Solid sorbents for CO2 capture standards and regulatory compliance for global industrial use

SEP 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO2 Capture Technology Evolution and Objectives

Carbon dioxide capture technologies have evolved significantly over the past several decades, transitioning from theoretical concepts to practical industrial applications. The journey began in the 1970s with basic absorption processes using liquid amines, primarily developed for natural gas sweetening operations. By the 1990s, these technologies gained renewed attention as climate change concerns escalated, prompting research into more efficient and cost-effective capture methods.

The evolution of solid sorbents represents a critical advancement in this technological progression. Early materials like activated carbon and zeolites demonstrated limited CO2 selectivity and capacity. The 2000s witnessed the emergence of metal-organic frameworks (MOFs), offering unprecedented surface areas and tunable pore structures. Concurrently, amine-functionalized silica materials combined the selectivity of amines with the stability advantages of solid supports.

Recent developments have focused on novel materials including porous polymers, carbon-based sorbents, and hybrid systems that integrate multiple capture mechanisms. These innovations aim to address the persistent challenges of energy requirements, material stability, and operational costs that have historically limited widespread implementation of carbon capture technologies.

The primary objectives for solid sorbent development center on achieving specific performance benchmarks essential for industrial viability. These include CO2 capture capacity exceeding 3 mmol/g under relevant conditions, selectivity factors above 100 for CO2 over N2, and regeneration energy requirements below 2.0 GJ/ton CO2. Additionally, materials must maintain performance over thousands of adsorption-desorption cycles while withstanding contaminants present in industrial gas streams.

From a regulatory perspective, the technology aims to enable compliance with increasingly stringent emission standards across different jurisdictions. The European Union's Industrial Emissions Directive, the United States EPA's Clean Air Act regulations, and similar frameworks in Asia establish varying requirements that drive technology development targets. The Paris Agreement's commitment to limiting global warming further emphasizes the need for scalable, efficient capture solutions.

Long-term objectives include developing materials that can achieve negative emissions when integrated with bioenergy systems (BECCS) and direct air capture applications. The technology roadmap envisions progressively reducing capture costs from current levels of $40-80 per ton CO2 to below $30 by 2030 and potentially under $20 by 2040, making carbon capture economically viable across diverse industrial sectors without significant subsidies.

The evolution of solid sorbents represents a critical advancement in this technological progression. Early materials like activated carbon and zeolites demonstrated limited CO2 selectivity and capacity. The 2000s witnessed the emergence of metal-organic frameworks (MOFs), offering unprecedented surface areas and tunable pore structures. Concurrently, amine-functionalized silica materials combined the selectivity of amines with the stability advantages of solid supports.

Recent developments have focused on novel materials including porous polymers, carbon-based sorbents, and hybrid systems that integrate multiple capture mechanisms. These innovations aim to address the persistent challenges of energy requirements, material stability, and operational costs that have historically limited widespread implementation of carbon capture technologies.

The primary objectives for solid sorbent development center on achieving specific performance benchmarks essential for industrial viability. These include CO2 capture capacity exceeding 3 mmol/g under relevant conditions, selectivity factors above 100 for CO2 over N2, and regeneration energy requirements below 2.0 GJ/ton CO2. Additionally, materials must maintain performance over thousands of adsorption-desorption cycles while withstanding contaminants present in industrial gas streams.

From a regulatory perspective, the technology aims to enable compliance with increasingly stringent emission standards across different jurisdictions. The European Union's Industrial Emissions Directive, the United States EPA's Clean Air Act regulations, and similar frameworks in Asia establish varying requirements that drive technology development targets. The Paris Agreement's commitment to limiting global warming further emphasizes the need for scalable, efficient capture solutions.

Long-term objectives include developing materials that can achieve negative emissions when integrated with bioenergy systems (BECCS) and direct air capture applications. The technology roadmap envisions progressively reducing capture costs from current levels of $40-80 per ton CO2 to below $30 by 2030 and potentially under $20 by 2040, making carbon capture economically viable across diverse industrial sectors without significant subsidies.

