Solid sorbents for CO2 capture for grid storage and industrial emission control applications

SEP 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO2 Capture Technology Background and Objectives

Carbon dioxide (CO2) capture technology has evolved significantly over the past decades, driven by the urgent need to mitigate climate change and reduce greenhouse gas emissions. The development trajectory began with conventional absorption methods using liquid amines in the 1930s, primarily for natural gas sweetening. By the 1990s, these technologies were adapted for power plant emissions control, marking the first generation of industrial CO2 capture solutions.

The technological evolution has accelerated in the 21st century with the emergence of solid sorbents as a promising alternative to liquid-based systems. These materials offer advantages including lower regeneration energy requirements, reduced corrosion issues, and greater operational flexibility. The progression from zeolites and activated carbons to metal-organic frameworks (MOFs) and amine-functionalized silica represents significant milestones in this technological journey.

Current research trends indicate a shift toward multifunctional sorbent materials that can operate effectively across varying temperature and pressure conditions. The integration of CO2 capture systems with energy storage mechanisms represents a particularly innovative direction, addressing both emission reduction and grid stability challenges simultaneously. This convergence of environmental and energy technologies reflects the growing recognition of climate-energy nexus solutions.

The primary technical objectives for solid sorbent CO2 capture systems encompass several dimensions. First, achieving high CO2 selectivity and capacity under realistic flue gas conditions remains paramount. Second, developing materials with rapid adsorption-desorption kinetics and long-term stability through multiple cycles is essential for commercial viability. Third, designing systems with minimal energy penalties for regeneration represents a critical economic factor.

For grid storage applications specifically, the objectives extend to developing capture systems that can effectively utilize intermittent renewable energy for regeneration processes. This capability would transform CO2 capture from a constant energy consumer to a flexible grid balancing resource. In industrial emission control contexts, the technology aims to achieve cost-effective capture across diverse emission sources with varying CO2 concentrations and impurity profiles.

The ultimate technological goal is to develop solid sorbent systems that achieve capture costs below $30 per ton of CO2, with regeneration energy requirements under 2 GJ/ton, while maintaining performance over thousands of cycles. These benchmarks would position solid sorbent technologies as economically viable solutions for widespread deployment across both power generation and industrial sectors, contributing significantly to global decarbonization efforts.

The technological evolution has accelerated in the 21st century with the emergence of solid sorbents as a promising alternative to liquid-based systems. These materials offer advantages including lower regeneration energy requirements, reduced corrosion issues, and greater operational flexibility. The progression from zeolites and activated carbons to metal-organic frameworks (MOFs) and amine-functionalized silica represents significant milestones in this technological journey.

Current research trends indicate a shift toward multifunctional sorbent materials that can operate effectively across varying temperature and pressure conditions. The integration of CO2 capture systems with energy storage mechanisms represents a particularly innovative direction, addressing both emission reduction and grid stability challenges simultaneously. This convergence of environmental and energy technologies reflects the growing recognition of climate-energy nexus solutions.

The primary technical objectives for solid sorbent CO2 capture systems encompass several dimensions. First, achieving high CO2 selectivity and capacity under realistic flue gas conditions remains paramount. Second, developing materials with rapid adsorption-desorption kinetics and long-term stability through multiple cycles is essential for commercial viability. Third, designing systems with minimal energy penalties for regeneration represents a critical economic factor.

For grid storage applications specifically, the objectives extend to developing capture systems that can effectively utilize intermittent renewable energy for regeneration processes. This capability would transform CO2 capture from a constant energy consumer to a flexible grid balancing resource. In industrial emission control contexts, the technology aims to achieve cost-effective capture across diverse emission sources with varying CO2 concentrations and impurity profiles.

