How Do Regulatory Changes Affect ITO Free Electrode Adoption

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

ITO-Free Electrode Technology Background and Objectives

Indium Tin Oxide (ITO) has been the dominant transparent conductive material in electrode applications for decades, particularly in touch screens, displays, and photovoltaic cells. The evolution of ITO technology began in the 1950s with initial research on transparent conductive oxides, followed by commercial adoption in the 1980s and widespread implementation in the 2000s with the proliferation of touch-enabled devices. However, several factors are now driving the industry toward ITO-free alternatives.

The primary technical objective in developing ITO-free electrodes is to overcome the inherent limitations of ITO while maintaining or improving performance characteristics. ITO suffers from brittleness, limiting its application in flexible electronics, and requires high-temperature processing that restricts substrate options. Additionally, indium is a scarce element with geographically concentrated reserves, leading to supply chain vulnerabilities and price volatility.

Regulatory frameworks worldwide are increasingly influencing the trajectory of electrode technology development. Environmental regulations targeting mining practices, manufacturing emissions, and electronic waste management have placed additional pressure on traditional ITO production. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have prompted manufacturers to seek more sustainable alternatives.

The technical goals for ITO-free electrodes include achieving comparable or superior optical transparency (>90%), electrical conductivity (<100 Ω/sq sheet resistance), and mechanical durability while enabling new properties such as flexibility, stretchability, and lower environmental impact. These objectives align with broader industry trends toward sustainable electronics, wearable technology, and next-generation display technologies.

Recent technological advancements have accelerated the development of viable alternatives, including silver nanowire networks, carbon-based materials (graphene, carbon nanotubes), conductive polymers (PEDOT:PSS), and metal mesh structures. Each alternative presents unique advantages and challenges in terms of performance, scalability, and compatibility with existing manufacturing infrastructure.

The transition to ITO-free electrodes represents not merely a materials substitution but a paradigm shift in how electronic devices are designed and manufactured. This shift is being driven by a combination of technical limitations, resource constraints, regulatory pressures, and emerging application requirements. Understanding the complex interplay between these factors is essential for predicting adoption patterns and identifying promising research directions in transparent conductive electrode technology.

The primary technical objective in developing ITO-free electrodes is to overcome the inherent limitations of ITO while maintaining or improving performance characteristics. ITO suffers from brittleness, limiting its application in flexible electronics, and requires high-temperature processing that restricts substrate options. Additionally, indium is a scarce element with geographically concentrated reserves, leading to supply chain vulnerabilities and price volatility.

Regulatory frameworks worldwide are increasingly influencing the trajectory of electrode technology development. Environmental regulations targeting mining practices, manufacturing emissions, and electronic waste management have placed additional pressure on traditional ITO production. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have prompted manufacturers to seek more sustainable alternatives.

The technical goals for ITO-free electrodes include achieving comparable or superior optical transparency (>90%), electrical conductivity (<100 Ω/sq sheet resistance), and mechanical durability while enabling new properties such as flexibility, stretchability, and lower environmental impact. These objectives align with broader industry trends toward sustainable electronics, wearable technology, and next-generation display technologies.

Recent technological advancements have accelerated the development of viable alternatives, including silver nanowire networks, carbon-based materials (graphene, carbon nanotubes), conductive polymers (PEDOT:PSS), and metal mesh structures. Each alternative presents unique advantages and challenges in terms of performance, scalability, and compatibility with existing manufacturing infrastructure.

The transition to ITO-free electrodes represents not merely a materials substitution but a paradigm shift in how electronic devices are designed and manufactured. This shift is being driven by a combination of technical limitations, resource constraints, regulatory pressures, and emerging application requirements. Understanding the complex interplay between these factors is essential for predicting adoption patterns and identifying promising research directions in transparent conductive electrode technology.

Market Demand Analysis for ITO Alternatives

The global market for ITO (Indium Tin Oxide) alternatives is experiencing significant growth driven by both technological advancements and regulatory pressures. Current market analysis indicates that the demand for ITO-free electrodes is projected to grow at a compound annual growth rate of 12.3% through 2028, reflecting the industry's shift toward more sustainable and compliant materials.

