How Anti-Reflective Coatings Balance Surface Hardness With Low Scatter On Plastics?

SEP 16, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

AR Coating Technology Evolution and Objectives

Anti-reflective (AR) coating technology has evolved significantly since its inception in the 1930s when F. Geffcken first developed multi-layer interference coatings. Initially applied primarily to glass substrates for optical instruments, AR coatings have progressively expanded to plastic substrates as polymer optics gained prominence in consumer electronics, automotive displays, and medical devices throughout the 1980s and 1990s.

The fundamental principle of AR coatings involves creating destructive interference of reflected light waves, thereby maximizing light transmission through the substrate. Early AR technologies for plastics faced significant challenges due to the inherent softness of polymer materials compared to glass, resulting in coatings that were either sufficiently hard but caused high scatter, or had low scatter but inadequate durability.

A pivotal advancement occurred in the early 2000s with the development of hybrid organic-inorganic materials, particularly sol-gel technologies, which offered a promising balance between hardness and optical performance. This was followed by plasma-enhanced chemical vapor deposition (PECVD) techniques that enabled the creation of dense, hard coatings at lower temperatures compatible with plastic substrates.

The current technological trajectory is moving toward nanolayered structures and gradient-index coatings that provide superior anti-reflective properties while maintaining mechanical resilience. These advanced structures distribute mechanical stress more effectively across the coating-substrate interface, reducing the likelihood of cracking or delamination while maintaining optical clarity.

Recent innovations include self-healing AR coatings incorporating dynamic chemical bonds that can reform after being broken, addressing the persistent challenge of scratch resistance. Additionally, superhydrophobic AR coatings are emerging, combining anti-reflective properties with water and dirt repellency to maintain optical performance in variable environmental conditions.

The primary objectives of contemporary AR coating development for plastics center on achieving a delicate balance: maximizing hardness for durability without increasing scatter that would compromise optical performance. Specific technical goals include developing coatings with Mohs hardness ratings above 3H while maintaining scatter below 0.5% across the visible spectrum, adhesion strength exceeding 5B on tape tests, and weatherability surpassing 1000 hours in accelerated testing conditions.

Additional objectives include reducing coating thickness to minimize stress at the coating-substrate interface, enhancing temperature stability for broader application ranges, and developing environmentally friendly deposition processes that reduce solvent use and energy consumption, aligning with global sustainability initiatives while maintaining cost-effectiveness for mass production.

The fundamental principle of AR coatings involves creating destructive interference of reflected light waves, thereby maximizing light transmission through the substrate. Early AR technologies for plastics faced significant challenges due to the inherent softness of polymer materials compared to glass, resulting in coatings that were either sufficiently hard but caused high scatter, or had low scatter but inadequate durability.

A pivotal advancement occurred in the early 2000s with the development of hybrid organic-inorganic materials, particularly sol-gel technologies, which offered a promising balance between hardness and optical performance. This was followed by plasma-enhanced chemical vapor deposition (PECVD) techniques that enabled the creation of dense, hard coatings at lower temperatures compatible with plastic substrates.

The current technological trajectory is moving toward nanolayered structures and gradient-index coatings that provide superior anti-reflective properties while maintaining mechanical resilience. These advanced structures distribute mechanical stress more effectively across the coating-substrate interface, reducing the likelihood of cracking or delamination while maintaining optical clarity.

Recent innovations include self-healing AR coatings incorporating dynamic chemical bonds that can reform after being broken, addressing the persistent challenge of scratch resistance. Additionally, superhydrophobic AR coatings are emerging, combining anti-reflective properties with water and dirt repellency to maintain optical performance in variable environmental conditions.

The primary objectives of contemporary AR coating development for plastics center on achieving a delicate balance: maximizing hardness for durability without increasing scatter that would compromise optical performance. Specific technical goals include developing coatings with Mohs hardness ratings above 3H while maintaining scatter below 0.5% across the visible spectrum, adhesion strength exceeding 5B on tape tests, and weatherability surpassing 1000 hours in accelerated testing conditions.

Additional objectives include reducing coating thickness to minimize stress at the coating-substrate interface, enhancing temperature stability for broader application ranges, and developing environmentally friendly deposition processes that reduce solvent use and energy consumption, aligning with global sustainability initiatives while maintaining cost-effectiveness for mass production.

