ITO Free Electrode Standardization Across Various Industries

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

ITO-Free Electrode Technology Background and Objectives

Indium Tin Oxide (ITO) has dominated the transparent conductive electrode market for decades due to its excellent combination of optical transparency and electrical conductivity. However, the increasing demand for flexible electronics, rising costs of indium, and environmental concerns have driven the search for alternative materials. The evolution of ITO-free electrode technology represents a significant shift in materials science and electronic manufacturing, with developments accelerating particularly over the past decade.

The historical trajectory of transparent conductive materials began with ITO's commercial adoption in the 1970s. By the early 2000s, limitations became apparent as touch screens and flexible displays emerged as dominant market forces. This technological inflection point catalyzed research into alternative materials including carbon nanotubes, graphene, metal nanowires, conductive polymers, and metal meshes, each offering unique advantages for specific applications.

Current market trends indicate a fragmented approach to ITO replacement, with different industries adopting various solutions based on their specific requirements. This fragmentation has created significant challenges in standardization across industries, leading to inefficiencies in manufacturing, increased costs, and slower adoption rates of new technologies.

The primary objective of this research is to establish a comprehensive framework for standardizing ITO-free electrode technologies across multiple industries including consumer electronics, automotive displays, photovoltaics, and emerging flexible electronics sectors. This standardization aims to facilitate technology transfer, reduce manufacturing complexity, and accelerate market adoption of these sustainable alternatives.

Technical goals include identifying common performance metrics that can be universally applied across different ITO-free technologies, establishing testing protocols that accurately reflect real-world performance requirements, and developing material specifications that can be referenced by manufacturers regardless of their industry vertical. Additionally, the research seeks to map compatibility pathways between different manufacturing processes and ITO-free materials to enable more seamless integration into existing production lines.

The long-term technological trajectory suggests a move toward hybrid solutions that combine multiple ITO-free materials to achieve optimal performance characteristics. Understanding how these hybrid approaches can be standardized represents a particularly challenging aspect of the research, as it requires consideration of complex material interactions and manufacturing processes.

By establishing industry-wide standards for ITO-free electrodes, this research aims to accelerate the transition away from indium-dependent technologies, supporting both environmental sustainability goals and the continued evolution of next-generation electronic devices with enhanced flexibility, durability, and performance characteristics.

The historical trajectory of transparent conductive materials began with ITO's commercial adoption in the 1970s. By the early 2000s, limitations became apparent as touch screens and flexible displays emerged as dominant market forces. This technological inflection point catalyzed research into alternative materials including carbon nanotubes, graphene, metal nanowires, conductive polymers, and metal meshes, each offering unique advantages for specific applications.

Current market trends indicate a fragmented approach to ITO replacement, with different industries adopting various solutions based on their specific requirements. This fragmentation has created significant challenges in standardization across industries, leading to inefficiencies in manufacturing, increased costs, and slower adoption rates of new technologies.

The primary objective of this research is to establish a comprehensive framework for standardizing ITO-free electrode technologies across multiple industries including consumer electronics, automotive displays, photovoltaics, and emerging flexible electronics sectors. This standardization aims to facilitate technology transfer, reduce manufacturing complexity, and accelerate market adoption of these sustainable alternatives.

Technical goals include identifying common performance metrics that can be universally applied across different ITO-free technologies, establishing testing protocols that accurately reflect real-world performance requirements, and developing material specifications that can be referenced by manufacturers regardless of their industry vertical. Additionally, the research seeks to map compatibility pathways between different manufacturing processes and ITO-free materials to enable more seamless integration into existing production lines.

The long-term technological trajectory suggests a move toward hybrid solutions that combine multiple ITO-free materials to achieve optimal performance characteristics. Understanding how these hybrid approaches can be standardized represents a particularly challenging aspect of the research, as it requires consideration of complex material interactions and manufacturing processes.

By establishing industry-wide standards for ITO-free electrodes, this research aims to accelerate the transition away from indium-dependent technologies, supporting both environmental sustainability goals and the continued evolution of next-generation electronic devices with enhanced flexibility, durability, and performance characteristics.

