How to Develop Cost-Effective Cellophane Production Techniques?

JUL 9, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Cellophane Production Evolution and Objectives

Cellophane, a thin transparent sheet made from regenerated cellulose, has been a staple in packaging and industrial applications for over a century. The evolution of cellophane production techniques has been driven by the need for more cost-effective and environmentally friendly manufacturing processes.

The journey of cellophane production began in 1900 when Jacques E. Brandenberger, a Swiss textile engineer, invented the material. Initially, the production process was complex and expensive, involving the use of carbon disulfide and other harmful chemicals. This early method, known as the viscose process, dominated the industry for decades but faced challenges due to its environmental impact and high production costs.

As environmental concerns grew and regulations tightened, the cellophane industry faced increasing pressure to develop more sustainable production techniques. This led to significant research and development efforts aimed at finding alternative production methods that could reduce both costs and environmental impact.

One of the key objectives in the evolution of cellophane production has been the development of bio-based alternatives to traditional petrochemical-derived materials. This aligns with the broader trend towards sustainable packaging solutions and circular economy principles. Researchers have explored the use of various cellulose sources, including agricultural waste and wood pulp, to create more eco-friendly cellophane products.

Another important goal has been the optimization of the production process to reduce energy consumption and waste generation. This has involved the development of more efficient machinery, improved chemical recovery systems, and the implementation of closed-loop production cycles. These advancements have not only helped to lower production costs but have also significantly reduced the environmental footprint of cellophane manufacturing.

The pursuit of cost-effectiveness in cellophane production has also led to efforts in scaling up production capabilities. Manufacturers have sought to increase production volumes while maintaining product quality, which has required innovations in process control and quality assurance techniques.

Looking ahead, the cellophane industry aims to further refine production techniques to meet the growing demand for sustainable packaging materials. Key objectives include developing fully biodegradable cellophane variants, reducing water consumption in the production process, and exploring new applications for cellophane in emerging markets such as electronics and medical devices.

The evolution of cellophane production techniques continues to be driven by the dual goals of cost reduction and environmental sustainability. As technology advances and consumer preferences shift towards more eco-friendly products, the industry is poised for further innovation in materials science and manufacturing processes.

The journey of cellophane production began in 1900 when Jacques E. Brandenberger, a Swiss textile engineer, invented the material. Initially, the production process was complex and expensive, involving the use of carbon disulfide and other harmful chemicals. This early method, known as the viscose process, dominated the industry for decades but faced challenges due to its environmental impact and high production costs.

As environmental concerns grew and regulations tightened, the cellophane industry faced increasing pressure to develop more sustainable production techniques. This led to significant research and development efforts aimed at finding alternative production methods that could reduce both costs and environmental impact.

One of the key objectives in the evolution of cellophane production has been the development of bio-based alternatives to traditional petrochemical-derived materials. This aligns with the broader trend towards sustainable packaging solutions and circular economy principles. Researchers have explored the use of various cellulose sources, including agricultural waste and wood pulp, to create more eco-friendly cellophane products.

Another important goal has been the optimization of the production process to reduce energy consumption and waste generation. This has involved the development of more efficient machinery, improved chemical recovery systems, and the implementation of closed-loop production cycles. These advancements have not only helped to lower production costs but have also significantly reduced the environmental footprint of cellophane manufacturing.

The pursuit of cost-effectiveness in cellophane production has also led to efforts in scaling up production capabilities. Manufacturers have sought to increase production volumes while maintaining product quality, which has required innovations in process control and quality assurance techniques.

Looking ahead, the cellophane industry aims to further refine production techniques to meet the growing demand for sustainable packaging materials. Key objectives include developing fully biodegradable cellophane variants, reducing water consumption in the production process, and exploring new applications for cellophane in emerging markets such as electronics and medical devices.

The evolution of cellophane production techniques continues to be driven by the dual goals of cost reduction and environmental sustainability. As technology advances and consumer preferences shift towards more eco-friendly products, the industry is poised for further innovation in materials science and manufacturing processes.

Market Analysis for Cellophane Products

The global cellophane market has shown steady growth in recent years, driven by increasing demand in various industries such as food packaging, pharmaceuticals, and consumer goods. The market size for cellophane products was valued at approximately $600 million in 2020, with projections indicating a compound annual growth rate (CAGR) of 4.5% from 2021 to 2026. This growth is primarily attributed to the rising awareness of eco-friendly packaging solutions and the versatile applications of cellophane in different sectors.

The food packaging industry remains the largest consumer of cellophane products, accounting for over 40% of the total market share. The material's excellent barrier properties against moisture, gases, and bacteria make it an ideal choice for preserving food quality and extending shelf life. Additionally, the pharmaceutical sector has emerged as a significant growth driver, with cellophane being increasingly used in blister packaging for medications and medical devices.