Market Demand Analysis for High-Performance AR Coatings

The global market for anti-reflective (AR) coatings on plastic substrates has experienced significant growth, driven primarily by expanding applications in consumer electronics, automotive displays, eyewear, and photovoltaic panels. Current market valuations indicate the AR coating sector reaching approximately 6.2 billion USD in 2023, with projections showing a compound annual growth rate of 8.3% through 2030.

Consumer electronics represents the largest demand segment, with smartphone displays, tablets, and laptop screens requiring increasingly sophisticated AR solutions that maintain clarity while resisting scratches and smudges. The premium smartphone market particularly values coatings that can deliver both optical performance and durability, with consumers willing to pay higher prices for devices featuring advanced display protection.

The optical eyewear industry has become a substantial driver for high-performance AR coatings, with prescription lens manufacturers reporting that over 70% of consumers now opt for anti-reflective treatments when purchasing new glasses. This segment demands coatings that balance hardness with comfort and optical clarity, creating specialized market requirements distinct from electronic applications.

Automotive displays represent the fastest-growing segment, with a projected growth rate exceeding 12% annually as vehicle manufacturers incorporate more sophisticated infotainment systems and digital dashboards. These applications require exceptionally durable AR coatings that can withstand extreme temperature variations and constant exposure to UV radiation while maintaining optical performance.

Market research indicates a clear price premium for AR coatings that successfully balance hardness with low scatter properties. Products achieving this balance command 30-45% higher prices than standard AR solutions, reflecting the technical difficulty and added value of such formulations.

Regional analysis shows Asia-Pacific dominating manufacturing capacity, with China, Japan, and South Korea collectively accounting for over 60% of global production. However, research and development leadership remains concentrated in North America and Western Europe, where specialized coating technologies are developed before being scaled in Asian production facilities.

Customer requirements analysis reveals an increasing demand for environmentally sustainable coating solutions, with over 40% of surveyed manufacturers citing regulatory compliance and environmental considerations as key factors in coating selection. This trend is driving innovation in water-based and solvent-free coating technologies that maintain performance while reducing environmental impact.

The market exhibits clear segmentation between mass-market applications requiring cost-effective solutions and premium applications where optical performance and durability command significant price premiums. This bifurcation creates distinct innovation pathways, with different technical approaches optimized for different market segments.

Consumer electronics represents the largest demand segment, with smartphone displays, tablets, and laptop screens requiring increasingly sophisticated AR solutions that maintain clarity while resisting scratches and smudges. The premium smartphone market particularly values coatings that can deliver both optical performance and durability, with consumers willing to pay higher prices for devices featuring advanced display protection.

The optical eyewear industry has become a substantial driver for high-performance AR coatings, with prescription lens manufacturers reporting that over 70% of consumers now opt for anti-reflective treatments when purchasing new glasses. This segment demands coatings that balance hardness with comfort and optical clarity, creating specialized market requirements distinct from electronic applications.

Automotive displays represent the fastest-growing segment, with a projected growth rate exceeding 12% annually as vehicle manufacturers incorporate more sophisticated infotainment systems and digital dashboards. These applications require exceptionally durable AR coatings that can withstand extreme temperature variations and constant exposure to UV radiation while maintaining optical performance.

Market research indicates a clear price premium for AR coatings that successfully balance hardness with low scatter properties. Products achieving this balance command 30-45% higher prices than standard AR solutions, reflecting the technical difficulty and added value of such formulations.

Regional analysis shows Asia-Pacific dominating manufacturing capacity, with China, Japan, and South Korea collectively accounting for over 60% of global production. However, research and development leadership remains concentrated in North America and Western Europe, where specialized coating technologies are developed before being scaled in Asian production facilities.

Customer requirements analysis reveals an increasing demand for environmentally sustainable coating solutions, with over 40% of surveyed manufacturers citing regulatory compliance and environmental considerations as key factors in coating selection. This trend is driving innovation in water-based and solvent-free coating technologies that maintain performance while reducing environmental impact.

The market exhibits clear segmentation between mass-market applications requiring cost-effective solutions and premium applications where optical performance and durability command significant price premiums. This bifurcation creates distinct innovation pathways, with different technical approaches optimized for different market segments.

