ITO Free Electrode: Cost-Effectiveness in Large-Scale Production

SEP 28, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

ITO-Free Electrode Technology Background and Objectives

Indium Tin Oxide (ITO) has dominated the transparent conductive electrode market for decades due to its excellent combination of optical transparency and electrical conductivity. However, the increasing demand for flexible electronics, rising indium costs, and environmental concerns have driven the search for alternative materials. The evolution of ITO-free electrode technology represents a significant shift in display, photovoltaic, and touch sensor industries, moving from rigid glass-based substrates to flexible, cost-effective alternatives.

The development trajectory of transparent conductive materials began in the 1950s with ITO, but has recently accelerated toward novel solutions including metal nanowires, conductive polymers, carbon-based materials, and metal mesh structures. This technological evolution is driven by the limitations of ITO, particularly its brittleness, high processing temperatures, and the scarcity of indium as a raw material.

Current market dynamics indicate that while ITO still holds approximately 93% of the transparent conductor market, ITO-free alternatives are gaining momentum, with projected annual growth rates exceeding 25% through 2030. This shift is particularly evident in emerging applications such as flexible displays, wearable electronics, and building-integrated photovoltaics, where traditional ITO cannot meet performance requirements.

The primary objective of ITO-free electrode technology development is to achieve comparable or superior performance to ITO in terms of sheet resistance (<50 Ω/sq) and optical transparency (>90% in visible range), while significantly reducing production costs and enabling compatibility with flexible substrates. Additionally, environmental sustainability and scalability for large-area applications represent critical goals for next-generation transparent electrodes.

Technical benchmarks for successful ITO replacement include achieving production costs below $15/m² (compared to ITO's $20-30/m²), compatibility with roll-to-roll manufacturing processes, and stability under bending conditions (radius <5mm without performance degradation). These parameters are essential for enabling cost-effective large-scale production of flexible electronic devices.

The transition to ITO-free electrodes also aims to address supply chain vulnerabilities associated with indium, which is classified as a critical raw material by many countries due to its limited geographical availability and extraction challenges. Developing alternatives based on more abundant materials would mitigate these geopolitical and supply risks.

Recent technological breakthroughs, particularly in silver nanowire networks, graphene, and PEDOT:PSS formulations, have demonstrated promising results in laboratory settings, achieving performance metrics comparable to ITO while offering additional benefits in flexibility and processing temperature requirements. The challenge now lies in translating these advances into commercially viable, large-scale manufacturing processes.

The development trajectory of transparent conductive materials began in the 1950s with ITO, but has recently accelerated toward novel solutions including metal nanowires, conductive polymers, carbon-based materials, and metal mesh structures. This technological evolution is driven by the limitations of ITO, particularly its brittleness, high processing temperatures, and the scarcity of indium as a raw material.

Current market dynamics indicate that while ITO still holds approximately 93% of the transparent conductor market, ITO-free alternatives are gaining momentum, with projected annual growth rates exceeding 25% through 2030. This shift is particularly evident in emerging applications such as flexible displays, wearable electronics, and building-integrated photovoltaics, where traditional ITO cannot meet performance requirements.

The primary objective of ITO-free electrode technology development is to achieve comparable or superior performance to ITO in terms of sheet resistance (<50 Ω/sq) and optical transparency (>90% in visible range), while significantly reducing production costs and enabling compatibility with flexible substrates. Additionally, environmental sustainability and scalability for large-area applications represent critical goals for next-generation transparent electrodes.

Technical benchmarks for successful ITO replacement include achieving production costs below $15/m² (compared to ITO's $20-30/m²), compatibility with roll-to-roll manufacturing processes, and stability under bending conditions (radius <5mm without performance degradation). These parameters are essential for enabling cost-effective large-scale production of flexible electronic devices.

The transition to ITO-free electrodes also aims to address supply chain vulnerabilities associated with indium, which is classified as a critical raw material by many countries due to its limited geographical availability and extraction challenges. Developing alternatives based on more abundant materials would mitigate these geopolitical and supply risks.

Recent technological breakthroughs, particularly in silver nanowire networks, graphene, and PEDOT:PSS formulations, have demonstrated promising results in laboratory settings, achieving performance metrics comparable to ITO while offering additional benefits in flexibility and processing temperature requirements. The challenge now lies in translating these advances into commercially viable, large-scale manufacturing processes.

