ITO Free Electrode: A New Horizon for Touchscreen Technology

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

ITO-Free Electrode Technology Background and Objectives

Touchscreen technology has evolved significantly since its inception in the 1960s, with Indium Tin Oxide (ITO) serving as the dominant transparent conductive material for decades. ITO's unique combination of optical transparency and electrical conductivity has made it the industry standard for touchscreen electrodes in smartphones, tablets, and various interactive displays. However, despite its widespread adoption, ITO presents several limitations that have prompted researchers and manufacturers to explore alternative solutions.

The evolution of touchscreen technology has been driven by consumer demands for thinner, more responsive, and increasingly durable devices. ITO's inherent brittleness, limited flexibility, and rising production costs have become significant constraints in meeting these market expectations. Additionally, the scarcity of indium as a natural resource has raised concerns about long-term sustainability and price stability, creating an urgent need for viable alternatives.

ITO-Free electrode technology represents a paradigm shift in touchscreen development, aiming to overcome these limitations while maintaining or improving upon the performance characteristics that made ITO successful. The primary objective of this technological transition is to develop alternative transparent conductive materials that offer comparable or superior optical and electrical properties while addressing ITO's shortcomings in flexibility, durability, and cost-effectiveness.

Recent advancements in nanomaterials science have accelerated the development of promising ITO alternatives, including silver nanowires, carbon nanotubes, graphene, conductive polymers, and metal mesh structures. Each of these materials presents unique advantages and challenges in terms of conductivity, transparency, manufacturing scalability, and integration with existing production processes.

The technical objectives for ITO-Free electrode technology include achieving sheet resistance below 100 ohms per square while maintaining optical transparency above 90% in the visible spectrum. Additionally, these materials must demonstrate mechanical flexibility with minimal degradation after repeated bending cycles, compatibility with roll-to-roll manufacturing processes, and environmental stability under various operating conditions.

Beyond performance metrics, ITO-Free electrode technology aims to enable new form factors and applications previously constrained by ITO's limitations. Flexible, foldable, and even stretchable displays represent emerging market opportunities that require conductive materials with mechanical properties fundamentally different from traditional ITO.

The trajectory of ITO-Free electrode development is closely aligned with broader industry trends toward sustainable manufacturing and reduced dependence on scarce natural resources. As such, research efforts are increasingly focused on materials that can be synthesized from abundant elements using environmentally responsible processes, supporting the technology sector's transition toward greater sustainability.

The evolution of touchscreen technology has been driven by consumer demands for thinner, more responsive, and increasingly durable devices. ITO's inherent brittleness, limited flexibility, and rising production costs have become significant constraints in meeting these market expectations. Additionally, the scarcity of indium as a natural resource has raised concerns about long-term sustainability and price stability, creating an urgent need for viable alternatives.

ITO-Free electrode technology represents a paradigm shift in touchscreen development, aiming to overcome these limitations while maintaining or improving upon the performance characteristics that made ITO successful. The primary objective of this technological transition is to develop alternative transparent conductive materials that offer comparable or superior optical and electrical properties while addressing ITO's shortcomings in flexibility, durability, and cost-effectiveness.

Recent advancements in nanomaterials science have accelerated the development of promising ITO alternatives, including silver nanowires, carbon nanotubes, graphene, conductive polymers, and metal mesh structures. Each of these materials presents unique advantages and challenges in terms of conductivity, transparency, manufacturing scalability, and integration with existing production processes.

The technical objectives for ITO-Free electrode technology include achieving sheet resistance below 100 ohms per square while maintaining optical transparency above 90% in the visible spectrum. Additionally, these materials must demonstrate mechanical flexibility with minimal degradation after repeated bending cycles, compatibility with roll-to-roll manufacturing processes, and environmental stability under various operating conditions.

Beyond performance metrics, ITO-Free electrode technology aims to enable new form factors and applications previously constrained by ITO's limitations. Flexible, foldable, and even stretchable displays represent emerging market opportunities that require conductive materials with mechanical properties fundamentally different from traditional ITO.

The trajectory of ITO-Free electrode development is closely aligned with broader industry trends toward sustainable manufacturing and reduced dependence on scarce natural resources. As such, research efforts are increasingly focused on materials that can be synthesized from abundant elements using environmentally responsible processes, supporting the technology sector's transition toward greater sustainability.