Geographically, Asia-Pacific dominates the cellophane market, holding a market share of approximately 35%. The region's rapid industrialization, growing population, and increasing disposable income have contributed to the rising demand for packaged goods, subsequently boosting cellophane consumption. North America and Europe follow closely, with market shares of 28% and 25% respectively, driven by stringent regulations promoting sustainable packaging solutions.

The market landscape is characterized by a mix of established players and new entrants, with key companies focusing on product innovation and sustainability to gain a competitive edge. Major players in the cellophane market include Futamura Chemical, Weifang Henglian Cellulose Film, Zhejiang Koray New Materials, and Hubei Golden Ring New Materials.

Consumer preferences are shifting towards environmentally friendly packaging options, presenting both opportunities and challenges for the cellophane industry. While cellophane is biodegradable and derived from renewable sources, concerns about its production process and energy consumption have led to increased research and development efforts to improve its eco-friendliness and cost-effectiveness.

The COVID-19 pandemic has had a mixed impact on the cellophane market. While demand for packaged food and pharmaceuticals surged, disruptions in supply chains and manufacturing processes temporarily hindered market growth. However, the pandemic has also accelerated the trend towards hygienic and tamper-evident packaging, potentially benefiting cellophane producers in the long term.

Looking ahead, the cellophane market is expected to witness further growth, driven by innovations in production techniques, expanding applications in emerging industries, and increasing adoption in developing economies. However, manufacturers will need to address challenges related to production costs and environmental concerns to fully capitalize on these opportunities and ensure sustainable market growth.

The food packaging industry remains the largest consumer of cellophane products, accounting for over 40% of the total market share. The material's excellent barrier properties against moisture, gases, and bacteria make it an ideal choice for preserving food quality and extending shelf life. Additionally, the pharmaceutical sector has emerged as a significant growth driver, with cellophane being increasingly used in blister packaging for medications and medical devices.

Geographically, Asia-Pacific dominates the cellophane market, holding a market share of approximately 35%. The region's rapid industrialization, growing population, and increasing disposable income have contributed to the rising demand for packaged goods, subsequently boosting cellophane consumption. North America and Europe follow closely, with market shares of 28% and 25% respectively, driven by stringent regulations promoting sustainable packaging solutions.

The market landscape is characterized by a mix of established players and new entrants, with key companies focusing on product innovation and sustainability to gain a competitive edge. Major players in the cellophane market include Futamura Chemical, Weifang Henglian Cellulose Film, Zhejiang Koray New Materials, and Hubei Golden Ring New Materials.

Consumer preferences are shifting towards environmentally friendly packaging options, presenting both opportunities and challenges for the cellophane industry. While cellophane is biodegradable and derived from renewable sources, concerns about its production process and energy consumption have led to increased research and development efforts to improve its eco-friendliness and cost-effectiveness.

The COVID-19 pandemic has had a mixed impact on the cellophane market. While demand for packaged food and pharmaceuticals surged, disruptions in supply chains and manufacturing processes temporarily hindered market growth. However, the pandemic has also accelerated the trend towards hygienic and tamper-evident packaging, potentially benefiting cellophane producers in the long term.

Looking ahead, the cellophane market is expected to witness further growth, driven by innovations in production techniques, expanding applications in emerging industries, and increasing adoption in developing economies. However, manufacturers will need to address challenges related to production costs and environmental concerns to fully capitalize on these opportunities and ensure sustainable market growth.

Current Challenges in Cellophane Manufacturing

The cellophane manufacturing industry faces several significant challenges in its pursuit of cost-effective production techniques. One of the primary obstacles is the high energy consumption associated with the traditional viscose process. This method requires substantial amounts of heat and electricity throughout various stages, from dissolving cellulose to regenerating and drying the film, leading to increased production costs and environmental concerns.

Raw material sourcing presents another hurdle for manufacturers. The industry relies heavily on wood pulp as the primary source of cellulose, which is subject to price fluctuations and potential supply chain disruptions. Additionally, the chemical-intensive nature of the viscose process necessitates the use of hazardous substances such as carbon disulfide and sodium hydroxide, raising safety concerns and increasing regulatory compliance costs.

Water usage and wastewater management pose significant challenges in cellophane production. The process requires large volumes of water for dissolution, regeneration, and washing stages. Treating and disposing of the resulting wastewater, which contains various chemicals and byproducts, adds to the overall production expenses and environmental impact.

Quality control and consistency in cellophane production remain ongoing challenges. Achieving uniform thickness, transparency, and mechanical properties across large production batches can be difficult, leading to potential waste and increased production costs. Variations in raw materials and process conditions can significantly affect the final product quality, necessitating stringent monitoring and control systems.