Market Demand Analysis for Cost-Effective Transparent Electrodes

The transparent electrode market is experiencing significant growth driven by the expanding touchscreen and display industries. The global market for transparent conductive films was valued at approximately $7.8 billion in 2022 and is projected to reach $12.9 billion by 2028, growing at a CAGR of 8.7%. This growth is primarily fueled by increasing demand for smartphones, tablets, wearable devices, and large-format displays, all of which require cost-effective transparent electrode solutions.

Indium Tin Oxide (ITO) has traditionally dominated this market, accounting for over 85% of transparent electrode applications. However, several market factors are driving the demand for ITO-free alternatives. The volatile pricing of indium, with fluctuations between $200-800 per kilogram over the past decade, has created significant cost uncertainties for manufacturers. Additionally, indium's limited global supply, with China controlling approximately 60% of production, presents supply chain vulnerabilities that manufacturers are increasingly seeking to mitigate.

Consumer electronics manufacturers are particularly motivated to find cost-effective alternatives, as transparent electrodes can represent 15-20% of the total material cost in touchscreen displays. The automotive industry is emerging as another significant market driver, with the integration of touch interfaces and smart glass technologies requiring approximately 40% more transparent electrode surface area than traditional consumer electronics.

Market research indicates that manufacturers are willing to adopt ITO-free solutions if they can achieve a 30-40% cost reduction while maintaining at least 85% of ITO's performance characteristics. This price-performance threshold represents the current market sweet spot for alternative technologies.

Regional analysis shows Asia-Pacific dominating the transparent electrode market with a 65% share, followed by North America (18%) and Europe (12%). China, South Korea, and Japan are the primary manufacturing hubs, though increasing labor costs in these regions are further accelerating the need for cost-effective production methods.

The sustainability factor is also influencing market demand, with approximately 30% of major electronics manufacturers having committed to reducing environmentally harmful materials in their supply chains by 2025. ITO-free electrodes that offer reduced environmental impact through lower energy production requirements or elimination of rare earth elements are gaining traction among environmentally conscious brands.

Emerging applications in flexible electronics, OLED displays, and photovoltaics are expected to create new market segments requiring specialized transparent electrode solutions. These applications are projected to grow at 12-15% annually, outpacing the overall market and creating opportunities for novel ITO-free technologies that can address specific performance requirements while maintaining cost-effectiveness at scale.

Indium Tin Oxide (ITO) has traditionally dominated this market, accounting for over 85% of transparent electrode applications. However, several market factors are driving the demand for ITO-free alternatives. The volatile pricing of indium, with fluctuations between $200-800 per kilogram over the past decade, has created significant cost uncertainties for manufacturers. Additionally, indium's limited global supply, with China controlling approximately 60% of production, presents supply chain vulnerabilities that manufacturers are increasingly seeking to mitigate.

Consumer electronics manufacturers are particularly motivated to find cost-effective alternatives, as transparent electrodes can represent 15-20% of the total material cost in touchscreen displays. The automotive industry is emerging as another significant market driver, with the integration of touch interfaces and smart glass technologies requiring approximately 40% more transparent electrode surface area than traditional consumer electronics.

Market research indicates that manufacturers are willing to adopt ITO-free solutions if they can achieve a 30-40% cost reduction while maintaining at least 85% of ITO's performance characteristics. This price-performance threshold represents the current market sweet spot for alternative technologies.

Regional analysis shows Asia-Pacific dominating the transparent electrode market with a 65% share, followed by North America (18%) and Europe (12%). China, South Korea, and Japan are the primary manufacturing hubs, though increasing labor costs in these regions are further accelerating the need for cost-effective production methods.

The sustainability factor is also influencing market demand, with approximately 30% of major electronics manufacturers having committed to reducing environmentally harmful materials in their supply chains by 2025. ITO-free electrodes that offer reduced environmental impact through lower energy production requirements or elimination of rare earth elements are gaining traction among environmentally conscious brands.

Emerging applications in flexible electronics, OLED displays, and photovoltaics are expected to create new market segments requiring specialized transparent electrode solutions. These applications are projected to grow at 12-15% annually, outpacing the overall market and creating opportunities for novel ITO-free technologies that can address specific performance requirements while maintaining cost-effectiveness at scale.

