Solid sorbents for CO2 capture for chemical and petrochemical industry applications

SEP 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO2 Capture Technology Background and Objectives

Carbon dioxide (CO2) capture has emerged as a critical technology in addressing global climate change challenges. The evolution of CO2 capture technologies spans several decades, with significant advancements occurring in response to increasing environmental concerns and regulatory pressures. Initially focused on post-combustion capture from power plants, the technology has expanded to address emissions from various industrial sectors, particularly chemical and petrochemical industries which contribute approximately 18% of global CO2 emissions.

Solid sorbents represent a promising advancement in the CO2 capture landscape, offering potential advantages over traditional liquid-based absorption methods. These materials have evolved from simple activated carbons and zeolites to sophisticated metal-organic frameworks (MOFs), covalent organic frameworks (COFs), and functionalized porous polymers. The technological trajectory indicates a shift toward materials with higher selectivity, capacity, and stability under industrial conditions.

The primary objective of solid sorbent development for CO2 capture in chemical and petrochemical applications is to achieve economically viable carbon reduction while maintaining operational efficiency. Specific technical goals include developing sorbents with CO2 capture capacity exceeding 3 mmol/g under relevant conditions, selectivity factors above 100 for CO2 over other flue gas components, and stability for at least 1,000 adsorption-desorption cycles.

Current research aims to reduce the energy penalty associated with sorbent regeneration, targeting a reduction from the current 2.5-3.5 GJ/ton CO2 to below 2.0 GJ/ton CO2. Additionally, there are efforts to develop sorbents capable of operating effectively in the presence of contaminants common in petrochemical processes, such as sulfur compounds and water vapor.

The technology evolution trend points toward multi-functional sorbents that can simultaneously capture CO2 and convert it into value-added products, aligning with circular economy principles. This approach could transform CO2 capture from a cost center to a potential revenue stream for chemical and petrochemical industries.

Looking forward, the field is moving toward integration of solid sorbent technologies with existing industrial processes, requiring sorbents that can withstand harsh conditions including high temperatures (up to 400°C) and pressures (up to 20 bar) common in petrochemical operations. The ultimate goal is to develop drop-in solutions that can be retrofitted to existing infrastructure with minimal process modifications, thereby accelerating industry adoption and environmental impact.

Solid sorbents represent a promising advancement in the CO2 capture landscape, offering potential advantages over traditional liquid-based absorption methods. These materials have evolved from simple activated carbons and zeolites to sophisticated metal-organic frameworks (MOFs), covalent organic frameworks (COFs), and functionalized porous polymers. The technological trajectory indicates a shift toward materials with higher selectivity, capacity, and stability under industrial conditions.

The primary objective of solid sorbent development for CO2 capture in chemical and petrochemical applications is to achieve economically viable carbon reduction while maintaining operational efficiency. Specific technical goals include developing sorbents with CO2 capture capacity exceeding 3 mmol/g under relevant conditions, selectivity factors above 100 for CO2 over other flue gas components, and stability for at least 1,000 adsorption-desorption cycles.

Current research aims to reduce the energy penalty associated with sorbent regeneration, targeting a reduction from the current 2.5-3.5 GJ/ton CO2 to below 2.0 GJ/ton CO2. Additionally, there are efforts to develop sorbents capable of operating effectively in the presence of contaminants common in petrochemical processes, such as sulfur compounds and water vapor.

The technology evolution trend points toward multi-functional sorbents that can simultaneously capture CO2 and convert it into value-added products, aligning with circular economy principles. This approach could transform CO2 capture from a cost center to a potential revenue stream for chemical and petrochemical industries.

Looking forward, the field is moving toward integration of solid sorbent technologies with existing industrial processes, requiring sorbents that can withstand harsh conditions including high temperatures (up to 400°C) and pressures (up to 20 bar) common in petrochemical operations. The ultimate goal is to develop drop-in solutions that can be retrofitted to existing infrastructure with minimal process modifications, thereby accelerating industry adoption and environmental impact.

