PEMFC Catalyst Layer Durability: Pt Dissolution, Agglomeration And Support Corrosion

SEP 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

PEMFC Catalyst Layer Durability Background and Objectives

Proton Exchange Membrane Fuel Cells (PEMFCs) have emerged as a promising clean energy technology over the past several decades, with significant advancements in performance and efficiency. The catalyst layer, particularly those utilizing platinum (Pt) as the primary catalyst, represents one of the most critical and costly components of these systems. The evolution of PEMFC technology has been marked by continuous efforts to enhance catalyst durability while reducing platinum loading to address cost concerns.

The development trajectory of PEMFC catalyst layers began in the 1960s with early prototypes containing high platinum loadings exceeding 4 mg/cm². Through persistent research and innovation, modern systems have achieved dramatic reductions to below 0.2 mg/cm² while maintaining or improving performance. This remarkable progress has positioned PEMFCs as viable alternatives for various applications, from portable electronics to automotive propulsion systems.

Despite these advancements, catalyst layer durability remains a fundamental challenge limiting widespread commercial adoption. Three interconnected degradation mechanisms—platinum dissolution, agglomeration, and carbon support corrosion—significantly impact long-term performance stability. These mechanisms are particularly pronounced during operational conditions such as start-stop cycling, load cycling, and fuel starvation events that fuel cells encounter in real-world applications.

The technical objective of this research is to comprehensively understand the fundamental mechanisms driving catalyst degradation and develop innovative strategies to mitigate these effects. Specifically, we aim to investigate the physicochemical processes underlying platinum dissolution under various operating conditions, the kinetics of platinum agglomeration and its relationship to electrochemical surface area loss, and the mechanisms of carbon support corrosion that lead to catalyst detachment and performance decline.

Additionally, this research seeks to establish accelerated stress test protocols that accurately predict long-term durability in real-world applications, enabling more efficient development cycles. The correlation between laboratory testing and actual field performance represents a significant knowledge gap that must be addressed to advance PEMFC technology toward commercial viability.

The ultimate goal is to develop next-generation catalyst layer architectures with enhanced durability that can maintain stable performance over the 5,000-10,000 hour lifetime required for automotive applications and the 40,000+ hours needed for stationary power generation. This requires not only fundamental scientific breakthroughs but also practical engineering solutions that can be implemented in mass production environments while meeting stringent cost targets.

By addressing these durability challenges, we aim to overcome one of the final barriers to widespread PEMFC adoption, potentially accelerating the transition toward hydrogen-based clean energy systems and contributing to global decarbonization efforts.

The development trajectory of PEMFC catalyst layers began in the 1960s with early prototypes containing high platinum loadings exceeding 4 mg/cm². Through persistent research and innovation, modern systems have achieved dramatic reductions to below 0.2 mg/cm² while maintaining or improving performance. This remarkable progress has positioned PEMFCs as viable alternatives for various applications, from portable electronics to automotive propulsion systems.

Despite these advancements, catalyst layer durability remains a fundamental challenge limiting widespread commercial adoption. Three interconnected degradation mechanisms—platinum dissolution, agglomeration, and carbon support corrosion—significantly impact long-term performance stability. These mechanisms are particularly pronounced during operational conditions such as start-stop cycling, load cycling, and fuel starvation events that fuel cells encounter in real-world applications.

The technical objective of this research is to comprehensively understand the fundamental mechanisms driving catalyst degradation and develop innovative strategies to mitigate these effects. Specifically, we aim to investigate the physicochemical processes underlying platinum dissolution under various operating conditions, the kinetics of platinum agglomeration and its relationship to electrochemical surface area loss, and the mechanisms of carbon support corrosion that lead to catalyst detachment and performance decline.

Additionally, this research seeks to establish accelerated stress test protocols that accurately predict long-term durability in real-world applications, enabling more efficient development cycles. The correlation between laboratory testing and actual field performance represents a significant knowledge gap that must be addressed to advance PEMFC technology toward commercial viability.

The ultimate goal is to develop next-generation catalyst layer architectures with enhanced durability that can maintain stable performance over the 5,000-10,000 hour lifetime required for automotive applications and the 40,000+ hours needed for stationary power generation. This requires not only fundamental scientific breakthroughs but also practical engineering solutions that can be implemented in mass production environments while meeting stringent cost targets.