Market Analysis for ITO Alternatives

The ITO (Indium Tin Oxide) alternatives market has experienced significant growth in recent years, driven by several key factors. The scarcity of indium, a critical component of ITO, has led to price volatility and supply chain concerns. Current market estimates value the global ITO alternatives market at approximately $5.7 billion, with projections indicating a compound annual growth rate of 12.3% through 2028.

Consumer electronics represents the largest application segment, accounting for nearly 40% of the total market share. This dominance stems from the increasing demand for touchscreens in smartphones, tablets, and other portable devices. The automotive sector follows as the second-largest consumer, with growing implementation of touch interfaces and smart displays in vehicle interiors.

Regionally, Asia-Pacific dominates the market landscape, holding over 60% of the global market share. This concentration is primarily due to the presence of major electronics manufacturing hubs in China, South Korea, Japan, and Taiwan. North America and Europe collectively represent approximately 30% of the market, with both regions showing increased adoption rates in specialized applications such as medical devices and aerospace.

From a materials perspective, silver nanowires currently lead the alternative materials segment with approximately 28% market share, followed closely by PEDOT:PSS at 22%, and metal mesh technologies at 18%. Graphene-based solutions, while promising, currently hold only about 7% of the market but demonstrate the highest growth rate among all alternatives.

The market dynamics are further influenced by sustainability concerns, with manufacturers increasingly prioritizing environmentally friendly alternatives. This trend is particularly evident in Europe, where regulatory frameworks increasingly favor materials with lower environmental impact. Cost considerations remain paramount, with manufacturers seeking alternatives that can match ITO's performance while offering economic advantages at scale.

End-user industries exhibit varying adoption rates, with consumer electronics showing the fastest transition to ITO alternatives, while more conservative sectors like medical devices and industrial equipment demonstrate slower migration patterns. This segmentation creates distinct market opportunities for materials optimized for specific application requirements.

The competitive landscape features both established materials science corporations and innovative startups, with strategic partnerships between material developers and device manufacturers becoming increasingly common. These collaborations aim to accelerate commercialization timelines and ensure material specifications align with manufacturing requirements.

Consumer electronics represents the largest application segment, accounting for nearly 40% of the total market share. This dominance stems from the increasing demand for touchscreens in smartphones, tablets, and other portable devices. The automotive sector follows as the second-largest consumer, with growing implementation of touch interfaces and smart displays in vehicle interiors.

Regionally, Asia-Pacific dominates the market landscape, holding over 60% of the global market share. This concentration is primarily due to the presence of major electronics manufacturing hubs in China, South Korea, Japan, and Taiwan. North America and Europe collectively represent approximately 30% of the market, with both regions showing increased adoption rates in specialized applications such as medical devices and aerospace.

From a materials perspective, silver nanowires currently lead the alternative materials segment with approximately 28% market share, followed closely by PEDOT:PSS at 22%, and metal mesh technologies at 18%. Graphene-based solutions, while promising, currently hold only about 7% of the market but demonstrate the highest growth rate among all alternatives.

The market dynamics are further influenced by sustainability concerns, with manufacturers increasingly prioritizing environmentally friendly alternatives. This trend is particularly evident in Europe, where regulatory frameworks increasingly favor materials with lower environmental impact. Cost considerations remain paramount, with manufacturers seeking alternatives that can match ITO's performance while offering economic advantages at scale.

End-user industries exhibit varying adoption rates, with consumer electronics showing the fastest transition to ITO alternatives, while more conservative sectors like medical devices and industrial equipment demonstrate slower migration patterns. This segmentation creates distinct market opportunities for materials optimized for specific application requirements.

The competitive landscape features both established materials science corporations and innovative startups, with strategic partnerships between material developers and device manufacturers becoming increasingly common. These collaborations aim to accelerate commercialization timelines and ensure material specifications align with manufacturing requirements.

