Comparative analysis of Nylon 6 versus Nylon 66 in engineering applications

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Nylon Engineering Polymers Background and Objectives

Nylon engineering polymers have revolutionized various industrial applications since their introduction in the 1930s. The development of these versatile materials began with Wallace Carothers' groundbreaking research at DuPont, leading to the commercial production of Nylon 6,6 in 1938. Subsequently, Nylon 6 was developed in Germany as an alternative pathway to similar properties. These two variants have since become the most commercially significant polyamide engineering polymers globally.

The evolution of nylon technology has been characterized by continuous improvements in processing techniques, molecular weight control, and the development of specialized grades for specific applications. From initial uses in textiles and military applications during World War II, nylons have expanded into automotive components, electrical connectors, consumer goods, and industrial machinery parts, demonstrating remarkable versatility across industries.

Current technological trends in nylon engineering polymers focus on enhancing performance characteristics through reinforcement with glass fibers, carbon fibers, and mineral fillers. Additionally, there is growing interest in developing bio-based nylon variants to address sustainability concerns and reduce dependence on petroleum-derived raw materials. The incorporation of nanotechnology to improve mechanical properties and flame retardancy represents another significant advancement in this field.

The primary objective of this technical research is to conduct a comprehensive comparative analysis of Nylon 6 and Nylon 66 in engineering applications. This analysis aims to evaluate their respective mechanical properties, thermal characteristics, chemical resistance, processing parameters, and economic considerations. By understanding the fundamental differences between these two materials, we can provide guidance for optimal material selection in specific engineering contexts.

Furthermore, this research seeks to identify application-specific advantages of each polymer type, considering factors such as moisture absorption, dimensional stability, and long-term performance under various environmental conditions. The analysis will also examine how different modification techniques affect the performance profiles of both materials, including the impact of various reinforcements and additives.

The technological goal extends to exploring emerging applications where the distinct properties of either Nylon 6 or Nylon 66 may offer competitive advantages. This includes evaluating their potential in additive manufacturing, lightweight structural components, and high-performance engineering applications where traditional materials face limitations. By mapping the technological landscape of these materials, this research aims to provide a foundation for future innovation and material development strategies.

Finally, this analysis will consider the sustainability aspects of both polymers, examining their recyclability, energy consumption during production, and overall environmental footprint, reflecting the increasing importance of these factors in material selection decisions across industries.

The evolution of nylon technology has been characterized by continuous improvements in processing techniques, molecular weight control, and the development of specialized grades for specific applications. From initial uses in textiles and military applications during World War II, nylons have expanded into automotive components, electrical connectors, consumer goods, and industrial machinery parts, demonstrating remarkable versatility across industries.

Current technological trends in nylon engineering polymers focus on enhancing performance characteristics through reinforcement with glass fibers, carbon fibers, and mineral fillers. Additionally, there is growing interest in developing bio-based nylon variants to address sustainability concerns and reduce dependence on petroleum-derived raw materials. The incorporation of nanotechnology to improve mechanical properties and flame retardancy represents another significant advancement in this field.

The primary objective of this technical research is to conduct a comprehensive comparative analysis of Nylon 6 and Nylon 66 in engineering applications. This analysis aims to evaluate their respective mechanical properties, thermal characteristics, chemical resistance, processing parameters, and economic considerations. By understanding the fundamental differences between these two materials, we can provide guidance for optimal material selection in specific engineering contexts.

Furthermore, this research seeks to identify application-specific advantages of each polymer type, considering factors such as moisture absorption, dimensional stability, and long-term performance under various environmental conditions. The analysis will also examine how different modification techniques affect the performance profiles of both materials, including the impact of various reinforcements and additives.

The technological goal extends to exploring emerging applications where the distinct properties of either Nylon 6 or Nylon 66 may offer competitive advantages. This includes evaluating their potential in additive manufacturing, lightweight structural components, and high-performance engineering applications where traditional materials face limitations. By mapping the technological landscape of these materials, this research aims to provide a foundation for future innovation and material development strategies.

Finally, this analysis will consider the sustainability aspects of both polymers, examining their recyclability, energy consumption during production, and overall environmental footprint, reflecting the increasing importance of these factors in material selection decisions across industries.