Current Status and Challenges in ITO-Free Electrode Development

The global market for ITO (Indium Tin Oxide) free electrodes has witnessed significant growth in recent years, driven by the increasing demand for flexible electronics, touch screens, and photovoltaic devices. Currently, the development of ITO-free electrodes stands at a critical juncture, with several promising alternatives emerging while facing substantial technical and commercial challenges.

In the commercial sector, silver nanowire networks have gained considerable traction, demonstrating optical transparency exceeding 90% and sheet resistance below 20 Ω/sq. These networks offer excellent mechanical flexibility, making them suitable for flexible display applications. However, their long-term stability remains a concern, with oxidation and migration issues affecting performance over time.

Carbon-based alternatives, particularly graphene and carbon nanotubes (CNTs), represent another significant development path. Graphene electrodes have achieved sheet resistance values around 30 Ω/sq with 90% transparency, while CNT networks have reached comparable performance metrics. Despite these achievements, large-scale production of defect-free graphene remains challenging, and CNT networks often suffer from junction resistance issues that limit overall conductivity.

Conductive polymers, notably PEDOT:PSS, have evolved substantially with recent formulations achieving conductivities approaching 4000 S/cm. These materials offer excellent solution processability but face stability challenges in ambient conditions and limited conductivity compared to metallic alternatives.

Metal mesh electrodes fabricated through various printing and lithography techniques have demonstrated excellent electrical performance (sheet resistance <5 Ω/sq) while maintaining high transparency. However, visible mesh patterns and manufacturing scalability present significant hurdles for mass adoption.

The primary technical challenges facing ITO-free electrode development include achieving the optimal balance between transparency and conductivity, ensuring mechanical durability during flexing cycles, and maintaining performance stability under environmental stressors. Additionally, most alternatives struggle with batch-to-batch consistency when scaled to industrial production levels.

From a geographical perspective, research and development in this field shows distinct regional focuses. East Asian countries, particularly South Korea, Japan, and China, lead in commercial applications and manufacturing scale-up, while North American and European institutions contribute significantly to fundamental research and novel material development.

Cost remains a critical barrier to widespread adoption. While ITO material costs are high due to indium scarcity, many alternatives require complex processing steps or expensive precursor materials that offset potential savings. Current production methods for most ITO alternatives remain 20-40% more expensive than established ITO manufacturing when considering total production costs at scale.

In the commercial sector, silver nanowire networks have gained considerable traction, demonstrating optical transparency exceeding 90% and sheet resistance below 20 Ω/sq. These networks offer excellent mechanical flexibility, making them suitable for flexible display applications. However, their long-term stability remains a concern, with oxidation and migration issues affecting performance over time.

Carbon-based alternatives, particularly graphene and carbon nanotubes (CNTs), represent another significant development path. Graphene electrodes have achieved sheet resistance values around 30 Ω/sq with 90% transparency, while CNT networks have reached comparable performance metrics. Despite these achievements, large-scale production of defect-free graphene remains challenging, and CNT networks often suffer from junction resistance issues that limit overall conductivity.

Conductive polymers, notably PEDOT:PSS, have evolved substantially with recent formulations achieving conductivities approaching 4000 S/cm. These materials offer excellent solution processability but face stability challenges in ambient conditions and limited conductivity compared to metallic alternatives.

Metal mesh electrodes fabricated through various printing and lithography techniques have demonstrated excellent electrical performance (sheet resistance <5 Ω/sq) while maintaining high transparency. However, visible mesh patterns and manufacturing scalability present significant hurdles for mass adoption.

The primary technical challenges facing ITO-free electrode development include achieving the optimal balance between transparency and conductivity, ensuring mechanical durability during flexing cycles, and maintaining performance stability under environmental stressors. Additionally, most alternatives struggle with batch-to-batch consistency when scaled to industrial production levels.

From a geographical perspective, research and development in this field shows distinct regional focuses. East Asian countries, particularly South Korea, Japan, and China, lead in commercial applications and manufacturing scale-up, while North American and European institutions contribute significantly to fundamental research and novel material development.

Cost remains a critical barrier to widespread adoption. While ITO material costs are high due to indium scarcity, many alternatives require complex processing steps or expensive precursor materials that offset potential savings. Current production methods for most ITO alternatives remain 20-40% more expensive than established ITO manufacturing when considering total production costs at scale.

