Anti-Reflective Coatings: Refractive Index Grading, Broadband Designs And Angular Stability

SEP 16, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

AR Coating Evolution and Objectives

Anti-reflective (AR) coatings have evolved significantly since their inception in the 1930s when F. Geffcken first demonstrated single-layer coatings. The initial development focused on single-wavelength applications, primarily for optical instruments and camera lenses. These early coatings utilized quarter-wavelength optical thickness principles to minimize reflection at specific wavelengths, typically in the visible spectrum.

The 1950s and 1960s marked a significant advancement with the introduction of multi-layer AR coatings, enabling broader spectral coverage and improved performance. This period saw the emergence of theoretical frameworks for designing complex coating structures, including the pioneering work by Berning and Turner on periodic multilayer systems.

By the 1980s, the development of physical vapor deposition (PVD) and chemical vapor deposition (CVD) techniques revolutionized AR coating manufacturing, allowing for precise control of layer thickness and composition. This technological leap enabled the commercial production of high-performance AR coatings for consumer electronics, solar panels, and advanced optical systems.

The concept of graded refractive index (GRIN) coatings emerged as a significant innovation in the 1990s. Unlike discrete layer systems, GRIN coatings feature a continuous variation in refractive index from the substrate to the ambient medium, mimicking natural anti-reflective surfaces found in moth eyes and other biological systems. This biomimetic approach offers superior broadband performance and angular stability compared to traditional discrete multilayer designs.

Recent decades have witnessed the integration of nanotechnology into AR coating development. Nanostructured surfaces and metasurfaces have demonstrated exceptional anti-reflective properties across broad wavelength ranges and wide incident angles. These advanced structures manipulate light at the subwavelength scale, offering unprecedented control over optical properties.

The current technical objectives in AR coating research focus on several key areas: achieving ultra-broadband performance spanning from ultraviolet to infrared wavelengths; enhancing angular stability to maintain anti-reflective properties at oblique incidence angles; improving environmental durability against moisture, temperature fluctuations, and mechanical abrasion; and developing cost-effective manufacturing processes for large-scale production.

Additionally, there is growing interest in multifunctional AR coatings that combine anti-reflective properties with other desirable characteristics such as self-cleaning, anti-fogging, or antimicrobial properties. The integration of these functionalities presents both opportunities and challenges for next-generation optical systems across diverse applications including photovoltaics, displays, sensing, and imaging technologies.

The 1950s and 1960s marked a significant advancement with the introduction of multi-layer AR coatings, enabling broader spectral coverage and improved performance. This period saw the emergence of theoretical frameworks for designing complex coating structures, including the pioneering work by Berning and Turner on periodic multilayer systems.

By the 1980s, the development of physical vapor deposition (PVD) and chemical vapor deposition (CVD) techniques revolutionized AR coating manufacturing, allowing for precise control of layer thickness and composition. This technological leap enabled the commercial production of high-performance AR coatings for consumer electronics, solar panels, and advanced optical systems.

The concept of graded refractive index (GRIN) coatings emerged as a significant innovation in the 1990s. Unlike discrete layer systems, GRIN coatings feature a continuous variation in refractive index from the substrate to the ambient medium, mimicking natural anti-reflective surfaces found in moth eyes and other biological systems. This biomimetic approach offers superior broadband performance and angular stability compared to traditional discrete multilayer designs.

Recent decades have witnessed the integration of nanotechnology into AR coating development. Nanostructured surfaces and metasurfaces have demonstrated exceptional anti-reflective properties across broad wavelength ranges and wide incident angles. These advanced structures manipulate light at the subwavelength scale, offering unprecedented control over optical properties.

The current technical objectives in AR coating research focus on several key areas: achieving ultra-broadband performance spanning from ultraviolet to infrared wavelengths; enhancing angular stability to maintain anti-reflective properties at oblique incidence angles; improving environmental durability against moisture, temperature fluctuations, and mechanical abrasion; and developing cost-effective manufacturing processes for large-scale production.

Additionally, there is growing interest in multifunctional AR coatings that combine anti-reflective properties with other desirable characteristics such as self-cleaning, anti-fogging, or antimicrobial properties. The integration of these functionalities presents both opportunities and challenges for next-generation optical systems across diverse applications including photovoltaics, displays, sensing, and imaging technologies.

