How to Leverage Global HDPE Supply for Strategic Growth?

HDPE Market Overview and Objectives

High-density polyethylene (HDPE) has emerged as a crucial material in various industries, driving global demand and shaping market dynamics. The HDPE market has experienced steady growth over the past decade, with a compound annual growth rate (CAGR) of approximately 4-5%. This growth is primarily attributed to the material's versatility, durability, and cost-effectiveness across multiple applications, including packaging, construction, and automotive sectors.

The global HDPE market size was valued at around $70 billion in 2020 and is projected to reach $100 billion by 2026. Asia-Pacific region dominates the market, accounting for over 40% of the global consumption, followed by North America and Europe. The increasing urbanization, infrastructure development, and rising disposable incomes in emerging economies are key factors driving the demand for HDPE products.

In recent years, the HDPE industry has faced challenges related to environmental concerns and sustainability. The growing awareness of plastic pollution has led to increased pressure on manufacturers to develop eco-friendly alternatives and improve recycling processes. This shift has created both challenges and opportunities for market players, necessitating strategic adaptations to maintain growth and market position.

The objectives for leveraging global HDPE supply for strategic growth are multifaceted. Firstly, companies aim to optimize their supply chain management to ensure a stable and cost-effective sourcing of raw materials. This involves diversifying supplier networks, implementing advanced forecasting techniques, and exploring vertical integration opportunities.

Secondly, there is a focus on innovation and product development to meet evolving customer needs and address environmental concerns. This includes the development of bio-based HDPE, enhancing recycling technologies, and creating value-added products with improved performance characteristics.

Thirdly, market expansion and penetration strategies are crucial for sustained growth. Companies are targeting emerging markets with high growth potential, while also strengthening their presence in established markets through strategic partnerships and acquisitions.

Lastly, sustainability initiatives have become a key objective for HDPE manufacturers. This involves investing in circular economy models, improving energy efficiency in production processes, and collaborating with stakeholders across the value chain to promote recycling and reduce environmental impact.

To achieve these objectives, companies must navigate complex global trade dynamics, regulatory landscapes, and technological advancements. The ability to adapt to market shifts, invest in research and development, and build strong customer relationships will be critical in leveraging the global HDPE supply for strategic growth in the coming years.

Global HDPE Demand Analysis

The global demand for High-Density Polyethylene (HDPE) has been steadily increasing over the past decade, driven by its versatile applications across various industries. HDPE's unique properties, including high strength-to-density ratio, chemical resistance, and durability, have made it a preferred material in packaging, construction, automotive, and consumer goods sectors.

In the packaging industry, HDPE remains a dominant player, particularly in the production of bottles, containers, and films. The growing e-commerce sector and increasing consumer preference for packaged goods have further boosted HDPE demand in this segment. The construction industry also contributes significantly to HDPE consumption, utilizing the material for pipes, fittings, and geomembranes. The material's resistance to corrosion and chemicals makes it ideal for water and gas distribution systems.

The automotive sector has been increasingly adopting HDPE for manufacturing fuel tanks, interior parts, and under-the-hood components. This trend is expected to continue as automakers focus on lightweight materials to improve fuel efficiency and reduce emissions. In the consumer goods sector, HDPE finds applications in household items, toys, and personal care products, driven by its safety profile and recyclability.

Geographically, Asia-Pacific leads the global HDPE demand, with China being the largest consumer. The region's rapid industrialization, urbanization, and population growth are key factors driving this demand. North America and Europe follow, with mature markets focusing on sustainable and recyclable HDPE products. Emerging economies in Latin America, Africa, and the Middle East are also showing increased HDPE consumption, primarily in infrastructure development and packaging applications.

The global HDPE market is influenced by several factors, including crude oil prices, environmental regulations, and technological advancements. The volatility in oil prices directly impacts HDPE production costs and, consequently, market dynamics. Environmental concerns and plastic waste management issues have led to increased focus on recycling and the development of bio-based alternatives, which may impact future demand patterns.

Despite these challenges, the overall outlook for global HDPE demand remains positive. The material's versatility, cost-effectiveness, and recyclability continue to drive its adoption across industries. Innovations in HDPE grades, such as high-performance variants for specific applications, are opening new market opportunities. Additionally, the growing emphasis on circular economy principles is encouraging the development of more efficient recycling technologies for HDPE, potentially creating a more sustainable demand cycle.

HDPE Production Challenges

The production of High-Density Polyethylene (HDPE) faces several significant challenges that impact global supply and strategic growth opportunities. One of the primary issues is the volatility of raw material costs, particularly ethylene, which is derived from petroleum or natural gas. Fluctuations in oil and gas prices directly affect HDPE production costs, making it difficult for manufacturers to maintain consistent pricing and profit margins.

Environmental concerns and regulatory pressures pose another substantial challenge. The production process of HDPE is energy-intensive and generates considerable greenhouse gas emissions. As governments worldwide implement stricter environmental regulations, HDPE manufacturers must invest in cleaner technologies and more sustainable production methods, which can be costly and time-consuming to implement.