Market Demand Analysis for Alternative Touchscreen Materials

The global touchscreen market has witnessed exponential growth over the past decade, with projections indicating continued expansion at a CAGR of 8.5% through 2028. This growth trajectory has traditionally been dominated by Indium Tin Oxide (ITO) based solutions. However, increasing concerns regarding indium scarcity, rising costs, and technical limitations have created substantial market demand for alternative touchscreen materials.

Market research indicates that device manufacturers are actively seeking ITO-free solutions due to several critical factors. The volatile pricing of indium, which has fluctuated between $200-700 per kilogram in recent years, has created significant cost uncertainties in the supply chain. Additionally, the geographical concentration of indium production, with China controlling approximately 60% of global supply, presents strategic risks for global electronics manufacturers.

Consumer electronics, representing the largest segment of the touchscreen market at 45% share, is driving demand for more durable and flexible display technologies. Traditional ITO electrodes exhibit brittleness that limits applications in emerging form factors such as foldable smartphones and rollable displays. Market surveys reveal that 78% of smartphone manufacturers consider flexibility a critical requirement for next-generation touchscreen materials.

The automotive sector presents another significant growth opportunity for ITO-free technologies. With touchscreen interfaces in vehicles expected to grow by 12% annually through 2027, manufacturers require solutions that offer enhanced durability, optical clarity, and performance in extreme temperature conditions - areas where traditional ITO solutions face limitations.

Environmental considerations are increasingly influencing market demand. The energy-intensive production process for ITO contributes significantly to the carbon footprint of touchscreen devices. Consumer awareness regarding sustainable electronics has risen, with 65% of consumers in developed markets expressing willingness to pay premium prices for environmentally friendly technologies.

The healthcare and industrial sectors are emerging as promising markets for alternative touchscreen materials. These sectors require specialized features such as antimicrobial properties, chemical resistance, and operation with gloved hands - capabilities that can be more readily engineered into newer alternative materials than traditional ITO.

Regional analysis shows that Asia-Pacific dominates the touchscreen market with 52% share, followed by North America and Europe. However, the fastest growth for alternative materials is occurring in North America, where research institutions and technology companies are heavily investing in next-generation display technologies. This regional innovation ecosystem is creating a fertile ground for the commercialization of ITO-free electrode technologies.

Market research indicates that device manufacturers are actively seeking ITO-free solutions due to several critical factors. The volatile pricing of indium, which has fluctuated between $200-700 per kilogram in recent years, has created significant cost uncertainties in the supply chain. Additionally, the geographical concentration of indium production, with China controlling approximately 60% of global supply, presents strategic risks for global electronics manufacturers.

Consumer electronics, representing the largest segment of the touchscreen market at 45% share, is driving demand for more durable and flexible display technologies. Traditional ITO electrodes exhibit brittleness that limits applications in emerging form factors such as foldable smartphones and rollable displays. Market surveys reveal that 78% of smartphone manufacturers consider flexibility a critical requirement for next-generation touchscreen materials.

The automotive sector presents another significant growth opportunity for ITO-free technologies. With touchscreen interfaces in vehicles expected to grow by 12% annually through 2027, manufacturers require solutions that offer enhanced durability, optical clarity, and performance in extreme temperature conditions - areas where traditional ITO solutions face limitations.

Environmental considerations are increasingly influencing market demand. The energy-intensive production process for ITO contributes significantly to the carbon footprint of touchscreen devices. Consumer awareness regarding sustainable electronics has risen, with 65% of consumers in developed markets expressing willingness to pay premium prices for environmentally friendly technologies.

The healthcare and industrial sectors are emerging as promising markets for alternative touchscreen materials. These sectors require specialized features such as antimicrobial properties, chemical resistance, and operation with gloved hands - capabilities that can be more readily engineered into newer alternative materials than traditional ITO.

Regional analysis shows that Asia-Pacific dominates the touchscreen market with 52% share, followed by North America and Europe. However, the fastest growth for alternative materials is occurring in North America, where research institutions and technology companies are heavily investing in next-generation display technologies. This regional innovation ecosystem is creating a fertile ground for the commercialization of ITO-free electrode technologies.

Current Status and Challenges in ITO-Free Electrode Development

The global touchscreen industry has witnessed significant evolution in recent years, with ITO (Indium Tin Oxide) traditionally dominating electrode materials. However, the current status of ITO-free electrode development reveals both promising advancements and persistent challenges. Internationally, research institutions and technology companies have made substantial progress in developing alternative materials, with silver nanowires, carbon nanotubes, graphene, and metal mesh technologies emerging as leading contenders.

