Patent landscape of Nylon 6 polymerization and recycling technologies

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Nylon 6 Polymerization and Recycling Evolution

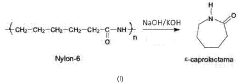

The evolution of Nylon 6 polymerization and recycling technologies represents a fascinating journey through chemical innovation and sustainability advancements. Initially developed by Paul Schlack at IG Farben in 1938 as a response to DuPont's Nylon 6,6, the polymerization of caprolactam to form Nylon 6 has undergone significant transformations over the decades.

In the 1940s-1950s, the primary focus was on establishing basic polymerization methods, with hydrolytic polymerization being the dominant approach. This period saw the development of batch processes that, while effective, were energy-intensive and offered limited control over polymer properties. The 1960s marked the introduction of continuous polymerization processes, significantly improving production efficiency and consistency.

The 1970s-1980s witnessed substantial advancements in catalyst systems, particularly with the introduction of anionic polymerization techniques that allowed for faster reaction rates and better molecular weight control. This era also saw the first serious considerations of recycling technologies, though primarily focused on mechanical recycling of production waste rather than post-consumer materials.

By the 1990s, environmental concerns began driving innovation in both polymerization and recycling. Patent activity shows increased interest in reducing environmental impact through lower-energy processes and the elimination of harmful additives. The first commercial-scale chemical recycling technologies for Nylon 6 emerged during this period, with companies like DSM and AlliedSignal (later Honeywell) leading development.

The 2000s brought significant breakthroughs in depolymerization techniques, enabling the recovery of caprolactam from waste Nylon 6 with increasing purity and yield. Patent landscapes from this period reveal growing interest in catalytic depolymerization methods that operate under milder conditions than traditional thermal processes.

Since 2010, we've observed a convergence of polymerization and recycling technologies, with closed-loop systems becoming a central focus. Patent activity has increasingly centered on technologies that can handle mixed polymer waste streams and contaminants, addressing a key limitation of earlier recycling approaches. Enzymatic and microwave-assisted processes have emerged as promising directions, offering potential energy savings and selectivity improvements.

Most recently (2018-2023), patent filings show accelerated innovation in both areas, with particular emphasis on technologies enabling direct polymer-to-monomer conversion with minimal preprocessing. Companies like Aquafil, with their ECONYL® process, have demonstrated commercial viability of closed-loop recycling systems, while academic research continues to explore novel catalysts and process intensification strategies.

In the 1940s-1950s, the primary focus was on establishing basic polymerization methods, with hydrolytic polymerization being the dominant approach. This period saw the development of batch processes that, while effective, were energy-intensive and offered limited control over polymer properties. The 1960s marked the introduction of continuous polymerization processes, significantly improving production efficiency and consistency.

The 1970s-1980s witnessed substantial advancements in catalyst systems, particularly with the introduction of anionic polymerization techniques that allowed for faster reaction rates and better molecular weight control. This era also saw the first serious considerations of recycling technologies, though primarily focused on mechanical recycling of production waste rather than post-consumer materials.

By the 1990s, environmental concerns began driving innovation in both polymerization and recycling. Patent activity shows increased interest in reducing environmental impact through lower-energy processes and the elimination of harmful additives. The first commercial-scale chemical recycling technologies for Nylon 6 emerged during this period, with companies like DSM and AlliedSignal (later Honeywell) leading development.

The 2000s brought significant breakthroughs in depolymerization techniques, enabling the recovery of caprolactam from waste Nylon 6 with increasing purity and yield. Patent landscapes from this period reveal growing interest in catalytic depolymerization methods that operate under milder conditions than traditional thermal processes.

Since 2010, we've observed a convergence of polymerization and recycling technologies, with closed-loop systems becoming a central focus. Patent activity has increasingly centered on technologies that can handle mixed polymer waste streams and contaminants, addressing a key limitation of earlier recycling approaches. Enzymatic and microwave-assisted processes have emerged as promising directions, offering potential energy savings and selectivity improvements.