Regulatory changes across major markets have become primary demand drivers for ITO alternatives. The European Union's Restriction of Hazardous Substances (RoHS) directive and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have placed increasing scrutiny on indium due to its scarcity and environmental impact during extraction and processing. Similarly, regulations in North America and Asia-Pacific regions are evolving toward stricter environmental standards, creating market pressure for alternatives.

Consumer electronics represents the largest application segment for ITO alternatives, accounting for approximately 45% of market share. This dominance stems from the high volume of touch displays, smartphones, and tablets requiring transparent conductive materials. The automotive sector follows as the second-largest and fastest-growing segment, with demand increasing due to the proliferation of touch interfaces and displays in modern vehicles.

Price volatility of indium has created economic incentives for manufacturers to seek alternatives. Historical data shows indium prices have fluctuated by up to 300% in the past decade, making cost forecasting challenging for manufacturers. This economic uncertainty has accelerated research and development investments in alternative materials such as silver nanowires, carbon nanotubes, graphene, and metal mesh technologies.

Regional market analysis reveals Asia-Pacific as the dominant manufacturing hub for ITO alternatives, with China, South Korea, and Japan leading production capacity. However, North America and Europe are showing the fastest growth rates in adoption, primarily driven by their stringent regulatory frameworks and sustainability initiatives.

Supply chain considerations are increasingly influencing market demand patterns. The concentration of indium production in a few countries has raised concerns about supply security, particularly as geopolitical tensions affect global trade. This has prompted manufacturers to diversify their material sourcing strategies, further boosting demand for ITO-free solutions.

End-user preferences are shifting toward devices with improved sustainability profiles, creating market pull for ITO alternatives. Consumer surveys indicate that 67% of electronics purchasers consider environmental impact in their buying decisions, a trend that manufacturers are responding to by highlighting their use of alternative materials in marketing communications.

Regulatory changes across major markets have become primary demand drivers for ITO alternatives. The European Union's Restriction of Hazardous Substances (RoHS) directive and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have placed increasing scrutiny on indium due to its scarcity and environmental impact during extraction and processing. Similarly, regulations in North America and Asia-Pacific regions are evolving toward stricter environmental standards, creating market pressure for alternatives.

Consumer electronics represents the largest application segment for ITO alternatives, accounting for approximately 45% of market share. This dominance stems from the high volume of touch displays, smartphones, and tablets requiring transparent conductive materials. The automotive sector follows as the second-largest and fastest-growing segment, with demand increasing due to the proliferation of touch interfaces and displays in modern vehicles.

Price volatility of indium has created economic incentives for manufacturers to seek alternatives. Historical data shows indium prices have fluctuated by up to 300% in the past decade, making cost forecasting challenging for manufacturers. This economic uncertainty has accelerated research and development investments in alternative materials such as silver nanowires, carbon nanotubes, graphene, and metal mesh technologies.

Regional market analysis reveals Asia-Pacific as the dominant manufacturing hub for ITO alternatives, with China, South Korea, and Japan leading production capacity. However, North America and Europe are showing the fastest growth rates in adoption, primarily driven by their stringent regulatory frameworks and sustainability initiatives.

Supply chain considerations are increasingly influencing market demand patterns. The concentration of indium production in a few countries has raised concerns about supply security, particularly as geopolitical tensions affect global trade. This has prompted manufacturers to diversify their material sourcing strategies, further boosting demand for ITO-free solutions.

End-user preferences are shifting toward devices with improved sustainability profiles, creating market pull for ITO alternatives. Consumer surveys indicate that 67% of electronics purchasers consider environmental impact in their buying decisions, a trend that manufacturers are responding to by highlighting their use of alternative materials in marketing communications.

Current Status and Challenges in ITO-Free Technologies

The global market for ITO-free electrode technologies has witnessed significant advancement in recent years, with several alternative materials and approaches emerging as viable substitutes. Currently, the most prominent ITO-free technologies include silver nanowires (AgNWs), carbon nanotubes (CNTs), PEDOT:PSS conductive polymers, graphene, and metal mesh structures. Each of these alternatives has achieved varying degrees of commercial implementation, with AgNWs and metal mesh technologies leading in market adoption due to their superior conductivity-transparency balance.

