Evaluation of Solid sorbents for CO2 capture patents and innovation potential in carbon management

SEP 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO2 Capture Sorbent Technology Background & Objectives

Carbon dioxide capture and storage (CCS) has emerged as a critical technology in the global effort to mitigate climate change. The development of solid sorbents for CO2 capture represents one of the most promising approaches within this field, offering potential advantages over traditional liquid absorption methods. The evolution of solid sorbent technology can be traced back to the early 2000s, when researchers began exploring alternatives to amine-based liquid absorbents due to their high energy requirements and corrosion issues.

The technological trajectory has progressed through several generations of materials, beginning with basic activated carbons and zeolites, advancing to metal-organic frameworks (MOFs), and more recently to engineered hybrid materials that combine the advantages of multiple sorbent types. This evolution reflects a continuous pursuit of materials with higher CO2 selectivity, improved capacity, enhanced stability under industrial conditions, and reduced regeneration energy requirements.

Current research trends indicate a growing focus on developing sorbents that can operate effectively under real-world conditions, including the presence of moisture, contaminants, and varying temperature regimes. Additionally, there is increasing emphasis on materials that can be manufactured at scale using environmentally sustainable processes, addressing the full lifecycle impact of carbon capture technologies.

The primary technical objectives in solid sorbent development center around achieving specific performance metrics: CO2 capture capacity exceeding 3 mmol/g under relevant conditions, selectivity factors above 100 for CO2 over N2, regeneration energy requirements below 2 GJ/ton CO2, and operational stability for thousands of adsorption-desorption cycles. These targets are driven by the economic imperative to reduce the cost of CO2 capture to below $40 per ton to enable widespread commercial deployment.

Beyond performance metrics, the field aims to develop sorbents compatible with existing industrial infrastructure, particularly power plants and industrial facilities that represent major point sources of CO2 emissions. The ultimate goal is to create a portfolio of specialized sorbent technologies tailored to different capture scenarios, from post-combustion flue gases to direct air capture applications.

The technological advancement of solid sorbents is increasingly viewed as a critical component of broader carbon management strategies, which encompass not only capture but also utilization and storage of CO2. This holistic approach recognizes that effective climate change mitigation requires integrated solutions that address the entire carbon lifecycle, with solid sorbents playing a pivotal role in the initial capture phase.

The technological trajectory has progressed through several generations of materials, beginning with basic activated carbons and zeolites, advancing to metal-organic frameworks (MOFs), and more recently to engineered hybrid materials that combine the advantages of multiple sorbent types. This evolution reflects a continuous pursuit of materials with higher CO2 selectivity, improved capacity, enhanced stability under industrial conditions, and reduced regeneration energy requirements.

Current research trends indicate a growing focus on developing sorbents that can operate effectively under real-world conditions, including the presence of moisture, contaminants, and varying temperature regimes. Additionally, there is increasing emphasis on materials that can be manufactured at scale using environmentally sustainable processes, addressing the full lifecycle impact of carbon capture technologies.

The primary technical objectives in solid sorbent development center around achieving specific performance metrics: CO2 capture capacity exceeding 3 mmol/g under relevant conditions, selectivity factors above 100 for CO2 over N2, regeneration energy requirements below 2 GJ/ton CO2, and operational stability for thousands of adsorption-desorption cycles. These targets are driven by the economic imperative to reduce the cost of CO2 capture to below $40 per ton to enable widespread commercial deployment.

Beyond performance metrics, the field aims to develop sorbents compatible with existing industrial infrastructure, particularly power plants and industrial facilities that represent major point sources of CO2 emissions. The ultimate goal is to create a portfolio of specialized sorbent technologies tailored to different capture scenarios, from post-combustion flue gases to direct air capture applications.

The technological advancement of solid sorbents is increasingly viewed as a critical component of broader carbon management strategies, which encompass not only capture but also utilization and storage of CO2. This holistic approach recognizes that effective climate change mitigation requires integrated solutions that address the entire carbon lifecycle, with solid sorbents playing a pivotal role in the initial capture phase.

Market Analysis for Carbon Capture Solutions

The global carbon capture and storage (CCS) market is experiencing significant growth, driven by increasing environmental concerns and stringent regulations aimed at reducing greenhouse gas emissions. As of 2023, the market for carbon capture solutions was valued at approximately $7.5 billion, with projections indicating a compound annual growth rate (CAGR) of 19.2% through 2030, potentially reaching $35.4 billion by the end of the decade.

