HDR10 vs Dolby Vision: Projecting Market Growth Potential

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

HDR Technology Evolution and Objectives

High Dynamic Range (HDR) technology represents a significant advancement in visual display capabilities, evolving from the limitations of Standard Dynamic Range (SDR) to deliver enhanced contrast, brightness, and color accuracy. The journey began in the early 2000s with research into expanded luminance ranges, culminating in the introduction of HDR10 as an open standard in 2015. This milestone marked the industry's recognition of consumers' desire for more immersive viewing experiences that better approximate human visual perception.

The evolution continued with the development of competing formats, most notably Dolby Vision, which emerged as a proprietary alternative offering dynamic metadata capabilities. While HDR10 established a static metadata approach with a 10-bit color depth, Dolby Vision pushed boundaries with 12-bit color potential and scene-by-scene optimization. This technological divergence has shaped the market landscape and influenced adoption strategies across the display industry.

Current objectives in HDR technology development focus on several key areas. First, increasing peak brightness capabilities while maintaining deep black levels to maximize contrast ratios. Second, expanding color gamut coverage to approach or exceed the BT.2020 color space, significantly broader than traditional Rec.709 standards. Third, improving metadata handling to optimize content presentation across diverse display capabilities.

Technical standardization remains a critical objective, with industry bodies like the UHD Alliance working to establish consistent implementation guidelines. The HDR10+ format emerged as an extension of HDR10, incorporating some dynamic metadata capabilities while maintaining an open standard approach, demonstrating the industry's response to Dolby Vision's technical advantages.

Content creation workflows represent another evolutionary focus, with camera manufacturers, post-production software developers, and content distributors adapting to support multiple HDR formats. This adaptation process has accelerated as streaming platforms increasingly position HDR content as a premium offering.

The projection market presents unique challenges for HDR implementation due to inherent limitations in achieving extreme brightness levels compared to direct-view displays. Consequently, specialized objectives have emerged for projection technology, including enhanced optical systems, advanced light modulation techniques, and sophisticated tone mapping algorithms to maximize perceived HDR effect within practical brightness constraints.

Looking forward, the industry aims to consolidate standards while pushing technical boundaries, with particular emphasis on improving backward compatibility, reducing implementation costs, and developing more sophisticated content-adaptive processing to optimize viewing experiences across diverse display technologies and viewing environments.

The evolution continued with the development of competing formats, most notably Dolby Vision, which emerged as a proprietary alternative offering dynamic metadata capabilities. While HDR10 established a static metadata approach with a 10-bit color depth, Dolby Vision pushed boundaries with 12-bit color potential and scene-by-scene optimization. This technological divergence has shaped the market landscape and influenced adoption strategies across the display industry.

Current objectives in HDR technology development focus on several key areas. First, increasing peak brightness capabilities while maintaining deep black levels to maximize contrast ratios. Second, expanding color gamut coverage to approach or exceed the BT.2020 color space, significantly broader than traditional Rec.709 standards. Third, improving metadata handling to optimize content presentation across diverse display capabilities.

Technical standardization remains a critical objective, with industry bodies like the UHD Alliance working to establish consistent implementation guidelines. The HDR10+ format emerged as an extension of HDR10, incorporating some dynamic metadata capabilities while maintaining an open standard approach, demonstrating the industry's response to Dolby Vision's technical advantages.

Content creation workflows represent another evolutionary focus, with camera manufacturers, post-production software developers, and content distributors adapting to support multiple HDR formats. This adaptation process has accelerated as streaming platforms increasingly position HDR content as a premium offering.

The projection market presents unique challenges for HDR implementation due to inherent limitations in achieving extreme brightness levels compared to direct-view displays. Consequently, specialized objectives have emerged for projection technology, including enhanced optical systems, advanced light modulation techniques, and sophisticated tone mapping algorithms to maximize perceived HDR effect within practical brightness constraints.

Looking forward, the industry aims to consolidate standards while pushing technical boundaries, with particular emphasis on improving backward compatibility, reducing implementation costs, and developing more sophisticated content-adaptive processing to optimize viewing experiences across diverse display technologies and viewing environments.