Current Status and Technical Barriers

The global market for ITO-free electrodes is experiencing significant growth, with the transparent conductive film market projected to reach $8.46 billion by 2026. Currently, indium tin oxide (ITO) dominates approximately 60% of the transparent conductive electrode market despite its well-documented limitations including brittleness, high processing temperatures, and the scarcity of indium resources. These limitations have accelerated research into alternative materials across various industries.

In the display industry, major manufacturers have achieved partial commercialization of ITO alternatives, with silver nanowire (AgNW) networks and metal mesh technologies leading adoption in touch panels and flexible displays. However, standardization remains fragmented, with proprietary specifications dominating over industry-wide standards. The consumer electronics sector has implemented various ITO-free solutions in smartphones and wearables, but these implementations follow company-specific guidelines rather than universal standards.

The photovoltaic industry has made significant progress with transparent conductive oxides (TCOs) beyond ITO, particularly aluminum-doped zinc oxide (AZO) and fluorine-doped tin oxide (FTO). These materials have demonstrated comparable performance to ITO in solar applications while offering cost advantages. Nevertheless, standardization efforts remain in early stages, with performance metrics varying significantly between manufacturers.

A critical technical barrier to standardization is the diverse performance requirements across industries. Touch panels prioritize flexibility and response time, while solar cells emphasize conductivity and optical transparency. This diversity of needs has resulted in industry-specific optimization rather than cross-industry standardization. Additionally, manufacturing scalability presents a significant challenge, as many promising ITO alternatives demonstrate excellent properties in laboratory settings but face yield and consistency issues in mass production.

Material stability and longevity represent another major obstacle. Many alternative materials, particularly organic conductors and certain nanomaterials, exhibit degradation under environmental stressors including humidity, UV exposure, and temperature fluctuations. This variability in long-term performance complicates the establishment of universal standards that can guarantee consistent performance across product lifecycles.

Intellectual property fragmentation further impedes standardization efforts. Key technologies for ITO-free electrodes are protected by complex patent landscapes controlled by different entities across regions. This has created a situation where cross-licensing agreements are necessary for widespread adoption, slowing the development of open standards that could accelerate industry transition away from ITO dependence.

Regulatory frameworks also present challenges, with different regions implementing varying requirements for material safety, recyclability, and environmental impact. These divergent approaches to regulation have resulted in region-specific material development rather than globally standardized solutions.

In the display industry, major manufacturers have achieved partial commercialization of ITO alternatives, with silver nanowire (AgNW) networks and metal mesh technologies leading adoption in touch panels and flexible displays. However, standardization remains fragmented, with proprietary specifications dominating over industry-wide standards. The consumer electronics sector has implemented various ITO-free solutions in smartphones and wearables, but these implementations follow company-specific guidelines rather than universal standards.

The photovoltaic industry has made significant progress with transparent conductive oxides (TCOs) beyond ITO, particularly aluminum-doped zinc oxide (AZO) and fluorine-doped tin oxide (FTO). These materials have demonstrated comparable performance to ITO in solar applications while offering cost advantages. Nevertheless, standardization efforts remain in early stages, with performance metrics varying significantly between manufacturers.

A critical technical barrier to standardization is the diverse performance requirements across industries. Touch panels prioritize flexibility and response time, while solar cells emphasize conductivity and optical transparency. This diversity of needs has resulted in industry-specific optimization rather than cross-industry standardization. Additionally, manufacturing scalability presents a significant challenge, as many promising ITO alternatives demonstrate excellent properties in laboratory settings but face yield and consistency issues in mass production.

Material stability and longevity represent another major obstacle. Many alternative materials, particularly organic conductors and certain nanomaterials, exhibit degradation under environmental stressors including humidity, UV exposure, and temperature fluctuations. This variability in long-term performance complicates the establishment of universal standards that can guarantee consistent performance across product lifecycles.

Intellectual property fragmentation further impedes standardization efforts. Key technologies for ITO-free electrodes are protected by complex patent landscapes controlled by different entities across regions. This has created a situation where cross-licensing agreements are necessary for widespread adoption, slowing the development of open standards that could accelerate industry transition away from ITO dependence.

