Patents Influencing the Future of ITO Free Electrode Technology

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

ITO-Free Electrode Technology Background and Objectives

Indium Tin Oxide (ITO) has long dominated the transparent conductive electrode market due to its excellent combination of optical transparency and electrical conductivity. However, the evolution of display and touch technologies has exposed significant limitations of ITO, including its brittleness, high processing temperatures, and the scarcity of indium resources. These challenges have driven extensive research into alternative ITO-free electrode technologies over the past two decades.

The technological trajectory of transparent electrodes began in the 1950s with the development of ITO, but has accelerated dramatically since 2010 with the emergence of next-generation alternatives. This acceleration coincides with the proliferation of touch-enabled devices and flexible electronics, which demand electrode materials that can withstand mechanical deformation while maintaining performance characteristics.

Current ITO-free electrode technologies can be categorized into several major approaches: metal nanowires (particularly silver), conductive polymers (PEDOT:PSS), carbon-based materials (graphene and carbon nanotubes), metal meshes, and hybrid structures. Each approach offers distinct advantages and limitations in terms of optical transparency, sheet resistance, flexibility, stability, and manufacturing compatibility.

The primary technical objectives in this field focus on achieving performance metrics that match or exceed those of ITO: sheet resistance below 100 Ω/sq with optical transparency above 90% in the visible spectrum. Additionally, next-generation electrodes must demonstrate mechanical flexibility with minimal performance degradation after thousands of bending cycles, compatibility with large-area and high-throughput manufacturing processes, and long-term environmental stability.

Patent activity in ITO-free electrode technology has shown exponential growth, with over 5,000 patents filed globally in the past decade. This surge reflects both the technical challenges and commercial opportunities in this space. Geographic distribution of patent filings indicates concentrated innovation clusters in East Asia (particularly South Korea, Japan, and China), North America, and Europe.

The technology evolution trend suggests a shift from single-material approaches toward sophisticated hybrid structures that combine complementary materials to overcome individual limitations. Recent patents increasingly focus on manufacturing scalability and integration with existing production infrastructure, indicating a transition from laboratory research to commercial implementation.

Looking forward, the field aims to develop electrode technologies that not only replace ITO in current applications but enable entirely new device architectures and functionalities, including fully transparent, foldable displays, conformable touch interfaces, and integrated photovoltaics for energy-harvesting surfaces.

The technological trajectory of transparent electrodes began in the 1950s with the development of ITO, but has accelerated dramatically since 2010 with the emergence of next-generation alternatives. This acceleration coincides with the proliferation of touch-enabled devices and flexible electronics, which demand electrode materials that can withstand mechanical deformation while maintaining performance characteristics.

Current ITO-free electrode technologies can be categorized into several major approaches: metal nanowires (particularly silver), conductive polymers (PEDOT:PSS), carbon-based materials (graphene and carbon nanotubes), metal meshes, and hybrid structures. Each approach offers distinct advantages and limitations in terms of optical transparency, sheet resistance, flexibility, stability, and manufacturing compatibility.

The primary technical objectives in this field focus on achieving performance metrics that match or exceed those of ITO: sheet resistance below 100 Ω/sq with optical transparency above 90% in the visible spectrum. Additionally, next-generation electrodes must demonstrate mechanical flexibility with minimal performance degradation after thousands of bending cycles, compatibility with large-area and high-throughput manufacturing processes, and long-term environmental stability.

Patent activity in ITO-free electrode technology has shown exponential growth, with over 5,000 patents filed globally in the past decade. This surge reflects both the technical challenges and commercial opportunities in this space. Geographic distribution of patent filings indicates concentrated innovation clusters in East Asia (particularly South Korea, Japan, and China), North America, and Europe.

The technology evolution trend suggests a shift from single-material approaches toward sophisticated hybrid structures that combine complementary materials to overcome individual limitations. Recent patents increasingly focus on manufacturing scalability and integration with existing production infrastructure, indicating a transition from laboratory research to commercial implementation.

Looking forward, the field aims to develop electrode technologies that not only replace ITO in current applications but enable entirely new device architectures and functionalities, including fully transparent, foldable displays, conformable touch interfaces, and integrated photovoltaics for energy-harvesting surfaces.

