ATR-FTIR Crystal Choices: Diamond Vs ZnSe Vs Ge—Spectral Range, Hardness And Chemistry

SEP 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

ATR-FTIR Crystal Technology Background and Objectives

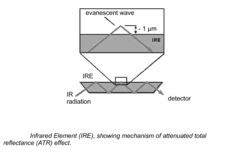

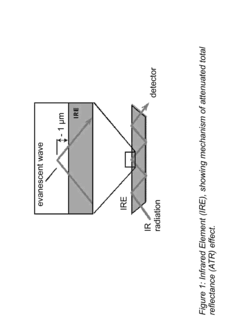

Attenuated Total Reflection Fourier Transform Infrared Spectroscopy (ATR-FTIR) has evolved significantly since its inception in the 1960s, transforming from a specialized analytical technique to an essential tool across numerous industries. The technology leverages the principle of total internal reflection, where infrared radiation penetrates a small distance beyond the reflecting surface into a sample material, creating an evanescent wave that interacts with the sample.

The crystal element serves as the heart of ATR-FTIR systems, acting as the interface between the infrared beam and the sample. Historically, the development of ATR crystals has followed a trajectory of increasing sophistication, moving from simple germanium and zinc selenide options to advanced diamond crystals that offer superior durability and performance characteristics.

Market demands have driven continuous innovation in crystal technology, with researchers seeking materials that provide optimal combinations of spectral range, hardness, and chemical compatibility. The evolution of these crystals has been closely tied to advancements in material science and optical engineering, enabling progressively more precise and reliable spectroscopic analysis.

Current technological trends indicate a growing preference for multi-purpose crystals that can accommodate diverse sample types while maintaining analytical precision. Diamond has emerged as a premium option, though zinc selenide and germanium continue to maintain significant market shares due to their cost-effectiveness and specific performance advantages in certain applications.

The primary technical objective in ATR crystal development centers on achieving an optimal balance between spectral performance, mechanical durability, and chemical resistance. Researchers aim to expand the functional range of these crystals while minimizing limitations such as spectral cutoffs, susceptibility to scratching, or vulnerability to chemical degradation.

Secondary objectives include reducing manufacturing costs, enhancing reproducibility of results, and improving ease of maintenance. These factors significantly impact the total cost of ownership and operational efficiency of ATR-FTIR systems, making them critical considerations in crystal selection and development.

Looking forward, the field is moving toward specialized crystal formulations tailored to specific industry applications, such as pharmaceutical quality control, environmental monitoring, and advanced materials characterization. This specialization represents a shift from general-purpose solutions toward application-optimized technologies that deliver superior performance in targeted use cases.

The ultimate goal of ATR crystal technology development remains the creation of versatile, durable, and high-performance interfaces that enable accurate molecular analysis across an expanding range of sample types and analytical conditions, thereby extending the utility and accessibility of infrared spectroscopy as an analytical method.

The crystal element serves as the heart of ATR-FTIR systems, acting as the interface between the infrared beam and the sample. Historically, the development of ATR crystals has followed a trajectory of increasing sophistication, moving from simple germanium and zinc selenide options to advanced diamond crystals that offer superior durability and performance characteristics.

Market demands have driven continuous innovation in crystal technology, with researchers seeking materials that provide optimal combinations of spectral range, hardness, and chemical compatibility. The evolution of these crystals has been closely tied to advancements in material science and optical engineering, enabling progressively more precise and reliable spectroscopic analysis.

Current technological trends indicate a growing preference for multi-purpose crystals that can accommodate diverse sample types while maintaining analytical precision. Diamond has emerged as a premium option, though zinc selenide and germanium continue to maintain significant market shares due to their cost-effectiveness and specific performance advantages in certain applications.

The primary technical objective in ATR crystal development centers on achieving an optimal balance between spectral performance, mechanical durability, and chemical resistance. Researchers aim to expand the functional range of these crystals while minimizing limitations such as spectral cutoffs, susceptibility to scratching, or vulnerability to chemical degradation.

