Solid sorbents for CO2 capture standards compliance and qualification for industrial use

SEP 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO2 Capture Sorbent Technology Evolution and Objectives

Carbon dioxide capture technology has evolved significantly over the past decades, transitioning from theoretical concepts to practical industrial applications. The development of solid sorbents for CO2 capture represents a critical advancement in addressing global climate change challenges. Initially, CO2 capture technologies primarily relied on liquid amine-based systems, which despite their effectiveness, presented challenges related to energy consumption, corrosion, and degradation. The evolution toward solid sorbents began in the early 2000s as researchers sought more efficient and environmentally friendly alternatives.

The technological progression of solid sorbents has followed several distinct phases. The first generation, developed around 2005-2010, focused on basic porous materials such as activated carbons and zeolites. These materials offered moderate CO2 selectivity but suffered from limited capacity and regeneration issues. The second generation (2010-2015) introduced metal-organic frameworks (MOFs) and functionalized silica, which demonstrated improved adsorption capacities and selectivity under laboratory conditions.

Current third-generation sorbents (2015-present) incorporate advanced materials including amine-grafted porous structures, hydrotalcite-derived compounds, and novel carbon-based composites. These materials aim to combine high CO2 selectivity with improved thermal stability and mechanical strength—critical factors for industrial deployment. The technological trajectory clearly indicates a shift from purely capacity-focused development toward holistic consideration of material performance under real industrial conditions.

The primary objective of solid sorbent technology development is to create materials capable of efficiently capturing CO2 from industrial flue gases while meeting stringent operational requirements. Specific technical goals include achieving CO2 capture rates exceeding 90% with minimal energy penalties, maintaining performance over thousands of adsorption-desorption cycles, and demonstrating resistance to contaminants commonly found in industrial emissions.

Additional objectives focus on scalability and economic viability. For industrial adoption, sorbent materials must be manufacturable at scale using readily available precursors and established production methods. Cost targets typically aim for capture costs below $40 per ton of CO2, representing a significant reduction from current technologies. Environmental considerations further shape development goals, with emphasis on minimizing water usage, eliminating toxic components, and ensuring end-of-life recyclability.

Looking forward, the technology roadmap emphasizes the development of standardized testing protocols and qualification frameworks specifically designed for solid sorbents. These standards will facilitate fair comparison between different materials and accelerate industrial adoption by providing clear performance benchmarks and compliance requirements. The ultimate objective remains creating commercially viable solid sorbent systems that can be deployed across various industrial sectors, from power generation to cement and steel production.

The technological progression of solid sorbents has followed several distinct phases. The first generation, developed around 2005-2010, focused on basic porous materials such as activated carbons and zeolites. These materials offered moderate CO2 selectivity but suffered from limited capacity and regeneration issues. The second generation (2010-2015) introduced metal-organic frameworks (MOFs) and functionalized silica, which demonstrated improved adsorption capacities and selectivity under laboratory conditions.

Current third-generation sorbents (2015-present) incorporate advanced materials including amine-grafted porous structures, hydrotalcite-derived compounds, and novel carbon-based composites. These materials aim to combine high CO2 selectivity with improved thermal stability and mechanical strength—critical factors for industrial deployment. The technological trajectory clearly indicates a shift from purely capacity-focused development toward holistic consideration of material performance under real industrial conditions.

The primary objective of solid sorbent technology development is to create materials capable of efficiently capturing CO2 from industrial flue gases while meeting stringent operational requirements. Specific technical goals include achieving CO2 capture rates exceeding 90% with minimal energy penalties, maintaining performance over thousands of adsorption-desorption cycles, and demonstrating resistance to contaminants commonly found in industrial emissions.

Additional objectives focus on scalability and economic viability. For industrial adoption, sorbent materials must be manufacturable at scale using readily available precursors and established production methods. Cost targets typically aim for capture costs below $40 per ton of CO2, representing a significant reduction from current technologies. Environmental considerations further shape development goals, with emphasis on minimizing water usage, eliminating toxic components, and ensuring end-of-life recyclability.