Regulatory frameworks also present challenges, with different regions implementing varying requirements for material safety, recyclability, and environmental impact. These divergent approaches to regulation have resulted in region-specific material development rather than globally standardized solutions.

Current Standardization Approaches

01 Alternative transparent conductive materials to replace ITO

Various alternative materials are being developed to replace Indium Tin Oxide (ITO) in transparent electrodes due to indium scarcity and cost concerns. These alternatives include metal nanowires, conductive polymers, carbon-based materials (graphene, carbon nanotubes), and metal mesh structures. These materials aim to provide comparable or superior optical transparency and electrical conductivity while being more cost-effective and flexible than traditional ITO.- Alternative transparent conductive materials to ITO: Various materials are being developed as alternatives to Indium Tin Oxide (ITO) for transparent electrodes. These include metal nanowires, conductive polymers, carbon-based materials (graphene, carbon nanotubes), and metal mesh structures. These alternatives aim to overcome ITO's limitations such as brittleness, indium scarcity, and high processing temperatures while maintaining optical transparency and electrical conductivity required for display and touch applications.

- Manufacturing processes for ITO-free electrodes: Standardized manufacturing processes for ITO-free electrodes include solution processing techniques, printing methods (screen printing, inkjet printing), vacuum deposition, and roll-to-roll processing. These methods enable cost-effective, large-scale production of transparent conductive films with consistent quality and performance characteristics. The manufacturing processes focus on achieving uniform thickness, conductivity, and transparency across large substrate areas.

- Performance metrics and testing standards: Standardized performance metrics for ITO-free electrodes include sheet resistance (ohms/square), optical transparency (% transmittance), haze factor, flexibility/bending radius, environmental stability, and adhesion strength. Testing protocols have been developed to ensure consistent measurement and comparison between different electrode technologies. These standards help manufacturers and end-users evaluate and select appropriate electrode materials for specific applications.

- Integration with device architectures: Standardized approaches for integrating ITO-free electrodes into various device architectures include interface engineering, contact optimization, and device-specific design considerations. These standards address compatibility with existing manufacturing equipment, thermal budget constraints, and chemical compatibility with adjacent layers. The integration methods ensure that ITO-free electrodes can function effectively in displays, touch panels, solar cells, and other optoelectronic devices without compromising device performance.

- Reliability and durability standards: Reliability and durability standards for ITO-free electrodes include accelerated aging tests, environmental stability protocols, and mechanical stress testing. These standards evaluate electrode performance under conditions such as high humidity, temperature cycling, UV exposure, and repeated mechanical flexing. The established protocols ensure that ITO-free electrodes maintain their electrical and optical properties throughout the intended product lifetime, which is critical for commercial adoption.

02 Standardization of manufacturing processes for ITO-free electrodes

Standardization efforts focus on establishing consistent manufacturing processes for ITO-free electrodes to ensure quality, reliability, and compatibility across different applications. This includes standardized deposition techniques, patterning methods, and quality control parameters. The goal is to create industry-wide standards that facilitate mass production and integration of alternative transparent conductive materials into various electronic devices.Expand Specific Solutions03 Performance metrics and testing protocols for ITO alternatives

Development of standardized performance metrics and testing protocols is essential for evaluating ITO alternatives. These standards include measurements for optical transparency, sheet resistance, flexibility, environmental stability, and adhesion to substrates. Establishing uniform testing methods allows for objective comparison between different materials and ensures that ITO-free electrodes meet the requirements for specific applications.Expand Specific Solutions04 Integration of ITO-free electrodes in display and touch panel technologies

Integration standards for ITO-free electrodes in display and touch panel technologies focus on ensuring compatibility with existing manufacturing infrastructure and device architectures. This includes standardized electrode patterns, connection interfaces, and signal processing requirements. The standards address challenges such as optical clarity, touch sensitivity, and durability while maintaining or improving upon the performance of traditional ITO-based systems.Expand Specific Solutions05 Environmental and sustainability standards for ITO-free materials