The ultimate technological goal is to develop solid sorbent systems that achieve capture costs below $30 per ton of CO2, with regeneration energy requirements under 2 GJ/ton, while maintaining performance over thousands of cycles. These benchmarks would position solid sorbent technologies as economically viable solutions for widespread deployment across both power generation and industrial sectors, contributing significantly to global decarbonization efforts.

Market Analysis for Carbon Capture Solutions

The global carbon capture market is experiencing significant growth, driven by increasing environmental regulations and corporate sustainability commitments. As of 2023, the market for carbon capture technologies is valued at approximately $7.5 billion, with projections indicating growth to reach $20 billion by 2030, representing a compound annual growth rate (CAGR) of over 15%.

Solid sorbents for CO2 capture represent a rapidly expanding segment within this market, currently accounting for about 25% of the total carbon capture technology market. This segment is expected to grow at an accelerated rate of 18-20% annually, outpacing other capture technologies due to advantages in energy efficiency and operational flexibility.

The industrial sector constitutes the largest market for solid sorbent technologies, with power generation, cement production, and steel manufacturing collectively representing over 65% of current applications. These industries are under mounting pressure to reduce emissions while maintaining operational efficiency, creating a strong demand pull for advanced capture solutions.

Geographically, North America and Europe lead in adoption, accounting for approximately 60% of the global market share. However, the Asia-Pacific region, particularly China and India, is witnessing the fastest growth rates, driven by rapid industrialization coupled with strengthening environmental policies. These emerging markets are expected to represent over 40% of new installations by 2028.

From a customer perspective, the market exhibits a dual structure. Large industrial corporations with significant emissions footprints constitute the primary customer segment, valuing turnkey solutions with proven reliability. Concurrently, a growing segment of medium-sized enterprises is entering the market, seeking more modular and scalable solutions that can be implemented with lower initial capital expenditure.

Price sensitivity varies significantly across market segments. Utility companies typically prioritize total cost of ownership over initial investment, while manufacturing industries tend to be more sensitive to upfront costs and implementation timelines. Current pricing for solid sorbent systems ranges from $40-80 per ton of CO2 captured, with industry analysts projecting a 30% cost reduction over the next five years as technologies mature and economies of scale improve.

Market barriers include high initial capital requirements, technical integration challenges with existing industrial processes, and regulatory uncertainty regarding carbon pricing mechanisms. Despite these challenges, the solid sorbent market benefits from increasing corporate net-zero commitments and the growing carbon credit trading ecosystem, which provides additional revenue streams for early adopters.

Solid sorbents for CO2 capture represent a rapidly expanding segment within this market, currently accounting for about 25% of the total carbon capture technology market. This segment is expected to grow at an accelerated rate of 18-20% annually, outpacing other capture technologies due to advantages in energy efficiency and operational flexibility.

The industrial sector constitutes the largest market for solid sorbent technologies, with power generation, cement production, and steel manufacturing collectively representing over 65% of current applications. These industries are under mounting pressure to reduce emissions while maintaining operational efficiency, creating a strong demand pull for advanced capture solutions.

Geographically, North America and Europe lead in adoption, accounting for approximately 60% of the global market share. However, the Asia-Pacific region, particularly China and India, is witnessing the fastest growth rates, driven by rapid industrialization coupled with strengthening environmental policies. These emerging markets are expected to represent over 40% of new installations by 2028.

From a customer perspective, the market exhibits a dual structure. Large industrial corporations with significant emissions footprints constitute the primary customer segment, valuing turnkey solutions with proven reliability. Concurrently, a growing segment of medium-sized enterprises is entering the market, seeking more modular and scalable solutions that can be implemented with lower initial capital expenditure.

Price sensitivity varies significantly across market segments. Utility companies typically prioritize total cost of ownership over initial investment, while manufacturing industries tend to be more sensitive to upfront costs and implementation timelines. Current pricing for solid sorbent systems ranges from $40-80 per ton of CO2 captured, with industry analysts projecting a 30% cost reduction over the next five years as technologies mature and economies of scale improve.

