How to Control Gas Evolution — Sensors & Limits

AUG 28, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Gas Evolution Control Technology Background and Objectives

Gas evolution control has emerged as a critical aspect of various industrial processes, particularly in chemical manufacturing, energy storage systems, and semiconductor production. The historical development of gas evolution control technologies can be traced back to the early 20th century, when rudimentary methods relied primarily on mechanical venting and basic pressure relief systems. As industrial processes became more sophisticated, the need for precise gas evolution control became increasingly apparent, driving technological innovation in this field.

The evolution of gas control technologies has followed a trajectory closely aligned with advancements in sensor technology, materials science, and automation systems. The 1970s and 1980s marked significant progress with the introduction of electronic monitoring systems, while the 1990s saw the integration of computerized control mechanisms. The past two decades have witnessed exponential growth in smart sensing technologies, IoT integration, and AI-driven predictive control systems that have revolutionized gas evolution management.

Current technological trends indicate a shift toward more precise, real-time monitoring and control systems that can detect minute changes in gas composition, pressure, and flow rates. The industry is moving away from reactive control mechanisms toward predictive and preventive approaches that anticipate potential gas evolution issues before they occur. This shift is particularly evident in high-risk environments where gas evolution can lead to safety hazards, product quality issues, or process inefficiencies.

The primary objective of modern gas evolution control technology is to establish comprehensive monitoring and management systems that can accurately detect, measure, and regulate gas production across various industrial applications. This includes developing sensors with higher sensitivity and selectivity, implementing robust control algorithms that can handle complex gas evolution scenarios, and creating integrated systems that provide seamless operation across different process conditions.

Additional technical goals include minimizing energy consumption in gas control systems, reducing the environmental impact of industrial gas emissions, and enhancing system reliability under extreme operating conditions. There is also a growing emphasis on developing cost-effective solutions that can be deployed across different scales of operation, from laboratory settings to large industrial facilities.

The convergence of advanced materials, sensor technologies, and computational methods presents unprecedented opportunities for innovation in gas evolution control. As industries continue to face stricter regulatory requirements and operational challenges, the development of more sophisticated gas evolution control technologies remains a priority for ensuring safety, efficiency, and sustainability in industrial processes.

The evolution of gas control technologies has followed a trajectory closely aligned with advancements in sensor technology, materials science, and automation systems. The 1970s and 1980s marked significant progress with the introduction of electronic monitoring systems, while the 1990s saw the integration of computerized control mechanisms. The past two decades have witnessed exponential growth in smart sensing technologies, IoT integration, and AI-driven predictive control systems that have revolutionized gas evolution management.

Current technological trends indicate a shift toward more precise, real-time monitoring and control systems that can detect minute changes in gas composition, pressure, and flow rates. The industry is moving away from reactive control mechanisms toward predictive and preventive approaches that anticipate potential gas evolution issues before they occur. This shift is particularly evident in high-risk environments where gas evolution can lead to safety hazards, product quality issues, or process inefficiencies.

The primary objective of modern gas evolution control technology is to establish comprehensive monitoring and management systems that can accurately detect, measure, and regulate gas production across various industrial applications. This includes developing sensors with higher sensitivity and selectivity, implementing robust control algorithms that can handle complex gas evolution scenarios, and creating integrated systems that provide seamless operation across different process conditions.

Additional technical goals include minimizing energy consumption in gas control systems, reducing the environmental impact of industrial gas emissions, and enhancing system reliability under extreme operating conditions. There is also a growing emphasis on developing cost-effective solutions that can be deployed across different scales of operation, from laboratory settings to large industrial facilities.

The convergence of advanced materials, sensor technologies, and computational methods presents unprecedented opportunities for innovation in gas evolution control. As industries continue to face stricter regulatory requirements and operational challenges, the development of more sophisticated gas evolution control technologies remains a priority for ensuring safety, efficiency, and sustainability in industrial processes.

Market Demand Analysis for Gas Monitoring Solutions

The global gas monitoring solutions market is experiencing robust growth driven by increasing safety regulations across industries and growing awareness about workplace hazards. Currently valued at approximately 2.7 billion USD, the market is projected to reach 3.8 billion USD by 2027, representing a compound annual growth rate of 7.2%. This growth trajectory is particularly pronounced in regions with stringent regulatory frameworks such as North America and Europe, while emerging economies in Asia-Pacific are showing accelerated adoption rates due to rapid industrialization.