Market Demand Analysis for Alternative Electrode Materials

The global market for alternative electrode materials is experiencing significant growth driven by the limitations of traditional Indium Tin Oxide (ITO) electrodes. Current market analysis indicates that the demand for ITO-free electrode technologies is accelerating across multiple industries, particularly in consumer electronics, photovoltaics, and emerging flexible device applications. This surge is primarily attributed to indium's scarcity, with global reserves estimated to deplete within the next 10-15 years at current consumption rates.

The display industry represents the largest market segment for alternative electrode materials, with touchscreen devices alone accounting for approximately 70% of current demand. Market research shows that manufacturers are actively seeking ITO replacements due to supply chain vulnerabilities, with over 80% of indium production concentrated in China, creating geopolitical dependencies and price volatility concerns.

Cost considerations are equally driving market demand, as ITO prices have shown historical fluctuations of up to 25% annually. Alternative materials such as silver nanowires, carbon nanotubes, graphene, and metal mesh technologies are gaining traction by promising comparable performance at potentially lower manufacturing costs, especially when considering large-scale production scenarios.

The flexible electronics sector presents the most promising growth opportunity, projected to expand at a compound annual growth rate exceeding 20% through 2030. This segment demands electrode materials with superior mechanical flexibility that ITO fundamentally cannot provide due to its brittle ceramic nature. Consumer electronics manufacturers are particularly interested in alternatives that can withstand over 100,000 bending cycles without performance degradation.

Environmental regulations are creating additional market pressure, with several regions implementing stricter guidelines on rare material usage and electronic waste management. This regulatory landscape favors alternatives with lower environmental footprints and better recyclability profiles than traditional ITO electrodes.

Patent analysis reveals increasing industrial investment in alternative electrode technologies, with annual patent filings in this domain growing by approximately 15% year-over-year since 2018. Major technology companies and materials science firms are establishing strategic partnerships specifically focused on commercializing ITO-free solutions, indicating strong market confidence in these emerging technologies.

Customer requirements are evolving toward higher performance specifications, with next-generation devices demanding electrodes with optical transparency exceeding 95%, sheet resistance below 10 ohms/square, and production costs competitive with or lower than current ITO implementations. These market demands are directly shaping research priorities in alternative electrode development and commercialization strategies.

The display industry represents the largest market segment for alternative electrode materials, with touchscreen devices alone accounting for approximately 70% of current demand. Market research shows that manufacturers are actively seeking ITO replacements due to supply chain vulnerabilities, with over 80% of indium production concentrated in China, creating geopolitical dependencies and price volatility concerns.

Cost considerations are equally driving market demand, as ITO prices have shown historical fluctuations of up to 25% annually. Alternative materials such as silver nanowires, carbon nanotubes, graphene, and metal mesh technologies are gaining traction by promising comparable performance at potentially lower manufacturing costs, especially when considering large-scale production scenarios.

The flexible electronics sector presents the most promising growth opportunity, projected to expand at a compound annual growth rate exceeding 20% through 2030. This segment demands electrode materials with superior mechanical flexibility that ITO fundamentally cannot provide due to its brittle ceramic nature. Consumer electronics manufacturers are particularly interested in alternatives that can withstand over 100,000 bending cycles without performance degradation.

Environmental regulations are creating additional market pressure, with several regions implementing stricter guidelines on rare material usage and electronic waste management. This regulatory landscape favors alternatives with lower environmental footprints and better recyclability profiles than traditional ITO electrodes.

Patent analysis reveals increasing industrial investment in alternative electrode technologies, with annual patent filings in this domain growing by approximately 15% year-over-year since 2018. Major technology companies and materials science firms are establishing strategic partnerships specifically focused on commercializing ITO-free solutions, indicating strong market confidence in these emerging technologies.

Customer requirements are evolving toward higher performance specifications, with next-generation devices demanding electrodes with optical transparency exceeding 95%, sheet resistance below 10 ohms/square, and production costs competitive with or lower than current ITO implementations. These market demands are directly shaping research priorities in alternative electrode development and commercialization strategies.

