How Patents Are Shaping the ITO Free Electrode Landscape

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

ITO-Free Electrode Technology Background and Objectives

Indium Tin Oxide (ITO) has dominated the transparent conductive electrode market for decades due to its excellent combination of optical transparency and electrical conductivity. However, the evolution of display and touch technologies has exposed significant limitations of ITO, including its brittleness, high processing temperatures, and escalating costs due to indium scarcity. These challenges have catalyzed an intensive search for alternative materials and technologies, marking the emergence of the ITO-free electrode landscape.

The technological evolution in this field traces back to the early 2000s when researchers began exploring carbon nanotubes and conductive polymers as potential alternatives. By the 2010s, graphene, silver nanowires, and metal mesh technologies gained significant traction, demonstrating comparable or superior performance to ITO in specific applications. This progression has been largely driven by the exponential growth in flexible electronics, wearable devices, and large-area displays that demand mechanical flexibility alongside electrical performance.

Patent activities in the ITO-free electrode space have shown remarkable growth, with annual filings increasing by approximately 300% between 2010 and 2020. This surge reflects both the technological maturity and commercial potential of these alternatives. Key patent clusters focus on material synthesis methods, deposition techniques, patterning processes, and integration solutions for various device architectures.

The primary technical objectives in this domain include achieving transparency above 90% in the visible spectrum while maintaining sheet resistance below 100 ohms/square, developing manufacturing processes compatible with roll-to-roll production for cost reduction, and ensuring long-term stability under various environmental conditions. Additionally, there is a growing emphasis on environmentally sustainable materials and processes that reduce reliance on rare elements and minimize ecological impact.

Regional analysis of patent filings reveals distinct technological approaches, with East Asian companies focusing heavily on metal nanowire technologies, European entities emphasizing conductive polymer solutions, and North American organizations leading in graphene and carbon nanotube innovations. This geographical distribution highlights the global nature of the competition and the diverse approaches being pursued.

The trajectory of ITO-free electrode technology is expected to continue its upward trend, with market projections suggesting a compound annual growth rate of 15-20% through 2030. This growth will likely be fueled by expanding applications in emerging sectors such as flexible photovoltaics, transparent heaters, electromagnetic shielding, and smart architectural glazing, all of which represent significant opportunities beyond the current focus on display technologies.

The technological evolution in this field traces back to the early 2000s when researchers began exploring carbon nanotubes and conductive polymers as potential alternatives. By the 2010s, graphene, silver nanowires, and metal mesh technologies gained significant traction, demonstrating comparable or superior performance to ITO in specific applications. This progression has been largely driven by the exponential growth in flexible electronics, wearable devices, and large-area displays that demand mechanical flexibility alongside electrical performance.

Patent activities in the ITO-free electrode space have shown remarkable growth, with annual filings increasing by approximately 300% between 2010 and 2020. This surge reflects both the technological maturity and commercial potential of these alternatives. Key patent clusters focus on material synthesis methods, deposition techniques, patterning processes, and integration solutions for various device architectures.

The primary technical objectives in this domain include achieving transparency above 90% in the visible spectrum while maintaining sheet resistance below 100 ohms/square, developing manufacturing processes compatible with roll-to-roll production for cost reduction, and ensuring long-term stability under various environmental conditions. Additionally, there is a growing emphasis on environmentally sustainable materials and processes that reduce reliance on rare elements and minimize ecological impact.

Regional analysis of patent filings reveals distinct technological approaches, with East Asian companies focusing heavily on metal nanowire technologies, European entities emphasizing conductive polymer solutions, and North American organizations leading in graphene and carbon nanotube innovations. This geographical distribution highlights the global nature of the competition and the diverse approaches being pursued.

The trajectory of ITO-free electrode technology is expected to continue its upward trend, with market projections suggesting a compound annual growth rate of 15-20% through 2030. This growth will likely be fueled by expanding applications in emerging sectors such as flexible photovoltaics, transparent heaters, electromagnetic shielding, and smart architectural glazing, all of which represent significant opportunities beyond the current focus on display technologies.