Current Challenges in Plastic AR Coating Development

The development of anti-reflective (AR) coatings for plastic substrates faces several significant technical challenges, primarily centered around the inherent contradiction between achieving optimal hardness and minimizing light scatter. Plastic substrates, unlike glass, possess lower thermal stability and surface hardness, making them more susceptible to scratches and environmental degradation. This vulnerability necessitates harder coatings, yet increasing coating hardness often leads to higher internal stress, which can cause delamination or cracking over time.

A fundamental challenge lies in the adhesion mechanism between AR coatings and plastic substrates. The relatively weak intermolecular forces at the plastic surface provide limited anchoring points for coating materials, resulting in adhesion failures under thermal cycling or mechanical stress. Current plasma treatment methods improve adhesion but often introduce surface irregularities that increase scatter, directly undermining the optical performance of the AR coating.

Material compatibility presents another significant hurdle. Many high-performance AR coating materials require deposition temperatures exceeding the glass transition temperature of common optical plastics like polycarbonate and PMMA. Lower temperature deposition processes typically yield coatings with suboptimal density, reduced hardness, and higher porosity—all factors that increase light scatter and reduce durability.

The dimensional stability of plastic substrates during coating processes creates additional complications. Thermal expansion mismatches between the substrate and coating layers generate internal stresses that can lead to optical distortions, particularly in precision applications. These stresses often manifest as micro-cracks that scatter light and degrade optical performance over time.

Environmental durability represents perhaps the most persistent challenge. AR-coated plastics must withstand humidity, temperature fluctuations, UV exposure, and chemical contact while maintaining both mechanical integrity and optical performance. Current hydrophobic top layers improve resistance to environmental factors but frequently compromise the anti-reflective properties or introduce additional scatter sites.

Manufacturing scalability remains problematic, with high-performance AR coatings typically requiring vacuum deposition techniques that are costly and time-intensive. Alternative methods like sol-gel processes offer better economics but struggle to deliver comparable hardness and scatter performance, creating a significant barrier to widespread adoption in consumer electronics and automotive applications.

The measurement and quality control of scatter performance on plastic AR coatings presents its own challenges, as traditional metrology techniques developed for glass substrates often fail to account for the unique optical properties and surface characteristics of coated plastics, leading to inconsistent production quality and performance variability.

A fundamental challenge lies in the adhesion mechanism between AR coatings and plastic substrates. The relatively weak intermolecular forces at the plastic surface provide limited anchoring points for coating materials, resulting in adhesion failures under thermal cycling or mechanical stress. Current plasma treatment methods improve adhesion but often introduce surface irregularities that increase scatter, directly undermining the optical performance of the AR coating.

Material compatibility presents another significant hurdle. Many high-performance AR coating materials require deposition temperatures exceeding the glass transition temperature of common optical plastics like polycarbonate and PMMA. Lower temperature deposition processes typically yield coatings with suboptimal density, reduced hardness, and higher porosity—all factors that increase light scatter and reduce durability.

The dimensional stability of plastic substrates during coating processes creates additional complications. Thermal expansion mismatches between the substrate and coating layers generate internal stresses that can lead to optical distortions, particularly in precision applications. These stresses often manifest as micro-cracks that scatter light and degrade optical performance over time.

Environmental durability represents perhaps the most persistent challenge. AR-coated plastics must withstand humidity, temperature fluctuations, UV exposure, and chemical contact while maintaining both mechanical integrity and optical performance. Current hydrophobic top layers improve resistance to environmental factors but frequently compromise the anti-reflective properties or introduce additional scatter sites.

Manufacturing scalability remains problematic, with high-performance AR coatings typically requiring vacuum deposition techniques that are costly and time-intensive. Alternative methods like sol-gel processes offer better economics but struggle to deliver comparable hardness and scatter performance, creating a significant barrier to widespread adoption in consumer electronics and automotive applications.

The measurement and quality control of scatter performance on plastic AR coatings presents its own challenges, as traditional metrology techniques developed for glass substrates often fail to account for the unique optical properties and surface characteristics of coated plastics, leading to inconsistent production quality and performance variability.

Current Hardness-Scatter Balancing Solutions

01 Hard coating materials for anti-reflective surfaces

Various hard coating materials can be applied to anti-reflective surfaces to improve durability while maintaining optical properties. These materials include metal oxides, silicon-based compounds, and hybrid organic-inorganic materials that provide scratch resistance while minimizing light scatter. The coatings are designed to withstand environmental stresses while maintaining transparency and anti-reflective properties.- Hard coating materials for anti-reflective surfaces: Various hard coating materials can be applied to anti-reflective surfaces to improve durability while maintaining optical properties. These materials include metal oxides, silicon-based compounds, and hybrid organic-inorganic compositions that provide enhanced scratch resistance and hardness. The coatings are designed to withstand environmental stresses while minimizing light scatter and maintaining transparency, which is crucial for optical applications.

