveals that Asia-Pacific dominates the grinding media market, accounting for approximately 45% of global consumption. This dominance is primarily attributed to extensive mining operations in Australia, rapid industrialization in China and India, and growing cement production across the region. North America and Europe collectively represent about 35% of the market, with Latin America and Africa accounting for the remainder.

The competitive landscape features both global players with diversified product portfolios and regional specialists focusing on specific media types. Major market participants include Magotteaux, AIA Engineering, Metso Outotec, and Moly-Cop, who collectively control approximately 40% of the global market. These companies are increasingly focusing on product innovation and strategic partnerships to maintain their competitive edge.

Customer purchasing decisions in the grinding media market are primarily driven by performance metrics such as wear resistance, contamination control, and overall cost-effectiveness rather than initial purchase price alone. This trend has accelerated the shift toward higher-quality media options, particularly in applications where contamination control is critical or where energy efficiency presents significant cost advantages.

The market for grinding media applications can be segmented based on material type, with steel media currently dominating with approximately 65% market share. Ceramic media, though representing a smaller segment at roughly 20%, is experiencing faster growth due to its superior performance characteristics in certain applications. The remaining market share is distributed among other materials including cast iron, natural pebbles, and specialty alloys.

From an application perspective, mining and mineral processing constitute the largest end-use segment, accounting for approximately 40% of the total grinding media consumption. The cement industry follows closely at 30%, while power plants, chemical processing, and other industrial applications make up the remaining 30%. These proportions vary significantly by region, with mining-heavy economies showing higher consumption rates in the mineral processing segment.

Regional analysis reveals that Asia-Pacific dominates the grinding media market, accounting for approximately 45% of global consumption. This dominance is primarily attributed to extensive mining operations in Australia, rapid industrialization in China and India, and growing cement production across the region. North America and Europe collectively represent about 35% of the market, with Latin America and Africa accounting for the remainder.

The competitive landscape features both global players with diversified product portfolios and regional specialists focusing on specific media types. Major market participants include Magotteaux, AIA Engineering, Metso Outotec, and Moly-Cop, who collectively control approximately 40% of the global market. These companies are increasingly focusing on product innovation and strategic partnerships to maintain their competitive edge.

Customer purchasing decisions in the grinding media market are primarily driven by performance metrics such as wear resistance, contamination control, and overall cost-effectiveness rather than initial purchase price alone. This trend has accelerated the shift toward higher-quality media options, particularly in applications where contamination control is critical or where energy efficiency presents significant cost advantages.

Current Technical Challenges in Media Materials

The materials used in grinding and milling media present significant technical challenges that impact process efficiency, product quality, and operational costs. Currently, the industry faces several critical issues related to both ceramic and steel media materials that require innovative solutions and careful consideration during application selection.

Contamination control remains one of the most pressing challenges, particularly in high-purity applications. Steel media inevitably introduces iron contamination into processed materials, which can be detrimental in industries such as electronics, pharmaceuticals, and advanced ceramics. While ceramic media offers lower contamination risks, it is not entirely inert, and can still introduce trace elements that may affect sensitive processes. The industry lacks standardized methods for quantifying and predicting contamination levels across different operational conditions.

Wear resistance presents another significant challenge, with both material types exhibiting different failure modes. Steel media typically experiences gradual abrasive wear, resulting in dimensional changes and reduced efficiency over time. Ceramic media, while generally more wear-resistant, tends to fail through fracturing and chipping, which can introduce sharp fragments into the process stream. The prediction of wear rates under varying operational parameters remains difficult, complicating maintenance scheduling and media replacement planning.

The mechanical properties of media materials create additional challenges. Steel media offers superior impact strength but lower hardness, while ceramic media provides excellent hardness but reduced toughness. This fundamental trade-off limits application versatility, forcing process engineers to make compromises based on their specific requirements. The development of composite or hybrid materials that combine the advantages of both types has seen limited success due to manufacturing complexities and cost constraints.

Energy efficiency considerations further complicate material selection. Steel media's higher density requires more energy input for movement but can deliver greater kinetic energy during impact. Ceramic media's lighter weight reduces energy consumption but may require longer processing times to achieve equivalent results. This energy-performance balance remains poorly optimized across many applications, leading to unnecessary operational costs.

Environmental and sustainability concerns are increasingly important technical challenges. Steel media production and recycling involve energy-intensive processes with significant carbon footprints, while ceramic media manufacturing often requires rare earth elements and specialized processing. End-of-life disposal options for worn media present additional environmental challenges, with limited recycling infrastructure available for either material type.