Consumer Demand Analysis for Premium Video Formats

The premium video format market has witnessed significant growth in recent years, driven by consumer demand for enhanced viewing experiences. HDR10 and Dolby Vision represent the leading high dynamic range technologies competing for market share in both home entertainment systems and commercial cinema installations. Consumer research indicates that awareness of premium video formats has increased substantially, with approximately 67% of North American consumers now familiar with HDR technology compared to just 38% three years ago.

Consumer purchasing patterns reveal a growing willingness to pay premium prices for superior visual experiences. Market surveys conducted across major metropolitan areas show that consumers are willing to pay an average of 15-20% more for devices supporting advanced HDR formats. This price premium acceptance is particularly pronounced among consumers aged 25-45 with disposable income dedicated to home entertainment systems.

The adoption rate of premium video formats varies significantly by region. North America and Western Europe lead in consumer adoption, with Asia-Pacific markets showing the fastest growth trajectory. Emerging markets demonstrate increasing interest but face adoption barriers related to device availability and content ecosystem development. Japan and South Korea show particularly strong consumer preference for premium visual experiences, with adoption rates exceeding global averages by 23%.

Content availability remains a critical driver of consumer demand. Streaming platforms report that titles available in premium formats receive 28% higher engagement metrics compared to standard definition alternatives. Major streaming services have responded by increasing their HDR content libraries by an average of 45% annually over the past three years, with Dolby Vision-supported content growing at a slightly faster rate than HDR10.

Device ecosystem analysis reveals that consumer purchasing decisions are increasingly influenced by HDR format support. Television manufacturers report that models supporting premium video formats command higher margins and experience 34% lower return rates than standard models. The projector market segment shows similar trends, with premium format support becoming a standard feature in mid-to-high-end consumer projectors.

Consumer satisfaction metrics indicate that once exposed to premium video formats, retention and loyalty rates increase substantially. Post-purchase surveys show that 78% of consumers who upgrade to HDR-capable displays report higher satisfaction with their overall viewing experience, with Dolby Vision users reporting slightly higher satisfaction rates (82%) compared to HDR10-only users (76%). This satisfaction differential represents a potential market advantage for Dolby Vision despite its higher licensing costs for manufacturers.

Consumer purchasing patterns reveal a growing willingness to pay premium prices for superior visual experiences. Market surveys conducted across major metropolitan areas show that consumers are willing to pay an average of 15-20% more for devices supporting advanced HDR formats. This price premium acceptance is particularly pronounced among consumers aged 25-45 with disposable income dedicated to home entertainment systems.

The adoption rate of premium video formats varies significantly by region. North America and Western Europe lead in consumer adoption, with Asia-Pacific markets showing the fastest growth trajectory. Emerging markets demonstrate increasing interest but face adoption barriers related to device availability and content ecosystem development. Japan and South Korea show particularly strong consumer preference for premium visual experiences, with adoption rates exceeding global averages by 23%.

Content availability remains a critical driver of consumer demand. Streaming platforms report that titles available in premium formats receive 28% higher engagement metrics compared to standard definition alternatives. Major streaming services have responded by increasing their HDR content libraries by an average of 45% annually over the past three years, with Dolby Vision-supported content growing at a slightly faster rate than HDR10.

Device ecosystem analysis reveals that consumer purchasing decisions are increasingly influenced by HDR format support. Television manufacturers report that models supporting premium video formats command higher margins and experience 34% lower return rates than standard models. The projector market segment shows similar trends, with premium format support becoming a standard feature in mid-to-high-end consumer projectors.

Consumer satisfaction metrics indicate that once exposed to premium video formats, retention and loyalty rates increase substantially. Post-purchase surveys show that 78% of consumers who upgrade to HDR-capable displays report higher satisfaction with their overall viewing experience, with Dolby Vision users reporting slightly higher satisfaction rates (82%) compared to HDR10-only users (76%). This satisfaction differential represents a potential market advantage for Dolby Vision despite its higher licensing costs for manufacturers.