Secondary objectives include reducing manufacturing costs, enhancing reproducibility of results, and improving ease of maintenance. These factors significantly impact the total cost of ownership and operational efficiency of ATR-FTIR systems, making them critical considerations in crystal selection and development.

Looking forward, the field is moving toward specialized crystal formulations tailored to specific industry applications, such as pharmaceutical quality control, environmental monitoring, and advanced materials characterization. This specialization represents a shift from general-purpose solutions toward application-optimized technologies that deliver superior performance in targeted use cases.

The ultimate goal of ATR crystal technology development remains the creation of versatile, durable, and high-performance interfaces that enable accurate molecular analysis across an expanding range of sample types and analytical conditions, thereby extending the utility and accessibility of infrared spectroscopy as an analytical method.

Market Analysis of ATR-FTIR Crystal Applications

The global ATR-FTIR crystal market has experienced significant growth in recent years, driven by increasing applications across pharmaceutical, chemical, food, and materials science industries. The market size for ATR-FTIR accessories was valued at approximately $120 million in 2022, with projections indicating a compound annual growth rate of 5.8% through 2028.

Diamond, Zinc Selenide (ZnSe), and Germanium (Ge) crystals represent the three primary segments in this market, each serving distinct application niches based on their unique properties. Diamond crystals command the highest market value share at 42%, despite their premium pricing, due to their exceptional durability and wide spectral range capabilities.

The pharmaceutical and life sciences sectors constitute the largest end-user segment, accounting for 38% of the total market demand. These industries particularly value the non-destructive analysis capabilities that ATR-FTIR crystals provide for quality control and formulation development. The chemical industry follows closely at 29% market share, where these crystals are essential for polymer analysis and reaction monitoring.

Regionally, North America leads the market with 35% share, followed by Europe (30%) and Asia-Pacific (25%). The Asia-Pacific region, particularly China and India, is witnessing the fastest growth rate at 7.2% annually, driven by expanding pharmaceutical manufacturing and chemical industries.

The competitive landscape features both specialized optical component manufacturers and analytical instrument companies. Key market players include Thermo Fisher Scientific, Bruker, Agilent Technologies, and PIKE Technologies, collectively holding approximately 65% market share. Mid-sized specialized crystal manufacturers like Specac and Harrick Scientific Products maintain significant presence in specific application niches.

Price sensitivity varies considerably across application segments. Research institutions and academic laboratories typically seek cost-effective solutions like ZnSe crystals, while pharmaceutical quality control and industrial applications often justify the premium for diamond crystals due to their longevity and chemical resistance.

Market trends indicate growing demand for multi-crystal ATR accessories that allow users to interchange between diamond, ZnSe, and Ge depending on specific sample requirements. This flexibility-focused product segment has grown by 15% annually over the past three years, reflecting end-users' desire for versatile analytical capabilities without investing in multiple complete systems.

Diamond, Zinc Selenide (ZnSe), and Germanium (Ge) crystals represent the three primary segments in this market, each serving distinct application niches based on their unique properties. Diamond crystals command the highest market value share at 42%, despite their premium pricing, due to their exceptional durability and wide spectral range capabilities.

The pharmaceutical and life sciences sectors constitute the largest end-user segment, accounting for 38% of the total market demand. These industries particularly value the non-destructive analysis capabilities that ATR-FTIR crystals provide for quality control and formulation development. The chemical industry follows closely at 29% market share, where these crystals are essential for polymer analysis and reaction monitoring.

Regionally, North America leads the market with 35% share, followed by Europe (30%) and Asia-Pacific (25%). The Asia-Pacific region, particularly China and India, is witnessing the fastest growth rate at 7.2% annually, driven by expanding pharmaceutical manufacturing and chemical industries.