Looking forward, the technology roadmap emphasizes the development of standardized testing protocols and qualification frameworks specifically designed for solid sorbents. These standards will facilitate fair comparison between different materials and accelerate industrial adoption by providing clear performance benchmarks and compliance requirements. The ultimate objective remains creating commercially viable solid sorbent systems that can be deployed across various industrial sectors, from power generation to cement and steel production.

Market Analysis for Industrial CO2 Capture Solutions

The global market for industrial CO2 capture solutions is experiencing significant growth, driven by increasing regulatory pressures and corporate sustainability commitments. Current market valuations indicate the carbon capture and storage (CCS) sector reached approximately $7.1 billion in 2022, with projections suggesting expansion to over $15 billion by 2030, representing a compound annual growth rate of 9.8%. Solid sorbent technologies specifically are gaining market share, currently accounting for about 18% of the total carbon capture technology market.

Regional analysis reveals distinct market characteristics across different territories. North America leads in market adoption, particularly in the United States where tax incentives like the 45Q credit have stimulated investment in carbon capture technologies. The European market shows strong growth potential due to stringent emissions regulations and the EU Emissions Trading System (ETS), which has maintained carbon prices above €80 per tonne throughout 2023, creating economic incentives for capture technologies.

The Asia-Pacific region, particularly China and India, represents the fastest-growing market segment with annual growth rates exceeding 12%, driven by rapid industrialization coupled with emerging climate policies. These markets are particularly receptive to cost-effective solid sorbent solutions that can be retrofitted to existing industrial facilities.

Industry segmentation indicates that power generation currently constitutes the largest application sector (34% of market share), followed by cement production (22%), chemical manufacturing (19%), and steel production (15%). These heavy industries face the greatest regulatory pressure and have the most concentrated CO2 emission sources, making them prime candidates for solid sorbent capture technologies.

Customer demand analysis reveals shifting priorities among industrial adopters. While cost remains the primary consideration (cited by 78% of potential customers in recent industry surveys), compliance with emerging regulations (65%) and corporate sustainability goals (59%) are increasingly important decision factors. Performance metrics most valued by customers include capture efficiency, energy penalty, operational flexibility, and total cost of ownership.

Market barriers include high capital expenditure requirements, uncertain regulatory frameworks in developing markets, and competition from alternative decarbonization strategies. The payback period for solid sorbent systems currently ranges from 5-8 years depending on regional carbon pricing, representing a significant hurdle for widespread adoption despite improving economics.

Emerging market opportunities exist in direct air capture applications, where solid sorbents offer significant advantages over liquid systems, and in smaller industrial applications where modular, scalable solutions are required. The market for qualified, standards-compliant solid sorbents is expected to grow at 1.5 times the rate of the overall carbon capture market through 2030.

Regional analysis reveals distinct market characteristics across different territories. North America leads in market adoption, particularly in the United States where tax incentives like the 45Q credit have stimulated investment in carbon capture technologies. The European market shows strong growth potential due to stringent emissions regulations and the EU Emissions Trading System (ETS), which has maintained carbon prices above €80 per tonne throughout 2023, creating economic incentives for capture technologies.

The Asia-Pacific region, particularly China and India, represents the fastest-growing market segment with annual growth rates exceeding 12%, driven by rapid industrialization coupled with emerging climate policies. These markets are particularly receptive to cost-effective solid sorbent solutions that can be retrofitted to existing industrial facilities.

Industry segmentation indicates that power generation currently constitutes the largest application sector (34% of market share), followed by cement production (22%), chemical manufacturing (19%), and steel production (15%). These heavy industries face the greatest regulatory pressure and have the most concentrated CO2 emission sources, making them prime candidates for solid sorbent capture technologies.