- Surface treatment techniques to reduce scatter: Specialized surface treatment methods can be employed to reduce light scatter in anti-reflective coatings. These techniques include plasma treatment, chemical etching, and polishing processes that minimize surface roughness at the nanoscale level. By creating smoother interfaces between coating layers, these treatments significantly reduce light scatter and improve optical clarity while maintaining the anti-reflective properties of the coating system.

- Multi-layer coating structures for optimized hardness and anti-reflection: Multi-layer coating architectures can be designed to provide both anti-reflective properties and enhanced surface hardness. These structures typically consist of alternating high and low refractive index materials with carefully controlled thicknesses. The top layer often incorporates hardening agents while underlying layers are optimized for anti-reflection. This approach allows for customization of both mechanical durability and optical performance in a single coating system.

- Nanoparticle incorporation for improved hardness and scatter reduction: Incorporating nanoparticles into anti-reflective coatings can simultaneously enhance surface hardness and reduce light scatter. Nanoparticles such as silica, alumina, or zirconia can be dispersed within coating matrices to improve mechanical properties without significantly affecting optical transparency. The size, distribution, and concentration of these nanoparticles are carefully controlled to minimize light scatter while maximizing the hardness enhancement effect.

- Measurement and characterization techniques for surface hardness and scatter: Advanced measurement and characterization methods are essential for evaluating the performance of anti-reflective coatings in terms of surface hardness and scatter. These techniques include nanoindentation for hardness testing, atomic force microscopy for surface roughness analysis, and specialized optical instruments for quantifying scatter. These measurement approaches enable precise quality control and optimization of coating formulations to achieve the desired balance between optical and mechanical properties.

02 Multilayer anti-reflective structures with enhanced hardness

Multilayer anti-reflective coatings can be engineered to provide both optical performance and mechanical durability. These structures typically consist of alternating high and low refractive index materials with specific thickness control to minimize reflection while maximizing hardness. Advanced deposition techniques ensure uniform layers with strong interfacial adhesion, reducing scatter and improving abrasion resistance.Expand Specific Solutions03 Surface treatments to reduce scatter in anti-reflective coatings

Various surface treatment methods can be employed to reduce light scatter in anti-reflective coatings. These include plasma treatments, chemical etching, and polishing techniques that minimize surface roughness at the nanoscale. By controlling surface morphology, these treatments help maintain optical clarity while reducing haze and unwanted light diffusion, which is critical for high-performance optical applications.Expand Specific Solutions04 Nanostructured anti-reflective coatings with improved mechanical properties

Nanostructured anti-reflective coatings incorporate precisely engineered surface features at the nanoscale to achieve both optical and mechanical benefits. These structures can include nanopillars, nanopores, or gradient-index layers that effectively reduce reflection while providing enhanced hardness and wear resistance. The nanostructuring helps distribute mechanical stress and prevents crack propagation, resulting in more durable anti-reflective surfaces with minimal scatter.Expand Specific Solutions05 Testing and measurement methods for hardness and scatter in anti-reflective coatings

Specialized testing and measurement techniques are essential for evaluating the performance of anti-reflective coatings in terms of hardness and scatter. These methods include nanoindentation for hardness testing, haze measurement, angle-resolved scatter analysis, and accelerated weathering tests. Advanced optical characterization tools help quantify the relationship between mechanical properties and optical performance, enabling optimization of coating formulations for specific applications.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The anti-reflective coatings market for plastics is currently in a growth phase, balancing the critical trade-off between surface hardness and low scatter properties. The global market is expanding steadily, driven by increasing demand in optical, automotive, and electronics applications, with an estimated market size exceeding $1.5 billion. Technologically, the field shows moderate maturity with ongoing innovation. Leading players like SCHOTT AG, Corning, and Nitto Denko have developed proprietary technologies balancing durability with optical performance, while research organizations such as Fraunhofer-Gesellschaft are advancing next-generation solutions. Companies including LG Chem, FUJIFILM, and Brewer Science are focusing on specialized applications requiring both mechanical resilience and superior optical properties, creating a competitive landscape where material science expertise and application-specific solutions are key differentiators.