The competitive landscape features both specialized optical component manufacturers and analytical instrument companies. Key market players include Thermo Fisher Scientific, Bruker, Agilent Technologies, and PIKE Technologies, collectively holding approximately 65% market share. Mid-sized specialized crystal manufacturers like Specac and Harrick Scientific Products maintain significant presence in specific application niches.

Price sensitivity varies considerably across application segments. Research institutions and academic laboratories typically seek cost-effective solutions like ZnSe crystals, while pharmaceutical quality control and industrial applications often justify the premium for diamond crystals due to their longevity and chemical resistance.

Market trends indicate growing demand for multi-crystal ATR accessories that allow users to interchange between diamond, ZnSe, and Ge depending on specific sample requirements. This flexibility-focused product segment has grown by 15% annually over the past three years, reflecting end-users' desire for versatile analytical capabilities without investing in multiple complete systems.

Current State and Challenges in Crystal Materials

The global ATR-FTIR crystal materials market is currently dominated by three primary materials: diamond, zinc selenide (ZnSe), and germanium (Ge). Each material occupies a specific niche based on its unique physical and chemical properties. Diamond crystals represent the premium segment, offering exceptional hardness (10 on Mohs scale) and the widest spectral range (2500-45000 nm), but at significantly higher costs. ZnSe crystals hold the middle market position with moderate hardness (2.7 Mohs) and good spectral range (4000-20000 nm), while germanium serves the lower-cost segment despite its brittleness (6 Mohs) and narrower spectral window (5500-14000 nm).

Recent technological advancements have improved manufacturing processes for all three materials, particularly in diamond synthesis, where chemical vapor deposition (CVD) techniques have reduced production costs by approximately 30% over the past five years. However, this has not yet translated to significant price reductions for end-users due to controlled market distribution channels and high purification requirements.

A major challenge facing the industry is the supply chain vulnerability for ZnSe and Ge crystals. Germanium extraction is geographically concentrated, with China controlling approximately 67% of global production, creating potential supply risks. Similarly, high-quality ZnSe production requires specialized facilities available in limited locations globally, primarily in the United States, Germany, and Japan.

Material durability presents another significant challenge, particularly for ZnSe crystals which are susceptible to scratching and chemical degradation when exposed to acids. While diamond crystals offer superior durability, their high cost prohibits widespread adoption in many applications. Germanium crystals face limitations due to their opacity in the visible spectrum and sensitivity to alkaline solutions.

Standardization across the industry remains problematic, with varying quality metrics between manufacturers creating inconsistencies in performance specifications. This has led to reliability issues in certain analytical applications, particularly in pharmaceutical and environmental testing sectors where precision is paramount.

Emerging research is focused on developing composite crystal materials and protective coatings to enhance durability while maintaining optical performance. Several research institutions, including MIT and Max Planck Institute, are investigating silicon-germanium alloys and diamond-like carbon coatings as potential solutions to current material limitations, though these technologies remain in early development stages.

Recent technological advancements have improved manufacturing processes for all three materials, particularly in diamond synthesis, where chemical vapor deposition (CVD) techniques have reduced production costs by approximately 30% over the past five years. However, this has not yet translated to significant price reductions for end-users due to controlled market distribution channels and high purification requirements.

A major challenge facing the industry is the supply chain vulnerability for ZnSe and Ge crystals. Germanium extraction is geographically concentrated, with China controlling approximately 67% of global production, creating potential supply risks. Similarly, high-quality ZnSe production requires specialized facilities available in limited locations globally, primarily in the United States, Germany, and Japan.

Material durability presents another significant challenge, particularly for ZnSe crystals which are susceptible to scratching and chemical degradation when exposed to acids. While diamond crystals offer superior durability, their high cost prohibits widespread adoption in many applications. Germanium crystals face limitations due to their opacity in the visible spectrum and sensitivity to alkaline solutions.

