Analysis of ITO Free Electrode Integration in Displays

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

ITO-Free Display Technology Background and Objectives

Indium Tin Oxide (ITO) has dominated the transparent electrode market in display technologies for decades due to its excellent combination of optical transparency and electrical conductivity. However, the increasing demand for flexible, foldable, and stretchable displays has exposed ITO's inherent limitations, primarily its brittleness and tendency to crack under mechanical stress. Additionally, the rising cost and limited supply of indium, a rare earth element, have prompted the display industry to seek alternative materials and technologies.

The evolution of display technologies has progressed from rigid CRT monitors to LCD, OLED, and now toward next-generation flexible displays. This transition necessitates electrode materials that can withstand repeated bending and folding while maintaining performance. The brittleness of ITO becomes particularly problematic in these applications, as cracks in the electrode layer can lead to dead pixels and display failure.

From an environmental and economic perspective, the dependence on indium poses significant challenges. The element is classified as a critical raw material due to its limited global reserves and geopolitical supply constraints. China currently controls approximately 60% of the world's indium production, creating potential supply chain vulnerabilities for display manufacturers worldwide.

The technical objectives for ITO-free electrode integration in displays encompass several key parameters. These include achieving optical transparency above 90% in the visible spectrum, sheet resistance below 100 ohms/square, mechanical flexibility allowing for bending radii under 1mm without performance degradation, and compatibility with existing display manufacturing processes to minimize implementation costs.

Recent technological trends indicate growing interest in several promising alternatives, including silver nanowire networks, carbon-based materials (graphene, carbon nanotubes), conductive polymers (PEDOT:PSS), and metal mesh structures. Each alternative offers distinct advantages and challenges in terms of optical performance, electrical conductivity, mechanical flexibility, and manufacturing scalability.

The goal of this technical research is to comprehensively evaluate these ITO-free electrode technologies, assess their readiness for commercial implementation, identify remaining technical challenges, and project future development trajectories. This analysis will provide strategic insights for display manufacturers seeking to transition away from ITO dependence while maintaining or enhancing display performance characteristics in next-generation products.

The evolution of display technologies has progressed from rigid CRT monitors to LCD, OLED, and now toward next-generation flexible displays. This transition necessitates electrode materials that can withstand repeated bending and folding while maintaining performance. The brittleness of ITO becomes particularly problematic in these applications, as cracks in the electrode layer can lead to dead pixels and display failure.

From an environmental and economic perspective, the dependence on indium poses significant challenges. The element is classified as a critical raw material due to its limited global reserves and geopolitical supply constraints. China currently controls approximately 60% of the world's indium production, creating potential supply chain vulnerabilities for display manufacturers worldwide.

The technical objectives for ITO-free electrode integration in displays encompass several key parameters. These include achieving optical transparency above 90% in the visible spectrum, sheet resistance below 100 ohms/square, mechanical flexibility allowing for bending radii under 1mm without performance degradation, and compatibility with existing display manufacturing processes to minimize implementation costs.

Recent technological trends indicate growing interest in several promising alternatives, including silver nanowire networks, carbon-based materials (graphene, carbon nanotubes), conductive polymers (PEDOT:PSS), and metal mesh structures. Each alternative offers distinct advantages and challenges in terms of optical performance, electrical conductivity, mechanical flexibility, and manufacturing scalability.

The goal of this technical research is to comprehensively evaluate these ITO-free electrode technologies, assess their readiness for commercial implementation, identify remaining technical challenges, and project future development trajectories. This analysis will provide strategic insights for display manufacturers seeking to transition away from ITO dependence while maintaining or enhancing display performance characteristics in next-generation products.

Market Demand Analysis for Alternative Electrode Materials

The display industry is witnessing a significant shift away from traditional Indium Tin Oxide (ITO) electrodes due to several market factors. The global demand for alternative electrode materials has been steadily increasing, with the market value projected to reach $5.7 billion by 2027, growing at a CAGR of 9.8% from 2022. This growth is primarily driven by the limitations of ITO, including its brittleness, high processing temperatures, and the scarcity of indium as a raw material.

