Ball Mill Liner Materials And Replacement Best Practices

AUG 22, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ball Mill Liner Materials Evolution and Objectives

Ball mill liners have undergone significant evolution since their inception in the mining and mineral processing industry. Initially, these critical components were predominantly made of manganese steel due to its work-hardening properties. The 1950s marked the beginning of systematic research into liner materials, focusing primarily on wear resistance and operational efficiency. By the 1970s, chromium-molybdenum alloys emerged as viable alternatives, offering improved hardness and impact resistance in high-stress grinding environments.

The technological advancement accelerated in the 1980s with the introduction of rubber liners, which revolutionized the industry by significantly reducing noise levels and energy consumption while extending maintenance intervals. This period also witnessed the first application of composite materials, combining metal and rubber elements to optimize performance in specific grinding conditions.

The 1990s brought high-chromium white iron liners to prominence, particularly in operations processing highly abrasive materials. These liners demonstrated exceptional wear resistance but presented challenges in terms of brittleness and installation complexity. Concurrently, research began exploring ceramic-embedded metal matrices, seeking to combine the hardness of ceramics with the toughness of metal substrates.

The early 2000s saw the development of sophisticated computer modeling techniques that enabled precise prediction of wear patterns and optimization of liner designs. This technological leap allowed manufacturers to create application-specific liner profiles that maximized grinding efficiency while minimizing material consumption. The introduction of advanced polymer composites during this period further expanded the material options available to mill operators.

Current research objectives in ball mill liner technology focus on several key areas. Primary among these is the development of materials with enhanced wear resistance while maintaining sufficient impact tolerance, particularly for high-energy grinding applications. Researchers are actively exploring nano-engineered surfaces and novel alloy compositions to achieve this balance.

Another critical objective is the reduction of downtime during liner replacement operations. This includes research into quick-change mechanisms, modular designs, and predictive maintenance systems that can accurately forecast optimal replacement intervals. The environmental impact of liner materials is also receiving increased attention, with efforts directed toward developing recyclable or biodegradable alternatives to traditional materials.

Energy efficiency remains a paramount concern, driving research into liner designs that minimize power consumption while maintaining or improving grinding performance. This includes investigations into optimized lifter profiles and innovative surface textures that enhance grinding media cascading patterns. The ultimate goal is to develop liner systems that maximize mineral liberation while minimizing energy input and maintenance requirements.

The technological advancement accelerated in the 1980s with the introduction of rubber liners, which revolutionized the industry by significantly reducing noise levels and energy consumption while extending maintenance intervals. This period also witnessed the first application of composite materials, combining metal and rubber elements to optimize performance in specific grinding conditions.

The 1990s brought high-chromium white iron liners to prominence, particularly in operations processing highly abrasive materials. These liners demonstrated exceptional wear resistance but presented challenges in terms of brittleness and installation complexity. Concurrently, research began exploring ceramic-embedded metal matrices, seeking to combine the hardness of ceramics with the toughness of metal substrates.

The early 2000s saw the development of sophisticated computer modeling techniques that enabled precise prediction of wear patterns and optimization of liner designs. This technological leap allowed manufacturers to create application-specific liner profiles that maximized grinding efficiency while minimizing material consumption. The introduction of advanced polymer composites during this period further expanded the material options available to mill operators.

Current research objectives in ball mill liner technology focus on several key areas. Primary among these is the development of materials with enhanced wear resistance while maintaining sufficient impact tolerance, particularly for high-energy grinding applications. Researchers are actively exploring nano-engineered surfaces and novel alloy compositions to achieve this balance.

Another critical objective is the reduction of downtime during liner replacement operations. This includes research into quick-change mechanisms, modular designs, and predictive maintenance systems that can accurately forecast optimal replacement intervals. The environmental impact of liner materials is also receiving increased attention, with efforts directed toward developing recyclable or biodegradable alternatives to traditional materials.

Energy efficiency remains a paramount concern, driving research into liner designs that minimize power consumption while maintaining or improving grinding performance. This includes investigations into optimized lifter profiles and innovative surface textures that enhance grinding media cascading patterns. The ultimate goal is to develop liner systems that maximize mineral liberation while minimizing energy input and maintenance requirements.