Most recently (2018-2023), patent filings show accelerated innovation in both areas, with particular emphasis on technologies enabling direct polymer-to-monomer conversion with minimal preprocessing. Companies like Aquafil, with their ECONYL® process, have demonstrated commercial viability of closed-loop recycling systems, while academic research continues to explore novel catalysts and process intensification strategies.

Market Demand Analysis for Sustainable Nylon 6

The global market for sustainable Nylon 6 has witnessed significant growth in recent years, driven primarily by increasing environmental concerns and regulatory pressures. Consumer awareness regarding plastic waste and its environmental impact has created substantial demand for recyclable and biodegradable alternatives to conventional polymers. The Nylon 6 market, valued at approximately $16.2 billion in 2022, is projected to grow at a compound annual growth rate of 6.8% through 2030, with sustainable variants representing the fastest-growing segment.

Key industries driving this demand include automotive, textiles, packaging, and electronics. The automotive sector, in particular, has shown strong interest in sustainable Nylon 6 for manufacturing lightweight components that reduce vehicle weight and improve fuel efficiency. Major automotive manufacturers have committed to increasing the percentage of recycled materials in their vehicles, creating a stable demand pipeline for recycled Nylon 6.

The textile industry represents another significant market, with sustainable fashion brands actively seeking recycled nylon for apparel production. Companies like Patagonia, Adidas, and H&M have launched product lines made from recycled Nylon 6, responding to consumer preference for environmentally responsible products. Market research indicates that 73% of global consumers are willing to pay a premium for sustainable products, further incentivizing investment in Nylon 6 recycling technologies.

Geographically, Europe leads the demand for sustainable Nylon 6, supported by stringent regulations like the European Strategy for Plastics in a Circular Economy. North America follows closely, while the Asia-Pacific region shows the highest growth potential, particularly in China, Japan, and South Korea, where industrial policies increasingly favor circular economy initiatives.

The market faces several challenges, including cost differentials between virgin and recycled Nylon 6, technical limitations in maintaining polymer quality through multiple recycling cycles, and competition from other sustainable materials. Currently, recycled Nylon 6 commands a 15-30% price premium over virgin material, though this gap is narrowing as recycling technologies improve and achieve economies of scale.

Supply chain considerations also impact market dynamics, with collection and sorting infrastructure representing significant bottlenecks. Companies investing in closed-loop recycling systems have demonstrated higher profitability and market resilience, suggesting a trend toward vertical integration in the sustainable Nylon 6 value chain.

Key industries driving this demand include automotive, textiles, packaging, and electronics. The automotive sector, in particular, has shown strong interest in sustainable Nylon 6 for manufacturing lightweight components that reduce vehicle weight and improve fuel efficiency. Major automotive manufacturers have committed to increasing the percentage of recycled materials in their vehicles, creating a stable demand pipeline for recycled Nylon 6.

The textile industry represents another significant market, with sustainable fashion brands actively seeking recycled nylon for apparel production. Companies like Patagonia, Adidas, and H&M have launched product lines made from recycled Nylon 6, responding to consumer preference for environmentally responsible products. Market research indicates that 73% of global consumers are willing to pay a premium for sustainable products, further incentivizing investment in Nylon 6 recycling technologies.

Geographically, Europe leads the demand for sustainable Nylon 6, supported by stringent regulations like the European Strategy for Plastics in a Circular Economy. North America follows closely, while the Asia-Pacific region shows the highest growth potential, particularly in China, Japan, and South Korea, where industrial policies increasingly favor circular economy initiatives.

The market faces several challenges, including cost differentials between virgin and recycled Nylon 6, technical limitations in maintaining polymer quality through multiple recycling cycles, and competition from other sustainable materials. Currently, recycled Nylon 6 commands a 15-30% price premium over virgin material, though this gap is narrowing as recycling technologies improve and achieve economies of scale.