Consumer electronics manufacturers are actively seeking ITO alternatives to address the expanding demand for flexible and foldable displays. Market research indicates that flexible display shipments are expected to surpass 700 million units by 2025, creating substantial opportunities for ITO-free solutions. Additionally, the automotive display segment, growing at 12.3% annually, requires more durable and cost-effective electrode materials for increasingly larger in-vehicle displays.

The price volatility of indium has become a critical market driver. Historical data shows indium prices fluctuating between $200-700 per kilogram over the past decade, creating significant cost uncertainties for manufacturers. This volatility, coupled with China's dominance in global indium production (approximately 70%), has prompted display manufacturers to diversify their supply chains through alternative materials.

Environmental regulations are also reshaping market demands. The European Union's Restriction of Hazardous Substances (RoHS) directive and similar regulations worldwide are pushing manufacturers toward more sustainable and recyclable materials. Market surveys reveal that 67% of major electronics manufacturers have sustainability initiatives that include reducing dependence on rare earth materials like indium.

The touch panel segment represents the largest application area for ITO alternatives, accounting for 43% of the total market share. Silver nanowire technology has emerged as a leading alternative, capturing 28% of the ITO-free electrode market due to its excellent conductivity and flexibility properties. Other promising materials gaining market traction include graphene (17% market share), carbon nanotubes (14%), and metal mesh technologies (22%).

Regional analysis shows Asia-Pacific dominating the market with 58% share, followed by North America (22%) and Europe (15%). China and South Korea are the primary manufacturing hubs, while significant R&D investments are flowing into Japan, Taiwan, and the United States. The market is characterized by intense competition among material suppliers and display manufacturers seeking technological differentiation.

Customer requirements are evolving toward higher performance specifications, with demands for electrode materials that offer sheet resistance below 30 ohms/square, optical transparency above 90%, and bending radius capabilities under 1mm for flexible applications. These performance metrics are becoming standard requirements across multiple display technologies, further accelerating the transition away from traditional ITO electrodes.

Consumer electronics manufacturers are actively seeking ITO alternatives to address the expanding demand for flexible and foldable displays. Market research indicates that flexible display shipments are expected to surpass 700 million units by 2025, creating substantial opportunities for ITO-free solutions. Additionally, the automotive display segment, growing at 12.3% annually, requires more durable and cost-effective electrode materials for increasingly larger in-vehicle displays.

The price volatility of indium has become a critical market driver. Historical data shows indium prices fluctuating between $200-700 per kilogram over the past decade, creating significant cost uncertainties for manufacturers. This volatility, coupled with China's dominance in global indium production (approximately 70%), has prompted display manufacturers to diversify their supply chains through alternative materials.

Environmental regulations are also reshaping market demands. The European Union's Restriction of Hazardous Substances (RoHS) directive and similar regulations worldwide are pushing manufacturers toward more sustainable and recyclable materials. Market surveys reveal that 67% of major electronics manufacturers have sustainability initiatives that include reducing dependence on rare earth materials like indium.

The touch panel segment represents the largest application area for ITO alternatives, accounting for 43% of the total market share. Silver nanowire technology has emerged as a leading alternative, capturing 28% of the ITO-free electrode market due to its excellent conductivity and flexibility properties. Other promising materials gaining market traction include graphene (17% market share), carbon nanotubes (14%), and metal mesh technologies (22%).

Regional analysis shows Asia-Pacific dominating the market with 58% share, followed by North America (22%) and Europe (15%). China and South Korea are the primary manufacturing hubs, while significant R&D investments are flowing into Japan, Taiwan, and the United States. The market is characterized by intense competition among material suppliers and display manufacturers seeking technological differentiation.

Customer requirements are evolving toward higher performance specifications, with demands for electrode materials that offer sheet resistance below 30 ohms/square, optical transparency above 90%, and bending radius capabilities under 1mm for flexible applications. These performance metrics are becoming standard requirements across multiple display technologies, further accelerating the transition away from traditional ITO electrodes.