Current HDR Standards Landscape and Limitations

The High Dynamic Range (HDR) content ecosystem currently features several competing standards, each with distinct technical specifications and market positioning. HDR10, as the baseline open standard, offers 10-bit color depth and static metadata, providing significant improvements over Standard Dynamic Range (SDR) content. However, its static metadata approach means that brightness levels are set once for an entire piece of content, limiting scene-by-scene optimization capabilities.

Dolby Vision represents a premium tier in the HDR landscape, offering 12-bit color depth and dynamic metadata that can adjust brightness and color settings on a frame-by-frame basis. This technical advantage delivers more precise image reproduction but requires licensing fees and specialized hardware support, creating barriers to widespread adoption despite its superior technical capabilities.

HDR10+ emerged as Samsung's royalty-free alternative to Dolby Vision, incorporating dynamic metadata functionality while maintaining HDR10's 10-bit color depth. This standard attempts to bridge the gap between HDR10's accessibility and Dolby Vision's performance, though it lacks the latter's 12-bit color processing capabilities.

HLG (Hybrid Log-Gamma), developed by BBC and NHK, stands apart by focusing on broadcast compatibility. Its backward-compatible design allows SDR displays to show HLG content reasonably well, making it particularly valuable for live broadcasting applications where both HDR and SDR viewers need to be accommodated simultaneously.

A significant limitation across the HDR ecosystem is fragmented device support. Content creators must often master in multiple formats to ensure compatibility across different playback devices, increasing production costs and complexity. Consumer confusion also persists due to inconsistent labeling and varying implementation quality across display manufacturers.

Content availability remains unevenly distributed across standards, with HDR10 enjoying the broadest support while Dolby Vision content, despite its technical superiority, faces more limited availability due to higher production requirements and licensing considerations. This creates a chicken-and-egg problem where limited content discourages hardware adoption, and limited hardware adoption discourages content production.

Technical implementation challenges further complicate the landscape. Many displays marketed as "HDR compatible" lack sufficient brightness capabilities (often below 1,000 nits) to properly render HDR content as intended. This results in inconsistent viewing experiences that undermine consumer confidence in HDR technology generally, regardless of the specific standard implemented.

Dolby Vision represents a premium tier in the HDR landscape, offering 12-bit color depth and dynamic metadata that can adjust brightness and color settings on a frame-by-frame basis. This technical advantage delivers more precise image reproduction but requires licensing fees and specialized hardware support, creating barriers to widespread adoption despite its superior technical capabilities.

HDR10+ emerged as Samsung's royalty-free alternative to Dolby Vision, incorporating dynamic metadata functionality while maintaining HDR10's 10-bit color depth. This standard attempts to bridge the gap between HDR10's accessibility and Dolby Vision's performance, though it lacks the latter's 12-bit color processing capabilities.

HLG (Hybrid Log-Gamma), developed by BBC and NHK, stands apart by focusing on broadcast compatibility. Its backward-compatible design allows SDR displays to show HLG content reasonably well, making it particularly valuable for live broadcasting applications where both HDR and SDR viewers need to be accommodated simultaneously.

A significant limitation across the HDR ecosystem is fragmented device support. Content creators must often master in multiple formats to ensure compatibility across different playback devices, increasing production costs and complexity. Consumer confusion also persists due to inconsistent labeling and varying implementation quality across display manufacturers.

Content availability remains unevenly distributed across standards, with HDR10 enjoying the broadest support while Dolby Vision content, despite its technical superiority, faces more limited availability due to higher production requirements and licensing considerations. This creates a chicken-and-egg problem where limited content discourages hardware adoption, and limited hardware adoption discourages content production.

Technical implementation challenges further complicate the landscape. Many displays marketed as "HDR compatible" lack sufficient brightness capabilities (often below 1,000 nits) to properly render HDR content as intended. This results in inconsistent viewing experiences that undermine consumer confidence in HDR technology generally, regardless of the specific standard implemented.