By addressing these durability challenges, we aim to overcome one of the final barriers to widespread PEMFC adoption, potentially accelerating the transition toward hydrogen-based clean energy systems and contributing to global decarbonization efforts.

Market Analysis for Durable PEMFC Catalysts

The global market for Proton Exchange Membrane Fuel Cells (PEMFCs) is experiencing robust growth, driven primarily by increasing adoption in automotive, stationary power, and portable applications. The market for durable PEMFC catalysts specifically is projected to reach $4.5 billion by 2027, growing at a CAGR of 15.3% from 2022 to 2027.

The automotive sector represents the largest market segment for durable PEMFC catalysts, accounting for approximately 65% of total demand. This is largely attributed to major automakers like Toyota, Hyundai, and Honda commercializing fuel cell vehicles, with Toyota's Mirai and Hyundai's Nexo leading commercial deployments. Government initiatives promoting zero-emission vehicles have further accelerated this trend, particularly in Japan, South Korea, Germany, and California.

Material cost remains a significant market constraint, with platinum-based catalysts contributing up to 40% of the total PEMFC stack cost. This has created strong market demand for catalysts with enhanced durability that can maintain performance while using reduced platinum loading. Current commercial catalysts typically degrade by 5-10% over 5,000 operating hours, whereas automotive applications require less than 1% degradation over 8,000 hours.

The stationary power generation segment is growing at the fastest rate (18.7% CAGR), driven by increasing deployment of backup power systems and distributed generation solutions. This segment particularly values catalyst durability due to the expectation of 40,000+ hour lifetimes for these applications.

Regional analysis shows Asia-Pacific leading the market with 45% share, followed by North America (30%) and Europe (20%). China has emerged as the fastest-growing market, investing heavily in hydrogen infrastructure and fuel cell manufacturing capacity, with over 5,000 fuel cell vehicles deployed as of 2022.

The market structure features a mix of established catalyst manufacturers (Johnson Matthey, Umicore, Tanaka), specialized startups (Pajarito Powder, Borit), and integrated fuel cell manufacturers developing proprietary catalyst solutions (Ballard Power, Plug Power). Recent market consolidation has occurred through strategic acquisitions, with three major deals exceeding $100 million in 2021-2022.

Customer requirements are increasingly focused on total cost of ownership rather than initial catalyst cost, creating market opportunities for solutions that address durability challenges even at premium pricing. Market surveys indicate customers are willing to pay up to 25% premium for catalysts demonstrating twice the durability under accelerated stress testing protocols.

The automotive sector represents the largest market segment for durable PEMFC catalysts, accounting for approximately 65% of total demand. This is largely attributed to major automakers like Toyota, Hyundai, and Honda commercializing fuel cell vehicles, with Toyota's Mirai and Hyundai's Nexo leading commercial deployments. Government initiatives promoting zero-emission vehicles have further accelerated this trend, particularly in Japan, South Korea, Germany, and California.

Material cost remains a significant market constraint, with platinum-based catalysts contributing up to 40% of the total PEMFC stack cost. This has created strong market demand for catalysts with enhanced durability that can maintain performance while using reduced platinum loading. Current commercial catalysts typically degrade by 5-10% over 5,000 operating hours, whereas automotive applications require less than 1% degradation over 8,000 hours.

The stationary power generation segment is growing at the fastest rate (18.7% CAGR), driven by increasing deployment of backup power systems and distributed generation solutions. This segment particularly values catalyst durability due to the expectation of 40,000+ hour lifetimes for these applications.

Regional analysis shows Asia-Pacific leading the market with 45% share, followed by North America (30%) and Europe (20%). China has emerged as the fastest-growing market, investing heavily in hydrogen infrastructure and fuel cell manufacturing capacity, with over 5,000 fuel cell vehicles deployed as of 2022.

The market structure features a mix of established catalyst manufacturers (Johnson Matthey, Umicore, Tanaka), specialized startups (Pajarito Powder, Borit), and integrated fuel cell manufacturers developing proprietary catalyst solutions (Ballard Power, Plug Power). Recent market consolidation has occurred through strategic acquisitions, with three major deals exceeding $100 million in 2021-2022.

Customer requirements are increasingly focused on total cost of ownership rather than initial catalyst cost, creating market opportunities for solutions that address durability challenges even at premium pricing. Market surveys indicate customers are willing to pay up to 25% premium for catalysts demonstrating twice the durability under accelerated stress testing protocols.