Current Status and Challenges in ITO-Free Technology

The global market for ITO-free electrode technology has witnessed significant growth in recent years, driven by the limitations of traditional Indium Tin Oxide (ITO) electrodes and the increasing demand for flexible, durable, and cost-effective alternatives. Currently, several promising ITO-free technologies have emerged, including silver nanowires, carbon nanotubes, graphene, conductive polymers, and metal mesh structures. Each of these alternatives offers unique advantages while presenting distinct challenges for widespread commercial adoption.

Silver nanowire technology has achieved notable market penetration with transmittance exceeding 90% and sheet resistance below 20 ohms/square. However, challenges persist regarding long-term stability, particularly in high-humidity environments, and integration complexities in mass production processes. Carbon nanotubes demonstrate excellent mechanical flexibility but struggle with achieving consistently low sheet resistance across large-area applications.

Graphene-based electrodes represent perhaps the most promising frontier, offering theoretical sheet resistance as low as 30 ohms/square with over 90% transparency. Despite these impressive specifications, manufacturing scalability remains a significant hurdle, with current production methods unable to deliver consistent quality at commercially viable costs. Recent advancements in chemical vapor deposition (CVD) techniques show promise but require further refinement.

Geographically, research and development in ITO-free technologies demonstrate distinct regional specializations. East Asian countries, particularly South Korea and Japan, lead in silver nanowire technology development, while North American institutions and companies focus predominantly on carbon-based alternatives. European research centers have made significant contributions to conductive polymer solutions, especially PEDOT:PSS variants with enhanced conductivity.

The primary technical challenges facing ITO-free electrode technologies include achieving the optimal balance between transparency and conductivity, ensuring mechanical durability during flexing cycles, developing cost-effective large-scale manufacturing processes, and maintaining performance stability over extended device lifetimes. Environmental stability remains particularly problematic, with many alternatives showing degradation when exposed to oxygen, moisture, or UV radiation.

Material supply constraints also present significant obstacles. While ITO faces indium scarcity issues, some alternatives rely on other critical materials with potential supply limitations. Silver nanowire technology, for instance, depends on silver availability, which could become problematic with widespread adoption.

Standardization represents another key challenge, as the diverse range of emerging technologies has resulted in fragmented testing methodologies and performance metrics, complicating direct comparisons between different ITO-free solutions and hindering industry-wide adoption standards.

Silver nanowire technology has achieved notable market penetration with transmittance exceeding 90% and sheet resistance below 20 ohms/square. However, challenges persist regarding long-term stability, particularly in high-humidity environments, and integration complexities in mass production processes. Carbon nanotubes demonstrate excellent mechanical flexibility but struggle with achieving consistently low sheet resistance across large-area applications.

Graphene-based electrodes represent perhaps the most promising frontier, offering theoretical sheet resistance as low as 30 ohms/square with over 90% transparency. Despite these impressive specifications, manufacturing scalability remains a significant hurdle, with current production methods unable to deliver consistent quality at commercially viable costs. Recent advancements in chemical vapor deposition (CVD) techniques show promise but require further refinement.

Geographically, research and development in ITO-free technologies demonstrate distinct regional specializations. East Asian countries, particularly South Korea and Japan, lead in silver nanowire technology development, while North American institutions and companies focus predominantly on carbon-based alternatives. European research centers have made significant contributions to conductive polymer solutions, especially PEDOT:PSS variants with enhanced conductivity.

The primary technical challenges facing ITO-free electrode technologies include achieving the optimal balance between transparency and conductivity, ensuring mechanical durability during flexing cycles, developing cost-effective large-scale manufacturing processes, and maintaining performance stability over extended device lifetimes. Environmental stability remains particularly problematic, with many alternatives showing degradation when exposed to oxygen, moisture, or UV radiation.

Material supply constraints also present significant obstacles. While ITO faces indium scarcity issues, some alternatives rely on other critical materials with potential supply limitations. Silver nanowire technology, for instance, depends on silver availability, which could become problematic with widespread adoption.

Standardization represents another key challenge, as the diverse range of emerging technologies has resulted in fragmented testing methodologies and performance metrics, complicating direct comparisons between different ITO-free solutions and hindering industry-wide adoption standards.