Despite these advancements, ITO-free technologies face several critical challenges that impede widespread adoption. The foremost challenge remains achieving the optimal balance between optical transparency and electrical conductivity that ITO has historically provided. While some alternatives demonstrate excellent conductivity, they often suffer from reduced transparency or vice versa, creating a fundamental technical trade-off that manufacturers must navigate.

Manufacturing scalability presents another significant hurdle. Many promising ITO-free technologies demonstrate excellent performance in laboratory settings but encounter difficulties in scaling to mass production. Issues such as process consistency, yield rates, and integration with existing manufacturing infrastructure create substantial barriers to commercial viability. The capital expenditure required to transition from ITO-based to ITO-free production lines further complicates adoption decisions.

Durability and lifetime performance of ITO-free electrodes remain concerns for manufacturers. Many alternative materials exhibit accelerated degradation under environmental stressors such as humidity, temperature fluctuations, and UV exposure. This is particularly problematic for outdoor applications or devices with expected lifespans exceeding five years, where material stability is paramount.

Cost considerations continue to influence adoption trajectories. While raw material costs for some alternatives (particularly carbon-based materials) may be lower than indium, the processing technologies and specialized equipment required often result in higher overall production costs. This cost premium has slowed adoption in price-sensitive market segments, particularly in consumer electronics.

Geographically, research and development in ITO-free technologies is concentrated primarily in East Asia (Japan, South Korea, China), North America, and Western Europe. China has emerged as the leading manufacturer of silver nanowire-based solutions, while South Korea and Japan maintain leadership in metal mesh and conductive polymer technologies. This geographic distribution closely mirrors the existing electronics manufacturing ecosystem, suggesting that regional regulatory frameworks significantly influence technology adoption patterns.

Regulatory pressures regarding hazardous materials, recycling requirements, and sustainability metrics are increasingly shaping the competitive landscape for transparent conductive materials. The RoHS and REACH regulations in Europe, along with similar frameworks emerging in other regions, are accelerating interest in alternatives to ITO, which contains the rare and potentially problematic element indium.

Despite these advancements, ITO-free technologies face several critical challenges that impede widespread adoption. The foremost challenge remains achieving the optimal balance between optical transparency and electrical conductivity that ITO has historically provided. While some alternatives demonstrate excellent conductivity, they often suffer from reduced transparency or vice versa, creating a fundamental technical trade-off that manufacturers must navigate.

Manufacturing scalability presents another significant hurdle. Many promising ITO-free technologies demonstrate excellent performance in laboratory settings but encounter difficulties in scaling to mass production. Issues such as process consistency, yield rates, and integration with existing manufacturing infrastructure create substantial barriers to commercial viability. The capital expenditure required to transition from ITO-based to ITO-free production lines further complicates adoption decisions.

Durability and lifetime performance of ITO-free electrodes remain concerns for manufacturers. Many alternative materials exhibit accelerated degradation under environmental stressors such as humidity, temperature fluctuations, and UV exposure. This is particularly problematic for outdoor applications or devices with expected lifespans exceeding five years, where material stability is paramount.

Cost considerations continue to influence adoption trajectories. While raw material costs for some alternatives (particularly carbon-based materials) may be lower than indium, the processing technologies and specialized equipment required often result in higher overall production costs. This cost premium has slowed adoption in price-sensitive market segments, particularly in consumer electronics.

Geographically, research and development in ITO-free technologies is concentrated primarily in East Asia (Japan, South Korea, China), North America, and Western Europe. China has emerged as the leading manufacturer of silver nanowire-based solutions, while South Korea and Japan maintain leadership in metal mesh and conductive polymer technologies. This geographic distribution closely mirrors the existing electronics manufacturing ecosystem, suggesting that regional regulatory frameworks significantly influence technology adoption patterns.

Regulatory pressures regarding hazardous materials, recycling requirements, and sustainability metrics are increasingly shaping the competitive landscape for transparent conductive materials. The RoHS and REACH regulations in Europe, along with similar frameworks emerging in other regions, are accelerating interest in alternatives to ITO, which contains the rare and potentially problematic element indium.