Solid sorbents for CO2 capture represent a rapidly expanding segment within this market, currently accounting for about 21% of the total carbon capture technology market share. This segment is expected to grow at an accelerated rate of 23.7% annually, outpacing other capture technologies due to advantages in energy efficiency and operational flexibility.

Geographically, North America leads the market with approximately 38% share, followed by Europe at 29% and Asia-Pacific at 24%. The remaining 9% is distributed across other regions. The United States, China, and Germany are the primary innovation hubs, collectively responsible for over 65% of patents filed in solid sorbent technologies over the past five years.

Industry sectors driving demand include power generation (42%), cement production (18%), steel manufacturing (15%), chemical processing (12%), and other industrial applications (13%). The power generation sector remains the largest consumer of carbon capture technologies due to the high concentration of emissions from coal and natural gas plants.

Key market drivers include increasingly stringent carbon pricing mechanisms, with carbon taxes now averaging $45-80 per ton in developed economies. Government incentives for carbon capture deployment have also expanded significantly, with the U.S. 45Q tax credit offering up to $85 per metric ton for captured and sequestered CO2.

Market barriers include high capital expenditure requirements, with typical industrial-scale solid sorbent systems costing between $400-700 million to implement. Technical challenges related to sorbent degradation and regeneration efficiency also remain significant obstacles to widespread adoption.

Customer segments show varying adoption patterns, with large utilities and multinational industrial corporations leading implementation, while medium-sized enterprises are increasingly exploring partnership models to access the technology. The market is also witnessing the emergence of Carbon Capture as a Service (CCaaS) business models, which may accelerate adoption among smaller industrial players by reducing upfront capital requirements.

Solid sorbents for CO2 capture represent a rapidly expanding segment within this market, currently accounting for about 21% of the total carbon capture technology market share. This segment is expected to grow at an accelerated rate of 23.7% annually, outpacing other capture technologies due to advantages in energy efficiency and operational flexibility.

Geographically, North America leads the market with approximately 38% share, followed by Europe at 29% and Asia-Pacific at 24%. The remaining 9% is distributed across other regions. The United States, China, and Germany are the primary innovation hubs, collectively responsible for over 65% of patents filed in solid sorbent technologies over the past five years.

Industry sectors driving demand include power generation (42%), cement production (18%), steel manufacturing (15%), chemical processing (12%), and other industrial applications (13%). The power generation sector remains the largest consumer of carbon capture technologies due to the high concentration of emissions from coal and natural gas plants.

Key market drivers include increasingly stringent carbon pricing mechanisms, with carbon taxes now averaging $45-80 per ton in developed economies. Government incentives for carbon capture deployment have also expanded significantly, with the U.S. 45Q tax credit offering up to $85 per metric ton for captured and sequestered CO2.

Market barriers include high capital expenditure requirements, with typical industrial-scale solid sorbent systems costing between $400-700 million to implement. Technical challenges related to sorbent degradation and regeneration efficiency also remain significant obstacles to widespread adoption.

Customer segments show varying adoption patterns, with large utilities and multinational industrial corporations leading implementation, while medium-sized enterprises are increasingly exploring partnership models to access the technology. The market is also witnessing the emergence of Carbon Capture as a Service (CCaaS) business models, which may accelerate adoption among smaller industrial players by reducing upfront capital requirements.

Global Status and Challenges in Solid Sorbent Technology

Solid sorbent technology for CO2 capture has emerged as a promising alternative to conventional liquid amine-based systems, attracting significant research and development efforts globally. Currently, the technology landscape is characterized by a diverse range of materials including activated carbons, zeolites, metal-organic frameworks (MOFs), amine-functionalized silicas, and hydrotalcites. The United States, European Union, China, and Japan lead in research output and patent filings, with academic institutions and national laboratories driving fundamental research while industrial players focus on scale-up and commercialization.

Despite promising laboratory results, solid sorbent technologies face substantial challenges in transitioning to industrial-scale applications. Material stability remains a critical concern, with many sorbents showing degradation after multiple adsorption-desorption cycles, particularly under real flue gas conditions containing contaminants like SOx and NOx. The trade-off between CO2 selectivity and energy requirements for regeneration continues to be a fundamental challenge, as materials with high CO2 affinity typically require more energy for sorbent regeneration.