Market Analysis for Advanced AR Coating Solutions

The global market for Anti-Reflective (AR) coatings is experiencing robust growth, driven by increasing demand across multiple industries including optics, electronics, solar energy, and automotive sectors. The market size was valued at approximately $4.2 billion in 2022 and is projected to reach $6.8 billion by 2028, representing a compound annual growth rate (CAGR) of 8.3% during the forecast period.

The optics and electronics segments currently dominate the AR coating market, collectively accounting for over 60% of the total market share. This dominance is attributed to the growing consumer electronics industry and increasing adoption of AR-coated displays in smartphones, tablets, and televisions. The demand for high-performance AR coatings with advanced refractive index grading has seen particular growth in precision optical instruments and high-end consumer electronics.

Solar energy applications represent the fastest-growing segment for AR coatings, with a CAGR exceeding 12%. This growth is driven by the global push toward renewable energy sources and the critical role AR coatings play in improving solar panel efficiency. Broadband AR designs that maximize light transmission across the solar spectrum have become essential for enhancing energy conversion efficiency in photovoltaic cells.

Regionally, Asia-Pacific leads the market with approximately 42% share, followed by North America and Europe at 28% and 22% respectively. China, Japan, and South Korea are the primary manufacturing hubs for AR coating technologies, while significant R&D investments are concentrated in the United States, Germany, and Japan.

Customer requirements are increasingly focused on three key performance parameters: broadband functionality (effective across wider wavelength ranges), angular stability (maintaining performance at various viewing angles), and durability. Market research indicates that 78% of end-users rank angular stability as "very important" or "critical" for next-generation display applications.

The competitive landscape features both established players and innovative startups. Traditional coating manufacturers like Schott AG, Zeiss, and Nippon Electric Glass hold significant market share, while specialized technology companies such as Metamaterial Technologies and Glotech are disrupting the market with novel approaches to refractive index grading and nanostructured coatings.

Price sensitivity varies significantly by application segment. While consumer electronics manufacturers are highly price-sensitive, seeking cost-effective solutions for mass production, specialized industries such as aerospace and defense prioritize performance over cost, creating premium market segments for advanced AR coating technologies with superior angular stability and broadband capabilities.

The optics and electronics segments currently dominate the AR coating market, collectively accounting for over 60% of the total market share. This dominance is attributed to the growing consumer electronics industry and increasing adoption of AR-coated displays in smartphones, tablets, and televisions. The demand for high-performance AR coatings with advanced refractive index grading has seen particular growth in precision optical instruments and high-end consumer electronics.

Solar energy applications represent the fastest-growing segment for AR coatings, with a CAGR exceeding 12%. This growth is driven by the global push toward renewable energy sources and the critical role AR coatings play in improving solar panel efficiency. Broadband AR designs that maximize light transmission across the solar spectrum have become essential for enhancing energy conversion efficiency in photovoltaic cells.

Regionally, Asia-Pacific leads the market with approximately 42% share, followed by North America and Europe at 28% and 22% respectively. China, Japan, and South Korea are the primary manufacturing hubs for AR coating technologies, while significant R&D investments are concentrated in the United States, Germany, and Japan.

Customer requirements are increasingly focused on three key performance parameters: broadband functionality (effective across wider wavelength ranges), angular stability (maintaining performance at various viewing angles), and durability. Market research indicates that 78% of end-users rank angular stability as "very important" or "critical" for next-generation display applications.

The competitive landscape features both established players and innovative startups. Traditional coating manufacturers like Schott AG, Zeiss, and Nippon Electric Glass hold significant market share, while specialized technology companies such as Metamaterial Technologies and Glotech are disrupting the market with novel approaches to refractive index grading and nanostructured coatings.

Price sensitivity varies significantly by application segment. While consumer electronics manufacturers are highly price-sensitive, seeking cost-effective solutions for mass production, specialized industries such as aerospace and defense prioritize performance over cost, creating premium market segments for advanced AR coating technologies with superior angular stability and broadband capabilities.