Standardization across the industry remains problematic, with varying quality metrics between manufacturers creating inconsistencies in performance specifications. This has led to reliability issues in certain analytical applications, particularly in pharmaceutical and environmental testing sectors where precision is paramount.

Emerging research is focused on developing composite crystal materials and protective coatings to enhance durability while maintaining optical performance. Several research institutions, including MIT and Max Planck Institute, are investigating silicon-germanium alloys and diamond-like carbon coatings as potential solutions to current material limitations, though these technologies remain in early development stages.

Comparative Analysis of Diamond, ZnSe, and Ge Crystals

01 Diamond ATR-FTIR crystal properties

Diamond crystals for ATR-FTIR spectroscopy offer the widest spectral range (45,000-10 cm⁻¹) and exceptional hardness (Mohs 10), making them highly resistant to scratching. They are chemically compatible with most substances except strong oxidizers and some molten metals. Their durability and broad transmission range make them ideal for routine analysis of various sample types, though they are the most expensive crystal option.- Diamond ATR-FTIR crystal properties: Diamond crystals offer the widest spectral range for ATR-FTIR applications, typically covering 4000-400 cm⁻¹ with some extending to 200 cm⁻¹. They possess exceptional hardness (10 on Mohs scale), making them highly resistant to scratching and physical damage. Diamond crystals are chemically compatible with most samples including strong acids and bases, but can be damaged by certain transition metals at high temperatures. Their high refractive index provides excellent sensitivity for various sample types.

- ZnSe ATR-FTIR crystal characteristics: Zinc Selenide (ZnSe) crystals provide a useful spectral range of approximately 4000-650 cm⁻¹, making them suitable for mid-infrared applications. With a moderate hardness (2.5 on Mohs scale), they require careful handling to prevent scratches. ZnSe crystals have good chemical compatibility with most organic solvents and neutral samples but are incompatible with strong acids and oxidizing agents. They offer a lower cost alternative to diamond for many routine analyses where extreme durability is not required.

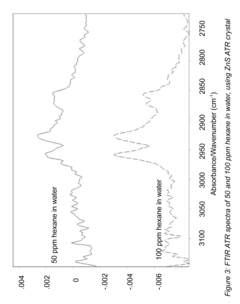

- Germanium ATR-FTIR crystal applications: Germanium (Ge) crystals feature a spectral range of approximately 4000-870 cm⁻¹, with limitations in the lower wavenumber region. With moderate hardness (6 on Mohs scale), they are more durable than ZnSe but less than diamond. Ge crystals have good chemical resistance to acids but can be damaged by strong bases. Their high refractive index makes them particularly valuable for analyzing highly absorbing or reflective samples, including carbon-filled materials and reflective surfaces where other crystals might produce distorted spectra.

- Comparative analysis of ATR-FTIR crystal materials: The selection between Diamond, ZnSe, and Ge crystals involves tradeoffs between spectral range, durability, and sample compatibility. Diamond offers the broadest spectral range and highest durability but at the highest cost. ZnSe provides good performance for routine analysis at moderate cost but with limited chemical resistance. Germanium excels with highly absorbing samples due to its high refractive index but has a more limited spectral range. The choice depends on specific application requirements, sample types, and budget constraints.

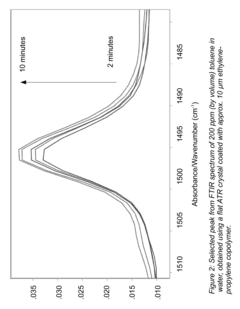

- Advanced manufacturing and modifications of ATR-FTIR crystals: Recent advances in crystal manufacturing have improved the performance of ATR-FTIR crystals through techniques such as specialized coatings, composite structures, and nanopatterning. These modifications can enhance durability, extend spectral range, or improve sensitivity for specific applications. Multi-bounce crystal configurations increase sensitivity for dilute samples, while specialized surface treatments can improve chemical resistance or facilitate specific sample interactions. Custom crystal geometries are also being developed for specialized applications like microfluidic systems and automated high-throughput analysis.