Market Demand Analysis for Advanced Mill Liners

The global market for advanced mill liners has been experiencing significant growth, driven primarily by the expanding mining and mineral processing industries. Current market analysis indicates that the ball mill liner segment holds a substantial share of the overall grinding equipment market, with an estimated value exceeding $2 billion annually. This growth trajectory is expected to continue as mining operations intensify in regions like Latin America, Africa, and Southeast Asia.

Market demand for advanced mill liners is primarily fueled by the mining industry's continuous pursuit of operational efficiency and cost reduction. End users are increasingly seeking liner materials that offer extended wear life, reduced maintenance requirements, and improved grinding efficiency. The copper and gold mining sectors represent the largest consumer base, followed by iron ore and cement industries, all of which require high-performance grinding solutions to maintain competitive operations.

A notable market trend is the shift from traditional metallic liners toward composite and rubber-lined solutions. This transition is particularly evident in operations processing abrasive materials where wear resistance is paramount. Market research indicates that operations utilizing advanced composite liners report up to 30% longer service intervals between replacements compared to conventional steel liners, translating to significant reduction in downtime costs.

Regional analysis reveals varying demand patterns, with mature mining regions like Australia and North America showing strong preference for premium, longer-lasting liner solutions despite higher initial costs. Conversely, emerging mining economies often prioritize lower upfront investment, creating a diverse market landscape that manufacturers must navigate with differentiated product offerings.

The replacement cycle for mill liners represents a substantial recurring revenue stream in this market. Typical replacement frequencies range from 3-12 months depending on material processed and operational conditions, creating a predictable aftermarket demand pattern that suppliers can forecast with reasonable accuracy.

Customer pain points driving innovation include the need for faster installation procedures, safer handling systems, and more predictable wear patterns. Mining operations report that liner replacement downtime costs can exceed $50,000 per hour in large operations, creating strong economic incentives for solutions that minimize maintenance windows.

Market segmentation shows distinct preferences across different ore types and mill configurations. SAG mills typically require different liner specifications than ball mills, while primary grinding circuits have different requirements than regrind applications. This segmentation has led to increased specialization among suppliers, with companies developing application-specific liner designs rather than one-size-fits-all solutions.

Market demand for advanced mill liners is primarily fueled by the mining industry's continuous pursuit of operational efficiency and cost reduction. End users are increasingly seeking liner materials that offer extended wear life, reduced maintenance requirements, and improved grinding efficiency. The copper and gold mining sectors represent the largest consumer base, followed by iron ore and cement industries, all of which require high-performance grinding solutions to maintain competitive operations.

A notable market trend is the shift from traditional metallic liners toward composite and rubber-lined solutions. This transition is particularly evident in operations processing abrasive materials where wear resistance is paramount. Market research indicates that operations utilizing advanced composite liners report up to 30% longer service intervals between replacements compared to conventional steel liners, translating to significant reduction in downtime costs.

Regional analysis reveals varying demand patterns, with mature mining regions like Australia and North America showing strong preference for premium, longer-lasting liner solutions despite higher initial costs. Conversely, emerging mining economies often prioritize lower upfront investment, creating a diverse market landscape that manufacturers must navigate with differentiated product offerings.

The replacement cycle for mill liners represents a substantial recurring revenue stream in this market. Typical replacement frequencies range from 3-12 months depending on material processed and operational conditions, creating a predictable aftermarket demand pattern that suppliers can forecast with reasonable accuracy.

Customer pain points driving innovation include the need for faster installation procedures, safer handling systems, and more predictable wear patterns. Mining operations report that liner replacement downtime costs can exceed $50,000 per hour in large operations, creating strong economic incentives for solutions that minimize maintenance windows.

Market segmentation shows distinct preferences across different ore types and mill configurations. SAG mills typically require different liner specifications than ball mills, while primary grinding circuits have different requirements than regrind applications. This segmentation has led to increased specialization among suppliers, with companies developing application-specific liner designs rather than one-size-fits-all solutions.