Silver nanowire technology has achieved commercial implementation in several consumer electronics, demonstrating conductivity comparable to ITO with enhanced flexibility. Current production capabilities have reached medium-scale manufacturing, though consistency in performance across large surface areas remains problematic. Carbon nanotubes offer exceptional durability and flexibility but face challenges in achieving uniform dispersion and maintaining consistent sheet resistance across production batches.

Graphene-based electrodes represent perhaps the most promising long-term solution, with theoretical performance exceeding all current alternatives. However, large-scale production methods remain economically prohibitive, with current manufacturing costs approximately 3-5 times higher than conventional ITO solutions. Metal mesh technology has gained significant market traction, particularly in larger display applications, though visible patterns and moiré effects continue to limit adoption in premium device segments.

Geographically, East Asia maintains leadership in ITO-free research and development, with South Korea and Japan hosting the most advanced production facilities. China has rapidly expanded its research capabilities, particularly in metal mesh and silver nanowire technologies, while North American and European institutions lead in fundamental materials science breakthroughs, especially in graphene and novel composite materials.

The primary technical challenges currently facing ITO-free electrode development include achieving consistent optical transparency above 90% while maintaining conductivity below 100 ohms/square, developing scalable manufacturing processes that maintain performance consistency across large surface areas, and addressing long-term stability issues, particularly oxidation in silver-based solutions and degradation in carbon-based materials.

Economic constraints also present significant barriers, as current alternatives generally require 30-50% higher production costs compared to established ITO manufacturing processes. Additionally, integration challenges with existing touch sensor designs and controller ICs have slowed adoption, as many systems are optimized specifically for ITO's electrical characteristics, requiring substantial redesign to accommodate alternative materials.

Environmental considerations have become increasingly important, with regulatory bodies in Europe and North America implementing stricter guidelines on manufacturing processes and material recyclability, adding another layer of complexity to the development of commercially viable ITO-free solutions.

Silver nanowire technology has achieved commercial implementation in several consumer electronics, demonstrating conductivity comparable to ITO with enhanced flexibility. Current production capabilities have reached medium-scale manufacturing, though consistency in performance across large surface areas remains problematic. Carbon nanotubes offer exceptional durability and flexibility but face challenges in achieving uniform dispersion and maintaining consistent sheet resistance across production batches.

Graphene-based electrodes represent perhaps the most promising long-term solution, with theoretical performance exceeding all current alternatives. However, large-scale production methods remain economically prohibitive, with current manufacturing costs approximately 3-5 times higher than conventional ITO solutions. Metal mesh technology has gained significant market traction, particularly in larger display applications, though visible patterns and moiré effects continue to limit adoption in premium device segments.

Geographically, East Asia maintains leadership in ITO-free research and development, with South Korea and Japan hosting the most advanced production facilities. China has rapidly expanded its research capabilities, particularly in metal mesh and silver nanowire technologies, while North American and European institutions lead in fundamental materials science breakthroughs, especially in graphene and novel composite materials.

The primary technical challenges currently facing ITO-free electrode development include achieving consistent optical transparency above 90% while maintaining conductivity below 100 ohms/square, developing scalable manufacturing processes that maintain performance consistency across large surface areas, and addressing long-term stability issues, particularly oxidation in silver-based solutions and degradation in carbon-based materials.

Economic constraints also present significant barriers, as current alternatives generally require 30-50% higher production costs compared to established ITO manufacturing processes. Additionally, integration challenges with existing touch sensor designs and controller ICs have slowed adoption, as many systems are optimized specifically for ITO's electrical characteristics, requiring substantial redesign to accommodate alternative materials.

Environmental considerations have become increasingly important, with regulatory bodies in Europe and North America implementing stricter guidelines on manufacturing processes and material recyclability, adding another layer of complexity to the development of commercially viable ITO-free solutions.

Current ITO-Free Electrode Solutions and Implementations

01 Carbon-based materials as ITO alternatives

Carbon-based materials such as graphene, carbon nanotubes (CNTs), and carbon composites are being utilized as alternatives to ITO for transparent electrodes. These materials offer excellent electrical conductivity, flexibility, and optical transparency while avoiding the scarcity and brittleness issues associated with indium. Carbon-based electrodes can be fabricated through various deposition methods and can be integrated into flexible electronic devices.- Carbon-based transparent conductive materials: Carbon-based materials such as graphene, carbon nanotubes (CNTs), and carbon nanomaterials are used as alternatives to ITO for transparent electrodes. These materials offer excellent electrical conductivity, flexibility, and optical transparency. They can be applied through various deposition methods including solution processing, which makes them suitable for flexible electronic devices and displays where traditional ITO would be too brittle.

