Developments in anode-free batteries for grid storage

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Anode-Free Battery Technology Background and Objectives

Energy storage technologies have evolved significantly over the past decades, with batteries emerging as a critical component for grid stabilization and renewable energy integration. Anode-free battery technology represents one of the most promising frontiers in energy storage innovation, offering theoretical energy densities that far exceed conventional lithium-ion batteries. The concept dates back to the early 2000s but has gained substantial momentum in the last decade as grid storage demands have intensified with the proliferation of intermittent renewable energy sources.

The evolution of anode-free batteries stems from the fundamental limitations of traditional battery architectures. Conventional lithium-ion batteries utilize graphite anodes that add weight, cost, and manufacturing complexity while limiting energy density. By eliminating the anode as a separate component and instead using lithium metal deposited directly during charging, anode-free designs can potentially achieve 60-80% higher energy density while reducing production costs by 10-20%.

Grid storage presents unique technical requirements compared to portable electronics or electric vehicles. These include longer cycle life expectations (10-20 years), enhanced safety profiles for large-scale installations, cost sensitivity (target <$100/kWh), and the ability to provide multiple hours of discharge at rated power. Anode-free battery technology aims to address these specific needs through innovative materials science and cell design.

The primary technical objective for anode-free batteries in grid applications is achieving stable cycling performance without capacity degradation over thousands of cycles. Current research focuses on preventing dendrite formation during lithium plating, which has historically been the main failure mechanism. Secondary objectives include improving rate capability for rapid response to grid fluctuations and enhancing thermal stability to eliminate the need for complex cooling systems in large installations.

Recent breakthroughs in electrolyte formulations and separator technologies have accelerated development timelines. Notably, the introduction of high-concentration electrolytes and ceramic-polymer composite separators has demonstrated promising results in laboratory settings, with some prototypes achieving over 400 cycles at 80% capacity retention—a significant improvement from earlier iterations that typically failed after 50-100 cycles.

The technology trajectory suggests anode-free batteries could reach commercial viability for grid storage applications within 5-7 years, potentially revolutionizing the economics of renewable energy integration. This timeline aligns with global grid modernization initiatives and the projected exponential growth in utility-scale storage deployments, which are expected to exceed 300 GWh annually by 2030.

The evolution of anode-free batteries stems from the fundamental limitations of traditional battery architectures. Conventional lithium-ion batteries utilize graphite anodes that add weight, cost, and manufacturing complexity while limiting energy density. By eliminating the anode as a separate component and instead using lithium metal deposited directly during charging, anode-free designs can potentially achieve 60-80% higher energy density while reducing production costs by 10-20%.

Grid storage presents unique technical requirements compared to portable electronics or electric vehicles. These include longer cycle life expectations (10-20 years), enhanced safety profiles for large-scale installations, cost sensitivity (target <$100/kWh), and the ability to provide multiple hours of discharge at rated power. Anode-free battery technology aims to address these specific needs through innovative materials science and cell design.

The primary technical objective for anode-free batteries in grid applications is achieving stable cycling performance without capacity degradation over thousands of cycles. Current research focuses on preventing dendrite formation during lithium plating, which has historically been the main failure mechanism. Secondary objectives include improving rate capability for rapid response to grid fluctuations and enhancing thermal stability to eliminate the need for complex cooling systems in large installations.

Recent breakthroughs in electrolyte formulations and separator technologies have accelerated development timelines. Notably, the introduction of high-concentration electrolytes and ceramic-polymer composite separators has demonstrated promising results in laboratory settings, with some prototypes achieving over 400 cycles at 80% capacity retention—a significant improvement from earlier iterations that typically failed after 50-100 cycles.

The technology trajectory suggests anode-free batteries could reach commercial viability for grid storage applications within 5-7 years, potentially revolutionizing the economics of renewable energy integration. This timeline aligns with global grid modernization initiatives and the projected exponential growth in utility-scale storage deployments, which are expected to exceed 300 GWh annually by 2030.