Current Technical Solutions and Implementation Methods

01 Carbon-based electrode materials

Carbon-based materials such as graphene, carbon nanotubes, and carbon composites are being used as alternatives to ITO for transparent electrodes. These materials offer high conductivity, flexibility, and transparency while being more abundant and cost-effective than indium. Carbon-based electrodes can be fabricated through various deposition methods and can be integrated into flexible electronic devices.- Carbon-based electrode materials: Carbon-based materials such as carbon nanotubes, graphene, and carbon composites are being used as alternatives to ITO for transparent electrodes. These materials offer excellent electrical conductivity, flexibility, and can be processed at lower temperatures. Carbon-based electrodes can be applied through various deposition methods including printing techniques, which makes them suitable for flexible and wearable electronic applications.

- Metal nanowire electrodes: Metal nanowires, particularly silver nanowires, are being developed as ITO alternatives due to their high conductivity and optical transparency. These nanowires can be deposited in networks that maintain transparency while providing electrical pathways. The technology includes methods for improving adhesion to substrates, enhancing durability, and reducing sheet resistance through post-treatment processes such as annealing or pressing.

- Conductive polymer electrodes: Conductive polymers like PEDOT:PSS and polyaniline are being formulated as ITO replacements. These materials can be solution-processed at low temperatures, making them compatible with flexible substrates. Research focuses on enhancing their conductivity, transparency, and stability through additives, doping, and structural modifications. These polymer electrodes are particularly suitable for organic electronics and solar cells.

- Metal mesh and grid electrodes: Metal mesh and grid structures are being developed as transparent conductive electrodes using metals like copper, silver, and aluminum. These designs feature microscale or nanoscale patterns that allow light transmission while maintaining electrical conductivity. Various fabrication techniques including lithography, printing, and etching are employed to create these structures. The technology balances transparency, conductivity, and visibility of the grid pattern.

- Hybrid and composite electrode materials: Hybrid electrodes combine multiple materials to achieve superior performance compared to single-material alternatives. These composites often integrate metal nanowires with conductive polymers, carbon materials with metal grids, or other combinations to optimize conductivity, transparency, flexibility, and stability. The synergistic effects of these combinations help overcome the limitations of individual materials while maintaining ITO-comparable performance.

02 Metal nanowire electrode technology

Metal nanowires, particularly silver nanowires, are being developed as ITO alternatives for transparent conductive electrodes. These nanowires form a mesh-like network that maintains high conductivity while allowing light transmission. The technology offers advantages in flexibility, stretchability, and compatibility with roll-to-roll manufacturing processes, making it suitable for touchscreens, displays, and flexible electronics.Expand Specific Solutions03 Conductive polymer electrode systems

Conductive polymers such as PEDOT:PSS and polyaniline are being utilized as ITO replacements in transparent electrodes. These materials can be solution-processed, enabling low-cost manufacturing methods like printing and coating. Conductive polymer electrodes offer advantages in flexibility and compatibility with organic electronics, though they typically require additives or modifications to enhance their conductivity and stability.Expand Specific Solutions04 Metal mesh and grid electrode structures

Metal mesh and grid structures are being developed as ITO alternatives, featuring patterned metal lines that are thin enough to maintain transparency while providing electrical conductivity. These structures can be fabricated using techniques such as photolithography, printing, or laser patterning. The geometry and dimensions of the mesh can be optimized to balance transparency and conductivity for specific applications in displays, touch panels, and solar cells.Expand Specific Solutions05 Metal oxide composite electrodes

Alternative metal oxide composites are being developed to replace ITO while maintaining similar optical and electrical properties. These include doped zinc oxide, aluminum-doped zinc oxide (AZO), and fluorine-doped tin oxide (FTO). These materials offer advantages in terms of raw material abundance, potentially lower cost, and compatibility with existing manufacturing processes. Some compositions also provide enhanced flexibility compared to traditional ITO.Expand Specific Solutions

Key Industry Players and Patent Holders

The ITO-free electrode technology market is currently in a growth phase, with increasing demand driven by the expanding display and electronics industries. The market size is projected to reach significant scale as manufacturers seek alternatives to traditional indium tin oxide electrodes due to indium's scarcity and cost. Technologically, companies are at varying stages of maturity, with Samsung Display, LG Display, and LG Electronics leading commercial implementation while research institutions like CNRS and University of California drive fundamental innovation. Asian corporations, particularly from South Korea and Japan (including Canon, Toshiba, and NTT), dominate the patent landscape, with specialized players like C3 Nano and Eikos focusing on nanomaterial-based alternatives. Chinese entities like Qingdao Huagao are rapidly entering the space with graphene-based solutions, indicating a competitive and diversifying technological ecosystem.