Customer demand analysis reveals shifting priorities among industrial adopters. While cost remains the primary consideration (cited by 78% of potential customers in recent industry surveys), compliance with emerging regulations (65%) and corporate sustainability goals (59%) are increasingly important decision factors. Performance metrics most valued by customers include capture efficiency, energy penalty, operational flexibility, and total cost of ownership.

Market barriers include high capital expenditure requirements, uncertain regulatory frameworks in developing markets, and competition from alternative decarbonization strategies. The payback period for solid sorbent systems currently ranges from 5-8 years depending on regional carbon pricing, representing a significant hurdle for widespread adoption despite improving economics.

Emerging market opportunities exist in direct air capture applications, where solid sorbents offer significant advantages over liquid systems, and in smaller industrial applications where modular, scalable solutions are required. The market for qualified, standards-compliant solid sorbents is expected to grow at 1.5 times the rate of the overall carbon capture market through 2030.

Current Solid Sorbent Technologies and Barriers

The current landscape of solid sorbent technologies for CO2 capture is characterized by a diverse array of materials with varying properties and performance characteristics. Amine-functionalized solid sorbents, particularly those based on mesoporous silica supports, have emerged as leading candidates due to their high CO2 selectivity and relatively low regeneration energy requirements. These materials typically achieve CO2 capacities of 2-4 mmol/g under ambient conditions, with regeneration temperatures between 80-120°C, making them suitable for post-combustion capture applications.

Metal-organic frameworks (MOFs) represent another promising class of solid sorbents, offering exceptional surface areas (up to 7000 m²/g) and tunable pore structures. Notable examples include Mg-MOF-74 and HKUST-1, which demonstrate CO2 capacities exceeding 5 mmol/g under specific conditions. However, their industrial deployment remains limited due to concerns regarding hydrothermal stability and manufacturing scalability.

Zeolites and activated carbons constitute more mature solid sorbent technologies with established manufacturing processes. While these materials offer moderate CO2 capacities (1-3 mmol/g), their relatively low cost and mechanical durability make them attractive for certain applications. Recent advances in zeolite synthesis have yielded materials with improved selectivity and reduced regeneration energy requirements.

Despite these technological advances, several significant barriers impede the widespread industrial adoption of solid sorbents for CO2 capture. Foremost among these is the challenge of maintaining performance stability over thousands of adsorption-desorption cycles under real industrial conditions. Many promising materials exhibit capacity degradation of 10-30% after just 100-200 cycles, particularly in the presence of flue gas contaminants such as SOx, NOx, and water vapor.

Manufacturing scalability presents another critical barrier. While laboratory-scale synthesis of advanced sorbents has demonstrated impressive results, translating these processes to industrial scales while maintaining performance and cost-effectiveness remains challenging. Current production methods for specialized MOFs and functionalized silicas typically yield kilogram quantities, whereas industrial implementation would require metric tons.

Economic viability constitutes a persistent obstacle, with current estimates placing CO2 capture costs using solid sorbents between $40-80 per ton of CO2. This range exceeds the threshold for economic feasibility in many applications, particularly in regions without strong carbon pricing mechanisms or regulatory frameworks.

Technical integration challenges also persist, including heat management during adsorption-desorption cycles, pressure drop considerations in fixed-bed configurations, and materials handling issues associated with solid sorbents. These engineering challenges require specialized equipment designs that have not yet been fully optimized for large-scale deployment.

Metal-organic frameworks (MOFs) represent another promising class of solid sorbents, offering exceptional surface areas (up to 7000 m²/g) and tunable pore structures. Notable examples include Mg-MOF-74 and HKUST-1, which demonstrate CO2 capacities exceeding 5 mmol/g under specific conditions. However, their industrial deployment remains limited due to concerns regarding hydrothermal stability and manufacturing scalability.

Zeolites and activated carbons constitute more mature solid sorbent technologies with established manufacturing processes. While these materials offer moderate CO2 capacities (1-3 mmol/g), their relatively low cost and mechanical durability make them attractive for certain applications. Recent advances in zeolite synthesis have yielded materials with improved selectivity and reduced regeneration energy requirements.