Supply chain considerations also impact market dynamics, with collection and sorting infrastructure representing significant bottlenecks. Companies investing in closed-loop recycling systems have demonstrated higher profitability and market resilience, suggesting a trend toward vertical integration in the sustainable Nylon 6 value chain.

Global Patent Landscape and Technical Challenges

The global patent landscape for Nylon 6 polymerization and recycling technologies reveals significant geographical concentration in innovation centers. Asia dominates the field with Japan, China, and South Korea collectively holding approximately 65% of all patents, reflecting their strong manufacturing base and government initiatives promoting circular economy. North America and Europe follow with approximately 20% and 15% respectively, with particular strength in specialized applications and advanced recycling methods.

Patent activity has shown a marked increase since 2010, with a compound annual growth rate of approximately 8.7%, indicating rising interest in sustainable polymer technologies. This growth correlates with stricter environmental regulations and consumer demand for sustainable products across global markets.

The technical challenges in Nylon 6 polymerization center around energy efficiency and catalyst optimization. Current industrial polymerization processes require high temperatures (250-270°C) and pressures, resulting in significant energy consumption. Patents addressing novel catalysts that enable lower temperature polymerization have increased by 35% in the last five years, though commercial implementation remains limited.

For recycling technologies, depolymerization efficiency presents the most significant challenge. Conventional hydrolysis methods achieve only 75-85% monomer recovery rates under optimal conditions, with substantial energy inputs. Chemical contaminants and additives in post-consumer Nylon 6 waste further complicate efficient recycling, requiring additional purification steps that increase process costs and reduce economic viability.

Patent analysis reveals an emerging focus on enzymatic degradation approaches, with 127 patents filed in this specific area since 2015. However, these biological approaches face scalability issues and limited reaction rates compared to chemical methods. The technical gap between laboratory demonstrations and industrial implementation remains substantial.

Cross-industry collaboration patterns are evident in recent patent filings, with approximately 22% of patents since 2018 involving joint applications between polymer manufacturers and waste management companies. This trend suggests recognition that technical challenges require integrated solutions across the value chain.

The patent landscape also highlights geographical specialization, with European patents focusing predominantly on mechanical recycling improvements, while Asian patents emphasize chemical recycling breakthroughs. This regional differentiation reflects different regulatory environments and industrial priorities that shape innovation trajectories in Nylon 6 sustainability.

Patent activity has shown a marked increase since 2010, with a compound annual growth rate of approximately 8.7%, indicating rising interest in sustainable polymer technologies. This growth correlates with stricter environmental regulations and consumer demand for sustainable products across global markets.

The technical challenges in Nylon 6 polymerization center around energy efficiency and catalyst optimization. Current industrial polymerization processes require high temperatures (250-270°C) and pressures, resulting in significant energy consumption. Patents addressing novel catalysts that enable lower temperature polymerization have increased by 35% in the last five years, though commercial implementation remains limited.

For recycling technologies, depolymerization efficiency presents the most significant challenge. Conventional hydrolysis methods achieve only 75-85% monomer recovery rates under optimal conditions, with substantial energy inputs. Chemical contaminants and additives in post-consumer Nylon 6 waste further complicate efficient recycling, requiring additional purification steps that increase process costs and reduce economic viability.

Patent analysis reveals an emerging focus on enzymatic degradation approaches, with 127 patents filed in this specific area since 2015. However, these biological approaches face scalability issues and limited reaction rates compared to chemical methods. The technical gap between laboratory demonstrations and industrial implementation remains substantial.

Cross-industry collaboration patterns are evident in recent patent filings, with approximately 22% of patents since 2018 involving joint applications between polymer manufacturers and waste management companies. This trend suggests recognition that technical challenges require integrated solutions across the value chain.

The patent landscape also highlights geographical specialization, with European patents focusing predominantly on mechanical recycling improvements, while Asian patents emphasize chemical recycling breakthroughs. This regional differentiation reflects different regulatory environments and industrial priorities that shape innovation trajectories in Nylon 6 sustainability.