The industry also grapples with capacity utilization issues. HDPE production facilities require significant capital investment, and optimal operation often demands running at near-full capacity. However, market demand fluctuations can lead to periods of overcapacity or underutilization, affecting operational efficiency and profitability.

Technical challenges in HDPE production include achieving consistent product quality across different grades and applications. Manufacturers must continually innovate to improve the physical and chemical properties of HDPE, such as strength, durability, and chemical resistance, to meet evolving customer requirements and compete with alternative materials.

Supply chain disruptions have emerged as a critical challenge, particularly in light of recent global events. The HDPE industry relies on complex, global supply networks for raw materials, equipment, and distribution. Disruptions due to geopolitical tensions, natural disasters, or pandemics can severely impact production capabilities and lead to supply shortages.

Competition from alternative materials presents an ongoing challenge. As industries seek more sustainable and cost-effective options, HDPE producers must continuously innovate to maintain their market position against materials like bioplastics, recycled plastics, and other polymer alternatives.

Lastly, the industry faces increasing pressure to address the end-of-life issues associated with HDPE products. The growing concern over plastic waste and its environmental impact necessitates investment in recycling technologies and the development of more easily recyclable HDPE formulations. This challenge requires a significant shift in product design, production processes, and waste management strategies, adding complexity to the overall production landscape.

Current HDPE Supply Strategies

01 HDPE production methods

Various methods for producing high-density polyethylene are described, including improvements in catalysts, polymerization processes, and reactor designs. These advancements aim to enhance the efficiency and quality of HDPE production, potentially increasing supply capabilities.- HDPE production methods: Various methods for producing high-density polyethylene are described, including improvements in catalysts, polymerization processes, and reactor designs. These advancements aim to enhance the efficiency and quality of HDPE production, potentially increasing supply capabilities.

- HDPE supply chain optimization: Techniques for optimizing the HDPE supply chain are presented, including inventory management systems, distribution networks, and logistics solutions. These approaches aim to improve the efficiency of HDPE supply from manufacturers to end-users.

- HDPE recycling and circular economy: Innovations in HDPE recycling processes and technologies are discussed, focusing on improving the quality of recycled HDPE and incorporating it back into the supply chain. These developments contribute to a more sustainable and circular economy for HDPE materials.

- HDPE material improvements: Advancements in HDPE material properties are explored, including enhanced strength, durability, and processability. These improvements can lead to expanded applications and potentially increased demand for HDPE in various industries.

- HDPE packaging solutions: Innovative HDPE packaging designs and manufacturing techniques are presented, focusing on improving functionality, sustainability, and cost-effectiveness. These developments can influence the demand and supply dynamics of HDPE in the packaging industry.

02 HDPE supply chain optimization

Innovations in supply chain management for HDPE, including improved logistics, storage solutions, and distribution networks. These developments focus on enhancing the efficiency of HDPE supply from manufacturers to end-users, potentially reducing costs and increasing availability.Expand Specific Solutions03 Recycling and sustainable HDPE supply

Advancements in HDPE recycling technologies and processes to create a more sustainable supply chain. This includes methods for collecting, sorting, and reprocessing HDPE materials, as well as incorporating recycled content into new HDPE products.Expand Specific Solutions04 HDPE material improvements

Developments in HDPE material properties and formulations to enhance performance characteristics. These improvements may lead to increased demand and supply of specialized HDPE grades for specific applications.Expand Specific Solutions05 HDPE packaging and transportation solutions

Innovations in packaging and transportation methods for HDPE resins and products. These developments aim to improve the efficiency of HDPE supply logistics, including bulk handling, storage, and transportation systems.Expand Specific Solutions

Key HDPE Industry Players

The global HDPE market is in a mature growth stage, characterized by steady demand and technological advancements. The market size is substantial, driven by diverse applications across industries. Technologically, HDPE production is well-established, with key players like China Petroleum & Chemical Corp., Dow Global Technologies LLC, and ExxonMobil Technology & Engineering Co. leading innovation. These companies, along with others such as LG Chem Ltd. and SABIC Global Technologies BV, are focusing on enhancing product properties and production efficiency. The competitive landscape is intense, with both established petrochemical giants and specialized chemical companies vying for market share through strategic partnerships, R&D investments, and global supply chain optimization.

China Petroleum & Chemical Corp.

Dow Global Technologies LLC

HDPE Innovation Breakthroughs

- A process involving two interconnected gas-phase reactors with different polymerization zones, where ethylene is polymerized under fast fluidization conditions in one zone and densified flow in another, allowing for the separation and reintroduction of polymer particles, enabling the incorporation of comonomers only into the high molecular weight fraction to achieve a broad and homogeneous molecular weight distribution.

