HDR10 vs Dolby Vision: Role in Liquid Crystal Display Technology

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

HDR Display Evolution and Objectives

High Dynamic Range (HDR) display technology has undergone significant evolution since its inception in the early 2000s. The journey began with Standard Dynamic Range (SDR) displays that offered limited brightness levels typically around 100 nits and a restricted color gamut. The introduction of HDR technology marked a revolutionary advancement in display capabilities, enabling screens to reproduce a wider range of luminance levels and color depth that more closely resembles what the human eye can perceive in natural environments.

The first major milestone in HDR evolution came with the development of HDR10, an open standard introduced in 2015 that supports 10-bit color depth and peak brightness levels up to 1,000 nits. This standard represented a substantial improvement over SDR technology, offering more vibrant colors and enhanced contrast ratios that significantly improved viewing experiences, particularly for LCD displays which had historically struggled with contrast limitations.

Dolby Vision emerged as a proprietary alternative to HDR10, offering 12-bit color depth and supporting brightness levels up to 10,000 nits. Unlike HDR10's static metadata approach, Dolby Vision implements dynamic metadata that allows for scene-by-scene or even frame-by-frame optimization of brightness, color, and contrast. This dynamic capability has positioned Dolby Vision as a premium HDR solution, particularly beneficial for LCD technology where precise backlight control is crucial for optimal HDR performance.

The technical objectives of HDR implementation in liquid crystal displays center around overcoming inherent LCD limitations. These include improving local dimming capabilities to enhance contrast ratios, developing more efficient backlight technologies to achieve higher peak brightness without excessive power consumption, and implementing advanced color management systems to fully utilize the expanded color gamut that HDR standards support.

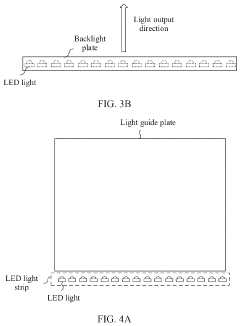

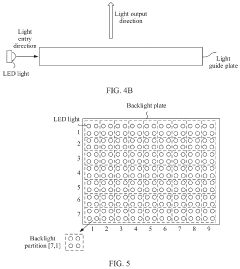

Recent advancements have focused on the development of hybrid technologies like Mini-LED backlighting, which combines traditional LCD panels with thousands of tiny LED zones to achieve more precise local dimming. This approach aims to bridge the gap between conventional LCD limitations and the superior contrast capabilities of OLED displays, while maintaining LCD's advantage in peak brightness performance.

The ultimate objective of HDR display evolution is to create viewing experiences that more accurately represent the full range of visual information captured by modern cameras and rendered by advanced graphics engines. For LCD technology specifically, this means continuing to refine backlight control systems, color processing algorithms, and panel response times to deliver HDR content with minimal artifacts and maximum visual impact across diverse viewing environments.

The first major milestone in HDR evolution came with the development of HDR10, an open standard introduced in 2015 that supports 10-bit color depth and peak brightness levels up to 1,000 nits. This standard represented a substantial improvement over SDR technology, offering more vibrant colors and enhanced contrast ratios that significantly improved viewing experiences, particularly for LCD displays which had historically struggled with contrast limitations.

Dolby Vision emerged as a proprietary alternative to HDR10, offering 12-bit color depth and supporting brightness levels up to 10,000 nits. Unlike HDR10's static metadata approach, Dolby Vision implements dynamic metadata that allows for scene-by-scene or even frame-by-frame optimization of brightness, color, and contrast. This dynamic capability has positioned Dolby Vision as a premium HDR solution, particularly beneficial for LCD technology where precise backlight control is crucial for optimal HDR performance.

The technical objectives of HDR implementation in liquid crystal displays center around overcoming inherent LCD limitations. These include improving local dimming capabilities to enhance contrast ratios, developing more efficient backlight technologies to achieve higher peak brightness without excessive power consumption, and implementing advanced color management systems to fully utilize the expanded color gamut that HDR standards support.

Recent advancements have focused on the development of hybrid technologies like Mini-LED backlighting, which combines traditional LCD panels with thousands of tiny LED zones to achieve more precise local dimming. This approach aims to bridge the gap between conventional LCD limitations and the superior contrast capabilities of OLED displays, while maintaining LCD's advantage in peak brightness performance.

