Techno-Economic Assessment Of LOHC Supply Chains

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

LOHC Technology Background and Objectives

Liquid Organic Hydrogen Carriers (LOHC) technology has emerged as a promising solution for hydrogen storage and transportation, addressing key challenges in the hydrogen economy. The concept of LOHC dates back to the early 2000s, but significant advancements have been made in the past decade, particularly in catalyst development and system integration. This technology utilizes reversible hydrogenation-dehydrogenation reactions of organic compounds to store and release hydrogen under controlled conditions.

The evolution of LOHC technology has been driven by the growing recognition of hydrogen as a clean energy vector and the need for efficient storage solutions beyond compressed gas or cryogenic liquid hydrogen. Early research focused primarily on identifying suitable carrier molecules with high hydrogen storage capacity, favorable thermodynamics, and minimal side reactions. More recent developments have concentrated on optimizing reaction conditions, improving catalyst performance, and enhancing system efficiency.

Current technological trends in LOHC systems include the development of novel carrier molecules with improved properties, advanced catalyst designs for faster kinetics at lower temperatures, and integrated systems that optimize heat management during hydrogenation and dehydrogenation processes. Additionally, there is increasing focus on scaling up LOHC technologies from laboratory demonstrations to industrial applications.

The primary objective of techno-economic assessment of LOHC supply chains is to evaluate the technical feasibility and economic viability of implementing LOHC-based hydrogen logistics at commercial scale. This includes analyzing the entire value chain from hydrogen production, hydrogenation of carrier molecules, transportation and storage of loaded carriers, to dehydrogenation at the point of use and recycling of unloaded carriers.

Specific technical goals include identifying optimal LOHC molecules for different applications, developing efficient catalysts for both hydrogenation and dehydrogenation reactions, designing energy-efficient processes with effective heat integration, and creating robust systems for handling and transporting LOHC materials. Economic objectives focus on reducing capital and operational costs, optimizing supply chain configurations, and achieving cost competitiveness with alternative hydrogen storage and transportation methods.

The assessment aims to provide a comprehensive understanding of how LOHC technology can bridge the gap between hydrogen production sites and end-users, potentially enabling a decentralized hydrogen infrastructure. It also seeks to identify key technological bottlenecks, economic barriers, and potential pathways for commercial deployment across various sectors including industrial applications, transportation, and energy storage.

The evolution of LOHC technology has been driven by the growing recognition of hydrogen as a clean energy vector and the need for efficient storage solutions beyond compressed gas or cryogenic liquid hydrogen. Early research focused primarily on identifying suitable carrier molecules with high hydrogen storage capacity, favorable thermodynamics, and minimal side reactions. More recent developments have concentrated on optimizing reaction conditions, improving catalyst performance, and enhancing system efficiency.

Current technological trends in LOHC systems include the development of novel carrier molecules with improved properties, advanced catalyst designs for faster kinetics at lower temperatures, and integrated systems that optimize heat management during hydrogenation and dehydrogenation processes. Additionally, there is increasing focus on scaling up LOHC technologies from laboratory demonstrations to industrial applications.

The primary objective of techno-economic assessment of LOHC supply chains is to evaluate the technical feasibility and economic viability of implementing LOHC-based hydrogen logistics at commercial scale. This includes analyzing the entire value chain from hydrogen production, hydrogenation of carrier molecules, transportation and storage of loaded carriers, to dehydrogenation at the point of use and recycling of unloaded carriers.

Specific technical goals include identifying optimal LOHC molecules for different applications, developing efficient catalysts for both hydrogenation and dehydrogenation reactions, designing energy-efficient processes with effective heat integration, and creating robust systems for handling and transporting LOHC materials. Economic objectives focus on reducing capital and operational costs, optimizing supply chain configurations, and achieving cost competitiveness with alternative hydrogen storage and transportation methods.

The assessment aims to provide a comprehensive understanding of how LOHC technology can bridge the gap between hydrogen production sites and end-users, potentially enabling a decentralized hydrogen infrastructure. It also seeks to identify key technological bottlenecks, economic barriers, and potential pathways for commercial deployment across various sectors including industrial applications, transportation, and energy storage.