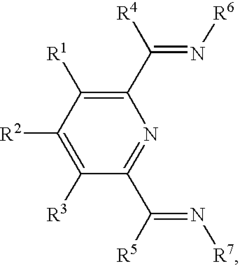

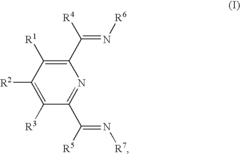

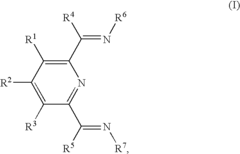

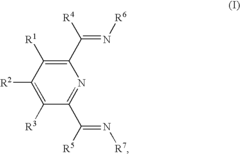

- The use of HDPE polymerized in the presence of an iron or cobalt complex catalyst, specifically a compound of formula (I), (II), or (III), to form a package with reduced water vapor and oxygen transmission rates, achieved by replacing or blending HDPE layers with the catalyst-complex-polymerized HDPE in packaging materials.

HDPE Trade Regulations

Understanding and navigating the complex landscape of HDPE trade regulations is crucial for leveraging global HDPE supply for strategic growth. These regulations vary significantly across different countries and regions, impacting the flow of HDPE in international markets.

In major HDPE-producing countries, such as the United States, China, and Saudi Arabia, export regulations often focus on ensuring domestic supply stability while promoting international trade. These may include export quotas, licensing requirements, and quality standards. For instance, the U.S. Department of Commerce oversees HDPE exports, requiring exporters to comply with specific documentation and reporting procedures.

Importing countries, particularly those with developing plastics industries, may implement tariffs or import duties on HDPE to protect domestic producers. However, many countries have reduced these barriers in recent years to support their manufacturing sectors. For example, India has lowered import duties on HDPE to boost its plastic processing industry.

Environmental regulations play an increasingly important role in HDPE trade. The Basel Convention on the Control of Transboundary Movements of Hazardous Wastes and Their Disposal affects the trade of plastic waste, including HDPE scrap. This has led to stricter controls on the movement of plastic waste between countries, impacting recycling and circular economy initiatives in the HDPE industry.

Free trade agreements (FTAs) significantly influence HDPE trade patterns. The United States-Mexico-Canada Agreement (USMCA), for instance, facilitates tariff-free trade of HDPE among these North American countries. Similarly, the Regional Comprehensive Economic Partnership (RCEP) in Asia-Pacific is expected to boost HDPE trade among member nations.

Quality standards and certifications are critical aspects of HDPE trade regulations. The International Organization for Standardization (ISO) provides guidelines for HDPE quality, which many countries adopt or adapt for their national standards. Compliance with these standards is often a prerequisite for market access.

Companies seeking to leverage global HDPE supply must also navigate anti-dumping regulations. Several countries have imposed anti-dumping duties on HDPE imports to protect domestic industries from unfair competition. For example, the European Union has applied anti-dumping measures on HDPE imports from certain Middle Eastern countries.

Understanding and complying with these diverse regulations is essential for companies aiming to optimize their global HDPE supply chains. It requires ongoing monitoring of regulatory changes, engagement with trade associations, and potentially, collaboration with local partners in key markets. By effectively navigating this complex regulatory landscape, companies can identify opportunities for strategic growth and mitigate risks in the global HDPE market.

Sustainability in HDPE Supply

Sustainability in HDPE supply has become a critical focus for the global plastics industry, driven by increasing environmental concerns and regulatory pressures. The production and use of High-Density Polyethylene (HDPE) have significant environmental impacts, including greenhouse gas emissions, energy consumption, and plastic waste generation. To leverage global HDPE supply for strategic growth, companies must prioritize sustainable practices throughout the supply chain.

One key aspect of sustainability in HDPE supply is the adoption of circular economy principles. This involves designing products for recyclability, implementing efficient collection and sorting systems, and investing in advanced recycling technologies. By increasing the recycling rates of HDPE products, companies can reduce their reliance on virgin materials and minimize waste generation.

Energy efficiency in HDPE production is another crucial area for sustainability improvement. Manufacturers are increasingly investing in energy-efficient equipment and processes to reduce their carbon footprint. This includes the use of renewable energy sources, such as solar and wind power, to power production facilities. Additionally, optimizing transportation and logistics can significantly reduce the overall environmental impact of HDPE supply chains.

The development of bio-based HDPE alternatives is gaining traction as a sustainable solution. These materials, derived from renewable resources such as sugarcane or corn, offer a lower carbon footprint compared to traditional petroleum-based HDPE. While still in the early stages of adoption, bio-based HDPE has the potential to revolutionize the industry and provide a more sustainable supply option.

Water conservation and responsible water management are also essential components of sustainable HDPE supply. Manufacturers are implementing water recycling systems and adopting water-efficient production processes to minimize their impact on local water resources. This is particularly important in water-stressed regions where HDPE production facilities operate.

Collaboration across the value chain is crucial for achieving sustainability goals in HDPE supply. Suppliers, manufacturers, distributors, and end-users must work together to develop innovative solutions and share best practices. This collaborative approach can lead to more efficient resource use, improved product design for recyclability, and the development of closed-loop systems for HDPE materials.

Transparency and traceability in the HDPE supply chain are becoming increasingly important for sustainability efforts. Companies are implementing advanced tracking systems and blockchain technology to provide visibility into the sourcing, production, and distribution of HDPE materials. This enables better monitoring of environmental impacts and helps identify areas for improvement throughout the supply chain.