Market barriers include high initial capital requirements, technical integration challenges with existing industrial processes, and regulatory uncertainty regarding carbon pricing mechanisms. Despite these challenges, the solid sorbent market benefits from increasing corporate net-zero commitments and the growing carbon credit trading ecosystem, which provides additional revenue streams for early adopters.

Current Solid Sorbent Technologies and Challenges

Current solid sorbent technologies for CO2 capture have evolved significantly in recent years, offering promising alternatives to traditional liquid-based capture methods. Physical adsorbents such as activated carbons, zeolites, and metal-organic frameworks (MOFs) represent the first generation of solid sorbents. Activated carbons provide cost-effective solutions with moderate CO2 selectivity and capacity, while zeolites offer higher selectivity but suffer from performance degradation in humid conditions. MOFs have emerged as highly tunable materials with exceptional surface areas exceeding 6,000 m²/g and CO2 capacities reaching 1.5 g CO2/g sorbent under optimal conditions.

Chemical adsorbents, including amine-functionalized silicas and polymers, constitute another major category. These materials combine the high selectivity of amines with the structural advantages of solid supports. Amine-grafted silicas can achieve CO2 capacities of 2-3 mmol/g with significantly lower regeneration energy requirements compared to aqueous amine solutions. Polymer-supported amines offer improved stability and reduced degradation rates during cycling operations.

Despite these advancements, several critical challenges persist in solid sorbent development. Stability issues remain paramount, with many promising materials showing performance degradation after multiple adsorption-desorption cycles. Hydrothermal stability is particularly problematic, as water vapor in flue gas streams can significantly reduce CO2 capacity and accelerate material degradation. For instance, many zeolites lose up to 50% of their capacity after exposure to moisture.

Heat management presents another significant challenge. The exothermic nature of CO2 adsorption creates temperature gradients within sorbent beds, reducing efficiency and potentially damaging materials. Current heat management systems add complexity and cost to capture installations, limiting commercial viability.

Scalability concerns also hinder widespread adoption. Laboratory-scale materials often face manufacturing challenges when produced at industrial quantities. MOFs, despite their exceptional properties, remain expensive to synthesize at scale, with costs ranging from $100-1,000/kg compared to activated carbon at $1-5/kg.

Regeneration energy requirements, while lower than liquid systems, still represent a substantial operational cost. Current solid sorbents require 2.0-3.5 GJ/tonne CO2 for regeneration, which must be further reduced to achieve economic viability in commercial applications.

Mechanical stability issues affect fixed-bed and fluidized-bed configurations, with particle attrition and crushing leading to pressure drop increases and material losses. Additionally, mass transfer limitations within sorbent particles can significantly reduce real-world performance compared to theoretical capacities, particularly in rapid-cycle operations required for industrial implementation.

Chemical adsorbents, including amine-functionalized silicas and polymers, constitute another major category. These materials combine the high selectivity of amines with the structural advantages of solid supports. Amine-grafted silicas can achieve CO2 capacities of 2-3 mmol/g with significantly lower regeneration energy requirements compared to aqueous amine solutions. Polymer-supported amines offer improved stability and reduced degradation rates during cycling operations.

Despite these advancements, several critical challenges persist in solid sorbent development. Stability issues remain paramount, with many promising materials showing performance degradation after multiple adsorption-desorption cycles. Hydrothermal stability is particularly problematic, as water vapor in flue gas streams can significantly reduce CO2 capacity and accelerate material degradation. For instance, many zeolites lose up to 50% of their capacity after exposure to moisture.

Heat management presents another significant challenge. The exothermic nature of CO2 adsorption creates temperature gradients within sorbent beds, reducing efficiency and potentially damaging materials. Current heat management systems add complexity and cost to capture installations, limiting commercial viability.