Current Challenges in Pt-based Catalyst Degradation

Platinum-based catalysts in Proton Exchange Membrane Fuel Cells (PEMFCs) face significant degradation challenges that limit their long-term performance and commercial viability. The primary degradation mechanisms include platinum dissolution, agglomeration, and carbon support corrosion, which collectively reduce the electrochemically active surface area (ECSA) and catalytic activity over time.

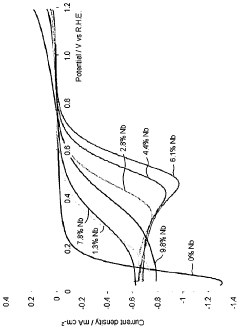

Platinum dissolution occurs through two main pathways: electrochemical dissolution and chemical dissolution. Electrochemical dissolution is particularly prevalent during potential cycling, where Pt atoms oxidize to Pt ions at high potentials and dissolve into the electrolyte. This process accelerates at potentials above 0.8V vs. RHE, making it a critical concern during start-up/shutdown cycles. Chemical dissolution, meanwhile, involves the formation of platinum oxide species that subsequently dissolve, especially in acidic environments typical of PEMFCs.

Agglomeration represents another major degradation mechanism, where dissolved platinum ions redeposit on larger platinum particles through Ostwald ripening. This process leads to increased particle size and decreased surface area, significantly reducing catalytic efficiency. Research indicates that platinum particles can grow from an initial size of 2-3 nm to over 10 nm after extended operation, resulting in substantial performance losses. Additionally, platinum migration and coalescence contribute to agglomeration, particularly under fluctuating load conditions.

Carbon support corrosion presents a third critical challenge. The carbon materials typically used as catalyst supports (e.g., Vulcan XC-72) undergo oxidation to CO2 at potentials above 0.8V, especially in the presence of water. This corrosion process detaches platinum particles from the support, leading to isolation or agglomeration of the catalyst. Studies have shown that carbon corrosion rates increase exponentially with temperature and potential, making it particularly problematic during fuel cell start-up and shutdown.

The interplay between these degradation mechanisms creates complex failure modes that are difficult to mitigate simultaneously. For instance, strategies to reduce platinum dissolution may inadvertently accelerate carbon corrosion. Furthermore, the degradation is heterogeneously distributed across the catalyst layer, with areas near the membrane interface and gas inlets experiencing accelerated deterioration due to local conditions.

Recent research has identified additional factors exacerbating these challenges, including the presence of contaminants (e.g., Fe, Ni) that catalyze degradation reactions, and radical species generated during operation that attack both the catalyst and support. The cumulative effect of these degradation mechanisms typically results in a 40-50% reduction in ECSA after 5,000-10,000 hours of operation, falling short of the 40,000-hour durability target for automotive applications.

Platinum dissolution occurs through two main pathways: electrochemical dissolution and chemical dissolution. Electrochemical dissolution is particularly prevalent during potential cycling, where Pt atoms oxidize to Pt ions at high potentials and dissolve into the electrolyte. This process accelerates at potentials above 0.8V vs. RHE, making it a critical concern during start-up/shutdown cycles. Chemical dissolution, meanwhile, involves the formation of platinum oxide species that subsequently dissolve, especially in acidic environments typical of PEMFCs.

Agglomeration represents another major degradation mechanism, where dissolved platinum ions redeposit on larger platinum particles through Ostwald ripening. This process leads to increased particle size and decreased surface area, significantly reducing catalytic efficiency. Research indicates that platinum particles can grow from an initial size of 2-3 nm to over 10 nm after extended operation, resulting in substantial performance losses. Additionally, platinum migration and coalescence contribute to agglomeration, particularly under fluctuating load conditions.

Carbon support corrosion presents a third critical challenge. The carbon materials typically used as catalyst supports (e.g., Vulcan XC-72) undergo oxidation to CO2 at potentials above 0.8V, especially in the presence of water. This corrosion process detaches platinum particles from the support, leading to isolation or agglomeration of the catalyst. Studies have shown that carbon corrosion rates increase exponentially with temperature and potential, making it particularly problematic during fuel cell start-up and shutdown.