Grid Storage Market Demand Analysis

The global grid storage market is experiencing unprecedented growth, driven by the increasing integration of renewable energy sources and the need for grid stability. As of 2023, the grid storage market was valued at approximately $15.9 billion and is projected to reach $51.7 billion by 2030, representing a compound annual growth rate (CAGR) of 18.4%. This remarkable expansion underscores the critical role that advanced energy storage technologies, particularly anode-free batteries, will play in the future energy landscape.

The primary market drivers for grid storage solutions include the rapid deployment of intermittent renewable energy sources, aging grid infrastructure requiring modernization, and increasing electricity demand volatility. Utility companies and grid operators are actively seeking cost-effective, long-duration energy storage solutions to address these challenges. Anode-free battery technology has emerged as a promising candidate due to its potential for higher energy density, reduced material costs, and improved safety profiles compared to conventional lithium-ion batteries.

Regional analysis reveals varying adoption patterns and market potential. North America currently leads the grid storage market with a 35% share, followed by Europe (28%) and Asia-Pacific (25%). However, the Asia-Pacific region is expected to witness the fastest growth rate of 22.3% through 2030, primarily due to aggressive renewable energy targets in China, Japan, and South Korea, coupled with substantial government investments in grid modernization initiatives.

From an application perspective, the market segments into frequency regulation, peak shaving, renewable integration, and backup power. Renewable integration represents the largest segment, accounting for 42% of the total market, as utilities seek to mitigate the intermittency challenges associated with solar and wind power generation. Peak shaving applications follow at 27%, driven by the increasing cost of peak electricity and demand charges.

Customer requirements for grid storage solutions are evolving rapidly. Key demands include longer cycle life (10,000+ cycles), extended duration capabilities (8-100+ hours), reduced levelized cost of storage (targeting below $100/kWh), and enhanced safety features. Anode-free battery technologies are particularly well-positioned to address these requirements, especially for applications requiring 8+ hours of duration.

Market barriers for anode-free batteries in grid storage include technology maturity concerns, high initial capital costs, regulatory uncertainties, and competition from established technologies like pumped hydro and conventional lithium-ion batteries. However, the declining cost curve for key materials and manufacturing processes suggests that anode-free batteries could achieve cost parity with traditional solutions by 2026-2027, potentially accelerating market adoption.

The primary market drivers for grid storage solutions include the rapid deployment of intermittent renewable energy sources, aging grid infrastructure requiring modernization, and increasing electricity demand volatility. Utility companies and grid operators are actively seeking cost-effective, long-duration energy storage solutions to address these challenges. Anode-free battery technology has emerged as a promising candidate due to its potential for higher energy density, reduced material costs, and improved safety profiles compared to conventional lithium-ion batteries.

Regional analysis reveals varying adoption patterns and market potential. North America currently leads the grid storage market with a 35% share, followed by Europe (28%) and Asia-Pacific (25%). However, the Asia-Pacific region is expected to witness the fastest growth rate of 22.3% through 2030, primarily due to aggressive renewable energy targets in China, Japan, and South Korea, coupled with substantial government investments in grid modernization initiatives.

From an application perspective, the market segments into frequency regulation, peak shaving, renewable integration, and backup power. Renewable integration represents the largest segment, accounting for 42% of the total market, as utilities seek to mitigate the intermittency challenges associated with solar and wind power generation. Peak shaving applications follow at 27%, driven by the increasing cost of peak electricity and demand charges.

Customer requirements for grid storage solutions are evolving rapidly. Key demands include longer cycle life (10,000+ cycles), extended duration capabilities (8-100+ hours), reduced levelized cost of storage (targeting below $100/kWh), and enhanced safety features. Anode-free battery technologies are particularly well-positioned to address these requirements, especially for applications requiring 8+ hours of duration.

Market barriers for anode-free batteries in grid storage include technology maturity concerns, high initial capital costs, regulatory uncertainties, and competition from established technologies like pumped hydro and conventional lithium-ion batteries. However, the declining cost curve for key materials and manufacturing processes suggests that anode-free batteries could achieve cost parity with traditional solutions by 2026-2027, potentially accelerating market adoption.