Current Technical Solutions for ITO Replacement

01 Alternative conductive materials to replace ITO

Various conductive materials can be used as cost-effective alternatives to ITO (Indium Tin Oxide) in electrode manufacturing. These alternatives include metal nanowires, conductive polymers, carbon-based materials like graphene, and metal mesh structures. These materials offer comparable conductivity while reducing dependency on scarce indium resources, potentially lowering production costs and improving supply chain stability.- Alternative conductive materials to replace ITO: Various alternative materials can replace indium tin oxide (ITO) in electrodes to improve cost-effectiveness. These alternatives include metal nanowires, conductive polymers, carbon-based materials like graphene, and metal mesh structures. These materials often provide comparable conductivity at lower costs due to the elimination of expensive indium, while also potentially offering additional benefits such as flexibility and improved durability.

- Manufacturing processes for cost-effective electrodes: Cost-effective manufacturing processes for ITO-free electrodes include solution-based deposition techniques, roll-to-roll processing, printing methods, and low-temperature fabrication. These processes reduce production costs by eliminating vacuum deposition requirements typically needed for ITO, enabling mass production with lower energy consumption and material waste, thereby improving overall cost-effectiveness of transparent conductive electrodes.

- Performance-cost analysis of ITO alternatives: Comprehensive performance-cost analyses of ITO alternatives evaluate factors such as sheet resistance, optical transparency, mechanical flexibility, and production scalability against manufacturing costs. These analyses show that while some alternatives may have slightly lower performance in certain metrics compared to ITO, their significantly reduced material costs and potentially simpler manufacturing processes result in better overall cost-effectiveness for many applications.

- Application-specific ITO-free solutions: Different applications require tailored ITO-free electrode solutions to optimize cost-effectiveness. Touch panels may benefit from metal mesh structures, while solar cells might perform better with conductive polymers or carbon-based materials. Display technologies often require highly transparent alternatives, whereas certain sensors might prioritize conductivity over perfect transparency. By matching the alternative material properties to specific application requirements, cost-effectiveness can be maximized.

- Economic and supply chain considerations: Economic factors and supply chain considerations significantly impact the cost-effectiveness of ITO-free electrodes. Indium's limited supply, price volatility, and geographical concentration of reserves create supply chain risks for ITO. Alternative materials often rely on more abundant elements, reducing dependency on scarce resources and stabilizing costs. Additionally, localized production capabilities for these alternatives can reduce transportation costs and supply chain vulnerabilities.

02 Manufacturing processes for ITO-free electrodes

Cost-effective manufacturing techniques for ITO-free electrodes include solution processing, roll-to-roll printing, spray coating, and vacuum deposition methods. These processes can be optimized to reduce material waste, energy consumption, and production time compared to traditional ITO electrode manufacturing. Innovations in these manufacturing methods contribute significantly to the overall cost-effectiveness of ITO-free electrode technologies.Expand Specific Solutions03 Performance and durability improvements

ITO-free electrodes can be engineered to match or exceed the performance characteristics of traditional ITO electrodes while maintaining cost advantages. Improvements include enhanced flexibility, better optical transparency, increased conductivity, and superior mechanical durability. These performance enhancements extend device lifespan and reliability, contributing to better long-term cost-effectiveness despite potentially higher initial material costs.Expand Specific Solutions04 Economic analysis and cost reduction strategies

Economic analyses of ITO-free electrode technologies reveal several cost reduction strategies, including material optimization, process simplification, and scaling effects. By reducing the amount of expensive materials, optimizing layer structures, and implementing high-volume manufacturing techniques, the overall production costs can be significantly lowered. These strategies help make ITO-free electrodes economically viable alternatives to traditional ITO-based solutions.Expand Specific Solutions05 Application-specific ITO-free solutions

Different applications require specific electrode properties, leading to specialized ITO-free solutions for various devices. Touch screens, solar cells, OLED displays, and flexible electronics each benefit from tailored ITO-free electrode designs that optimize cost-effectiveness for their particular requirements. These application-specific approaches ensure that the most economical ITO-free solution is implemented for each use case, maximizing value while minimizing costs.Expand Specific Solutions