Fraunhofer-Gesellschaft eV

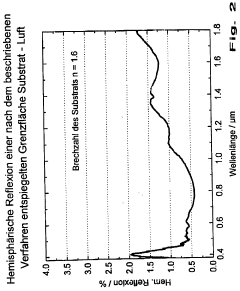

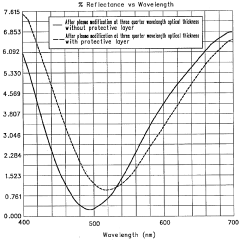

Technical Solution: Fraunhofer has developed an innovative plasma-assisted coating technology specifically designed for plastic optical components that require both anti-reflective properties and surface durability. Their approach utilizes a combination of plasma pre-treatment and magnetron sputtering to create multi-layer interference coatings with exceptional adhesion to plastic substrates. The process begins with a low-pressure oxygen plasma treatment that activates the plastic surface, creating functional groups that enhance chemical bonding with subsequent layers. This is followed by deposition of a gradient-index coating structure consisting of alternating high and low refractive index materials (typically SiO2 and TiO2) with precisely controlled thicknesses in the nanometer range. Fraunhofer's technology incorporates an intermediate layer containing silicon oxynitride that serves as both an adhesion promoter and stress-relief layer, preventing delamination during thermal cycling. The final coating structure achieves reflection values below 0.7% across the visible spectrum while providing a pencil hardness of 3H-5H depending on the specific formulation. Testing has demonstrated that these coatings maintain optical performance after 500 hours of accelerated weathering and resist damage from standard cleaning procedures[3][7][8].

Strengths: Exceptional adhesion to plastic substrates due to the plasma pre-treatment process, resulting in coatings that resist delamination even under environmental stress. The technology allows precise optical design for specific wavelength requirements. Weaknesses: The plasma and vacuum deposition processes require sophisticated equipment and careful process control, increasing manufacturing complexity and cost. The coating performance is somewhat substrate-dependent, requiring optimization for different plastic materials.

SCHOTT AG

Technical Solution: SCHOTT has developed a hybrid sol-gel technology for anti-reflective coatings on plastic substrates that addresses the critical balance between hardness and optical performance. Their approach utilizes organically modified ceramic materials (ORMOCER®) that combine the durability of inorganic materials with the flexibility of organic compounds. The coating process begins with a nano-composite primer layer that enhances adhesion to various plastic substrates including polycarbonate and PMMA. This is followed by multiple functional layers with precisely controlled porosity to create a gradient refractive index profile. SCHOTT's proprietary formulation incorporates silica nanoparticles (15-25nm diameter) dispersed in a modified siloxane matrix, creating a structure that minimizes light scatter while providing mechanical stability. The coating is cured using a combination of thermal and UV processes that promote cross-linking without damaging the substrate. This results in coatings with pencil hardness ratings of 2H-4H while maintaining reflection values below 0.8% across the visible spectrum. The technology has been successfully implemented in automotive displays, optical sensors, and consumer electronics applications[4][6].

Strengths: Excellent balance of optical performance and mechanical durability, with strong adhesion to multiple plastic substrate types. The sol-gel approach allows for cost-effective processing without requiring vacuum deposition equipment. Weaknesses: Coating thickness uniformity can be challenging to maintain over large areas, potentially leading to optical variations. The curing process requires precise control to achieve optimal hardness without introducing stress that could lead to cracking.

Key Patents and Innovations in AR Coating Technology

Anti-reflection coating and method for producing same

PatentWO1998039673A1

Innovation

- An anti-reflection layer with a carrier layer of optically transparent material featuring stochastically distributed macrostructures and microstructures with period lengths less than the radiation wavelength, combining the benefits of anti-glare layers and sub-wavelength gratings to reduce hemispherical reflections and maintain contrast ratios.