- Metal nanowire networks: Metal nanowire networks, particularly those made from silver, copper, or gold, provide an effective ITO-free electrode solution. These nanowires form interconnected networks that maintain high electrical conductivity while allowing light to pass through the spaces between wires. The technology offers advantages in flexibility, stretchability, and can be manufactured using solution-based processes at lower temperatures than ITO, making it compatible with plastic substrates for flexible electronics.

- Conductive polymers for flexible electrodes: Conductive polymers such as PEDOT:PSS (poly(3,4-ethylenedioxythiophene) polystyrene sulfonate) and polyaniline serve as viable alternatives to ITO for transparent electrodes. These materials offer advantages in flexibility, solution processability, and compatibility with roll-to-roll manufacturing. While typically having lower conductivity than ITO, their mechanical properties make them particularly suitable for flexible and wearable electronic applications where bendability is crucial.

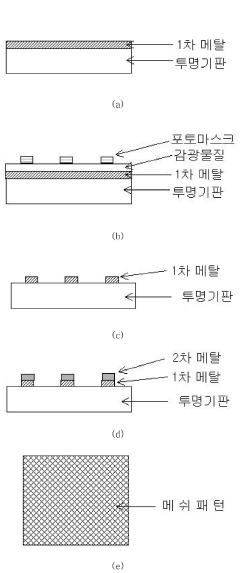

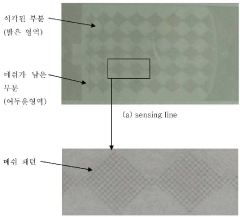

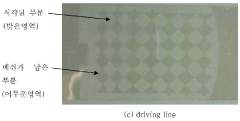

- Metal mesh and grid structures: Metal mesh and grid structures utilize patterned metal lines to create transparent conductive electrodes. These structures balance transparency and conductivity by using thin metal lines arranged in grid patterns with open spaces between them. The approach allows light to pass through the openings while the metal provides electrical conductivity. Various fabrication methods including lithography, printing, and laser patterning can be used to create these structures for applications in touch screens, displays, and solar cells.

- Metal oxide composites and doped materials: Alternative metal oxide composites and doped materials are developed to replace ITO while maintaining similar optical and electrical properties. These include aluminum-doped zinc oxide (AZO), fluorine-doped tin oxide (FTO), and various other doped metal oxide combinations. These materials aim to provide comparable transparency and conductivity to ITO but with better mechanical properties, lower processing temperatures, or reduced dependency on scarce elements like indium.

02 Metal nanowire network electrodes

Metal nanowire networks, particularly those made from silver, copper, or gold, provide a viable ITO-free electrode solution. These nanowires form conductive meshes that maintain high transparency while offering superior flexibility compared to ITO. The performance of these electrodes can be enhanced through various post-treatment processes to improve conductivity and stability. These networks are particularly suitable for flexible displays and touch panels.Expand Specific Solutions03 Conductive polymers for transparent electrodes

Conductive polymers such as PEDOT:PSS and polyaniline are being developed as ITO alternatives for transparent electrodes. These materials offer advantages including solution processability, mechanical flexibility, and compatibility with roll-to-roll manufacturing. Various doping strategies and composite formations with other materials can enhance their conductivity and stability, making them suitable for organic electronics and flexible displays.Expand Specific Solutions04 Metal mesh and grid electrodes

Metal mesh and grid structures are being employed as ITO-free transparent electrodes. These designs utilize thin metal lines arranged in patterns that balance conductivity and transparency. Fabrication techniques include photolithography, printing methods, and laser patterning. The geometry and dimensions of the mesh can be optimized to achieve the desired balance between optical transparency and electrical conductivity for various applications including touch screens and solar cells.Expand Specific Solutions05 Metal oxide composites and multilayer structures

Alternative metal oxide composites and multilayer structures are being developed to replace ITO. These include combinations of various metal oxides such as zinc oxide, aluminum-doped zinc oxide (AZO), and molybdenum oxide, often in layered configurations with thin metals. These structures can achieve comparable transparency and conductivity to ITO while using more abundant materials. Various deposition techniques including sputtering and solution processing are employed to create these alternative transparent conductive electrodes.Expand Specific Solutions