Market Demand Analysis for Alternative Transparent Conductive Materials

The transparent conductive materials market is experiencing significant growth driven by the expanding electronics industry, particularly in displays, touch panels, and photovoltaic applications. The traditional market leader, Indium Tin Oxide (ITO), faces increasing challenges due to indium's scarcity, rising costs, and brittleness limitations for flexible applications, creating substantial demand for alternative materials.

Global demand for transparent conductive materials is projected to reach $8.46 billion by 2025, growing at a CAGR of 9.8% from 2020. This growth is primarily fueled by the rapid expansion of the touch panel market, which has seen exponential growth with the proliferation of smartphones, tablets, and other touch-enabled devices. Additionally, the emerging flexible electronics sector requires materials with mechanical flexibility that ITO cannot provide.

The photovoltaic industry represents another significant market driver, with transparent electrodes being essential components in solar cells. As renewable energy adoption accelerates globally, the demand for cost-effective, high-performance transparent conductive materials continues to rise. The automotive sector is also emerging as a key consumer, with smart windows and integrated displays requiring transparent electrodes with specific performance characteristics.

Regional analysis reveals Asia-Pacific as the dominant market, accounting for approximately 65% of global consumption, primarily due to the concentration of electronics manufacturing in countries like China, South Korea, and Japan. North America and Europe follow, with growing demand driven by research activities and premium electronics production.

Consumer preferences are shifting toward devices with improved durability, flexibility, and energy efficiency, creating market pull for ITO alternatives. Materials such as silver nanowires, carbon nanotubes, graphene, conductive polymers, and metal mesh are gaining traction as they address various limitations of ITO while offering additional benefits like flexibility and improved conductivity.

Price sensitivity varies by application segment, with consumer electronics manufacturers willing to pay premium prices for materials offering significant performance advantages, while cost remains a critical factor in large-area applications like solar cells. The total addressable market for ITO alternatives is expected to reach $3.2 billion by 2025, representing a significant opportunity for innovative materials that can match or exceed ITO's optical and electrical performance while addressing its limitations.

Industry surveys indicate that 78% of electronics manufacturers are actively seeking ITO alternatives for next-generation products, highlighting the market's readiness for technological transition. This demand is further accelerated by sustainability concerns, as manufacturers increasingly prioritize materials with lower environmental impact and more stable supply chains.

Global demand for transparent conductive materials is projected to reach $8.46 billion by 2025, growing at a CAGR of 9.8% from 2020. This growth is primarily fueled by the rapid expansion of the touch panel market, which has seen exponential growth with the proliferation of smartphones, tablets, and other touch-enabled devices. Additionally, the emerging flexible electronics sector requires materials with mechanical flexibility that ITO cannot provide.

The photovoltaic industry represents another significant market driver, with transparent electrodes being essential components in solar cells. As renewable energy adoption accelerates globally, the demand for cost-effective, high-performance transparent conductive materials continues to rise. The automotive sector is also emerging as a key consumer, with smart windows and integrated displays requiring transparent electrodes with specific performance characteristics.

Regional analysis reveals Asia-Pacific as the dominant market, accounting for approximately 65% of global consumption, primarily due to the concentration of electronics manufacturing in countries like China, South Korea, and Japan. North America and Europe follow, with growing demand driven by research activities and premium electronics production.

Consumer preferences are shifting toward devices with improved durability, flexibility, and energy efficiency, creating market pull for ITO alternatives. Materials such as silver nanowires, carbon nanotubes, graphene, conductive polymers, and metal mesh are gaining traction as they address various limitations of ITO while offering additional benefits like flexibility and improved conductivity.

Price sensitivity varies by application segment, with consumer electronics manufacturers willing to pay premium prices for materials offering significant performance advantages, while cost remains a critical factor in large-area applications like solar cells. The total addressable market for ITO alternatives is expected to reach $3.2 billion by 2025, representing a significant opportunity for innovative materials that can match or exceed ITO's optical and electrical performance while addressing its limitations.

Industry surveys indicate that 78% of electronics manufacturers are actively seeking ITO alternatives for next-generation products, highlighting the market's readiness for technological transition. This demand is further accelerated by sustainability concerns, as manufacturers increasingly prioritize materials with lower environmental impact and more stable supply chains.