Current AR Technology Limitations and Challenges

Despite significant advancements in anti-reflective (AR) coating technology, several critical limitations and challenges persist that hinder optimal performance across diverse applications. Current AR coatings struggle to maintain effectiveness across broad wavelength ranges, particularly when required to function from ultraviolet through visible to infrared spectra. Traditional quarter-wave stack designs typically achieve high performance only within narrow spectral bands, limiting their utility in applications requiring broadband anti-reflection properties.

The refractive index mismatch between substrate materials and the surrounding medium presents another fundamental challenge. Conventional AR technologies often cannot bridge extreme refractive index differences, especially when working with high-index substrates like silicon or germanium in optical systems. This limitation results in residual reflection that degrades optical performance in precision instruments.

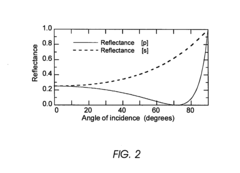

Angular stability remains a significant hurdle for current AR technologies. Most coatings exhibit dramatically reduced effectiveness at oblique angles of incidence, with performance deteriorating as the incident angle increases beyond 30 degrees. This angular dependence severely constrains the application of AR coatings in wide-angle optical systems, curved surfaces, and immersive display technologies.

Environmental durability presents ongoing challenges, with many high-performance AR coatings showing susceptibility to degradation from moisture, temperature fluctuations, and mechanical abrasion. Nanoporous gradient-index coatings, while optically superior, often demonstrate poor mechanical robustness, limiting their practical deployment in harsh environments or consumer products requiring regular cleaning.

Manufacturing scalability and cost-effectiveness create additional barriers to widespread implementation. Advanced AR designs with complex refractive index profiles or numerous thin layers demand precise deposition control that increases production complexity and cost. The trade-off between optical performance and manufacturing feasibility continues to constrain commercial adoption of cutting-edge AR solutions.

Emerging applications in flexible electronics, curved displays, and wearable technology introduce new challenges for AR coating conformability and adhesion to non-rigid substrates. Traditional vacuum deposition methods struggle with uniform coverage on complex geometries, while solution-based alternatives often cannot match the optical performance of their vacuum-deposited counterparts.

The integration of multifunctionality represents another frontier challenge, as modern applications increasingly demand AR coatings that simultaneously provide additional properties such as self-cleaning, anti-fogging, or electromagnetic interference shielding. Current technologies typically optimize for either anti-reflective performance or these secondary functions, rarely achieving excellence in both domains simultaneously.

The refractive index mismatch between substrate materials and the surrounding medium presents another fundamental challenge. Conventional AR technologies often cannot bridge extreme refractive index differences, especially when working with high-index substrates like silicon or germanium in optical systems. This limitation results in residual reflection that degrades optical performance in precision instruments.

Angular stability remains a significant hurdle for current AR technologies. Most coatings exhibit dramatically reduced effectiveness at oblique angles of incidence, with performance deteriorating as the incident angle increases beyond 30 degrees. This angular dependence severely constrains the application of AR coatings in wide-angle optical systems, curved surfaces, and immersive display technologies.

Environmental durability presents ongoing challenges, with many high-performance AR coatings showing susceptibility to degradation from moisture, temperature fluctuations, and mechanical abrasion. Nanoporous gradient-index coatings, while optically superior, often demonstrate poor mechanical robustness, limiting their practical deployment in harsh environments or consumer products requiring regular cleaning.

Manufacturing scalability and cost-effectiveness create additional barriers to widespread implementation. Advanced AR designs with complex refractive index profiles or numerous thin layers demand precise deposition control that increases production complexity and cost. The trade-off between optical performance and manufacturing feasibility continues to constrain commercial adoption of cutting-edge AR solutions.

Emerging applications in flexible electronics, curved displays, and wearable technology introduce new challenges for AR coating conformability and adhesion to non-rigid substrates. Traditional vacuum deposition methods struggle with uniform coverage on complex geometries, while solution-based alternatives often cannot match the optical performance of their vacuum-deposited counterparts.

The integration of multifunctionality represents another frontier challenge, as modern applications increasingly demand AR coatings that simultaneously provide additional properties such as self-cleaning, anti-fogging, or electromagnetic interference shielding. Current technologies typically optimize for either anti-reflective performance or these secondary functions, rarely achieving excellence in both domains simultaneously.