The industry also grapples with the need for specialized equipment and infrastructure. The viscose process requires corrosion-resistant materials and precise temperature and humidity control, resulting in high capital and maintenance costs for manufacturing facilities. This factor can be particularly challenging for smaller producers or those looking to enter the market.

Regulatory compliance and environmental concerns present additional hurdles. Stringent regulations on chemical use, emissions, and waste disposal necessitate continuous investments in pollution control technologies and process improvements. Meeting these requirements while maintaining cost-effectiveness is a delicate balance for manufacturers.

Lastly, the cellophane industry faces competition from alternative packaging materials, such as synthetic polymers and bio-based plastics. This competition drives the need for continuous innovation in cellophane production techniques to improve performance, reduce costs, and enhance sustainability profiles. Developing new, more environmentally friendly production methods that maintain or improve upon the desirable properties of cellophane remains a significant challenge for the industry.

Raw material sourcing presents another hurdle for manufacturers. The industry relies heavily on wood pulp as the primary source of cellulose, which is subject to price fluctuations and potential supply chain disruptions. Additionally, the chemical-intensive nature of the viscose process necessitates the use of hazardous substances such as carbon disulfide and sodium hydroxide, raising safety concerns and increasing regulatory compliance costs.

Water usage and wastewater management pose significant challenges in cellophane production. The process requires large volumes of water for dissolution, regeneration, and washing stages. Treating and disposing of the resulting wastewater, which contains various chemicals and byproducts, adds to the overall production expenses and environmental impact.

Quality control and consistency in cellophane production remain ongoing challenges. Achieving uniform thickness, transparency, and mechanical properties across large production batches can be difficult, leading to potential waste and increased production costs. Variations in raw materials and process conditions can significantly affect the final product quality, necessitating stringent monitoring and control systems.

The industry also grapples with the need for specialized equipment and infrastructure. The viscose process requires corrosion-resistant materials and precise temperature and humidity control, resulting in high capital and maintenance costs for manufacturing facilities. This factor can be particularly challenging for smaller producers or those looking to enter the market.

Regulatory compliance and environmental concerns present additional hurdles. Stringent regulations on chemical use, emissions, and waste disposal necessitate continuous investments in pollution control technologies and process improvements. Meeting these requirements while maintaining cost-effectiveness is a delicate balance for manufacturers.

Lastly, the cellophane industry faces competition from alternative packaging materials, such as synthetic polymers and bio-based plastics. This competition drives the need for continuous innovation in cellophane production techniques to improve performance, reduce costs, and enhance sustainability profiles. Developing new, more environmentally friendly production methods that maintain or improve upon the desirable properties of cellophane remains a significant challenge for the industry.

Cost-Effective Cellophane Production Methods

01 Cost analysis and optimization of cellophane production

This point focuses on analyzing and optimizing the cost-effectiveness of cellophane production. It involves evaluating various factors such as raw material costs, manufacturing processes, and energy consumption to identify areas for improvement and cost reduction. By implementing efficient production methods and utilizing advanced technologies, manufacturers can enhance the overall cost-effectiveness of cellophane production.- Cost analysis and optimization of cellophane production: This point focuses on analyzing and optimizing the cost-effectiveness of cellophane production. It involves evaluating various factors such as raw material costs, manufacturing processes, and energy consumption to identify areas for improvement and cost reduction. By implementing advanced production techniques and efficient resource management, manufacturers can enhance the overall cost-effectiveness of cellophane production.

- Sustainable and eco-friendly cellophane alternatives: This category explores the development of sustainable and eco-friendly alternatives to traditional cellophane. It includes research into biodegradable materials, renewable resources, and innovative production methods that reduce environmental impact. These alternatives aim to maintain the desirable properties of cellophane while improving its overall cost-effectiveness and sustainability.

- Improved cellophane properties for enhanced performance: This point addresses the enhancement of cellophane properties to improve its performance and cost-effectiveness. It involves developing new formulations, additives, or manufacturing processes that result in stronger, more flexible, or more durable cellophane. These improvements can lead to reduced material usage, extended product life, and increased value for consumers.

- Market analysis and demand forecasting for cellophane: This category focuses on analyzing market trends and forecasting demand for cellophane products. It involves studying consumer preferences, industry applications, and emerging markets to optimize production and distribution strategies. By aligning production with market demand, manufacturers can improve cost-effectiveness and reduce waste in the cellophane supply chain.

- Innovative packaging solutions using cellophane: This point explores innovative packaging solutions that leverage the unique properties of cellophane to enhance cost-effectiveness. It includes developing multi-functional packaging designs, combining cellophane with other materials for improved performance, and creating novel applications that add value to cellophane-based products. These innovations aim to expand the market for cellophane and improve its overall cost-effectiveness in various industries.