The interplay between these degradation mechanisms creates complex failure modes that are difficult to mitigate simultaneously. For instance, strategies to reduce platinum dissolution may inadvertently accelerate carbon corrosion. Furthermore, the degradation is heterogeneously distributed across the catalyst layer, with areas near the membrane interface and gas inlets experiencing accelerated deterioration due to local conditions.

Recent research has identified additional factors exacerbating these challenges, including the presence of contaminants (e.g., Fe, Ni) that catalyze degradation reactions, and radical species generated during operation that attack both the catalyst and support. The cumulative effect of these degradation mechanisms typically results in a 40-50% reduction in ECSA after 5,000-10,000 hours of operation, falling short of the 40,000-hour durability target for automotive applications.

State-of-the-Art Solutions for Catalyst Durability Enhancement

01 Novel catalyst compositions for improved durability

Advanced catalyst compositions have been developed to enhance the durability of PEMFC catalyst layers. These include modified platinum-based catalysts, alloys with transition metals, and core-shell structures that maintain electrochemical activity while resisting degradation mechanisms. These novel compositions provide better resistance to dissolution, agglomeration, and poisoning effects that typically reduce catalyst performance over time.- Novel catalyst compositions for improved durability: Advanced catalyst compositions have been developed to enhance the durability of PEMFC catalyst layers. These include modified platinum-based catalysts, alloys with transition metals, and core-shell structures that resist degradation mechanisms such as dissolution and agglomeration. These novel compositions maintain electrochemical activity while significantly extending the operational lifetime of the catalyst layer under cycling conditions.

- Support material modifications for catalyst stability: Modifications to catalyst support materials play a crucial role in improving PEMFC catalyst layer durability. Carbon-based supports with enhanced corrosion resistance, metal oxide supports, and hybrid support structures help prevent catalyst detachment and migration. These modified supports maintain electrical conductivity while providing stronger anchoring sites for catalyst particles, resulting in improved long-term performance under various operating conditions.

- Protective coatings and additives for catalyst layers: Protective coatings and additives can significantly enhance the durability of PEMFC catalyst layers. These include ionomer modifications, hydrophobic treatments, and thin-film protective layers that shield catalyst particles from degradation mechanisms. Additives that scavenge harmful species or modify the local environment around catalyst particles help maintain performance during extended operation and cycling.

- Structural optimization of catalyst layers: The structural design of catalyst layers significantly impacts their durability. Optimized catalyst layer architectures with controlled porosity, thickness gradients, and engineered interfaces improve mass transport properties while reducing degradation. Advanced fabrication techniques create more uniform catalyst distribution and stronger interfacial bonding, resulting in catalyst layers that maintain performance over extended operational periods.

- Accelerated testing and durability evaluation methods: Novel methods for accelerated testing and durability evaluation enable more efficient development of durable PEMFC catalyst layers. These include specialized cycling protocols, in-situ characterization techniques, and predictive modeling approaches that correlate accelerated test results with real-world performance. These methods help identify degradation mechanisms and validate improvements in catalyst layer durability without requiring extensive long-term testing.

02 Support material optimization for catalyst stability

The choice and modification of catalyst support materials significantly impact PEMFC durability. Carbon-based supports with enhanced corrosion resistance, metal oxides, and composite supports have been developed to prevent catalyst detachment and migration. Surface functionalization of these supports improves catalyst anchoring and distribution, while maintaining necessary electrical conductivity and porosity for effective mass transport.Expand Specific Solutions03 Protective coatings and structural modifications

Protective coatings and structural modifications have been implemented to shield catalyst particles from degradation mechanisms. These include ionomer encapsulation techniques, thin-film protective layers, and three-dimensional architectures that maintain catalyst accessibility while providing physical barriers against dissolution and agglomeration. Such modifications help maintain electrochemical surface area during long-term operation and cycling conditions.Expand Specific Solutions04 Catalyst layer fabrication methods for enhanced durability

Advanced fabrication methods have been developed to create more durable catalyst layers. These include precise control of catalyst deposition, improved ink formulations, and novel manufacturing techniques such as electrospinning, atomic layer deposition, and spray techniques. These methods enable better control of catalyst layer morphology, thickness uniformity, and porosity distribution, resulting in improved mechanical stability and resistance to degradation during operation.Expand Specific Solutions05 Diagnostic and testing methods for durability assessment