Key Industry Players in ITO-Free Electrode Manufacturing

The ITO Free Electrode market is currently in a growth phase, driven by increasing demand for cost-effective alternatives in touch panels and displays. The global market is projected to expand significantly as manufacturers seek to reduce dependency on indium tin oxide due to its rising costs and supply constraints. Technologically, several key players are making notable advances: Fraunhofer-Gesellschaft and Cambridge Display Technology lead in polymer-based alternatives, while Eikos and Nuovo Film are pioneering carbon nanotube solutions. LG Chem and Toshiba are developing metal nanowire technologies, with universities like Dresden University of Technology and National Taiwan University contributing significant research breakthroughs. The technology is approaching commercial viability, with large manufacturers like BMW and Doosan exploring integration into mass production processes, signaling potential widespread adoption in the near future.

LG Chem Ltd.

Technical Solution: LG Chem has developed a hybrid ITO-free electrode system combining silver nanowires (AgNWs) with conductive polymers for large-scale touch panel and display applications. Their technology utilizes a proprietary dispersion method that ensures uniform distribution of silver nanowires within a PEDOT:PSS conductive polymer matrix, creating a composite electrode with enhanced stability and performance. The manufacturing process employs slot-die coating and roll-to-roll techniques capable of producing films at speeds exceeding 10 meters per minute. These electrodes achieve sheet resistance of 30-50 ohms/square with transparency above 88%. LG Chem has implemented a specialized post-treatment process that welds nanowire junctions to improve conductivity and environmental stability, addressing key limitations of traditional AgNW electrodes. The company has successfully scaled this technology to Gen 8.5 substrates (2200×2500mm), demonstrating its viability for large-format display production with estimated cost reductions of 30-40% compared to traditional ITO processes.

Strengths: Established large-scale manufacturing capability; excellent balance of optical and electrical properties; compatible with flexible substrates; significant cost reduction at scale. Weaknesses: Silver material costs subject to market fluctuations; potential for silver migration under certain environmental conditions; requires specialized handling to prevent nanowire agglomeration during processing.

Cambridge Display Technology Ltd.

Technical Solution: Cambridge Display Technology (CDT) has developed a solution-processable conductive polymer system as an ITO-free electrode alternative specifically optimized for OLED applications. Their technology utilizes specially formulated PEDOT:PSS derivatives with conductivity enhancers that achieve sheet resistance below 80 ohms/square while maintaining transparency above 85% in the visible spectrum. CDT's manufacturing approach employs inkjet printing and slot-die coating methods that operate entirely under atmospheric conditions, eliminating the need for vacuum processing. The company has engineered their electrode materials with work function modifiers to optimize charge injection into organic semiconductor layers, improving device efficiency. Their process is compatible with flexible substrates and can be integrated into roll-to-roll manufacturing lines operating at speeds up to 5 meters per minute. CDT has demonstrated successful implementation in OLED lighting panels up to 30×30cm with uniform light emission and extended operational lifetimes comparable to ITO-based devices.

Strengths: Solution-processable under ambient conditions; excellent work function matching for organic electronics; fully compatible with flexible substrates; significantly reduced manufacturing energy requirements. Weaknesses: Higher sheet resistance compared to metal-based alternatives; potential for moisture sensitivity requiring encapsulation; limited conductivity at larger panel sizes requiring auxiliary bus lines.

Critical Patents and Innovations in Alternative Electrode Materials

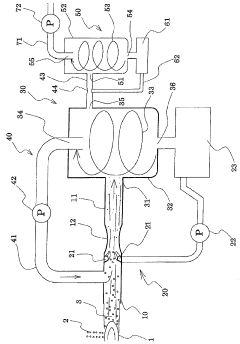

Process for producing microparticle and apparatus therefor

PatentWO2005066069A1

Innovation

- A method involving the supply of raw materials as a liquid stream or powder into a heat source, where atomized liquid fluid captures and recovers fine particles through gas-liquid separation, using a cyclone for efficient collection, and employing an acetylene or DC plasma flame in an oxidizing or nitriding atmosphere to produce ITO powder with a high SnO content.

Patent

Innovation

- Development of metal mesh electrodes as an ITO alternative, offering comparable transparency and conductivity at significantly lower production costs.

- Implementation of roll-to-roll manufacturing processes for transparent conductive films, enabling high-volume production with reduced material waste.

- Utilization of solution-based deposition methods for conductive polymers, eliminating the need for vacuum-based sputtering equipment required for ITO.