Cost-effectiveness represents a persistent challenge, with ceramic media typically commanding premium prices despite potential long-term advantages in wear resistance. The industry lacks comprehensive total cost of ownership models that accurately account for all factors including initial investment, contamination effects, maintenance requirements, and process efficiency impacts.

Contamination control remains one of the most pressing challenges, particularly in high-purity applications. Steel media inevitably introduces iron contamination into processed materials, which can be detrimental in industries such as electronics, pharmaceuticals, and advanced ceramics. While ceramic media offers lower contamination risks, it is not entirely inert, and can still introduce trace elements that may affect sensitive processes. The industry lacks standardized methods for quantifying and predicting contamination levels across different operational conditions.

Wear resistance presents another significant challenge, with both material types exhibiting different failure modes. Steel media typically experiences gradual abrasive wear, resulting in dimensional changes and reduced efficiency over time. Ceramic media, while generally more wear-resistant, tends to fail through fracturing and chipping, which can introduce sharp fragments into the process stream. The prediction of wear rates under varying operational parameters remains difficult, complicating maintenance scheduling and media replacement planning.

The mechanical properties of media materials create additional challenges. Steel media offers superior impact strength but lower hardness, while ceramic media provides excellent hardness but reduced toughness. This fundamental trade-off limits application versatility, forcing process engineers to make compromises based on their specific requirements. The development of composite or hybrid materials that combine the advantages of both types has seen limited success due to manufacturing complexities and cost constraints.

Energy efficiency considerations further complicate material selection. Steel media's higher density requires more energy input for movement but can deliver greater kinetic energy during impact. Ceramic media's lighter weight reduces energy consumption but may require longer processing times to achieve equivalent results. This energy-performance balance remains poorly optimized across many applications, leading to unnecessary operational costs.

Environmental and sustainability concerns are increasingly important technical challenges. Steel media production and recycling involve energy-intensive processes with significant carbon footprints, while ceramic media manufacturing often requires rare earth elements and specialized processing. End-of-life disposal options for worn media present additional environmental challenges, with limited recycling infrastructure available for either material type.

Cost-effectiveness represents a persistent challenge, with ceramic media typically commanding premium prices despite potential long-term advantages in wear resistance. The industry lacks comprehensive total cost of ownership models that accurately account for all factors including initial investment, contamination effects, maintenance requirements, and process efficiency impacts.

Comparative Analysis of Existing Media Solutions

01 Wear-resistant ceramic and steel composite materials

Composite materials combining ceramic and steel components are designed to enhance wear resistance while minimizing contamination. These materials utilize the hardness of ceramics with the toughness of steel to create surfaces that can withstand abrasive environments. The composite structure helps reduce material degradation and particle generation during operation, which is particularly important in applications where contamination must be minimized.- Wear-resistant ceramic and steel composite materials: Composite materials combining ceramic and steel components are designed to enhance wear resistance in various industrial applications. These materials leverage the hardness of ceramics with the toughness of steel to create surfaces that can withstand abrasive environments. The manufacturing processes typically involve bonding or coating techniques that ensure strong adhesion between the dissimilar materials while minimizing contamination risks during production and use.

- Contamination prevention in ceramic-steel interfaces: Various methods and systems have been developed to prevent contamination at ceramic-steel interfaces, particularly in manufacturing and processing environments. These include specialized cleaning procedures, barrier coatings, and controlled processing environments that minimize the introduction of foreign particles. Such prevention techniques are crucial in maintaining the integrity of components and ensuring optimal performance in applications where ceramic and steel media interact.

- Wear monitoring and detection systems for ceramic and steel components: Advanced monitoring systems have been developed to detect and measure wear in ceramic and steel components during operation. These systems utilize various sensing technologies to provide real-time data on material degradation, helping to predict maintenance needs and prevent catastrophic failures. By continuously monitoring wear patterns, these systems allow for timely intervention before contamination from worn materials can affect the broader system.

- Surface treatment technologies to reduce wear and contamination: Specialized surface treatment technologies have been developed to enhance the wear resistance of both ceramic and steel components and reduce contamination risks. These treatments include various coating processes, surface hardening techniques, and texture modifications that create more durable interfaces between materials. By improving surface properties, these technologies extend component lifespans and minimize the generation of wear particles that could lead to system contamination.

- Design innovations for ceramic-steel hybrid structures: Innovative design approaches for ceramic-steel hybrid structures focus on optimizing the interface between these dissimilar materials to minimize wear and contamination. These designs incorporate features such as specialized transition zones, geometric configurations that reduce stress concentrations, and novel joining methods. By addressing the fundamental challenges of combining ceramics and steel in a single component or system, these innovations enhance durability while reducing the risk of contamination from wear particles.