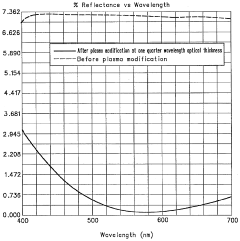

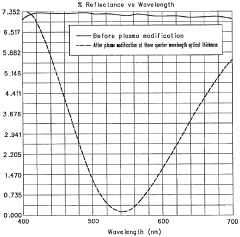

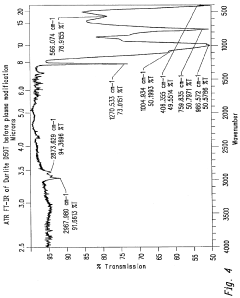

Method for forming interference anti-reflective coatings by plasma surface modification

PatentInactiveUS5580606A

Innovation

- The use of microwave plasma modification to apply a hard organo-silica coating on plastic substrates, followed by curing and immersion in a fluorine-containing solution, to achieve interference anti-reflective coatings with low reflectance, high abrasion resistance, and chemical resistance, using specific organic silicon compounds and plasma parameters like downstream microwave plasma.

Environmental Impact and Sustainability Considerations

The environmental impact of anti-reflective (AR) coating processes on plastic substrates has become increasingly significant as sustainability concerns drive industry standards. Traditional AR coating methods often involve hazardous chemicals, including volatile organic compounds (VOCs) and fluorinated compounds, which pose substantial environmental risks through air and water pollution. These chemicals contribute to greenhouse gas emissions and can persist in ecosystems for extended periods, affecting wildlife and human health.

Manufacturing processes for AR coatings typically require substantial energy consumption, particularly in vacuum deposition techniques that demand high temperatures and specialized equipment. This energy footprint represents a significant environmental consideration when evaluating the overall sustainability of AR coating technologies. Additionally, the waste streams generated during production often contain toxic materials that require specialized disposal procedures to prevent environmental contamination.

Recent innovations have focused on developing more environmentally friendly alternatives. Water-based coating formulations have emerged as promising substitutes for solvent-based systems, significantly reducing VOC emissions while maintaining optical performance. Similarly, sol-gel processes utilizing silica-based materials offer reduced environmental impact compared to traditional methods, though challenges remain in achieving comparable hardness and scratch resistance.

The recyclability of coated plastic components presents another critical sustainability challenge. The presence of AR coatings can complicate recycling processes, as these thin films may introduce contaminants into the recycled plastic stream. Research into coating technologies that maintain compatibility with existing recycling infrastructure is gaining momentum, with biodegradable coating materials showing particular promise for applications where product lifecycle is relatively short.

Life cycle assessment (LCA) studies comparing different AR coating technologies reveal that environmental impacts vary significantly based on production method, substrate material, and end-of-life considerations. These assessments indicate that while some newer technologies reduce environmental burden during manufacturing, they may present challenges during disposal or recycling phases. Comprehensive LCA approaches are becoming essential tools for manufacturers seeking to optimize both performance and sustainability metrics.

Regulatory frameworks worldwide are increasingly addressing the environmental aspects of coating technologies. The European Union's REACH regulations and similar initiatives in other regions have accelerated the transition away from certain harmful substances previously common in AR coating formulations. This regulatory landscape continues to evolve, driving innovation toward greener chemistry approaches that maintain the delicate balance between optical performance, durability, and environmental responsibility.

Manufacturing processes for AR coatings typically require substantial energy consumption, particularly in vacuum deposition techniques that demand high temperatures and specialized equipment. This energy footprint represents a significant environmental consideration when evaluating the overall sustainability of AR coating technologies. Additionally, the waste streams generated during production often contain toxic materials that require specialized disposal procedures to prevent environmental contamination.

Recent innovations have focused on developing more environmentally friendly alternatives. Water-based coating formulations have emerged as promising substitutes for solvent-based systems, significantly reducing VOC emissions while maintaining optical performance. Similarly, sol-gel processes utilizing silica-based materials offer reduced environmental impact compared to traditional methods, though challenges remain in achieving comparable hardness and scratch resistance.

The recyclability of coated plastic components presents another critical sustainability challenge. The presence of AR coatings can complicate recycling processes, as these thin films may introduce contaminants into the recycled plastic stream. Research into coating technologies that maintain compatibility with existing recycling infrastructure is gaining momentum, with biodegradable coating materials showing particular promise for applications where product lifecycle is relatively short.

Life cycle assessment (LCA) studies comparing different AR coating technologies reveal that environmental impacts vary significantly based on production method, substrate material, and end-of-life considerations. These assessments indicate that while some newer technologies reduce environmental burden during manufacturing, they may present challenges during disposal or recycling phases. Comprehensive LCA approaches are becoming essential tools for manufacturers seeking to optimize both performance and sustainability metrics.