Market Demand Analysis for Nylon 6 and Nylon 66

The global market for nylon polymers has shown consistent growth over the past decade, with Nylon 6 and Nylon 66 maintaining dominant positions in the engineering plastics segment. The combined market value for these two materials reached approximately $26.3 billion in 2022, with projections indicating growth to $32.7 billion by 2027, representing a compound annual growth rate (CAGR) of 4.5%.

Nylon 66 has traditionally commanded a premium position in the market due to its superior mechanical properties, particularly in high-temperature applications. This material currently holds about 58% of the combined Nylon 6/66 market share, though this represents a gradual decline from its 65% share a decade ago. The automotive sector remains the largest consumer of Nylon 66, accounting for 40% of its total consumption, primarily in under-hood components where temperature resistance is critical.

Nylon 6, meanwhile, has been gaining market share steadily, driven by its cost advantages and improving performance characteristics. The material has seen particularly strong growth in consumer electronics, packaging, and textile applications, with these sectors collectively representing 45% of its consumption. The price differential between Nylon 6 and Nylon 66 (with Nylon 6 typically 15-20% less expensive) has been a significant factor in this market shift.

Regional analysis reveals distinct consumption patterns. North America and Europe maintain higher proportions of Nylon 66 usage (62% and 59% respectively), while Asia-Pacific markets show stronger preference for Nylon 6 (55% market share). This regional variation reflects both established industrial practices and price sensitivity in developing markets.

Supply chain considerations have significantly impacted market dynamics since 2018. Shortages of adipic acid and hexamethylenediamine (key raw materials for Nylon 66) created substantial price volatility, with spot prices increasing by up to 40% during peak shortage periods. This situation accelerated the engineering redesign of many applications to accommodate Nylon 6 as a substitute material.

Industry surveys indicate that 73% of engineering design teams now consider material substitution between Nylon 6 and Nylon 66 during initial design phases, compared to only 48% five years ago. This trend suggests increasing market fluidity between these materials, with technical requirements rather than tradition increasingly driving material selection.

Sustainability factors are emerging as significant market drivers. Nylon 6 offers advantages in recyclability through depolymerization processes, while Nylon 66 typically requires more energy-intensive manufacturing. Environmental regulations, particularly in Europe and increasingly in North America, are creating market pressure favoring materials with lower carbon footprints and better end-of-life management options.

Nylon 66 has traditionally commanded a premium position in the market due to its superior mechanical properties, particularly in high-temperature applications. This material currently holds about 58% of the combined Nylon 6/66 market share, though this represents a gradual decline from its 65% share a decade ago. The automotive sector remains the largest consumer of Nylon 66, accounting for 40% of its total consumption, primarily in under-hood components where temperature resistance is critical.

Nylon 6, meanwhile, has been gaining market share steadily, driven by its cost advantages and improving performance characteristics. The material has seen particularly strong growth in consumer electronics, packaging, and textile applications, with these sectors collectively representing 45% of its consumption. The price differential between Nylon 6 and Nylon 66 (with Nylon 6 typically 15-20% less expensive) has been a significant factor in this market shift.

Regional analysis reveals distinct consumption patterns. North America and Europe maintain higher proportions of Nylon 66 usage (62% and 59% respectively), while Asia-Pacific markets show stronger preference for Nylon 6 (55% market share). This regional variation reflects both established industrial practices and price sensitivity in developing markets.

Supply chain considerations have significantly impacted market dynamics since 2018. Shortages of adipic acid and hexamethylenediamine (key raw materials for Nylon 66) created substantial price volatility, with spot prices increasing by up to 40% during peak shortage periods. This situation accelerated the engineering redesign of many applications to accommodate Nylon 6 as a substitute material.

Industry surveys indicate that 73% of engineering design teams now consider material substitution between Nylon 6 and Nylon 66 during initial design phases, compared to only 48% five years ago. This trend suggests increasing market fluidity between these materials, with technical requirements rather than tradition increasingly driving material selection.

Sustainability factors are emerging as significant market drivers. Nylon 6 offers advantages in recyclability through depolymerization processes, while Nylon 66 typically requires more energy-intensive manufacturing. Environmental regulations, particularly in Europe and increasingly in North America, are creating market pressure favoring materials with lower carbon footprints and better end-of-life management options.