Global Market Analysis for Industrial CO2 Capture Solutions

The global market for industrial CO2 capture solutions has experienced significant growth in recent years, driven by increasing environmental regulations and corporate sustainability commitments. The market was valued at approximately $2.5 billion in 2022 and is projected to reach $7.3 billion by 2030, representing a compound annual growth rate of 14.2% during the forecast period.

North America currently dominates the market with about 35% share, led by the United States where tax incentives like the 45Q credit have stimulated investment in carbon capture technologies. The European market accounts for roughly 30% of global demand, with stringent EU Emissions Trading System (ETS) regulations driving adoption across industrial sectors. The Asia-Pacific region, particularly China and Japan, represents the fastest-growing market segment with projected growth rates exceeding 16% annually through 2030.

By industry vertical, power generation constitutes the largest application segment (40%), followed by cement production (22%), chemical manufacturing (18%), and steel production (15%). These carbon-intensive industries face mounting pressure to reduce emissions while maintaining operational efficiency, creating substantial demand for effective capture solutions.

Solid sorbent technologies are gaining significant market traction, with their segment expected to grow at 17.8% annually, outpacing traditional solvent-based systems. This growth is attributed to their lower energy requirements, reduced environmental impact, and versatility across different industrial applications. Metal-organic frameworks (MOFs) and amine-functionalized sorbents are emerging as particularly promising subcategories within this space.

Market dynamics are increasingly influenced by regulatory frameworks that vary significantly by region. The EU's Carbon Border Adjustment Mechanism (CBAM) is reshaping international trade considerations, while China's national emissions trading scheme is driving domestic demand. In the United States, the Inflation Reduction Act has allocated over $12 billion specifically for carbon capture initiatives, creating substantial market opportunities.

Customer adoption patterns reveal a preference for turnkey solutions that integrate seamlessly with existing industrial processes. Price sensitivity remains high, with cost per ton of CO2 captured being the primary decision factor for most industrial buyers. Current market prices range from $40-100 per ton depending on technology maturity and application scale, with solid sorbent solutions increasingly competitive at the lower end of this range.

North America currently dominates the market with about 35% share, led by the United States where tax incentives like the 45Q credit have stimulated investment in carbon capture technologies. The European market accounts for roughly 30% of global demand, with stringent EU Emissions Trading System (ETS) regulations driving adoption across industrial sectors. The Asia-Pacific region, particularly China and Japan, represents the fastest-growing market segment with projected growth rates exceeding 16% annually through 2030.

By industry vertical, power generation constitutes the largest application segment (40%), followed by cement production (22%), chemical manufacturing (18%), and steel production (15%). These carbon-intensive industries face mounting pressure to reduce emissions while maintaining operational efficiency, creating substantial demand for effective capture solutions.

Solid sorbent technologies are gaining significant market traction, with their segment expected to grow at 17.8% annually, outpacing traditional solvent-based systems. This growth is attributed to their lower energy requirements, reduced environmental impact, and versatility across different industrial applications. Metal-organic frameworks (MOFs) and amine-functionalized sorbents are emerging as particularly promising subcategories within this space.

Market dynamics are increasingly influenced by regulatory frameworks that vary significantly by region. The EU's Carbon Border Adjustment Mechanism (CBAM) is reshaping international trade considerations, while China's national emissions trading scheme is driving domestic demand. In the United States, the Inflation Reduction Act has allocated over $12 billion specifically for carbon capture initiatives, creating substantial market opportunities.

Customer adoption patterns reveal a preference for turnkey solutions that integrate seamlessly with existing industrial processes. Price sensitivity remains high, with cost per ton of CO2 captured being the primary decision factor for most industrial buyers. Current market prices range from $40-100 per ton depending on technology maturity and application scale, with solid sorbent solutions increasingly competitive at the lower end of this range.

Solid Sorbents Technology Status and Barriers

The current global landscape of solid sorbents for CO2 capture reveals significant technological advancements alongside persistent challenges. Leading research institutions and industrial entities have developed various classes of solid sorbents including metal-organic frameworks (MOFs), zeolites, activated carbons, and amine-functionalized materials. These materials demonstrate promising CO2 capture capacities under laboratory conditions, with some MOFs achieving theoretical capacities exceeding 300 mg CO2/g sorbent. However, the translation of these laboratory successes to industrial-scale applications remains limited.