Manufacturing scalability presents another significant hurdle. Many high-performance materials developed in laboratories utilize complex synthesis procedures and expensive precursors, making large-scale production economically prohibitive. The gap between gram-scale synthesis and ton-scale manufacturing requirements has slowed commercial deployment, with only a limited number of pilot projects currently operational worldwide.

Heat management during adsorption (exothermic) and desorption (endothermic) processes represents a substantial engineering challenge. Efficient heat transfer systems are essential for maintaining optimal operating conditions and minimizing energy penalties, but current reactor designs often struggle with temperature control in scaled-up systems.

Mechanical stability issues, including attrition resistance and pressure drop considerations in fixed or fluidized bed configurations, further complicate implementation. Many promising materials with excellent CO2 capture properties exhibit poor mechanical properties, leading to particle breakdown during operation and subsequent pressure drop increases or material loss.

The regulatory landscape adds another layer of complexity, with varying carbon pricing mechanisms and environmental regulations across different regions creating an uneven playing field for technology deployment. Without stronger policy incentives, the economic case for solid sorbent technologies remains challenging compared to established carbon capture methods.

Recent technological breakthroughs in material science, particularly in the development of hierarchical porous structures and composite materials, offer potential solutions to some of these challenges. However, bridging the gap between laboratory performance and industrial requirements necessitates coordinated efforts across the research community, industry stakeholders, and policy makers to accelerate development and deployment of these promising technologies.

Despite promising laboratory results, solid sorbent technologies face substantial challenges in transitioning to industrial-scale applications. Material stability remains a critical concern, with many sorbents showing degradation after multiple adsorption-desorption cycles, particularly under real flue gas conditions containing contaminants like SOx and NOx. The trade-off between CO2 selectivity and energy requirements for regeneration continues to be a fundamental challenge, as materials with high CO2 affinity typically require more energy for sorbent regeneration.

Manufacturing scalability presents another significant hurdle. Many high-performance materials developed in laboratories utilize complex synthesis procedures and expensive precursors, making large-scale production economically prohibitive. The gap between gram-scale synthesis and ton-scale manufacturing requirements has slowed commercial deployment, with only a limited number of pilot projects currently operational worldwide.

Heat management during adsorption (exothermic) and desorption (endothermic) processes represents a substantial engineering challenge. Efficient heat transfer systems are essential for maintaining optimal operating conditions and minimizing energy penalties, but current reactor designs often struggle with temperature control in scaled-up systems.

Mechanical stability issues, including attrition resistance and pressure drop considerations in fixed or fluidized bed configurations, further complicate implementation. Many promising materials with excellent CO2 capture properties exhibit poor mechanical properties, leading to particle breakdown during operation and subsequent pressure drop increases or material loss.

The regulatory landscape adds another layer of complexity, with varying carbon pricing mechanisms and environmental regulations across different regions creating an uneven playing field for technology deployment. Without stronger policy incentives, the economic case for solid sorbent technologies remains challenging compared to established carbon capture methods.

Recent technological breakthroughs in material science, particularly in the development of hierarchical porous structures and composite materials, offer potential solutions to some of these challenges. However, bridging the gap between laboratory performance and industrial requirements necessitates coordinated efforts across the research community, industry stakeholders, and policy makers to accelerate development and deployment of these promising technologies.

Current Solid Sorbent Solutions for Carbon Capture

01 Metal-organic frameworks (MOFs) for CO2 capture

Metal-organic frameworks represent a promising class of solid sorbents for CO2 capture due to their high surface area, tunable pore size, and customizable chemical functionality. These crystalline materials consist of metal ions or clusters coordinated to organic ligands, creating porous structures that can selectively adsorb CO2. Their modular nature allows for precise engineering of binding sites to enhance CO2 selectivity and capacity, while maintaining good regeneration properties under various operating conditions.- Metal-organic frameworks (MOFs) for CO2 capture: Metal-organic frameworks represent a promising class of solid sorbents for CO2 capture due to their high surface area, tunable pore size, and customizable chemical functionality. These crystalline materials consist of metal ions or clusters coordinated to organic ligands, creating porous structures that can selectively adsorb CO2. Their modular nature allows for precise engineering of binding sites to enhance CO2 selectivity and capacity, while maintaining good regeneration properties under various operating conditions.