Current State and Challenges in ITO-Free Electrode Development

The global ITO-free electrode landscape is currently experiencing significant technological evolution, driven by the limitations of traditional indium tin oxide (ITO) electrodes. Despite ITO's widespread use in transparent conductive applications, its inherent brittleness, limited flexibility, and the scarcity of indium have catalyzed intensive research into alternative materials and technologies.

Patent analysis reveals several promising ITO-free electrode technologies at various stages of development. Metal nanowire networks, particularly those based on silver, have demonstrated excellent conductivity and transparency properties, with companies like Cambrios and C3Nano holding substantial patent portfolios in this domain. However, challenges persist regarding long-term stability, oxidation resistance, and manufacturing scalability.

Carbon-based materials represent another significant category, with graphene and carbon nanotubes (CNTs) showing remarkable potential. Samsung and LG have secured numerous patents on graphene electrode fabrication methods, while companies like Canatu have specialized in CNT-based transparent electrodes. The primary challenges here involve consistent quality control during large-scale production and achieving uniformity across large surface areas.

Conductive polymers, particularly PEDOT:PSS, have gained traction for flexible electronics applications, with patents from Heraeus and Agfa focusing on enhancing conductivity while maintaining transparency. However, these materials still face stability issues in various environmental conditions and generally exhibit lower conductivity compared to their inorganic counterparts.

Metal mesh technologies have emerged as another viable alternative, with companies like 3M and Fujifilm holding key patents. While offering excellent conductivity, challenges remain in minimizing optical effects like moiré patterns and developing cost-effective manufacturing processes for fine-pitch meshes.

Geographically, patent activity shows concentration in East Asia (particularly Japan, South Korea, and China), North America, and Europe, reflecting the global competition in this strategic technology area. Chinese companies and research institutions have dramatically increased their patent filings in the past five years, indicating a shifting landscape in intellectual property ownership.

Technical barriers currently limiting widespread adoption include achieving the optimal balance between transparency and conductivity, developing scalable and cost-effective manufacturing processes, ensuring long-term stability under various environmental conditions, and addressing integration challenges with existing device architectures. Additionally, many promising laboratory-scale technologies face significant hurdles in transitioning to industrial-scale production.

The regulatory landscape adds another layer of complexity, with environmental regulations increasingly restricting certain manufacturing processes and materials, particularly those involving toxic solvents or rare earth elements.

Patent analysis reveals several promising ITO-free electrode technologies at various stages of development. Metal nanowire networks, particularly those based on silver, have demonstrated excellent conductivity and transparency properties, with companies like Cambrios and C3Nano holding substantial patent portfolios in this domain. However, challenges persist regarding long-term stability, oxidation resistance, and manufacturing scalability.

Carbon-based materials represent another significant category, with graphene and carbon nanotubes (CNTs) showing remarkable potential. Samsung and LG have secured numerous patents on graphene electrode fabrication methods, while companies like Canatu have specialized in CNT-based transparent electrodes. The primary challenges here involve consistent quality control during large-scale production and achieving uniformity across large surface areas.

Conductive polymers, particularly PEDOT:PSS, have gained traction for flexible electronics applications, with patents from Heraeus and Agfa focusing on enhancing conductivity while maintaining transparency. However, these materials still face stability issues in various environmental conditions and generally exhibit lower conductivity compared to their inorganic counterparts.

Metal mesh technologies have emerged as another viable alternative, with companies like 3M and Fujifilm holding key patents. While offering excellent conductivity, challenges remain in minimizing optical effects like moiré patterns and developing cost-effective manufacturing processes for fine-pitch meshes.

Geographically, patent activity shows concentration in East Asia (particularly Japan, South Korea, and China), North America, and Europe, reflecting the global competition in this strategic technology area. Chinese companies and research institutions have dramatically increased their patent filings in the past five years, indicating a shifting landscape in intellectual property ownership.