Current State and Challenges in Liner Technology

The global ball mill liner technology landscape presents a complex picture of innovation alongside persistent challenges. Current liner materials predominantly include high-chromium cast iron, manganese steel, rubber, and composite materials, each offering distinct performance characteristics. High-chromium cast iron liners deliver excellent wear resistance but suffer from brittleness and high replacement costs. Manganese steel liners provide superior impact resistance through work hardening but demonstrate lower abrasion resistance in certain applications. Rubber liners offer noise reduction and protection against corrosion while composite liners attempt to balance durability with weight considerations.

Despite technological advancements, the industry continues to face significant challenges in liner performance optimization. Wear mechanisms remain incompletely understood, particularly the complex interactions between different ore types and liner materials under varying operational conditions. This knowledge gap hampers the development of truly application-specific liner solutions. Additionally, the trade-off between hardness and toughness continues to challenge materials engineers, as increasing one property typically compromises the other.

Maintenance challenges represent another critical area of concern. Current replacement practices often require extensive downtime, directly impacting production efficiency and operational costs. The industry standard of 24-48 hours for complete liner replacement significantly affects mill availability. Furthermore, the weight of metal liners creates safety hazards during installation and removal, necessitating specialized equipment and trained personnel.

Geographically, advanced liner technology development is concentrated in mining technology hubs including Australia, South Africa, Chile, Canada, and parts of Europe. Chinese manufacturers have rapidly expanded their market presence through cost-competitive offerings, though quality consistency remains variable. This geographical distribution creates disparities in access to cutting-edge liner technologies across different mining regions.

Environmental considerations are increasingly influencing liner technology development. Traditional manufacturing processes for metal liners are energy-intensive and generate significant carbon emissions. End-of-life disposal presents additional environmental challenges, particularly for composite materials that may contain non-biodegradable components. The industry faces growing pressure to develop more sustainable liner solutions that maintain performance while reducing environmental impact.

Cost factors continue to constrain innovation in liner technology. High-performance materials command premium prices that smaller mining operations struggle to justify despite potential long-term savings through extended wear life. This economic reality has created a two-tier market where advanced liner technologies remain primarily accessible to large-scale operations with substantial capital resources.

Despite technological advancements, the industry continues to face significant challenges in liner performance optimization. Wear mechanisms remain incompletely understood, particularly the complex interactions between different ore types and liner materials under varying operational conditions. This knowledge gap hampers the development of truly application-specific liner solutions. Additionally, the trade-off between hardness and toughness continues to challenge materials engineers, as increasing one property typically compromises the other.

Maintenance challenges represent another critical area of concern. Current replacement practices often require extensive downtime, directly impacting production efficiency and operational costs. The industry standard of 24-48 hours for complete liner replacement significantly affects mill availability. Furthermore, the weight of metal liners creates safety hazards during installation and removal, necessitating specialized equipment and trained personnel.

Geographically, advanced liner technology development is concentrated in mining technology hubs including Australia, South Africa, Chile, Canada, and parts of Europe. Chinese manufacturers have rapidly expanded their market presence through cost-competitive offerings, though quality consistency remains variable. This geographical distribution creates disparities in access to cutting-edge liner technologies across different mining regions.

Environmental considerations are increasingly influencing liner technology development. Traditional manufacturing processes for metal liners are energy-intensive and generate significant carbon emissions. End-of-life disposal presents additional environmental challenges, particularly for composite materials that may contain non-biodegradable components. The industry faces growing pressure to develop more sustainable liner solutions that maintain performance while reducing environmental impact.

Cost factors continue to constrain innovation in liner technology. High-performance materials command premium prices that smaller mining operations struggle to justify despite potential long-term savings through extended wear life. This economic reality has created a two-tier market where advanced liner technologies remain primarily accessible to large-scale operations with substantial capital resources.

Current Material Solutions and Replacement Techniques

01 Advanced materials for ball mill liners

Various advanced materials are used for ball mill liners to improve durability and performance. These include composite materials, high-chromium alloys, ceramic-metal composites, and wear-resistant steel alloys. These materials are designed to withstand the harsh grinding environment while extending the service life of the mill liners. The selection of appropriate materials depends on the specific grinding conditions, material being processed, and operational requirements.- Advanced materials for ball mill liners: Various advanced materials are used for ball mill liners to improve durability and performance. These include composite materials, wear-resistant alloys, and specialized metals that can withstand the harsh grinding environment. The selection of appropriate materials can significantly extend the service life of the liners and reduce maintenance frequency. These advanced materials offer superior resistance to abrasion, impact, and corrosion compared to traditional options.