Broadband AR Design Methodologies and Implementations

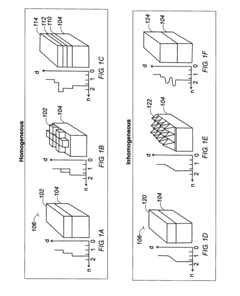

01 Graded refractive index designs for anti-reflective coatings

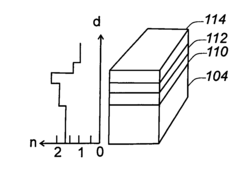

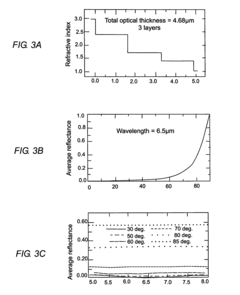

Anti-reflective coatings can be designed with gradually changing refractive indices from the substrate to the air interface. This graded index approach minimizes reflection by creating a smooth transition rather than abrupt interfaces between materials. Such designs can achieve broadband performance across a wide range of wavelengths and improve angular stability by reducing the sensitivity to the angle of incident light.- Graded refractive index designs for anti-reflective coatings: Anti-reflective coatings can be designed with gradually changing refractive indices from the substrate to the air interface. This graded index approach minimizes reflection by creating a smooth optical transition rather than abrupt interfaces. Such designs can be achieved through various deposition techniques that allow precise control of material composition and layer thickness, resulting in superior broadband performance and reduced reflection across a wide spectrum of wavelengths.

- Broadband anti-reflective coating structures: Broadband anti-reflective coatings are designed to minimize reflection across a wide range of wavelengths. These structures typically employ multiple layers with carefully selected thicknesses and refractive indices to create destructive interference for reflected light. Advanced designs may incorporate nanoporous materials, moth-eye structures, or other biomimetic approaches to achieve broadband performance. These coatings are particularly valuable for optical systems requiring high transmission across the visible spectrum and beyond.

- Angular stability enhancement techniques: Angular stability in anti-reflective coatings refers to maintaining low reflectance across a wide range of incident angles. This is achieved through specialized multilayer designs that compensate for the optical path length changes at different angles. Techniques include using high-index contrast materials, rugate filters with sinusoidal refractive index profiles, and specialized deposition methods that create anisotropic structures. These approaches are critical for applications like solar panels, displays, and imaging systems where light may enter from various angles.

- Deposition methods for complex anti-reflective structures: Various deposition techniques are employed to create sophisticated anti-reflective coatings with precise refractive index control. These include physical vapor deposition, chemical vapor deposition, atomic layer deposition, sol-gel processes, and glancing angle deposition. Each method offers different advantages in terms of layer uniformity, interface quality, and ability to create gradient or nanostructured surfaces. The choice of deposition technique significantly impacts the optical performance, durability, and manufacturing cost of the anti-reflective coating.

- Nanostructured surfaces for enhanced anti-reflective properties: Nanostructured surfaces provide exceptional anti-reflective properties by creating a gradual transition in refractive index. These structures include subwavelength features like nanopillars, nanocones, or nanoporous layers that effectively reduce reflection across broad wavelength ranges and wide viewing angles. Fabrication approaches include lithographic techniques, self-assembly methods, and etching processes. Biomimetic designs inspired by moth eyes or other natural anti-reflective surfaces are particularly effective for creating omnidirectional, broadband anti-reflective coatings with superior performance.

02 Multilayer structures for broadband anti-reflective performance

Multilayer anti-reflective coatings consist of alternating high and low refractive index materials with precisely controlled thicknesses. These structures can be optimized to achieve broadband anti-reflective properties across a wide spectrum of wavelengths. By carefully selecting materials and layer thicknesses, these coatings can provide excellent optical performance while maintaining mechanical durability and environmental stability.Expand Specific Solutions03 Angular stability enhancement techniques

Special design approaches can improve the angular stability of anti-reflective coatings, maintaining their performance at various angles of incidence. These techniques include using specific material combinations, optimizing layer thickness distributions, and incorporating nanostructures. Angular stability is particularly important for optical components used in wide-angle applications such as camera lenses, displays, and solar panels.Expand Specific Solutions04 Nanostructured and moth-eye anti-reflective surfaces