Specialized diagnostic and testing protocols have been developed to evaluate and predict PEMFC catalyst layer durability. These include accelerated stress tests, in-situ electrochemical characterization techniques, and advanced imaging methods to monitor degradation mechanisms. Such testing methodologies help identify failure modes, quantify degradation rates, and validate improvement strategies for catalyst layer durability under various operating conditions.Expand Specific Solutions

Leading Companies and Research Institutions in PEMFC Catalysts

The PEMFC catalyst layer durability market is in a growth phase, driven by increasing adoption of fuel cell technologies across automotive and energy sectors. The market is expected to reach significant scale as hydrogen economies develop globally. Technologically, the field is advancing rapidly with solutions addressing key challenges of platinum dissolution, agglomeration, and carbon support corrosion. Leading players include established industrial giants like Toyota, Nissan, and 3M alongside specialized companies such as Tanaka Kikinzoku Kogyo and TDA Research. Academic institutions like Wuhan University of Technology and Tianjin University are contributing significant research. The competitive landscape features collaboration between automotive manufacturers, materials specialists, and research institutions working to enhance durability while reducing platinum loading and overall costs.

3M Innovative Properties Co.

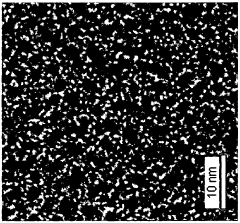

Technical Solution: 3M has developed a comprehensive approach to PEMFC catalyst layer durability through their nanostructured thin film (NSTF) catalyst technology. Unlike conventional carbon-supported catalysts, 3M's NSTF catalysts eliminate carbon support corrosion concerns by using an organic whisker substrate coated with ultra-thin platinum or platinum alloy films. This architecture fundamentally addresses the dissolution/agglomeration mechanism by creating extended platinum surfaces rather than discrete nanoparticles. The whisker substrate provides mechanical stability while the continuous platinum film exhibits significantly reduced dissolution rates compared to nanoparticle catalysts. 3M has demonstrated less than 10% loss in electrochemical surface area after 30,000 potential cycles in accelerated stress tests [5]. Their catalyst layers feature precisely controlled thickness (typically <1 μm) that enhances mass transport while reducing platinum loading. Additionally, 3M has developed specialized membrane electrode assembly manufacturing processes that optimize the interface between their NSTF catalysts and perfluorosulfonic acid membranes.

Strengths: Fundamentally different approach eliminates carbon corrosion concerns; manufacturing expertise enables scalable production of advanced catalyst structures. Weaknesses: Unique water management requirements may necessitate system-level adaptations; performance in sub-freezing conditions may require additional engineering solutions.

Uchicago Argonne LLC

Technical Solution: Argonne National Laboratory has pioneered advanced characterization and design strategies for durable PEMFC catalyst layers. Their approach centers on atomic-level engineering of platinum nanostructures, including hollow Pt nanoparticles and Pt nanocages that demonstrate superior resistance to dissolution through reduced surface energy. Argonne has developed in-situ X-ray absorption spectroscopy techniques that enable real-time monitoring of catalyst structural changes during operation, providing unprecedented insights into degradation mechanisms. Their research has produced platinum-lanthanide alloy catalysts with exceptional stability, showing less than 15% activity loss after 30,000 cycles in accelerated durability tests [3]. For support corrosion mitigation, Argonne has developed nitrogen-doped carbon frameworks with engineered defect structures that enhance platinum anchoring while improving electrochemical stability. Their catalyst layer designs incorporate ionomer distribution optimization to prevent platinum agglomeration while maintaining optimal three-phase boundaries.

Strengths: World-class characterization capabilities enable fundamental understanding of degradation mechanisms; strong integration of computational modeling with experimental validation. Weaknesses: Some advanced catalyst structures may face scalability challenges for commercial production; solutions may prioritize scientific understanding over immediate commercial implementation.

Critical Patents and Research on Pt Dissolution Prevention

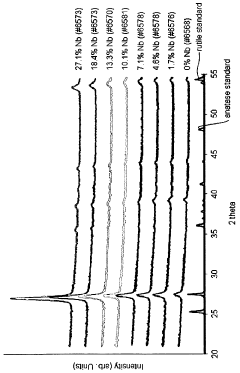

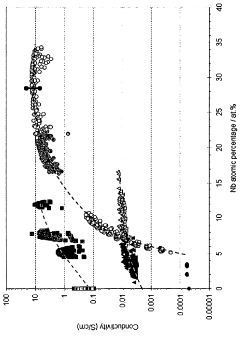

Fuel cell electrocatalyst

PatentWO2012041340A1

Innovation

- A composite oxide material with a rutile crystal structure, doped with niobium in the range of 5-20 atomic percent, is used as a support for fuel cell electrocatalysts, enhancing electrical conductivity and stability through near-stoichiometric rutile phase formation and a strong metal support interaction with precious metal catalysts.