Industrial sectors including oil and gas, chemicals, mining, and manufacturing constitute the primary demand drivers, collectively accounting for over 65% of the total market share. The oil and gas sector alone represents nearly 28% of the market, given the critical nature of gas monitoring in preventing catastrophic incidents and ensuring operational safety in potentially explosive environments.

Healthcare facilities, semiconductor manufacturing, and food processing industries are emerging as significant secondary markets, driven by specific requirements for monitoring medical gases, clean room environments, and food safety compliance respectively. These sectors are increasingly investing in advanced gas monitoring solutions to meet regulatory requirements and optimize operational efficiency.

From a technological perspective, demand is shifting from traditional fixed gas detection systems toward integrated solutions that offer real-time monitoring, wireless connectivity, and data analytics capabilities. IoT-enabled gas sensors that can be remotely monitored and provide predictive maintenance alerts are experiencing the highest growth rate at approximately 12% annually, significantly outpacing the overall market.

Consumer demand patterns reveal a strong preference for multi-gas detection systems that can simultaneously monitor various gases including carbon monoxide, hydrogen sulfide, oxygen, and combustible gases. These systems command a premium price point but deliver superior value through comprehensive protection and reduced equipment footprint.

Geographically, North America leads the market with approximately 35% share, followed by Europe at 28% and Asia-Pacific at 25%. However, the highest growth rates are being observed in developing regions of Asia-Pacific and Middle East, where industrial expansion and strengthening regulatory frameworks are creating new market opportunities.

The COVID-19 pandemic has further accelerated market growth by highlighting the importance of air quality monitoring in enclosed spaces, creating new application segments in commercial buildings, educational institutions, and public transportation systems. This trend is expected to continue as organizations worldwide implement enhanced safety protocols and environmental monitoring systems.

Industrial sectors including oil and gas, chemicals, mining, and manufacturing constitute the primary demand drivers, collectively accounting for over 65% of the total market share. The oil and gas sector alone represents nearly 28% of the market, given the critical nature of gas monitoring in preventing catastrophic incidents and ensuring operational safety in potentially explosive environments.

Healthcare facilities, semiconductor manufacturing, and food processing industries are emerging as significant secondary markets, driven by specific requirements for monitoring medical gases, clean room environments, and food safety compliance respectively. These sectors are increasingly investing in advanced gas monitoring solutions to meet regulatory requirements and optimize operational efficiency.

From a technological perspective, demand is shifting from traditional fixed gas detection systems toward integrated solutions that offer real-time monitoring, wireless connectivity, and data analytics capabilities. IoT-enabled gas sensors that can be remotely monitored and provide predictive maintenance alerts are experiencing the highest growth rate at approximately 12% annually, significantly outpacing the overall market.

Consumer demand patterns reveal a strong preference for multi-gas detection systems that can simultaneously monitor various gases including carbon monoxide, hydrogen sulfide, oxygen, and combustible gases. These systems command a premium price point but deliver superior value through comprehensive protection and reduced equipment footprint.

Geographically, North America leads the market with approximately 35% share, followed by Europe at 28% and Asia-Pacific at 25%. However, the highest growth rates are being observed in developing regions of Asia-Pacific and Middle East, where industrial expansion and strengthening regulatory frameworks are creating new market opportunities.

The COVID-19 pandemic has further accelerated market growth by highlighting the importance of air quality monitoring in enclosed spaces, creating new application segments in commercial buildings, educational institutions, and public transportation systems. This trend is expected to continue as organizations worldwide implement enhanced safety protocols and environmental monitoring systems.

Current Gas Sensing Technologies and Challenges

Gas sensing technologies have evolved significantly over the past decades, with various methods developed to detect and monitor different types of gases in diverse environments. Currently, the market is dominated by several key technologies, each with specific advantages and limitations that affect their application in controlling gas evolution processes.

Electrochemical sensors represent one of the most widely adopted technologies, offering high sensitivity and selectivity for gases such as carbon monoxide, hydrogen sulfide, and nitrogen oxides. These sensors operate by measuring the current produced by gas reactions at the sensing electrode. While they provide excellent accuracy at relatively low costs, they suffer from limited lifespans (typically 1-3 years) and are susceptible to cross-sensitivity issues when multiple target gases are present.