Market Analysis for Industrial CO2 Capture Solutions

The global market for industrial CO2 capture solutions is experiencing significant growth, driven by increasing regulatory pressures and corporate sustainability commitments. Current market valuations indicate the carbon capture and storage (CCS) market reached approximately $2.9 billion in 2022, with projections suggesting expansion to $5.6 billion by 2027, representing a compound annual growth rate of 14.2%. Within this broader market, solid sorbents technology specifically is gaining traction as a promising segment with substantial growth potential.

Chemical and petrochemical industries collectively account for roughly 13% of global industrial CO2 emissions, making them prime candidates for carbon capture implementation. These sectors face mounting pressure from carbon pricing mechanisms, which have expanded to cover over 20% of global emissions in various jurisdictions, with prices ranging from $5 to $130 per ton depending on the region.

Market demand is particularly strong in regions with established carbon pricing mechanisms, including the European Union, parts of North America, and increasingly in Asia-Pacific countries. The EU's carbon price under its Emissions Trading System has maintained levels above €80 per ton throughout 2023, creating strong economic incentives for industrial decarbonization solutions.

Customer segmentation reveals three primary market categories: large integrated petrochemical companies seeking comprehensive solutions, medium-sized chemical manufacturers requiring modular and scalable systems, and specialty chemical producers looking for application-specific capture technologies. Each segment presents distinct requirements regarding capture efficiency, energy consumption, and integration capabilities.

Competitive analysis indicates that while traditional amine-based liquid sorbent technologies currently dominate with approximately 65% market share, solid sorbents are gaining momentum due to their lower regeneration energy requirements and reduced environmental impact. Metal-organic frameworks (MOFs) and amine-functionalized porous materials are experiencing particularly strong interest, with several commercial-scale demonstration projects underway.

Market barriers include high capital expenditure requirements, with typical industrial-scale installations ranging from $40-150 million depending on capacity and integration complexity. Additionally, operational costs remain a significant concern, with current technologies adding approximately $40-80 per ton of captured CO2 to production costs, depending on the specific application and energy prices.

The market outlook remains highly positive, with solid sorbent technologies projected to capture 25-30% of the industrial carbon capture market by 2030, representing a significant shift from their current 10-15% share. This growth trajectory is supported by increasing carbon prices, stricter emissions regulations, and continued technological improvements that are expected to reduce implementation costs by 30-40% over the next decade.

Chemical and petrochemical industries collectively account for roughly 13% of global industrial CO2 emissions, making them prime candidates for carbon capture implementation. These sectors face mounting pressure from carbon pricing mechanisms, which have expanded to cover over 20% of global emissions in various jurisdictions, with prices ranging from $5 to $130 per ton depending on the region.

Market demand is particularly strong in regions with established carbon pricing mechanisms, including the European Union, parts of North America, and increasingly in Asia-Pacific countries. The EU's carbon price under its Emissions Trading System has maintained levels above €80 per ton throughout 2023, creating strong economic incentives for industrial decarbonization solutions.

Customer segmentation reveals three primary market categories: large integrated petrochemical companies seeking comprehensive solutions, medium-sized chemical manufacturers requiring modular and scalable systems, and specialty chemical producers looking for application-specific capture technologies. Each segment presents distinct requirements regarding capture efficiency, energy consumption, and integration capabilities.

Competitive analysis indicates that while traditional amine-based liquid sorbent technologies currently dominate with approximately 65% market share, solid sorbents are gaining momentum due to their lower regeneration energy requirements and reduced environmental impact. Metal-organic frameworks (MOFs) and amine-functionalized porous materials are experiencing particularly strong interest, with several commercial-scale demonstration projects underway.

Market barriers include high capital expenditure requirements, with typical industrial-scale installations ranging from $40-150 million depending on capacity and integration complexity. Additionally, operational costs remain a significant concern, with current technologies adding approximately $40-80 per ton of captured CO2 to production costs, depending on the specific application and energy prices.