A primary barrier to widespread implementation is the durability issue. Most advanced sorbents experience significant degradation after multiple adsorption-desorption cycles, with performance decreases of 15-30% observed after just 100 cycles in industrial environments. This degradation substantially impacts the economic viability of these technologies, as frequent sorbent replacement increases operational costs beyond acceptable thresholds for many industries.

Scalability presents another significant challenge. While laboratory synthesis can produce high-quality sorbents with consistent properties, industrial-scale production often results in materials with reduced performance and inconsistent characteristics. Current manufacturing techniques struggle to maintain nanopore uniformity and functional group distribution at scale, resulting in capture efficiency reductions of up to 40% compared to laboratory samples.

Energy requirements for regeneration remain prohibitively high for many solid sorbents. The most efficient systems currently require 2.5-3.5 GJ/tonne CO2 captured, whereas economic viability for widespread adoption necessitates reducing this to below 2.0 GJ/tonne. This energy penalty significantly impacts the overall carbon footprint of the capture process, sometimes negating the environmental benefits in energy-intensive industries.

Regulatory frameworks present additional complexities. The absence of standardized testing protocols for solid sorbents creates uncertainty in performance verification across different operational conditions. Current standards primarily address liquid-based capture systems, leaving a regulatory gap for solid sorbent technologies. This lack of standardization impedes international certification and compliance, particularly challenging for multinational corporations seeking consistent implementation across global operations.

Cost remains perhaps the most significant barrier. Current production costs for advanced solid sorbents range from $50-200/kg, whereas widespread industrial adoption would require costs below $20/kg. The economic equation is further complicated by uncertain carbon pricing mechanisms globally, making return-on-investment calculations difficult for potential adopters and limiting capital investment in this technology sector.

A primary barrier to widespread implementation is the durability issue. Most advanced sorbents experience significant degradation after multiple adsorption-desorption cycles, with performance decreases of 15-30% observed after just 100 cycles in industrial environments. This degradation substantially impacts the economic viability of these technologies, as frequent sorbent replacement increases operational costs beyond acceptable thresholds for many industries.

Scalability presents another significant challenge. While laboratory synthesis can produce high-quality sorbents with consistent properties, industrial-scale production often results in materials with reduced performance and inconsistent characteristics. Current manufacturing techniques struggle to maintain nanopore uniformity and functional group distribution at scale, resulting in capture efficiency reductions of up to 40% compared to laboratory samples.

Energy requirements for regeneration remain prohibitively high for many solid sorbents. The most efficient systems currently require 2.5-3.5 GJ/tonne CO2 captured, whereas economic viability for widespread adoption necessitates reducing this to below 2.0 GJ/tonne. This energy penalty significantly impacts the overall carbon footprint of the capture process, sometimes negating the environmental benefits in energy-intensive industries.

Regulatory frameworks present additional complexities. The absence of standardized testing protocols for solid sorbents creates uncertainty in performance verification across different operational conditions. Current standards primarily address liquid-based capture systems, leaving a regulatory gap for solid sorbent technologies. This lack of standardization impedes international certification and compliance, particularly challenging for multinational corporations seeking consistent implementation across global operations.

Cost remains perhaps the most significant barrier. Current production costs for advanced solid sorbents range from $50-200/kg, whereas widespread industrial adoption would require costs below $20/kg. The economic equation is further complicated by uncertain carbon pricing mechanisms globally, making return-on-investment calculations difficult for potential adopters and limiting capital investment in this technology sector.

Current Solid Sorbent Solutions and Implementation

01 Regulatory compliance for CO2 capture technologies

Solid sorbents used for CO2 capture must comply with various regulatory standards and frameworks. These regulations ensure that the capture technologies meet environmental safety requirements, emission reduction targets, and operational guidelines. Compliance involves certification processes, reporting mechanisms, and adherence to international agreements on carbon capture and storage. Companies must navigate these regulatory landscapes to successfully implement CO2 capture solutions.- Regulatory compliance frameworks for CO2 capture technologies: Various regulatory frameworks govern the implementation of CO2 capture technologies using solid sorbents. These regulations establish standards for emissions reduction, monitoring requirements, and verification protocols. Compliance with these frameworks is essential for the deployment of carbon capture systems in industrial settings and ensures that the technologies meet environmental protection goals while maintaining operational safety.