Technical Characteristics and Challenges Comparison

Nylon 6 and Nylon 66 represent two of the most widely used engineering polyamides, each possessing distinct technical characteristics that influence their application suitability. Nylon 6 exhibits superior impact resistance and flexibility compared to Nylon 66, making it particularly valuable in applications requiring absorption of mechanical shock or vibration. This enhanced toughness stems from its molecular structure, which features a single monomer arrangement that allows for greater chain mobility.

Conversely, Nylon 66, composed of two different monomers, demonstrates higher tensile strength, rigidity, and heat resistance. Its melting point of approximately 260°C exceeds Nylon 6's 220°C, providing a critical advantage in high-temperature engineering environments. This temperature differential significantly impacts the material selection process for applications operating near these thermal thresholds.

Moisture absorption represents a significant challenge for both materials, though with varying degrees of severity. Nylon 6 typically absorbs 2.5-3.0% moisture at equilibrium under standard conditions, whereas Nylon 66 absorbs approximately 1.5-1.8%. This higher moisture sensitivity in Nylon 6 leads to more pronounced dimensional instability and potential mechanical property degradation in humid environments.

Processing characteristics also differ substantially between these polyamides. Nylon 6 offers easier processing with lower melt viscosity and broader processing temperature windows, facilitating more complex molding operations. Nylon 66 requires more precise temperature control during processing but yields parts with superior surface finish and dimensional stability.

Chemical resistance profiles diverge significantly, with Nylon 66 demonstrating superior resistance to weak acids and oxidizing agents, while Nylon 6 performs better against strong acids and certain solvents. This chemical differentiation becomes particularly relevant in automotive applications where exposure to various fluids is common.

Cost considerations present another technical challenge, as Nylon 6 typically commands a 10-15% lower raw material cost than Nylon 66. However, this initial cost advantage must be balanced against performance requirements, as Nylon 66's superior mechanical properties may reduce material usage or extend component lifespan in certain applications.

Weathering resistance presents challenges for both materials, with UV exposure causing yellowing and property degradation. Nylon 66 generally exhibits slightly better weathering resistance, though both materials typically require stabilizers or protective measures for outdoor applications. This limitation has spurred development of specialized grades with enhanced UV stabilization packages.

Conversely, Nylon 66, composed of two different monomers, demonstrates higher tensile strength, rigidity, and heat resistance. Its melting point of approximately 260°C exceeds Nylon 6's 220°C, providing a critical advantage in high-temperature engineering environments. This temperature differential significantly impacts the material selection process for applications operating near these thermal thresholds.

Moisture absorption represents a significant challenge for both materials, though with varying degrees of severity. Nylon 6 typically absorbs 2.5-3.0% moisture at equilibrium under standard conditions, whereas Nylon 66 absorbs approximately 1.5-1.8%. This higher moisture sensitivity in Nylon 6 leads to more pronounced dimensional instability and potential mechanical property degradation in humid environments.

Processing characteristics also differ substantially between these polyamides. Nylon 6 offers easier processing with lower melt viscosity and broader processing temperature windows, facilitating more complex molding operations. Nylon 66 requires more precise temperature control during processing but yields parts with superior surface finish and dimensional stability.

Chemical resistance profiles diverge significantly, with Nylon 66 demonstrating superior resistance to weak acids and oxidizing agents, while Nylon 6 performs better against strong acids and certain solvents. This chemical differentiation becomes particularly relevant in automotive applications where exposure to various fluids is common.

Cost considerations present another technical challenge, as Nylon 6 typically commands a 10-15% lower raw material cost than Nylon 66. However, this initial cost advantage must be balanced against performance requirements, as Nylon 66's superior mechanical properties may reduce material usage or extend component lifespan in certain applications.

Weathering resistance presents challenges for both materials, with UV exposure causing yellowing and property degradation. Nylon 66 generally exhibits slightly better weathering resistance, though both materials typically require stabilizers or protective measures for outdoor applications. This limitation has spurred development of specialized grades with enhanced UV stabilization packages.