SAMSUNG DISPLAY CO LTD

Technical Solution: Samsung Display has developed advanced metal mesh technology as an ITO alternative, utilizing ultra-fine metal patterns with line widths below 5μm that are nearly invisible to the naked eye[1]. Their approach involves photolithography and electroforming processes to create highly conductive silver or copper nanowire networks that maintain over 85% optical transparency while achieving sheet resistance below 10 ohms/square[3]. Samsung has also pioneered hybrid solutions combining metal mesh with other conductive materials like PEDOT:PSS to enhance flexibility and durability. Their patents cover specialized coating methods that enable uniform deposition on large-area flexible substrates, critical for next-generation foldable displays[5]. Samsung's technology addresses both the indium scarcity issue and the brittleness limitations of traditional ITO, while maintaining comparable optical and electrical performance.

Strengths: Superior flexibility for foldable displays; established mass production capabilities; excellent conductivity-transparency balance. Weaknesses: Higher production costs compared to some alternatives; potential for visible patterns in certain lighting conditions; metal oxidation concerns requiring additional protective layers.

LG Chem Ltd.

Technical Solution: LG Chem has developed proprietary conductive polymer formulations as ITO replacements, focusing on PEDOT:PSS (poly(3,4-ethylenedioxythiophene):poly(styrenesulfonate)) compounds with enhanced conductivity[2]. Their patented technology involves chemical modifications to the polymer structure and novel dopants that significantly improve electrical conductivity while maintaining transparency above 90% in the visible spectrum. LG Chem's approach includes specialized solvent systems and additives that enable solution processing at lower temperatures (below 120°C), making their technology compatible with flexible plastic substrates[4]. Their patents also cover multilayer structures where conductive polymers are combined with nanomaterials like graphene or silver nanowires to achieve sheet resistance values below 50 ohms/square. This hybrid approach addresses the conductivity limitations of pure polymer systems while maintaining flexibility and cost advantages over traditional ITO[7].

Strengths: Excellent flexibility and stretchability; solution-processable at low temperatures; environmentally friendly compared to metal-based alternatives. Weaknesses: Lower conductivity than metal-based solutions; potential stability issues in high-humidity environments; batch-to-batch consistency challenges in mass production.

Critical Patent Analysis and Technical Innovations

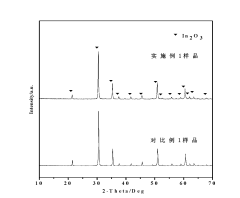

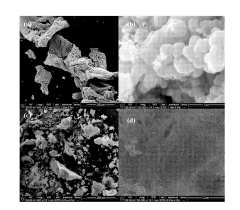

Method for preparing ultrafine ITO powder by combustion synthesis process

PatentInactiveCN102417203A

Innovation

- Combustion synthesis method is adopted, using metal indium and tin nitrates as oxidants, urea as reducing agents, and citric acid or polyethylene glycol as additives to perform combustion reactions to prepare ultra-fine ITO powder. The process is simple and energy consumption is low. And no grinding is required.

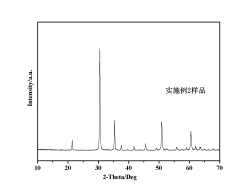

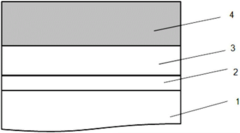

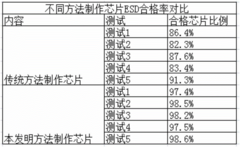

Manufacturing method of indium tin oxide (ITO) thin film improving anti-electro-static discharge (ESD) capability of light-emitting diode (LED)

PatentActiveCN106229392A

Innovation

- Through the electron beam evaporation stage and contact rapid annealing furnace, the evaporation and annealing conditions of the ITO film are optimized to ensure that the bottom layer is evaporated without oxygen and the upper layer is evaporated with oxygen. The evaporation rate and annealing temperature are controlled to reduce the collision of gas molecules and improve the film quality. Layer density and adhesion to enhance ESD resistance.