LOHC Market Demand Analysis

The global market for Liquid Organic Hydrogen Carriers (LOHC) is experiencing significant growth driven by the increasing focus on hydrogen as a clean energy vector. Current market assessments indicate that the LOHC technology market could reach several billion dollars by 2030, with a compound annual growth rate exceeding 25% between 2023 and 2030. This growth trajectory is primarily fueled by the urgent need for efficient hydrogen storage and transportation solutions to support the emerging hydrogen economy.

The demand for LOHC technology is particularly strong in regions with ambitious hydrogen strategies, including Europe, Japan, South Korea, and increasingly China. These markets are characterized by substantial investments in hydrogen infrastructure and a strategic push toward decarbonization across various sectors. The European Union's Hydrogen Strategy, which aims to install at least 40 GW of renewable hydrogen electrolyzers by 2030, represents a significant market opportunity for LOHC supply chains.

Industrial applications currently dominate the LOHC market demand landscape, with refineries, ammonia production, and steel manufacturing showing particular interest in this technology. These sectors require large volumes of hydrogen and are under increasing pressure to reduce their carbon footprint. The ability of LOHC systems to leverage existing liquid fuel infrastructure makes them especially attractive for industrial hydrogen consumers seeking cost-effective decarbonization pathways.

Transportation represents another emerging market segment for LOHC technology. Heavy-duty vehicles, maritime shipping, and potentially aviation are exploring hydrogen as an alternative fuel, creating demand for efficient hydrogen carrier systems. The maritime sector, in particular, has shown interest in LOHC technology due to its compatibility with existing bunkering infrastructure and higher volumetric energy density compared to compressed or liquefied hydrogen.

Market analysis reveals that end-users prioritize several key factors when considering LOHC solutions: total system cost (including carrier material, hydrogenation/dehydrogenation equipment, and operational expenses), energy efficiency of the hydrogen release process, safety characteristics, and integration capabilities with existing infrastructure. The current market shows a willingness to pay premium prices for LOHC solutions that offer significant advantages in these areas.

Regional market differences are notable, with Japan and Germany leading in LOHC technology development and deployment. Japan's strategic focus on hydrogen imports has created particular interest in LOHC as a means of establishing international hydrogen supply chains. Meanwhile, emerging markets in the Middle East and Australia are positioning themselves as potential hydrogen exporters, creating additional demand for efficient hydrogen carrier technologies like LOHC.

The demand for LOHC technology is particularly strong in regions with ambitious hydrogen strategies, including Europe, Japan, South Korea, and increasingly China. These markets are characterized by substantial investments in hydrogen infrastructure and a strategic push toward decarbonization across various sectors. The European Union's Hydrogen Strategy, which aims to install at least 40 GW of renewable hydrogen electrolyzers by 2030, represents a significant market opportunity for LOHC supply chains.

Industrial applications currently dominate the LOHC market demand landscape, with refineries, ammonia production, and steel manufacturing showing particular interest in this technology. These sectors require large volumes of hydrogen and are under increasing pressure to reduce their carbon footprint. The ability of LOHC systems to leverage existing liquid fuel infrastructure makes them especially attractive for industrial hydrogen consumers seeking cost-effective decarbonization pathways.

Transportation represents another emerging market segment for LOHC technology. Heavy-duty vehicles, maritime shipping, and potentially aviation are exploring hydrogen as an alternative fuel, creating demand for efficient hydrogen carrier systems. The maritime sector, in particular, has shown interest in LOHC technology due to its compatibility with existing bunkering infrastructure and higher volumetric energy density compared to compressed or liquefied hydrogen.

Market analysis reveals that end-users prioritize several key factors when considering LOHC solutions: total system cost (including carrier material, hydrogenation/dehydrogenation equipment, and operational expenses), energy efficiency of the hydrogen release process, safety characteristics, and integration capabilities with existing infrastructure. The current market shows a willingness to pay premium prices for LOHC solutions that offer significant advantages in these areas.

Regional market differences are notable, with Japan and Germany leading in LOHC technology development and deployment. Japan's strategic focus on hydrogen imports has created particular interest in LOHC as a means of establishing international hydrogen supply chains. Meanwhile, emerging markets in the Middle East and Australia are positioning themselves as potential hydrogen exporters, creating additional demand for efficient hydrogen carrier technologies like LOHC.

Global LOHC Development Status and Challenges

Liquid Organic Hydrogen Carriers (LOHC) technology has gained significant momentum globally as a promising solution for hydrogen storage and transportation. Currently, the global LOHC development landscape shows varying degrees of maturity across different regions, with Germany, Japan, and Australia leading research efforts. These countries have established dedicated research centers and pilot projects demonstrating the technical feasibility of LOHC systems at scale.