Current Engineering Applications and Solutions

01 Structural and chemical differences between Nylon 6 and Nylon 66

Nylon 6 and Nylon 66 have different molecular structures and chemical compositions. Nylon 6 is made from caprolactam and has a single monomer unit, while Nylon 66 is made from hexamethylenediamine and adipic acid, resulting in two different monomer units. These structural differences lead to variations in their physical properties, melting points, and applications in various industries.- Manufacturing processes for Nylon 6 and Nylon 66: Various manufacturing processes are employed for producing Nylon 6 and Nylon 66 polymers with specific properties. These processes include polymerization techniques, extrusion methods, and specialized treatments to enhance the physical and chemical characteristics of the resulting nylon materials. The manufacturing processes can be optimized to control molecular weight, crystallinity, and other properties that affect the performance of the final products.

- Blending of Nylon 6 and Nylon 66 with other materials: Nylon 6 and Nylon 66 can be blended with various other materials to create composites with enhanced properties. These blends may incorporate other polymers, reinforcing agents, fillers, or additives to improve mechanical strength, thermal stability, chemical resistance, or processing characteristics. The resulting composite materials offer advantages over pure nylon polymers for specific applications where standard nylon properties are insufficient.

- Applications of Nylon 6 and Nylon 66 in textiles and fibers: Nylon 6 and Nylon 66 are widely used in textile and fiber applications due to their excellent mechanical properties, durability, and processability. These polyamides can be processed into fibers for various textile products including clothing, carpets, industrial fabrics, and technical textiles. The specific properties of each nylon type make them suitable for different textile applications, with processing techniques tailored to achieve desired fiber characteristics.

- Modification techniques for improving Nylon 6 and Nylon 66 properties: Various modification techniques can be applied to Nylon 6 and Nylon 66 to enhance their properties for specific applications. These modifications include chemical treatments, surface modifications, incorporation of functional groups, and other processes that alter the polymer structure or surface characteristics. Modified nylons exhibit improved properties such as better heat resistance, reduced water absorption, enhanced chemical resistance, or improved compatibility with other materials.

- Recycling and sustainable production of Nylon 6 and Nylon 66: Methods for recycling Nylon 6 and Nylon 66 materials and developing more sustainable production processes are increasingly important. These approaches include chemical recycling techniques, mechanical recycling methods, and bio-based production pathways. Recycled nylon materials can be reprocessed into new products while maintaining acceptable performance characteristics, contributing to circular economy goals and reducing environmental impact of nylon production and disposal.

02 Blending Nylon 6 and Nylon 66 for enhanced properties

Blending Nylon 6 and Nylon 66 can create materials with improved mechanical properties, thermal stability, and chemical resistance compared to either polymer alone. The blend ratio can be adjusted to achieve specific performance characteristics such as increased tensile strength, impact resistance, and dimensional stability. These blends are often used in automotive parts, electrical components, and industrial applications where high performance is required.Expand Specific Solutions03 Processing techniques for Nylon 6 and Nylon 66

Various processing techniques can be applied to Nylon 6 and Nylon 66, including injection molding, extrusion, and fiber spinning. Each polymer requires specific processing parameters due to their different melting points and rheological properties. Nylon 66 typically requires higher processing temperatures than Nylon 6. Proper drying before processing is essential for both polymers to prevent hydrolysis and maintain optimal mechanical properties in the final products.Expand Specific Solutions04 Modification and reinforcement of Nylon 6 and Nylon 66

Both Nylon 6 and Nylon 66 can be modified with various additives and reinforcing materials to enhance their properties. Glass fibers, carbon fibers, and mineral fillers are commonly used to improve mechanical strength and dimensional stability. Chemical modifications, such as the addition of impact modifiers, flame retardants, and UV stabilizers, can tailor these polymers for specific applications and environmental conditions, extending their usability across different industries.Expand Specific Solutions05 Applications and performance comparison of Nylon 6 and Nylon 66

Nylon 6 and Nylon 66 are used in various applications based on their specific performance characteristics. Nylon 66 generally offers higher heat resistance, stiffness, and mechanical strength, making it suitable for automotive components and industrial parts subjected to high temperatures and mechanical stress. Nylon 6 typically provides better impact resistance and processability, making it preferred for textile fibers, films, and consumer goods. The selection between these polymers depends on the specific requirements of the application, including mechanical properties, thermal stability, and cost considerations.Expand Specific Solutions

Key Manufacturers and Industry Landscape

The engineering plastics market for Nylon 6 and Nylon 66 is in a mature growth phase with global market size exceeding $25 billion, driven by automotive, electrical, and industrial applications. Technologically, both materials have reached high maturity levels with ongoing innovations in composites and sustainable formulations. Key players demonstrate varying specialization: Kingfa Sci. & Tech. and Shanghai Kingfa lead in modified plastics development; Ascend Performance Materials dominates Nylon 66 production; Toray and Mitsubishi Gas Chemical excel in high-performance variants; while companies like HYOSUNG and CGN Juner focus on specialized applications. The competitive landscape shows regional strengths with Asian manufacturers expanding market share through cost advantages and technical innovations.