The ultimate objective of HDR display evolution is to create viewing experiences that more accurately represent the full range of visual information captured by modern cameras and rendered by advanced graphics engines. For LCD technology specifically, this means continuing to refine backlight control systems, color processing algorithms, and panel response times to deliver HDR content with minimal artifacts and maximum visual impact across diverse viewing environments.

Market Demand Analysis for Premium Display Technologies

The premium display technology market has witnessed substantial growth in recent years, driven primarily by increasing consumer demand for superior visual experiences across multiple platforms. HDR (High Dynamic Range) technologies, particularly HDR10 and Dolby Vision, have emerged as significant differentiators in the liquid crystal display (LCD) segment, commanding premium pricing and influencing purchasing decisions.

Consumer research indicates that visual quality has become a primary consideration for buyers, with 78% of consumers rating picture quality as "very important" when purchasing new televisions. This trend extends beyond home entertainment to professional monitors, mobile devices, and automotive displays, creating a multi-faceted market for premium display technologies.

The streaming content ecosystem has been instrumental in driving market demand for HDR-capable displays. Major platforms including Netflix, Amazon Prime, Disney+, and Apple TV+ have expanded their HDR content libraries significantly, with Dolby Vision titles growing at approximately 40% annually. This content proliferation creates a compelling use case for consumers to upgrade their display technology.

In the television segment, premium LCD displays featuring advanced HDR capabilities represent the fastest-growing category by revenue, despite overall flat unit sales in mature markets. The average selling price of HDR-capable televisions remains 30% higher than standard displays, with Dolby Vision-certified models commanding an additional premium over basic HDR10 models.

Professional markets present another significant growth vector. Content creation studios, post-production facilities, and professional photographers increasingly require displays capable of accurately representing HDR content. This specialized segment values the expanded color gamut and precise luminance control offered by advanced HDR implementations.

Mobile device manufacturers have recognized this market trend, with flagship smartphones and tablets increasingly featuring HDR-capable displays. The mobile premium display market is projected to grow substantially as streaming services optimize HDR content for on-the-go consumption.

Regional analysis reveals varying adoption rates, with North America and Western Europe leading in premium display technology penetration. Asian markets, particularly China and South Korea, show accelerating growth rates as disposable income increases and domestic manufacturers enhance their HDR implementation capabilities.

Consumer education remains a challenge, with surveys indicating confusion about different HDR standards. Despite this, awareness of HDR as a desirable feature has reached mainstream levels, with recognition rates exceeding 65% among television shoppers in developed markets.

The commercial display sector represents an emerging opportunity, with digital signage, hospitality, and retail environments beginning to adopt HDR technologies to create more impactful visual experiences and differentiate their customer engagement strategies.

Consumer research indicates that visual quality has become a primary consideration for buyers, with 78% of consumers rating picture quality as "very important" when purchasing new televisions. This trend extends beyond home entertainment to professional monitors, mobile devices, and automotive displays, creating a multi-faceted market for premium display technologies.

The streaming content ecosystem has been instrumental in driving market demand for HDR-capable displays. Major platforms including Netflix, Amazon Prime, Disney+, and Apple TV+ have expanded their HDR content libraries significantly, with Dolby Vision titles growing at approximately 40% annually. This content proliferation creates a compelling use case for consumers to upgrade their display technology.

In the television segment, premium LCD displays featuring advanced HDR capabilities represent the fastest-growing category by revenue, despite overall flat unit sales in mature markets. The average selling price of HDR-capable televisions remains 30% higher than standard displays, with Dolby Vision-certified models commanding an additional premium over basic HDR10 models.

Professional markets present another significant growth vector. Content creation studios, post-production facilities, and professional photographers increasingly require displays capable of accurately representing HDR content. This specialized segment values the expanded color gamut and precise luminance control offered by advanced HDR implementations.

Mobile device manufacturers have recognized this market trend, with flagship smartphones and tablets increasingly featuring HDR-capable displays. The mobile premium display market is projected to grow substantially as streaming services optimize HDR content for on-the-go consumption.

Regional analysis reveals varying adoption rates, with North America and Western Europe leading in premium display technology penetration. Asian markets, particularly China and South Korea, show accelerating growth rates as disposable income increases and domestic manufacturers enhance their HDR implementation capabilities.