- Innovative liner replacement systems: Modern ball mills incorporate innovative systems for liner replacement that reduce downtime and improve safety. These systems include quick-release mechanisms, modular designs that allow for partial replacements, and specialized tools for efficient installation and removal. Some designs feature self-aligning components that simplify the replacement process and ensure proper positioning of new liners. These innovations help minimize production losses during maintenance operations.

- Specialized liner designs for different mill sections: Different sections of ball mills require specialized liner designs to optimize performance. Feed end liners, discharge end liners, and central section liners each have unique configurations to address specific operational challenges. These designs may include varied profiles, thicknesses, and attachment methods based on the particular wear patterns and material flow characteristics in each section. Customized designs can significantly improve grinding efficiency and extend the operational life of the mill.

- Monitoring and predictive maintenance systems: Advanced monitoring systems are employed to track liner wear and predict optimal replacement timing. These systems use sensors, imaging technology, and data analytics to continuously assess liner condition without interrupting mill operation. Predictive maintenance approaches help operators schedule replacements at the most cost-effective intervals, avoiding both premature replacements and catastrophic failures. Some systems can detect uneven wear patterns and alert maintenance teams to potential issues before they cause significant problems.

- Eco-friendly and cost-effective liner solutions: Environmentally sustainable and economically efficient liner solutions are becoming increasingly important in ball mill operations. These include recyclable materials, liners with reduced environmental footprint, and designs that optimize material usage while maintaining performance. Some innovations focus on energy efficiency by reducing friction or improving grinding dynamics. Cost-effective solutions balance initial investment with longevity and operational benefits to provide the best overall value for mill operators.

02 Innovative liner designs and configurations

Novel designs and configurations of ball mill liners have been developed to enhance grinding efficiency and reduce wear. These include wave-shaped liners, stepped liners, and modular liner systems that can be easily replaced. The geometric patterns and arrangements of the liners affect the motion of the grinding media and material, optimizing the grinding process while minimizing energy consumption. Some designs incorporate special features to improve material flow and prevent buildup.Expand Specific Solutions03 Liner replacement systems and methods

Efficient methods and systems for replacing ball mill liners have been developed to minimize downtime and improve safety. These include quick-change liner systems, specialized tools for liner removal and installation, and methodologies for planning and executing liner replacements. Some systems allow for partial replacement of worn sections without removing the entire liner assembly. Proper planning and execution of liner replacement operations are critical for maintaining mill productivity.Expand Specific Solutions04 Wear monitoring and prediction technologies

Technologies for monitoring and predicting liner wear have been developed to optimize replacement timing and extend liner life. These include sensor-based monitoring systems, predictive modeling software, and inspection methodologies that can assess liner condition without stopping the mill. By accurately predicting when liners need replacement, operators can schedule maintenance during planned downtime and avoid unexpected failures that could damage the mill or cause production losses.Expand Specific Solutions05 Eco-friendly and cost-effective liner solutions

Environmentally sustainable and cost-effective approaches to ball mill liner materials and replacement have been developed. These include recyclable liner materials, energy-efficient designs that reduce power consumption, and liners made from locally available materials to reduce transportation costs and carbon footprint. Some solutions focus on extending liner life through improved material formulations or surface treatments, reducing the frequency of replacements and associated waste generation.Expand Specific Solutions

Key Industry Players and Manufacturers Analysis

The ball mill liner materials and replacement practices market is in a mature growth phase, characterized by steady technological advancements and increasing demand for efficiency improvements. The global market size is estimated to be substantial, driven by mining, cement, and metallurgical industries requiring durable grinding solutions. From a technological maturity perspective, established players like Metso Outotec Finland, CITIC Heavy Industries, and Christian Pfeiffer Maschinenfabrik demonstrate advanced capabilities in developing wear-resistant materials and innovative liner designs. Research institutions such as Kunming University of Science & Technology and Tianjin University are contributing to material science advancements, while steel manufacturers including POSCO Holdings, voestalpine AG, and Steel Authority of India provide specialized alloys. The competitive landscape shows a blend of equipment manufacturers, material suppliers, and research entities collaborating to extend liner life and optimize mill performance.