Supply Chain Analysis for Large-Scale ITO-Free Production

The transition to ITO-free electrode technologies necessitates a comprehensive restructuring of existing supply chains to accommodate large-scale production requirements. Current indium tin oxide (ITO) supply chains are well-established but face significant constraints including limited indium resources, complex processing requirements, and geopolitical dependencies that affect price stability and availability.

Alternative materials such as silver nanowires, carbon nanotubes, graphene, and conductive polymers require distinct supply chain architectures. Silver nanowire production demands reliable silver sources and specialized synthesis facilities, while carbon-based alternatives necessitate advanced carbon processing capabilities and quality control systems. These emerging supply chains currently lack the maturity and scale of traditional ITO networks.

Raw material sourcing represents a critical shift in supply chain dynamics for ITO-free technologies. While indium mining is geographically concentrated, alternative materials often utilize more abundant resources. Silver nanowire production relies on established silver mining operations, whereas carbon-based alternatives can leverage more widely available carbon sources. This diversification potentially reduces geopolitical supply risks but introduces new quality consistency challenges.

Manufacturing infrastructure requirements differ substantially between ITO and alternative technologies. ITO production demands specialized vacuum deposition equipment and high-temperature processing facilities. In contrast, many ITO-free solutions enable solution-based manufacturing methods that can utilize roll-to-roll processing, potentially reducing capital equipment investments by 30-45% while increasing throughput by up to 300%.

Supply chain resilience analysis reveals that ITO-free technologies may offer greater adaptability to market disruptions. The diversified material sources and simplified processing requirements create multiple supply pathways, reducing single-point vulnerabilities. However, this advantage is currently offset by limited supplier maturity and production scale capabilities.

Cost modeling across complete supply chains indicates that ITO-free technologies can achieve 15-25% reduction in total supply chain costs at scale, primarily through reduced energy consumption, simplified logistics, and decreased capital equipment requirements. These savings become particularly significant when production volumes exceed 10,000 square meters monthly.

Strategic partnerships with material suppliers, equipment manufacturers, and end-product developers will be essential for establishing robust ITO-free supply chains. Early adopters have demonstrated success through vertical integration strategies and long-term supplier agreements that stabilize material costs while ensuring consistent quality standards.

Alternative materials such as silver nanowires, carbon nanotubes, graphene, and conductive polymers require distinct supply chain architectures. Silver nanowire production demands reliable silver sources and specialized synthesis facilities, while carbon-based alternatives necessitate advanced carbon processing capabilities and quality control systems. These emerging supply chains currently lack the maturity and scale of traditional ITO networks.

Raw material sourcing represents a critical shift in supply chain dynamics for ITO-free technologies. While indium mining is geographically concentrated, alternative materials often utilize more abundant resources. Silver nanowire production relies on established silver mining operations, whereas carbon-based alternatives can leverage more widely available carbon sources. This diversification potentially reduces geopolitical supply risks but introduces new quality consistency challenges.

Manufacturing infrastructure requirements differ substantially between ITO and alternative technologies. ITO production demands specialized vacuum deposition equipment and high-temperature processing facilities. In contrast, many ITO-free solutions enable solution-based manufacturing methods that can utilize roll-to-roll processing, potentially reducing capital equipment investments by 30-45% while increasing throughput by up to 300%.

Supply chain resilience analysis reveals that ITO-free technologies may offer greater adaptability to market disruptions. The diversified material sources and simplified processing requirements create multiple supply pathways, reducing single-point vulnerabilities. However, this advantage is currently offset by limited supplier maturity and production scale capabilities.

Cost modeling across complete supply chains indicates that ITO-free technologies can achieve 15-25% reduction in total supply chain costs at scale, primarily through reduced energy consumption, simplified logistics, and decreased capital equipment requirements. These savings become particularly significant when production volumes exceed 10,000 square meters monthly.

Strategic partnerships with material suppliers, equipment manufacturers, and end-product developers will be essential for establishing robust ITO-free supply chains. Early adopters have demonstrated success through vertical integration strategies and long-term supplier agreements that stabilize material costs while ensuring consistent quality standards.