Consumer education remains a challenge, with surveys indicating confusion about different HDR standards. Despite this, awareness of HDR as a desirable feature has reached mainstream levels, with recognition rates exceeding 65% among television shoppers in developed markets.

The commercial display sector represents an emerging opportunity, with digital signage, hospitality, and retail environments beginning to adopt HDR technologies to create more impactful visual experiences and differentiate their customer engagement strategies.

HDR Standards Current Status and Technical Barriers

The current HDR (High Dynamic Range) landscape is dominated by two major standards: HDR10 and Dolby Vision, each with distinct technical specifications and market positioning. HDR10, as an open standard, has achieved widespread adoption across the display industry, supporting 10-bit color depth and static metadata. This standard can represent a maximum brightness of 1,000 nits and utilizes the Rec.2020 color space, offering significant improvements over traditional SDR content.

Dolby Vision, meanwhile, represents a more advanced proprietary standard with 12-bit color depth capability and dynamic metadata that can adjust brightness, contrast, and color settings on a scene-by-scene or even frame-by-frame basis. It supports brightness levels up to 10,000 nits theoretically, though current LCD implementations typically max out at 1,000-4,000 nits due to hardware limitations.

Despite their technological merits, both standards face significant implementation challenges in LCD technology. The primary technical barrier remains the inherent contrast limitation of LCD panels. Unlike OLED or microLED technologies that can completely turn off individual pixels, LCD displays rely on backlight systems that struggle to achieve true blacks, resulting in compromised contrast ratios that diminish HDR impact.

Local dimming technology has emerged as a partial solution, dividing the backlight into multiple zones that can be independently controlled. However, even advanced mini-LED backlights with thousands of dimming zones suffer from blooming effects where bright objects on dark backgrounds create visible halos, undermining the precision required for optimal HDR presentation.

Color volume representation presents another significant challenge. While both standards specify wide color gamuts, LCD panels struggle to maintain color accuracy at high brightness levels due to physical limitations of liquid crystal materials and color filters. This results in color shifting and reduced saturation at peak brightness, particularly affecting Dolby Vision content which demands greater precision across its wider dynamic range.

Power consumption and thermal management constitute additional barriers, as achieving high peak brightness in LCD displays requires substantial power, generating heat that can degrade panel performance and longevity. This is particularly problematic for Dolby Vision implementation, which may demand sustained high brightness for certain content.

The cost factor remains significant as well. While HDR10 implementation requires minimal additional hardware, fully realizing Dolby Vision's potential necessitates more sophisticated processing chips, enhanced panel specifications, and licensing fees. This creates a market segmentation where budget and mid-range displays often support only HDR10, while Dolby Vision remains confined to premium product tiers.

Dolby Vision, meanwhile, represents a more advanced proprietary standard with 12-bit color depth capability and dynamic metadata that can adjust brightness, contrast, and color settings on a scene-by-scene or even frame-by-frame basis. It supports brightness levels up to 10,000 nits theoretically, though current LCD implementations typically max out at 1,000-4,000 nits due to hardware limitations.

Despite their technological merits, both standards face significant implementation challenges in LCD technology. The primary technical barrier remains the inherent contrast limitation of LCD panels. Unlike OLED or microLED technologies that can completely turn off individual pixels, LCD displays rely on backlight systems that struggle to achieve true blacks, resulting in compromised contrast ratios that diminish HDR impact.

Local dimming technology has emerged as a partial solution, dividing the backlight into multiple zones that can be independently controlled. However, even advanced mini-LED backlights with thousands of dimming zones suffer from blooming effects where bright objects on dark backgrounds create visible halos, undermining the precision required for optimal HDR presentation.

Color volume representation presents another significant challenge. While both standards specify wide color gamuts, LCD panels struggle to maintain color accuracy at high brightness levels due to physical limitations of liquid crystal materials and color filters. This results in color shifting and reduced saturation at peak brightness, particularly affecting Dolby Vision content which demands greater precision across its wider dynamic range.

Power consumption and thermal management constitute additional barriers, as achieving high peak brightness in LCD displays requires substantial power, generating heat that can degrade panel performance and longevity. This is particularly problematic for Dolby Vision implementation, which may demand sustained high brightness for certain content.