Scalability concerns also hinder widespread adoption. Laboratory-scale materials often face manufacturing challenges when produced at industrial quantities. MOFs, despite their exceptional properties, remain expensive to synthesize at scale, with costs ranging from $100-1,000/kg compared to activated carbon at $1-5/kg.

Regeneration energy requirements, while lower than liquid systems, still represent a substantial operational cost. Current solid sorbents require 2.0-3.5 GJ/tonne CO2 for regeneration, which must be further reduced to achieve economic viability in commercial applications.

Mechanical stability issues affect fixed-bed and fluidized-bed configurations, with particle attrition and crushing leading to pressure drop increases and material losses. Additionally, mass transfer limitations within sorbent particles can significantly reduce real-world performance compared to theoretical capacities, particularly in rapid-cycle operations required for industrial implementation.

Existing Solid Sorbent Solutions for CO2 Capture

01 Metal-organic frameworks (MOFs) for CO2 capture

Metal-organic frameworks are crystalline porous materials composed of metal ions or clusters coordinated with organic ligands. They have high surface areas, tunable pore sizes, and can be functionalized to enhance CO2 selectivity and adsorption capacity. MOFs can be designed with specific metal centers and organic linkers to optimize CO2 capture performance under various conditions, making them promising candidates for post-combustion carbon capture applications.- Metal-organic frameworks (MOFs) for CO2 capture: Metal-organic frameworks are crystalline porous materials composed of metal ions or clusters coordinated with organic ligands. They have high surface areas, tunable pore sizes, and can be functionalized to enhance CO2 selectivity and adsorption capacity. MOFs can be designed with specific metal centers and organic linkers to optimize CO2 capture performance under various conditions, making them promising candidates for carbon capture applications.

- Amine-functionalized solid sorbents: Amine-functionalized materials are widely used for CO2 capture due to their strong chemical affinity for CO2. These sorbents typically consist of amines grafted onto porous supports such as silica, activated carbon, or polymers. The amine groups react with CO2 to form carbamates or bicarbonates, enabling efficient capture even at low CO2 concentrations. These materials can be regenerated through temperature or pressure swing processes, making them suitable for industrial carbon capture applications.

- Zeolite-based CO2 adsorbents: Zeolites are crystalline aluminosilicate materials with well-defined pore structures that can selectively adsorb CO2. Their high thermal stability, mechanical strength, and tunable properties make them attractive for carbon capture applications. Zeolites can be modified through ion exchange, metal incorporation, or surface functionalization to enhance CO2 selectivity and capacity. These materials are particularly effective for pressure swing adsorption systems and can be regenerated multiple times without significant performance degradation.

- Carbon-based sorbents for CO2 capture: Carbon-based materials such as activated carbon, carbon nanotubes, and graphene derivatives are effective CO2 adsorbents due to their high surface area and porous structure. These materials can be functionalized with nitrogen-containing groups or metal particles to enhance CO2 selectivity and adsorption capacity. Carbon-based sorbents offer advantages including low cost, high thermal stability, and resistance to moisture, making them suitable for various carbon capture applications including post-combustion capture and direct air capture.

- Composite and hybrid sorbent materials: Composite and hybrid materials combine different types of sorbents to leverage their complementary properties for enhanced CO2 capture performance. These materials may integrate organic and inorganic components, such as polymer-inorganic hybrids, MOF-polymer composites, or amine-functionalized mesoporous silica. The synergistic effects between components can improve adsorption capacity, selectivity, stability, and regeneration efficiency. These advanced materials are designed to overcome limitations of single-component sorbents and optimize performance under specific operating conditions.