CITIC Heavy Industries Co., Ltd.

Technical Solution: CITIC Heavy Industries has pioneered high-chromium composite liners with graduated hardness profiles, featuring a surface hardness of 62-65 HRC that transitions to more impact-resistant inner layers. Their proprietary casting process creates microstructural refinements that enhance both wear resistance and impact toughness simultaneously[1]. The company's "CITIC-Liner" system incorporates specialized wave patterns designed through fluid dynamics modeling to optimize material flow and reduce energy consumption by 8-12% compared to traditional liners[2]. Their replacement methodology employs specialized hydraulic tools that enable safe liner removal and installation, reducing replacement time by approximately 30% while enhancing worker safety. CITIC has also developed an AI-based wear prediction system that analyzes operational parameters including mill speed, charge volume, and ore characteristics to forecast optimal replacement timing with 85-90% accuracy[3]. Their latest innovation includes composite liners with embedded sensors for real-time monitoring of liner condition and mill performance.

Strengths: Exceptional balance between hardness and impact resistance through graduated material properties; energy-efficient liner designs that reduce operational costs; advanced wear prediction capabilities. Weaknesses: Higher initial cost compared to standard liners; specialized maintenance expertise required; replacement systems optimized primarily for larger mill operations with less flexibility for smaller installations.

Scanalyse Pty Ltd.

Technical Solution: Scanalyse has revolutionized ball mill liner monitoring and replacement practices through their MillMapper™ and CrusherMapper™ laser scanning technologies. Their system creates high-precision 3D models of mill interiors with accuracy to within 1mm, enabling detailed wear pattern analysis without requiring physical access to the mill[1]. This technology allows for the identification of localized wear hotspots and optimization of liner designs based on actual operational data. Scanalyse's predictive analytics platform integrates operational parameters including mill speed, ball charge, feed characteristics, and historical wear data to forecast optimal replacement timing with 92-95% accuracy[2]. Their methodology includes comprehensive liner replacement planning tools that optimize the sequence of liner removal and installation to minimize downtime. The company has also developed specialized liner materials in partnership with metallurgical experts, featuring gradient-hardened alloys that provide up to 40% longer service life compared to conventional materials in certain applications[3]. Their latest innovation includes real-time wear monitoring through permanently installed laser systems that provide continuous data on liner condition.

Strengths: Industry-leading measurement and monitoring technology; data-driven approach to liner optimization; comprehensive planning tools for efficient replacement. Weaknesses: Higher implementation costs for monitoring systems; requires integration with existing mill control systems; primarily focused on monitoring rather than manufacturing liner materials directly.

Critical Patents and Innovations in Liner Technology

Drum lining for ball mills

PatentInactiveEP0693317A1

Innovation

- A profiled surface on highly wear-resistant, pressed, and sintered bricks, such as aluminum or zirconium oxide bricks, with designs like wavy, step-shaped, or tooth-shaped profiles, reduces friction and wear, enhancing milling performance and service life by engaging balls effectively without slipping back.

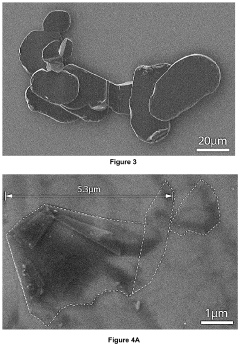

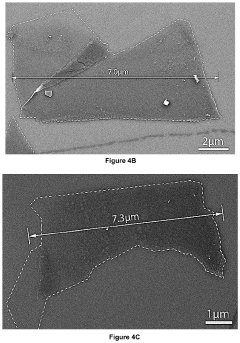

Production of boron nitride nanosheets

PatentPendingUS20240025742A1

Innovation

- The use of a viscous liquid ball milling medium with a viscosity of 100 to 100,000 mPa·s and polymeric milling equipment reduces the impact energy, enabling the production of larger, higher-quality boron nitride nanosheets by minimizing ball-to-ball and ball-to-jar impacts, and potentially combining with ultrasonication for enhanced exfoliation.

