How to Analyze HDPE Market Trends for Investment Decisions?

HDPE Market Overview

High-density polyethylene (HDPE) is a versatile thermoplastic polymer with a wide range of applications across various industries. The global HDPE market has been experiencing steady growth, driven by increasing demand in packaging, construction, and automotive sectors. As of 2021, the market size was valued at approximately USD 84 billion, with projections indicating a compound annual growth rate (CAGR) of around 4.5% through 2028.

The HDPE market is characterized by its regional dynamics, with Asia-Pacific dominating the global landscape. This region accounts for over 40% of the total market share, primarily due to rapid industrialization, urbanization, and infrastructure development in countries like China and India. North America and Europe follow as significant contributors, with mature markets and a focus on sustainable and recyclable HDPE products.

Key drivers influencing the HDPE market include the growing demand for flexible packaging solutions, particularly in the food and beverage industry. The material's excellent barrier properties, chemical resistance, and durability make it an ideal choice for packaging applications. Additionally, the construction sector's expansion, especially in developing economies, has boosted the demand for HDPE pipes and fittings due to their corrosion resistance and long service life.

The automotive industry's shift towards lightweight materials to improve fuel efficiency has also positively impacted HDPE demand. The polymer's use in fuel tanks, interior components, and under-the-hood applications continues to grow, supporting market expansion.

However, the HDPE market faces challenges, primarily related to environmental concerns and fluctuating raw material prices. The increasing focus on plastic waste reduction and recycling has led to stricter regulations in many regions, potentially impacting market growth. Volatility in crude oil prices, a key raw material for HDPE production, can significantly affect manufacturing costs and profit margins.

Despite these challenges, technological advancements in HDPE production and processing are opening new avenues for market growth. Innovations in catalyst technology and the development of biobased HDPE are expected to drive market expansion and address sustainability concerns. The recycling sector is also evolving, with improved collection and processing technologies enhancing the circularity of HDPE products.

For investors considering the HDPE market, it's crucial to monitor global economic trends, regulatory landscapes, and technological developments. The market's resilience during economic downturns, coupled with its essential role in various industries, makes it an attractive option for long-term investment strategies. However, the industry's sensitivity to oil prices and environmental regulations necessitates a careful and informed approach to investment decisions.

Demand Analysis

The global High-Density Polyethylene (HDPE) market has been experiencing steady growth, driven by increasing demand across various industries. The packaging sector remains the largest consumer of HDPE, accounting for a significant portion of the market share. This demand is fueled by the material's excellent moisture barrier properties, chemical resistance, and durability, making it ideal for packaging applications in food, beverages, and personal care products.

The construction industry is another major contributor to HDPE demand, particularly in pipe and fitting applications. The growing infrastructure development in emerging economies and the need for replacing aging water and sewage systems in developed countries are key factors driving this demand. HDPE pipes are preferred for their corrosion resistance, flexibility, and long service life, making them a cost-effective solution for various construction projects.

In the automotive sector, HDPE is gaining traction as manufacturers seek lightweight materials to improve fuel efficiency and reduce emissions. The material is increasingly used in fuel tanks, interior components, and under-the-hood applications. As the automotive industry continues to evolve towards electric vehicles, the demand for HDPE in this sector is expected to grow further.

The agriculture industry also contributes significantly to HDPE demand, with applications in irrigation systems, greenhouse films, and storage containers. The increasing adoption of modern farming techniques and the need for efficient water management systems in agriculture are driving the demand for HDPE products in this sector.

Geographically, Asia-Pacific remains the largest market for HDPE, led by China and India. The rapid industrialization, urbanization, and growing middle-class population in these countries are fueling the demand for HDPE across various end-use industries. North America and Europe follow as mature markets with steady demand, primarily driven by replacement needs and technological advancements in HDPE applications.