Ascend Performance Materials Operations LLC

Technical Solution: Ascend Performance Materials has developed proprietary technologies for both Nylon 6 and Nylon 66 production, with particular expertise in Nylon 66. Their Vydyne® portfolio features engineered Nylon 66 compounds with enhanced thermal stability up to 230°C, compared to Nylon 6's typical maximum of 180°C. Their comparative analysis demonstrates Nylon 66's superior mechanical properties, including 15-20% higher tensile strength and significantly better retention of mechanical properties at elevated temperatures. Ascend has pioneered flame-retardant Nylon 66 formulations that maintain UL94 V-0 ratings while preserving mechanical integrity, addressing a traditional weakness of polyamides. Their research also focuses on the comparative moisture absorption characteristics, with their specialized Nylon 66 grades showing 30% less moisture uptake than standard Nylon 6, resulting in more consistent dimensional stability in varying environmental conditions.

Strengths: Industry-leading expertise in Nylon 66 production; comprehensive material characterization capabilities; vertically integrated manufacturing. Weaknesses: Higher production costs for Nylon 66 compared to Nylon 6; greater dependence on adipic acid and hexamethylenediamine raw materials which face supply constraints.

HYOSUNG Corp.

Technical Solution: HYOSUNG has developed a comparative engineering approach between Nylon 6 and Nylon 66 through their POKETONE™ technology platform. Their research demonstrates that while their Nylon 66 formulations offer superior heat resistance (HDT of 250°C versus 200°C for Nylon 6), they've engineered specialized Nylon 6 variants with enhanced crystallization properties that narrow this performance gap. HYOSUNG's proprietary processing techniques allow their Nylon 6 to achieve 90% of the mechanical strength of Nylon 66 at approximately 70% of the raw material cost. Their comparative analysis focuses particularly on automotive applications, where their modified Nylon 6 demonstrates comparable chemical resistance to automotive fluids as Nylon 66, but with improved impact resistance at low temperatures (-30°C). HYOSUNG has also developed hybrid formulations that combine the processing advantages of Nylon 6 with selective performance characteristics of Nylon 66, creating cost-effective engineering solutions for applications with moderate heat exposure requirements.

Strengths: Cost-effective engineering solutions; strong position in automotive applications; innovative hybrid formulations. Weaknesses: Modified Nylon 6 still cannot fully match Nylon 66's heat resistance; requires more complex processing to achieve comparable properties.

Critical Patents and Technical Literature Review

Flame-retarding composite nylon and preparation method thereof

PatentActiveCN108822538A

Innovation

- Using components such as nylon, compatible toughening agent, ultrafine talc, anti-UV agent, antioxidant, lubricant, decabromodiphenylethane and antimony trioxide, it is grafted with maleic anhydride compatibilizer and The combination of diffusion oil optimizes the component ratio and processing technology to improve the flame retardant performance and wear resistance of the material.

Nylon 66 based on transition metal and rare earth complex modification and method thereof

PatentActiveCN116478533A

Innovation

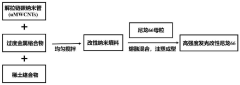

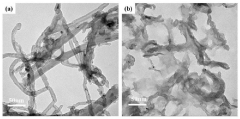

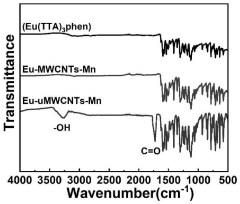

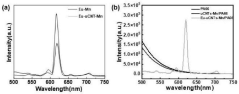

- Integration of unzipped carbon nanotubes anchored with transition metals as nanofiller for Nylon 66 modification, resulting in approximately 75% improvement in tensile strength compared to pure Nylon 66.