Wear Mechanism Analysis and Prediction Models

The wear mechanisms in ball mill liners represent a complex interplay of mechanical, chemical, and thermal factors that collectively determine the service life of these critical components. Abrasive wear occurs when hard mineral particles slide or roll between the liner and grinding media, gradually removing material from the liner surface. This mechanism is particularly prevalent in mills processing highly abrasive ores such as quartz or granite.

Impact wear, another dominant mechanism, results from the direct collision of grinding media against the liner surface. The repeated high-energy impacts cause material deformation, fatigue, and eventual spalling or cracking. The severity of impact wear correlates directly with mill rotational speed, ball size, and material hardness differential between the grinding media and liner.

Corrosive wear emerges as a significant factor in wet grinding operations, where chemical reactions between the slurry and liner material accelerate material degradation. The combination of corrosion and mechanical wear—known as corrosion-abrasion synergy—can increase wear rates by 2-3 times compared to purely mechanical wear processes.

Thermal fatigue constitutes another wear mechanism, particularly in operations with significant temperature fluctuations. The repeated thermal expansion and contraction create stress gradients that eventually lead to crack formation and propagation within the liner material.

Prediction models for liner wear have evolved significantly, from simple empirical formulas to sophisticated computational approaches. Traditional models like the Bond equation provide baseline estimates but fail to account for the complex interplay of multiple wear mechanisms. Modern finite element analysis (FEA) models incorporate discrete element method (DEM) simulations to predict wear patterns with greater accuracy by simulating the motion and interaction of individual particles within the mill.

Machine learning approaches represent the cutting edge in wear prediction, utilizing historical wear data, operational parameters, and material properties to develop predictive algorithms. These models can achieve prediction accuracies of 85-95% when properly trained with comprehensive datasets spanning multiple replacement cycles.

Real-time monitoring systems using acoustic emissions, vibration analysis, and advanced imaging techniques now enable continuous assessment of liner condition, allowing for dynamic adjustment of prediction models. These systems can detect early signs of abnormal wear patterns, potentially extending liner life by 15-20% through timely interventions in operational parameters.

Impact wear, another dominant mechanism, results from the direct collision of grinding media against the liner surface. The repeated high-energy impacts cause material deformation, fatigue, and eventual spalling or cracking. The severity of impact wear correlates directly with mill rotational speed, ball size, and material hardness differential between the grinding media and liner.

Corrosive wear emerges as a significant factor in wet grinding operations, where chemical reactions between the slurry and liner material accelerate material degradation. The combination of corrosion and mechanical wear—known as corrosion-abrasion synergy—can increase wear rates by 2-3 times compared to purely mechanical wear processes.

Thermal fatigue constitutes another wear mechanism, particularly in operations with significant temperature fluctuations. The repeated thermal expansion and contraction create stress gradients that eventually lead to crack formation and propagation within the liner material.

Prediction models for liner wear have evolved significantly, from simple empirical formulas to sophisticated computational approaches. Traditional models like the Bond equation provide baseline estimates but fail to account for the complex interplay of multiple wear mechanisms. Modern finite element analysis (FEA) models incorporate discrete element method (DEM) simulations to predict wear patterns with greater accuracy by simulating the motion and interaction of individual particles within the mill.

Machine learning approaches represent the cutting edge in wear prediction, utilizing historical wear data, operational parameters, and material properties to develop predictive algorithms. These models can achieve prediction accuracies of 85-95% when properly trained with comprehensive datasets spanning multiple replacement cycles.

Real-time monitoring systems using acoustic emissions, vibration analysis, and advanced imaging techniques now enable continuous assessment of liner condition, allowing for dynamic adjustment of prediction models. These systems can detect early signs of abnormal wear patterns, potentially extending liner life by 15-20% through timely interventions in operational parameters.

Sustainability and Cost-Efficiency Considerations

Sustainability and cost-efficiency have become paramount considerations in ball mill liner material selection and replacement practices. The mining and mineral processing industries face increasing pressure to reduce environmental footprints while maintaining economic viability. Modern approaches must balance immediate operational costs against long-term sustainability goals.