02 Amine-functionalized solid sorbents

Amine-functionalized materials represent a significant class of solid sorbents for CO2 capture. These materials combine the high CO2 selectivity of amines with the structural advantages of solid supports. The amine groups form chemical bonds with CO2 molecules through carbamate formation, enabling efficient capture even at low CO2 concentrations. Common supports include silica, polymers, and porous carbon materials, which can be impregnated or grafted with various amine compounds to enhance adsorption capacity and kinetics.Expand Specific Solutions03 Zeolite-based CO2 adsorbents

Zeolites are crystalline aluminosilicate materials with well-defined pore structures that can selectively adsorb CO2. Their high thermal stability, regenerability, and relatively low cost make them attractive for industrial carbon capture applications. The CO2 adsorption properties of zeolites can be enhanced through ion exchange, framework modification, or incorporation of functional groups. Different zeolite structures (such as 13X, 5A, and ZSM-5) offer varying adsorption capacities and selectivities depending on their pore architecture and Si/Al ratio.Expand Specific Solutions04 Carbon-based sorbents for CO2 capture

Carbon-based materials, including activated carbons, carbon nanotubes, and graphene derivatives, serve as effective CO2 adsorbents due to their high surface area, tunable porosity, and surface chemistry. These materials can be modified through chemical activation, nitrogen doping, or functionalization to enhance CO2 selectivity and capacity. Carbon-based sorbents offer advantages such as low cost, high stability, and ease of regeneration, making them suitable for various carbon capture scenarios including direct air capture and post-combustion applications.Expand Specific Solutions05 Composite and hybrid sorbent materials

Composite and hybrid materials combine the advantages of different sorbent types to achieve enhanced CO2 capture performance. These materials may integrate organic and inorganic components, such as polymer-inorganic hybrids, MOF-polymer composites, or amine-functionalized mesoporous silica. The synergistic effects between components can lead to improved adsorption capacity, selectivity, stability, and regenerability. These advanced materials often address the limitations of single-component sorbents while maintaining their beneficial properties, offering promising solutions for next-generation carbon capture technologies.Expand Specific Solutions

Leading Companies in Solid Sorbent Development

The solid sorbents for CO2 capture market is in a growth phase, driven by increasing focus on grid storage and industrial emission control applications. The global market size is expanding rapidly, with projections exceeding $2 billion by 2030. Technologically, the field shows varying maturity levels across different sorbent types. Leading players include established energy corporations like Sinopec Group and Korea Electric Power Corp, which are leveraging their industrial infrastructure for large-scale implementation. Research institutions such as West Virginia University and NTNU are advancing fundamental technologies, while specialized companies like Carboncapture and Mantel Capture are developing innovative commercial solutions. The competitive landscape features a mix of traditional energy companies transitioning to cleaner technologies and newer entrants focused exclusively on carbon capture innovations.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced solid sorbent technologies for CO2 capture focusing on metal-organic frameworks (MOFs) and amine-functionalized materials. Their proprietary MOF-based sorbents demonstrate exceptional CO2 selectivity and capacity under industrial conditions, with adsorption capacities reaching 4-6 mmol/g at relevant flue gas concentrations. Sinopec has implemented pilot-scale demonstrations at several power plants, showing regeneration energy requirements approximately 30% lower than conventional liquid amine scrubbing processes. Their technology incorporates a temperature swing adsorption (TSA) process with optimized heat integration, allowing for efficient sorbent regeneration at temperatures below 120°C. The company has also developed specialized fixed-bed reactors with enhanced heat transfer characteristics to address the thermal management challenges inherent in solid sorbent systems, enabling more efficient cycling and reduced energy penalties during the capture process.

Strengths: Sinopec's solid sorbent technology offers significantly reduced regeneration energy requirements compared to liquid amine systems, with excellent stability over multiple adsorption-desorption cycles (>1000 cycles with minimal degradation). Weaknesses: The technology faces challenges in scaling up production of specialized MOF materials at competitive costs, and the current system designs still require optimization for handling the pressure drops associated with fixed-bed configurations in large-scale applications.