- Amine-functionalized solid sorbents: Amine-functionalized materials have emerged as effective solid sorbents for CO2 capture by leveraging the strong chemical interaction between amine groups and CO2 molecules. These sorbents typically consist of amines grafted onto high-surface-area supports such as silica, activated carbon, or polymeric substrates. The amine functionality enables selective CO2 adsorption even at low concentrations, while the solid support provides mechanical stability and helps mitigate issues related to corrosion and volatility associated with liquid amine systems.

- Zeolite-based CO2 capture systems: Zeolites are crystalline aluminosilicate materials with well-defined pore structures that make them suitable for CO2 capture applications. Their molecular sieving properties allow for selective adsorption of CO2 over other gases based on molecular size and shape. Zeolites can be modified through ion exchange, dealumination, or incorporation of functional groups to enhance their CO2 adsorption capacity and selectivity. These materials offer advantages including thermal stability, resistance to degradation, and relatively low cost for large-scale carbon capture implementations.

- Carbon-based sorbents for CO2 capture: Carbon-based materials, including activated carbon, carbon nanotubes, and graphene derivatives, represent an important class of solid sorbents for CO2 capture. These materials offer high surface area, tunable porosity, and surface chemistry that can be optimized for CO2 adsorption. Carbon-based sorbents can be functionalized with nitrogen-containing groups or metal particles to enhance their CO2 capture performance. Their advantages include relatively low cost, good thermal stability, and the potential for sustainable production from biomass or waste materials.

- Hybrid and composite sorbent systems: Hybrid and composite sorbent systems combine different materials to create synergistic effects for enhanced CO2 capture performance. These systems may integrate organic and inorganic components, such as polymer-inorganic composites, mixed matrix materials, or layered structures. By combining the advantageous properties of multiple materials, these hybrid sorbents can achieve improved CO2 selectivity, capacity, kinetics, and stability. The composite approach allows for tailoring material properties to specific capture conditions while potentially overcoming limitations of single-component sorbents.

02 Amine-functionalized solid sorbents

Amine-functionalized materials have emerged as effective solid sorbents for CO2 capture by leveraging the strong chemical interaction between amine groups and CO2 molecules. These sorbents typically consist of a high-surface-area support material (such as silica, alumina, or porous polymers) impregnated or grafted with various amine compounds. The amine functionality enables selective CO2 adsorption even at low partial pressures, making these materials suitable for post-combustion capture applications where CO2 is diluted in flue gas streams.Expand Specific Solutions03 Carbon-based sorbents for CO2 capture

Carbon-based materials offer significant potential as solid sorbents for CO2 capture due to their high surface area, tunable porosity, and relatively low production costs. These sorbents include activated carbons, carbon molecular sieves, graphene-based materials, and carbon nanotubes. Their adsorption properties can be enhanced through various activation methods and surface modifications to increase CO2 selectivity. Carbon-based sorbents are particularly attractive for their thermal stability, mechanical strength, and potential for sustainable production from biomass or waste materials.Expand Specific Solutions04 Zeolites and molecular sieves for selective CO2 adsorption

Zeolites and molecular sieves are crystalline aluminosilicate materials with well-defined pore structures that enable molecular sieving effects for selective CO2 capture. These materials separate gas molecules based on differences in molecular size, shape, and polarity. Their uniform pore size distribution, high thermal stability, and strong interaction with CO2 make them suitable for pressure swing adsorption processes. Various zeolite frameworks can be synthesized or modified to optimize CO2 adsorption capacity, selectivity, and regeneration energy requirements.Expand Specific Solutions05 Novel hybrid and composite sorbent materials

Hybrid and composite sorbent materials combine the advantages of different material classes to create synergistic effects for enhanced CO2 capture performance. These innovative materials include polymer-inorganic composites, mixed matrix materials, and hierarchically structured sorbents with optimized mass transfer properties. By integrating multiple functional components, these materials can simultaneously address multiple challenges in CO2 capture, such as balancing high adsorption capacity with fast kinetics, good selectivity, and efficient regeneration. The modular design approach enables tailoring of material properties for specific capture conditions.Expand Specific Solutions