Material selection significantly impacts both sustainability and cost-efficiency. Traditional steel liners, while initially less expensive, often require frequent replacement and generate substantial waste. Advanced composite materials, though carrying higher upfront costs, offer extended service life and reduced replacement frequency, ultimately lowering the total cost of ownership. Rubber and rubber-metal composite liners demonstrate excellent wear resistance while consuming less energy during operation, reducing the carbon footprint of grinding operations.

Energy consumption represents a critical factor in sustainability assessments. Studies indicate that optimized liner designs can reduce power consumption by 5-15%, translating to significant cost savings and reduced greenhouse gas emissions. The relationship between liner profile maintenance and energy efficiency creates a direct link between operational practices and environmental impact. Mills operating with worn liners typically consume 8-12% more energy than those with properly maintained profiles.

Waste management strategies have evolved to address the environmental concerns of liner replacement. Recycling programs for spent metal liners now achieve recovery rates exceeding 90% in advanced operations. Some manufacturers have implemented take-back programs, creating closed-loop systems that minimize landfill contributions. Additionally, innovative refurbishment techniques extend liner service life, reducing the frequency of complete replacements and associated material consumption.

Life cycle assessment (LCA) methodologies provide comprehensive frameworks for evaluating the true environmental and economic costs of liner materials. These assessments consider raw material extraction, manufacturing processes, operational performance, and end-of-life disposal. Recent LCA studies reveal that high-performance composite liners, despite higher initial costs, can reduce lifetime carbon emissions by 25-40% compared to traditional options when accounting for energy savings and extended replacement intervals.

Water conservation has emerged as another sustainability consideration, particularly in water-stressed regions. Certain liner materials and designs can improve grinding efficiency, reducing water requirements for processing. Advanced liner systems that optimize ball motion patterns can decrease water consumption by 3-7%, representing significant savings in regions where water resources are limited or expensive.

Return on investment calculations for sustainable liner solutions must incorporate multiple factors beyond purchase price, including installation time, operational efficiency, and maintenance requirements. Companies implementing comprehensive cost-efficiency models report payback periods of 8-18 months for premium liner investments, with sustainability benefits continuing to accrue throughout the extended service life.

Material selection significantly impacts both sustainability and cost-efficiency. Traditional steel liners, while initially less expensive, often require frequent replacement and generate substantial waste. Advanced composite materials, though carrying higher upfront costs, offer extended service life and reduced replacement frequency, ultimately lowering the total cost of ownership. Rubber and rubber-metal composite liners demonstrate excellent wear resistance while consuming less energy during operation, reducing the carbon footprint of grinding operations.

Energy consumption represents a critical factor in sustainability assessments. Studies indicate that optimized liner designs can reduce power consumption by 5-15%, translating to significant cost savings and reduced greenhouse gas emissions. The relationship between liner profile maintenance and energy efficiency creates a direct link between operational practices and environmental impact. Mills operating with worn liners typically consume 8-12% more energy than those with properly maintained profiles.

Waste management strategies have evolved to address the environmental concerns of liner replacement. Recycling programs for spent metal liners now achieve recovery rates exceeding 90% in advanced operations. Some manufacturers have implemented take-back programs, creating closed-loop systems that minimize landfill contributions. Additionally, innovative refurbishment techniques extend liner service life, reducing the frequency of complete replacements and associated material consumption.

Life cycle assessment (LCA) methodologies provide comprehensive frameworks for evaluating the true environmental and economic costs of liner materials. These assessments consider raw material extraction, manufacturing processes, operational performance, and end-of-life disposal. Recent LCA studies reveal that high-performance composite liners, despite higher initial costs, can reduce lifetime carbon emissions by 25-40% compared to traditional options when accounting for energy savings and extended replacement intervals.

Water conservation has emerged as another sustainability consideration, particularly in water-stressed regions. Certain liner materials and designs can improve grinding efficiency, reducing water requirements for processing. Advanced liner systems that optimize ball motion patterns can decrease water consumption by 3-7%, representing significant savings in regions where water resources are limited or expensive.

Return on investment calculations for sustainable liner solutions must incorporate multiple factors beyond purchase price, including installation time, operational efficiency, and maintenance requirements. Companies implementing comprehensive cost-efficiency models report payback periods of 8-18 months for premium liner investments, with sustainability benefits continuing to accrue throughout the extended service life.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!