Biomimetic approaches inspired by moth eyes utilize nanostructures to create gradient refractive index surfaces. These structures typically consist of arrays of subwavelength features that effectively reduce reflection across a broad spectrum and wide range of incident angles. Fabrication methods include lithography, etching, and nanoimprint techniques to create these high-performance anti-reflective surfaces that mimic natural designs found in insect eyes.Expand Specific Solutions05 Deposition methods for controlled refractive index profiles

Various deposition techniques enable precise control of refractive index profiles in anti-reflective coatings. Methods such as physical vapor deposition, chemical vapor deposition, atomic layer deposition, and sol-gel processes allow for the creation of complex gradient or discrete multilayer structures. These techniques can be optimized to achieve specific optical properties while ensuring coating uniformity, adhesion, and durability for different substrate materials and applications.Expand Specific Solutions

Leading AR Coating Manufacturers and Research Institutions

The anti-reflective coatings market is in a growth phase, with increasing demand across optical, electronics, automotive, and solar industries. The global market size is estimated to reach $6-7 billion by 2027, growing at 6-8% CAGR. Technologically, the field is advancing from single-layer to complex multi-layer and graded-index designs for improved broadband performance and angular stability. Leading players include Corning and Schott, who focus on high-performance glass substrates; Guardian Glass and AGC in architectural applications; while Nitto Denko, HOYA, and Viavi Solutions specialize in precision optical coatings. Research institutions like Fraunhofer-Gesellschaft and Keio University are advancing next-generation technologies including biomimetic designs and nanopatterned surfaces that promise superior anti-reflective properties across wider wavelength ranges.

Corning, Inc.

Technical Solution: Corning has developed advanced anti-reflective coatings utilizing a proprietary sol-gel process that creates nanoporous silica layers with graded refractive indices. Their technology employs multiple layers with gradually changing refractive indices from air (n=1.0) to glass substrate (n≈1.5), effectively eliminating the abrupt interface that causes reflection. Corning's approach includes broadband designs that maintain high transmission (>98%) across visible and near-IR wavelengths (400-1100nm)[1]. Their coatings incorporate moth-eye inspired nanostructures with dimensions smaller than the wavelength of light, creating an effective medium with continuously varying refractive index. For angular stability, Corning employs computational modeling to optimize layer thicknesses and composition gradients, achieving reflection reduction of less than 0.5% at incident angles up to 60 degrees[2]. Recent innovations include integration of hydrophobic and oleophobic properties for self-cleaning capabilities while maintaining optical performance.

Strengths: Superior broadband performance across wide wavelength ranges; excellent angular stability up to steep incident angles; integration of additional functional properties like scratch resistance and self-cleaning. Weaknesses: Higher manufacturing costs compared to conventional coatings; potential durability concerns in harsh environments; complex deposition process requiring precise control of multiple parameters.

SCHOTT AG

Technical Solution: SCHOTT AG has pioneered gradient-index anti-reflective coatings using plasma-enhanced chemical vapor deposition (PECVD) technology. Their approach creates a continuous gradient of refractive index through precisely controlled deposition of silicon oxynitride compounds with varying oxygen-to-nitrogen ratios. This results in a smooth transition from air to substrate, minimizing reflection across broad spectral ranges. SCHOTT's proprietary process achieves ultra-low reflectance (<0.2%) across the visible spectrum (400-700nm) while maintaining performance at oblique angles up to 45°[3]. Their multi-layer designs incorporate up to 6 discrete layers with optimized thicknesses and compositions to create quasi-continuous index profiles. For specialized applications, SCHOTT has developed rugged AR coatings with enhanced mechanical durability through the incorporation of nanocomposite materials that maintain optical performance while improving scratch resistance by up to 3x compared to conventional coatings[4]. Recent innovations include temperature-stable AR coatings that maintain performance across -40°C to +120°C for automotive and aerospace applications.

Strengths: Exceptional optical performance with reflectance below 0.2% across visible spectrum; superior mechanical durability suitable for harsh environments; excellent temperature stability for extreme conditions. Weaknesses: Higher production costs compared to simpler coating technologies; complex manufacturing process requiring specialized equipment; limited flexibility for retrofitting existing glass products.