Norwegian University of Science & Technology

Technical Solution: The Norwegian University of Science & Technology (NTNU) has developed an advanced solid sorbent system for CO2 capture focusing on calcium looping technology optimized for industrial applications. Their approach utilizes modified calcium oxide (CaO) sorbents with specialized dopants and support structures that significantly enhance cycling stability and resistance to sintering—a common challenge in calcium-based capture systems. NTNU's technology demonstrates CO2 capture capacities of 0.4-0.5 g CO2/g sorbent in the initial cycles, with innovative material modifications maintaining capacities above 0.3 g CO2/g sorbent even after hundreds of carbonation-calcination cycles. Their process operates at higher temperatures (650-700°C for carbonation, 850-950°C for calcination) than amine-based systems, making it particularly suitable for integration with industrial processes where high-grade waste heat is available. NTNU has developed a dual fluidized bed reactor configuration that enables efficient heat transfer and solid handling, with demonstrated capture efficiencies exceeding 90% in pilot-scale testing. A key innovation in their approach is the incorporation of steam reactivation steps between cycles, which has been shown to partially restore capacity losses and extend sorbent lifetime. The system is particularly well-suited for cement and steel manufacturing applications, where the high operating temperatures align well with existing process conditions.

Strengths: NTNU's calcium looping technology offers exceptionally high theoretical CO2 carrying capacities and operates at temperatures that enable efficient integration with industrial waste heat streams, potentially reducing overall energy penalties. The abundant and low-cost nature of calcium-based materials provides economic advantages for large-scale deployment. Weaknesses: Despite improvements, the system still faces challenges with sorbent degradation over extended cycling, requiring periodic makeup of fresh material. The high operating temperatures also necessitate specialized reactor materials and designs that can increase capital costs compared to lower-temperature alternatives.

Key Innovations in Solid Sorbent Materials

Solid sorbents for capturing co 2

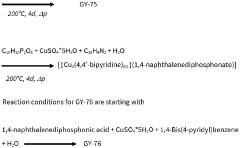

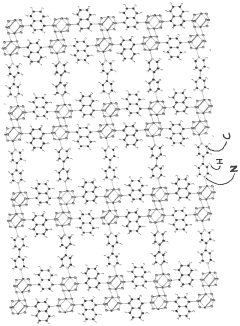

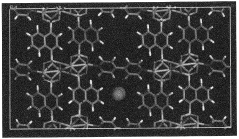

PatentWO2023232666A1

Innovation

- Development of phosphonate and organoarsonate MOFs with specific molecular formulas, such as [{M2(4,4’-bipyridine)0.5}(l,4-naphthalenediphosphonate)] and [{M2(4,4’-bipyridine)0.5}(l,4-naphthalenediarsonate)], which maintain selectivity and stability under harsh conditions, including high humidity and temperatures up to 360°C, by creating a hydrophobic environment that favors CO2 physisorption over H2O.

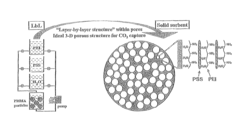

Layered solid sorbents for carbon dioxide capture

PatentActiveUS8889589B2

Innovation

- Development of nano-layered solid sorbents using electrostatic layer-by-layer nanoassembly, where positively charged polyethylenimine and negatively charged polystyrene sulfonate layers are alternately deposited on a porous substrate, enhancing CO2 capture and transport kinetics.

Regulatory Framework for Carbon Capture Implementation

The regulatory landscape for carbon capture technologies is rapidly evolving as governments worldwide implement policies to address climate change. The Paris Agreement has been a significant catalyst, with many nations incorporating carbon capture requirements into their Nationally Determined Contributions (NDCs). In the United States, the 45Q tax credit provides substantial financial incentives for carbon capture projects, offering up to $50 per metric ton of CO2 stored geologically and $35 per ton for enhanced oil recovery applications.

The European Union has established the Innovation Fund to support carbon capture projects, complemented by the EU Emissions Trading System (ETS) which creates a market-based incentive for emissions reduction. The United Kingdom has developed its own regulatory framework through the CCS Infrastructure Fund, allocating £1 billion to accelerate deployment of carbon capture technologies across industrial clusters.