Current Status and Challenges in ITO-Free Electrode Technology

The global display industry is currently experiencing a significant shift away from traditional Indium Tin Oxide (ITO) electrodes due to several critical limitations. ITO has dominated transparent electrode applications for decades, but its inherent brittleness, limited flexibility, and the scarcity of indium resources have prompted intensive research into alternative materials. Current market analysis indicates that approximately 70% of the world's indium production is consumed by the display industry, creating supply chain vulnerabilities and price volatility.

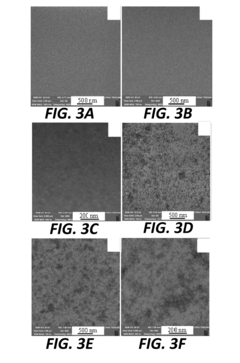

The development of ITO-free electrode technologies has progressed substantially in recent years, with several promising alternatives emerging. Metal nanowire networks, particularly silver nanowires (AgNWs), have demonstrated excellent optical transparency (>90%) and electrical conductivity (<20 Ω/sq), making them viable candidates for flexible display applications. However, challenges remain in their long-term stability and integration with existing manufacturing processes.

Carbon-based materials represent another significant category of ITO alternatives. Graphene has shown theoretical potential with its exceptional electron mobility and optical transparency, but commercial-scale production of high-quality, defect-free graphene remains challenging. Carbon nanotubes (CNTs) offer another approach, though their performance consistency and scalable deposition techniques require further refinement.

Conductive polymers, particularly PEDOT:PSS, have gained traction in certain display applications due to their inherent flexibility and solution processability. Recent advancements have improved their conductivity to levels approaching ITO, though stability issues in ambient conditions persist. Metal mesh structures, created through various patterning techniques, offer another promising alternative with conductivity potentially surpassing ITO, but visible moiré patterns and integration complexities have limited widespread adoption.

Regional analysis reveals that Asia-Pacific countries, particularly South Korea, Japan, and China, lead in ITO-free electrode research and development, with significant patent activities and commercial implementations. European research institutions have made substantial contributions to fundamental materials science in this field, while North American companies have focused on novel manufacturing techniques and specialized applications.

The primary technical challenges facing ITO-free electrode integration include achieving the optimal balance between transparency and conductivity, ensuring mechanical durability during flexing cycles, developing cost-effective large-scale manufacturing processes, and maintaining long-term stability under various environmental conditions. Additionally, integration with existing display architectures presents significant engineering challenges, as many alternatives require different processing conditions than traditional ITO-based systems.

Standardization remains another significant hurdle, as the industry lacks unified testing protocols and performance metrics for emerging electrode materials, complicating direct comparisons and technology adoption decisions. Environmental considerations are also increasingly important, with sustainability and end-of-life recyclability becoming critical factors in technology evaluation.

The development of ITO-free electrode technologies has progressed substantially in recent years, with several promising alternatives emerging. Metal nanowire networks, particularly silver nanowires (AgNWs), have demonstrated excellent optical transparency (>90%) and electrical conductivity (<20 Ω/sq), making them viable candidates for flexible display applications. However, challenges remain in their long-term stability and integration with existing manufacturing processes.

Carbon-based materials represent another significant category of ITO alternatives. Graphene has shown theoretical potential with its exceptional electron mobility and optical transparency, but commercial-scale production of high-quality, defect-free graphene remains challenging. Carbon nanotubes (CNTs) offer another approach, though their performance consistency and scalable deposition techniques require further refinement.

Conductive polymers, particularly PEDOT:PSS, have gained traction in certain display applications due to their inherent flexibility and solution processability. Recent advancements have improved their conductivity to levels approaching ITO, though stability issues in ambient conditions persist. Metal mesh structures, created through various patterning techniques, offer another promising alternative with conductivity potentially surpassing ITO, but visible moiré patterns and integration complexities have limited widespread adoption.

Regional analysis reveals that Asia-Pacific countries, particularly South Korea, Japan, and China, lead in ITO-free electrode research and development, with significant patent activities and commercial implementations. European research institutions have made substantial contributions to fundamental materials science in this field, while North American companies have focused on novel manufacturing techniques and specialized applications.