The recycling trend is gaining momentum in the HDPE market, influenced by increasing environmental concerns and regulatory pressures. This shift towards circular economy principles is expected to impact the virgin HDPE market, potentially creating new opportunities for recycled HDPE products and influencing investment decisions in the sector.

Looking ahead, the HDPE market is projected to continue its growth trajectory, with emerging applications in 3D printing, medical devices, and renewable energy sectors offering new avenues for expansion. However, the market faces challenges from increasing environmental regulations and competition from alternative materials, which investors should carefully consider in their decision-making process.

Technical Challenges

Analyzing HDPE market trends for investment decisions presents several technical challenges that require careful consideration. One of the primary difficulties lies in the complexity of data collection and interpretation. The HDPE market is influenced by numerous factors, including raw material prices, production capacities, and global economic conditions, making it challenging to gather comprehensive and reliable data.

Furthermore, the volatility of the petrochemical industry, which directly impacts HDPE production, adds another layer of complexity to trend analysis. Fluctuations in oil prices and geopolitical events can cause rapid shifts in market dynamics, requiring sophisticated forecasting models and real-time data processing capabilities.

Another significant challenge is the need for advanced analytics tools and methodologies. Traditional statistical methods may not be sufficient to capture the intricate relationships between various market factors. Machine learning and artificial intelligence techniques are increasingly necessary to identify patterns and predict future trends accurately. However, implementing these advanced analytics solutions requires substantial investment in technology infrastructure and skilled personnel.

The global nature of the HDPE market also presents challenges in terms of regional variations and trade dynamics. Different regions may have distinct regulatory environments, consumption patterns, and production capacities, making it difficult to develop a unified analysis framework. Analysts must account for these regional differences while also considering the impact of international trade agreements and tariffs on market trends.

Additionally, the HDPE market is subject to rapid technological advancements and shifts in consumer preferences. New applications for HDPE and emerging alternatives can disrupt established market patterns. Keeping pace with these innovations and accurately assessing their potential impact on market trends requires continuous monitoring and expertise across multiple disciplines.

Environmental concerns and sustainability initiatives pose another technical challenge in HDPE market analysis. The growing focus on recycling and circular economy principles is reshaping the industry landscape. Analysts must incorporate these factors into their models, considering the potential effects of recycling rates, regulatory changes, and consumer attitudes towards plastic usage on market dynamics.

Lastly, the integration of diverse data sources presents a significant technical hurdle. Combining information from industry reports, company financial statements, government statistics, and real-time market data requires sophisticated data integration and management systems. Ensuring data quality, consistency, and timeliness across these various sources is crucial for accurate trend analysis and informed investment decisions.

Current HDPE Solutions

01 Improved HDPE production processes

Advancements in HDPE production processes focus on enhancing efficiency, reducing costs, and improving product quality. These innovations include new catalyst systems, optimized polymerization techniques, and improved reactor designs. Such developments aim to meet the growing demand for high-performance HDPE in various applications.- Improved HDPE production processes: Advancements in HDPE production processes focus on enhancing efficiency, reducing costs, and improving product quality. These innovations include new catalyst systems, optimized polymerization techniques, and improved reactor designs. Such developments aim to meet the growing demand for high-performance HDPE in various industries.

- HDPE applications in packaging: The HDPE market is experiencing growth in packaging applications, particularly in food and beverage containers, personal care products, and industrial packaging. Innovations in this area focus on improving barrier properties, enhancing recyclability, and developing lightweight solutions to meet sustainability goals and consumer preferences.

- Recycling and sustainability trends: Increasing focus on environmental sustainability is driving innovations in HDPE recycling technologies and the development of bio-based HDPE alternatives. This trend includes improved sorting and processing methods for recycled HDPE, as well as the integration of recycled content into new HDPE products to create a more circular economy.

- HDPE in construction and infrastructure: The construction and infrastructure sectors are adopting HDPE for various applications due to its durability, chemical resistance, and low maintenance requirements. Innovations in this area include HDPE pipes for water and gas distribution, geomembranes for environmental protection, and HDPE-based materials for 3D printing in construction.