Current State and Technical Challenges of Anode-Free Batteries

Anode-free battery technology represents a significant advancement in energy storage systems, particularly for grid-scale applications. Currently, these batteries exist primarily in research laboratories and early commercial prototypes, with limited deployment in real-world grid storage scenarios. The fundamental architecture eliminates the traditional anode material during assembly, instead allowing lithium or other active materials to plate onto a current collector during charging, creating an in-situ anode. This design potentially increases energy density by 30-50% compared to conventional lithium-ion batteries.

The global research landscape shows concentrated development efforts in North America, East Asia (particularly China, Japan, and South Korea), and Europe. Academic institutions like Stanford University, MIT, and Tsinghua University have published groundbreaking research, while companies including QuantumScape, SolidEnergy Systems, and CATL are advancing commercial applications.

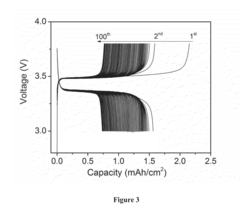

Despite promising developments, anode-free batteries face significant technical challenges. The most critical issue is dendrite formation during charging cycles, where lithium deposits unevenly, creating branch-like structures that can penetrate the separator and cause short circuits. This phenomenon severely limits cycle life, with most current prototypes achieving only 50-200 cycles before significant capacity degradation—far below the 1,000+ cycles required for grid applications.

Another major challenge is the high reactivity of lithium metal with electrolytes, resulting in continuous SEI (Solid Electrolyte Interphase) formation that consumes active lithium and electrolyte. This parasitic reaction leads to capacity fade and reduced coulombic efficiency, typically below 99.5% in current systems, whereas grid applications require >99.9% efficiency for long-term viability.

Mechanical stress during cycling presents additional complications, as volume changes during plating and stripping cause expansion and contraction that can damage cell components. This mechanical instability contributes to performance degradation and safety concerns, particularly at the scale required for grid storage.

Manufacturing scalability remains problematic, with current production methods requiring extremely controlled environments to prevent moisture and oxygen contamination. The precision needed for uniform current collector surfaces and electrolyte distribution presents significant barriers to mass production.

Safety concerns persist due to thermal runaway risks associated with lithium metal, particularly in large-format cells necessary for grid applications. Current thermal management systems and safety protocols require substantial enhancement before widespread deployment can be considered viable.

The global research landscape shows concentrated development efforts in North America, East Asia (particularly China, Japan, and South Korea), and Europe. Academic institutions like Stanford University, MIT, and Tsinghua University have published groundbreaking research, while companies including QuantumScape, SolidEnergy Systems, and CATL are advancing commercial applications.

Despite promising developments, anode-free batteries face significant technical challenges. The most critical issue is dendrite formation during charging cycles, where lithium deposits unevenly, creating branch-like structures that can penetrate the separator and cause short circuits. This phenomenon severely limits cycle life, with most current prototypes achieving only 50-200 cycles before significant capacity degradation—far below the 1,000+ cycles required for grid applications.

Another major challenge is the high reactivity of lithium metal with electrolytes, resulting in continuous SEI (Solid Electrolyte Interphase) formation that consumes active lithium and electrolyte. This parasitic reaction leads to capacity fade and reduced coulombic efficiency, typically below 99.5% in current systems, whereas grid applications require >99.9% efficiency for long-term viability.

Mechanical stress during cycling presents additional complications, as volume changes during plating and stripping cause expansion and contraction that can damage cell components. This mechanical instability contributes to performance degradation and safety concerns, particularly at the scale required for grid storage.

Manufacturing scalability remains problematic, with current production methods requiring extremely controlled environments to prevent moisture and oxygen contamination. The precision needed for uniform current collector surfaces and electrolyte distribution presents significant barriers to mass production.

Safety concerns persist due to thermal runaway risks associated with lithium metal, particularly in large-format cells necessary for grid applications. Current thermal management systems and safety protocols require substantial enhancement before widespread deployment can be considered viable.