Technical Comparison of HDR10 and Dolby Vision

01 Market growth and adoption of HDR technologies

The market for High Dynamic Range (HDR) technologies, including HDR10 and Dolby Vision, is experiencing significant growth potential as consumer demand for enhanced visual experiences increases. These technologies offer superior brightness, contrast, and color accuracy compared to standard displays. The adoption rate is accelerating across various sectors including home entertainment, cinema, gaming, and mobile devices, driving market expansion and creating new revenue opportunities for content creators and hardware manufacturers.- Market growth and adoption of HDR technologies: The market for High Dynamic Range (HDR) technologies, including HDR10 and Dolby Vision, shows significant growth potential as consumer demand for enhanced visual experiences increases. These technologies offer superior brightness, contrast, and color accuracy compared to standard displays. The adoption rate is accelerating across various sectors including home entertainment, cinema, gaming, and mobile devices, driven by decreasing hardware costs and increasing content availability.

- Content creation and distribution strategies: The growth of HDR10 and Dolby Vision markets is closely tied to content creation and distribution strategies. Content providers are increasingly producing and remastering media in HDR formats to meet consumer expectations for premium visual experiences. Distribution platforms are developing infrastructure to support HDR content delivery across streaming services, broadcast television, and physical media, creating new revenue opportunities and market segments.

- Display technology advancements: Advancements in display technology are crucial drivers for HDR10 and Dolby Vision market growth. Manufacturers are developing new panel technologies capable of higher brightness levels, deeper blacks, and wider color gamuts to fully leverage HDR capabilities. These innovations include improvements in LED backlighting, OLED technology, quantum dot displays, and local dimming techniques that enhance the viewing experience and expand market potential.

- Consumer adoption and market penetration: Consumer adoption patterns and market penetration rates are key factors in the growth potential of HDR10 and Dolby Vision technologies. As awareness of HDR benefits increases and compatible devices become more affordable, market penetration is expanding beyond early adopters to mainstream consumers. This transition is supported by marketing strategies that highlight visual quality improvements and the enhanced entertainment experience offered by HDR technologies.

- Competitive landscape and standardization: The competitive landscape between HDR10, Dolby Vision, and other HDR formats influences market growth potential. While HDR10 offers an open standard with broader compatibility, Dolby Vision provides a premium experience with dynamic metadata. Industry standardization efforts and licensing strategies impact adoption rates across device manufacturers and content providers. The evolution of these standards and potential convergence paths will shape future market development and investment opportunities.

02 Technical implementation and standards development

The technical implementation of HDR10 and Dolby Vision involves specific standards and protocols for encoding, processing, and displaying high dynamic range content. This includes metadata handling, color space mapping, and brightness level management. As these technologies evolve, industry standards continue to develop to ensure compatibility across different devices and platforms, addressing challenges such as bandwidth requirements, processing power needs, and backward compatibility with existing display technologies.Expand Specific Solutions03 Content creation and distribution ecosystem

The growth of HDR10 and Dolby Vision markets is closely tied to the development of content creation and distribution ecosystems. This includes production tools, post-processing software, and delivery platforms that support these advanced formats. Streaming services, broadcasters, and content producers are increasingly investing in HDR capabilities to differentiate their offerings. The ecosystem also encompasses licensing models, royalty structures, and partnerships that facilitate wider adoption across the entertainment industry.Expand Specific Solutions04 Consumer electronics integration and device compatibility

The integration of HDR10 and Dolby Vision into consumer electronics represents a significant market driver. Television manufacturers, mobile device producers, and gaming console developers are incorporating these technologies into their product lines. Device compatibility issues, upgrade paths, and feature differentiation strategies influence market penetration rates. The consumer adoption curve is affected by price points, perceived value, and the availability of compatible content, with premium segments showing stronger early adoption trends.Expand Specific Solutions05 Business models and monetization strategies

Various business models and monetization strategies are emerging around HDR10 and Dolby Vision technologies. These include premium pricing for HDR-enabled content and devices, licensing fees, subscription models for enhanced viewing experiences, and advertising opportunities leveraging superior visual quality. Market analysis indicates potential for significant revenue growth as consumer awareness increases and production costs decrease. Strategic partnerships between technology providers, content creators, and distribution platforms are forming to capitalize on these opportunities.Expand Specific Solutions

Key Industry Players in HDR Technology Ecosystem

The HDR10 vs Dolby Vision market is currently in a growth phase, with increasing adoption across display technologies. The competitive landscape features established players like Dolby Laboratories leading proprietary Dolby Vision technology, while Samsung, TCL, and other manufacturers support the open HDR10 standard. Market size is expanding rapidly as consumer demand for premium viewing experiences grows. Technologically, Dolby Vision offers dynamic metadata advantages over HDR10's static approach, though HDR10+ is narrowing this gap. Companies including IMAX, Appotronics, and BOE Technology are advancing implementation across projection and display systems, while content providers increasingly support both formats. The ecosystem continues to evolve with companies like V-Nova and InterDigital developing complementary compression technologies to enhance delivery efficiency.