Despite the progress, several technical challenges persist in LOHC implementation. The energy efficiency of the hydrogenation and dehydrogenation processes remains a critical concern, with current systems requiring substantial energy input that reduces overall efficiency. Most commercial LOHC systems operate at 30-40% round-trip efficiency, significantly lower than competing technologies like compressed hydrogen storage.

Material stability presents another major challenge, as carrier molecules must withstand hundreds of hydrogenation-dehydrogenation cycles without degradation. Current carrier materials show degradation rates of 0.1-0.5% per cycle, necessitating periodic replacement and increasing operational costs. Additionally, catalyst performance and longevity require improvement, as noble metal catalysts used in dehydrogenation processes face deactivation issues under industrial conditions.

The geographical distribution of LOHC technology development shows concentration in countries with strong hydrogen strategies. Japan's AHEAD consortium has demonstrated maritime LOHC transport between Brunei and Japan. Germany's Hydrogenious Technologies has established commercial-scale LOHC systems in Europe. Australia is leveraging its renewable energy potential to develop export-oriented LOHC supply chains targeting Asian markets.

Infrastructure compatibility represents a significant barrier to widespread adoption. Existing petroleum infrastructure requires modifications to handle LOHC materials safely, with estimated retrofit costs ranging from $500,000 to $2 million per terminal. Regulatory frameworks across different jurisdictions also lack harmonization, creating uncertainty for cross-border LOHC supply chains.

Economic viability remains the overarching challenge, with current LOHC supply chains demonstrating levelized costs of $5-7 per kg of hydrogen delivered, approximately 2-3 times higher than fossil-based hydrogen. Capital expenditure for LOHC plants ranges from $1,500-2,500 per kg/day of hydrogen processing capacity, necessitating significant investment for commercial-scale implementation.

Recent technological breakthroughs, including novel carrier materials like N-ethylcarbazole and dibenzyltoluene, show promise for improving system performance. Research initiatives focusing on non-noble metal catalysts and process intensification techniques are gradually addressing efficiency challenges, potentially reducing costs by 30-40% within the next decade.

Despite the progress, several technical challenges persist in LOHC implementation. The energy efficiency of the hydrogenation and dehydrogenation processes remains a critical concern, with current systems requiring substantial energy input that reduces overall efficiency. Most commercial LOHC systems operate at 30-40% round-trip efficiency, significantly lower than competing technologies like compressed hydrogen storage.

Material stability presents another major challenge, as carrier molecules must withstand hundreds of hydrogenation-dehydrogenation cycles without degradation. Current carrier materials show degradation rates of 0.1-0.5% per cycle, necessitating periodic replacement and increasing operational costs. Additionally, catalyst performance and longevity require improvement, as noble metal catalysts used in dehydrogenation processes face deactivation issues under industrial conditions.

The geographical distribution of LOHC technology development shows concentration in countries with strong hydrogen strategies. Japan's AHEAD consortium has demonstrated maritime LOHC transport between Brunei and Japan. Germany's Hydrogenious Technologies has established commercial-scale LOHC systems in Europe. Australia is leveraging its renewable energy potential to develop export-oriented LOHC supply chains targeting Asian markets.

Infrastructure compatibility represents a significant barrier to widespread adoption. Existing petroleum infrastructure requires modifications to handle LOHC materials safely, with estimated retrofit costs ranging from $500,000 to $2 million per terminal. Regulatory frameworks across different jurisdictions also lack harmonization, creating uncertainty for cross-border LOHC supply chains.

Economic viability remains the overarching challenge, with current LOHC supply chains demonstrating levelized costs of $5-7 per kg of hydrogen delivered, approximately 2-3 times higher than fossil-based hydrogen. Capital expenditure for LOHC plants ranges from $1,500-2,500 per kg/day of hydrogen processing capacity, necessitating significant investment for commercial-scale implementation.

Recent technological breakthroughs, including novel carrier materials like N-ethylcarbazole and dibenzyltoluene, show promise for improving system performance. Research initiatives focusing on non-noble metal catalysts and process intensification techniques are gradually addressing efficiency challenges, potentially reducing costs by 30-40% within the next decade.