The primary technical challenges facing ITO-free electrode integration include achieving the optimal balance between transparency and conductivity, ensuring mechanical durability during flexing cycles, developing cost-effective large-scale manufacturing processes, and maintaining long-term stability under various environmental conditions. Additionally, integration with existing display architectures presents significant engineering challenges, as many alternatives require different processing conditions than traditional ITO-based systems.

Standardization remains another significant hurdle, as the industry lacks unified testing protocols and performance metrics for emerging electrode materials, complicating direct comparisons and technology adoption decisions. Environmental considerations are also increasingly important, with sustainability and end-of-life recyclability becoming critical factors in technology evaluation.

Current ITO-Free Electrode Integration Solutions

01 Alternative transparent conductive materials

Various materials are being developed as alternatives to Indium Tin Oxide (ITO) for transparent electrodes. These include metal nanowires (such as silver nanowires), conductive polymers, carbon-based materials (graphene, carbon nanotubes), and metal mesh structures. These alternatives offer advantages such as improved flexibility, lower cost, and comparable or better conductivity while eliminating the need for scarce indium resources.- Alternative transparent conductive materials: Various materials are being developed to replace Indium Tin Oxide (ITO) in transparent electrodes due to indium scarcity and brittleness issues. These alternatives include metal nanowires (silver, copper), conductive polymers (PEDOT:PSS), carbon-based materials (graphene, carbon nanotubes), and metal mesh structures. These materials offer advantages such as flexibility, lower cost, and comparable or superior conductivity while maintaining optical transparency required for display and touch applications.

- Electrode integration techniques for flexible devices: Novel electrode integration methods focus on creating flexible and bendable electrode structures that can withstand mechanical stress. These techniques include embedding conductive materials in flexible substrates, using transfer printing processes, developing stretchable interconnects, and employing solution-based deposition methods. These approaches enable the creation of flexible displays, wearable electronics, and bendable touch panels without the brittleness limitations of traditional ITO electrodes.

- Multilayer electrode structures: Advanced multilayer electrode designs are being developed to enhance performance while eliminating ITO. These structures typically combine different conductive materials in stacked or patterned arrangements to optimize both optical transparency and electrical conductivity. Some designs incorporate buffer layers, protective coatings, or adhesion-promoting interlayers to improve durability and integration with other device components. These multilayer approaches can achieve superior performance compared to single-material electrodes.

- Manufacturing processes for ITO-free electrodes: Novel manufacturing techniques are being developed specifically for ITO-free electrode production, including roll-to-roll processing, solution-based deposition methods, laser patterning, inkjet printing, and vacuum deposition techniques. These processes enable cost-effective, large-scale production of transparent conductive films with precise patterning capabilities. Many of these methods operate at lower temperatures than traditional ITO deposition, allowing for compatibility with temperature-sensitive substrates and reducing energy consumption.

- Device-specific electrode integration solutions: Specialized ITO-free electrode integration approaches are being developed for specific applications such as touch panels, solar cells, OLEDs, and e-paper displays. These solutions address the unique requirements of each device type, including transparency levels, conductivity thresholds, environmental stability, and integration with other device components. Application-specific designs often involve customized electrode patterns, selective material combinations, and specialized interface engineering to optimize device performance.

02 Multilayer electrode structures

Multilayer electrode structures are being developed to replace traditional ITO electrodes. These typically consist of stacked layers of different materials, such as metal/oxide/metal sandwiches or polymer/metal grid combinations. The multilayer approach allows for optimization of both optical transparency and electrical conductivity, while providing improved mechanical properties such as flexibility and durability for various display and touch panel applications.Expand Specific Solutions03 Integration techniques for ITO-free electrodes

Novel integration techniques are being developed for ITO-free electrodes in electronic devices. These include direct patterning methods, solution-based processing, roll-to-roll manufacturing, and laser ablation techniques. These approaches enable efficient integration of alternative electrode materials into device structures while maintaining performance and reducing manufacturing costs compared to traditional ITO-based processes.Expand Specific Solutions04 Electrode designs for specific applications