Technical barriers currently limiting widespread adoption include achieving the optimal balance between transparency and conductivity, developing scalable and cost-effective manufacturing processes, ensuring long-term stability under various environmental conditions, and addressing integration challenges with existing device architectures. Additionally, many promising laboratory-scale technologies face significant hurdles in transitioning to industrial-scale production.

The regulatory landscape adds another layer of complexity, with environmental regulations increasingly restricting certain manufacturing processes and materials, particularly those involving toxic solvents or rare earth elements.

Current Technical Solutions and Patent Strategies

01 Carbon-based materials as ITO alternatives

Carbon-based materials such as graphene, carbon nanotubes (CNTs), and carbon nanomaterials offer excellent electrical conductivity and optical transparency, making them suitable alternatives to ITO for transparent electrodes. These materials provide flexibility, durability, and can be processed at lower temperatures compared to ITO. Carbon-based electrodes can be applied in various electronic devices including touch screens, displays, and solar cells.- Carbon-based transparent conductive materials: Carbon-based materials such as graphene, carbon nanotubes (CNTs), and carbon nanosheets are being used as alternatives to ITO for transparent electrodes. These materials offer excellent electrical conductivity, flexibility, and optical transparency. They can be applied through various deposition methods including solution processing, which makes them suitable for flexible electronic devices and displays where traditional ITO would be too brittle.

- Metal nanowire networks: Metal nanowire networks, particularly those made from silver, copper, or gold, provide an effective ITO alternative for transparent electrodes. These nanowires form interconnected networks that maintain high electrical conductivity while allowing light transmission. The flexibility of these networks makes them ideal for bendable displays and touch panels. Various fabrication techniques including solution processing and printing methods can be used to create these electrodes.

- Conductive polymers for flexible electrodes: Conductive polymers such as PEDOT:PSS (poly(3,4-ethylenedioxythiophene) polystyrene sulfonate) and polyaniline are being developed as ITO replacements. These materials offer advantages including solution processability, mechanical flexibility, and compatibility with roll-to-roll manufacturing. They can be enhanced through various doping strategies to improve conductivity while maintaining transparency, making them suitable for flexible displays and organic electronics.

- Metal mesh and grid structures: Metal mesh and grid structures utilize patterned thin metal lines to create transparent conductive electrodes. These structures balance optical transparency and electrical conductivity by optimizing the grid geometry. Fabrication methods include photolithography, nanoimprint lithography, and laser patterning. The resulting electrodes offer lower sheet resistance than ITO while maintaining good optical properties, making them suitable for large-area applications like solar cells and displays.

- Hybrid and composite electrode materials: Hybrid and composite electrodes combine multiple conductive materials to achieve superior performance compared to single-material alternatives. Common combinations include metal nanowires with conductive polymers, graphene with metal grids, or carbon nanotubes with metal nanoparticles. These hybrid structures leverage the complementary properties of different materials to optimize conductivity, transparency, and mechanical flexibility while overcoming the limitations of individual components.

02 Metal nanowire networks for transparent electrodes

Metal nanowire networks, particularly those made from silver, copper, or gold, can replace ITO in transparent electrode applications. These nanowires form conductive meshes that maintain high transparency while providing excellent electrical conductivity. The fabrication methods include solution processing techniques that are more cost-effective than traditional ITO deposition. These electrodes demonstrate good mechanical flexibility and can be integrated into flexible electronic devices.Expand Specific Solutions03 Conductive polymers as ITO replacements

Conductive polymers such as PEDOT:PSS (poly(3,4-ethylenedioxythiophene) polystyrene sulfonate) and polyaniline offer viable alternatives to ITO for transparent electrode applications. These materials can be solution-processed at low temperatures, enabling compatibility with flexible substrates. While typically having lower conductivity than ITO, their flexibility, stretchability, and cost-effectiveness make them attractive for applications in flexible displays, touch panels, and organic electronics.Expand Specific Solutions04 Metal oxide composites for transparent electrodes

Alternative metal oxide composites, such as aluminum-doped zinc oxide (AZO), gallium-doped zinc oxide (GZO), and fluorine-doped tin oxide (FTO), can replace ITO in transparent electrode applications. These materials offer comparable optical transparency and electrical conductivity to ITO but can be produced using more abundant and less expensive raw materials. The fabrication methods include sputtering, chemical vapor deposition, and sol-gel processes, allowing for integration into various electronic devices.Expand Specific Solutions05 Mesh-based transparent electrode structures