The market outlook remains highly positive, with solid sorbent technologies projected to capture 25-30% of the industrial carbon capture market by 2030, representing a significant shift from their current 10-15% share. This growth trajectory is supported by increasing carbon prices, stricter emissions regulations, and continued technological improvements that are expected to reduce implementation costs by 30-40% over the next decade.

Current Solid Sorbents Technology Landscape and Barriers

The current landscape of solid sorbents for CO2 capture in chemical and petrochemical industries is characterized by a diverse array of materials with varying properties and performance metrics. Zeolites, metal-organic frameworks (MOFs), activated carbons, and amine-functionalized silicas represent the predominant classes of solid sorbents being investigated and deployed. Each material category offers distinct advantages in terms of selectivity, capacity, and regeneration energy requirements, with MOFs demonstrating particularly promising CO2 uptake capacities exceeding 4 mmol/g under relevant industrial conditions.

Commercial implementation of solid sorbent technologies remains limited despite significant research advancements. Only a handful of demonstration projects have progressed beyond laboratory scale, with notable examples including Carbon Clean's proprietary sorbent technology and Svante's structured adsorbent technology, both operating at the 10-30 ton CO2/day scale. This gap between research and commercialization highlights the persistent technical and economic barriers facing widespread adoption.

A critical technical challenge is the stability of sorbents under real industrial conditions. Most petrochemical and chemical processes generate flue gases containing contaminants such as SOx, NOx, and water vapor, which can significantly degrade sorbent performance over multiple adsorption-desorption cycles. Current materials typically demonstrate 10-30% capacity loss after 100-1000 cycles, falling short of the 5,000+ cycles needed for economic viability without frequent replacement.

Energy requirements for sorbent regeneration present another substantial barrier. While solid sorbents generally offer improvements over liquid amine scrubbing (which requires 3.5-4.2 GJ/ton CO2), the most advanced solid sorbent systems still consume 2.0-3.0 GJ/ton CO2. This energy penalty significantly impacts the overall economics of carbon capture implementation in energy-intensive industries.

Scale-up challenges further complicate commercial deployment. The production of high-performance sorbents at industrial scale often results in material properties that deviate from laboratory-synthesized samples. Additionally, the engineering of efficient contacting systems that minimize pressure drop while maximizing gas-solid interaction remains problematic, particularly for fine powder sorbents that exhibit favorable kinetics but poor flow properties.

Cost considerations represent perhaps the most significant barrier to widespread adoption. Current estimates place the cost of CO2 capture using solid sorbents between $50-90 per ton CO2, which exceeds the economic threshold for implementation in most chemical and petrochemical applications without regulatory incentives. Material costs, particularly for advanced MOFs and functionalized sorbents, can reach $100-500/kg, compared to conventional activated carbons at $5-20/kg.

Geographical distribution of solid sorbent technology development shows concentration in North America, Europe, and East Asia, with limited research infrastructure in developing economies where chemical industry growth is most rapid. This disparity may impact global deployment potential as carbon regulations become more stringent worldwide.

Commercial implementation of solid sorbent technologies remains limited despite significant research advancements. Only a handful of demonstration projects have progressed beyond laboratory scale, with notable examples including Carbon Clean's proprietary sorbent technology and Svante's structured adsorbent technology, both operating at the 10-30 ton CO2/day scale. This gap between research and commercialization highlights the persistent technical and economic barriers facing widespread adoption.

A critical technical challenge is the stability of sorbents under real industrial conditions. Most petrochemical and chemical processes generate flue gases containing contaminants such as SOx, NOx, and water vapor, which can significantly degrade sorbent performance over multiple adsorption-desorption cycles. Current materials typically demonstrate 10-30% capacity loss after 100-1000 cycles, falling short of the 5,000+ cycles needed for economic viability without frequent replacement.