Key Industry Players in CO2 Capture

The solid sorbents for CO2 capture market is currently in a growth phase, with increasing global focus on carbon management technologies. The market size is expanding rapidly, projected to reach significant scale as carbon reduction initiatives accelerate worldwide. Technologically, the field shows varying maturity levels, with companies like China Petroleum & Chemical Corp. and Sinopec leading development in Asia, while Korea Electric Power Corp. and its subsidiaries demonstrate strong innovation in Korea. Western players including Climeworks AG, Global Thermostat, and ExxonMobil Technology & Engineering are advancing commercial applications. Academic institutions such as Arizona State University, Norwegian University of Science & Technology, and Chinese research institutes like Dalian Institute of Chemical Physics are contributing fundamental breakthroughs. The competitive landscape reflects a blend of established energy corporations, specialized carbon capture firms, and research organizations collaborating to address technical challenges in scalability and cost-effectiveness.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced solid sorbent technologies for CO2 capture focusing on metal-organic frameworks (MOFs) and amine-functionalized materials. Their patented approach involves hierarchical porous structures that combine micropores for high CO2 selectivity with mesopores for enhanced mass transfer kinetics. Sinopec's technology employs a temperature swing adsorption (TSA) process where CO2 is captured at lower temperatures (40-60°C) and released at moderate temperatures (90-120°C), significantly reducing regeneration energy requirements compared to conventional liquid amine scrubbing. Their solid sorbents demonstrate CO2 capture capacities of 3-5 mmol/g with high selectivity over N2 (>100:1) and maintain stability over 1000+ adsorption-desorption cycles[1]. Sinopec has integrated these materials into modular carbon capture units that can be retrofitted to existing power plants and industrial facilities, with pilot demonstrations showing capture rates of 90%+ with energy penalties reduced by approximately 30% compared to first-generation capture technologies.

Strengths: High CO2 selectivity and capacity, lower regeneration energy requirements (1.5-2.0 GJ/ton CO2 compared to 3.0-4.0 GJ/ton for conventional amine scrubbing), and excellent cyclic stability. Weaknesses: Higher initial capital costs for sorbent manufacturing, potential sensitivity to SOx and NOx contaminants in flue gas streams, and challenges in large-scale production of specialized MOF materials.

Climeworks AG

Technical Solution: Climeworks AG has developed a proprietary direct air capture (DAC) technology using specialized solid sorbents to extract CO2 directly from ambient air. Their patented approach employs amine-functionalized filter materials arranged in modular air contactor units that passively capture CO2 when air flows through them. The company's innovation lies in their cyclic adsorption-desorption process where sorbent-loaded filters capture CO2 at ambient conditions and release concentrated CO2 when heated to approximately 100°C using low-grade waste heat or renewable energy sources[4]. Climeworks' commercial plants achieve capture costs currently estimated at $600-800 per ton of CO2, with technology roadmaps targeting $200-300 per ton by 2030 through economies of scale and material improvements[5]. Their sorbent materials demonstrate remarkable selectivity for CO2 even at atmospheric concentrations (~415 ppm) and maintain performance over thousands of cycles. The modular design allows for flexible deployment from kilogram to kiloton scale, with their largest facility in Iceland (Orca) capturing 4,000 tons of CO2 annually, which is permanently sequestered through mineralization in basaltic rock formations. Climeworks has also pioneered the integration of DAC with renewable energy sources, utilizing geothermal heat in Iceland and solar energy in other installations to minimize the carbon footprint of the capture process itself.

Strengths: Ability to capture CO2 directly from ambient air (not just point sources), modular and scalable technology, integration with permanent geological storage, and independence from emission sources. Weaknesses: Currently high capture costs compared to point-source capture, significant energy requirements for sorbent regeneration, and relatively low CO2 throughput per unit area of installed equipment.

Patent Analysis of Advanced Sorbent Materials

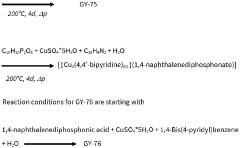

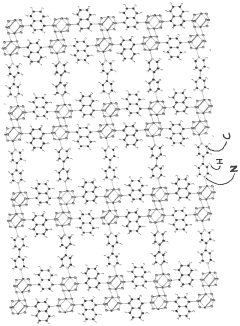

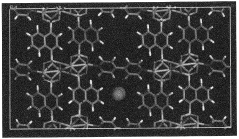

Solid sorbents for capturing co 2

PatentWO2023232666A1

Innovation

- Development of phosphonate and organoarsonate MOFs with specific molecular formulas, such as [{M2(4,4’-bipyridine)0.5}(l,4-naphthalenediphosphonate)] and [{M2(4,4’-bipyridine)0.5}(l,4-naphthalenediarsonate)], which maintain selectivity and stability under harsh conditions, including high humidity and temperatures up to 360°C, by creating a hydrophobic environment that favors CO2 physisorption over H2O.