Metal mesh electrodes consisting of fine metallic grid patterns can serve as ITO alternatives. These structures combine high conductivity of metals with optical transparency achieved through optimized grid designs. Fabrication techniques include photolithography, nanoimprint lithography, and direct printing methods. The mesh geometry can be tailored to balance transparency and conductivity requirements for specific applications such as touch sensors, displays, and photovoltaic devices.Expand Specific Solutions

Key Industry Players and Patent Holders in ITO-Free Technology

The ITO-free electrode landscape is evolving rapidly in a growth phase, with the market expected to reach significant expansion due to increasing demand for flexible displays and touch panels. Currently, the technology is in mid-maturity, with major players developing diverse approaches to overcome indium tin oxide limitations. Companies like Samsung Display, LG Display, and BOE Technology are leading commercial implementation, while Idemitsu Kosan, LG Chem, and Canon focus on material innovations. Research institutions such as CNRS and KAIST contribute fundamental breakthroughs. Patent activities reveal intense competition in carbon nanotube solutions (Eikos), metal mesh technologies (3M), and silver nanowire applications (Samsung Electronics), with Asian manufacturers dominating the intellectual property landscape.

SAMSUNG DISPLAY CO LTD

Technical Solution: Samsung Display has developed advanced ITO-free electrode technologies using metal mesh and silver nanowire structures. Their patented approach incorporates ultra-thin metal grids with line widths below 2μm, achieving transparency above 90% while maintaining sheet resistance under 10 ohms/square. The company has pioneered a unique manufacturing process that embeds these conductive structures within flexible polymer substrates, enabling bendable and foldable displays without the brittleness associated with traditional ITO. Samsung's patents cover both the material composition and the roll-to-roll manufacturing techniques that allow for cost-effective mass production of these electrodes. Their technology specifically addresses the mechanical durability issues that have limited ITO applications in flexible electronics, with documented bend radius capabilities exceeding 100,000 cycles at 1mm radius without performance degradation.

Strengths: Superior flexibility and durability compared to ITO, enabling truly foldable displays. High optical transparency with excellent conductivity. Established manufacturing infrastructure for mass production. Weaknesses: Higher initial production costs compared to traditional ITO. Metal mesh patterns may create visible moiré effects in certain display applications.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed a comprehensive patent portfolio around metal nanowire network technologies as ITO replacements. Their proprietary approach uses silver nanowires with controlled aspect ratios (length/diameter >1000) embedded in conductive polymers to create highly transparent (>93%) and conductive (<30 ohms/square) electrode structures. BOE's patents cover specialized surface modification techniques that enhance nanowire adhesion to various substrates while maintaining network connectivity. The company has pioneered a unique solution to the traditional silver nanowire stability issues through encapsulation methods that prevent oxidation and sulfidation, extending operational lifetime beyond 10,000 hours under high temperature and humidity conditions. Their manufacturing process innovations include roll-to-roll compatible deposition techniques that achieve uniform nanowire distribution across large areas (>2000×2000mm), enabling cost-effective production for large displays. BOE has successfully implemented this technology in commercial touch panels and flexible displays.

Strengths: Excellent combination of optical transparency and electrical conductivity. Compatible with flexible substrates for next-generation display applications. Established manufacturing processes for large-area production. Weaknesses: Long-term stability concerns in harsh environmental conditions. Potential for silver migration under electrical stress in certain applications.