Energy requirements for sorbent regeneration present another substantial barrier. While solid sorbents generally offer improvements over liquid amine scrubbing (which requires 3.5-4.2 GJ/ton CO2), the most advanced solid sorbent systems still consume 2.0-3.0 GJ/ton CO2. This energy penalty significantly impacts the overall economics of carbon capture implementation in energy-intensive industries.

Scale-up challenges further complicate commercial deployment. The production of high-performance sorbents at industrial scale often results in material properties that deviate from laboratory-synthesized samples. Additionally, the engineering of efficient contacting systems that minimize pressure drop while maximizing gas-solid interaction remains problematic, particularly for fine powder sorbents that exhibit favorable kinetics but poor flow properties.

Cost considerations represent perhaps the most significant barrier to widespread adoption. Current estimates place the cost of CO2 capture using solid sorbents between $50-90 per ton CO2, which exceeds the economic threshold for implementation in most chemical and petrochemical applications without regulatory incentives. Material costs, particularly for advanced MOFs and functionalized sorbents, can reach $100-500/kg, compared to conventional activated carbons at $5-20/kg.

Geographical distribution of solid sorbent technology development shows concentration in North America, Europe, and East Asia, with limited research infrastructure in developing economies where chemical industry growth is most rapid. This disparity may impact global deployment potential as carbon regulations become more stringent worldwide.

Mainstream Solid Sorbent Solutions for Industrial Applications

01 Metal-organic frameworks (MOFs) for CO2 capture

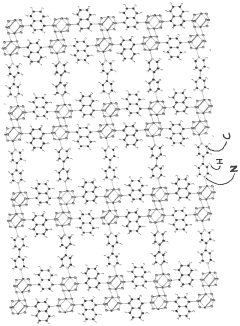

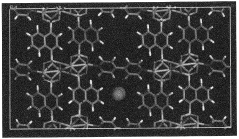

Metal-organic frameworks are crystalline porous materials composed of metal ions or clusters coordinated to organic ligands, forming one-, two-, or three-dimensional structures. These materials have high surface areas, tunable pore sizes, and chemical functionality that make them effective for selective CO2 adsorption. MOFs can be designed with specific metal centers and organic linkers to enhance CO2 binding affinity and selectivity, while maintaining good regeneration properties under mild conditions.- Metal-organic frameworks (MOFs) for CO2 capture: Metal-organic frameworks are porous crystalline materials composed of metal ions or clusters coordinated with organic ligands. These materials have high surface areas and tunable pore sizes, making them effective for selective CO2 adsorption. MOFs can be designed with specific functional groups to enhance CO2 binding affinity and selectivity. Their modular nature allows for customization of properties such as adsorption capacity, regeneration energy, and stability under various conditions.

- Amine-functionalized solid sorbents: Amine-functionalized materials represent a significant class of CO2 sorbents that operate through chemical adsorption mechanisms. These materials typically consist of amines grafted onto porous supports such as silica, activated carbon, or polymers. The amine groups react with CO2 to form carbamates or bicarbonates, enabling high selectivity even at low CO2 concentrations. These sorbents can be regenerated through temperature or pressure swing processes, making them suitable for cyclic capture operations in industrial settings.

- Zeolite-based CO2 capture materials: Zeolites are crystalline aluminosilicate materials with well-defined microporous structures that can selectively adsorb CO2 molecules. Their high thermal stability and mechanical strength make them suitable for industrial applications. The CO2 capture performance of zeolites can be enhanced through ion exchange, framework modification, or incorporation of functional groups. These materials typically operate through physical adsorption mechanisms and can be regenerated using temperature or pressure swing processes.

- Carbon-based sorbents for CO2 capture: Carbon-based materials, including activated carbon, carbon nanotubes, and graphene derivatives, offer promising platforms for CO2 capture. These materials can be modified with various functional groups to enhance CO2 adsorption capacity and selectivity. Their advantages include high surface area, good thermal stability, low cost, and ease of regeneration. Carbon-based sorbents can be produced from renewable or waste resources, making them environmentally sustainable options for carbon capture applications.