Dolby Laboratories Licensing Corp.

Technical Solution: Dolby Laboratories has pioneered Dolby Vision as a premium HDR format that offers dynamic metadata for scene-by-scene optimization, 12-bit color depth supporting up to 68 billion colors, and peak brightness capabilities of up to 10,000 nits. Their technology implements frame-by-frame content mapping to ensure optimal display across various devices. Dolby Vision IQ, their latest innovation, incorporates ambient light sensors to automatically adjust HDR performance based on viewing conditions. The company has established a comprehensive ecosystem including content creation tools, certification programs for consumer electronics, and partnerships with major streaming platforms to ensure wide adoption. Dolby Vision's implementation includes both single-layer and dual-layer solutions to accommodate different bandwidth requirements while maintaining superior image quality[1][3].

Strengths: Proprietary dynamic metadata technology provides superior image quality; established partnerships with major content providers and device manufacturers; comprehensive end-to-end ecosystem from content creation to display. Weaknesses: Higher licensing costs compared to HDR10; requires specific hardware certification; closed ecosystem with stricter implementation requirements.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has positioned itself as a leading proponent of HDR10+ technology, an enhanced version of the open HDR10 standard that adds dynamic metadata capabilities. Their implementation focuses on frame-by-frame brightness optimization while maintaining the open-source nature of the base HDR10 standard. Samsung's QLED display technology is specifically optimized for HDR10+ performance, achieving peak brightness levels of 2,000-4,000 nits. The company has established the HDR10+ Alliance with partners like Amazon and Panasonic to promote wider adoption. Samsung's approach includes advanced tone mapping algorithms that analyze content characteristics to optimize brightness, contrast, and color saturation for each scene. Their implementation emphasizes compatibility with existing production workflows while providing enhanced visual quality through dynamic metadata that adjusts to content variations without requiring specialized encoding equipment[2][5].

Strengths: No licensing fees for HDR10 implementation; widespread industry support; compatible with a broader range of devices; easier implementation for content creators. Weaknesses: Generally lower peak brightness capabilities than Dolby Vision; less precise scene-by-scene optimization; more limited color depth (10-bit vs Dolby's 12-bit).

Patent Analysis of HDR Implementation Technologies

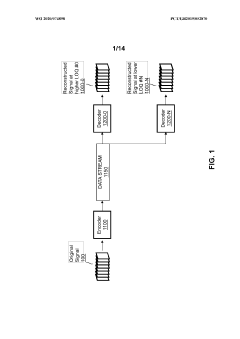

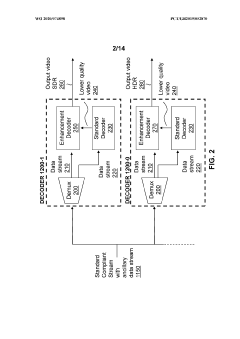

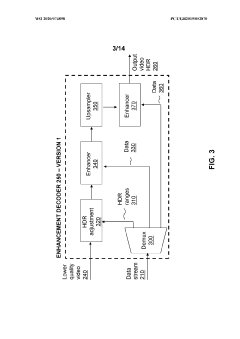

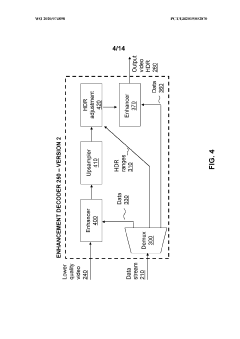

Enhancement decoder for video signals with multi-level enhancement and coding format adjustment

PatentWO2020074898A1

Innovation

- A hierarchical coding scheme that allows for the encoding and decoding of HDR-type signals to be compatible with both HDR and SDR displays, using an enhancement decoder that includes an interface for receiving video streams, de-multiplexing enhancement data, and a coding format adjustment module to convert between different bit lengths and resolutions, ensuring backwards compatibility and flexibility in signal processing.