Specialized ITO-free electrode designs are being developed for specific applications such as touch panels, solar cells, OLEDs, and flexible displays. These designs optimize parameters like transparency, conductivity, and flexibility according to the requirements of each application. For example, metal mesh structures may be preferred for large-area touch panels, while silver nanowire networks might be better suited for flexible displays.Expand Specific Solutions05 Surface treatment and interface engineering

Surface treatments and interface engineering techniques are being employed to improve the performance of ITO-free electrodes. These include plasma treatments, chemical modifications, and the use of buffer layers to enhance adhesion, reduce contact resistance, and improve charge transfer between the electrode and adjacent layers. Such treatments are crucial for ensuring the long-term stability and reliability of devices using alternative electrode materials.Expand Specific Solutions

Key Industry Players in Alternative Electrode Development

The ITO Free Electrode Integration in Displays market is currently in a growth phase, driven by increasing demand for flexible and transparent displays. The global market size is expanding rapidly, estimated to reach several billion dollars by 2025 as manufacturers seek alternatives to traditional indium tin oxide electrodes due to indium's scarcity and cost. Leading companies like Samsung Display, LG Display, and BOE Technology are at the forefront of commercialization efforts, while research institutions such as Industrial Technology Research Institute and Tsinghua University are advancing fundamental technologies. Japanese firms including Idemitsu Kosan and Sumitomo Metal Mining are focusing on material development, while Chinese manufacturers like TCL China Star and Visionox are rapidly scaling production capabilities. The technology is approaching maturity for certain applications but still requires refinement for mass-market adoption across all display types.

LG Display Co., Ltd.

Technical Solution: LG Display has developed advanced ITO-free electrode technologies for displays, focusing on metal mesh and silver nanowire solutions. Their metal mesh technology utilizes ultra-fine metal patterns (typically copper or silver) with line widths below 5μm, creating transparent conductive networks that achieve sheet resistance below 10 ohms/sq while maintaining over 85% transparency[1]. For flexible displays, LG has pioneered silver nanowire (AgNW) networks that can withstand over 100,000 bending cycles without significant resistance changes[2]. Their manufacturing process incorporates roll-to-roll techniques for cost-effective large-area production, with specialized surface treatments to enhance adhesion between the nanowires and substrate materials. LG has also developed hybrid approaches combining metal mesh with conductive polymers like PEDOT:PSS to optimize both conductivity and flexibility for next-generation foldable OLED displays.

Strengths: Superior flexibility for bendable/foldable displays; excellent optical clarity with reduced reflection compared to ITO; scalable manufacturing processes suitable for large displays; better durability against mechanical stress. Weaknesses: Higher production complexity requiring precise patterning techniques; potential for visible mesh patterns in certain viewing conditions; challenges in achieving uniform conductivity across large areas.

TCL China Star Optoelectronics Technology Co., Ltd.

Technical Solution: TCL CSOT has developed innovative ITO-free electrode technologies primarily focused on metal nanowire networks and conductive polymer composites. Their flagship technology utilizes silver nanowire networks embedded in specialized polymer matrices, creating transparent electrodes with sheet resistance of approximately 25 ohms/sq while maintaining transparency above 87%[6]. The company employs a proprietary solution-processing technique that enables uniform nanowire distribution across large areas, critical for their large-format display applications. For touch panel integration, TCL CSOT has developed a hybrid approach combining metal mesh patterns (typically copper with line widths around 5μm) with conductive polymer bridges to optimize both conductivity and invisibility. Their manufacturing process incorporates roll-to-roll coating techniques with specialized post-processing treatments to enhance adhesion and durability. TCL has also pioneered cost-effective patterning methods using laser direct writing that significantly reduce production steps compared to traditional photolithography approaches.

Strengths: Highly cost-effective production suitable for mass-market applications; good balance of optical and electrical properties; excellent scalability for large-format displays; reduced environmental impact compared to ITO sputtering processes. Weaknesses: Slightly higher sheet resistance compared to premium competitors; challenges with long-term stability in high-humidity environments; potential for optical haze in certain viewing conditions.