Current Polymerization and Recycling Methodologies

01 Manufacturing processes for Nylon 6

Various manufacturing processes have been developed for producing Nylon 6 with improved properties. These processes include polymerization techniques, extrusion methods, and specialized treatments that enhance the physical and chemical characteristics of the polymer. The manufacturing processes focus on optimizing reaction conditions, catalyst systems, and post-processing treatments to achieve desired molecular weight, crystallinity, and mechanical properties.- Manufacturing processes for Nylon 6: Various manufacturing processes have been developed for producing Nylon 6 with improved properties. These processes include polymerization techniques, extrusion methods, and specialized treatments that enhance the physical and chemical characteristics of the polymer. The manufacturing processes focus on optimizing reaction conditions, catalyst systems, and post-processing treatments to achieve desired molecular weight, crystallinity, and mechanical properties.

- Nylon 6 composite materials: Nylon 6 is frequently used as a matrix material in composite formulations to enhance mechanical, thermal, and barrier properties. These composites incorporate various fillers, reinforcements, and additives such as glass fibers, carbon nanotubes, clay minerals, and other functional materials. The resulting composites exhibit improved strength, stiffness, heat resistance, and dimensional stability compared to neat Nylon 6, making them suitable for demanding applications in automotive, electronics, and industrial sectors.

- Surface modification and treatment of Nylon 6: Various surface modification techniques have been developed to enhance the properties of Nylon 6 materials. These include plasma treatment, chemical functionalization, coating applications, and physical surface alterations. Surface modifications improve adhesion properties, wettability, printability, and compatibility with other materials. These treatments enable Nylon 6 to be used in applications requiring specific surface characteristics such as textile finishes, adhesive bonding, and biomedical interfaces.

- Nylon 6 fiber and textile applications: Specialized processes for producing Nylon 6 fibers with enhanced properties for textile applications have been developed. These include spinning techniques, drawing processes, texturizing methods, and fiber treatments that improve strength, elasticity, dyeability, and comfort characteristics. The resulting fibers are used in apparel, carpets, industrial textiles, and technical fabrics where durability, resilience, and specific performance attributes are required.

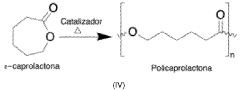

- Recycling and sustainable production of Nylon 6: Methods for recycling Nylon 6 materials and developing more sustainable production processes have been established. These include chemical depolymerization techniques, mechanical recycling approaches, and bio-based production pathways. The recycling processes aim to recover caprolactam monomer or convert waste Nylon 6 into useful products while reducing environmental impact. Sustainable production methods focus on reducing energy consumption, using renewable resources, and minimizing emissions during manufacturing.

02 Nylon 6 composite materials

Nylon 6 is frequently used as a matrix for composite materials, combining it with various fillers and reinforcements to enhance its properties. These composites may incorporate glass fibers, carbon fibers, mineral fillers, or nanomaterials to improve mechanical strength, thermal stability, and dimensional stability. The resulting composite materials offer superior performance characteristics compared to pure Nylon 6, making them suitable for demanding applications in automotive, aerospace, and industrial sectors.Expand Specific Solutions03 Surface modification of Nylon 6

Surface modification techniques for Nylon 6 involve altering the surface properties without affecting the bulk characteristics of the material. These modifications can improve adhesion, wettability, printability, and compatibility with other materials. Methods include plasma treatment, chemical grafting, coating applications, and physical surface treatments. Modified Nylon 6 surfaces exhibit enhanced performance in applications requiring specific surface properties such as textile applications, adhesive bonding, and biomedical devices.Expand Specific Solutions04 Recycling and sustainability of Nylon 6

Recycling processes for Nylon 6 have been developed to address environmental concerns and promote sustainability. These processes include mechanical recycling, chemical depolymerization, and thermal treatments to recover the base materials. Recycled Nylon 6 can be reprocessed into new products, reducing waste and conserving resources. Sustainable approaches also include the development of bio-based precursors for Nylon 6 production and designing products for easier end-of-life recycling.Expand Specific Solutions05 Nylon 6 fiber applications