02 ZnSe ATR-FTIR crystal characteristics

Zinc Selenide (ZnSe) crystals provide a useful spectral range of approximately 20,000-500 cm⁻¹, making them suitable for mid-infrared applications. With moderate hardness (Mohs 2.5), they require careful handling to prevent scratching. ZnSe has good chemical compatibility with most organic solvents but is incompatible with strong acids and oxidizing agents. These crystals are commonly used for liquid and soft sample analysis due to their relatively low cost and good optical properties.Expand Specific Solutions03 Germanium ATR-FTIR crystal applications

Germanium (Ge) crystals feature a spectral range of approximately 5,500-600 cm⁻¹ and moderate hardness (Mohs 6). They have higher refractive index compared to other ATR crystals, resulting in shallower penetration depth, making them particularly suitable for analyzing strongly absorbing or opaque samples. Ge crystals are chemically resistant to acids but can be damaged by strong bases. They are often used for analyzing carbon-filled materials, rubbers, and highly absorbing aqueous solutions.Expand Specific Solutions04 Comparative performance of ATR-FTIR crystals

The selection of ATR-FTIR crystals depends on specific application requirements. Diamond offers the best overall performance with superior durability and spectral range but at higher cost. ZnSe provides good performance for routine analysis of non-acidic samples at moderate cost. Germanium is preferred for highly absorbing samples due to its shallow penetration depth. The choice between these materials involves trade-offs between spectral range, chemical compatibility, hardness, and cost-effectiveness based on the specific analytical needs.Expand Specific Solutions05 Innovations in ATR-FTIR crystal technology

Recent innovations in ATR-FTIR crystal technology include multi-layer and composite crystal designs that combine the advantages of different materials. These developments include specialized coatings to improve durability and chemical resistance, micro and nano-structured crystal surfaces for enhanced sensitivity, and temperature-controlled crystal systems for analyzing samples under varying thermal conditions. Advanced manufacturing techniques have also improved crystal quality and reduced costs, making high-performance ATR-FTIR analysis more accessible.Expand Specific Solutions

Key Manufacturers and Suppliers in ATR-FTIR Industry

The ATR-FTIR crystal market is in a growth phase, with increasing demand driven by analytical chemistry applications across pharmaceutical, chemical, and materials science sectors. The market is characterized by a competitive landscape featuring specialized manufacturers like Element Six Ltd. (diamond crystals), Corning, Inc. (optical materials), and SAES Getters SpA (advanced materials). Technical differentiation centers on the trade-offs between spectral range, hardness, and chemical compatibility of the three main crystal types: Diamond offers superior durability but limited spectral range, ZnSe provides good mid-range performance at moderate cost, while Ge excels in specific applications requiring higher refractive index. Research institutions like Fujian Institute of Research and universities collaborate with commercial players to advance crystal technology and expand application possibilities.

Element Six Ltd.

Technical Solution: Element Six specializes in synthetic diamond technology and has developed advanced CVD (Chemical Vapor Deposition) diamond crystals specifically optimized for ATR-FTIR spectroscopy. Their diamond ATR crystals feature exceptional hardness (Mohs 10), the broadest spectral range (45,000-2,500 cm-1), and superior chemical resistance to both acids and bases. Their proprietary manufacturing process creates ultra-pure diamond with minimal defects, ensuring optimal infrared transmission. Element Six's diamond ATR crystals maintain performance integrity even under extreme pressure conditions and harsh chemical environments, making them ideal for demanding industrial applications. The company has also developed specialized anti-reflection coatings to maximize energy throughput and improve signal-to-noise ratios in their diamond ATR elements, particularly beneficial for trace analysis applications.