Current LOHC Supply Chain Solutions

01 Economic viability of LOHC systems

The techno-economic assessment of Liquid Organic Hydrogen Carrier (LOHC) systems evaluates their economic viability compared to conventional hydrogen storage methods. These assessments consider capital expenditure, operational costs, energy efficiency, and return on investment across the entire hydrogen value chain. Economic models demonstrate how LOHC systems can become cost-competitive at scale, particularly when considering long-distance hydrogen transport and storage requirements.- Economic viability of LOHC systems: Techno-economic assessments of LOHC systems focus on evaluating the economic viability of hydrogen storage and transportation using liquid organic carriers. These assessments consider factors such as capital expenditure, operational costs, energy efficiency, and market competitiveness compared to alternative hydrogen storage methods. The analyses typically include cost modeling for the complete LOHC value chain, from hydrogenation facilities to dehydrogenation plants, and identify key economic drivers and barriers to commercial implementation.

- LOHC carrier selection and performance evaluation: The selection of appropriate LOHC compounds significantly impacts the overall system efficiency and economics. Techno-economic assessments evaluate different carrier molecules based on their hydrogen storage capacity, hydrogenation/dehydrogenation kinetics, thermal stability, and lifecycle costs. Comparative analyses of carriers such as dibenzyl toluene, methylcyclohexane, and other cyclic hydrocarbons help identify optimal carriers for specific applications, considering both technical performance and economic factors.

- Energy integration and efficiency optimization: Energy consumption represents a significant cost factor in LOHC systems, particularly for the endothermic dehydrogenation process. Techno-economic assessments focus on strategies for energy integration, waste heat recovery, and process optimization to improve overall system efficiency. These assessments evaluate various heat integration configurations, catalyst systems, and reactor designs to reduce energy requirements and operational costs, thereby enhancing the economic viability of LOHC technology.

- Infrastructure and supply chain economics: The development of LOHC infrastructure requires significant investment and careful planning. Techno-economic assessments analyze the costs associated with transportation networks, storage facilities, and distribution systems for LOHC-based hydrogen delivery. These studies evaluate different supply chain configurations, including centralized versus distributed hydrogenation/dehydrogenation facilities, and assess the economic implications of integrating LOHC systems with existing infrastructure such as refineries, chemical plants, and fueling stations.

- Market applications and business models: Different market applications for LOHC technology present varying economic challenges and opportunities. Techno-economic assessments evaluate business models for applications such as grid-scale energy storage, hydrogen refueling stations, industrial hydrogen supply, and maritime fuel. These analyses consider factors such as market size, competitive positioning against alternative technologies, regulatory frameworks, and potential revenue streams to identify economically viable implementation pathways and business strategies for LOHC technology commercialization.

02 LOHC production and regeneration processes

Various production and regeneration processes for LOHC systems have been developed to optimize hydrogen loading and unloading cycles. These processes focus on improving catalyst efficiency, reducing energy requirements for dehydrogenation, and extending the lifespan of carrier molecules. Technical innovations include novel catalyst formulations, reactor designs, and process integration approaches that enhance the overall efficiency of hydrogen storage and release from organic carriers.Expand Specific Solutions03 Infrastructure requirements for LOHC implementation

The implementation of LOHC technology requires specific infrastructure considerations including storage facilities, transportation networks, and integration with existing energy systems. Assessments evaluate the capital investments needed for hydrogenation and dehydrogenation plants, specialized transport containers, and distribution networks. The compatibility of LOHC systems with existing petroleum infrastructure offers significant advantages for rapid deployment and scaling of hydrogen economy solutions.Expand Specific Solutions04 Environmental impact and sustainability analysis

Environmental impact assessments of LOHC systems analyze their sustainability compared to alternative hydrogen storage methods. These analyses include life cycle assessments, carbon footprint calculations, and evaluation of potential environmental risks. The recyclability of carrier molecules, energy efficiency of the complete cycle, and potential for integration with renewable energy sources are key factors in determining the overall environmental benefits of LOHC technology in decarbonization efforts.Expand Specific Solutions05 Integration of LOHC with renewable energy systems

The integration of LOHC technology with renewable energy systems presents opportunities for efficient energy storage and transportation. Technical and economic assessments evaluate how LOHC systems can address intermittency challenges of renewable energy sources by providing long-term, large-scale hydrogen storage capabilities. These integrated systems enable better utilization of excess renewable electricity through power-to-hydrogen-to-power pathways, enhancing grid stability and facilitating sector coupling between electricity, transportation, and industrial applications.Expand Specific Solutions