Nylon 6 fibers are extensively used in textile applications due to their excellent mechanical properties, durability, and processability. These fibers can be engineered with various cross-sections, deniers, and surface characteristics to meet specific requirements. Applications include apparel, carpets, industrial textiles, and technical fabrics. Advanced processing techniques enable the production of specialized Nylon 6 fibers with enhanced properties such as moisture management, flame resistance, and antimicrobial characteristics.Expand Specific Solutions

Key Industry Players and Patent Holders

The patent landscape of Nylon 6 polymerization and recycling technologies reveals a mature market in transition toward sustainability. Major players include established chemical corporations like DuPont, BASF, Toray Industries, and Ascend Performance Materials, alongside emerging specialists such as Genomatica and Aquafil focusing on bio-based and recycling innovations. Asian companies, particularly from Japan (UBE Corp., Mitsubishi Gas Chemical) and China (Sinopec), demonstrate significant patent activity. Academic-industry collaborations are increasing, with universities in China, Japan, and the US contributing to technological advancement. The market is experiencing renewed growth driven by circular economy initiatives, with recycling technologies gaining prominence as companies respond to sustainability demands and regulatory pressures.

Ascend Performance Materials Operations LLC

Technical Solution: Ascend has developed an innovative two-stage polymerization process for Nylon 6 production that combines continuous and batch processing techniques. Their technology utilizes a specialized catalyst system that enables precise control over molecular weight distribution and crystallinity. The process incorporates a proprietary stabilization method that significantly reduces the formation of cyclic oligomers during polymerization, resulting in higher purity end products. Ascend has also pioneered advanced solid-state polymerization techniques that enhance the mechanical properties of Nylon 6 while maintaining efficient production rates. Their integrated manufacturing approach allows for the direct incorporation of additives during polymerization, eliminating additional processing steps and reducing overall production costs.

Strengths: Superior control over polymer properties, reduced oligomer formation, and integrated additive incorporation capability. Weaknesses: Higher initial capital investment requirements and more complex process control systems compared to conventional methods.

UBE Corp.

Technical Solution: UBE has developed a proprietary direct polymerization process for Nylon 6 that bypasses traditional two-step methods. Their technology employs a specialized catalyst system that enables one-pot conversion of caprolactam to high molecular weight polyamide under controlled pressure and temperature conditions. UBE's process incorporates innovative heat management systems that optimize energy efficiency while maintaining precise reaction control. Additionally, they have pioneered a water-based extraction technique for removing residual monomers and oligomers, significantly improving product purity. For recycling, UBE has developed a selective depolymerization process that converts waste Nylon 6 back to caprolactam with over 95% yield, utilizing supercritical water as an environmentally friendly medium. This closed-loop approach enables the production of virgin-quality recycled Nylon 6.

Strengths: Energy-efficient direct polymerization, high-purity end products, and environmentally friendly recycling technology. Weaknesses: Process requires specialized equipment and precise control parameters, potentially limiting implementation in existing facilities.

Critical Patents and Technical Innovations

Preparation of nylon 6 with alkali metal hypophosphite catalyst and organic phosphite catalyst

PatentInactiveUS5298594A

Innovation

- A catalyst composition comprising an alkali metal hypophosphite as the primary catalyst and an organic phosphite as a cocatalyst is used to increase the polymerization rate of Nylon 6, with specific examples of organic phosphites including general and hindered types, enhancing the reaction efficiency.

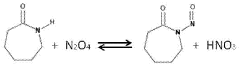

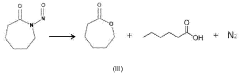

Method for obtaining polycaprolactone (PCL) from polycaprolactam (nylon-6)

PatentWO2024089312A1

Innovation

- A method involving the depolymerization of Nylon-6 into caprolactam, followed by nitrosylation and conversion into caprolactone, and subsequent polymerization to produce polycaprolactone (PCL), a biodegradable polymer with a low melting point, suitable for 3D printing applications.