Despite these technological advances, several significant barriers impede the widespread industrial adoption of solid sorbents for CO2 capture. Foremost among these is the challenge of maintaining performance stability over thousands of adsorption-desorption cycles under real industrial conditions. Many promising materials exhibit capacity degradation of 10-30% after just 100-200 cycles, particularly in the presence of flue gas contaminants such as SOx, NOx, and water vapor.

Manufacturing scalability presents another critical barrier. While laboratory-scale synthesis of advanced sorbents has demonstrated impressive results, translating these processes to industrial scales while maintaining performance and cost-effectiveness remains challenging. Current production methods for specialized MOFs and functionalized silicas typically yield kilogram quantities, whereas industrial implementation would require metric tons.

Economic viability constitutes a persistent obstacle, with current estimates placing CO2 capture costs using solid sorbents between $40-80 per ton of CO2. This range exceeds the threshold for economic feasibility in many applications, particularly in regions without strong carbon pricing mechanisms or regulatory frameworks.

Technical integration challenges also persist, including heat management during adsorption-desorption cycles, pressure drop considerations in fixed-bed configurations, and materials handling issues associated with solid sorbents. These engineering challenges require specialized equipment designs that have not yet been fully optimized for large-scale deployment.

Mainstream Solid Sorbent Implementation Strategies

01 Amine-based solid sorbents for CO2 capture

Amine-based solid sorbents are widely used for CO2 capture due to their high selectivity and capacity. These materials typically consist of amine functional groups immobilized on porous supports such as silica or activated carbon. The qualification standards for these sorbents often focus on their CO2 adsorption capacity, selectivity, stability during multiple adsorption-desorption cycles, and resistance to degradation in the presence of contaminants like SOx and NOx.- Amine-based solid sorbents for CO2 capture: Amine-based solid sorbents are widely used for CO2 capture due to their high selectivity and capacity. These materials typically consist of amine functional groups immobilized on porous supports such as silica or polymers. The standards for these sorbents focus on their CO2 adsorption capacity, selectivity, stability during multiple adsorption-desorption cycles, and resistance to degradation in the presence of impurities like SOx and NOx. Qualification testing includes evaluation of mechanical strength, thermal stability, and performance under realistic flue gas conditions.

- Metal-organic frameworks (MOFs) for CO2 capture compliance: Metal-organic frameworks represent an advanced class of porous materials with exceptional surface areas and tunable pore structures for CO2 capture. Standards compliance for MOFs involves rigorous testing of their structural integrity, hydrothermal stability, and performance under varying temperature and pressure conditions. Qualification procedures include assessment of CO2 uptake capacity, selectivity over other gases, regenerability, and long-term stability. MOFs must meet specific benchmarks for adsorption kinetics and demonstrate consistent performance across multiple production batches to achieve certification for industrial applications.

- Testing protocols and certification standards for CO2 sorbents: Standardized testing protocols are essential for qualifying solid sorbents for CO2 capture applications. These protocols include procedures for measuring key performance indicators such as working capacity, selectivity, regeneration energy, and mechanical durability. Certification standards typically require accelerated aging tests, performance evaluation under simulated industrial conditions, and assessment of environmental impact. International standards organizations have developed specific guidelines for evaluating sorbent materials, including requirements for sample preparation, testing conditions, and data reporting to ensure consistency and comparability across different laboratories and technologies.

- Environmental and safety compliance for CO2 capture sorbents: Solid sorbents for CO2 capture must comply with environmental and safety regulations before industrial deployment. This includes assessment of potential environmental impacts, toxicity testing, and evaluation of disposal or recycling options at end-of-life. Safety compliance involves characterization of dust explosion risks, chemical stability during storage and handling, and potential for hazardous decomposition products. Qualification procedures include leaching tests to ensure no harmful substances are released during operation, as well as fire safety testing and assessment of potential worker exposure risks. Comprehensive life cycle assessment is increasingly required to evaluate the overall environmental footprint of sorbent materials.