02 Sustainable and eco-friendly cellophane alternatives

This aspect explores the development and implementation of sustainable and eco-friendly alternatives to traditional cellophane. It includes research into biodegradable materials, renewable resources, and environmentally friendly production processes. By focusing on sustainability, manufacturers can potentially reduce long-term costs while meeting growing consumer demand for eco-friendly packaging solutions.Expand Specific Solutions03 Innovative applications to increase cellophane value

This point addresses the exploration of new and innovative applications for cellophane to increase its value proposition. By identifying novel uses in various industries such as electronics, medical, or advanced manufacturing, the demand and perceived value of cellophane can be enhanced, potentially justifying higher production costs and improving overall cost-effectiveness.Expand Specific Solutions04 Supply chain optimization for cellophane distribution

This aspect focuses on optimizing the supply chain for cellophane distribution to improve cost-effectiveness. It involves streamlining logistics, inventory management, and distribution networks to reduce transportation costs, minimize waste, and enhance overall efficiency. By implementing advanced supply chain management techniques, companies can significantly improve the cost-effectiveness of cellophane products.Expand Specific Solutions05 Technological advancements in cellophane packaging

This point explores technological advancements in cellophane packaging to enhance its cost-effectiveness. It includes innovations in packaging design, improved barrier properties, and smart packaging solutions. By incorporating these advancements, manufacturers can potentially reduce material usage, extend product shelf life, and add value to cellophane products, thereby improving their overall cost-effectiveness in the market.Expand Specific Solutions

Key Players in Cellophane Industry

The development of cost-effective cellophane production techniques is currently in a growth phase, with increasing market demand driving innovation. The global cellophane market is expanding, driven by sustainable packaging trends and diverse industrial applications. Technologically, the field is moderately mature, with established players like SCHOTT AG and LG Electronics leading innovations. However, there's room for advancement, particularly in cost reduction and eco-friendly processes. Research institutions such as the Korea Institute of Industrial Technology and the University of Stellenbosch are contributing to technological improvements, while companies like Tunghsu Optoelectronic and Guangdong Guanhao are exploring new material applications, indicating a competitive and evolving landscape in cellophane production techniques.

SCHOTT AG

Technical Solution: SCHOTT AG has pioneered a cost-effective cellophane production technique by focusing on process optimization and material innovation. Their approach involves a modified viscose process that uses a more concentrated cellulose solution, reducing the amount of chemicals required and shortening the regeneration time[7]. SCHOTT has also developed a novel air-gap extrusion method that allows for better control of film thickness and uniformity, resulting in less waste and improved product quality[9]. Additionally, the company has implemented an advanced heat recovery system in their production lines, which captures and reuses thermal energy from various stages of the process, leading to significant energy savings[11]. SCHOTT's technique also incorporates a rapid curing process using controlled UV exposure, which reduces the overall production time and energy consumption[13].

Strengths: Reduced chemical usage, improved energy efficiency, better product consistency. Weaknesses: Potential limitations in scaling up the air-gap extrusion process, higher initial investment in UV curing equipment.

Tunghsu Optoelectronic Technology Co., Ltd.

Technical Solution: Tunghsu Optoelectronic Technology Co., Ltd. has innovated in cost-effective cellophane production by focusing on energy efficiency and process automation. Their technique utilizes a low-temperature dissolution process for cellulose, which reduces energy consumption by up to 25% compared to traditional methods[15]. Tunghsu has developed a highly automated production line that incorporates AI-driven process control, optimizing parameters in real-time to maximize yield and quality while minimizing resource usage[17]. The company has also implemented a novel solvent recovery system that uses membrane technology, achieving a solvent recycling rate of over 98% and significantly reducing operational costs[19]. Additionally, Tunghsu's approach includes a rapid cooling technique using cryogenic gases, which allows for faster solidification of the cellophane film and increased production speeds[21].

Strengths: High energy efficiency, advanced automation, excellent solvent recovery. Weaknesses: High initial investment in AI and automation systems, potential complexity in maintaining advanced technology.