The cost factor remains significant as well. While HDR10 implementation requires minimal additional hardware, fully realizing Dolby Vision's potential necessitates more sophisticated processing chips, enhanced panel specifications, and licensing fees. This creates a market segmentation where budget and mid-range displays often support only HDR10, while Dolby Vision remains confined to premium product tiers.

HDR10 vs Dolby Vision Technical Implementation

01 HDR10 and Dolby Vision display technologies

High Dynamic Range (HDR10) and Dolby Vision are advanced display technologies that enhance the visual experience by providing greater contrast, brightness, and color accuracy. These technologies allow for more realistic and immersive viewing experiences by expanding the range of colors and brightness levels that can be displayed on compatible screens. The implementation of these technologies in various display devices enables content to be viewed with more detail in both bright and dark scenes.- HDR10 and Dolby Vision display technologies: High Dynamic Range (HDR10) and Dolby Vision are advanced display technologies that enhance the visual experience by providing greater contrast, brightness, and color accuracy. These technologies allow for more realistic and immersive viewing experiences by expanding the range of colors and brightness levels that can be displayed on compatible screens. The implementation of these technologies in various display devices has revolutionized how content is consumed.

- Content encoding and processing for HDR formats: The encoding and processing of content for HDR formats involves specialized algorithms and methods to capture, process, and deliver high dynamic range content. This includes techniques for converting standard dynamic range (SDR) content to HDR formats, as well as methods for optimizing HDR content for different display capabilities. These processes ensure that the full potential of HDR10 and Dolby Vision can be realized across various viewing platforms.

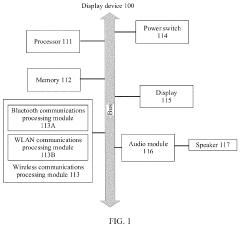

- HDR-compatible hardware and devices: The development of hardware and devices compatible with HDR10 and Dolby Vision standards is crucial for the adoption of these technologies. This includes televisions, monitors, projectors, and mobile devices designed to support high dynamic range content. These devices incorporate specialized components and circuitry to process and display HDR content correctly, ensuring that viewers can experience the enhanced visual quality offered by HDR10 and Dolby Vision.

- Signal transmission and compatibility solutions: Signal transmission and compatibility solutions for HDR content address the challenges of delivering high dynamic range content across different platforms and devices. This includes methods for transmitting HDR signals through various interfaces (such as HDMI), techniques for ensuring backward compatibility with non-HDR devices, and solutions for adapting HDR content to different display capabilities. These solutions are essential for the seamless integration of HDR technologies into existing content delivery ecosystems.

- User interface and control systems for HDR content: User interface and control systems for HDR content focus on providing viewers with intuitive ways to interact with and optimize their HDR viewing experience. This includes on-screen displays, remote control functions, and automatic adjustment features that help users get the most out of HDR10 and Dolby Vision content. These systems may also include calibration tools and presets designed specifically for different types of HDR content, ensuring optimal viewing experiences across various content types.

02 Signal processing for HDR content

Signal processing techniques are essential for handling HDR content, including both HDR10 and Dolby Vision formats. These techniques involve specialized algorithms for tone mapping, color grading, and dynamic range adjustment to ensure optimal display of HDR content across different devices. The processing systems can analyze and adjust content in real-time to maintain visual quality while adapting to the capabilities of the display device.Expand Specific Solutions03 HDR content compatibility and conversion

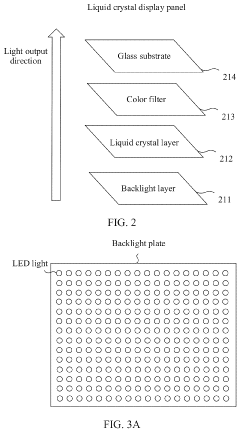

Systems and methods for ensuring compatibility between different HDR formats, particularly between HDR10 and Dolby Vision, are crucial for content delivery. These include conversion techniques that allow content created in one format to be displayed on devices supporting another format without significant loss of quality. Such compatibility solutions enable broader adoption of HDR technologies across various consumer electronics and content distribution platforms.Expand Specific Solutions04 HDR-enabled display hardware