Current Anode-Free Battery Solutions for Grid Applications

01 Anode-free battery design and structure

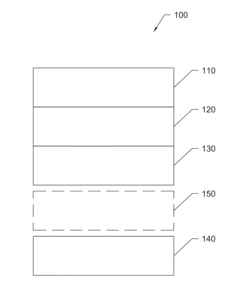

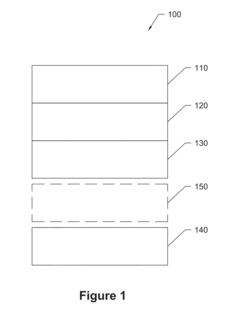

Anode-free batteries eliminate the traditional anode material during manufacturing, instead relying on in-situ formation of the anode during the first charge cycle. This design significantly increases energy density by reducing inactive components and simplifying battery construction. The structure typically includes a current collector where lithium or other active materials plate during charging, eliminating the need for pre-lithiated anodes and reducing overall battery weight and volume.- Anode-free battery design and structure: Anode-free batteries eliminate the traditional anode material during manufacturing, instead forming the anode in-situ during the first charge cycle when lithium ions plate onto the current collector. This design significantly increases energy density by reducing inactive components and simplifying battery construction. The structure typically includes a lithium metal-free negative electrode, a separator, and a lithium-containing cathode, with the anode forming during operation through electrochemical processes.

- Electrolyte compositions for anode-free batteries: Specialized electrolyte formulations are critical for anode-free battery performance, addressing challenges like dendrite formation and low Coulombic efficiency. These electrolytes often contain additives that form stable solid electrolyte interphases (SEI) on the current collector surface, facilitating uniform lithium deposition. Advanced formulations may include fluorinated solvents, high-concentration electrolytes, or ionic liquids that improve lithium ion transport while minimizing side reactions that lead to capacity fade.

- Current collector materials and treatments: The current collector in anode-free batteries serves as the substrate for lithium deposition and plays a crucial role in battery performance. Various materials including copper, nickel, and carbon-based substrates can be used, often with surface modifications to improve lithium nucleation and adhesion. Treatments such as plasma etching, chemical modification, or application of artificial SEI layers help create uniform lithium deposition, prevent dendrite formation, and enhance cycling stability.

- Protection layers and interface engineering: Interface engineering is essential in anode-free batteries to control lithium deposition behavior. Protective layers between the current collector and electrolyte can significantly improve cycling performance by promoting uniform lithium plating and preventing side reactions. These layers may consist of polymers, ceramics, or composite materials that allow lithium ion transport while blocking electrolyte components. Advanced designs incorporate gradient or multi-layer structures that combine mechanical strength with ionic conductivity.

- Manufacturing methods and scale-up techniques: Manufacturing anode-free batteries presents unique challenges compared to conventional lithium-ion batteries. Specialized production techniques focus on precise control of moisture and oxygen levels during assembly, as these can significantly impact first-cycle efficiency and long-term performance. Roll-to-roll processing adaptations, modified stacking procedures, and specialized electrolyte filling methods have been developed to enable commercial production. Scale-up approaches often emphasize maintaining the pristine surface condition of current collectors and ensuring uniform electrolyte distribution.

02 Electrolyte compositions for anode-free batteries

Specialized electrolyte formulations are crucial for anode-free battery performance, as they must facilitate uniform metal deposition during charging while preventing dendrite formation. These electrolytes often contain additives that create stable solid electrolyte interphase (SEI) layers and promote homogeneous plating. Advanced formulations may include fluorinated solvents, high-concentration salt systems, or ionic liquids that improve cycling efficiency and battery lifespan by controlling the electrodeposition process.Expand Specific Solutions03 Protective layers and interfaces for metal deposition

Protective layers and engineered interfaces are implemented to control metal deposition in anode-free batteries. These include artificial SEI layers, functional coatings on current collectors, and gradient structures that guide uniform metal plating. Such protective interfaces prevent dendrite formation, reduce side reactions with the electrolyte, and enhance cycling stability. Materials used include polymers, ceramics, and composite structures that maintain physical and chemical stability during repeated plating and stripping cycles.Expand Specific Solutions04 Current collector materials and modifications

Advanced current collector designs are essential for anode-free batteries, as they serve as the substrate for metal deposition. Innovations include 3D structured collectors, porous architectures, and surface-modified metals that guide uniform plating. These collectors may feature nanoscale texturing, chemical modifications, or composite structures that enhance adhesion of the plated metal while maintaining electronic conductivity. Such designs help control the nucleation and growth of metal deposits, preventing dendrite formation and improving cycling performance.Expand Specific Solutions05 Manufacturing methods and cell assembly techniques