Strengths: Unmatched durability and chemical resistance; extremely long operational lifetime; highest refractive index (2.4) providing excellent sensitivity; suitable for the broadest range of sample types. Weaknesses: Significantly higher cost compared to ZnSe and Ge alternatives; limited availability of large crystal sizes; requires specialized mounting due to hardness.

Corning, Inc.

Technical Solution: Corning has developed proprietary ATR crystal manufacturing techniques focusing on ZnSe and Ge materials for FTIR spectroscopy. Their ZnSe crystals are engineered through a controlled vapor deposition process that minimizes defects and optimizes transmission in the 4000-650 cm-1 range. Corning's approach includes specialized surface treatments that enhance ZnSe's durability (Mohs hardness 2.5) while maintaining its excellent transmission properties. For applications requiring analysis of strongly absorbing samples, Corning's germanium crystals feature precisely controlled optical properties with a refractive index of 4.0 and effective range of 5,500-870 cm-1. Their manufacturing process ensures consistent crystal quality with minimal variation between production batches. Corning has also developed multi-bounce ATR accessories that compensate for the limited depth of penetration in higher refractive index materials, enhancing sensitivity without sacrificing spectral quality.

Strengths: Cost-effective crystal solutions compared to diamond; excellent manufacturing consistency; specialized surface treatments to enhance durability; comprehensive range of crystal geometries and configurations. Weaknesses: ZnSe crystals vulnerable to scratching and chemical attack from acids and strong bases; Ge crystals brittle and temperature-sensitive with limited spectral range compared to diamond.

Technical Innovations in ATR-FTIR Crystal Design

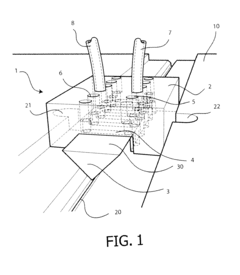

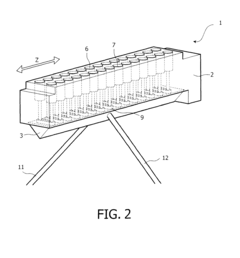

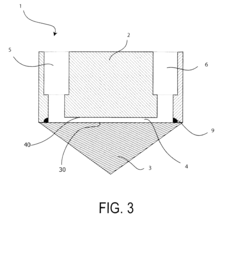

Device for multiple ATR analysis

PatentInactiveEP2116839A1

Innovation

- A device with an ATR element featuring a sample compartment with multiple chambers, allowing for the analysis of multiple samples, and an organic compound for grafting the ATR element to stabilize it against hydrolysis, enabling simultaneous analysis of multiple samples and improving surface stability.

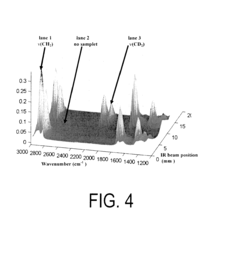

Method for detecting and measuring low concentrations of contaminants using attenuated total reflectance spectroscopy in the mid-IR range

PatentInactiveUS8735822B2

Innovation

- Utilizing uncoated hydrophobic zinc sulfide or hydrophilic ATR crystals attached to fiber-optic probes, which interact with samples to concentrate organic or water molecules near the crystal surface, eliminating the need for pretreatment or extraction and enhancing detection sensitivity to parts per million levels without surface modifications.

Cost-Benefit Analysis of Different Crystal Materials

When evaluating ATR-FTIR crystal materials for analytical applications, cost considerations must be balanced against performance requirements. Diamond crystals represent the highest initial investment, with prices typically ranging from $1,500 to $5,000 depending on quality and dimensions. However, this substantial upfront cost is offset by diamond's exceptional durability and chemical resistance, resulting in minimal maintenance expenses and extended operational lifetimes often exceeding 10 years. The total cost of ownership for diamond crystals frequently proves economical for high-throughput laboratories despite the significant initial expenditure.