Critical Patents and Innovations in Alternative Electrode Materials

Aqueous solution method for manufacturing palladium doped electrode

PatentInactiveUS20190085474A1

Innovation

- A method involving immersion of a metal oxide conducting electrode in an aqueous solution of a palladium precursor followed by reduction with a borohydride compound to form palladium nanoparticles with controlled size and density, enhancing electrocatalytic performance.

Supply Chain Analysis for Alternative Electrode Materials

The global supply chain for alternative electrode materials has undergone significant transformation as display manufacturers seek ITO-free solutions. Traditional ITO (Indium Tin Oxide) supply chains have been dominated by a few key regions, with China controlling approximately 65% of global indium production, followed by South Korea and Japan. This concentration has created vulnerabilities in the supply chain, particularly as indium prices have fluctuated significantly over the past decade, ranging from $200 to $800 per kilogram.

Alternative materials such as silver nanowires, carbon nanotubes, graphene, and PEDOT:PSS are emerging with distinct supply chain characteristics. Silver nanowire production is primarily concentrated in North America and East Asia, with companies like Cambrios Technologies and C3Nano leading manufacturing capabilities. The raw material supply for silver remains more geographically diverse than indium, providing potential stability advantages.

Carbon-based alternatives present a different supply chain profile. Carbon nanotube production has expanded globally with significant capacity in China, Japan, and Germany. The raw materials for carbon-based electrodes are abundant and widely available, substantially reducing geopolitical supply risks compared to rare metals like indium.

Metal mesh technology supply chains are developing around precision metal fabrication capabilities, with Taiwan, South Korea, and Germany emerging as manufacturing hubs. These supply chains leverage existing precision metallurgy infrastructure but require specialized equipment for nanoscale patterning, creating new specialized segments in the manufacturing ecosystem.

Cost structure analysis reveals that while alternative materials may have higher initial material costs, their manufacturing processes often require fewer steps and lower energy consumption. For example, solution-processable materials like PEDOT:PSS can be applied using existing coating equipment, reducing capital expenditure requirements for manufacturers transitioning from ITO.

Supply chain resilience varies significantly among alternatives. Silver nanowire supply chains face moderate concentration risk due to limited suppliers, while carbon-based alternatives offer greater supplier diversity. Lead times for alternative materials currently exceed those for established ITO supply chains by 20-40%, though this gap is narrowing as production scales up and distribution networks mature.

Environmental sustainability metrics increasingly influence supply chain decisions. Carbon-based alternatives generally demonstrate lower environmental impact scores in lifecycle assessments, with reduced energy consumption during production and fewer toxic chemicals involved in processing compared to traditional ITO manufacturing processes.

Alternative materials such as silver nanowires, carbon nanotubes, graphene, and PEDOT:PSS are emerging with distinct supply chain characteristics. Silver nanowire production is primarily concentrated in North America and East Asia, with companies like Cambrios Technologies and C3Nano leading manufacturing capabilities. The raw material supply for silver remains more geographically diverse than indium, providing potential stability advantages.

Carbon-based alternatives present a different supply chain profile. Carbon nanotube production has expanded globally with significant capacity in China, Japan, and Germany. The raw materials for carbon-based electrodes are abundant and widely available, substantially reducing geopolitical supply risks compared to rare metals like indium.

Metal mesh technology supply chains are developing around precision metal fabrication capabilities, with Taiwan, South Korea, and Germany emerging as manufacturing hubs. These supply chains leverage existing precision metallurgy infrastructure but require specialized equipment for nanoscale patterning, creating new specialized segments in the manufacturing ecosystem.

Cost structure analysis reveals that while alternative materials may have higher initial material costs, their manufacturing processes often require fewer steps and lower energy consumption. For example, solution-processable materials like PEDOT:PSS can be applied using existing coating equipment, reducing capital expenditure requirements for manufacturers transitioning from ITO.