- Composite and hybrid sorbent materials: Composite and hybrid materials combine different types of sorbents to leverage their complementary properties for enhanced CO2 capture performance. These materials may integrate organic and inorganic components, such as polymer-inorganic hybrids, MOF-polymer composites, or multi-functional layered structures. The synergistic effects in these materials can lead to improved adsorption capacity, selectivity, stability, and regenerability compared to single-component sorbents. These advanced materials are designed to overcome limitations of traditional sorbents and optimize performance under specific operating conditions.

02 Amine-functionalized solid sorbents

Amine-functionalized materials represent a significant class of solid sorbents for CO2 capture. These materials incorporate various amine groups onto solid supports such as silica, alumina, or polymeric substrates. The amine groups react with CO2 through chemisorption mechanisms, forming carbamates or bicarbonates. These sorbents typically offer high CO2 selectivity, good capacity at low partial pressures, and can be regenerated at lower temperatures compared to traditional liquid amine systems, reducing the overall energy penalty for CO2 capture.Expand Specific Solutions03 Zeolite-based CO2 adsorbents

Zeolites are crystalline aluminosilicate materials with well-defined pore structures that can effectively capture CO2 through physical adsorption mechanisms. Their molecular sieving properties allow for selective adsorption of CO2 over other gases based on molecular size and shape. Zeolites can be modified by ion exchange, introducing cations like lithium, sodium, or calcium to enhance CO2 adsorption capacity. These materials offer advantages including thermal stability, resistance to degradation, and relatively low cost, making them suitable for industrial-scale carbon capture applications.Expand Specific Solutions04 Carbon-based sorbents for CO2 capture

Carbon-based materials, including activated carbons, carbon nanotubes, and graphene derivatives, serve as effective CO2 adsorbents. These materials can be produced from various precursors including biomass, coal, or synthetic sources. Their high surface area, tunable pore structure, and surface chemistry can be optimized for CO2 capture. Carbon-based sorbents can be further enhanced through chemical activation, nitrogen doping, or incorporation of metal particles to improve CO2 binding affinity. They offer advantages including low cost, high thermal stability, and resistance to moisture, making them suitable for practical carbon capture applications.Expand Specific Solutions05 Regeneration methods for solid CO2 sorbents

Effective regeneration strategies are crucial for the practical implementation of solid sorbents in CO2 capture systems. Various approaches include temperature swing adsorption (TSA), pressure swing adsorption (PSA), vacuum swing adsorption (VSA), and combinations thereof. Novel methods such as microwave-assisted regeneration, electrical swing adsorption, and steam stripping have been developed to reduce energy requirements. The regeneration process must balance energy efficiency, sorbent stability over multiple cycles, and CO2 purity in the desorbed stream. Optimized regeneration techniques significantly impact the overall economics and feasibility of solid sorbent-based carbon capture technologies.Expand Specific Solutions