Infrared (IR) sensors have gained prominence for detecting gases that absorb infrared radiation, particularly carbon dioxide and hydrocarbons. These non-dispersive infrared (NDIR) sensors offer exceptional stability and specificity but come with higher price points and power requirements. Their immunity to poisoning makes them valuable in harsh industrial environments, though their bulky nature can limit integration possibilities in compact systems.

Semiconductor (MOS) sensors dominate consumer and low-cost industrial applications due to their affordability and small form factor. These sensors detect gases through changes in electrical conductivity when gas molecules interact with the semiconductor surface. However, they exhibit significant challenges including poor selectivity, environmental drift, and high power consumption during the heating cycle necessary for operation.

Catalytic bead sensors excel in combustible gas detection but face limitations in discriminating between different flammable gases. Their robustness makes them suitable for industrial safety applications, though they require regular calibration and can be poisoned by certain compounds, reducing their effectiveness over time.

Emerging technologies such as optical fiber sensors, acoustic sensors, and microelectromechanical systems (MEMS) are addressing some limitations of traditional approaches. These newer technologies offer improvements in miniaturization, power efficiency, and multi-gas detection capabilities, though many remain in developmental stages or early commercial deployment.

A significant challenge across all gas sensing technologies is achieving the optimal balance between sensitivity, selectivity, response time, and cost. Many industrial applications require detection at parts-per-billion levels while maintaining accuracy in complex gas mixtures. Additionally, sensor drift over time necessitates regular calibration, increasing maintenance costs and potentially compromising safety if not properly managed.

Integration challenges persist when implementing comprehensive gas monitoring systems, particularly in achieving seamless communication between sensors and control systems. The establishment of appropriate alarm thresholds that balance safety concerns with operational efficiency remains a complex undertaking across industries where gas evolution control is critical.

Electrochemical sensors represent one of the most widely adopted technologies, offering high sensitivity and selectivity for gases such as carbon monoxide, hydrogen sulfide, and nitrogen oxides. These sensors operate by measuring the current produced by gas reactions at the sensing electrode. While they provide excellent accuracy at relatively low costs, they suffer from limited lifespans (typically 1-3 years) and are susceptible to cross-sensitivity issues when multiple target gases are present.

Infrared (IR) sensors have gained prominence for detecting gases that absorb infrared radiation, particularly carbon dioxide and hydrocarbons. These non-dispersive infrared (NDIR) sensors offer exceptional stability and specificity but come with higher price points and power requirements. Their immunity to poisoning makes them valuable in harsh industrial environments, though their bulky nature can limit integration possibilities in compact systems.

Semiconductor (MOS) sensors dominate consumer and low-cost industrial applications due to their affordability and small form factor. These sensors detect gases through changes in electrical conductivity when gas molecules interact with the semiconductor surface. However, they exhibit significant challenges including poor selectivity, environmental drift, and high power consumption during the heating cycle necessary for operation.

Catalytic bead sensors excel in combustible gas detection but face limitations in discriminating between different flammable gases. Their robustness makes them suitable for industrial safety applications, though they require regular calibration and can be poisoned by certain compounds, reducing their effectiveness over time.

Emerging technologies such as optical fiber sensors, acoustic sensors, and microelectromechanical systems (MEMS) are addressing some limitations of traditional approaches. These newer technologies offer improvements in miniaturization, power efficiency, and multi-gas detection capabilities, though many remain in developmental stages or early commercial deployment.

A significant challenge across all gas sensing technologies is achieving the optimal balance between sensitivity, selectivity, response time, and cost. Many industrial applications require detection at parts-per-billion levels while maintaining accuracy in complex gas mixtures. Additionally, sensor drift over time necessitates regular calibration, increasing maintenance costs and potentially compromising safety if not properly managed.

Integration challenges persist when implementing comprehensive gas monitoring systems, particularly in achieving seamless communication between sensors and control systems. The establishment of appropriate alarm thresholds that balance safety concerns with operational efficiency remains a complex undertaking across industries where gas evolution control is critical.

Current Gas Evolution Control Solutions

01 Electrochemical gas evolution control systems

These systems control gas evolution in electrochemical processes through specialized electrode designs, electrolyte compositions, and current regulation. They optimize gas production rates while minimizing unwanted side reactions in applications such as water electrolysis, fuel cells, and industrial electrochemical processes. Advanced monitoring and feedback mechanisms ensure precise control over gas generation rates and composition.- Electrochemical gas evolution control systems: These systems control gas evolution in electrochemical processes through specialized electrode designs, electrolyte compositions, and current regulation. They optimize gas production rates while minimizing unwanted side reactions, particularly in water electrolysis, fuel cells, and industrial electroplating operations. Advanced monitoring sensors and feedback control mechanisms ensure precise gas generation rates and composition.