- HDPE composites and blends: Development of HDPE composites and blends with other materials is a growing trend to enhance specific properties such as strength, impact resistance, or thermal stability. These innovations aim to expand the application range of HDPE in industries like automotive, aerospace, and consumer goods manufacturing.

02 HDPE composites and blends

The market trend shows increased interest in HDPE composites and blends, combining HDPE with other materials to enhance specific properties. These formulations aim to improve strength, durability, or other characteristics for specialized applications in industries such as packaging, construction, and automotive.Expand Specific Solutions03 Sustainable and recycled HDPE

Growing environmental concerns drive the development of sustainable HDPE solutions, including bio-based HDPE and improved recycling technologies. The market is shifting towards circular economy principles, with increased focus on recycled HDPE content and recyclable HDPE products.Expand Specific Solutions04 HDPE for specialized applications

The HDPE market is expanding into specialized applications, such as medical devices, 3D printing filaments, and high-performance packaging. These applications require tailored HDPE grades with specific properties, driving innovation in material formulation and processing techniques.Expand Specific Solutions05 HDPE processing and manufacturing technologies

Advancements in HDPE processing and manufacturing technologies focus on improving production efficiency, reducing energy consumption, and enhancing product quality. These innovations include new extrusion techniques, molding processes, and quality control methods for HDPE products.Expand Specific Solutions

Key Market Players

The HDPE market is in a mature growth stage, characterized by steady demand and established production processes. The global market size is substantial, with projections indicating continued growth driven by increasing applications in packaging, construction, and automotive industries. Technologically, HDPE production is well-developed, with major players like Dow Global Technologies, ExxonMobil Chemical Patents, and SABIC Global Technologies leading innovation. These companies, along with others such as Chevron Phillips Chemical and LG Chem, are focusing on enhancing product properties, improving production efficiency, and developing sustainable solutions. The competitive landscape is intense, with companies investing in R&D to differentiate their offerings and capture market share in this evolving sector.

Dow Global Technologies LLC

ExxonMobil Chemical Patents, Inc.

HDPE Innovations

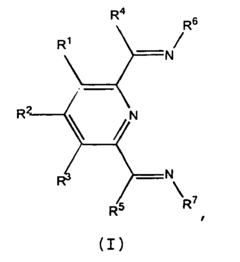

- The use of an iron or cobalt complex catalyst system for polymerizing ethylene, where the catalyst component includes specific compounds with hydrocarbyl, inert functional groups, and aryl substitutions, resulting in HDPE with lower water vapor and oxygen transmission rates, suitable for improved packaging applications.

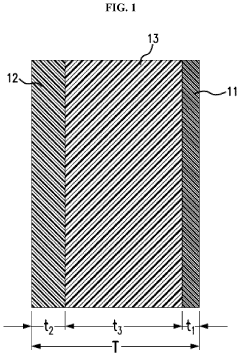

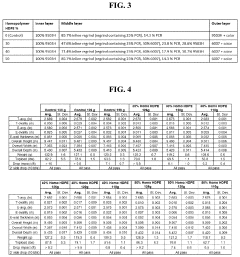

- A molded multilayer polymer structure comprising a body wall with a first layer of copolymer HDPE, a second layer of homopolymer HDPE, and a third layer that combines both, with a total weight content of homopolymer HDPE at least 30 wt-%, including regrind and post-consumer resin, to achieve improved mechanical and ESCR properties without costly processes.

Supply Chain Analysis

The supply chain analysis for the HDPE market is crucial for making informed investment decisions. The HDPE supply chain typically consists of several key stages, including raw material sourcing, production, distribution, and end-use applications.

Raw material sourcing primarily involves the procurement of ethylene, which is derived from natural gas or crude oil. The availability and pricing of these feedstocks significantly impact the overall HDPE market trends. Fluctuations in oil and gas prices directly affect the production costs of HDPE, influencing market dynamics and investment potential.