Leading Companies and Research Institutions in Solid Sorbents

The solid sorbents for CO2 capture market in the chemical and petrochemical industry is currently in a growth phase, with increasing adoption driven by stringent emission regulations. The global market size is expanding rapidly, expected to reach several billion dollars by 2030 as industries seek cost-effective carbon capture solutions. Technology maturity varies across different sorbent types, with companies demonstrating diverse approaches. Major players include established energy corporations like China Petroleum & Chemical Corp. (Sinopec) and Korea Electric Power Corp., alongside specialized firms such as Carboncapture, Inc. and Global Thermostat. Academic institutions including University of Southern California, Zhejiang University, and Norwegian University of Science & Technology are advancing fundamental research, while industrial players focus on scaling commercial applications for real-world deployment.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced metal-organic frameworks (MOFs) for CO2 capture in petrochemical applications. Their proprietary MOF materials feature exceptionally high surface areas (>3000 m²/g) and tunable pore structures specifically designed for selective CO2 adsorption. Sinopec's technology integrates these sorbents into pressure/temperature swing adsorption systems that can be retrofitted into existing petrochemical facilities. Their pilot projects have demonstrated CO2 capture efficiencies exceeding 90% with regeneration energy requirements approximately 30% lower than conventional amine scrubbing processes[1]. Sinopec has also pioneered composite sorbents combining MOFs with mesoporous supports to enhance mechanical stability and adsorption kinetics, allowing for rapid cycling in industrial settings. Their integrated approach includes on-site regeneration systems that minimize energy penalties while producing high-purity CO2 streams suitable for utilization or sequestration[2].

Strengths: High selectivity for CO2 even in complex gas mixtures typical in petrochemical processes; lower energy requirements for regeneration compared to liquid sorbents; modular design allows for scalable implementation. Weaknesses: Higher initial capital costs compared to conventional technologies; potential degradation of sorbent performance over multiple cycles; requires precise process control to maintain optimal performance.

Dalian University of Technology

Technical Solution: Dalian University of Technology has pioneered innovative amine-functionalized mesoporous silica materials for CO2 capture in industrial applications. Their research team has developed hierarchical porous structures with optimized amine loading (3-6 mmol N/g) that achieve CO2 adsorption capacities of 3-5 mmol/g under conditions relevant to petrochemical flue gases[3]. A distinguishing feature of their technology is the development of water-resistant sorbents that maintain performance in humid conditions typical of real industrial environments. Their materials incorporate specially designed hydrophobic components that prevent water competition while maintaining CO2 selectivity. The university has also developed novel microwave-assisted regeneration methods that significantly reduce the energy requirements for sorbent regeneration by 25-40% compared to conventional thermal approaches[4]. Recent advancements include composite materials combining the benefits of physical and chemical adsorption mechanisms, allowing for effective capture across varying CO2 concentrations and temperatures encountered in petrochemical processes.

Strengths: Exceptional stability under industrial conditions including presence of contaminants; lower regeneration energy requirements; high CO2 selectivity even at low partial pressures. Weaknesses: Current synthesis methods may be challenging to scale economically; potential for amine leaching during extended operation; higher material costs compared to some conventional sorbents.

Key Patents and Technical Innovations in CO2 Capture Materials

Solid sorbents for capturing co 2

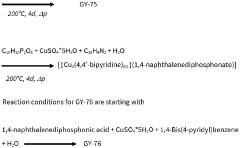

PatentWO2023232666A1

Innovation

- Development of phosphonate and organoarsonate MOFs with specific molecular formulas, such as [{M2(4,4’-bipyridine)0.5}(l,4-naphthalenediphosphonate)] and [{M2(4,4’-bipyridine)0.5}(l,4-naphthalenediarsonate)], which maintain selectivity and stability under harsh conditions, including high humidity and temperatures up to 360°C, by creating a hydrophobic environment that favors CO2 physisorption over H2O.

Layered solid sorbents for carbon dioxide capture

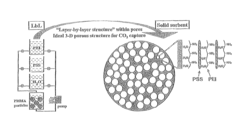

PatentActiveUS8889589B2

Innovation

- Development of nano-layered solid sorbents using electrostatic layer-by-layer nanoassembly, where positively charged polyethylenimine and negatively charged polystyrene sulfonate layers are alternately deposited on a porous substrate, enhancing CO2 capture and transport kinetics.

Techno-economic Assessment of Solid Sorbent Implementation

The implementation of solid sorbents for CO2 capture in chemical and petrochemical industries requires thorough techno-economic assessment to determine viability and cost-effectiveness. Current economic analyses indicate that solid sorbent technologies can potentially reduce capture costs by 30-40% compared to conventional amine scrubbing processes, with estimated costs ranging from $40-70 per ton of CO2 captured depending on the specific sorbent material and process configuration.