Key Industry Players in Alternative Electrode Materials

The ITO Free Electrode touchscreen technology market is currently in an early growth phase, characterized by increasing R&D investments and emerging commercial applications. The global market size is projected to expand significantly as manufacturers seek alternatives to traditional indium tin oxide electrodes due to indium's limited supply and rising costs. From a technical maturity perspective, companies like BOE Technology Group and LG Innotek are leading development with advanced prototypes, while Eastman Kodak and Gunze Ltd. have made notable progress in alternative conductive materials. Traditional display manufacturers including Innolux and Samsung Electro-Mechanics are actively exploring this technology to maintain competitive positioning. The ecosystem is further enriched by specialized players like Shenzhen Junda Touch Windows focusing on implementation in various device categories.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed advanced metal mesh technology as an ITO-free electrode solution for touchscreens. Their approach utilizes ultra-fine metal grid patterns (typically copper or silver) with line widths below 5μm, creating transparent conductive structures that maintain over 90% optical transparency while achieving sheet resistance below 10 ohms/square. BOE's manufacturing process employs photolithography and nano-imprinting techniques to create these precise metal mesh patterns on flexible substrates. The company has integrated this technology into both rigid and flexible display applications, with particular success in large-format touchscreens where ITO's inherent resistance limitations become more pronounced. BOE has also developed proprietary algorithms to minimize moiré patterns that can occur between the metal mesh and display pixel structures.

Strengths: Superior conductivity compared to ITO, enabling faster response times and better performance in large displays; Flexibility allowing for curved and foldable applications; Better durability with resistance to bending fatigue. Weaknesses: Higher visible pattern potential requiring careful optical engineering; More complex manufacturing process than traditional ITO; Potential for higher initial production costs until economies of scale are achieved.

LG Innotek Co., Ltd.

Technical Solution: LG Innotek has pioneered a hybrid metal mesh technology for ITO-free electrodes that combines nanowire structures with patterned metal grids. Their solution features silver nanowire networks embedded in polymer matrices, achieving sheet resistance as low as 15 ohms/square while maintaining transparency above 88%. The company employs a roll-to-roll manufacturing process that significantly reduces production costs compared to traditional ITO sputtering methods. LG Innotek's technology incorporates a proprietary anti-reflection layer that enhances outdoor visibility and reduces glare. Their ITO-free electrodes have been successfully implemented in automotive displays and consumer electronics, demonstrating excellent performance in high-humidity and temperature-variable environments where traditional ITO solutions often degrade. The company has also developed specialized surface treatments to enhance touch sensitivity and reduce interference patterns.

Strengths: Excellent optical clarity with minimal haze; Superior environmental stability compared to ITO; Cost-effective roll-to-roll manufacturing capability; Compatibility with flexible substrates. Weaknesses: Requires specialized equipment for nanowire deposition; Potential for silver migration in high-humidity environments requiring additional protective layers; More complex quality control processes than traditional ITO manufacturing.

Critical Patents and Innovations in Alternative Electrode Materials

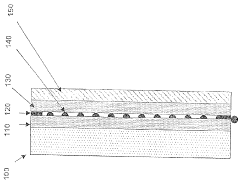

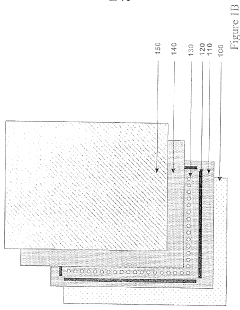

Symmetric touch screen system with carbon nanotube-based transparent conductive electrode pairs

PatentWO2008127780A2

Innovation

- A symmetric touch screen system utilizing carbon nanotube-based transparent conductive electrodes, where both electrodes are composed of unaligned nanotube fabrics, eliminating the need for ITO and providing a flexible, optically transparent, and chemically stable solution with enhanced mechanical properties.

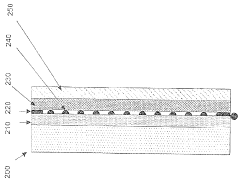

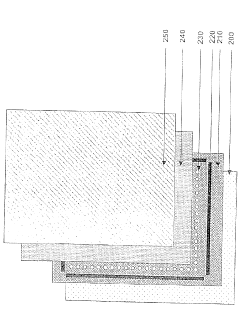

Touch panel and its manufacturing method

PatentInactiveKR1020130022170A

Innovation

- Replacement of ITO transparent electrodes with smooth metallic foil (Cu, Ni, etc.) to address the limited indium resources and increasing material costs.