Regulatory frameworks typically address four key areas: permitting processes, liability frameworks, monitoring requirements, and financial incentives. Permitting processes for solid sorbent CO2 capture systems must navigate environmental impact assessments, safety protocols, and land use regulations. These vary significantly by jurisdiction, creating compliance challenges for multinational implementation.

Liability frameworks determine responsibility for long-term storage and potential leakage risks, with most regulatory systems requiring operators to maintain financial assurance mechanisms. Monitoring, reporting, and verification (MRV) protocols are essential components of regulatory compliance, with increasing standardization of measurement methodologies for solid sorbent performance and CO2 storage integrity.

Financial mechanisms include direct subsidies, tax incentives, carbon pricing, and public-private partnerships. The effectiveness of these instruments varies based on local market conditions and policy stability. Recent regulatory trends show movement toward technology-neutral performance standards rather than prescriptive requirements, allowing innovation in solid sorbent technologies while maintaining environmental safeguards.

Cross-border regulatory harmonization remains a challenge, particularly for grid storage applications that may span multiple jurisdictions. Industry stakeholders are advocating for standardized protocols to reduce compliance costs and accelerate technology deployment. Several international organizations, including the International Organization for Standardization (ISO) and the Global CCS Institute, are working to develop unified frameworks for carbon capture technologies.

Regulatory uncertainty presents a significant barrier to investment in solid sorbent technologies. Projects typically require 20+ year timeframes for return on investment, making policy stability crucial for commercial viability. Forward-looking regulatory approaches are beginning to incorporate lifecycle assessment requirements to ensure that carbon capture solutions deliver genuine climate benefits when all environmental impacts are considered.

The European Union has established the Innovation Fund to support carbon capture projects, complemented by the EU Emissions Trading System (ETS) which creates a market-based incentive for emissions reduction. The United Kingdom has developed its own regulatory framework through the CCS Infrastructure Fund, allocating £1 billion to accelerate deployment of carbon capture technologies across industrial clusters.

Regulatory frameworks typically address four key areas: permitting processes, liability frameworks, monitoring requirements, and financial incentives. Permitting processes for solid sorbent CO2 capture systems must navigate environmental impact assessments, safety protocols, and land use regulations. These vary significantly by jurisdiction, creating compliance challenges for multinational implementation.

Liability frameworks determine responsibility for long-term storage and potential leakage risks, with most regulatory systems requiring operators to maintain financial assurance mechanisms. Monitoring, reporting, and verification (MRV) protocols are essential components of regulatory compliance, with increasing standardization of measurement methodologies for solid sorbent performance and CO2 storage integrity.

Financial mechanisms include direct subsidies, tax incentives, carbon pricing, and public-private partnerships. The effectiveness of these instruments varies based on local market conditions and policy stability. Recent regulatory trends show movement toward technology-neutral performance standards rather than prescriptive requirements, allowing innovation in solid sorbent technologies while maintaining environmental safeguards.

Cross-border regulatory harmonization remains a challenge, particularly for grid storage applications that may span multiple jurisdictions. Industry stakeholders are advocating for standardized protocols to reduce compliance costs and accelerate technology deployment. Several international organizations, including the International Organization for Standardization (ISO) and the Global CCS Institute, are working to develop unified frameworks for carbon capture technologies.

Regulatory uncertainty presents a significant barrier to investment in solid sorbent technologies. Projects typically require 20+ year timeframes for return on investment, making policy stability crucial for commercial viability. Forward-looking regulatory approaches are beginning to incorporate lifecycle assessment requirements to ensure that carbon capture solutions deliver genuine climate benefits when all environmental impacts are considered.