- Performance standards for solid sorbent materials: Specific performance standards have been developed for solid sorbent materials used in CO2 capture. These standards address criteria such as adsorption capacity, selectivity, regeneration efficiency, and operational stability under various conditions. Materials must meet these performance benchmarks to be considered viable for commercial carbon capture applications, ensuring consistent and reliable CO2 removal across different industrial environments.

- Testing and certification protocols for CO2 capture systems: Standardized testing and certification protocols have been established to validate the performance of solid sorbent-based CO2 capture systems. These protocols include methodologies for measuring capture efficiency, energy consumption, and operational reliability. Certification processes ensure that carbon capture technologies meet industry standards and regulatory requirements before deployment at commercial scale, providing confidence to stakeholders regarding system performance.

- Environmental impact assessment requirements: Environmental impact assessment requirements for solid sorbent CO2 capture technologies address the lifecycle environmental footprint of these systems. These assessments evaluate factors such as resource consumption, waste generation, and potential environmental hazards associated with sorbent materials. Regulatory frameworks require comprehensive analysis of environmental impacts before permitting the deployment of carbon capture systems, ensuring sustainable implementation of these technologies.

- International standards harmonization for carbon capture: Efforts to harmonize international standards for solid sorbent CO2 capture technologies aim to create consistent global frameworks for implementation and compliance. These initiatives facilitate technology transfer, market development, and cross-border deployment of carbon capture systems. Harmonized standards address technical specifications, safety requirements, and performance metrics, enabling more efficient global scaling of carbon capture technologies while ensuring consistent quality and safety across different jurisdictions.

02 Material standards for solid sorbents

Specific material standards govern the composition, structure, and performance of solid sorbents used in CO2 capture. These standards define acceptable purity levels, particle size distributions, mechanical strength, and chemical stability requirements. Standardized testing protocols are established to evaluate adsorption capacity, selectivity, regeneration efficiency, and cyclic stability of sorbents. Adherence to these material standards ensures consistent performance and reliability of CO2 capture systems across different applications.Expand Specific Solutions03 Environmental impact assessment and certification

Solid sorbents for CO2 capture undergo rigorous environmental impact assessments to evaluate their lifecycle sustainability. This includes analysis of raw material sourcing, manufacturing processes, operational energy requirements, and end-of-life disposal. Certification systems verify that sorbents meet environmental performance criteria and do not create secondary pollution issues. These assessments help quantify the net environmental benefit of implementing specific sorbent technologies and ensure they contribute positively to climate change mitigation efforts.Expand Specific Solutions04 Performance monitoring and reporting requirements

Regulatory frameworks mandate specific monitoring and reporting protocols for CO2 capture systems using solid sorbents. These requirements include continuous measurement of capture efficiency, energy consumption, and emissions data. Operators must implement quality assurance systems, maintain detailed operational records, and submit periodic performance reports to regulatory authorities. Advanced monitoring technologies and standardized reporting formats facilitate compliance with these requirements and enable verification of carbon reduction claims.Expand Specific Solutions05 International standards harmonization for global deployment

As CO2 capture technologies are deployed globally, efforts are underway to harmonize international standards for solid sorbents. These initiatives aim to establish consistent performance metrics, testing methodologies, and certification processes across different jurisdictions. International collaboration facilitates technology transfer, reduces market barriers, and enables comparable assessment of different sorbent technologies. Harmonized standards support the development of global carbon markets and cross-border implementation of carbon capture projects.Expand Specific Solutions