- Development of a touch panel with low sheet resistance using metallic foil electrodes, overcoming the high surface resistance constraints of ITO.

- Implementation of fine pattern formation with various shapes that was previously constrained by ITO's limitations.

Supply Chain Considerations for ITO Alternatives

The supply chain for ITO (Indium Tin Oxide) alternatives represents a critical consideration in the transition toward ITO-free electrode technologies. The current ITO supply chain faces significant challenges, primarily due to the scarcity of indium, which constitutes approximately 0.0001% of the Earth's crust. This rarity has led to price volatility and supply constraints, with China controlling approximately 50-60% of global indium production.

Alternative materials present distinct supply chain advantages and challenges. Silver nanowire (AgNW) networks offer excellent conductivity but rely on silver, another precious metal with its own supply limitations. However, the minimal amount required per device creates a more sustainable supply chain model compared to ITO. Manufacturing processes for AgNW are also less energy-intensive, reducing production costs and environmental impact.

Carbon-based alternatives such as graphene and carbon nanotubes present promising supply chain resilience. Carbon is abundant, potentially eliminating the geopolitical dependencies associated with indium. However, the manufacturing infrastructure for high-quality, large-scale production of these materials remains underdeveloped, creating short-term implementation barriers despite long-term supply chain benefits.

Metal mesh technologies utilize conventional metals like copper and aluminum, which benefit from established global supply chains and recycling infrastructures. This approach leverages existing manufacturing capabilities, potentially accelerating market adoption through reduced supply chain disruption. The primary challenge lies in developing cost-effective fine-line patterning techniques at scale.

PEDOT:PSS and other conductive polymers offer perhaps the most revolutionary supply chain model, as they can be synthesized from organic compounds without reliance on mining operations. This creates opportunities for localized production facilities closer to assembly plants, reducing transportation costs and supply chain vulnerabilities.

Regional diversification represents another critical consideration. Currently, Asia dominates the touchscreen manufacturing ecosystem, but ITO alternatives could enable geographic redistribution of production capabilities. This would mitigate supply chain risks associated with regional disruptions while potentially creating new manufacturing opportunities in Europe and North America.

The transition period will require dual-supply chain management as manufacturers gradually shift from ITO to alternative materials. This necessitates careful planning to avoid production disruptions and ensure consistent product quality across different material platforms. Companies must develop expertise in multiple material systems simultaneously, creating short-term operational complexity but long-term supply chain resilience.

Alternative materials present distinct supply chain advantages and challenges. Silver nanowire (AgNW) networks offer excellent conductivity but rely on silver, another precious metal with its own supply limitations. However, the minimal amount required per device creates a more sustainable supply chain model compared to ITO. Manufacturing processes for AgNW are also less energy-intensive, reducing production costs and environmental impact.

Carbon-based alternatives such as graphene and carbon nanotubes present promising supply chain resilience. Carbon is abundant, potentially eliminating the geopolitical dependencies associated with indium. However, the manufacturing infrastructure for high-quality, large-scale production of these materials remains underdeveloped, creating short-term implementation barriers despite long-term supply chain benefits.

Metal mesh technologies utilize conventional metals like copper and aluminum, which benefit from established global supply chains and recycling infrastructures. This approach leverages existing manufacturing capabilities, potentially accelerating market adoption through reduced supply chain disruption. The primary challenge lies in developing cost-effective fine-line patterning techniques at scale.

PEDOT:PSS and other conductive polymers offer perhaps the most revolutionary supply chain model, as they can be synthesized from organic compounds without reliance on mining operations. This creates opportunities for localized production facilities closer to assembly plants, reducing transportation costs and supply chain vulnerabilities.

Regional diversification represents another critical consideration. Currently, Asia dominates the touchscreen manufacturing ecosystem, but ITO alternatives could enable geographic redistribution of production capabilities. This would mitigate supply chain risks associated with regional disruptions while potentially creating new manufacturing opportunities in Europe and North America.

The transition period will require dual-supply chain management as manufacturers gradually shift from ITO to alternative materials. This necessitates careful planning to avoid production disruptions and ensure consistent product quality across different material platforms. Companies must develop expertise in multiple material systems simultaneously, creating short-term operational complexity but long-term supply chain resilience.