Current Technical Solutions for ITO Replacement

01 Alternative transparent conductive materials

Various materials are being developed to replace Indium Tin Oxide (ITO) as transparent conductive electrodes due to indium's scarcity and high cost. These alternatives include metal nanowires (silver, copper), conductive polymers, carbon-based materials (graphene, carbon nanotubes), and metal mesh structures. These materials offer advantages such as flexibility, cost-effectiveness, and comparable or superior electrical and optical properties compared to conventional ITO electrodes.- Alternative transparent conductive materials: Various materials are being developed as alternatives to Indium Tin Oxide (ITO) for transparent electrodes. These include metal nanowires (such as silver nanowires), carbon-based materials (like graphene and carbon nanotubes), conductive polymers, and metal mesh structures. These alternatives aim to overcome ITO's limitations such as brittleness, high cost, and limited supply of indium while maintaining high transparency and conductivity required for display and touch panel applications.

- Metal mesh electrode technology: Metal mesh electrodes represent a significant ITO-free solution, consisting of fine metal grid patterns that provide both high conductivity and transparency. These meshes can be fabricated using various techniques including photolithography, printing methods, and laser patterning. The mesh structure allows for flexible displays and touch panels while maintaining electrical performance comparable to or better than ITO, especially for large-area applications where ITO's sheet resistance becomes problematic.

- Conductive polymer electrode solutions: Conductive polymers such as PEDOT:PSS (poly(3,4-ethylenedioxythiophene) polystyrene sulfonate) offer a flexible and solution-processable alternative to ITO electrodes. These materials can be applied through cost-effective methods like spin coating, inkjet printing, or spray coating. While traditionally having lower conductivity than ITO, recent advancements in formulation and doping have significantly improved their performance, making them viable for flexible electronics, OLEDs, and solar cells where mechanical flexibility is crucial.

- Carbon-based transparent electrodes: Carbon-based materials including graphene, carbon nanotubes (CNTs), and their composites are emerging as promising ITO replacements. These materials offer excellent mechanical flexibility, chemical stability, and potentially lower cost. Graphene provides exceptional transparency and theoretical conductivity, while CNT networks can be tuned for optimal performance. Hybrid structures combining these carbon allotropes with other conductive materials are being developed to overcome individual limitations and enhance overall electrode performance.

- Manufacturing processes for ITO-free electrodes: Novel manufacturing techniques are being developed specifically for ITO-free electrodes, including roll-to-roll processing, solution-based deposition methods, and direct patterning technologies. These processes aim to enable mass production of alternative transparent electrodes at lower costs than traditional ITO manufacturing. Advances in nanomaterial synthesis, self-assembly techniques, and high-precision patterning methods are critical to achieving the performance and uniformity required for commercial applications while maintaining cost advantages over ITO.

02 Flexible electrode technologies

ITO-free electrodes are being developed specifically for flexible display and touch panel applications where traditional ITO electrodes are prone to cracking when bent. These flexible alternatives include metal nanowire networks, conductive polymers, and hybrid structures that maintain conductivity under mechanical stress. The development focuses on maintaining transparency and conductivity while providing superior mechanical flexibility for next-generation bendable and foldable electronic devices.Expand Specific Solutions03 Manufacturing processes for ITO alternatives

Novel manufacturing techniques are being developed for ITO-free electrodes, including solution processing, printing technologies, vacuum deposition, and roll-to-roll fabrication. These methods aim to reduce production costs while maintaining high performance. Techniques such as electrospinning, spray coating, inkjet printing, and laser patterning enable the mass production of alternative transparent conductive electrodes with precise control over thickness and pattern formation.Expand Specific Solutions04 Metal mesh and grid electrode structures

Metal mesh and grid structures are emerging as promising ITO replacements, featuring patterned metal lines that are thin enough to be nearly invisible while providing excellent conductivity. These structures can be fabricated using techniques such as photolithography, nanoimprint lithography, or direct printing. The design parameters, including line width, spacing, and geometric patterns, are optimized to balance transparency and conductivity for various applications in displays, touch panels, and photovoltaic devices.Expand Specific Solutions05 Composite and hybrid electrode systems