Key Industry Players in LOHC Supply Chain

The LOHC (Liquid Organic Hydrogen Carrier) supply chain market is currently in its early growth phase, characterized by increasing research activities and emerging commercial applications. The global hydrogen economy, which LOHC technology supports, is projected to reach $500-700 billion by 2050. Technologically, LOHC systems are advancing from laboratory to demonstration scale, with varying maturity levels across key players. Hydrogenious LOHC Technologies leads commercial deployment, while academic institutions (Tsinghua University, Chongqing University) focus on fundamental research. Energy giants (Saudi Aramco, PetroChina, Sinopec) are investing in LOHC as part of hydrogen strategy portfolios, while technology providers (Bosch, UOP) are developing complementary components. The ecosystem shows a balanced mix of specialized startups, established corporations, and research institutions working to overcome technical and economic barriers.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed a comprehensive LOHC supply chain solution that leverages its vast domestic infrastructure network. Their technology focuses on methylcyclohexane-toluene and decalin-naphthalene carrier systems, with proprietary catalyst formulations that enhance conversion efficiency while reducing precious metal requirements. Sinopec's approach integrates hydrogen production from multiple sources, including coal gasification with carbon capture, natural gas reforming, and renewable electrolysis, creating flexible pathways for hydrogen delivery. Their techno-economic assessment framework incorporates detailed modeling of regional hydrogen demand patterns across industrial, transportation, and power generation sectors in China, optimizing supply chain configurations for different market segments. Sinopec has implemented pilot-scale LOHC facilities integrated with their refinery operations, demonstrating the feasibility of repurposing existing petrochemical infrastructure for hydrogen logistics. Their economic analysis includes comprehensive evaluation of various transportation modes (pipeline, rail, truck) across China's diverse geography, identifying optimal distribution strategies for different regions.

Strengths: Extensive domestic infrastructure network that can be leveraged for LOHC distribution; significant experience with hydrogenation processes from refining operations; strong government backing for hydrogen initiatives; vertical integration across the entire value chain. Weaknesses: Technology development primarily focused on domestic market conditions which may limit international applicability; heavy reliance on coal-based hydrogen production faces increasing environmental scrutiny; less transparent about technical performance metrics compared to Western competitors.

Evonik Operations GmbH

Technical Solution: Evonik has developed an innovative LOHC technology platform centered around their proprietary carrier compounds, which offer improved hydrogen storage capacity and release kinetics compared to conventional carriers. Their system utilizes heterocyclic compounds that achieve hydrogen loading of up to 7 wt%, exceeding the capacity of traditional LOHC materials. Evonik's approach incorporates specialized catalyst systems that operate at lower temperatures (280-320°C) for the dehydrogenation process, reducing the energy penalty associated with hydrogen release. Their techno-economic assessment framework evaluates the entire value chain from hydrogen production to end-use, with particular focus on industrial applications where their LOHC technology can integrate with existing chemical processes. Evonik has demonstrated their technology at pilot scale, showing stable carrier performance over hundreds of hydrogenation-dehydrogenation cycles with minimal degradation. Their economic modeling incorporates detailed analysis of carrier production costs, catalyst lifetime considerations, and infrastructure compatibility to provide comprehensive levelized cost of hydrogen delivery across various transportation distances and volumes.

Strengths: Advanced materials expertise enabling development of higher-capacity carrier compounds; integration capabilities with existing chemical industry infrastructure; strong intellectual property position in specialized LOHC compounds. Weaknesses: Less established in commercial implementation compared to some competitors; higher production costs for specialized carrier compounds may impact overall economics; requires development of dedicated infrastructure for their specific carrier systems.

Critical LOHC Patents and Technical Literature

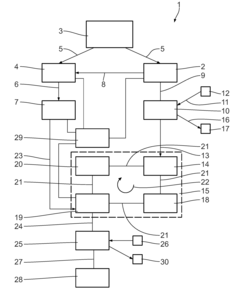

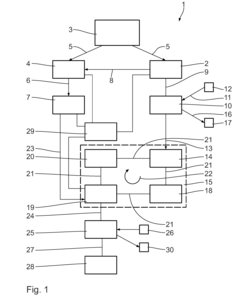

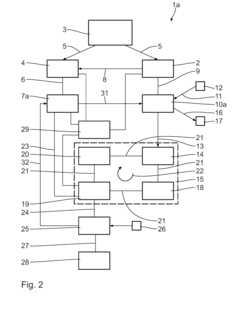

System and method for storing and releasing energy

PatentActiveUS20160301093A1

Innovation

- A system comprising a hydrogen production unit, a hydrogen storage device, a heat generation unit, and a heat storage unit, where hydrogen is stored chemically bound with a carrier medium, allowing for efficient storage and release of energy using heat from the heat storage unit during energy-rich and energy-poor periods.