- Quality control and performance validation for commercial CO2 sorbents: Quality control procedures for commercial CO2 capture sorbents involve rigorous batch testing and performance validation against established benchmarks. This includes verification of physical properties such as particle size distribution, surface area, pore volume, and mechanical strength. Performance validation requires demonstration of consistent CO2 capture efficiency across multiple production batches, stability under cyclic operation, and resistance to contaminants. Qualification standards often mandate third-party verification of key performance metrics and may include requirements for statistical process control during manufacturing. Advanced characterization techniques are employed to ensure structural integrity and functional performance meet specified standards before commercial deployment.

02 Metal-organic frameworks (MOFs) for CO2 capture compliance

Metal-organic frameworks represent an advanced class of porous materials with exceptional CO2 capture properties. Standards for MOF qualification include framework stability under humid conditions, thermal stability during regeneration cycles, and mechanical integrity. Compliance testing for MOFs typically involves characterization of surface area, pore volume, crystal structure integrity, and CO2 uptake capacity under various temperature and pressure conditions relevant to industrial applications.Expand Specific Solutions03 Testing protocols and certification standards for CO2 sorbents

Standardized testing protocols are essential for qualifying solid sorbents for CO2 capture applications. These protocols typically include accelerated aging tests, performance under simulated flue gas conditions, and evaluation of regeneration efficiency. Certification standards often require demonstration of consistent performance over thousands of adsorption-desorption cycles, minimal pressure drop in fixed-bed configurations, and compliance with environmental regulations regarding potential leaching of harmful components from the sorbent material.Expand Specific Solutions04 Environmental and safety compliance for CO2 capture sorbents

Solid sorbents for CO2 capture must meet stringent environmental and safety standards before industrial deployment. Qualification procedures include toxicity assessments, evaluation of potential dust formation during handling, fire and explosion risk assessments, and analysis of environmental impact throughout the sorbent lifecycle. Compliance requirements also address the disposal or recycling of spent sorbent materials, ensuring they don't create secondary environmental problems after their useful life in carbon capture applications.Expand Specific Solutions05 Performance validation and quality control standards

Quality control standards for solid CO2 sorbents focus on batch-to-batch consistency, scalability of production processes, and long-term performance stability. Validation procedures typically include benchmark testing against reference materials, statistical analysis of performance parameters, and in-situ monitoring capabilities. Standards compliance often requires detailed documentation of manufacturing processes, raw material specifications, and implementation of quality management systems that ensure consistent sorbent performance in industrial-scale carbon capture operations.Expand Specific Solutions

Leading Companies and Research Institutions in CO2 Capture

The solid sorbents for CO2 capture market is in a growth phase, with increasing regulatory pressure driving adoption across industries. The market size is expanding rapidly as carbon capture becomes essential for emissions reduction strategies. Technologically, the field shows varying maturity levels, with companies like Korea Electric Power Corp. and its subsidiaries demonstrating significant advancements in utility-scale applications. Research institutions such as USC, Rice University, and Beijing University of Technology are developing next-generation sorbent technologies. Major energy corporations including China Petroleum & Chemical Corp., ExxonMobil, and Climeworks are investing heavily in commercialization efforts, with Climeworks notably achieving third-party certification for direct air capture solutions. The competitive landscape features both established power utilities and specialized technology developers working toward industrial-scale implementation.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced solid sorbent technologies for CO2 capture focusing on metal-organic frameworks (MOFs) and amine-functionalized materials. Their proprietary MOF-based sorbents demonstrate exceptional CO2 selectivity and capacity under industrial flue gas conditions, with adsorption capacities reaching 4-6 mmol/g at typical power plant operating temperatures. Sinopec has implemented a pilot-scale demonstration at their Qilu Petrochemical facility, capturing approximately 40,000 tons of CO2 annually using structured amine-modified silica sorbents that maintain stability through hundreds of adsorption-desorption cycles. Their technology employs a temperature-vacuum swing adsorption (TVSA) process that reduces regeneration energy requirements to 2.0-2.5 GJ/ton CO2, significantly lower than conventional amine scrubbing methods. Sinopec has also developed specialized qualification protocols for their sorbents, including accelerated aging tests simulating 5+ years of industrial operation to ensure compliance with emission standards and operational reliability.