Specialized hardware components are required to support HDR10 and Dolby Vision in display devices. These include advanced backlighting systems, high-performance image processors, and enhanced panel technologies capable of reproducing the wider color gamut and brightness range demanded by HDR content. The hardware implementations focus on achieving accurate color reproduction, higher peak brightness, and deeper black levels to fully realize the benefits of HDR content.Expand Specific Solutions05 Content creation and mastering for HDR formats

Content creation and mastering tools specifically designed for HDR10 and Dolby Vision enable filmmakers and content producers to take full advantage of these formats. These tools include specialized cameras, color grading software, and mastering workflows that preserve the intended visual experience throughout the production pipeline. The mastering process ensures that the creative intent is maintained when content is distributed across different platforms and displayed on various devices.Expand Specific Solutions

Key Industry Players in HDR Display Ecosystem

The HDR10 vs Dolby Vision competition in LCD technology is currently in a growth phase, with the market expanding rapidly as consumers demand superior visual experiences. The global HDR display market is projected to reach significant scale, driven by increasing adoption in premium televisions and mobile devices. Technologically, major players demonstrate varying levels of maturity: BOE Technology, TCL China Star, and LG Display lead in manufacturing capabilities for both standards, while Sharp and Samsung have established strong HDR10 implementations. Dolby Vision's advanced capabilities are being championed by companies like Intel and Huawei in their respective ecosystems. The competitive landscape shows a strategic division between companies adopting the royalty-free HDR10 standard versus those investing in Dolby Vision's premium features for differentiation in high-end display products.

TCL China Star Optoelectronics Technology Co., Ltd.

Technical Solution: TCL CSOT has pioneered advanced LCD technologies supporting both HDR10 and Dolby Vision, with particular focus on their proprietary QLED technology. Their high-end panels utilize quantum dot enhancement film (QDEF) to achieve over 100% DCI-P3 color gamut coverage. For HDR implementation, TCL CSOT employs mini-LED backlighting with up to 1,000+ independent dimming zones in premium models, achieving peak brightness levels of 2,000+ nits while maintaining contrast ratios exceeding 150,000:1. Their panels support 10-bit native color depth for HDR10 and process the 12-bit dynamic metadata required by Dolby Vision. TCL CSOT's proprietary HDR processing engine dynamically adjusts contrast, brightness, and color saturation on a frame-by-frame basis, optimizing content for either HDR10's static metadata or Dolby Vision's dynamic approach. Their latest innovation includes dual-cell LCD technology (marketed as "Vidrian") that stacks two LCD panels to dramatically improve contrast performance specifically for HDR content.

Strengths: Industry-leading brightness capabilities; excellent color volume performance; cost-effective manufacturing allowing HDR technologies in mid-range products. Weaknesses: Local dimming algorithms sometimes produce visible blooming; viewing angle limitations compared to OLED; higher power consumption when operating at peak HDR brightness levels.

Sharp Corp.

Technical Solution: Sharp has developed proprietary AQUOS LCD technology supporting both HDR10 and Dolby Vision standards. Their premium panels feature UV²A (Ultraviolet-induced multi-domain Vertical Alignment) technology that enhances light transmittance while maintaining deep black levels. For HDR implementation, Sharp employs full-array local dimming with hundreds of independently controlled zones, achieving peak brightness of 1,200+ nits and contrast ratios exceeding 20,000:1. Sharp's Spectros Rich Color Technology expands the color gamut to cover approximately 90% of DCI-P3, supporting 10-bit color depth for HDR10 and processing capabilities for Dolby Vision's 12-bit dynamic metadata. Their proprietary HDR Master Drive technology utilizes advanced algorithms to analyze incoming content and optimize backlight control, reducing blooming artifacts while preserving highlight details. Sharp has also implemented advanced thermal management systems to maintain consistent HDR performance during extended viewing periods, addressing a common limitation in LCD HDR displays where brightness diminishes over time due to heat buildup.

Strengths: Excellent motion handling for fast-moving HDR content; superior light uniformity across the panel; good balance of brightness and contrast. Weaknesses: Fewer local dimming zones than leading competitors; limited implementation of quantum dot technology in current lineup; viewing angle limitations typical of VA panel technology.

Core Patents and Innovations in HDR Display Technology

Display brightness adjustment method and related apparatus

PatentActiveUS11869450B2

Innovation

- A method that continuously adjusts display brightness by determining average pixel brightness values for each backlight partition, calculating initial and actual dimming duty cycles, and adjusting drive current values within the power supply's maximum and minimum current limits to ensure peak brightness and smooth gradation.