- Development of a fluorescent hybrid luminescent material by combining rare earth ion organic ligands with transition metal-anchored carbon nanotubes, achieving fluorescence intensity up to 3.0×105 candela.

- Novel three-step preparation method combining mechanical mixing and melt extrusion techniques to create modified Nylon 66 masterbatch with enhanced mechanical and optical properties.

Sustainability and Environmental Impact Assessment

The environmental impact of nylon production and use has become increasingly important as industries strive for greater sustainability. When comparing Nylon 6 and Nylon 66 from an environmental perspective, several key factors must be considered including raw material sourcing, energy consumption during production, emissions, recyclability, and end-of-life management.

Nylon 6 demonstrates certain environmental advantages over Nylon 66, primarily in its production process. The manufacturing of Nylon 6 requires approximately 20-30% less energy compared to Nylon 66 production, resulting in a lower carbon footprint. Additionally, Nylon 6 production generates fewer greenhouse gas emissions and requires less water usage throughout its lifecycle.

The recyclability factor significantly favors Nylon 6. It can be depolymerized back to its monomer (caprolactam) through hydrolysis processes with recovery rates exceeding 99%, enabling closed-loop recycling systems. Conversely, Nylon 66 presents greater challenges in recycling due to its dual-monomer structure, typically limiting it to mechanical recycling methods that result in quality degradation over multiple cycles.

Life Cycle Assessment (LCA) studies indicate that Nylon 6 generally exhibits a 15-25% lower environmental impact across categories including global warming potential, acidification, and resource depletion. However, these advantages must be balanced against application-specific requirements, as Nylon 66's superior mechanical properties may enable longer product lifespans in certain engineering applications.

Recent innovations in bio-based precursors are reshaping the sustainability profile of both materials. Bio-based Nylon 6 variants derived from renewable resources like castor oil show promise in reducing dependence on petroleum feedstocks. Similarly, partially bio-based Nylon 66 formulations are emerging, though commercial viability remains limited compared to conventional production methods.

Waste management considerations reveal that both materials present challenges regarding biodegradability, with decomposition times exceeding several decades in landfill conditions. However, thermal recovery methods can recapture energy value from nylon waste, with Nylon 6 offering slightly higher calorific values during incineration processes.

Regulatory frameworks increasingly influence material selection decisions, with extended producer responsibility policies and plastic waste reduction initiatives favoring materials with established recycling infrastructures. This regulatory landscape generally advantages Nylon 6 due to its more developed recycling technologies and circular economy potential.

In conclusion, while Nylon 6 demonstrates overall environmental advantages compared to Nylon 66, material selection decisions must balance sustainability considerations against specific performance requirements in engineering applications. The ongoing development of bio-based alternatives and recycling technologies continues to improve the environmental profiles of both materials.

Nylon 6 demonstrates certain environmental advantages over Nylon 66, primarily in its production process. The manufacturing of Nylon 6 requires approximately 20-30% less energy compared to Nylon 66 production, resulting in a lower carbon footprint. Additionally, Nylon 6 production generates fewer greenhouse gas emissions and requires less water usage throughout its lifecycle.

The recyclability factor significantly favors Nylon 6. It can be depolymerized back to its monomer (caprolactam) through hydrolysis processes with recovery rates exceeding 99%, enabling closed-loop recycling systems. Conversely, Nylon 66 presents greater challenges in recycling due to its dual-monomer structure, typically limiting it to mechanical recycling methods that result in quality degradation over multiple cycles.

Life Cycle Assessment (LCA) studies indicate that Nylon 6 generally exhibits a 15-25% lower environmental impact across categories including global warming potential, acidification, and resource depletion. However, these advantages must be balanced against application-specific requirements, as Nylon 66's superior mechanical properties may enable longer product lifespans in certain engineering applications.

Recent innovations in bio-based precursors are reshaping the sustainability profile of both materials. Bio-based Nylon 6 variants derived from renewable resources like castor oil show promise in reducing dependence on petroleum feedstocks. Similarly, partially bio-based Nylon 66 formulations are emerging, though commercial viability remains limited compared to conventional production methods.

Waste management considerations reveal that both materials present challenges regarding biodegradability, with decomposition times exceeding several decades in landfill conditions. However, thermal recovery methods can recapture energy value from nylon waste, with Nylon 6 offering slightly higher calorific values during incineration processes.