Strengths: Extensive industrial implementation experience, integrated supply chain for sorbent manufacturing, and proprietary regeneration processes with lower energy penalties. Weaknesses: Higher initial capital costs compared to conventional technologies, and potential challenges with sorbent degradation in the presence of SOx and NOx contaminants in industrial flue gas streams.

Climeworks AG

Technical Solution: Climeworks has developed a groundbreaking direct air capture (DAC) technology utilizing specialized solid sorbents to extract CO2 directly from ambient air. Their proprietary amine-functionalized filter materials are engineered to selectively bind with CO2 molecules even at the extremely low atmospheric concentrations (approximately 415 ppm). The company's modular collectors feature optimized air flow patterns that maximize contact between air and sorbent surfaces while minimizing pressure drop and energy consumption. Climeworks' sorbents demonstrate remarkable durability, maintaining performance through thousands of adsorption-desorption cycles under varying humidity and temperature conditions. Their regeneration process operates at relatively low temperatures (80-100°C), allowing the use of waste heat or renewable energy sources. Climeworks has progressed beyond laboratory scale to commercial deployment with multiple operational facilities, including their Orca plant in Iceland which captures 4,000 tons of CO2 annually. Their qualification standards include rigorous life-cycle assessment and environmental impact analysis to ensure compliance with international standards. The captured CO2 meets purity specifications for various applications including carbonation of beverages, greenhouse enrichment, and most importantly, permanent geological storage when combined with mineralization processes as demonstrated in their Icelandic operations.

Strengths: Proven commercial-scale implementation, modular and scalable technology design, and ability to achieve negative emissions when powered by renewable energy. Weaknesses: Higher energy requirements per ton of CO2 captured compared to point-source capture technologies, and current high cost structure (estimated at $600-800 per ton of CO2) limiting widespread adoption without policy support.

Key Patents and Technical Innovations in Sorbent Design

Highly attrition resistant and dry regenerable sorbents for carbon dioxide capture

PatentInactiveUS8110523B2

Innovation

- A dry regenerable sorbent is developed using a method that mixes active components, supports, and inorganic binders to create a slurry, which is then spray-dried to produce sorbent particles with optimized shape, size, and mechanical strength, allowing for efficient CO2 capture and regeneration at lower temperatures.

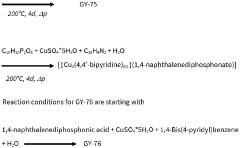

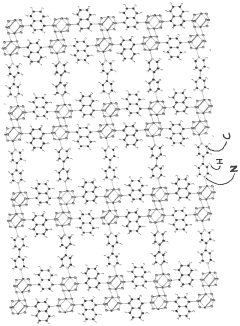

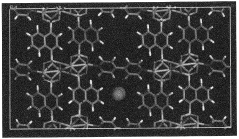

Solid sorbents for capturing co 2

PatentWO2023232666A1

Innovation

- Development of phosphonate and organoarsonate MOFs with specific molecular formulas, such as [{M2(4,4’-bipyridine)0.5}(l,4-naphthalenediphosphonate)] and [{M2(4,4’-bipyridine)0.5}(l,4-naphthalenediarsonate)], which maintain selectivity and stability under harsh conditions, including high humidity and temperatures up to 360°C, by creating a hydrophobic environment that favors CO2 physisorption over H2O.