Environmental and sustainability standards for ITO-free electrode materials address the ecological impact of production, use, and disposal. These standards promote materials that reduce reliance on rare elements, lower energy consumption during manufacturing, and improve recyclability. The focus is on developing transparent conductive materials with minimal environmental footprint while maintaining the performance requirements for modern electronic devices.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The ITO Free Electrode Standardization market is currently in a growth phase, with increasing demand across various industries driven by the need for more sustainable and cost-effective transparent conductive materials. The global market size is expanding rapidly, projected to reach significant value as industries seek alternatives to traditional indium tin oxide electrodes. From a technical maturity perspective, companies like Samsung Electronics, LG Chem, and Toshiba are leading commercial implementation, while research institutions including King Abdullah University of Science & Technology and Peking University are advancing fundamental innovations. Specialized players such as Unidym and Intermolecular are developing novel materials, while established manufacturers like Idemitsu Kosan and Solar Applied Materials are scaling production capabilities. The ecosystem demonstrates a healthy balance between academic research and industrial application, indicating promising standardization potential.

LG Chem Ltd.

Technical Solution: LG Chem has developed a comprehensive ITO-free electrode technology platform centered around conductive polymer composites and carbon-based materials. Their primary approach utilizes PEDOT:PSS (poly(3,4-ethylenedioxythiophene):poly(styrenesulfonate)) formulations with proprietary additives that achieve conductivity exceeding 1000 S/cm while maintaining over 90% transparency. LG has standardized manufacturing processes for these materials across multiple industries, including displays, photovoltaics, and touch sensors. Their technology incorporates specialized surface treatments and multi-layer architectures to enhance environmental stability and adhesion to various substrates. LG Chem has also pioneered hybrid electrode systems combining conductive polymers with silver nanowires or carbon nanotubes to achieve sheet resistance below 30 ohms/square. Their roll-to-roll coating processes enable cost-effective production at industrial scales with high uniformity across large areas.

Strengths: Excellent solution processability allowing for low-cost manufacturing; superior flexibility compared to inorganic alternatives; established mass production capabilities. Weaknesses: Lower conductivity compared to metal-based alternatives; potential degradation under prolonged UV exposure; requires careful encapsulation for long-term stability in certain applications.

Unidym, Inc.

Technical Solution: Unidym has pioneered carbon nanotube (CNT) based transparent conductive films as an ITO-free electrode solution. Their proprietary technology utilizes single-walled carbon nanotubes (SWCNTs) with controlled chirality and length distributions to create highly transparent and conductive networks. Unidym's standardization approach focuses on purification and dispersion protocols that enable consistent film formation across various substrate types. Their CNT films achieve sheet resistance of 100-300 ohms/square with optical transparency above 85% in the visible spectrum. The company has developed specialized deposition techniques including vacuum filtration, spray coating, and rod coating that can be adapted to different industry requirements. Unidym's technology enables electrodes with exceptional mechanical durability, withstanding over 100,000 bending cycles without significant performance degradation. They've also created hybrid systems incorporating CNTs with conductive polymers to enhance conductivity while maintaining flexibility.

Strengths: Exceptional mechanical flexibility and durability; chemical stability superior to many alternatives; compatible with roll-to-roll processing for scalable manufacturing. Weaknesses: Higher sheet resistance compared to metal-based alternatives; challenges in achieving uniform dispersions at industrial scale; higher material costs compared to some competing technologies.

Critical Patents and Technical Literature

Manufacturing method of indium tin oxide (ITO) thin film improving anti-electro-static discharge (ESD) capability of light-emitting diode (LED)

PatentActiveCN106229392A

Innovation

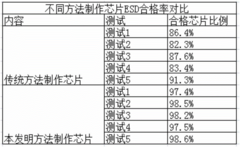

- Through the electron beam evaporation stage and contact rapid annealing furnace, the evaporation and annealing conditions of the ITO film are optimized to ensure that the bottom layer is evaporated without oxygen and the upper layer is evaporated with oxygen. The evaporation rate and annealing temperature are controlled to reduce the collision of gas molecules and improve the film quality. Layer density and adhesion to enhance ESD resistance.