Critical Patent Analysis and Technical Innovations

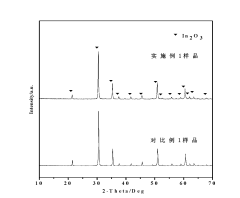

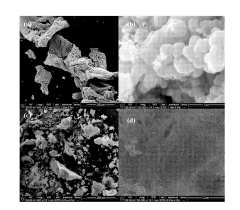

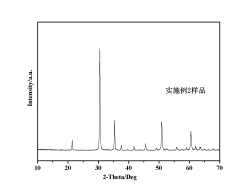

Method for preparing ultrafine ITO powder by combustion synthesis process

PatentInactiveCN102417203A

Innovation

- Combustion synthesis method is adopted, using metal indium and tin nitrates as oxidants, urea as reducing agents, and citric acid or polyethylene glycol as additives to perform combustion reactions to prepare ultra-fine ITO powder. The process is simple and energy consumption is low. And no grinding is required.

Patent Landscape and IP Strategy Considerations

The patent landscape for ITO-free electrode technologies has evolved significantly over the past decade, with a marked increase in filing activity since 2015. Major technology companies and research institutions have established strong patent portfolios, creating a complex intellectual property environment. Companies like Samsung, LG Display, and BOE Technology have emerged as dominant patent holders, with their portfolios covering various alternative materials and manufacturing processes for transparent conductive electrodes.

Strategic patent filing patterns reveal geographical concentration in key manufacturing regions, with China, South Korea, and the United States leading in patent applications. This geographical distribution reflects the industrial significance of these regions in display and touch panel manufacturing. The patent landscape shows clustering around specific alternative materials, with metal nanowire networks, conductive polymers, and carbon-based materials (particularly graphene) representing the most heavily protected technological approaches.

Freedom-to-operate challenges are increasingly significant in this space as patent thickets develop around key materials and processes. Companies entering the ITO-free electrode market face potential infringement risks, necessitating comprehensive IP due diligence. The landscape analysis reveals several white space opportunities in hybrid material systems and novel deposition techniques that remain relatively underexplored in patent filings.

Cross-licensing agreements have become a common strategy among major players to navigate the complex patent landscape. These agreements allow companies to access essential technologies while reducing litigation risks. Additionally, defensive patenting strategies are increasingly employed to protect R&D investments and secure competitive positions in this rapidly evolving field.

Patent quality analysis indicates varying levels of claim breadth and enforceability across the landscape. Pioneer patents with fundamental claims on material compositions and basic manufacturing processes hold significant blocking potential, while improvement patents focus on incremental enhancements to existing technologies. This stratification creates a multi-layered IP environment where strategic patent positioning becomes crucial for market entry and technology development.

For companies developing ITO-free electrode technologies, a proactive IP strategy should include regular landscape monitoring, strategic patent filing in key jurisdictions, and consideration of licensing opportunities. The analysis suggests that building a diversified patent portfolio covering both materials and manufacturing processes provides the strongest competitive position in this technologically dynamic field.

Strategic patent filing patterns reveal geographical concentration in key manufacturing regions, with China, South Korea, and the United States leading in patent applications. This geographical distribution reflects the industrial significance of these regions in display and touch panel manufacturing. The patent landscape shows clustering around specific alternative materials, with metal nanowire networks, conductive polymers, and carbon-based materials (particularly graphene) representing the most heavily protected technological approaches.

Freedom-to-operate challenges are increasingly significant in this space as patent thickets develop around key materials and processes. Companies entering the ITO-free electrode market face potential infringement risks, necessitating comprehensive IP due diligence. The landscape analysis reveals several white space opportunities in hybrid material systems and novel deposition techniques that remain relatively underexplored in patent filings.

Cross-licensing agreements have become a common strategy among major players to navigate the complex patent landscape. These agreements allow companies to access essential technologies while reducing litigation risks. Additionally, defensive patenting strategies are increasingly employed to protect R&D investments and secure competitive positions in this rapidly evolving field.

Patent quality analysis indicates varying levels of claim breadth and enforceability across the landscape. Pioneer patents with fundamental claims on material compositions and basic manufacturing processes hold significant blocking potential, while improvement patents focus on incremental enhancements to existing technologies. This stratification creates a multi-layered IP environment where strategic patent positioning becomes crucial for market entry and technology development.

For companies developing ITO-free electrode technologies, a proactive IP strategy should include regular landscape monitoring, strategic patent filing in key jurisdictions, and consideration of licensing opportunities. The analysis suggests that building a diversified patent portfolio covering both materials and manufacturing processes provides the strongest competitive position in this technologically dynamic field.