Regulatory Framework and Compliance Requirements

The regulatory landscape for solid sorbents in CO2 capture technologies is complex and evolving rapidly as governments worldwide implement increasingly stringent emissions standards. Currently, the primary regulatory frameworks governing these technologies include the Clean Air Act in the United States, the EU Emissions Trading System, and various national carbon pricing mechanisms. These regulations establish baseline requirements for emissions reduction technologies, including performance standards, safety protocols, and environmental impact assessments.

For solid sorbent technologies to achieve industrial qualification, they must meet specific technical standards developed by organizations such as ISO, ASTM International, and the International Energy Agency. Standard ISO 14034 for Environmental Technology Verification (ETV) provides a framework for validating the performance claims of innovative environmental technologies, including CO2 capture solutions. Additionally, ASTM D6646 outlines standard test methods for carbon dioxide sorption by solid materials.

Compliance requirements typically include demonstration of capture efficiency (generally requiring >85% CO2 removal), operational stability over extended periods (minimum 5,000-10,000 hours), and minimal degradation rates (<1% capacity loss per 100 cycles). Sorbent materials must also meet stringent safety classifications under regulations such as REACH in Europe and TSCA in the United States, particularly regarding potential toxicity, flammability, and environmental persistence.

The qualification process for industrial deployment involves multiple stages of testing and certification. Laboratory validation must be followed by pilot-scale demonstrations (typically 0.5-5 MWe) and subsequently larger demonstration projects (20-50 MWe) before full commercial implementation. Each stage requires comprehensive data collection on performance metrics, including energy penalties, sorbent lifetime, regeneration requirements, and operational costs.

Emerging regulatory trends indicate a shift toward lifecycle assessment requirements, where sorbent materials must demonstrate favorable environmental profiles across their entire lifecycle, from raw material extraction through disposal or recycling. This includes considerations of embodied carbon, water usage, and potential for secondary environmental impacts such as leaching of hazardous substances.

Regulatory compliance also increasingly demands standardized reporting protocols for monitoring, reporting, and verification (MRV) of captured CO2. These protocols must align with carbon accounting frameworks to enable integration with carbon markets and tax incentives, which are becoming critical economic drivers for CO2 capture technology deployment in industrial settings.

For solid sorbent technologies to achieve industrial qualification, they must meet specific technical standards developed by organizations such as ISO, ASTM International, and the International Energy Agency. Standard ISO 14034 for Environmental Technology Verification (ETV) provides a framework for validating the performance claims of innovative environmental technologies, including CO2 capture solutions. Additionally, ASTM D6646 outlines standard test methods for carbon dioxide sorption by solid materials.

Compliance requirements typically include demonstration of capture efficiency (generally requiring >85% CO2 removal), operational stability over extended periods (minimum 5,000-10,000 hours), and minimal degradation rates (<1% capacity loss per 100 cycles). Sorbent materials must also meet stringent safety classifications under regulations such as REACH in Europe and TSCA in the United States, particularly regarding potential toxicity, flammability, and environmental persistence.

The qualification process for industrial deployment involves multiple stages of testing and certification. Laboratory validation must be followed by pilot-scale demonstrations (typically 0.5-5 MWe) and subsequently larger demonstration projects (20-50 MWe) before full commercial implementation. Each stage requires comprehensive data collection on performance metrics, including energy penalties, sorbent lifetime, regeneration requirements, and operational costs.

Emerging regulatory trends indicate a shift toward lifecycle assessment requirements, where sorbent materials must demonstrate favorable environmental profiles across their entire lifecycle, from raw material extraction through disposal or recycling. This includes considerations of embodied carbon, water usage, and potential for secondary environmental impacts such as leaching of hazardous substances.

Regulatory compliance also increasingly demands standardized reporting protocols for monitoring, reporting, and verification (MRV) of captured CO2. These protocols must align with carbon accounting frameworks to enable integration with carbon markets and tax incentives, which are becoming critical economic drivers for CO2 capture technology deployment in industrial settings.