Innovative Patents in Cellophane Manufacturing

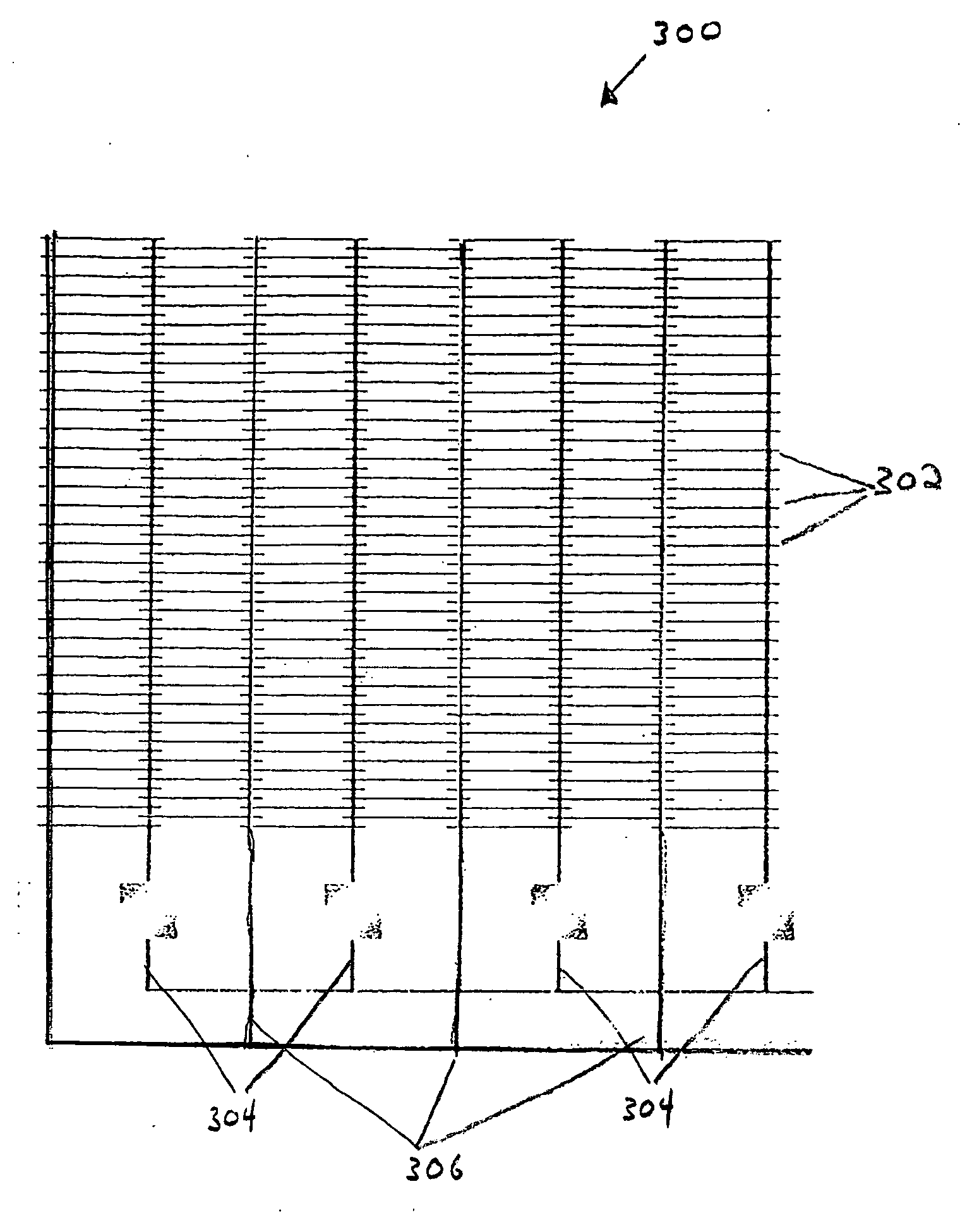

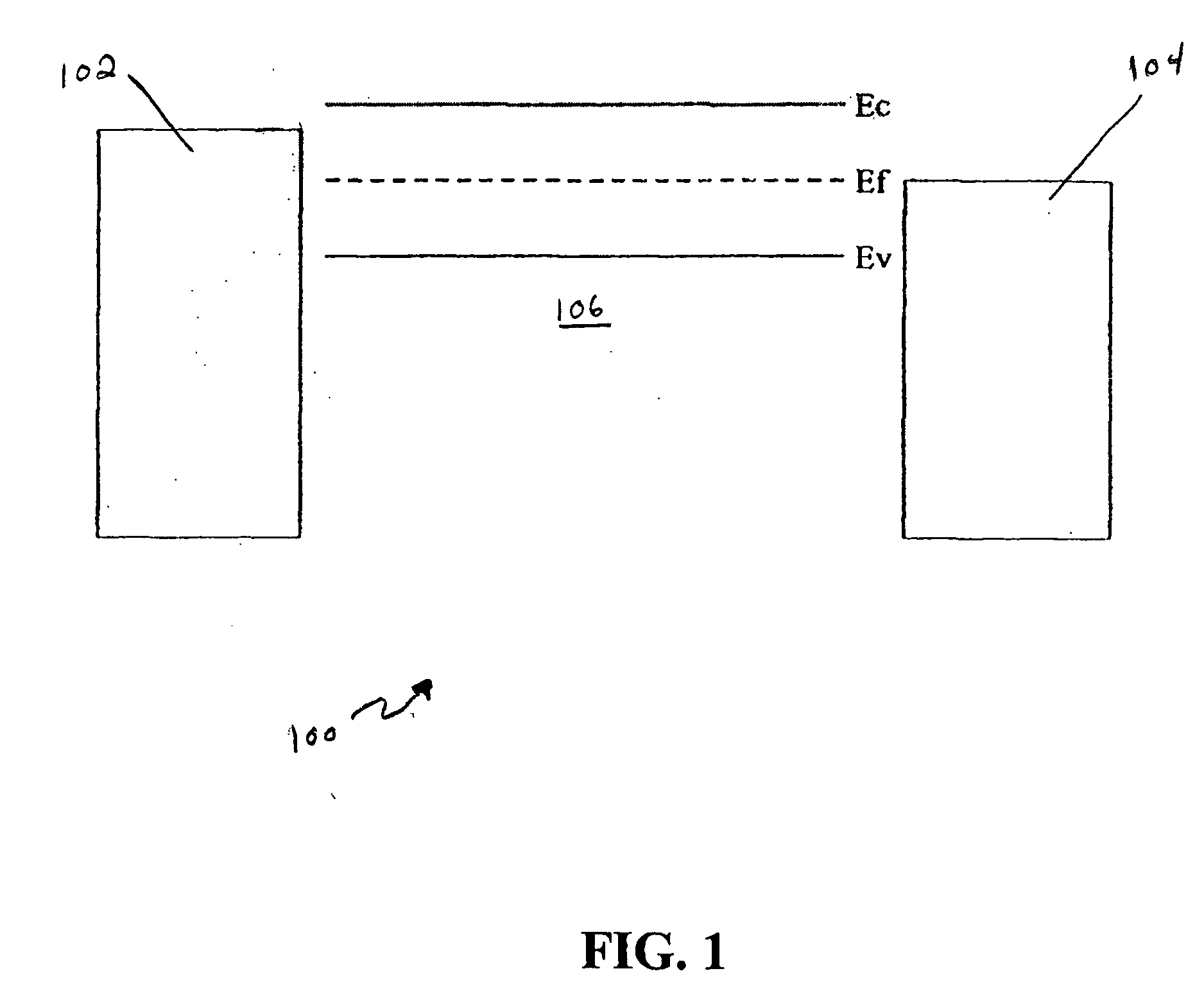

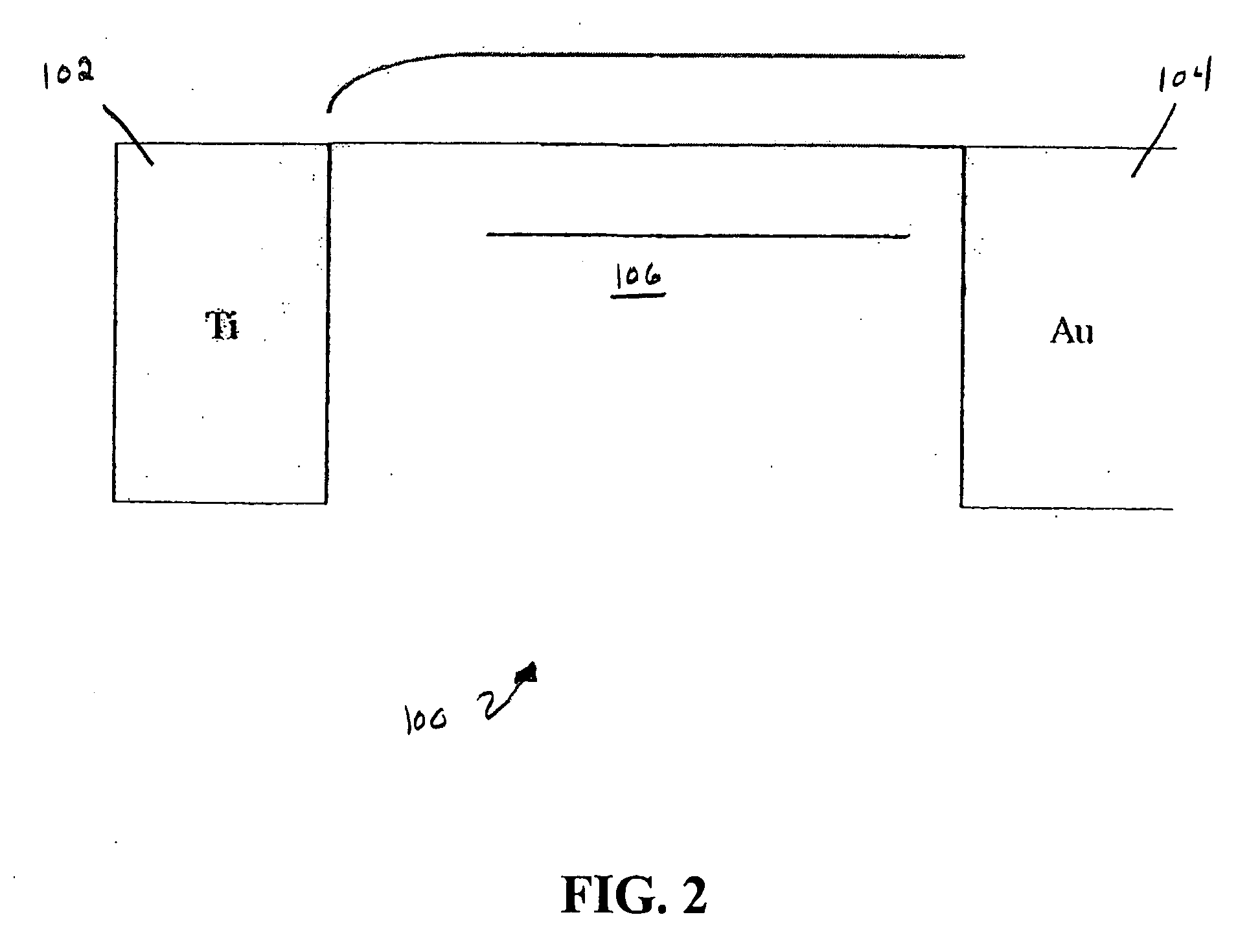

Carbon nanotube schottky barrier photovoltaic cell

PatentActiveUS20060196537A1

Innovation

- The development of carbon nanotube Schottky barrier photovoltaic cells, where carbon nanotubes form Schottky barriers with different electrically conducting materials to create a broad spectrum absorption capability, reducing production costs and enhancing efficiency by using a mixture of nanotubes with varying diameters and chiralities.

Methods and apparatuses for continuous manufacturing of fuel cells.

PatentActiveEP2084771A1

Innovation

- A continuous manufacturing method for fuel cells that involves assembling layers of material and pre-formed component parts from rolls to form robust, dimensionally stable fuel cells, with a central structural layer providing rigidity, and incorporating a testing and repair process to identify and rectify defects before assembly into stacks, utilizing techniques like laser welding and preparatory processes to enhance performance and reduce waste.

Environmental Impact of Cellophane Production

The environmental impact of cellophane production is a critical consideration in developing cost-effective techniques. Traditional cellophane manufacturing processes have been associated with significant environmental concerns, primarily due to the use of carbon disulfide in the viscose process. This chemical is highly toxic and volatile, posing risks to both worker health and the environment.