The production stage of HDPE involves polymerization processes that convert ethylene into high-density polyethylene. This stage is characterized by large-scale manufacturing facilities operated by petrochemical companies. The production capacity and utilization rates of these facilities are important indicators of market supply and demand balance.

Distribution networks play a vital role in the HDPE supply chain. These networks include transportation infrastructure, storage facilities, and logistics services that facilitate the movement of HDPE from production sites to end-users. The efficiency and cost-effectiveness of these distribution channels can significantly impact market competitiveness and regional price variations.

End-use applications for HDPE span various industries, including packaging, construction, automotive, and consumer goods. Understanding the demand patterns and growth prospects in these sectors is essential for predicting HDPE market trends. Changes in consumer behavior, regulatory environments, and technological advancements in these industries can drive shifts in HDPE consumption.

Supply chain disruptions, such as natural disasters, geopolitical events, or global health crises, can have profound effects on the HDPE market. These disruptions may lead to supply shortages, price volatility, and shifts in regional market dynamics. Analyzing the resilience and adaptability of the HDPE supply chain to such disruptions is crucial for assessing investment risks and opportunities.

The global nature of the HDPE market necessitates consideration of international trade flows and tariff policies. Import-export dynamics between major producing and consuming regions can significantly influence regional supply-demand balances and pricing structures. Trade agreements, tariffs, and geopolitical tensions can create both challenges and opportunities within the HDPE supply chain.

Sustainability considerations are increasingly shaping the HDPE supply chain. The growing emphasis on circular economy principles and recycling initiatives is driving changes in production processes, material sourcing, and end-of-life management for HDPE products. Analyzing these sustainability trends and their impact on the supply chain is essential for long-term investment strategies in the HDPE market.

Sustainability Factors

Sustainability factors play a crucial role in analyzing HDPE market trends for investment decisions. The growing emphasis on environmental responsibility and circular economy principles has significantly impacted the HDPE industry, creating both challenges and opportunities for investors.

One of the primary sustainability factors influencing HDPE market trends is the increasing demand for recycled HDPE. As consumers and regulatory bodies push for more sustainable packaging solutions, manufacturers are incorporating higher percentages of recycled content into their products. This shift has led to the development of advanced recycling technologies and the establishment of more efficient collection and sorting systems.

The carbon footprint of HDPE production and transportation is another critical sustainability factor to consider. Investors should analyze companies' efforts to reduce greenhouse gas emissions throughout the supply chain, including the use of renewable energy sources in manufacturing processes and the optimization of logistics networks to minimize transportation-related emissions.

Biodegradability and compostability are emerging trends in the plastics industry that may impact HDPE market dynamics. While HDPE is not inherently biodegradable, research into additives and alternative formulations that enhance its environmental breakdown is ongoing. Investors should monitor developments in this area, as breakthroughs could potentially disrupt traditional HDPE markets.

Water conservation in HDPE production is becoming increasingly important, especially in regions facing water scarcity. Companies implementing water-efficient manufacturing processes and closed-loop water systems may have a competitive advantage in terms of sustainability performance and operational costs.

The regulatory landscape surrounding single-use plastics and packaging waste is evolving rapidly. Investors must stay informed about current and upcoming regulations that may affect HDPE demand, such as extended producer responsibility schemes, plastic taxes, and bans on certain plastic products. These policies can significantly influence market dynamics and investment opportunities.

Life cycle assessments (LCAs) are gaining prominence in evaluating the overall environmental impact of HDPE products. Investors should consider how companies are utilizing LCAs to improve their product designs and manufacturing processes, as this can indicate long-term sustainability commitment and potential for market leadership.

Lastly, the development of bio-based alternatives to traditional petroleum-derived HDPE is an important trend to watch. While currently representing a small market share, bio-based HDPE could gain traction as technology improves and production scales up. Investors should assess the potential of these alternatives to disrupt or complement existing HDPE markets.