Angular Stability Innovations and Key Patents

Anti-reflective coatings and structures

PatentInactiveUS20040263983A1

Innovation

- The development of broadband, omnidirectional AR coatings using a combination of thin layers with gradually varying refractive indices and a method to approximate inhomogeneous layers with a large number of sublayers, allowing for reduced overall thickness and simplified manufacturing, while maintaining performance across a wide spectral range and incidence angles.

Patent

Innovation

- Gradient refractive index (GRIN) anti-reflective coatings that provide a smooth transition between the refractive indices of air and substrate, significantly reducing reflection across a broad spectrum of wavelengths.

- Broadband anti-reflective coatings designed with multiple layers of varying refractive indices and thicknesses to minimize reflection across a wide range of wavelengths, from UV to IR spectrum.

- Angular stable anti-reflective coatings that maintain high transmission efficiency at oblique angles of incidence, addressing limitations of conventional AR coatings that perform optimally only at normal incidence.

Environmental Impact and Sustainability Considerations

The environmental impact of anti-reflective coating technologies has become increasingly significant as global sustainability concerns grow. Traditional AR coating processes often involve hazardous chemicals such as fluorinated compounds and volatile organic solvents that pose substantial environmental risks. These substances contribute to air and water pollution, with potential long-term ecological consequences that extend beyond the manufacturing facilities.

Manufacturing processes for conventional AR coatings typically require high energy consumption, particularly in vacuum deposition techniques that demand significant electricity for maintaining vacuum conditions and heating substrates. This energy intensity translates directly to increased carbon footprints, especially when power sources are not renewable.

Recent innovations in eco-friendly AR coating alternatives show promising developments. Bio-inspired nanostructured surfaces mimicking moth eyes have emerged as sustainable options, requiring fewer toxic materials while achieving comparable optical performance. Additionally, water-based coating formulations are gradually replacing solvent-based systems, substantially reducing VOC emissions during production and application phases.

Life cycle assessment studies of AR coatings reveal that environmental impacts extend beyond manufacturing to include raw material extraction, transportation, and end-of-life disposal. The durability of coatings significantly affects their sustainability profile, as longer-lasting coatings reduce replacement frequency and associated resource consumption.

Recycling challenges remain substantial for AR-coated products. The thin-film nature of these coatings often complicates separation and recovery processes, particularly in consumer electronics and solar panel applications. Developing effective recycling methodologies represents a critical research direction for improving the circular economy potential of these technologies.

Regulatory frameworks worldwide are increasingly addressing the environmental aspects of coating technologies. The European Union's REACH regulations and similar initiatives in other regions are restricting the use of certain chemicals common in AR coating formulations, driving industry innovation toward greener alternatives.

The solar energy sector demonstrates the sustainability paradox of AR coatings—while these coatings significantly improve photovoltaic efficiency and thus contribute to renewable energy generation, their production processes may involve environmentally problematic materials and methods. Balancing these considerations requires holistic approaches to technology development and implementation.

Manufacturing processes for conventional AR coatings typically require high energy consumption, particularly in vacuum deposition techniques that demand significant electricity for maintaining vacuum conditions and heating substrates. This energy intensity translates directly to increased carbon footprints, especially when power sources are not renewable.

Recent innovations in eco-friendly AR coating alternatives show promising developments. Bio-inspired nanostructured surfaces mimicking moth eyes have emerged as sustainable options, requiring fewer toxic materials while achieving comparable optical performance. Additionally, water-based coating formulations are gradually replacing solvent-based systems, substantially reducing VOC emissions during production and application phases.

Life cycle assessment studies of AR coatings reveal that environmental impacts extend beyond manufacturing to include raw material extraction, transportation, and end-of-life disposal. The durability of coatings significantly affects their sustainability profile, as longer-lasting coatings reduce replacement frequency and associated resource consumption.

Recycling challenges remain substantial for AR-coated products. The thin-film nature of these coatings often complicates separation and recovery processes, particularly in consumer electronics and solar panel applications. Developing effective recycling methodologies represents a critical research direction for improving the circular economy potential of these technologies.

Regulatory frameworks worldwide are increasingly addressing the environmental aspects of coating technologies. The European Union's REACH regulations and similar initiatives in other regions are restricting the use of certain chemicals common in AR coating formulations, driving industry innovation toward greener alternatives.