Industry Leaders in Solid Sorbent Technology

The solid sorbents for CO2 capture market is in a growth phase, with increasing regulatory focus on carbon emissions driving adoption. The global market size is expanding rapidly due to industrial decarbonization initiatives, particularly in energy and petrochemical sectors. Technologically, the field shows varying maturity levels across different sorbent types. Leading players include established energy corporations like Sinopec Group and Korea Electric Power Corp, which are leveraging their industrial infrastructure for large-scale implementation. Research institutions such as University of Southern California and Rice University are advancing fundamental technologies, while specialized companies like Carboncapture, Inc. and Global Thermostat are developing innovative commercial solutions. Chemical manufacturers including BASF and Wacker Chemie provide essential materials expertise, creating a competitive ecosystem balancing established industrial players with emerging technology providers.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced metal-organic frameworks (MOFs) and amine-functionalized mesoporous silica materials for CO2 capture. Their proprietary technology includes a two-stage temperature swing adsorption (TSA) process that achieves over 90% capture efficiency while reducing energy penalties by approximately 30% compared to conventional liquid amine scrubbing. Sinopec has implemented these solid sorbents in pilot projects across multiple refineries in China, demonstrating scalability from 10 tons/day to 100 tons/day CO2 capture capacity. Their regulatory compliance framework includes comprehensive life cycle assessment protocols that meet both Chinese national standards and international ISO guidelines for carbon capture technologies.

Strengths: Extensive industrial implementation experience; integrated approach combining material development with process engineering; strong domestic regulatory compliance expertise. Weaknesses: International certification processes still in development; higher initial capital costs compared to conventional technologies; regeneration energy requirements still need optimization for certain industrial applications.

BASF Corp.

Technical Solution: BASF has pioneered the development of metal-organic frameworks (MOFs) and zeolitic imidazolate frameworks (ZIFs) specifically engineered for industrial CO2 capture applications. Their proprietary OASE® blue technology integrates advanced solid sorbents with optimized process design, achieving capture rates exceeding 95% while reducing energy consumption by up to 40% compared to conventional amine scrubbing. BASF's solid sorbents feature enhanced stability under industrial flue gas conditions, withstanding contaminants like SOx and NOx while maintaining performance over thousands of adsorption-desorption cycles. The company has established a comprehensive regulatory compliance framework that aligns with EU Emissions Trading System requirements, ISO 14064 standards, and the Greenhouse Gas Protocol, ensuring their technologies meet global certification requirements across different jurisdictions.

Strengths: Industry-leading material stability and longevity; comprehensive regulatory compliance packages tailored to different global markets; extensive commercial-scale implementation experience. Weaknesses: Higher initial capital investment compared to conventional technologies; requires specialized technical expertise for implementation; performance can be affected by extreme humidity conditions in certain industrial environments.

Key Patents and Research in CO2 Capture Materials

Solid sorbents for capturing co 2

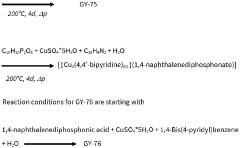

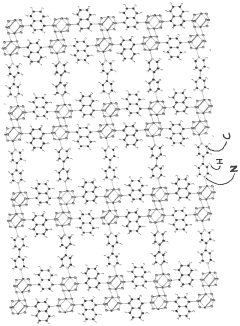

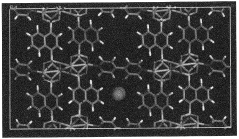

PatentWO2023232666A1

Innovation

- Development of phosphonate and organoarsonate MOFs with specific molecular formulas, such as [{M2(4,4’-bipyridine)0.5}(l,4-naphthalenediphosphonate)] and [{M2(4,4’-bipyridine)0.5}(l,4-naphthalenediarsonate)], which maintain selectivity and stability under harsh conditions, including high humidity and temperatures up to 360°C, by creating a hydrophobic environment that favors CO2 physisorption over H2O.

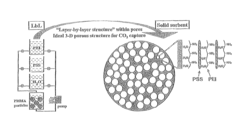

Layered solid sorbents for carbon dioxide capture

PatentActiveUS8889589B2

Innovation

- Development of nano-layered solid sorbents using electrostatic layer-by-layer nanoassembly, where positively charged polyethylenimine and negatively charged polystyrene sulfonate layers are alternately deposited on a porous substrate, enhancing CO2 capture and transport kinetics.

International Regulatory Framework for Carbon Capture

The global regulatory landscape for carbon capture technologies, particularly those utilizing solid sorbents, has evolved significantly in recent years as nations strive to meet climate commitments. The Paris Agreement serves as the cornerstone of international climate policy, establishing the framework within which carbon capture regulations operate. Under this agreement, countries have developed Nationally Determined Contributions (NDCs) that often include provisions for carbon capture deployment and standards.