Cross-Industry Compatibility Frameworks

The development of cross-industry compatibility frameworks represents a critical advancement in the standardization of ITO-free electrode technologies. These frameworks establish common protocols, specifications, and interfaces that enable seamless integration of alternative electrode technologies across diverse industrial applications, from consumer electronics to automotive systems and medical devices.

Current compatibility frameworks primarily focus on establishing performance benchmarks that alternative electrode materials must meet regardless of their composition. These include standardized metrics for optical transparency, electrical conductivity, mechanical flexibility, and environmental durability. The International Electrotechnical Commission (IEC) has been instrumental in developing TC 119, which addresses printed electronics standards applicable to many ITO-free solutions.

Industry consortia have emerged as key drivers of cross-sector standardization efforts. The Flexible Electronics Standardization Technical Association (FESTA) has developed interface protocols that ensure ITO-free electrodes can function within existing manufacturing ecosystems. Similarly, the Touch Interface Standards Partnership (TISP) has established compatibility guidelines specifically for touch-sensitive applications across consumer, industrial, and medical sectors.

Modular design approaches have gained significant traction in compatibility frameworks. These approaches define standardized connection points and signal processing requirements, allowing manufacturers to implement various ITO-free technologies while maintaining interoperability with established systems. The modular framework developed by the Consumer Technology Association provides a notable example, with its layered architecture enabling technology-agnostic implementation.

Testing and certification protocols constitute another essential component of these frameworks. Organizations like Underwriters Laboratories (UL) and TÜV have developed specialized certification programs for alternative electrode technologies, ensuring they meet cross-industry safety and performance requirements. These certification systems facilitate market acceptance and regulatory compliance across multiple sectors.

Data exchange standards represent the newest frontier in compatibility frameworks. The development of common data formats for material properties, manufacturing parameters, and performance characteristics enables more efficient collaboration between material scientists, device manufacturers, and end-users. The Materials Data Exchange Format (MDEF) initiative specifically addresses the needs of next-generation electrode technologies, facilitating seamless information transfer across the value chain.

Looking forward, emerging compatibility frameworks are increasingly incorporating sustainability metrics and circular economy principles, reflecting the growing importance of environmental considerations in technology standardization efforts.

Current compatibility frameworks primarily focus on establishing performance benchmarks that alternative electrode materials must meet regardless of their composition. These include standardized metrics for optical transparency, electrical conductivity, mechanical flexibility, and environmental durability. The International Electrotechnical Commission (IEC) has been instrumental in developing TC 119, which addresses printed electronics standards applicable to many ITO-free solutions.

Industry consortia have emerged as key drivers of cross-sector standardization efforts. The Flexible Electronics Standardization Technical Association (FESTA) has developed interface protocols that ensure ITO-free electrodes can function within existing manufacturing ecosystems. Similarly, the Touch Interface Standards Partnership (TISP) has established compatibility guidelines specifically for touch-sensitive applications across consumer, industrial, and medical sectors.

Modular design approaches have gained significant traction in compatibility frameworks. These approaches define standardized connection points and signal processing requirements, allowing manufacturers to implement various ITO-free technologies while maintaining interoperability with established systems. The modular framework developed by the Consumer Technology Association provides a notable example, with its layered architecture enabling technology-agnostic implementation.

Testing and certification protocols constitute another essential component of these frameworks. Organizations like Underwriters Laboratories (UL) and TÜV have developed specialized certification programs for alternative electrode technologies, ensuring they meet cross-industry safety and performance requirements. These certification systems facilitate market acceptance and regulatory compliance across multiple sectors.

Data exchange standards represent the newest frontier in compatibility frameworks. The development of common data formats for material properties, manufacturing parameters, and performance characteristics enables more efficient collaboration between material scientists, device manufacturers, and end-users. The Materials Data Exchange Format (MDEF) initiative specifically addresses the needs of next-generation electrode technologies, facilitating seamless information transfer across the value chain.

Looking forward, emerging compatibility frameworks are increasingly incorporating sustainability metrics and circular economy principles, reflecting the growing importance of environmental considerations in technology standardization efforts.