Solid sorbents for capturing co 2

PatentWO2023232666A1

Innovation

- Development of phosphonate and organoarsonate MOFs with specific molecular formulas, such as [{M2(4,4’-bipyridine)0.5}(l,4-naphthalenediphosphonate)] and [{M2(4,4’-bipyridine)0.5}(l,4-naphthalenediarsonate)], which maintain selectivity and stability under harsh conditions, including high humidity and temperatures up to 360°C, by creating a hydrophobic environment that favors CO2 physisorption over H2O.

Regulatory Framework for Carbon Management

The regulatory landscape for carbon management has evolved significantly in recent years, reflecting growing global concern about climate change. International frameworks such as the Paris Agreement have established binding commitments for nations to reduce greenhouse gas emissions, with carbon capture technologies playing a crucial role in meeting these targets. The agreement specifically encourages the development and deployment of innovative carbon capture solutions, including solid sorbent technologies.

At the regional level, the European Union has implemented the Emissions Trading System (ETS), which creates economic incentives for carbon capture by establishing a price on carbon emissions. The EU Innovation Fund specifically allocates resources for breakthrough technologies in carbon capture, providing financial support for solid sorbent research and commercialization. Similarly, the United States has introduced the 45Q tax credit, offering up to $50 per metric ton of CO2 captured and sequestered, significantly improving the economic viability of solid sorbent technologies.

Regulatory standards for carbon capture technologies are increasingly focusing on efficiency metrics and environmental impact assessments. ISO standards for carbon capture technologies (ISO/TC 265) provide guidelines for technology evaluation, while environmental protection agencies worldwide are developing specific permitting requirements for carbon capture facilities. These standards often include minimum capture efficiency requirements, which directly influence the development trajectory of solid sorbent technologies.

Intellectual property regulations also significantly impact innovation in this field. Patent laws in major jurisdictions provide 20-year protection for novel solid sorbent technologies, though with variations in enforcement strength. Recent trends show increasing patent activity in solid sorbents for CO2 capture, particularly in materials like metal-organic frameworks (MOFs) and amine-functionalized adsorbents, reflecting regulatory incentives for innovation.

Looking forward, emerging regulatory frameworks are likely to further accelerate development in this sector. Carbon border adjustment mechanisms being considered by several jurisdictions would create additional economic incentives for carbon capture technologies. Meanwhile, standardization bodies are working to establish performance metrics specifically for solid sorbent technologies, which will provide clearer benchmarks for technology developers and potentially streamline approval processes for new solutions entering the market.

At the regional level, the European Union has implemented the Emissions Trading System (ETS), which creates economic incentives for carbon capture by establishing a price on carbon emissions. The EU Innovation Fund specifically allocates resources for breakthrough technologies in carbon capture, providing financial support for solid sorbent research and commercialization. Similarly, the United States has introduced the 45Q tax credit, offering up to $50 per metric ton of CO2 captured and sequestered, significantly improving the economic viability of solid sorbent technologies.

Regulatory standards for carbon capture technologies are increasingly focusing on efficiency metrics and environmental impact assessments. ISO standards for carbon capture technologies (ISO/TC 265) provide guidelines for technology evaluation, while environmental protection agencies worldwide are developing specific permitting requirements for carbon capture facilities. These standards often include minimum capture efficiency requirements, which directly influence the development trajectory of solid sorbent technologies.

Intellectual property regulations also significantly impact innovation in this field. Patent laws in major jurisdictions provide 20-year protection for novel solid sorbent technologies, though with variations in enforcement strength. Recent trends show increasing patent activity in solid sorbents for CO2 capture, particularly in materials like metal-organic frameworks (MOFs) and amine-functionalized adsorbents, reflecting regulatory incentives for innovation.

Looking forward, emerging regulatory frameworks are likely to further accelerate development in this sector. Carbon border adjustment mechanisms being considered by several jurisdictions would create additional economic incentives for carbon capture technologies. Meanwhile, standardization bodies are working to establish performance metrics specifically for solid sorbent technologies, which will provide clearer benchmarks for technology developers and potentially streamline approval processes for new solutions entering the market.