Economic Viability Assessment of LOHC Systems

The economic viability of Liquid Organic Hydrogen Carrier (LOHC) systems represents a critical factor in determining their potential for widespread adoption in the hydrogen economy. Current economic assessments indicate that LOHC technology requires significant capital investment, with hydrogenation and dehydrogenation plants constituting approximately 60-70% of total infrastructure costs. These facilities demand specialized catalysts and operate under specific temperature and pressure conditions that contribute to their high capital expenditure.

Operational expenses for LOHC systems are primarily driven by energy requirements, particularly for the dehydrogenation process which is endothermic and requires substantial heat input. Energy costs typically account for 40-50% of the total levelized cost of hydrogen delivery via LOHC pathways. The carrier material itself represents another significant cost component, with current market prices for established carriers like dibenzyl toluene ranging from $3-5 per kilogram.

Comparative analyses with alternative hydrogen transport methods reveal that LOHC systems become economically competitive at medium to long distances (>200 km) where compressed hydrogen transport via tube trailers becomes less efficient. For maritime applications, LOHC shows particular promise due to its stability and volumetric advantages, potentially offering cost benefits over liquefied hydrogen for international shipping routes.

Sensitivity analyses demonstrate that the economic viability of LOHC systems is heavily influenced by several key parameters. Hydrogen throughput represents the most critical factor, with facilities operating at higher capacities achieving significantly improved economics through economies of scale. Energy prices—particularly electricity and heat costs—directly impact operational expenses, while carrier lifetime (number of hydrogenation/dehydrogenation cycles before degradation) affects the amortization of carrier material costs.

Recent techno-economic models suggest that under optimistic scenarios with high utilization rates and improved catalyst performance, LOHC hydrogen delivery costs could potentially reach $3-4 per kilogram by 2030, approaching cost parity with fossil-based hydrogen production methods. However, these projections depend on technological advancements in catalyst efficiency and heat integration strategies to reduce energy consumption during dehydrogenation.

The economic case for LOHC systems strengthens in regions with significant renewable energy potential but limited hydrogen demand, where the technology enables effective energy export through chemical storage rather than electrical transmission infrastructure. This value proposition is particularly relevant for countries developing green hydrogen export strategies based on abundant solar or wind resources.

Operational expenses for LOHC systems are primarily driven by energy requirements, particularly for the dehydrogenation process which is endothermic and requires substantial heat input. Energy costs typically account for 40-50% of the total levelized cost of hydrogen delivery via LOHC pathways. The carrier material itself represents another significant cost component, with current market prices for established carriers like dibenzyl toluene ranging from $3-5 per kilogram.

Comparative analyses with alternative hydrogen transport methods reveal that LOHC systems become economically competitive at medium to long distances (>200 km) where compressed hydrogen transport via tube trailers becomes less efficient. For maritime applications, LOHC shows particular promise due to its stability and volumetric advantages, potentially offering cost benefits over liquefied hydrogen for international shipping routes.

Sensitivity analyses demonstrate that the economic viability of LOHC systems is heavily influenced by several key parameters. Hydrogen throughput represents the most critical factor, with facilities operating at higher capacities achieving significantly improved economics through economies of scale. Energy prices—particularly electricity and heat costs—directly impact operational expenses, while carrier lifetime (number of hydrogenation/dehydrogenation cycles before degradation) affects the amortization of carrier material costs.

Recent techno-economic models suggest that under optimistic scenarios with high utilization rates and improved catalyst performance, LOHC hydrogen delivery costs could potentially reach $3-4 per kilogram by 2030, approaching cost parity with fossil-based hydrogen production methods. However, these projections depend on technological advancements in catalyst efficiency and heat integration strategies to reduce energy consumption during dehydrogenation.

The economic case for LOHC systems strengthens in regions with significant renewable energy potential but limited hydrogen demand, where the technology enables effective energy export through chemical storage rather than electrical transmission infrastructure. This value proposition is particularly relevant for countries developing green hydrogen export strategies based on abundant solar or wind resources.