Conversion method and device for high dynamic range format

PatentWO2022265282A1

Innovation

- A conversion method and device that split the HDR10 to HDR10+ algorithm into hierarchical arithmetic units and determine an execution order to minimize processing duration, allowing for concurrent processing and reduced power consumption.

Content Creation and Distribution Pipeline

The content creation and distribution pipeline for HDR technologies represents a critical component in the ecosystem that delivers high dynamic range experiences to consumers. For HDR10 and Dolby Vision, this pipeline encompasses several distinct stages that significantly impact the final viewing experience on liquid crystal displays.

Content creation begins with capture using high-end digital cameras capable of recording wide color gamuts and expanded dynamic ranges. HDR10 content typically requires cameras that can capture at least 10-bit color depth, while Dolby Vision productions often utilize 12-bit capable equipment to take full advantage of its technical specifications. During post-production, colorists work with specialized monitors and grading software to establish the creative intent for HDR content.

The mastering process differs significantly between these formats. HDR10 content is mastered with static metadata that sets consistent parameters throughout the entire content. In contrast, Dolby Vision employs dynamic metadata that can adjust brightness, contrast, and color settings on a scene-by-scene or even frame-by-frame basis, allowing for more precise representation of creative intent across varying display capabilities.

Distribution channels must accommodate the increased data requirements of HDR content. Streaming platforms like Netflix, Amazon Prime, and Disney+ have implemented adaptive bitrate technologies to deliver HDR10 and Dolby Vision content based on available bandwidth. Physical media distribution through Ultra HD Blu-ray discs supports both formats, with Dolby Vision requiring additional licensing and certification processes.

Broadcast infrastructure presents unique challenges for HDR distribution. While HDR10 has been more readily adopted due to its open standard nature, Dolby Vision's proprietary format requires specialized encoding equipment and licensing agreements. Hybrid Log-Gamma (HLG) has emerged as an alternative specifically designed for broadcast applications, offering backward compatibility with SDR displays.

Content delivery networks (CDNs) play a crucial role in optimizing the delivery of HDR content to consumers. These networks must manage the increased file sizes associated with HDR content while maintaining streaming quality across varying network conditions. For LCD displays specifically, the distribution pipeline must account for the display technology's limitations in local dimming capabilities and peak brightness levels.

The final stage involves display-side processing, where LCD televisions interpret the incoming HDR signals. HDR10 content relies on the display's built-in tone mapping to adapt content to the screen's capabilities, while Dolby Vision-enabled displays utilize the dynamic metadata to optimize presentation based on the specific display's performance characteristics, potentially offering more consistent image quality across different LCD models.

Content creation begins with capture using high-end digital cameras capable of recording wide color gamuts and expanded dynamic ranges. HDR10 content typically requires cameras that can capture at least 10-bit color depth, while Dolby Vision productions often utilize 12-bit capable equipment to take full advantage of its technical specifications. During post-production, colorists work with specialized monitors and grading software to establish the creative intent for HDR content.

The mastering process differs significantly between these formats. HDR10 content is mastered with static metadata that sets consistent parameters throughout the entire content. In contrast, Dolby Vision employs dynamic metadata that can adjust brightness, contrast, and color settings on a scene-by-scene or even frame-by-frame basis, allowing for more precise representation of creative intent across varying display capabilities.

Distribution channels must accommodate the increased data requirements of HDR content. Streaming platforms like Netflix, Amazon Prime, and Disney+ have implemented adaptive bitrate technologies to deliver HDR10 and Dolby Vision content based on available bandwidth. Physical media distribution through Ultra HD Blu-ray discs supports both formats, with Dolby Vision requiring additional licensing and certification processes.

Broadcast infrastructure presents unique challenges for HDR distribution. While HDR10 has been more readily adopted due to its open standard nature, Dolby Vision's proprietary format requires specialized encoding equipment and licensing agreements. Hybrid Log-Gamma (HLG) has emerged as an alternative specifically designed for broadcast applications, offering backward compatibility with SDR displays.

Content delivery networks (CDNs) play a crucial role in optimizing the delivery of HDR content to consumers. These networks must manage the increased file sizes associated with HDR content while maintaining streaming quality across varying network conditions. For LCD displays specifically, the distribution pipeline must account for the display technology's limitations in local dimming capabilities and peak brightness levels.