Regulatory frameworks increasingly influence material selection decisions, with extended producer responsibility policies and plastic waste reduction initiatives favoring materials with established recycling infrastructures. This regulatory landscape generally advantages Nylon 6 due to its more developed recycling technologies and circular economy potential.

In conclusion, while Nylon 6 demonstrates overall environmental advantages compared to Nylon 66, material selection decisions must balance sustainability considerations against specific performance requirements in engineering applications. The ongoing development of bio-based alternatives and recycling technologies continues to improve the environmental profiles of both materials.

Cost-Performance Analysis in Various Industries

The cost-performance ratio of Nylon 6 versus Nylon 66 varies significantly across different industrial applications, creating distinct value propositions in each sector. In automotive applications, Nylon 66 traditionally commands a 15-25% price premium over Nylon 6, yet delivers superior heat resistance (HDT of 80°C versus 65°C) and mechanical strength that justify this cost difference for under-hood components and structural parts. However, recent supply chain disruptions in adipic acid production have caused Nylon 66 prices to fluctuate by up to 40%, prompting automotive manufacturers to reconsider Nylon 6 for less demanding applications.

In the electrical and electronics industry, the cost-benefit analysis reveals that Nylon 6's lower price point (averaging $2.10-2.50/kg compared to Nylon 66's $2.80-3.20/kg) makes it particularly attractive for consumer electronics housings and cable ties where extreme temperature resistance is unnecessary. The 20-30% cost savings outweigh the marginal performance differences in these applications, driving increased adoption rates of 8-12% annually for Nylon 6 in this sector.

The consumer goods industry demonstrates perhaps the most nuanced cost-performance relationship between these polymers. For household appliances, the lifecycle cost analysis indicates that while Nylon 66 components may cost 15-20% more initially, their superior dimensional stability and resistance to repeated stress cycles can extend product lifespans by 30-40%, resulting in better long-term economics despite higher upfront costs.

Industrial equipment manufacturers face different cost considerations, particularly regarding maintenance intervals and downtime costs. Analysis of total ownership costs reveals that Nylon 66's superior fatigue resistance and chemical stability in industrial environments can reduce maintenance frequency by up to 25% compared to Nylon 6 alternatives, offsetting its higher acquisition cost in applications such as conveyor systems and industrial bearings.

The construction sector presents a compelling case for Nylon 6, where its lower processing temperature (220-230°C versus 270-290°C for Nylon 66) translates to energy savings of approximately 15-20% during manufacturing. Combined with its 20-25% lower raw material cost and comparable performance in ambient temperature applications, Nylon 6 demonstrates superior cost-efficiency for construction fittings, fasteners, and non-structural components where extreme mechanical properties are not critical requirements.

In the electrical and electronics industry, the cost-benefit analysis reveals that Nylon 6's lower price point (averaging $2.10-2.50/kg compared to Nylon 66's $2.80-3.20/kg) makes it particularly attractive for consumer electronics housings and cable ties where extreme temperature resistance is unnecessary. The 20-30% cost savings outweigh the marginal performance differences in these applications, driving increased adoption rates of 8-12% annually for Nylon 6 in this sector.

The consumer goods industry demonstrates perhaps the most nuanced cost-performance relationship between these polymers. For household appliances, the lifecycle cost analysis indicates that while Nylon 66 components may cost 15-20% more initially, their superior dimensional stability and resistance to repeated stress cycles can extend product lifespans by 30-40%, resulting in better long-term economics despite higher upfront costs.

Industrial equipment manufacturers face different cost considerations, particularly regarding maintenance intervals and downtime costs. Analysis of total ownership costs reveals that Nylon 66's superior fatigue resistance and chemical stability in industrial environments can reduce maintenance frequency by up to 25% compared to Nylon 6 alternatives, offsetting its higher acquisition cost in applications such as conveyor systems and industrial bearings.

The construction sector presents a compelling case for Nylon 6, where its lower processing temperature (220-230°C versus 270-290°C for Nylon 66) translates to energy savings of approximately 15-20% during manufacturing. Combined with its 20-25% lower raw material cost and comparable performance in ambient temperature applications, Nylon 6 demonstrates superior cost-efficiency for construction fittings, fasteners, and non-structural components where extreme mechanical properties are not critical requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!