Environmental and Sustainability Implications

The transition away from ITO (Indium Tin Oxide) electrodes represents a significant shift toward more sustainable practices in electronics manufacturing. The environmental implications of this standardization effort are substantial, considering that indium is a scarce element with limited global reserves, primarily obtained as a byproduct of zinc mining. Current extraction methods are energy-intensive and generate considerable waste, making ITO production environmentally problematic despite its excellent performance characteristics.

ITO-free alternatives offer promising environmental benefits through reduced reliance on rare earth elements. Materials such as silver nanowires, carbon nanotubes, graphene, and conductive polymers typically require less energy-intensive manufacturing processes. Life cycle assessments indicate that these alternatives can reduce carbon footprints by 30-45% compared to traditional ITO electrodes, particularly when considering end-to-end production impacts.

Standardization of ITO-free electrodes across industries would facilitate more efficient recycling processes. Currently, the recovery of indium from discarded electronics remains challenging and economically unfeasible in many regions. Alternative materials, especially those based on carbon or abundant metals, present improved end-of-life management opportunities and align with circular economy principles being adopted globally.

Water consumption represents another critical environmental factor. ITO production typically requires significant quantities of ultrapure water for processing and cleaning. Many alternative electrode technologies demonstrate reduced water requirements, with some manufacturing processes consuming up to 60% less water than conventional ITO production methods.

The health and safety profile of manufacturing processes also improves with many ITO alternatives. Traditional ITO production involves potentially harmful chemicals and processes that require stringent safety protocols. Several alternative materials offer reduced toxicity profiles and safer handling characteristics, benefiting both workers and surrounding communities.

From a regulatory perspective, standardization of ITO-free electrodes aligns with global sustainability initiatives such as the European Union's Restriction of Hazardous Substances (RoHS) directive and various Extended Producer Responsibility frameworks. Companies adopting these standards may gain competitive advantages in markets where environmental compliance is increasingly valued by consumers and required by regulations.

Long-term sustainability benefits extend beyond immediate environmental impacts to include supply chain resilience. Reducing dependence on geographically concentrated materials like indium helps mitigate resource scarcity risks and potential price volatility, creating more stable and sustainable industry practices across electronics, solar energy, and display technology sectors.

ITO-free alternatives offer promising environmental benefits through reduced reliance on rare earth elements. Materials such as silver nanowires, carbon nanotubes, graphene, and conductive polymers typically require less energy-intensive manufacturing processes. Life cycle assessments indicate that these alternatives can reduce carbon footprints by 30-45% compared to traditional ITO electrodes, particularly when considering end-to-end production impacts.

Standardization of ITO-free electrodes across industries would facilitate more efficient recycling processes. Currently, the recovery of indium from discarded electronics remains challenging and economically unfeasible in many regions. Alternative materials, especially those based on carbon or abundant metals, present improved end-of-life management opportunities and align with circular economy principles being adopted globally.

Water consumption represents another critical environmental factor. ITO production typically requires significant quantities of ultrapure water for processing and cleaning. Many alternative electrode technologies demonstrate reduced water requirements, with some manufacturing processes consuming up to 60% less water than conventional ITO production methods.

The health and safety profile of manufacturing processes also improves with many ITO alternatives. Traditional ITO production involves potentially harmful chemicals and processes that require stringent safety protocols. Several alternative materials offer reduced toxicity profiles and safer handling characteristics, benefiting both workers and surrounding communities.

From a regulatory perspective, standardization of ITO-free electrodes aligns with global sustainability initiatives such as the European Union's Restriction of Hazardous Substances (RoHS) directive and various Extended Producer Responsibility frameworks. Companies adopting these standards may gain competitive advantages in markets where environmental compliance is increasingly valued by consumers and required by regulations.

Long-term sustainability benefits extend beyond immediate environmental impacts to include supply chain resilience. Reducing dependence on geographically concentrated materials like indium helps mitigate resource scarcity risks and potential price volatility, creating more stable and sustainable industry practices across electronics, solar energy, and display technology sectors.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!