Economic Viability of Solid Sorbent Implementation

The economic viability of solid sorbent implementation for CO2 capture represents a critical factor in determining the widespread adoption of these technologies in carbon management strategies. Current cost analyses indicate that solid sorbent-based capture systems could potentially achieve capture costs between $40-70 per ton of CO2, depending on the specific sorbent material, process configuration, and scale of implementation.

Capital expenditure (CAPEX) for solid sorbent systems typically includes costs for sorbent manufacturing, equipment fabrication, and installation of capture units. These initial investments are generally lower than those required for conventional amine-based liquid absorption systems, primarily due to reduced equipment corrosion concerns and potentially smaller physical footprints. However, the economic advantage is partially offset by the current limited economies of scale in sorbent production.

Operational expenditure (OPEX) considerations reveal both advantages and challenges. Solid sorbents typically require less energy for regeneration compared to liquid solvents, with potential energy savings of 20-30%. This translates to lower operational costs over the system lifetime. However, sorbent degradation and replacement costs remain significant economic factors, with current materials requiring replacement every 1-3 years depending on operating conditions and contaminant exposure.

Market analysis suggests that solid sorbent technologies could become economically competitive with conventional carbon capture approaches by 2030, assuming continued improvements in sorbent durability and manufacturing scale-up. Sensitivity analyses indicate that energy costs and sorbent lifetime are the most influential parameters affecting overall economic viability.

Integration with existing industrial processes presents additional economic considerations. Retrofitting existing facilities with solid sorbent systems may require significant process modifications, though the modular nature of many solid sorbent technologies could facilitate phased implementation approaches that distribute capital costs over time.

Policy incentives significantly impact economic viability calculations. Carbon pricing mechanisms, tax credits for carbon capture (such as the 45Q tax credit in the US), and regulatory frameworks mandating emissions reductions all improve the business case for solid sorbent implementation. Current models suggest that carbon prices above $50-60 per ton would make most solid sorbent technologies economically viable across multiple industrial sectors.

Future economic projections indicate potential for substantial cost reductions through technological learning, manufacturing optimization, and increased competition among technology providers. Achieving capture costs below $30 per ton appears feasible within the next decade, which would position solid sorbent technologies as economically attractive options for meeting increasingly stringent carbon management requirements.

Capital expenditure (CAPEX) for solid sorbent systems typically includes costs for sorbent manufacturing, equipment fabrication, and installation of capture units. These initial investments are generally lower than those required for conventional amine-based liquid absorption systems, primarily due to reduced equipment corrosion concerns and potentially smaller physical footprints. However, the economic advantage is partially offset by the current limited economies of scale in sorbent production.

Operational expenditure (OPEX) considerations reveal both advantages and challenges. Solid sorbents typically require less energy for regeneration compared to liquid solvents, with potential energy savings of 20-30%. This translates to lower operational costs over the system lifetime. However, sorbent degradation and replacement costs remain significant economic factors, with current materials requiring replacement every 1-3 years depending on operating conditions and contaminant exposure.

Market analysis suggests that solid sorbent technologies could become economically competitive with conventional carbon capture approaches by 2030, assuming continued improvements in sorbent durability and manufacturing scale-up. Sensitivity analyses indicate that energy costs and sorbent lifetime are the most influential parameters affecting overall economic viability.

Integration with existing industrial processes presents additional economic considerations. Retrofitting existing facilities with solid sorbent systems may require significant process modifications, though the modular nature of many solid sorbent technologies could facilitate phased implementation approaches that distribute capital costs over time.

Policy incentives significantly impact economic viability calculations. Carbon pricing mechanisms, tax credits for carbon capture (such as the 45Q tax credit in the US), and regulatory frameworks mandating emissions reductions all improve the business case for solid sorbent implementation. Current models suggest that carbon prices above $50-60 per ton would make most solid sorbent technologies economically viable across multiple industrial sectors.

Future economic projections indicate potential for substantial cost reductions through technological learning, manufacturing optimization, and increased competition among technology providers. Achieving capture costs below $30 per ton appears feasible within the next decade, which would position solid sorbent technologies as economically attractive options for meeting increasingly stringent carbon management requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!