The European Union leads with its comprehensive regulatory framework through the EU Emissions Trading System (EU ETS) and the Carbon Border Adjustment Mechanism (CBAM). These mechanisms establish clear standards for CO2 capture efficiency and monitoring requirements that solid sorbent technologies must meet. The EU Innovation Fund specifically supports novel carbon capture technologies, including advanced solid sorbent development.

In North America, the United States has implemented the 45Q tax credit system, providing significant financial incentives for carbon capture projects that meet specific performance standards. The EPA's Clean Air Act regulations further establish guidelines for emissions control that indirectly affect sorbent technology requirements. Canada's federal carbon pricing system and Clean Fuel Standard similarly create regulatory drivers for carbon capture implementation.

The Asia-Pacific region demonstrates varying regulatory approaches. China's national emissions trading scheme, launched in 2021, is gradually incorporating carbon capture requirements. Japan's Green Innovation Fund supports carbon capture technologies that meet stringent efficiency standards, while Australia's Emissions Reduction Fund provides credits for verified carbon capture projects.

International standards organizations play a crucial role in harmonizing technical requirements. ISO/TC 265 has developed standards specifically for carbon capture technologies, including ISO 27919 for performance evaluation of post-combustion CO2 capture systems. These standards establish testing protocols and performance metrics that solid sorbent technologies must satisfy for international certification.

Regulatory compliance challenges for solid sorbent technologies include varying efficiency requirements across jurisdictions, differing monitoring and reporting protocols, and inconsistent life cycle assessment methodologies. The International Energy Agency (IEA) and Global CCS Institute are working to address these challenges through harmonization initiatives and best practice guidelines for regulatory frameworks.

Emerging regulatory trends indicate movement toward performance-based standards rather than technology-specific requirements, allowing innovative solid sorbent solutions to compete based on efficiency and cost-effectiveness rather than conforming to prescriptive technical specifications.

The European Union leads with its comprehensive regulatory framework through the EU Emissions Trading System (EU ETS) and the Carbon Border Adjustment Mechanism (CBAM). These mechanisms establish clear standards for CO2 capture efficiency and monitoring requirements that solid sorbent technologies must meet. The EU Innovation Fund specifically supports novel carbon capture technologies, including advanced solid sorbent development.

In North America, the United States has implemented the 45Q tax credit system, providing significant financial incentives for carbon capture projects that meet specific performance standards. The EPA's Clean Air Act regulations further establish guidelines for emissions control that indirectly affect sorbent technology requirements. Canada's federal carbon pricing system and Clean Fuel Standard similarly create regulatory drivers for carbon capture implementation.

The Asia-Pacific region demonstrates varying regulatory approaches. China's national emissions trading scheme, launched in 2021, is gradually incorporating carbon capture requirements. Japan's Green Innovation Fund supports carbon capture technologies that meet stringent efficiency standards, while Australia's Emissions Reduction Fund provides credits for verified carbon capture projects.

International standards organizations play a crucial role in harmonizing technical requirements. ISO/TC 265 has developed standards specifically for carbon capture technologies, including ISO 27919 for performance evaluation of post-combustion CO2 capture systems. These standards establish testing protocols and performance metrics that solid sorbent technologies must satisfy for international certification.

Regulatory compliance challenges for solid sorbent technologies include varying efficiency requirements across jurisdictions, differing monitoring and reporting protocols, and inconsistent life cycle assessment methodologies. The International Energy Agency (IEA) and Global CCS Institute are working to address these challenges through harmonization initiatives and best practice guidelines for regulatory frameworks.

Emerging regulatory trends indicate movement toward performance-based standards rather than technology-specific requirements, allowing innovative solid sorbent solutions to compete based on efficiency and cost-effectiveness rather than conforming to prescriptive technical specifications.

Environmental Impact Assessment of Sorbent Technologies

The environmental impact assessment of solid sorbent technologies for CO2 capture reveals both significant benefits and potential concerns that must be addressed through comprehensive lifecycle analysis. These technologies demonstrate considerable advantages over traditional amine-based liquid absorption methods, particularly in terms of reduced energy consumption and associated greenhouse gas emissions. Studies indicate that solid sorbents can achieve 20-40% lower energy penalties during regeneration processes, translating to substantial reductions in indirect CO2 emissions from power generation.