The solar energy sector demonstrates the sustainability paradox of AR coatings—while these coatings significantly improve photovoltaic efficiency and thus contribute to renewable energy generation, their production processes may involve environmentally problematic materials and methods. Balancing these considerations requires holistic approaches to technology development and implementation.

Manufacturing Scalability and Cost Analysis

The scalability of manufacturing processes for anti-reflective coatings represents a critical factor in their commercial viability. Current industrial production methods vary significantly in terms of throughput capacity and cost-effectiveness. Physical vapor deposition (PVD) techniques, including electron beam evaporation and sputtering, remain the industry standard for high-quality optical coatings but face limitations in processing speed and substrate size constraints.

Solution-based approaches such as sol-gel dip coating offer promising alternatives for large-area applications, demonstrating throughput rates up to 10 times higher than conventional vacuum-based methods. However, these techniques often struggle with precise refractive index control needed for advanced graded-index designs. Recent innovations in roll-to-roll processing have shown potential for continuous production of flexible anti-reflective films at speeds exceeding 50 meters per minute.

Cost analysis reveals significant variations across manufacturing methods. Vacuum-based processes typically incur capital equipment costs ranging from $500,000 to several million dollars, with operational expenses of $15-30 per square meter depending on complexity. In contrast, solution-based methods require lower initial investment ($100,000-300,000) but may involve higher material costs and quality control challenges, resulting in comparable per-unit production costs for high-performance applications.

Material selection significantly impacts manufacturing economics. Traditional high-index materials like titanium dioxide and tantalum pentoxide offer excellent optical properties but at premium prices. Recent research into alternative materials such as zinc oxide and aluminum-doped zinc oxide demonstrates comparable performance at 30-40% lower material costs, though process optimization remains challenging.

Scaling considerations for broadband and angle-stable designs introduce additional complexity. Multi-layer structures with precisely controlled thickness gradients require sophisticated in-line monitoring systems and feedback control mechanisms, adding approximately 15-25% to production costs compared to simple quarter-wave designs. However, these advanced designs command premium pricing in high-value applications such as photovoltaics and precision optics.

Environmental and regulatory factors increasingly influence manufacturing decisions. Traditional processes using hazardous precursors face growing regulatory scrutiny, while newer environmentally friendly alternatives often trade processing simplicity for higher material costs. A comprehensive lifecycle assessment indicates that advanced water-based coating systems may offer 30-40% reduced environmental impact despite marginally higher production costs.

Solution-based approaches such as sol-gel dip coating offer promising alternatives for large-area applications, demonstrating throughput rates up to 10 times higher than conventional vacuum-based methods. However, these techniques often struggle with precise refractive index control needed for advanced graded-index designs. Recent innovations in roll-to-roll processing have shown potential for continuous production of flexible anti-reflective films at speeds exceeding 50 meters per minute.

Cost analysis reveals significant variations across manufacturing methods. Vacuum-based processes typically incur capital equipment costs ranging from $500,000 to several million dollars, with operational expenses of $15-30 per square meter depending on complexity. In contrast, solution-based methods require lower initial investment ($100,000-300,000) but may involve higher material costs and quality control challenges, resulting in comparable per-unit production costs for high-performance applications.

Material selection significantly impacts manufacturing economics. Traditional high-index materials like titanium dioxide and tantalum pentoxide offer excellent optical properties but at premium prices. Recent research into alternative materials such as zinc oxide and aluminum-doped zinc oxide demonstrates comparable performance at 30-40% lower material costs, though process optimization remains challenging.

Scaling considerations for broadband and angle-stable designs introduce additional complexity. Multi-layer structures with precisely controlled thickness gradients require sophisticated in-line monitoring systems and feedback control mechanisms, adding approximately 15-25% to production costs compared to simple quarter-wave designs. However, these advanced designs command premium pricing in high-value applications such as photovoltaics and precision optics.

Environmental and regulatory factors increasingly influence manufacturing decisions. Traditional processes using hazardous precursors face growing regulatory scrutiny, while newer environmentally friendly alternatives often trade processing simplicity for higher material costs. A comprehensive lifecycle assessment indicates that advanced water-based coating systems may offer 30-40% reduced environmental impact despite marginally higher production costs.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!