Regulatory Framework for Hydrogen Carriers

The regulatory landscape for hydrogen carriers, particularly Liquid Organic Hydrogen Carriers (LOHCs), is evolving rapidly as governments worldwide recognize hydrogen's potential in decarbonization strategies. Currently, regulations governing LOHC supply chains span multiple domains including safety standards, transportation protocols, and environmental compliance requirements.

At the international level, organizations such as the International Organization for Standardization (ISO) and the International Maritime Organization (IMO) are developing specific standards for hydrogen carriers. The ISO/TC 197 committee focuses on hydrogen technologies standardization, while the IMO has begun incorporating hydrogen carriers into its International Code for the Construction and Equipment of Ships Carrying Liquefied Gases in Bulk (IGC Code).

European Union regulations present the most comprehensive framework through the European Hydrogen Strategy and the European Green Deal. These initiatives establish clear guidelines for hydrogen production, transportation, and storage, with specific provisions for carrier technologies like LOHCs. The EU's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation directly impacts LOHC deployment by requiring thorough safety assessments of carrier compounds.

In the United States, regulatory oversight is distributed across multiple agencies. The Department of Energy (DOE) provides technical standards and funding initiatives, while the Department of Transportation (DOT) regulates hydrogen transport. The Pipeline and Hazardous Materials Safety Administration (PHMSA) has begun developing specific protocols for LOHC transportation through existing infrastructure.

Asian markets demonstrate varying regulatory approaches. Japan's Strategic Roadmap for Hydrogen and Fuel Cells includes specific provisions for carrier technologies, positioning the country as a leader in LOHC implementation. South Korea's Hydrogen Economy Roadmap similarly addresses carrier technologies, while China's regulatory framework remains under development with a focus on domestic production capabilities.

Regulatory gaps persist in several critical areas. Cross-border transportation of LOHCs lacks harmonized international standards, creating potential bottlenecks in global supply chains. Additionally, end-of-life management and recycling protocols for spent carrier materials remain underdeveloped in most jurisdictions.

Future regulatory developments will likely focus on standardizing safety protocols, establishing certification schemes for carrier purity and quality, and developing specific environmental impact assessment methodologies for LOHC technologies. The integration of these regulations into existing energy infrastructure frameworks represents a significant challenge that will shape the economic viability of LOHC supply chains in the coming decades.

At the international level, organizations such as the International Organization for Standardization (ISO) and the International Maritime Organization (IMO) are developing specific standards for hydrogen carriers. The ISO/TC 197 committee focuses on hydrogen technologies standardization, while the IMO has begun incorporating hydrogen carriers into its International Code for the Construction and Equipment of Ships Carrying Liquefied Gases in Bulk (IGC Code).

European Union regulations present the most comprehensive framework through the European Hydrogen Strategy and the European Green Deal. These initiatives establish clear guidelines for hydrogen production, transportation, and storage, with specific provisions for carrier technologies like LOHCs. The EU's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation directly impacts LOHC deployment by requiring thorough safety assessments of carrier compounds.

In the United States, regulatory oversight is distributed across multiple agencies. The Department of Energy (DOE) provides technical standards and funding initiatives, while the Department of Transportation (DOT) regulates hydrogen transport. The Pipeline and Hazardous Materials Safety Administration (PHMSA) has begun developing specific protocols for LOHC transportation through existing infrastructure.

Asian markets demonstrate varying regulatory approaches. Japan's Strategic Roadmap for Hydrogen and Fuel Cells includes specific provisions for carrier technologies, positioning the country as a leader in LOHC implementation. South Korea's Hydrogen Economy Roadmap similarly addresses carrier technologies, while China's regulatory framework remains under development with a focus on domestic production capabilities.

Regulatory gaps persist in several critical areas. Cross-border transportation of LOHCs lacks harmonized international standards, creating potential bottlenecks in global supply chains. Additionally, end-of-life management and recycling protocols for spent carrier materials remain underdeveloped in most jurisdictions.

Future regulatory developments will likely focus on standardizing safety protocols, establishing certification schemes for carrier purity and quality, and developing specific environmental impact assessment methodologies for LOHC technologies. The integration of these regulations into existing energy infrastructure frameworks represents a significant challenge that will shape the economic viability of LOHC supply chains in the coming decades.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!