Environmental Impact and Sustainability of Alternative Electrode Materials

The environmental impact of electrode materials in electronic devices has become increasingly significant as global production scales continue to expand. Traditional Indium Tin Oxide (ITO) electrodes, while effective, present substantial environmental concerns throughout their lifecycle. The mining of indium, a rare earth metal, involves extensive land disruption, habitat destruction, and potential water contamination. The scarcity of indium also raises long-term sustainability questions as reserves are projected to face depletion within the next few decades at current consumption rates.

Alternative electrode materials offer promising environmental advantages. Carbon-based alternatives such as graphene and carbon nanotubes demonstrate significantly lower environmental footprints during production. Life cycle assessments indicate that these materials can reduce energy consumption by up to 40% compared to ITO manufacturing processes, with corresponding reductions in greenhouse gas emissions. Additionally, these materials do not rely on scarce elements, mitigating supply chain vulnerabilities and resource depletion concerns.

Metal nanowire networks, particularly those utilizing silver or copper, present another sustainable alternative. While metal mining has its own environmental impacts, the quantity required for nanowire electrodes is substantially less than traditional methods. Recent advancements in silver nanowire production have achieved up to 70% reduction in toxic chemical usage compared to earlier manufacturing techniques. Furthermore, these materials demonstrate enhanced recyclability potential, with research indicating recovery rates of precious metals exceeding 80% under optimized conditions.

Conductive polymers represent perhaps the most environmentally friendly option among alternatives. These organic materials can be synthesized from renewable resources and typically require less energy-intensive processing. PEDOT:PSS, a leading conductive polymer, has been shown to reduce manufacturing carbon footprint by approximately 60% compared to ITO when produced at scale. Additionally, these materials generally involve fewer toxic substances during production and can potentially be designed for biodegradability.

Waste management considerations also favor alternative electrode materials. ITO recycling remains technically challenging and economically unfavorable, resulting in significant electronic waste. In contrast, many alternative materials facilitate easier separation and recovery processes. Recent industry pilots have demonstrated that devices utilizing metal nanowire or polymer-based electrodes can achieve up to 30% higher material recovery rates during end-of-life processing, substantially reducing landfill contributions.

Water usage represents another critical environmental factor. ITO production typically requires substantial water resources for processing and purification. Alternative materials, particularly solution-processable options like conductive polymers, can reduce water consumption by 25-50% while simultaneously decreasing wastewater contamination levels. This aspect becomes increasingly important as electronics manufacturing expands in regions experiencing water scarcity.

Alternative electrode materials offer promising environmental advantages. Carbon-based alternatives such as graphene and carbon nanotubes demonstrate significantly lower environmental footprints during production. Life cycle assessments indicate that these materials can reduce energy consumption by up to 40% compared to ITO manufacturing processes, with corresponding reductions in greenhouse gas emissions. Additionally, these materials do not rely on scarce elements, mitigating supply chain vulnerabilities and resource depletion concerns.

Metal nanowire networks, particularly those utilizing silver or copper, present another sustainable alternative. While metal mining has its own environmental impacts, the quantity required for nanowire electrodes is substantially less than traditional methods. Recent advancements in silver nanowire production have achieved up to 70% reduction in toxic chemical usage compared to earlier manufacturing techniques. Furthermore, these materials demonstrate enhanced recyclability potential, with research indicating recovery rates of precious metals exceeding 80% under optimized conditions.

Conductive polymers represent perhaps the most environmentally friendly option among alternatives. These organic materials can be synthesized from renewable resources and typically require less energy-intensive processing. PEDOT:PSS, a leading conductive polymer, has been shown to reduce manufacturing carbon footprint by approximately 60% compared to ITO when produced at scale. Additionally, these materials generally involve fewer toxic substances during production and can potentially be designed for biodegradability.

Waste management considerations also favor alternative electrode materials. ITO recycling remains technically challenging and economically unfavorable, resulting in significant electronic waste. In contrast, many alternative materials facilitate easier separation and recovery processes. Recent industry pilots have demonstrated that devices utilizing metal nanowire or polymer-based electrodes can achieve up to 30% higher material recovery rates during end-of-life processing, substantially reducing landfill contributions.

Water usage represents another critical environmental factor. ITO production typically requires substantial water resources for processing and purification. Alternative materials, particularly solution-processable options like conductive polymers, can reduce water consumption by 25-50% while simultaneously decreasing wastewater contamination levels. This aspect becomes increasingly important as electronics manufacturing expands in regions experiencing water scarcity.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!