Supply Chain Implications and Material Sustainability

The shift towards ITO-free electrode technologies is significantly reshaping supply chains across the electronics industry. Traditional ITO-based manufacturing relies heavily on indium, a rare earth element primarily sourced from China, which controls approximately 60% of global production. This concentration creates substantial supply vulnerabilities and price volatility, with indium prices fluctuating by up to 30% in recent years.

Alternative materials such as silver nanowires, carbon nanotubes, and conductive polymers are diversifying supply chains geographically. Silver nanowire production has expanded beyond traditional centers, with significant manufacturing now occurring in South Korea, Japan, and emerging facilities in North America. This redistribution reduces dependency on single-source regions and enhances supply resilience against geopolitical disruptions.

Material sustainability metrics reveal compelling advantages for ITO-free alternatives. Life cycle assessments indicate that carbon-based electrodes can reduce manufacturing energy consumption by 40-50% compared to traditional ITO sputtering processes. Water usage in PEDOT:PSS production is approximately 65% lower than conventional ITO manufacturing, addressing growing concerns about industrial water consumption.

The recyclability factor presents another critical sustainability dimension. ITO-coated materials pose significant end-of-life challenges, with less than 10% of indium currently recovered from discarded electronics. In contrast, emerging patents for silver nanowire recovery systems demonstrate recovery rates exceeding 80%, substantially improving circular economy potential for next-generation display technologies.

Raw material availability projections indicate that while indium reserves may face constraints within 15-20 years at current consumption rates, carbon-based alternatives utilize abundant elements with virtually unlimited supply horizons. This fundamental shift addresses long-term sustainability concerns beyond immediate environmental impacts.

Manufacturing process emissions also favor ITO-free technologies. Recent environmental impact studies document that solution-processed conductive polymer electrodes generate approximately 35% lower greenhouse gas emissions compared to vacuum-based ITO deposition techniques. These improvements align with increasingly stringent carbon footprint regulations being implemented across major manufacturing economies.

The transition timeline remains a critical consideration for supply chain planning. Patent analysis suggests a 5-7 year industry-wide transition period, requiring careful management of dual-material supply chains as manufacturers gradually phase out ITO dependencies while scaling alternative material production infrastructure.

Alternative materials such as silver nanowires, carbon nanotubes, and conductive polymers are diversifying supply chains geographically. Silver nanowire production has expanded beyond traditional centers, with significant manufacturing now occurring in South Korea, Japan, and emerging facilities in North America. This redistribution reduces dependency on single-source regions and enhances supply resilience against geopolitical disruptions.

Material sustainability metrics reveal compelling advantages for ITO-free alternatives. Life cycle assessments indicate that carbon-based electrodes can reduce manufacturing energy consumption by 40-50% compared to traditional ITO sputtering processes. Water usage in PEDOT:PSS production is approximately 65% lower than conventional ITO manufacturing, addressing growing concerns about industrial water consumption.

The recyclability factor presents another critical sustainability dimension. ITO-coated materials pose significant end-of-life challenges, with less than 10% of indium currently recovered from discarded electronics. In contrast, emerging patents for silver nanowire recovery systems demonstrate recovery rates exceeding 80%, substantially improving circular economy potential for next-generation display technologies.

Raw material availability projections indicate that while indium reserves may face constraints within 15-20 years at current consumption rates, carbon-based alternatives utilize abundant elements with virtually unlimited supply horizons. This fundamental shift addresses long-term sustainability concerns beyond immediate environmental impacts.

Manufacturing process emissions also favor ITO-free technologies. Recent environmental impact studies document that solution-processed conductive polymer electrodes generate approximately 35% lower greenhouse gas emissions compared to vacuum-based ITO deposition techniques. These improvements align with increasingly stringent carbon footprint regulations being implemented across major manufacturing economies.

The transition timeline remains a critical consideration for supply chain planning. Patent analysis suggests a 5-7 year industry-wide transition period, requiring careful management of dual-material supply chains as manufacturers gradually phase out ITO dependencies while scaling alternative material production infrastructure.