ZnSe crystals occupy the mid-range price point, generally costing between $300 and $1,200. This moderate initial investment makes ZnSe an attractive option for laboratories with budget constraints. However, the material's susceptibility to scratching and chemical degradation, particularly from acids and strong oxidizers, necessitates more frequent replacement cycles of approximately 2-4 years depending on usage patterns. Maintenance costs and downtime must be factored into the long-term financial assessment of ZnSe implementations.

Germanium crystals typically range from $400 to $1,500, positioning them between ZnSe and diamond in the cost spectrum. While more durable than ZnSe, germanium remains vulnerable to alkaline solutions and mechanical damage, resulting in replacement cycles averaging 3-5 years. The higher refractive index of germanium provides superior performance with highly absorbing samples, potentially justifying the additional cost for specific applications despite its limited spectral range.

Beyond acquisition expenses, operational considerations significantly impact the cost-benefit equation. Diamond's broad spectral range (4000-400 cm⁻¹) enables comprehensive analysis capabilities, eliminating the need for multiple crystal types in many laboratory settings. Conversely, ZnSe and germanium present more limited ranges (4000-650 cm⁻¹ and 4000-700 cm⁻¹ respectively), potentially necessitating supplementary equipment for comprehensive analyses.

Productivity factors further influence the financial calculus. Diamond's exceptional hardness (Mohs 10) minimizes sample preparation requirements and enables rapid cleaning between analyses, enhancing throughput capacity. ZnSe and germanium require more careful handling protocols and extended cleaning procedures, potentially reducing analytical efficiency by 15-30% compared to diamond-equipped systems.

For applications involving aggressive chemicals or abrasive samples, the replacement frequency of ZnSe or germanium crystals can escalate operational costs substantially, potentially exceeding the initial price differential with diamond within 3-5 years. Conversely, facilities analyzing primarily benign samples may achieve optimal cost-efficiency with ZnSe crystals despite their shorter service life.

ZnSe crystals occupy the mid-range price point, generally costing between $300 and $1,200. This moderate initial investment makes ZnSe an attractive option for laboratories with budget constraints. However, the material's susceptibility to scratching and chemical degradation, particularly from acids and strong oxidizers, necessitates more frequent replacement cycles of approximately 2-4 years depending on usage patterns. Maintenance costs and downtime must be factored into the long-term financial assessment of ZnSe implementations.

Germanium crystals typically range from $400 to $1,500, positioning them between ZnSe and diamond in the cost spectrum. While more durable than ZnSe, germanium remains vulnerable to alkaline solutions and mechanical damage, resulting in replacement cycles averaging 3-5 years. The higher refractive index of germanium provides superior performance with highly absorbing samples, potentially justifying the additional cost for specific applications despite its limited spectral range.

Beyond acquisition expenses, operational considerations significantly impact the cost-benefit equation. Diamond's broad spectral range (4000-400 cm⁻¹) enables comprehensive analysis capabilities, eliminating the need for multiple crystal types in many laboratory settings. Conversely, ZnSe and germanium present more limited ranges (4000-650 cm⁻¹ and 4000-700 cm⁻¹ respectively), potentially necessitating supplementary equipment for comprehensive analyses.

Productivity factors further influence the financial calculus. Diamond's exceptional hardness (Mohs 10) minimizes sample preparation requirements and enables rapid cleaning between analyses, enhancing throughput capacity. ZnSe and germanium require more careful handling protocols and extended cleaning procedures, potentially reducing analytical efficiency by 15-30% compared to diamond-equipped systems.

For applications involving aggressive chemicals or abrasive samples, the replacement frequency of ZnSe or germanium crystals can escalate operational costs substantially, potentially exceeding the initial price differential with diamond within 3-5 years. Conversely, facilities analyzing primarily benign samples may achieve optimal cost-efficiency with ZnSe crystals despite their shorter service life.

Environmental and Safety Considerations for Crystal Selection

When selecting ATR-FTIR crystals for analytical applications, environmental and safety considerations play a crucial role beyond mere technical specifications. These factors impact laboratory operations, personnel safety, and environmental compliance.