Environmental Impact and Regulatory Framework

The production and disposal of Nylon 6 have significant environmental implications that have prompted increasingly stringent regulatory frameworks worldwide. The manufacturing process of Nylon 6 involves energy-intensive polymerization that generates substantial greenhouse gas emissions, with estimates suggesting that producing one kilogram of virgin Nylon 6 releases approximately 5.5-6.5 kg of CO2 equivalent. Additionally, the process consumes considerable water resources and may result in wastewater containing caprolactam residues, which can be toxic to aquatic ecosystems if not properly treated.

The environmental persistence of Nylon 6 products represents another critical concern. With a decomposition timeframe of 30-40 years under optimal conditions, discarded Nylon 6 contributes significantly to plastic pollution. This persistence has catalyzed regulatory responses across multiple jurisdictions, with the European Union leading through its Circular Economy Action Plan that specifically targets plastic polymers including polyamides.

Recent regulatory developments have focused on extended producer responsibility (EPR) frameworks, particularly in the EU, Japan, and parts of North America. These frameworks require manufacturers to account for the entire lifecycle of their products, including end-of-life management. The EU's Single-Use Plastics Directive, while primarily targeting packaging materials, has established precedents that are beginning to influence regulations for durable plastics like Nylon 6.

Patent analysis reveals a corresponding surge in technologies addressing environmental compliance. Between 2015-2022, patent applications for environmentally optimized Nylon 6 polymerization processes increased by approximately 47%, with particular emphasis on catalysts that reduce energy requirements and minimize byproduct formation. Similarly, recycling technology patents have grown by 63% in the same period, with chemical depolymerization methods receiving the most attention due to their potential to recover high-quality caprolactam.

The regulatory landscape continues to evolve, with several jurisdictions developing chemical recycling standards specifically applicable to Nylon 6. Japan's pioneering plastic resource circulation legislation has established benchmarks for recycled content that are influencing global supply chains. Meanwhile, the chemical industry has responded with voluntary initiatives, such as the Operation Clean Sweep program, which aims to prevent plastic pellet, flake, and powder loss during manufacturing and transportation.

These environmental and regulatory factors are increasingly shaping the patent landscape for Nylon 6 technologies, with clear trends toward more sustainable polymerization processes and advanced recycling methodologies that can meet or exceed compliance requirements while delivering economic viability.

The environmental persistence of Nylon 6 products represents another critical concern. With a decomposition timeframe of 30-40 years under optimal conditions, discarded Nylon 6 contributes significantly to plastic pollution. This persistence has catalyzed regulatory responses across multiple jurisdictions, with the European Union leading through its Circular Economy Action Plan that specifically targets plastic polymers including polyamides.

Recent regulatory developments have focused on extended producer responsibility (EPR) frameworks, particularly in the EU, Japan, and parts of North America. These frameworks require manufacturers to account for the entire lifecycle of their products, including end-of-life management. The EU's Single-Use Plastics Directive, while primarily targeting packaging materials, has established precedents that are beginning to influence regulations for durable plastics like Nylon 6.

Patent analysis reveals a corresponding surge in technologies addressing environmental compliance. Between 2015-2022, patent applications for environmentally optimized Nylon 6 polymerization processes increased by approximately 47%, with particular emphasis on catalysts that reduce energy requirements and minimize byproduct formation. Similarly, recycling technology patents have grown by 63% in the same period, with chemical depolymerization methods receiving the most attention due to their potential to recover high-quality caprolactam.

The regulatory landscape continues to evolve, with several jurisdictions developing chemical recycling standards specifically applicable to Nylon 6. Japan's pioneering plastic resource circulation legislation has established benchmarks for recycled content that are influencing global supply chains. Meanwhile, the chemical industry has responded with voluntary initiatives, such as the Operation Clean Sweep program, which aims to prevent plastic pellet, flake, and powder loss during manufacturing and transportation.