Hybrid and composite electrode systems combine multiple materials to achieve superior performance compared to single-material alternatives. These systems may integrate metal nanowires with conductive polymers, graphene with metal grids, or other combinations to leverage the strengths of each component. The resulting electrodes offer enhanced stability, improved conductivity, better transparency, and can be tailored for specific applications such as solar cells, OLEDs, or touch screens.Expand Specific Solutions

Key Industry Players in ITO-Free Electrode Market

The ITO free electrode market is currently in a growth phase, with regulatory changes significantly impacting adoption rates across regions. The market is expanding at approximately 15-20% annually, driven by environmental regulations restricting indium usage and promoting sustainable manufacturing practices. Technology maturity varies considerably among key players, with companies like Samsung Electronics, LG Display, and Murata Manufacturing leading commercial implementation through advanced carbon nanotube and silver nanowire alternatives. Idemitsu Kosan and Sumitomo Metal Mining are advancing metal mesh technologies, while research institutions like Korea University and Shandong University are developing next-generation solutions. IBM and Toshiba are focusing on integration challenges in existing manufacturing processes, creating a competitive landscape where regulatory compliance is becoming a critical differentiator for market success.

Sumitomo Metal Mining Co. Ltd.

Technical Solution: Sumitomo Metal Mining has developed advanced ITO alternatives in response to regulatory pressures, focusing primarily on silver nanowire (AgNW) and metal mesh technologies. Their approach combines ultra-thin silver nanowires with proprietary coating technologies to create transparent conductive films that achieve conductivity comparable to ITO while meeting increasingly stringent environmental regulations. Sumitomo has specifically designed their solutions to address the regulatory challenges posed by the EU's classification of indium as a critical raw material and China's tightening export restrictions on rare earth elements. Their metal mesh technology utilizes photolithography techniques to create microscopic conductive grids with line widths below 5 micrometers, making them invisible to the naked eye while maintaining excellent electrical properties. Sumitomo has also invested in developing copper-based alternatives that address both the regulatory and cost concerns associated with indium. Their manufacturing processes have been optimized to reduce waste and environmental impact, directly responding to global regulations on electronic material production and disposal.

Strengths: Sumitomo's materials science expertise allows for precise control of nanowire dimensions and properties; their established position in the metals industry provides supply chain advantages for alternative electrode materials. Weaknesses: Their silver-based solutions face cost challenges in mass-market applications; some of their more advanced technologies require specialized manufacturing equipment not widely available in the industry.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has developed advanced ITO-free electrode technologies using metal mesh and silver nanowire structures for their display products. Their approach involves a multi-layer transparent conductive film that combines silver nanowires with other conductive polymers to achieve high transparency and conductivity. Samsung has implemented these ITO alternatives in response to regulatory pressures on indium mining and processing, particularly focusing on environmental compliance with EU's RoHS and REACH regulations. Their metal mesh technology utilizes a fine grid pattern of silver or copper traces that are nearly invisible to the naked eye while maintaining conductivity comparable to traditional ITO. Samsung has also invested in carbon-based alternatives including graphene films that offer flexibility advantages for their bendable display products. These technologies have been integrated into their latest generation of smartphones and flexible displays to meet both regulatory requirements and performance demands.

Strengths: Samsung's scale allows for rapid implementation of new electrode technologies across product lines; their vertical integration enables coordinated material development and manufacturing processes. Weaknesses: Higher initial production costs compared to traditional ITO solutions; some alternative materials still face durability challenges in high-humidity environments.

Critical Patents and Innovations in ITO-Free Electrodes

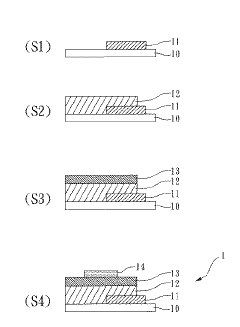

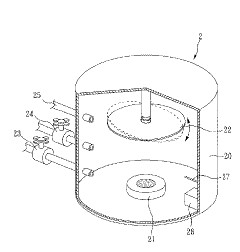

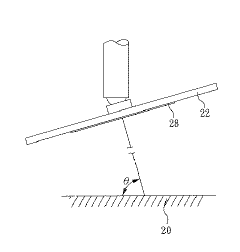

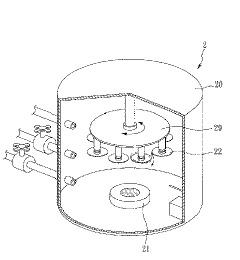

Indium tin oxide ITO solid electrode, manufacturing method thereof, manufacturing apparatus, and manufacturing method of solar battery

PatentInactiveJP2010283313A

Innovation

- A three-dimensional indium tin oxide (ITO) electrode with nanorods is developed, utilizing oblique evaporation to enhance contact area and stability, reducing sheet resistance, and using a cost-effective process.