- Biological gas evolution management: Systems designed to control gas production in biological processes such as fermentation, anaerobic digestion, and wastewater treatment. These incorporate specialized microorganisms, nutrient regulation, and environmental parameter control to optimize desired gas production while minimizing harmful emissions. Monitoring equipment tracks gas composition and production rates, with automated systems adjusting conditions to maintain optimal biological activity.

- Industrial process gas evolution control: These systems manage gas evolution in manufacturing processes like metal processing, chemical synthesis, and materials production. They employ specialized equipment including pressure regulators, flow controllers, and gas scrubbers to maintain precise atmospheric conditions. Advanced monitoring systems detect deviations from optimal gas parameters, triggering automated adjustments to prevent quality issues or safety hazards.

- Safety systems for hazardous gas management: Specialized systems designed to control potentially dangerous gas evolution in industrial settings. These incorporate gas detection sensors, emergency ventilation systems, and automated shutdown mechanisms to prevent dangerous accumulations. Advanced predictive algorithms identify potential gas evolution events before they become critical, while containment technologies safely capture and neutralize hazardous gases.

- Energy storage and battery gas management: Systems specifically designed to control gas evolution in batteries and energy storage devices. These incorporate specialized venting mechanisms, catalytic recombination systems, and pressure management technologies to prevent dangerous gas buildup. Advanced battery management systems monitor cell conditions to predict and prevent excessive gas generation, while specialized materials and designs minimize unwanted gas-producing reactions during charging and discharging cycles.

02 Gas evolution control in battery systems

Control systems designed specifically for managing gas evolution in battery technologies, particularly during charging and discharging cycles. These systems incorporate pressure relief mechanisms, catalytic recombination, and thermal management to prevent dangerous gas buildup. Advanced battery management systems monitor cell conditions to adjust charging parameters and prevent conditions that lead to excessive gassing.Expand Specific Solutions03 Industrial process gas evolution management

Systems for controlling gas evolution in industrial processes such as chemical manufacturing, metallurgy, and wastewater treatment. These incorporate specialized reactors, catalysts, and process control algorithms to manage reaction kinetics and gas production rates. Monitoring equipment tracks gas composition and flow rates in real-time, allowing for automated adjustments to maintain optimal conditions and prevent hazardous situations.Expand Specific Solutions04 Gas evolution control through material design

Innovative materials and structures designed to control gas evolution processes. These include specialized membranes, porous materials, and composite structures that can selectively permit, block, or catalyze gas formation. Advanced material designs incorporate nanoscale features that influence gas nucleation and bubble formation dynamics, providing precise control over gas evolution processes in various applications.Expand Specific Solutions05 Safety systems for gas evolution control

Safety-focused systems designed to prevent hazardous conditions resulting from uncontrolled gas evolution. These incorporate pressure relief devices, gas detection sensors, automated shutdown mechanisms, and containment structures. Emergency response protocols and redundant safety features ensure that gas evolution processes remain within safe operating parameters even during abnormal conditions or equipment failures.Expand Specific Solutions

Key Industry Players in Gas Sensing Market

The gas evolution control technology market is currently in a growth phase, with increasing demand driven by safety and efficiency requirements across industries. The market size is expanding as industries adopt advanced gas monitoring solutions, estimated to reach several billion dollars by 2025. Technologically, the field shows varying maturity levels, with companies like Robert Bosch GmbH, Honeywell, and DENSO leading with sophisticated sensor technologies and integrated control systems. NGK Insulators and H2scan offer specialized hydrogen detection solutions, while Siemens Energy and Continental Automotive focus on industrial applications. Toyota, Hyundai, and Kia are advancing automotive-specific gas monitoring systems. The competitive landscape features established industrial giants alongside specialized sensor technology providers, with innovation focused on miniaturization, increased sensitivity, and IoT integration.

DENSO Corp.