The final stage involves display-side processing, where LCD televisions interpret the incoming HDR signals. HDR10 content relies on the display's built-in tone mapping to adapt content to the screen's capabilities, while Dolby Vision-enabled displays utilize the dynamic metadata to optimize presentation based on the specific display's performance characteristics, potentially offering more consistent image quality across different LCD models.

Consumer Experience and Adoption Factors

Consumer adoption of HDR technologies in LCD displays is primarily driven by the perceived enhancement in viewing experience. Research indicates that when presented with side-by-side comparisons, consumers consistently prefer HDR content over standard dynamic range (SDR), with particular appreciation for the increased brightness, deeper blacks, and more vibrant colors that both HDR10 and Dolby Vision deliver.

The adoption curve for these technologies follows distinct patterns across different consumer segments. Early adopters, typically technology enthusiasts and home theater aficionados, have embraced premium displays featuring Dolby Vision despite the higher price point. Meanwhile, the mass market has gravitated toward HDR10-compatible displays, which offer significant improvements over SDR at more accessible price points.

Content availability remains a critical factor influencing consumer adoption. While HDR10 content has achieved broader distribution across streaming platforms, physical media, and gaming consoles, Dolby Vision's more limited content library has somewhat restricted its mainstream appeal. However, the growing catalog of Dolby Vision content on premium streaming services is gradually shifting this dynamic.

Consumer education presents a significant challenge in the adoption landscape. Market research reveals considerable confusion among average consumers regarding the differences between HDR formats and their benefits. Many consumers purchase HDR-capable displays without fully understanding the technology or how to access HDR content, limiting the realized value of their investment.

Device ecosystem compatibility also shapes adoption patterns. The fragmentation of HDR standards across different devices creates friction in the consumer experience. Users with mixed-brand ecosystems often encounter compatibility issues when attempting to view HDR content across different devices, leading to frustration and reduced engagement with the technology.

Price sensitivity analysis demonstrates that while consumers recognize the superior quality of Dolby Vision, the premium pricing has limited its penetration to higher-end market segments. The price-performance ratio of HDR10 has positioned it as the dominant standard in mid-range displays, which constitute the largest segment of the LCD market.

User interface and automatic content detection capabilities significantly impact consumer satisfaction. Displays that seamlessly switch between HDR modes without requiring manual intervention receive higher satisfaction ratings. This factor has become increasingly important as consumers expect technology to be intuitive rather than requiring technical knowledge to operate effectively.

The adoption curve for these technologies follows distinct patterns across different consumer segments. Early adopters, typically technology enthusiasts and home theater aficionados, have embraced premium displays featuring Dolby Vision despite the higher price point. Meanwhile, the mass market has gravitated toward HDR10-compatible displays, which offer significant improvements over SDR at more accessible price points.

Content availability remains a critical factor influencing consumer adoption. While HDR10 content has achieved broader distribution across streaming platforms, physical media, and gaming consoles, Dolby Vision's more limited content library has somewhat restricted its mainstream appeal. However, the growing catalog of Dolby Vision content on premium streaming services is gradually shifting this dynamic.

Consumer education presents a significant challenge in the adoption landscape. Market research reveals considerable confusion among average consumers regarding the differences between HDR formats and their benefits. Many consumers purchase HDR-capable displays without fully understanding the technology or how to access HDR content, limiting the realized value of their investment.

Device ecosystem compatibility also shapes adoption patterns. The fragmentation of HDR standards across different devices creates friction in the consumer experience. Users with mixed-brand ecosystems often encounter compatibility issues when attempting to view HDR content across different devices, leading to frustration and reduced engagement with the technology.

Price sensitivity analysis demonstrates that while consumers recognize the superior quality of Dolby Vision, the premium pricing has limited its penetration to higher-end market segments. The price-performance ratio of HDR10 has positioned it as the dominant standard in mid-range displays, which constitute the largest segment of the LCD market.

User interface and automatic content detection capabilities significantly impact consumer satisfaction. Displays that seamlessly switch between HDR modes without requiring manual intervention receive higher satisfaction ratings. This factor has become increasingly important as consumers expect technology to be intuitive rather than requiring technical knowledge to operate effectively.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!