Techno-Economic Assessment of Solid Sorbent Technologies

The techno-economic assessment of solid sorbent technologies for CO2 capture reveals significant potential for cost reduction compared to conventional amine-based absorption processes. Current economic analyses indicate that solid sorbents could reduce the energy penalty of carbon capture by 30-40%, translating to potential cost savings of $15-25 per ton of CO2 captured when implemented at industrial scale.

Capital expenditure for solid sorbent systems varies considerably based on sorbent material selection, with metal-organic frameworks (MOFs) and zeolites representing higher initial investment but potentially lower long-term operational costs. Preliminary estimates suggest installation costs ranging from $40-70 million for a medium-sized industrial facility capturing 500,000 tons of CO2 annually, with economies of scale significantly improving economics for larger implementations.

Operational expenditure is dominated by sorbent replacement costs and energy requirements for regeneration. Advanced materials like functionalized silica and activated carbon demonstrate promising durability with replacement intervals of 2-5 years under industrial conditions, while novel porous polymer networks show potential for extending this to 5-7 years, substantially improving lifetime economics.

Energy consumption analysis indicates that temperature swing adsorption (TSA) systems utilizing solid sorbents require 2.0-2.8 GJ/ton CO2, compared to 3.5-4.2 GJ/ton for conventional amine systems. This represents a significant efficiency improvement, though actual performance remains dependent on integration with existing industrial processes and heat recovery systems.

Sensitivity analysis reveals that economic viability is most influenced by sorbent capacity, regeneration energy requirements, and material lifetime. A 10% improvement in sorbent CO2 capacity can translate to approximately 7-9% reduction in overall capture costs, highlighting the importance of continued materials development.

Market deployment scenarios suggest that with current technological trajectories, solid sorbent systems could achieve commercial competitiveness by 2025-2027 for selected industrial applications, particularly in cement and steel production where high CO2 concentrations improve capture economics. Full market penetration across diverse industrial sectors would likely require carbon prices exceeding $50-60 per ton to ensure economic viability without additional policy support.

Return on investment calculations indicate payback periods of 7-12 years under current carbon pricing schemes, though this could improve to 4-6 years with anticipated technological improvements and more stringent emissions regulations expected in the coming decade.

Capital expenditure for solid sorbent systems varies considerably based on sorbent material selection, with metal-organic frameworks (MOFs) and zeolites representing higher initial investment but potentially lower long-term operational costs. Preliminary estimates suggest installation costs ranging from $40-70 million for a medium-sized industrial facility capturing 500,000 tons of CO2 annually, with economies of scale significantly improving economics for larger implementations.

Operational expenditure is dominated by sorbent replacement costs and energy requirements for regeneration. Advanced materials like functionalized silica and activated carbon demonstrate promising durability with replacement intervals of 2-5 years under industrial conditions, while novel porous polymer networks show potential for extending this to 5-7 years, substantially improving lifetime economics.

Energy consumption analysis indicates that temperature swing adsorption (TSA) systems utilizing solid sorbents require 2.0-2.8 GJ/ton CO2, compared to 3.5-4.2 GJ/ton for conventional amine systems. This represents a significant efficiency improvement, though actual performance remains dependent on integration with existing industrial processes and heat recovery systems.

Sensitivity analysis reveals that economic viability is most influenced by sorbent capacity, regeneration energy requirements, and material lifetime. A 10% improvement in sorbent CO2 capacity can translate to approximately 7-9% reduction in overall capture costs, highlighting the importance of continued materials development.

Market deployment scenarios suggest that with current technological trajectories, solid sorbent systems could achieve commercial competitiveness by 2025-2027 for selected industrial applications, particularly in cement and steel production where high CO2 concentrations improve capture economics. Full market penetration across diverse industrial sectors would likely require carbon prices exceeding $50-60 per ton to ensure economic viability without additional policy support.

Return on investment calculations indicate payback periods of 7-12 years under current carbon pricing schemes, though this could improve to 4-6 years with anticipated technological improvements and more stringent emissions regulations expected in the coming decade.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!