Environmental and Sustainability Impact of ITO Alternatives

The environmental impact of ITO (Indium Tin Oxide) has become a critical consideration in the development of alternative electrode materials. As indium is classified as a critical raw material with limited global reserves, its extraction and processing pose significant environmental challenges. Mining operations for indium are energy-intensive and often result in habitat destruction, soil contamination, and water pollution. The refining process further contributes to carbon emissions and generates hazardous waste streams that require careful management.

ITO-free alternatives are increasingly being developed with sustainability as a core design principle. Patent analysis reveals a growing trend toward materials with reduced environmental footprints. Silver nanowire technologies, for instance, demonstrate up to 30% lower carbon emissions during production compared to traditional ITO manufacturing. Similarly, PEDOT:PSS-based solutions utilize organic compounds that can be synthesized from renewable resources, significantly reducing dependence on rare earth minerals.

Carbon-based alternatives such as graphene and carbon nanotubes show particular promise from a sustainability perspective. Recent patents highlight manufacturing methods that utilize bio-based precursors and low-temperature processing, dramatically reducing energy consumption. These materials also offer end-of-life advantages, with some patents describing recyclable electrode structures that can be recovered and reprocessed with minimal quality degradation.

Metal mesh technologies have evolved to address both performance and environmental concerns. Patent filings from 2018-2023 show increasing emphasis on manufacturing processes that minimize material waste through precise deposition techniques. Several patents describe closed-loop systems that recover and reuse up to 90% of metal precursors that would otherwise be discarded during traditional manufacturing.

Life cycle assessment (LCA) data cited in recent patent applications demonstrates that many ITO alternatives offer significant improvements in multiple environmental impact categories. For example, metal nanowire electrodes can reduce global warming potential by 25-40% compared to ITO, while also decreasing acidification potential and resource depletion metrics. These environmental benefits are increasingly being highlighted as competitive advantages in patent claims.

Regulatory considerations are also driving innovation in this space. Patents filed in regions with stringent environmental regulations, such as the EU, frequently incorporate design elements that facilitate compliance with directives like RoHS, REACH, and the upcoming Sustainable Products Initiative. This regulatory landscape is accelerating the development of ITO alternatives that not only match performance requirements but also align with circular economy principles.

ITO-free alternatives are increasingly being developed with sustainability as a core design principle. Patent analysis reveals a growing trend toward materials with reduced environmental footprints. Silver nanowire technologies, for instance, demonstrate up to 30% lower carbon emissions during production compared to traditional ITO manufacturing. Similarly, PEDOT:PSS-based solutions utilize organic compounds that can be synthesized from renewable resources, significantly reducing dependence on rare earth minerals.

Carbon-based alternatives such as graphene and carbon nanotubes show particular promise from a sustainability perspective. Recent patents highlight manufacturing methods that utilize bio-based precursors and low-temperature processing, dramatically reducing energy consumption. These materials also offer end-of-life advantages, with some patents describing recyclable electrode structures that can be recovered and reprocessed with minimal quality degradation.

Metal mesh technologies have evolved to address both performance and environmental concerns. Patent filings from 2018-2023 show increasing emphasis on manufacturing processes that minimize material waste through precise deposition techniques. Several patents describe closed-loop systems that recover and reuse up to 90% of metal precursors that would otherwise be discarded during traditional manufacturing.

Life cycle assessment (LCA) data cited in recent patent applications demonstrates that many ITO alternatives offer significant improvements in multiple environmental impact categories. For example, metal nanowire electrodes can reduce global warming potential by 25-40% compared to ITO, while also decreasing acidification potential and resource depletion metrics. These environmental benefits are increasingly being highlighted as competitive advantages in patent claims.

Regulatory considerations are also driving innovation in this space. Patents filed in regions with stringent environmental regulations, such as the EU, frequently incorporate design elements that facilitate compliance with directives like RoHS, REACH, and the upcoming Sustainable Products Initiative. This regulatory landscape is accelerating the development of ITO alternatives that not only match performance requirements but also align with circular economy principles.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!