Diamond crystals represent the safest option from both handling and environmental perspectives. Their exceptional chemical inertness means minimal risk of contamination or degradation when exposed to harsh chemicals or environments. Additionally, diamond's extreme hardness (Mohs 10) virtually eliminates concerns about physical damage during routine handling, reducing replacement frequency and associated waste generation.

ZnSe crystals present moderate environmental and safety challenges. While less hazardous than germanium, ZnSe contains selenium, which can pose toxicity concerns if improperly handled or disposed of. Laboratory personnel should implement proper handling protocols, including wearing appropriate gloves when touching ZnSe crystals to prevent potential selenium absorption through skin contact. Environmental regulations in many jurisdictions classify selenium-containing waste as requiring special disposal procedures.

Germanium crystals demand the most stringent safety protocols among the three options. Germanium dust and compounds can cause irritation to respiratory systems and eyes. More critically, germanium crystals become toxic when heated above certain temperatures, potentially releasing harmful vapors. This necessitates careful temperature control during analysis and proper ventilation systems in laboratories utilizing germanium ATR crystals.

Disposal considerations vary significantly between crystal types. Diamond's longevity minimizes disposal frequency, while both ZnSe and germanium require adherence to electronic waste or hazardous material disposal regulations depending on local legislation. Organizations should establish clear end-of-life management protocols for these materials.

Cleaning procedures also carry environmental implications. Diamond's resistance to most solvents allows for environmentally friendly cleaning agents, whereas ZnSe and germanium often require more aggressive solvents that may have higher environmental impact profiles. Laboratories should develop cleaning protocols that balance effective maintenance with minimal environmental footprint.

Regulatory compliance represents another critical dimension. Facilities using ZnSe or germanium crystals may face additional reporting requirements under chemical management regulations such as REACH in Europe or similar frameworks in other regions. Documentation of proper handling, storage, and disposal becomes essential for audit purposes and environmental compliance.

Diamond crystals represent the safest option from both handling and environmental perspectives. Their exceptional chemical inertness means minimal risk of contamination or degradation when exposed to harsh chemicals or environments. Additionally, diamond's extreme hardness (Mohs 10) virtually eliminates concerns about physical damage during routine handling, reducing replacement frequency and associated waste generation.

ZnSe crystals present moderate environmental and safety challenges. While less hazardous than germanium, ZnSe contains selenium, which can pose toxicity concerns if improperly handled or disposed of. Laboratory personnel should implement proper handling protocols, including wearing appropriate gloves when touching ZnSe crystals to prevent potential selenium absorption through skin contact. Environmental regulations in many jurisdictions classify selenium-containing waste as requiring special disposal procedures.

Germanium crystals demand the most stringent safety protocols among the three options. Germanium dust and compounds can cause irritation to respiratory systems and eyes. More critically, germanium crystals become toxic when heated above certain temperatures, potentially releasing harmful vapors. This necessitates careful temperature control during analysis and proper ventilation systems in laboratories utilizing germanium ATR crystals.

Disposal considerations vary significantly between crystal types. Diamond's longevity minimizes disposal frequency, while both ZnSe and germanium require adherence to electronic waste or hazardous material disposal regulations depending on local legislation. Organizations should establish clear end-of-life management protocols for these materials.

Cleaning procedures also carry environmental implications. Diamond's resistance to most solvents allows for environmentally friendly cleaning agents, whereas ZnSe and germanium often require more aggressive solvents that may have higher environmental impact profiles. Laboratories should develop cleaning protocols that balance effective maintenance with minimal environmental footprint.

Regulatory compliance represents another critical dimension. Facilities using ZnSe or germanium crystals may face additional reporting requirements under chemical management regulations such as REACH in Europe or similar frameworks in other regions. Documentation of proper handling, storage, and disposal becomes essential for audit purposes and environmental compliance.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!