Environmental Impact and Sustainability of ITO-Free Materials

The environmental impact of Indium Tin Oxide (ITO) has become a critical concern in touchscreen manufacturing. ITO extraction involves energy-intensive mining processes that generate significant carbon emissions. Additionally, indium is classified as a rare earth element with limited global reserves, raising serious sustainability concerns about its long-term availability for electronics production.

ITO-free alternatives present compelling environmental advantages. Materials such as silver nanowires, carbon nanotubes, graphene, and conductive polymers generally require less energy-intensive production processes. Life cycle assessments indicate that these alternatives can reduce carbon footprints by 35-60% compared to traditional ITO-based touchscreens, depending on the specific material and manufacturing technique employed.

Waste management represents another significant environmental challenge with conventional ITO touchscreens. The complex composition of these screens makes recycling difficult, with less than 1% of indium currently being recovered from end-of-life electronics. In contrast, many ITO-free materials offer improved recyclability profiles. For instance, PEDOT:PSS-based touchscreens can be more easily disassembled, and the polymers potentially recovered through specialized chemical processes.

The manufacturing processes for ITO-free electrodes typically involve fewer toxic chemicals and generate less hazardous waste. Silver nanowire production, while still requiring careful handling of silver compounds, eliminates the need for the harsh acids used in ITO etching. Similarly, carbon-based alternatives like graphene can be produced using more environmentally benign chemical vapor deposition techniques or even sustainable biomass precursors.

Water consumption metrics also favor ITO-free technologies. Traditional ITO manufacturing requires substantial water usage for cleaning and processing steps. Alternative materials like metal mesh electrodes can reduce water requirements by up to 40%, representing significant conservation potential as the electronics industry continues to expand globally.

Regulatory frameworks worldwide are increasingly recognizing these environmental benefits. The European Union's Restriction of Hazardous Substances (RoHS) directive and similar regulations in other regions are driving manufacturers toward more sustainable materials. Several major electronics companies have already established sustainability roadmaps that explicitly target the reduction or elimination of rare earth elements like indium in their supply chains.

As consumer awareness of electronic waste issues grows, the market advantage of environmentally superior touchscreen technologies becomes increasingly significant. Manufacturers adopting ITO-free solutions can leverage this as a competitive differentiator, particularly among environmentally conscious consumer segments who prioritize sustainable product attributes in their purchasing decisions.

ITO-free alternatives present compelling environmental advantages. Materials such as silver nanowires, carbon nanotubes, graphene, and conductive polymers generally require less energy-intensive production processes. Life cycle assessments indicate that these alternatives can reduce carbon footprints by 35-60% compared to traditional ITO-based touchscreens, depending on the specific material and manufacturing technique employed.

Waste management represents another significant environmental challenge with conventional ITO touchscreens. The complex composition of these screens makes recycling difficult, with less than 1% of indium currently being recovered from end-of-life electronics. In contrast, many ITO-free materials offer improved recyclability profiles. For instance, PEDOT:PSS-based touchscreens can be more easily disassembled, and the polymers potentially recovered through specialized chemical processes.

The manufacturing processes for ITO-free electrodes typically involve fewer toxic chemicals and generate less hazardous waste. Silver nanowire production, while still requiring careful handling of silver compounds, eliminates the need for the harsh acids used in ITO etching. Similarly, carbon-based alternatives like graphene can be produced using more environmentally benign chemical vapor deposition techniques or even sustainable biomass precursors.

Water consumption metrics also favor ITO-free technologies. Traditional ITO manufacturing requires substantial water usage for cleaning and processing steps. Alternative materials like metal mesh electrodes can reduce water requirements by up to 40%, representing significant conservation potential as the electronics industry continues to expand globally.

Regulatory frameworks worldwide are increasingly recognizing these environmental benefits. The European Union's Restriction of Hazardous Substances (RoHS) directive and similar regulations in other regions are driving manufacturers toward more sustainable materials. Several major electronics companies have already established sustainability roadmaps that explicitly target the reduction or elimination of rare earth elements like indium in their supply chains.

As consumer awareness of electronic waste issues grows, the market advantage of environmentally superior touchscreen technologies becomes increasingly significant. Manufacturers adopting ITO-free solutions can leverage this as a competitive differentiator, particularly among environmentally conscious consumer segments who prioritize sustainable product attributes in their purchasing decisions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!