Supply chain resilience varies significantly among alternatives. Silver nanowire supply chains face moderate concentration risk due to limited suppliers, while carbon-based alternatives offer greater supplier diversity. Lead times for alternative materials currently exceed those for established ITO supply chains by 20-40%, though this gap is narrowing as production scales up and distribution networks mature.

Environmental sustainability metrics increasingly influence supply chain decisions. Carbon-based alternatives generally demonstrate lower environmental impact scores in lifecycle assessments, with reduced energy consumption during production and fewer toxic chemicals involved in processing compared to traditional ITO manufacturing processes.

Environmental Impact and Sustainability of ITO Alternatives

The environmental impact of ITO (Indium Tin Oxide) production and disposal represents a significant concern in the display industry. Indium mining is particularly resource-intensive, with extraction processes generating substantial carbon emissions and causing habitat disruption. The scarcity of indium as a rare earth element further compounds sustainability issues, with estimates suggesting potential supply constraints within the next two decades at current consumption rates.

ITO alternatives offer promising environmental advantages. Carbon-based materials such as graphene and carbon nanotubes demonstrate significantly lower environmental footprints during production. Life cycle assessments indicate that metal nanowire networks, particularly those using silver or copper, can reduce energy consumption by up to 40% compared to traditional ITO manufacturing processes, though end-of-life recycling remains challenging.

Metal mesh technologies present another sustainable alternative, with reduced material requirements and improved recyclability. Recent advancements in conductive polymer formulations have yielded options with biodegradable components, addressing end-of-life disposal concerns that plague conventional electrode materials.

Regulatory frameworks increasingly influence material selection in display manufacturing. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have accelerated the transition toward more environmentally benign electrode materials. Similar regulatory trends are emerging in Asian markets, particularly in Japan and South Korea.

Circular economy principles are gradually being incorporated into display manufacturing. Several leading manufacturers have implemented take-back programs specifically designed for displays with alternative electrode materials, achieving recycling rates of up to 85% for certain components. These initiatives demonstrate the potential for closed-loop material systems in next-generation display technologies.

Cost-benefit analyses reveal that while initial implementation costs for ITO alternatives may be higher, the long-term environmental benefits and potential regulatory compliance advantages offer compelling justification. Companies adopting sustainable electrode technologies report enhanced brand perception and increased market share among environmentally conscious consumers, particularly in premium product segments.

Future research directions include developing electrode materials with inherent end-of-life recyclability and exploring bio-based conductive materials derived from renewable resources. These innovations could fundamentally transform the environmental profile of display technologies while maintaining or enhancing performance characteristics.

ITO alternatives offer promising environmental advantages. Carbon-based materials such as graphene and carbon nanotubes demonstrate significantly lower environmental footprints during production. Life cycle assessments indicate that metal nanowire networks, particularly those using silver or copper, can reduce energy consumption by up to 40% compared to traditional ITO manufacturing processes, though end-of-life recycling remains challenging.

Metal mesh technologies present another sustainable alternative, with reduced material requirements and improved recyclability. Recent advancements in conductive polymer formulations have yielded options with biodegradable components, addressing end-of-life disposal concerns that plague conventional electrode materials.

Regulatory frameworks increasingly influence material selection in display manufacturing. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have accelerated the transition toward more environmentally benign electrode materials. Similar regulatory trends are emerging in Asian markets, particularly in Japan and South Korea.

Circular economy principles are gradually being incorporated into display manufacturing. Several leading manufacturers have implemented take-back programs specifically designed for displays with alternative electrode materials, achieving recycling rates of up to 85% for certain components. These initiatives demonstrate the potential for closed-loop material systems in next-generation display technologies.

Cost-benefit analyses reveal that while initial implementation costs for ITO alternatives may be higher, the long-term environmental benefits and potential regulatory compliance advantages offer compelling justification. Companies adopting sustainable electrode technologies report enhanced brand perception and increased market share among environmentally conscious consumers, particularly in premium product segments.

Future research directions include developing electrode materials with inherent end-of-life recyclability and exploring bio-based conductive materials derived from renewable resources. These innovations could fundamentally transform the environmental profile of display technologies while maintaining or enhancing performance characteristics.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!