Technical Solution: DENSO has pioneered a comprehensive gas evolution control system specifically designed for automotive and industrial applications. Their technology utilizes a network of miniaturized solid-state gas sensors with specialized catalytic layers that provide selective detection of multiple gas species simultaneously[2]. The system incorporates advanced signal processing algorithms that can distinguish between normal operational gas emissions and potentially hazardous conditions, reducing false alarms while maintaining safety. DENSO's solution features integrated thermal management to maintain optimal sensor operating conditions across extreme temperature ranges (-40°C to +125°C), ensuring consistent performance in harsh environments[4]. Their gas control architecture includes adaptive threshold management that automatically adjusts warning and shutdown limits based on operational conditions and historical data patterns. The system also incorporates self-diagnostic capabilities that continuously monitor sensor health and performance, alerting operators to potential sensor degradation before measurement accuracy is compromised.

Strengths: Exceptional durability with proven 10+ year operational lifespan in harsh environments; compact form factor allowing integration in space-constrained applications; rapid response time under 3 seconds for critical gas detection. Weaknesses: Higher power consumption compared to passive detection systems; requires periodic recalibration for maximum accuracy; more complex installation requirements than basic gas detection systems.

Robert Bosch GmbH

Technical Solution: Bosch has developed advanced gas evolution control systems that integrate multiple sensor technologies for comprehensive monitoring. Their solution combines electrochemical, semiconductor, and infrared sensors in a single platform to detect various gases simultaneously. The system employs predictive algorithms that analyze gas evolution patterns to anticipate potential issues before they become critical. Bosch's technology includes self-calibrating sensors that maintain accuracy over extended periods without manual intervention[1]. Their gas control systems feature redundant sensing elements to ensure reliability in safety-critical applications, with automatic compensation for environmental factors like temperature and humidity that might otherwise affect measurement accuracy[3]. The system architecture includes distributed sensing nodes connected to a central monitoring unit, enabling both localized and system-wide gas management with millisecond response times to dangerous conditions.

Strengths: Exceptional reliability with 99.99% uptime in critical applications; comprehensive multi-gas detection capabilities; advanced predictive maintenance features that reduce false alarms by up to 85%. Weaknesses: Higher initial implementation cost compared to simpler systems; requires more complex integration with existing infrastructure; power consumption may be challenging for battery-operated applications.

Critical Gas Sensor Technologies Analysis

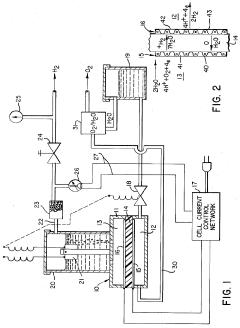

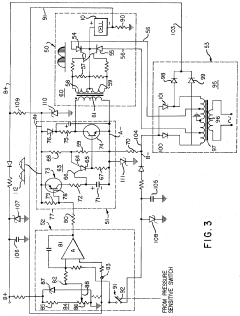

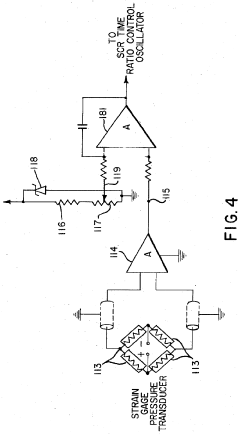

Current controlled regulation of gas evolution in a solid polymer electrolyte electrolysis unit

PatentInactiveUS3870616A

Innovation

- A control system that senses output gas pressure and adjusts current flow to the electrolysis cell using silicon controlled rectifiers and a variable pulse generator, allowing for continuous or intermittent control of gas evolution rates to manage pressure and flow.

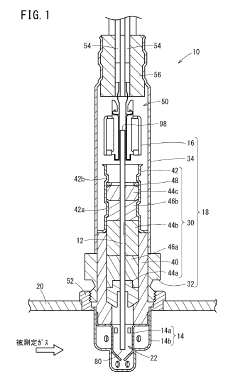

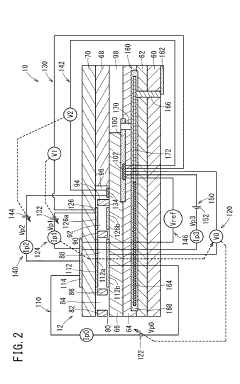

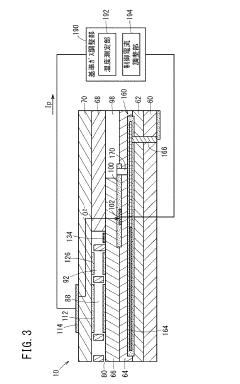

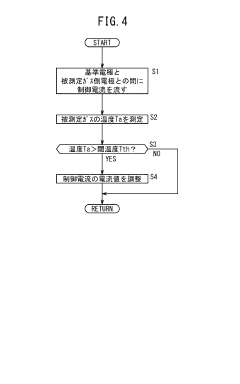

Gas sensor and control method thereof

PatentActiveJP2020165761A

Innovation

- A gas sensor design incorporating multiple layers of oxygen ion-conducting solid electrolytes with a reference gas introduction space, a reference electrode, and a heater unit for temperature adjustment, along with a control method that adjusts the control current based on temperature differences to maintain oxygen concentration and suppress noise.