Capital expenditure considerations include initial investment in adsorption columns, regeneration equipment, material handling systems, and process control infrastructure. For a typical mid-sized petrochemical facility processing 500,000 tons of CO2 annually, capital costs range between $50-80 million, with solid sorbent systems generally requiring 15-25% less upfront investment than liquid absorption alternatives.

Operational expenditures are dominated by energy requirements for sorbent regeneration, material replacement costs due to degradation, and maintenance expenses. Energy consumption typically ranges from 1.5-3.0 GJ per ton of CO2 captured, significantly lower than the 3.5-4.5 GJ/ton for conventional amine systems. Annual sorbent replacement costs vary from 5-15% of initial sorbent investment, depending on operating conditions and material stability.

Sensitivity analysis reveals that economic viability is most influenced by regeneration energy requirements, sorbent lifetime, and CO2 concentration in flue gas. For instance, extending sorbent lifetime from 2 to 5 years can reduce levelized cost of capture by approximately 18%, while improving regeneration efficiency by 20% can decrease operational costs by 15-25%.

Integration costs with existing petrochemical infrastructure must be carefully evaluated, with brownfield implementations typically requiring 30-40% higher capital investment than greenfield projects due to space constraints and process modifications. Return on investment periods generally range from 5-8 years without carbon pricing mechanisms, potentially decreasing to 3-5 years with carbon prices above $50/ton.

Scale-up considerations demonstrate favorable economics at larger capacities, with cost per ton of CO2 captured decreasing by approximately 15% when scaling from 100,000 to 500,000 tons annual capacity. However, this economy of scale plateaus beyond approximately 1 million tons annual capacity due to modular design limitations and increased complexity of heat integration systems.

Capital expenditure considerations include initial investment in adsorption columns, regeneration equipment, material handling systems, and process control infrastructure. For a typical mid-sized petrochemical facility processing 500,000 tons of CO2 annually, capital costs range between $50-80 million, with solid sorbent systems generally requiring 15-25% less upfront investment than liquid absorption alternatives.

Operational expenditures are dominated by energy requirements for sorbent regeneration, material replacement costs due to degradation, and maintenance expenses. Energy consumption typically ranges from 1.5-3.0 GJ per ton of CO2 captured, significantly lower than the 3.5-4.5 GJ/ton for conventional amine systems. Annual sorbent replacement costs vary from 5-15% of initial sorbent investment, depending on operating conditions and material stability.

Sensitivity analysis reveals that economic viability is most influenced by regeneration energy requirements, sorbent lifetime, and CO2 concentration in flue gas. For instance, extending sorbent lifetime from 2 to 5 years can reduce levelized cost of capture by approximately 18%, while improving regeneration efficiency by 20% can decrease operational costs by 15-25%.

Integration costs with existing petrochemical infrastructure must be carefully evaluated, with brownfield implementations typically requiring 30-40% higher capital investment than greenfield projects due to space constraints and process modifications. Return on investment periods generally range from 5-8 years without carbon pricing mechanisms, potentially decreasing to 3-5 years with carbon prices above $50/ton.

Scale-up considerations demonstrate favorable economics at larger capacities, with cost per ton of CO2 captured decreasing by approximately 15% when scaling from 100,000 to 500,000 tons annual capacity. However, this economy of scale plateaus beyond approximately 1 million tons annual capacity due to modular design limitations and increased complexity of heat integration systems.

Environmental Impact and Sustainability Considerations

The implementation of solid sorbents for CO2 capture in chemical and petrochemical industries presents significant environmental implications that extend beyond the primary goal of carbon reduction. These technologies must be evaluated through a comprehensive sustainability lens that considers their full lifecycle environmental footprint.