Regulatory frameworks worldwide are increasingly addressing the environmental aspects of coating technologies. The European Union's REACH regulations and similar initiatives in other regions have accelerated the transition away from certain harmful substances previously common in AR coating formulations. This regulatory landscape continues to evolve, driving innovation toward greener chemistry approaches that maintain the delicate balance between optical performance, durability, and environmental responsibility.

Manufacturing Process Optimization Strategies

Manufacturing Process Optimization Strategies for anti-reflective coatings on plastic substrates requires a delicate balance between achieving surface hardness and minimizing light scatter. The optimization begins with substrate preparation, where plasma treatment or chemical cleaning processes must be precisely controlled to create an ideal surface for coating adhesion without introducing micro-roughness that could increase scatter.

Vacuum deposition techniques, particularly ion-assisted deposition (IAD), represent a significant advancement in this field. By carefully controlling ion energy and flux during the deposition process, manufacturers can create densely packed coating structures with improved hardness while maintaining smooth interfaces between layers. The optimization of chamber pressure, deposition rate, and substrate temperature during this process directly impacts the coating's mechanical and optical properties.

Solution-based coating methods offer alternative approaches, with sol-gel techniques showing particular promise for plastic substrates. The critical parameters include solution viscosity, withdrawal speed, and curing conditions. Advanced manufacturing facilities have implemented real-time monitoring systems that adjust these parameters dynamically, resulting in up to 30% improvement in coating uniformity and hardness.

Curing processes represent another crucial optimization point. UV curing technologies have evolved to provide rapid hardening while minimizing thermal stress on plastic substrates. The latest systems employ variable intensity UV sources that can be programmed to follow specific curing profiles, gradually building cross-linking density without creating internal stresses that lead to micro-fractures and subsequent light scatter.

Post-deposition treatments have emerged as effective optimization strategies. Controlled thermal annealing below the plastic's glass transition temperature can enhance coating hardness without degrading optical properties. Similarly, plasma post-treatment can improve surface properties through careful control of plasma chemistry and exposure time.

Quality control integration within the manufacturing process represents a paradigm shift in optimization. In-line optical monitoring systems now provide real-time feedback on coating thickness uniformity and scatter properties, allowing for immediate process adjustments. Advanced facilities employ machine learning algorithms that analyze this data to predict coating performance and suggest process modifications before defects occur.

The implementation of clean room technologies specifically designed for plastic coating operations has significantly reduced particulate contamination, which is a primary cause of scatter sites. Modular clean room designs with specialized air flow patterns around coating equipment have demonstrated up to 40% reduction in defect rates compared to conventional setups.

Vacuum deposition techniques, particularly ion-assisted deposition (IAD), represent a significant advancement in this field. By carefully controlling ion energy and flux during the deposition process, manufacturers can create densely packed coating structures with improved hardness while maintaining smooth interfaces between layers. The optimization of chamber pressure, deposition rate, and substrate temperature during this process directly impacts the coating's mechanical and optical properties.

Solution-based coating methods offer alternative approaches, with sol-gel techniques showing particular promise for plastic substrates. The critical parameters include solution viscosity, withdrawal speed, and curing conditions. Advanced manufacturing facilities have implemented real-time monitoring systems that adjust these parameters dynamically, resulting in up to 30% improvement in coating uniformity and hardness.

Curing processes represent another crucial optimization point. UV curing technologies have evolved to provide rapid hardening while minimizing thermal stress on plastic substrates. The latest systems employ variable intensity UV sources that can be programmed to follow specific curing profiles, gradually building cross-linking density without creating internal stresses that lead to micro-fractures and subsequent light scatter.

Post-deposition treatments have emerged as effective optimization strategies. Controlled thermal annealing below the plastic's glass transition temperature can enhance coating hardness without degrading optical properties. Similarly, plasma post-treatment can improve surface properties through careful control of plasma chemistry and exposure time.

Quality control integration within the manufacturing process represents a paradigm shift in optimization. In-line optical monitoring systems now provide real-time feedback on coating thickness uniformity and scatter properties, allowing for immediate process adjustments. Advanced facilities employ machine learning algorithms that analyze this data to predict coating performance and suggest process modifications before defects occur.

The implementation of clean room technologies specifically designed for plastic coating operations has significantly reduced particulate contamination, which is a primary cause of scatter sites. Modular clean room designs with specialized air flow patterns around coating equipment have demonstrated up to 40% reduction in defect rates compared to conventional setups.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!