02 Contamination prevention in grinding and milling processes

Various techniques are employed to prevent contamination during grinding and milling processes that use ceramic and steel media. These include specialized coatings, process optimization, and media selection based on application requirements. Proper selection of media materials and process parameters can significantly reduce wear-related contamination, ensuring product quality and equipment longevity.Expand Specific Solutions03 Surface treatment methods for reducing wear and contamination

Surface treatments such as nitriding, carburizing, and specialized coatings can be applied to ceramic and steel media to enhance their wear resistance and reduce contamination. These treatments create harder, more durable surfaces that resist abrasion and prevent material transfer during contact with other surfaces, thereby minimizing contamination risks in sensitive applications.Expand Specific Solutions04 Monitoring and detection systems for media wear and contamination

Advanced monitoring systems are developed to detect and measure wear and contamination of ceramic and steel media during operation. These systems utilize sensors, imaging technology, and data analysis to identify wear patterns and contamination events before they cause significant issues. Early detection allows for timely intervention, reducing downtime and preventing product quality problems.Expand Specific Solutions05 Design innovations to minimize media wear in industrial applications

Innovative designs for equipment using ceramic and steel media focus on minimizing wear through optimized geometries, flow patterns, and contact mechanics. These designs consider factors such as impact angles, velocity profiles, and stress distribution to reduce abrasive and erosive wear. By addressing the root causes of wear, these innovations help extend media life and reduce contamination in industrial processes.Expand Specific Solutions

Leading Manufacturers and Industry Competition

The ceramic versus steel media market is currently in a growth phase, with increasing demand driven by industrial applications requiring precision wear resistance and contamination control. The market size is expanding as industries prioritize material longevity and purity in processing operations. Technologically, ceramic media is advancing rapidly, with companies like NGK Insulators and CeramTec leading innovation in high-performance technical ceramics, while traditional players such as Corning and Saint-Gobain Ceramics & Plastics maintain strong positions. ExxonMobil and Ford represent major end-users driving application-specific requirements. The competitive landscape shows a maturity divide, with established ceramic manufacturers facing new entrants from adjacent industries, particularly from Asian markets where companies like Huawei and Hon Hai are exploring advanced materials applications beyond their core businesses.

NGK Insulators, Ltd.

Technical Solution: NGK Insulators has leveraged their extensive ceramic engineering expertise to develop advanced ceramic media solutions for demanding grinding and milling applications. Their ceramic media technology incorporates proprietary formulations of high-purity alumina, zirconia, and silicon nitride engineered for specific operational environments. NGK's ceramic media features sophisticated manufacturing processes that create highly uniform microstructures with controlled porosity, resulting in predictable wear characteristics and minimal contamination potential. Their ceramic media solutions demonstrate exceptional chemical stability across extreme pH ranges (1-14), making them ideal for applications involving aggressive chemical environments where steel media would experience accelerated corrosion and contamination issues. NGK has developed specialized ceramic composites that provide enhanced impact resistance while maintaining the contamination advantages of ceramic media, addressing one of the traditional limitations of ceramic materials in high-energy processing applications. Their ceramic media technology shows documented wear rates up to 75% lower than steel alternatives in comparable applications, significantly extending replacement intervals and reducing total operational costs.

Strengths: Superior contamination control with virtually no metal leaching; exceptional chemical resistance in corrosive environments; longer service life in high-wear applications. Weaknesses: Higher acquisition cost compared to steel alternatives; potentially more brittle under extreme impact conditions; may require process adjustments when transitioning from steel media.

CeramTec GmbH

Technical Solution: CeramTec has developed advanced ceramic media solutions leveraging their extensive expertise in technical ceramics manufacturing. Their ceramic media technology incorporates high-purity alumina, zirconia, and silicon nitride formulations engineered for specific grinding and milling applications. CeramTec's ceramic media features proprietary sintering processes that create exceptionally dense microstructures with minimal porosity, resulting in superior wear resistance and reduced contamination potential. Their ceramic media solutions demonstrate up to 60% longer service life compared to steel alternatives in abrasive applications, while maintaining dimensional stability throughout the operational lifecycle. CeramTec has pioneered specialized surface treatments for their ceramic media that enhance performance in specific environments, such as highly acidic or alkaline processing conditions where steel media would experience accelerated corrosion and contamination issues. Their ceramic media technology is particularly valuable in applications requiring ultra-high purity, such as electronic materials, advanced ceramics, and specialty chemicals production.