The environmental benefits of solid sorbent technologies are substantial when compared to conventional carbon capture methods. Traditional amine-based liquid absorption systems typically require high regeneration energy, leading to increased fossil fuel consumption and associated emissions. In contrast, properly designed solid sorbents can reduce energy penalties by 30-40%, resulting in lower indirect CO2 emissions from power generation required for the capture process.

Water consumption represents another critical environmental consideration. While liquid absorption systems consume substantial quantities of water for solvent makeup and cooling, solid sorbents generally require minimal water inputs. This advantage becomes particularly significant in water-stressed regions where petrochemical facilities often operate, potentially reducing freshwater withdrawal by up to 80% compared to conventional technologies.

The production and disposal of solid sorbents also warrant careful environmental assessment. Manufacturing processes for advanced materials like metal-organic frameworks (MOFs) or functionalized silica may involve energy-intensive synthesis routes and potentially hazardous chemicals. Life cycle assessment (LCA) studies indicate that the environmental payback period—the time required for the environmental benefits of captured CO2 to outweigh the environmental costs of sorbent production—ranges from 3 months to 2 years depending on sorbent type and application conditions.

Sorbent degradation and replacement cycles introduce additional sustainability considerations. Materials with longer operational lifespans significantly reduce waste generation and resource consumption. Recent advancements in thermally and chemically stable sorbents have extended average replacement intervals from months to years, substantially improving their sustainability profile.

Land use impacts must also be evaluated, as solid sorbent systems may require additional infrastructure within existing industrial facilities. However, their generally smaller physical footprint compared to liquid systems (approximately 25-40% reduction in spatial requirements) minimizes this concern while potentially allowing for retrofitting existing operations without major spatial modifications.

The holistic environmental assessment of solid sorbent technologies must ultimately consider their contribution to circular economy principles. Emerging research focuses on developing regeneration and recycling pathways for spent sorbents, potentially transforming what would be waste materials into valuable inputs for other industrial processes, thereby closing material loops and enhancing overall sustainability performance.

The environmental benefits of solid sorbent technologies are substantial when compared to conventional carbon capture methods. Traditional amine-based liquid absorption systems typically require high regeneration energy, leading to increased fossil fuel consumption and associated emissions. In contrast, properly designed solid sorbents can reduce energy penalties by 30-40%, resulting in lower indirect CO2 emissions from power generation required for the capture process.

Water consumption represents another critical environmental consideration. While liquid absorption systems consume substantial quantities of water for solvent makeup and cooling, solid sorbents generally require minimal water inputs. This advantage becomes particularly significant in water-stressed regions where petrochemical facilities often operate, potentially reducing freshwater withdrawal by up to 80% compared to conventional technologies.

The production and disposal of solid sorbents also warrant careful environmental assessment. Manufacturing processes for advanced materials like metal-organic frameworks (MOFs) or functionalized silica may involve energy-intensive synthesis routes and potentially hazardous chemicals. Life cycle assessment (LCA) studies indicate that the environmental payback period—the time required for the environmental benefits of captured CO2 to outweigh the environmental costs of sorbent production—ranges from 3 months to 2 years depending on sorbent type and application conditions.

Sorbent degradation and replacement cycles introduce additional sustainability considerations. Materials with longer operational lifespans significantly reduce waste generation and resource consumption. Recent advancements in thermally and chemically stable sorbents have extended average replacement intervals from months to years, substantially improving their sustainability profile.

Land use impacts must also be evaluated, as solid sorbent systems may require additional infrastructure within existing industrial facilities. However, their generally smaller physical footprint compared to liquid systems (approximately 25-40% reduction in spatial requirements) minimizes this concern while potentially allowing for retrofitting existing operations without major spatial modifications.

The holistic environmental assessment of solid sorbent technologies must ultimately consider their contribution to circular economy principles. Emerging research focuses on developing regeneration and recycling pathways for spent sorbents, potentially transforming what would be waste materials into valuable inputs for other industrial processes, thereby closing material loops and enhancing overall sustainability performance.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!