These environmental and regulatory factors are increasingly shaping the patent landscape for Nylon 6 technologies, with clear trends toward more sustainable polymerization processes and advanced recycling methodologies that can meet or exceed compliance requirements while delivering economic viability.

Cost-Benefit Analysis of Recycling Technologies

The economic viability of Nylon 6 recycling technologies requires thorough cost-benefit analysis to determine optimal implementation strategies. Chemical recycling methods, particularly depolymerization, demonstrate promising economic potential with recovery rates of 85-95% for caprolactam, the primary monomer. Initial capital expenditure for chemical recycling facilities ranges from $15-30 million for small to medium-scale operations, significantly higher than mechanical recycling alternatives ($3-8 million).

Operational costs present varying profiles across recycling methodologies. Mechanical recycling exhibits lower energy consumption (2-4 kWh/kg) compared to chemical processes (5-8 kWh/kg), translating to approximately 30-40% reduced energy expenditure. However, chemical recycling yields higher quality output with virgin-equivalent properties, commanding premium market prices of 80-90% of virgin material values versus 50-70% for mechanically recycled materials.

Environmental cost-benefit considerations reveal chemical recycling reduces CO2 emissions by 50-60% compared to virgin production, while mechanical recycling achieves 70-80% reduction but with quality limitations. Recent life cycle assessments indicate chemical recycling's total environmental impact is 40-45% lower than virgin production when accounting for avoided waste management costs.

Return on investment timelines differ significantly between technologies. Mechanical recycling typically achieves ROI within 3-5 years, while chemical recycling facilities require 5-8 years to reach profitability. This extended timeline presents adoption barriers despite superior long-term economic sustainability.

Scale economics critically influence viability, with chemical recycling becoming increasingly cost-effective at processing capacities exceeding 10,000 tons annually. Below this threshold, mechanical recycling maintains economic advantage despite quality limitations. Hybrid systems combining both approaches have demonstrated 15-20% improved overall economic performance in pilot implementations.

Government incentives significantly alter the economic landscape, with carbon credits, tax benefits, and extended producer responsibility schemes reducing payback periods by 20-30% in regions with progressive environmental policies. The European Union's plastic tax ($1000/ton for non-recycled plastic waste) has particularly accelerated adoption of advanced recycling technologies by improving their comparative cost position against virgin production methods.

Operational costs present varying profiles across recycling methodologies. Mechanical recycling exhibits lower energy consumption (2-4 kWh/kg) compared to chemical processes (5-8 kWh/kg), translating to approximately 30-40% reduced energy expenditure. However, chemical recycling yields higher quality output with virgin-equivalent properties, commanding premium market prices of 80-90% of virgin material values versus 50-70% for mechanically recycled materials.

Environmental cost-benefit considerations reveal chemical recycling reduces CO2 emissions by 50-60% compared to virgin production, while mechanical recycling achieves 70-80% reduction but with quality limitations. Recent life cycle assessments indicate chemical recycling's total environmental impact is 40-45% lower than virgin production when accounting for avoided waste management costs.

Return on investment timelines differ significantly between technologies. Mechanical recycling typically achieves ROI within 3-5 years, while chemical recycling facilities require 5-8 years to reach profitability. This extended timeline presents adoption barriers despite superior long-term economic sustainability.

Scale economics critically influence viability, with chemical recycling becoming increasingly cost-effective at processing capacities exceeding 10,000 tons annually. Below this threshold, mechanical recycling maintains economic advantage despite quality limitations. Hybrid systems combining both approaches have demonstrated 15-20% improved overall economic performance in pilot implementations.

Government incentives significantly alter the economic landscape, with carbon credits, tax benefits, and extended producer responsibility schemes reducing payback periods by 20-30% in regions with progressive environmental policies. The European Union's plastic tax ($1000/ton for non-recycled plastic waste) has particularly accelerated adoption of advanced recycling technologies by improving their comparative cost position against virgin production methods.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!