Water consumption represents another critical environmental parameter where solid sorbents excel. Unlike conventional wet scrubbing technologies that require substantial water resources for operation, most solid sorbent systems operate under relatively dry conditions, potentially reducing water usage by 70-85% in comparable capture scenarios. This advantage becomes particularly significant in water-stressed regions where industrial carbon capture deployment faces additional sustainability challenges.

However, the environmental profile of sorbent technologies extends beyond operational impacts to include raw material extraction, manufacturing processes, and end-of-life considerations. The production of advanced materials such as metal-organic frameworks (MOFs), zeolites, and functionalized porous carbons often involves energy-intensive synthesis routes and potentially hazardous chemical precursors. Recent lifecycle assessments have identified hotspots in manufacturing chains where environmental burdens may partially offset operational benefits if not properly managed.

Waste management and material degradation present additional environmental challenges. Most solid sorbents experience performance deterioration over multiple capture-regeneration cycles, necessitating periodic replacement. The disposal or recycling pathways for spent sorbents remain underdeveloped in current regulatory frameworks, creating potential environmental liabilities. Particularly concerning are novel nanomaterials whose environmental fate and ecotoxicological profiles remain incompletely characterized.

Land use impacts vary significantly between sorbent technologies, with some requiring substantial spatial footprints for effective implementation at industrial scales. This consideration becomes especially relevant when retrofitting existing facilities with space constraints or when planning greenfield installations in environmentally sensitive areas. Comparative spatial efficiency metrics indicate that advanced structured sorbents may offer 30-50% reductions in land requirements compared to conventional approaches.

Regulatory frameworks increasingly demand comprehensive environmental impact assessments that address these multifaceted considerations. The EU's Environmental Impact Assessment Directive and similar regulations in other jurisdictions now specifically reference carbon capture technologies, requiring detailed evaluation of environmental consequences beyond simple carbon accounting. Industry leaders are responding by developing standardized environmental performance metrics that facilitate transparent comparison between competing sorbent technologies.

Water consumption represents another critical environmental parameter where solid sorbents excel. Unlike conventional wet scrubbing technologies that require substantial water resources for operation, most solid sorbent systems operate under relatively dry conditions, potentially reducing water usage by 70-85% in comparable capture scenarios. This advantage becomes particularly significant in water-stressed regions where industrial carbon capture deployment faces additional sustainability challenges.

However, the environmental profile of sorbent technologies extends beyond operational impacts to include raw material extraction, manufacturing processes, and end-of-life considerations. The production of advanced materials such as metal-organic frameworks (MOFs), zeolites, and functionalized porous carbons often involves energy-intensive synthesis routes and potentially hazardous chemical precursors. Recent lifecycle assessments have identified hotspots in manufacturing chains where environmental burdens may partially offset operational benefits if not properly managed.

Waste management and material degradation present additional environmental challenges. Most solid sorbents experience performance deterioration over multiple capture-regeneration cycles, necessitating periodic replacement. The disposal or recycling pathways for spent sorbents remain underdeveloped in current regulatory frameworks, creating potential environmental liabilities. Particularly concerning are novel nanomaterials whose environmental fate and ecotoxicological profiles remain incompletely characterized.

Land use impacts vary significantly between sorbent technologies, with some requiring substantial spatial footprints for effective implementation at industrial scales. This consideration becomes especially relevant when retrofitting existing facilities with space constraints or when planning greenfield installations in environmentally sensitive areas. Comparative spatial efficiency metrics indicate that advanced structured sorbents may offer 30-50% reductions in land requirements compared to conventional approaches.

Regulatory frameworks increasingly demand comprehensive environmental impact assessments that address these multifaceted considerations. The EU's Environmental Impact Assessment Directive and similar regulations in other jurisdictions now specifically reference carbon capture technologies, requiring detailed evaluation of environmental consequences beyond simple carbon accounting. Industry leaders are responding by developing standardized environmental performance metrics that facilitate transparent comparison between competing sorbent technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!