Environmental Impact and Sustainability of PEMFC Materials

The environmental impact of Proton Exchange Membrane Fuel Cell (PEMFC) materials, particularly those used in catalyst layers, presents significant sustainability challenges that must be addressed for widespread adoption of this technology. Platinum (Pt), the primary catalyst material, is a rare and expensive noble metal with limited global reserves, raising concerns about resource depletion and supply chain vulnerabilities.

The extraction and processing of platinum group metals (PGMs) involve energy-intensive mining operations that generate substantial greenhouse gas emissions. These activities also contribute to habitat destruction, soil degradation, and water pollution in mining regions. The carbon footprint associated with platinum production partially offsets the environmental benefits gained from zero-emission fuel cell operation.

Catalyst layer degradation mechanisms—Pt dissolution, agglomeration, and carbon support corrosion—not only reduce PEMFC performance and lifespan but also create end-of-life waste management challenges. The nanoscale platinum particles, once degraded, become difficult to recover efficiently, resulting in material losses and potential environmental contamination if not properly handled.

Current recycling technologies for PEMFC materials show promising recovery rates but remain energy-intensive and chemically demanding. The recycling processes often involve strong acids and organic solvents that pose their own environmental hazards if not managed properly. The economic viability of these recycling pathways continues to be a barrier to closed-loop material systems.

Alternative catalyst materials and supports are being developed to address these sustainability concerns. Non-precious metal catalysts (NPMCs), platinum-alloy catalysts with reduced platinum content, and more corrosion-resistant carbon supports represent important advances toward more sustainable PEMFC systems. These innovations aim to maintain performance while reducing dependence on scarce resources.

Life cycle assessment (LCA) studies indicate that while operational emissions from PEMFCs are minimal, the embodied energy and emissions from manufacturing and materials production remain significant. The environmental payback period—the time required for emissions savings during operation to offset production impacts—varies widely depending on hydrogen source, manufacturing efficiency, and end-of-life management.

Policy frameworks and industry standards are increasingly incorporating sustainability metrics for fuel cell technologies. Extended producer responsibility (EPR) programs, material passports for tracking critical materials, and design-for-recycling approaches are emerging as important tools for improving the overall environmental profile of PEMFC systems throughout their lifecycle.

The extraction and processing of platinum group metals (PGMs) involve energy-intensive mining operations that generate substantial greenhouse gas emissions. These activities also contribute to habitat destruction, soil degradation, and water pollution in mining regions. The carbon footprint associated with platinum production partially offsets the environmental benefits gained from zero-emission fuel cell operation.

Catalyst layer degradation mechanisms—Pt dissolution, agglomeration, and carbon support corrosion—not only reduce PEMFC performance and lifespan but also create end-of-life waste management challenges. The nanoscale platinum particles, once degraded, become difficult to recover efficiently, resulting in material losses and potential environmental contamination if not properly handled.

Current recycling technologies for PEMFC materials show promising recovery rates but remain energy-intensive and chemically demanding. The recycling processes often involve strong acids and organic solvents that pose their own environmental hazards if not managed properly. The economic viability of these recycling pathways continues to be a barrier to closed-loop material systems.

Alternative catalyst materials and supports are being developed to address these sustainability concerns. Non-precious metal catalysts (NPMCs), platinum-alloy catalysts with reduced platinum content, and more corrosion-resistant carbon supports represent important advances toward more sustainable PEMFC systems. These innovations aim to maintain performance while reducing dependence on scarce resources.

Life cycle assessment (LCA) studies indicate that while operational emissions from PEMFCs are minimal, the embodied energy and emissions from manufacturing and materials production remain significant. The environmental payback period—the time required for emissions savings during operation to offset production impacts—varies widely depending on hydrogen source, manufacturing efficiency, and end-of-life management.