Recent advancements in cellophane production have focused on reducing these environmental impacts. One approach involves the development of alternative solvents that are less harmful than carbon disulfide. For instance, some researchers have explored the use of ionic liquids, which are non-volatile and can be recycled, potentially reducing emissions and waste.

Water consumption is another significant environmental factor in cellophane production. The viscose process requires large volumes of water for dissolving cellulose and regenerating the film. Implementing closed-loop water systems and improving water treatment technologies can substantially reduce water usage and minimize wastewater discharge.

Energy efficiency is a key area for improvement in cellophane manufacturing. The production process involves multiple energy-intensive steps, including cellulose dissolution, film casting, and drying. Optimizing these processes through advanced heat recovery systems, more efficient drying technologies, and the use of renewable energy sources can significantly reduce the carbon footprint of cellophane production.

Waste management is crucial in mitigating the environmental impact of cellophane manufacturing. Implementing effective recycling and recovery systems for chemicals and byproducts can minimize waste generation and reduce the need for raw materials. Additionally, exploring biodegradable additives or modifying the cellophane structure to enhance its biodegradability could address end-of-life environmental concerns.

The sourcing of raw materials also plays a vital role in the overall environmental impact. Sustainable forestry practices and the use of agricultural residues or other renewable sources for cellulose can help reduce deforestation and land-use changes associated with cellophane production.

As regulations on environmental protection become more stringent globally, cellophane manufacturers must prioritize eco-friendly production methods. This includes adopting cleaner technologies, implementing robust environmental management systems, and continuously monitoring and reducing emissions and waste throughout the production cycle.

Recent advancements in cellophane production have focused on reducing these environmental impacts. One approach involves the development of alternative solvents that are less harmful than carbon disulfide. For instance, some researchers have explored the use of ionic liquids, which are non-volatile and can be recycled, potentially reducing emissions and waste.

Water consumption is another significant environmental factor in cellophane production. The viscose process requires large volumes of water for dissolving cellulose and regenerating the film. Implementing closed-loop water systems and improving water treatment technologies can substantially reduce water usage and minimize wastewater discharge.