Specialized manufacturing processes have been developed for anode-free batteries to ensure proper cell assembly without traditional anode materials. These include dry-room processing, advanced stacking and winding techniques, and precise electrolyte filling methods. Novel approaches focus on creating optimal interfaces between the current collector and separator, controlling stack pressure, and ensuring uniform electrolyte distribution. These manufacturing innovations address the unique challenges of anode-free designs while maintaining scalability for commercial production.Expand Specific Solutions

Key Industry Players in Grid-Scale Energy Storage

Anode-free battery technology for grid storage is in an early growth phase, with market size expected to expand significantly due to increasing renewable energy integration. The technology is still evolving, with varying maturity levels across key players. Companies like Tesla and LG Energy Solution are leading commercial deployment, while IBM and TeraWatt Technology focus on advanced research. CATL (Ningde Amperex) and GS Yuasa are scaling up production capabilities. Academic-industry partnerships involving institutions like Fudan University and Vanderbilt University are accelerating innovation. The competitive landscape features both established battery manufacturers and specialized startups like Wildcat Discovery Technologies and BroadBit Batteries, creating a dynamic ecosystem driving technological advancement.

LG Energy Solution Ltd.

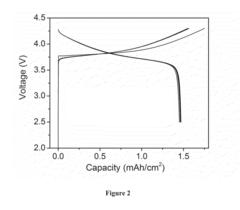

Technical Solution: LG Energy Solution has pioneered anode-free battery technology for grid storage applications through their "Zero-Carbon" battery platform. Their approach employs a copper current collector that serves as the substrate for lithium plating during initial charge cycles, eliminating the need for traditional graphite anodes. The company has developed proprietary electrolyte formulations containing fluorinated additives that form protective interfaces on the lithium metal surface, significantly reducing parasitic reactions. Their grid storage systems utilize advanced pressure-regulation mechanisms that maintain optimal stack pressure to suppress dendrite growth. LG has demonstrated prototype cells achieving energy densities of approximately 400 Wh/kg with retention of 80% capacity after 400 cycles - a significant improvement over conventional lithium-ion batteries used in stationary applications.

Strengths: Exceptional energy density (approximately 400 Wh/kg), reduced material costs, and simplified manufacturing processes. Weaknesses: Limited cycle life compared to conventional lithium-ion batteries, challenges with scaling production to commercial levels, and potential thermal management issues during high-rate charging.

Tesla, Inc.

Technical Solution: Tesla has developed innovative anode-free battery technology for grid storage applications, focusing on their proprietary "tabless" electrode design that eliminates the traditional graphite anode. Their approach utilizes lithium metal directly deposited on the current collector during initial charging, significantly increasing energy density by approximately 25-30% compared to conventional lithium-ion batteries. Tesla's grid storage solutions incorporate advanced battery management systems that optimize charging protocols to mitigate dendrite formation - a critical challenge in anode-free designs. The company has integrated this technology into their Megapack utility-scale storage systems, achieving energy densities exceeding 300 Wh/kg while maintaining cycle stability through specialized electrolyte formulations that create stable solid-electrolyte interphase layers.

Strengths: Higher energy density (25-30% increase), reduced manufacturing costs by eliminating anode materials, and simplified production processes. Weaknesses: Potential safety concerns related to lithium dendrite formation, shorter cycle life compared to conventional lithium-ion batteries, and challenges with fast-charging capabilities.

Critical Patents and Technical Innovations in Anode-Free Designs

Battery and electrolytes therefor

PatentPendingCA3219323A1

Innovation

- Incorporating a conductive spacer to increase internal pressure within the battery cell, combined with a hybrid electrolyte comprising diglyme and lithium nitrate, which forms a robust solvation structure and inorganic-rich solid-electrolyte interphase, enhancing Li deposition homogeneity and cycle stability.

Anode-free rechargeable battery

PatentActiveUS20160261000A1

Innovation

- An anode-free rechargeable battery design utilizing a lithium cation-based electrolyte with a porous polymer separator and specific lithium salts dissolved in non-aqueous solvents, where the anode is formed in situ during charging and consumed during discharge, eliminating the need for a traditional anode and enhancing Coulombic Efficiency.