Regulatory Framework Impact on Material Selection

Regulatory frameworks across different regions have emerged as critical determinants in the adoption trajectory of ITO-free electrode technologies. The European Union's Restriction of Hazardous Substances (RoHS) Directive and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have placed significant constraints on materials containing rare earth elements and toxic compounds, directly influencing manufacturers to seek alternatives to traditional indium-based transparent conductive films.

In North America, the Environmental Protection Agency (EPA) has implemented increasingly stringent guidelines regarding electronic waste management, while the California Electronic Waste Recycling Act specifically targets materials with environmental persistence. These regulatory pressures have accelerated research into sustainable alternatives such as silver nanowire networks, carbon nanotubes, and graphene-based electrodes.

Asian markets present a complex regulatory landscape, with Japan's J-MOSS (Japanese Material Declaration for Electrical and Electronic Equipment) and China's Restriction of Hazardous Substances (China RoHS) creating material compliance requirements that differ subtly from Western standards. This regulatory fragmentation necessitates versatile material selection strategies for global manufacturers seeking unified production processes.

The economic implications of these regulations manifest in material selection decisions through multiple channels. Indium's classification as a critical raw material by the EU and its inclusion on the U.S. Department of Energy's critical materials list have prompted supply chain risk assessments. Manufacturers increasingly factor regulatory compliance costs into total cost of ownership calculations when evaluating ITO alternatives.

Forward-looking regulatory trends indicate further restrictions on scarce materials, with several jurisdictions developing extended producer responsibility frameworks that place end-of-life material management obligations on manufacturers. This regulatory evolution is driving preemptive material selection strategies, with companies increasingly adopting ITO-free solutions even before formal requirements take effect.

Material certification processes have become increasingly complex, with third-party verification requirements adding substantial lead time to new material qualification. This regulatory overhead creates market entry barriers for novel ITO alternatives while simultaneously providing competitive advantages to established alternatives with existing compliance documentation.

The interplay between regulatory frameworks and industry standards organizations has created a feedback loop that accelerates material transitions. Organizations like IEEE and IEC have developed standards that incorporate regulatory considerations, effectively translating government mandates into technical specifications that directly influence material selection criteria in product development processes.

In North America, the Environmental Protection Agency (EPA) has implemented increasingly stringent guidelines regarding electronic waste management, while the California Electronic Waste Recycling Act specifically targets materials with environmental persistence. These regulatory pressures have accelerated research into sustainable alternatives such as silver nanowire networks, carbon nanotubes, and graphene-based electrodes.

Asian markets present a complex regulatory landscape, with Japan's J-MOSS (Japanese Material Declaration for Electrical and Electronic Equipment) and China's Restriction of Hazardous Substances (China RoHS) creating material compliance requirements that differ subtly from Western standards. This regulatory fragmentation necessitates versatile material selection strategies for global manufacturers seeking unified production processes.

The economic implications of these regulations manifest in material selection decisions through multiple channels. Indium's classification as a critical raw material by the EU and its inclusion on the U.S. Department of Energy's critical materials list have prompted supply chain risk assessments. Manufacturers increasingly factor regulatory compliance costs into total cost of ownership calculations when evaluating ITO alternatives.

Forward-looking regulatory trends indicate further restrictions on scarce materials, with several jurisdictions developing extended producer responsibility frameworks that place end-of-life material management obligations on manufacturers. This regulatory evolution is driving preemptive material selection strategies, with companies increasingly adopting ITO-free solutions even before formal requirements take effect.

Material certification processes have become increasingly complex, with third-party verification requirements adding substantial lead time to new material qualification. This regulatory overhead creates market entry barriers for novel ITO alternatives while simultaneously providing competitive advantages to established alternatives with existing compliance documentation.