Economic Viability and Scalability Assessment

The economic viability of solid sorbents for CO2 capture represents a critical factor in their widespread adoption. Current cost analyses indicate that first-generation solid sorbent technologies require capital investments of $600-900 per ton of CO2 captured annually, with operational costs ranging from $40-70 per ton. These figures, while improving, still present challenges for commercial deployment without supportive policy frameworks or carbon pricing mechanisms.

Scale-up considerations reveal significant hurdles in transitioning from laboratory demonstrations to industrial implementation. Pilot projects utilizing metal-organic frameworks (MOFs) and amine-functionalized materials have demonstrated capture capacities of 1-10 tons CO2/day, but industrial applications require capacities 100-1000 times greater. The manufacturing infrastructure for advanced sorbents remains underdeveloped, with current production volumes typically limited to kilogram quantities rather than the tons needed for commercial deployment.

Energy requirements for solid sorbent systems show promising efficiency gains compared to traditional liquid amine scrubbing. Regeneration energy demands of 2.0-3.0 GJ/ton CO2 for advanced solid sorbents represent a 20-40% improvement over conventional technologies, potentially reducing operational costs significantly when scaled. However, these efficiency advantages must be maintained during scale-up to preserve economic benefits.

Market analysis indicates that industrial emission control applications may reach economic viability sooner than grid storage implementations. Cement and steel manufacturing sectors, with concentrated CO2 streams and fewer alternatives for decarbonization, present near-term opportunities with potential break-even points at carbon prices of $50-70/ton. Grid storage applications face more challenging economics, requiring either higher carbon prices ($80-100/ton) or technological breakthroughs to reduce costs.

Supply chain considerations reveal potential bottlenecks in raw material availability for certain high-performance sorbents. Rare earth elements and specialized organic linkers used in some MOF formulations may face supply constraints at industrial scales. Alternative formulations using earth-abundant materials show promise but often with performance trade-offs that impact overall system economics.

Lifecycle assessment studies suggest that solid sorbent technologies can achieve net carbon reductions after 3-6 months of operation, depending on manufacturing processes and energy sources. This favorable carbon payback period strengthens the long-term economic case but requires investors to accept longer return horizons than typical industrial projects.

Scale-up considerations reveal significant hurdles in transitioning from laboratory demonstrations to industrial implementation. Pilot projects utilizing metal-organic frameworks (MOFs) and amine-functionalized materials have demonstrated capture capacities of 1-10 tons CO2/day, but industrial applications require capacities 100-1000 times greater. The manufacturing infrastructure for advanced sorbents remains underdeveloped, with current production volumes typically limited to kilogram quantities rather than the tons needed for commercial deployment.

Energy requirements for solid sorbent systems show promising efficiency gains compared to traditional liquid amine scrubbing. Regeneration energy demands of 2.0-3.0 GJ/ton CO2 for advanced solid sorbents represent a 20-40% improvement over conventional technologies, potentially reducing operational costs significantly when scaled. However, these efficiency advantages must be maintained during scale-up to preserve economic benefits.

Market analysis indicates that industrial emission control applications may reach economic viability sooner than grid storage implementations. Cement and steel manufacturing sectors, with concentrated CO2 streams and fewer alternatives for decarbonization, present near-term opportunities with potential break-even points at carbon prices of $50-70/ton. Grid storage applications face more challenging economics, requiring either higher carbon prices ($80-100/ton) or technological breakthroughs to reduce costs.

Supply chain considerations reveal potential bottlenecks in raw material availability for certain high-performance sorbents. Rare earth elements and specialized organic linkers used in some MOF formulations may face supply constraints at industrial scales. Alternative formulations using earth-abundant materials show promise but often with performance trade-offs that impact overall system economics.

Lifecycle assessment studies suggest that solid sorbent technologies can achieve net carbon reductions after 3-6 months of operation, depending on manufacturing processes and energy sources. This favorable carbon payback period strengthens the long-term economic case but requires investors to accept longer return horizons than typical industrial projects.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!