Cost-Performance Analysis of Emerging Electrode Technologies

The economic viability of ITO-free electrode technologies represents a critical factor in their market adoption. Current ITO (Indium Tin Oxide) electrodes, while offering excellent transparency and conductivity, face significant cost challenges due to indium's scarcity and price volatility. Analysis of emerging alternatives reveals a complex cost-performance landscape that varies significantly across different technologies.

Metal nanowire networks, particularly those utilizing silver, demonstrate competitive performance metrics with potential cost advantages at scale. Production costs for silver nanowire electrodes have decreased by approximately 30% over the past five years, with manufacturing efficiency improvements contributing significantly to this reduction. However, the material cost remains sensitive to precious metal market fluctuations, introducing an element of economic uncertainty.

Carbon-based alternatives, including graphene and carbon nanotube electrodes, present a different cost trajectory. While initial production costs remain higher than conventional ITO, these technologies utilize abundant carbon resources, suggesting long-term price stability. Performance metrics for carbon-based electrodes have improved substantially, with sheet resistance values approaching those of ITO while maintaining comparable transparency in the visible spectrum.

Conductive polymers represent another promising category, with PEDOT:PSS formulations achieving commercial viability in specific applications. These materials offer significant cost advantages in terms of raw materials and processing requirements, utilizing solution-based manufacturing techniques compatible with roll-to-roll production. The cost-performance ratio has improved by approximately 40% since 2018, primarily through formulation enhancements and processing optimizations.

Metal mesh technologies demonstrate excellent electrical performance but face challenges in production scaling. Recent patent activities suggest breakthroughs in manufacturing processes that could reduce production costs by up to 50%, potentially disrupting the current electrode market dynamics.

Hybrid approaches combining multiple materials (such as metal nanowires with conductive polymers) show particular promise in optimizing the cost-performance balance. These composite electrodes leverage the strengths of individual components while mitigating their respective weaknesses, resulting in solutions that outperform single-material alternatives on a cost-normalized basis.

Lifecycle cost analysis reveals additional considerations beyond initial production expenses. ITO-free alternatives generally demonstrate superior mechanical flexibility and durability, potentially reducing replacement costs in applications subject to mechanical stress. Furthermore, several emerging technologies utilize environmentally abundant materials, reducing exposure to supply chain disruptions that have historically affected ITO pricing.

Metal nanowire networks, particularly those utilizing silver, demonstrate competitive performance metrics with potential cost advantages at scale. Production costs for silver nanowire electrodes have decreased by approximately 30% over the past five years, with manufacturing efficiency improvements contributing significantly to this reduction. However, the material cost remains sensitive to precious metal market fluctuations, introducing an element of economic uncertainty.

Carbon-based alternatives, including graphene and carbon nanotube electrodes, present a different cost trajectory. While initial production costs remain higher than conventional ITO, these technologies utilize abundant carbon resources, suggesting long-term price stability. Performance metrics for carbon-based electrodes have improved substantially, with sheet resistance values approaching those of ITO while maintaining comparable transparency in the visible spectrum.

Conductive polymers represent another promising category, with PEDOT:PSS formulations achieving commercial viability in specific applications. These materials offer significant cost advantages in terms of raw materials and processing requirements, utilizing solution-based manufacturing techniques compatible with roll-to-roll production. The cost-performance ratio has improved by approximately 40% since 2018, primarily through formulation enhancements and processing optimizations.

Metal mesh technologies demonstrate excellent electrical performance but face challenges in production scaling. Recent patent activities suggest breakthroughs in manufacturing processes that could reduce production costs by up to 50%, potentially disrupting the current electrode market dynamics.

Hybrid approaches combining multiple materials (such as metal nanowires with conductive polymers) show particular promise in optimizing the cost-performance balance. These composite electrodes leverage the strengths of individual components while mitigating their respective weaknesses, resulting in solutions that outperform single-material alternatives on a cost-normalized basis.

Lifecycle cost analysis reveals additional considerations beyond initial production expenses. ITO-free alternatives generally demonstrate superior mechanical flexibility and durability, potentially reducing replacement costs in applications subject to mechanical stress. Furthermore, several emerging technologies utilize environmentally abundant materials, reducing exposure to supply chain disruptions that have historically affected ITO pricing.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!