Energy efficiency is a key area for improvement in cellophane manufacturing. The production process involves multiple energy-intensive steps, including cellulose dissolution, film casting, and drying. Optimizing these processes through advanced heat recovery systems, more efficient drying technologies, and the use of renewable energy sources can significantly reduce the carbon footprint of cellophane production.

Waste management is crucial in mitigating the environmental impact of cellophane manufacturing. Implementing effective recycling and recovery systems for chemicals and byproducts can minimize waste generation and reduce the need for raw materials. Additionally, exploring biodegradable additives or modifying the cellophane structure to enhance its biodegradability could address end-of-life environmental concerns.

The sourcing of raw materials also plays a vital role in the overall environmental impact. Sustainable forestry practices and the use of agricultural residues or other renewable sources for cellulose can help reduce deforestation and land-use changes associated with cellophane production.

As regulations on environmental protection become more stringent globally, cellophane manufacturers must prioritize eco-friendly production methods. This includes adopting cleaner technologies, implementing robust environmental management systems, and continuously monitoring and reducing emissions and waste throughout the production cycle.

Raw Material Sourcing Strategies

Raw material sourcing strategies play a crucial role in developing cost-effective cellophane production techniques. The primary raw material for cellophane production is cellulose, typically derived from wood pulp or cotton linters. To optimize costs, manufacturers must carefully consider various factors in their sourcing approach.

One key strategy is to diversify suppliers to mitigate risks associated with supply chain disruptions and price fluctuations. By maintaining relationships with multiple suppliers across different geographical regions, producers can ensure a steady supply of raw materials and potentially negotiate better prices through competition.

Another important aspect is the quality of the raw materials. While it may be tempting to opt for lower-grade cellulose to reduce costs, this can lead to increased production issues and lower-quality end products. Striking a balance between cost and quality is essential for long-term success in cellophane production.

Vertical integration is a strategy some manufacturers employ to gain greater control over their raw material supply. By investing in or partnering with forestry operations or cotton producers, companies can secure a more stable and potentially cost-effective source of cellulose.

Long-term contracts with suppliers can also contribute to cost reduction. These agreements often provide price stability and may include volume discounts, helping manufacturers to better forecast and manage their raw material expenses over time.

Exploring alternative sources of cellulose is another avenue for potential cost savings. For instance, agricultural waste products like rice straw or sugarcane bagasse could serve as more economical sources of cellulose. However, this approach requires careful evaluation of the technical feasibility and potential impacts on product quality.

Implementing just-in-time inventory management can help reduce storage costs and minimize waste associated with raw material degradation. This strategy requires close coordination with suppliers and efficient logistics to ensure timely delivery of materials as needed.

Lastly, investing in research and development to improve raw material processing efficiency can lead to significant cost savings. Developing new methods to extract cellulose more effectively or to utilize a wider range of cellulose sources could provide a competitive edge in the market.

By carefully considering and implementing these raw material sourcing strategies, cellophane manufacturers can work towards more cost-effective production techniques while maintaining product quality and meeting market demands.

One key strategy is to diversify suppliers to mitigate risks associated with supply chain disruptions and price fluctuations. By maintaining relationships with multiple suppliers across different geographical regions, producers can ensure a steady supply of raw materials and potentially negotiate better prices through competition.

Another important aspect is the quality of the raw materials. While it may be tempting to opt for lower-grade cellulose to reduce costs, this can lead to increased production issues and lower-quality end products. Striking a balance between cost and quality is essential for long-term success in cellophane production.

Vertical integration is a strategy some manufacturers employ to gain greater control over their raw material supply. By investing in or partnering with forestry operations or cotton producers, companies can secure a more stable and potentially cost-effective source of cellulose.

Long-term contracts with suppliers can also contribute to cost reduction. These agreements often provide price stability and may include volume discounts, helping manufacturers to better forecast and manage their raw material expenses over time.

Exploring alternative sources of cellulose is another avenue for potential cost savings. For instance, agricultural waste products like rice straw or sugarcane bagasse could serve as more economical sources of cellulose. However, this approach requires careful evaluation of the technical feasibility and potential impacts on product quality.

Implementing just-in-time inventory management can help reduce storage costs and minimize waste associated with raw material degradation. This strategy requires close coordination with suppliers and efficient logistics to ensure timely delivery of materials as needed.

Lastly, investing in research and development to improve raw material processing efficiency can lead to significant cost savings. Developing new methods to extract cellulose more effectively or to utilize a wider range of cellulose sources could provide a competitive edge in the market.

By carefully considering and implementing these raw material sourcing strategies, cellophane manufacturers can work towards more cost-effective production techniques while maintaining product quality and meeting market demands.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!