Safety Standards and Compliance Requirements

Effective gas evolution control systems must adhere to a comprehensive framework of safety standards and compliance requirements established by various international and regional regulatory bodies. The International Electrotechnical Commission (IEC) provides foundational standards such as IEC 60079 series for equipment used in explosive atmospheres, which directly applies to environments where gas evolution poses significant risks. These standards specify the design requirements, testing methodologies, and certification processes for sensors and monitoring equipment.

In the United States, the Occupational Safety and Health Administration (OSHA) enforces regulations under 29 CFR 1910.119 for process safety management, requiring facilities to implement robust gas detection systems with appropriate alarm thresholds. The National Fire Protection Association (NFPA) complements these requirements through standards like NFPA 69 for explosion prevention systems and NFPA 72 for fire alarm and signaling systems, which include specifications for gas detection equipment integration.

European regulations, particularly the ATEX Directive 2014/34/EU, mandate strict compliance for equipment and protective systems intended for use in potentially explosive atmospheres. This directive establishes essential health and safety requirements and conformity assessment procedures that manufacturers must follow when designing gas evolution control systems.

Industry-specific standards further refine these requirements. For instance, semiconductor manufacturing facilities must comply with SEMI S2 guidelines, which specify safety requirements for semiconductor manufacturing equipment, including gas detection systems with defined response times and accuracy levels. Similarly, the petrochemical industry follows API RP 556 for instrumentation, control, and protective systems in refineries.

Calibration and maintenance requirements constitute another critical aspect of compliance. Standards such as ISO/IEC 17025 establish guidelines for the competence of testing and calibration laboratories, ensuring that gas sensors maintain their accuracy over time. Regular calibration intervals, typically ranging from monthly to quarterly depending on the application, must be documented and traceable.

Alarm threshold settings must align with established exposure limits such as NIOSH Recommended Exposure Limits (RELs), ACGIH Threshold Limit Values (TLVs), and OSHA Permissible Exposure Limits (PELs). Modern gas evolution control systems typically implement multi-level alarm structures: advisory alarms at 20-25% of the lower explosive limit (LEL), warning alarms at 40-50% LEL, and emergency shutdown triggers at 60% LEL.

Documentation and certification requirements complete the compliance framework. Manufacturers must provide detailed technical files, risk assessments, and declarations of conformity. End-users must maintain records of system performance, calibration history, and incident responses to demonstrate ongoing compliance during regulatory inspections.

In the United States, the Occupational Safety and Health Administration (OSHA) enforces regulations under 29 CFR 1910.119 for process safety management, requiring facilities to implement robust gas detection systems with appropriate alarm thresholds. The National Fire Protection Association (NFPA) complements these requirements through standards like NFPA 69 for explosion prevention systems and NFPA 72 for fire alarm and signaling systems, which include specifications for gas detection equipment integration.

European regulations, particularly the ATEX Directive 2014/34/EU, mandate strict compliance for equipment and protective systems intended for use in potentially explosive atmospheres. This directive establishes essential health and safety requirements and conformity assessment procedures that manufacturers must follow when designing gas evolution control systems.

Industry-specific standards further refine these requirements. For instance, semiconductor manufacturing facilities must comply with SEMI S2 guidelines, which specify safety requirements for semiconductor manufacturing equipment, including gas detection systems with defined response times and accuracy levels. Similarly, the petrochemical industry follows API RP 556 for instrumentation, control, and protective systems in refineries.

Calibration and maintenance requirements constitute another critical aspect of compliance. Standards such as ISO/IEC 17025 establish guidelines for the competence of testing and calibration laboratories, ensuring that gas sensors maintain their accuracy over time. Regular calibration intervals, typically ranging from monthly to quarterly depending on the application, must be documented and traceable.