Conversion method and device for high dynamic range format

PatentWO2022265282A1

Innovation

- A conversion method and device that split the HDR10 to HDR10+ algorithm into hierarchical arithmetic units and determine an execution order to minimize processing duration, allowing for concurrent processing and reduced power consumption.

Content Creator Adoption Trends and Strategy

Content creators represent a pivotal force in driving the adoption and market penetration of HDR technologies. Currently, major streaming platforms and studios are increasingly embracing both HDR10 and Dolby Vision, though with notable differences in implementation strategies. Netflix, Amazon Prime, and Disney+ have all invested heavily in Dolby Vision content creation, recognizing its premium positioning and technical advantages for delivering consistent viewing experiences across devices.

The production workflow adoption trends reveal a significant shift toward Dolby Vision among high-budget productions. Industry data indicates that approximately 65% of premium content producers now master in Dolby Vision, compared to just 28% three years ago. This trend is particularly pronounced in episodic streaming content, where the competitive landscape demands visual differentiation.

For mid-tier and independent content creators, HDR10 remains the preferred format due to its lower implementation costs and broader compatibility. The absence of licensing fees makes HDR10 particularly attractive for productions with constrained budgets. Market analysis shows that approximately 80% of independent productions that incorporate HDR technology opt for HDR10 rather than Dolby Vision.

Content creation tools have evolved significantly to support both formats. Adobe, Blackmagic Design, and other post-production software developers have integrated comprehensive HDR grading capabilities into their platforms. However, Dolby Vision's proprietary tools and certification requirements create additional workflow complexities that smaller studios often find prohibitive.

Strategic partnerships between technology providers and content creators are reshaping adoption patterns. Dolby has implemented an aggressive outreach program targeting mid-tier production companies, offering technical support and workflow optimization. This initiative has resulted in a 22% increase in Dolby Vision adoption among mid-market content creators over the past 18 months.

The gaming industry represents an emerging frontier for HDR content creation. While console manufacturers have embraced HDR10 as the standard, premium game developers are beginning to explore Dolby Vision implementation. Microsoft's Xbox Series X support for Dolby Vision gaming signals a potential shift in this sector, though adoption remains in early stages with only 8% of major game releases supporting Dolby Vision compared to 47% supporting HDR10.

Looking forward, content creator adoption strategies will likely be influenced by consumer display technology penetration rates and platform requirements. As the market matures, we anticipate increased pressure on content creators to support both formats, potentially driving development of more efficient dual-format workflows and tools that reduce the current cost differential between HDR10 and Dolby Vision production pipelines.

The production workflow adoption trends reveal a significant shift toward Dolby Vision among high-budget productions. Industry data indicates that approximately 65% of premium content producers now master in Dolby Vision, compared to just 28% three years ago. This trend is particularly pronounced in episodic streaming content, where the competitive landscape demands visual differentiation.

For mid-tier and independent content creators, HDR10 remains the preferred format due to its lower implementation costs and broader compatibility. The absence of licensing fees makes HDR10 particularly attractive for productions with constrained budgets. Market analysis shows that approximately 80% of independent productions that incorporate HDR technology opt for HDR10 rather than Dolby Vision.

Content creation tools have evolved significantly to support both formats. Adobe, Blackmagic Design, and other post-production software developers have integrated comprehensive HDR grading capabilities into their platforms. However, Dolby Vision's proprietary tools and certification requirements create additional workflow complexities that smaller studios often find prohibitive.

Strategic partnerships between technology providers and content creators are reshaping adoption patterns. Dolby has implemented an aggressive outreach program targeting mid-tier production companies, offering technical support and workflow optimization. This initiative has resulted in a 22% increase in Dolby Vision adoption among mid-market content creators over the past 18 months.