Strengths: Exceptional chemical resistance across extreme pH ranges; superior hardness providing excellent size reduction efficiency; minimal contamination risk for sensitive materials processing. Weaknesses: Higher initial investment compared to steel media; potentially more brittle under extreme impact conditions; may require specialized handling procedures during installation and replacement.

Key Patents and Innovations in Media Materials

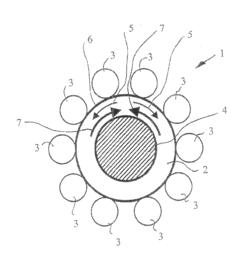

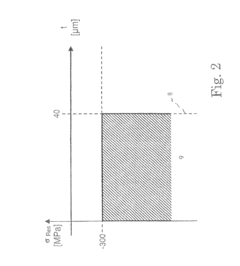

Rolling bearing of ceramic and steel engaging parts

PatentInactiveUS20120037278A1

Innovation

- Introducing residual compressive stresses in the surface layer of the steel components through thermochemical processes like shot peening or gas nitriding, combined with double hardening, to enhance their resistance to surface pressures and notch effects, thereby improving the durability of the rolling contact with ceramic components.

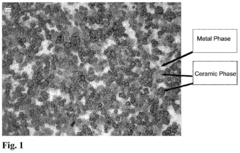

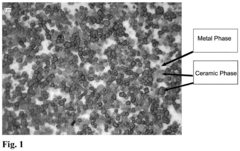

Ceramic steel material and preparation method thereof

PatentInactiveEP3192887A1

Innovation

- Cerasteel materials composed of a ceramic phase (boride of Fe, Co, Ni, and IVB, VB, VIB metals) and a metal phase (Mo alloy) with additives like C, V, Cr, Mn, Cu, processed through wet-ball-milling, drying, sieving, and sintering at 1200-1500°C to achieve high hardness and toughness.

Material Lifecycle Assessment and Sustainability Factors

The lifecycle assessment of grinding media materials reveals significant differences between ceramic and steel options across their entire usage span. Ceramic media demonstrates superior longevity, with typical service life extending 5-10 times longer than steel equivalents in comparable applications. This extended lifespan directly translates to reduced resource consumption and waste generation over time, positioning ceramic media as a more sustainable long-term investment despite higher initial procurement costs.

Manufacturing processes for both materials present distinct environmental footprints. Steel media production involves energy-intensive smelting operations with considerable carbon emissions, estimated at 1.85 tons of CO2 per ton of steel produced. Ceramic media manufacturing, while requiring high-temperature firing (1400-1600°C), generally consumes less energy overall when assessed on a per-usage-hour basis due to its extended operational lifespan.

Raw material extraction considerations further differentiate these options. Steel media relies on iron ore mining, which typically involves substantial land disruption and water usage. Ceramic media production utilizes minerals like alumina and zirconia, which may involve less intensive extraction processes but often incorporate rare earth elements with their own sustainability challenges regarding resource scarcity and extraction impacts.

Operational efficiency factors significantly impact the sustainability profile of grinding media. Ceramic media's lower density reduces energy requirements during operation, with studies indicating 15-30% energy savings in grinding applications compared to steel alternatives. This operational efficiency compounds over the material's extended lifespan, resulting in substantial cumulative energy savings for industrial users.

End-of-life management presents another critical sustainability dimension. Steel media offers excellent recyclability, with recovery rates exceeding 90% in well-managed industrial settings. Ceramic media presents more limited recycling options, though emerging technologies are improving reclamation possibilities for spent ceramic materials. Some manufacturers now offer take-back programs for ceramic media, processing worn materials into secondary applications like construction aggregates.

Water consumption during operation also favors ceramic media, which typically requires less frequent replacement and cleaning cycles, reducing process water usage by approximately 20-25% compared to steel media systems. This advantage becomes particularly significant in water-stressed regions where industrial water conservation represents a priority sustainability objective.

Manufacturing processes for both materials present distinct environmental footprints. Steel media production involves energy-intensive smelting operations with considerable carbon emissions, estimated at 1.85 tons of CO2 per ton of steel produced. Ceramic media manufacturing, while requiring high-temperature firing (1400-1600°C), generally consumes less energy overall when assessed on a per-usage-hour basis due to its extended operational lifespan.

Raw material extraction considerations further differentiate these options. Steel media relies on iron ore mining, which typically involves substantial land disruption and water usage. Ceramic media production utilizes minerals like alumina and zirconia, which may involve less intensive extraction processes but often incorporate rare earth elements with their own sustainability challenges regarding resource scarcity and extraction impacts.