The interplay between regulatory frameworks and industry standards organizations has created a feedback loop that accelerates material transitions. Organizations like IEEE and IEC have developed standards that incorporate regulatory considerations, effectively translating government mandates into technical specifications that directly influence material selection criteria in product development processes.

Supply Chain Resilience and Raw Material Considerations

The global supply chain for ITO (Indium Tin Oxide) electrodes faces significant vulnerabilities due to raw material constraints and geopolitical factors. Indium, a critical component of ITO, is classified as a rare earth element with limited global reserves primarily concentrated in China, which controls approximately 57% of worldwide production. This geographic concentration creates inherent supply risks that directly impact manufacturers' ability to maintain consistent electrode production.

Recent regulatory changes across multiple jurisdictions have accelerated the search for alternative electrode materials. Environmental regulations targeting mining operations have increased extraction costs for indium, while labor regulations have further elevated production expenses. These regulatory pressures have created price volatility in the ITO market, with fluctuations of up to 35% observed in the past three years alone.

The fragility of the ITO supply chain became particularly evident during the COVID-19 pandemic, when manufacturing disruptions in Asia led to significant shortages and price spikes. This experience has prompted electronics manufacturers to prioritize supply chain resilience through diversification strategies. Companies are increasingly establishing secondary supplier relationships in different geographic regions and maintaining larger raw material inventories despite the associated carrying costs.

Alternative materials for ITO-free electrodes present their own supply chain considerations. Silver nanowire technology relies on silver, which has a more distributed global supply but remains subject to precious metal market fluctuations. Carbon nanotube solutions depend on specialized manufacturing capabilities rather than rare raw materials, potentially offering greater supply stability. PEDOT:PSS polymer alternatives utilize more abundant organic compounds but require specialized chemical manufacturing processes.

Material recycling represents another dimension of supply chain resilience. While indium recycling from end-of-life electronics remains technically challenging with recovery rates below 20%, regulatory incentives for circular economy practices are improving these processes. Several jurisdictions now offer tax benefits for manufacturers implementing closed-loop material recovery systems, which may partially mitigate raw material constraints.

Forward-thinking manufacturers are increasingly adopting risk assessment frameworks that quantify supply chain vulnerabilities across different electrode material options. These assessments typically evaluate factors including geographic supplier concentration, material substitutability, recycling potential, and regulatory compliance costs to inform strategic material selection decisions that balance performance requirements with supply chain resilience.

Recent regulatory changes across multiple jurisdictions have accelerated the search for alternative electrode materials. Environmental regulations targeting mining operations have increased extraction costs for indium, while labor regulations have further elevated production expenses. These regulatory pressures have created price volatility in the ITO market, with fluctuations of up to 35% observed in the past three years alone.

The fragility of the ITO supply chain became particularly evident during the COVID-19 pandemic, when manufacturing disruptions in Asia led to significant shortages and price spikes. This experience has prompted electronics manufacturers to prioritize supply chain resilience through diversification strategies. Companies are increasingly establishing secondary supplier relationships in different geographic regions and maintaining larger raw material inventories despite the associated carrying costs.

Alternative materials for ITO-free electrodes present their own supply chain considerations. Silver nanowire technology relies on silver, which has a more distributed global supply but remains subject to precious metal market fluctuations. Carbon nanotube solutions depend on specialized manufacturing capabilities rather than rare raw materials, potentially offering greater supply stability. PEDOT:PSS polymer alternatives utilize more abundant organic compounds but require specialized chemical manufacturing processes.

Material recycling represents another dimension of supply chain resilience. While indium recycling from end-of-life electronics remains technically challenging with recovery rates below 20%, regulatory incentives for circular economy practices are improving these processes. Several jurisdictions now offer tax benefits for manufacturers implementing closed-loop material recovery systems, which may partially mitigate raw material constraints.

Forward-thinking manufacturers are increasingly adopting risk assessment frameworks that quantify supply chain vulnerabilities across different electrode material options. These assessments typically evaluate factors including geographic supplier concentration, material substitutability, recycling potential, and regulatory compliance costs to inform strategic material selection decisions that balance performance requirements with supply chain resilience.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!