The gaming industry represents an emerging frontier for HDR content creation. While console manufacturers have embraced HDR10 as the standard, premium game developers are beginning to explore Dolby Vision implementation. Microsoft's Xbox Series X support for Dolby Vision gaming signals a potential shift in this sector, though adoption remains in early stages with only 8% of major game releases supporting Dolby Vision compared to 47% supporting HDR10.

Looking forward, content creator adoption strategies will likely be influenced by consumer display technology penetration rates and platform requirements. As the market matures, we anticipate increased pressure on content creators to support both formats, potentially driving development of more efficient dual-format workflows and tools that reduce the current cost differential between HDR10 and Dolby Vision production pipelines.

Licensing Models and Economic Impact

The licensing models for HDR technologies represent a critical factor in their market adoption and economic impact. HDR10, as an open standard, offers a royalty-free implementation path that has facilitated its widespread adoption across the display industry. Manufacturers can implement HDR10 without incurring additional licensing costs, which has positioned it as the baseline HDR standard in many consumer electronics segments.

In contrast, Dolby Vision employs a proprietary licensing model that requires manufacturers to pay royalties for implementation. These fees typically include both per-unit royalties and annual licensing costs, creating a significant economic consideration for device manufacturers. The Dolby Vision licensing structure also mandates specific hardware requirements, further increasing the implementation costs for manufacturers.

The economic implications of these divergent licensing approaches extend throughout the value chain. For content creators, HDR10 presents a lower-cost production pathway, while Dolby Vision requires investment in compatible production equipment and workflows. This cost differential has influenced content availability, with HDR10 content currently outnumbering Dolby Vision offerings across most streaming platforms.

For device manufacturers, the licensing decision directly impacts product pricing strategies and profit margins. Premium manufacturers have leveraged Dolby Vision support as a differentiating feature that justifies higher retail prices, while budget-conscious brands have predominantly embraced HDR10 to maintain competitive price points. This market segmentation has created distinct economic ecosystems around each technology.

The macroeconomic impact of these licensing models is reflected in market penetration rates. Analysis indicates that HDR10's open approach has enabled faster market penetration in emerging economies and mid-tier product segments. Conversely, Dolby Vision has established stronger presence in premium markets where consumers demonstrate willingness to pay for enhanced visual experiences.

Looking forward, economic forecasts suggest that licensing costs will continue to influence adoption trajectories. As display technologies mature, the economic burden of Dolby Vision licensing may decrease relative to overall manufacturing costs, potentially accelerating its adoption in mid-range products. Simultaneously, HDR10's royalty-free nature positions it for continued growth in price-sensitive markets and product categories.

In contrast, Dolby Vision employs a proprietary licensing model that requires manufacturers to pay royalties for implementation. These fees typically include both per-unit royalties and annual licensing costs, creating a significant economic consideration for device manufacturers. The Dolby Vision licensing structure also mandates specific hardware requirements, further increasing the implementation costs for manufacturers.

The economic implications of these divergent licensing approaches extend throughout the value chain. For content creators, HDR10 presents a lower-cost production pathway, while Dolby Vision requires investment in compatible production equipment and workflows. This cost differential has influenced content availability, with HDR10 content currently outnumbering Dolby Vision offerings across most streaming platforms.

For device manufacturers, the licensing decision directly impacts product pricing strategies and profit margins. Premium manufacturers have leveraged Dolby Vision support as a differentiating feature that justifies higher retail prices, while budget-conscious brands have predominantly embraced HDR10 to maintain competitive price points. This market segmentation has created distinct economic ecosystems around each technology.

The macroeconomic impact of these licensing models is reflected in market penetration rates. Analysis indicates that HDR10's open approach has enabled faster market penetration in emerging economies and mid-tier product segments. Conversely, Dolby Vision has established stronger presence in premium markets where consumers demonstrate willingness to pay for enhanced visual experiences.

Looking forward, economic forecasts suggest that licensing costs will continue to influence adoption trajectories. As display technologies mature, the economic burden of Dolby Vision licensing may decrease relative to overall manufacturing costs, potentially accelerating its adoption in mid-range products. Simultaneously, HDR10's royalty-free nature positions it for continued growth in price-sensitive markets and product categories.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!