Alarm threshold settings must align with established exposure limits such as NIOSH Recommended Exposure Limits (RELs), ACGIH Threshold Limit Values (TLVs), and OSHA Permissible Exposure Limits (PELs). Modern gas evolution control systems typically implement multi-level alarm structures: advisory alarms at 20-25% of the lower explosive limit (LEL), warning alarms at 40-50% LEL, and emergency shutdown triggers at 60% LEL.

Documentation and certification requirements complete the compliance framework. Manufacturers must provide detailed technical files, risk assessments, and declarations of conformity. End-users must maintain records of system performance, calibration history, and incident responses to demonstrate ongoing compliance during regulatory inspections.

Environmental Impact of Gas Evolution Control Systems

Gas evolution control systems, while essential for industrial safety and operational efficiency, carry significant environmental implications that must be carefully considered. The emissions from industrial processes containing various gases such as carbon dioxide, methane, sulfur compounds, and volatile organic compounds (VOCs) contribute substantially to environmental degradation when improperly managed. Advanced gas evolution control systems help mitigate these impacts through precise monitoring and regulation, but their implementation also introduces environmental considerations.

The primary environmental benefit of effective gas control systems is the reduction of greenhouse gas emissions. By accurately detecting and limiting the release of methane and carbon dioxide, these systems directly contribute to climate change mitigation efforts. Studies indicate that industrial facilities implementing comprehensive gas monitoring can reduce their carbon footprint by 15-30%, depending on the sector and technologies employed.

Water pollution prevention represents another critical environmental advantage. Many industrial gases, when dissolved in water, can alter pH levels and introduce toxic compounds into aquatic ecosystems. Modern gas evolution control systems that prevent these emissions help protect water resources, particularly in areas where industrial facilities operate near sensitive watersheds or coastal zones.

However, the environmental footprint of the control systems themselves warrants consideration. The manufacturing, installation, and operation of gas sensors and control equipment require energy and resources. The electronic components often contain rare earth elements and other materials with significant extraction impacts. Life cycle assessments reveal that the environmental payback period for these systems typically ranges from 6 months to 3 years, depending on the application intensity and the specific gases being controlled.

Waste management challenges also emerge when sensors and control equipment reach end-of-life. Many components contain hazardous materials that require specialized disposal procedures. The environmental sustainability of gas evolution control systems can be enhanced through design approaches that facilitate component recycling and minimize hazardous material content.

Energy consumption patterns of continuous monitoring systems present another environmental consideration. While newer sensor technologies have become increasingly energy-efficient, comprehensive gas monitoring networks still contribute to facility energy demands. The implementation of renewable energy sources to power these systems can significantly reduce their operational environmental impact.

The regulatory landscape increasingly recognizes these environmental dimensions, with many jurisdictions now requiring environmental impact assessments specifically addressing gas control technologies when approving new industrial installations or modifications to existing facilities.

The primary environmental benefit of effective gas control systems is the reduction of greenhouse gas emissions. By accurately detecting and limiting the release of methane and carbon dioxide, these systems directly contribute to climate change mitigation efforts. Studies indicate that industrial facilities implementing comprehensive gas monitoring can reduce their carbon footprint by 15-30%, depending on the sector and technologies employed.

Water pollution prevention represents another critical environmental advantage. Many industrial gases, when dissolved in water, can alter pH levels and introduce toxic compounds into aquatic ecosystems. Modern gas evolution control systems that prevent these emissions help protect water resources, particularly in areas where industrial facilities operate near sensitive watersheds or coastal zones.

However, the environmental footprint of the control systems themselves warrants consideration. The manufacturing, installation, and operation of gas sensors and control equipment require energy and resources. The electronic components often contain rare earth elements and other materials with significant extraction impacts. Life cycle assessments reveal that the environmental payback period for these systems typically ranges from 6 months to 3 years, depending on the application intensity and the specific gases being controlled.

Waste management challenges also emerge when sensors and control equipment reach end-of-life. Many components contain hazardous materials that require specialized disposal procedures. The environmental sustainability of gas evolution control systems can be enhanced through design approaches that facilitate component recycling and minimize hazardous material content.

Energy consumption patterns of continuous monitoring systems present another environmental consideration. While newer sensor technologies have become increasingly energy-efficient, comprehensive gas monitoring networks still contribute to facility energy demands. The implementation of renewable energy sources to power these systems can significantly reduce their operational environmental impact.

The regulatory landscape increasingly recognizes these environmental dimensions, with many jurisdictions now requiring environmental impact assessments specifically addressing gas control technologies when approving new industrial installations or modifications to existing facilities.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!