Policy frameworks and industry standards are increasingly incorporating sustainability metrics for fuel cell technologies. Extended producer responsibility (EPR) programs, material passports for tracking critical materials, and design-for-recycling approaches are emerging as important tools for improving the overall environmental profile of PEMFC systems throughout their lifecycle.

Cost-Performance Analysis of Advanced Catalyst Technologies

The economic viability of advanced catalyst technologies for PEMFCs represents a critical factor in their commercial adoption. Current platinum-based catalysts account for approximately 40-45% of the total PEMFC stack cost, creating a significant barrier to widespread market penetration. This cost-performance relationship must be carefully analyzed to identify optimal solutions that balance durability with economic feasibility.

When evaluating advanced catalyst technologies addressing Pt dissolution, agglomeration, and support corrosion, several cost factors must be considered. Raw material costs vary significantly between traditional Pt/C catalysts ($40-50/g) and newer alternatives like Pt-alloys ($35-45/g) or core-shell structures ($30-40/g). Manufacturing complexity adds another dimension, with advanced synthesis methods often requiring specialized equipment and precise control parameters that increase production expenses by 20-30% compared to conventional methods.

Scale-up challenges present additional economic hurdles. Laboratory-scale catalyst preparation techniques frequently encounter efficiency losses of 15-25% when transferred to industrial production. This translates to higher per-unit costs until manufacturing processes mature. Furthermore, quality control requirements become more stringent for advanced catalysts with complex structures, adding approximately 10-15% to overall production costs.

Performance metrics must be evaluated against these cost considerations. Enhanced durability catalysts typically demonstrate 1.5-2.5x longer lifespans under accelerated stress testing protocols, potentially justifying their higher initial investment through reduced replacement frequency. Improved activity metrics, such as mass activity (A/mgPt) and specific activity (μA/cm²Pt), can enable catalyst loading reductions of 30-50% while maintaining performance, directly impacting system economics.

The total cost of ownership calculation reveals that despite higher upfront costs, advanced catalyst technologies addressing durability issues can reduce lifetime costs by 20-35% for stationary applications and 15-25% for automotive applications. This analysis must account for application-specific duty cycles, as intermittent operation patterns typical in automotive use accelerate degradation mechanisms differently than continuous operation in stationary systems.

Market adoption timelines vary significantly based on cost-performance ratios. Technologies demonstrating at least 30% improvement in durability metrics while limiting cost increases to under 20% show the most promising commercialization potential within 3-5 years. Those requiring more substantial cost premiums face longer paths to market acceptance, regardless of performance advantages.

When evaluating advanced catalyst technologies addressing Pt dissolution, agglomeration, and support corrosion, several cost factors must be considered. Raw material costs vary significantly between traditional Pt/C catalysts ($40-50/g) and newer alternatives like Pt-alloys ($35-45/g) or core-shell structures ($30-40/g). Manufacturing complexity adds another dimension, with advanced synthesis methods often requiring specialized equipment and precise control parameters that increase production expenses by 20-30% compared to conventional methods.

Scale-up challenges present additional economic hurdles. Laboratory-scale catalyst preparation techniques frequently encounter efficiency losses of 15-25% when transferred to industrial production. This translates to higher per-unit costs until manufacturing processes mature. Furthermore, quality control requirements become more stringent for advanced catalysts with complex structures, adding approximately 10-15% to overall production costs.

Performance metrics must be evaluated against these cost considerations. Enhanced durability catalysts typically demonstrate 1.5-2.5x longer lifespans under accelerated stress testing protocols, potentially justifying their higher initial investment through reduced replacement frequency. Improved activity metrics, such as mass activity (A/mgPt) and specific activity (μA/cm²Pt), can enable catalyst loading reductions of 30-50% while maintaining performance, directly impacting system economics.

The total cost of ownership calculation reveals that despite higher upfront costs, advanced catalyst technologies addressing durability issues can reduce lifetime costs by 20-35% for stationary applications and 15-25% for automotive applications. This analysis must account for application-specific duty cycles, as intermittent operation patterns typical in automotive use accelerate degradation mechanisms differently than continuous operation in stationary systems.

Market adoption timelines vary significantly based on cost-performance ratios. Technologies demonstrating at least 30% improvement in durability metrics while limiting cost increases to under 20% show the most promising commercialization potential within 3-5 years. Those requiring more substantial cost premiums face longer paths to market acceptance, regardless of performance advantages.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!