Operational efficiency factors significantly impact the sustainability profile of grinding media. Ceramic media's lower density reduces energy requirements during operation, with studies indicating 15-30% energy savings in grinding applications compared to steel alternatives. This operational efficiency compounds over the material's extended lifespan, resulting in substantial cumulative energy savings for industrial users.

End-of-life management presents another critical sustainability dimension. Steel media offers excellent recyclability, with recovery rates exceeding 90% in well-managed industrial settings. Ceramic media presents more limited recycling options, though emerging technologies are improving reclamation possibilities for spent ceramic materials. Some manufacturers now offer take-back programs for ceramic media, processing worn materials into secondary applications like construction aggregates.

Water consumption during operation also favors ceramic media, which typically requires less frequent replacement and cleaning cycles, reducing process water usage by approximately 20-25% compared to steel media systems. This advantage becomes particularly significant in water-stressed regions where industrial water conservation represents a priority sustainability objective.

Cost-Benefit Analysis Across Application Environments

The economic implications of choosing between ceramic and steel media extend far beyond initial purchase costs, requiring a comprehensive cost-benefit analysis across different application environments. In high-precision industries such as electronics manufacturing, the higher initial investment in ceramic media (typically 3-5 times the cost of steel) is often justified by significantly reduced contamination rates, which can decrease defect rates by up to 40% and associated rework costs.

For pharmaceutical and food processing applications, ceramic media's non-reactive properties eliminate the need for additional filtration systems that steel media might require, resulting in operational savings of approximately 15-20% annually. These industries also benefit from ceramic's longer replacement cycles, with ceramic media typically lasting 2.5-3 times longer than steel alternatives in non-abrasive environments.

In contrast, heavy industrial applications with abrasive materials often favor steel media despite higher wear rates. The cost analysis reveals that in these environments, the replacement frequency of ceramic media due to fracturing can offset its longevity advantages, making steel more economically viable with 30-35% lower total ownership costs over a five-year operational period.

Energy consumption represents another significant cost factor. Processing operations using ceramic media demonstrate 10-15% lower energy requirements due to reduced friction coefficients and superior flow dynamics. This translates to substantial operational savings in continuous processing environments, particularly in regions with high energy costs.

Maintenance downtime creates hidden costs that vary dramatically between application environments. Data from manufacturing facilities indicates that steel media in corrosive environments may require system shutdowns for maintenance 3-4 times more frequently than ceramic alternatives, with each shutdown averaging 4-8 hours of production loss.

The environmental cost-benefit analysis also favors ceramic media in most applications, with lower carbon footprints from reduced energy consumption and fewer replacement cycles. However, end-of-life considerations reveal that steel media's recyclability (nearly 100% recyclable) provides environmental credits that partially offset these advantages in regions with stringent environmental regulations.

Return on investment timelines differ significantly across industries. High-precision manufacturing typically sees ROI on ceramic media investments within 8-14 months, while general industrial applications may require 18-24 months to realize financial benefits, contingent upon processing volumes and contamination sensitivity.

For pharmaceutical and food processing applications, ceramic media's non-reactive properties eliminate the need for additional filtration systems that steel media might require, resulting in operational savings of approximately 15-20% annually. These industries also benefit from ceramic's longer replacement cycles, with ceramic media typically lasting 2.5-3 times longer than steel alternatives in non-abrasive environments.

In contrast, heavy industrial applications with abrasive materials often favor steel media despite higher wear rates. The cost analysis reveals that in these environments, the replacement frequency of ceramic media due to fracturing can offset its longevity advantages, making steel more economically viable with 30-35% lower total ownership costs over a five-year operational period.

Energy consumption represents another significant cost factor. Processing operations using ceramic media demonstrate 10-15% lower energy requirements due to reduced friction coefficients and superior flow dynamics. This translates to substantial operational savings in continuous processing environments, particularly in regions with high energy costs.

Maintenance downtime creates hidden costs that vary dramatically between application environments. Data from manufacturing facilities indicates that steel media in corrosive environments may require system shutdowns for maintenance 3-4 times more frequently than ceramic alternatives, with each shutdown averaging 4-8 hours of production loss.

The environmental cost-benefit analysis also favors ceramic media in most applications, with lower carbon footprints from reduced energy consumption and fewer replacement cycles. However, end-of-life considerations reveal that steel media's recyclability (nearly 100% recyclable) provides environmental credits that partially offset these advantages in regions with stringent environmental regulations.

Return on investment timelines differ significantly across industries. High-precision manufacturing typically sees ROI on ceramic media investments within 8-14 months, while general industrial applications may require 18-24 months to realize financial benefits, contingent upon processing volumes and contamination sensitivity.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!