Regulatory Framework and Policy Incentives for Grid Storage

The regulatory landscape for grid storage technologies, particularly for anode-free batteries, has evolved significantly in recent years as governments worldwide recognize the critical role of energy storage in transitioning to renewable energy systems. In the United States, the Federal Energy Regulatory Commission (FERC) Order 841 represents a landmark policy that requires regional transmission organizations to establish market rules allowing energy storage resources to participate in wholesale electricity markets, creating substantial opportunities for anode-free battery deployment.

The European Union has implemented the Clean Energy Package, which includes specific provisions for energy storage, removing double charging and establishing a clearer regulatory framework that benefits advanced battery technologies. Additionally, the European Battery Alliance has mobilized significant investment to strengthen the European battery value chain, with specific incentives for innovative technologies like anode-free systems that promise higher energy density and improved safety profiles.

China's 14th Five-Year Plan explicitly prioritizes advanced energy storage technologies, offering subsidies and tax incentives for grid-scale battery installations. The country's energy storage mandate requires a certain percentage of renewable energy capacity to be paired with storage solutions, creating a guaranteed market for emerging battery technologies.

Financial incentives have become increasingly sophisticated across jurisdictions. Investment tax credits, accelerated depreciation schedules, and capacity payments specifically designed for storage assets have improved the economic viability of anode-free battery projects. The U.S. Inflation Reduction Act of 2022 provides substantial tax credits for standalone storage projects, removing previous requirements that storage be paired with renewable generation.

Performance-based regulations are emerging as a critical policy tool, with grid operators establishing metrics for response time, cycling capability, and duration that can be advantageous for anode-free batteries' technical characteristics. These regulations often include premium payments for storage assets that can provide multiple grid services simultaneously.

Safety standards and certification processes are still evolving for novel battery chemistries. Regulatory bodies like UL in North America and IEC internationally are developing specific testing protocols for anode-free designs, addressing their unique safety considerations. The establishment of these standards is crucial for market acceptance and insurance underwriting for large-scale deployments.

Carbon pricing mechanisms in various regions provide indirect support for battery storage by increasing the value of renewable energy integration and peak shifting capabilities. As these mechanisms mature and carbon prices increase, the business case for advanced grid storage solutions strengthens proportionally.

The European Union has implemented the Clean Energy Package, which includes specific provisions for energy storage, removing double charging and establishing a clearer regulatory framework that benefits advanced battery technologies. Additionally, the European Battery Alliance has mobilized significant investment to strengthen the European battery value chain, with specific incentives for innovative technologies like anode-free systems that promise higher energy density and improved safety profiles.

China's 14th Five-Year Plan explicitly prioritizes advanced energy storage technologies, offering subsidies and tax incentives for grid-scale battery installations. The country's energy storage mandate requires a certain percentage of renewable energy capacity to be paired with storage solutions, creating a guaranteed market for emerging battery technologies.

Financial incentives have become increasingly sophisticated across jurisdictions. Investment tax credits, accelerated depreciation schedules, and capacity payments specifically designed for storage assets have improved the economic viability of anode-free battery projects. The U.S. Inflation Reduction Act of 2022 provides substantial tax credits for standalone storage projects, removing previous requirements that storage be paired with renewable generation.

Performance-based regulations are emerging as a critical policy tool, with grid operators establishing metrics for response time, cycling capability, and duration that can be advantageous for anode-free batteries' technical characteristics. These regulations often include premium payments for storage assets that can provide multiple grid services simultaneously.

Safety standards and certification processes are still evolving for novel battery chemistries. Regulatory bodies like UL in North America and IEC internationally are developing specific testing protocols for anode-free designs, addressing their unique safety considerations. The establishment of these standards is crucial for market acceptance and insurance underwriting for large-scale deployments.

Carbon pricing mechanisms in various regions provide indirect support for battery storage by increasing the value of renewable energy integration and peak shifting capabilities. As these mechanisms mature and carbon prices increase, the business case for advanced grid storage solutions strengthens proportionally.

Lifecycle Assessment and Sustainability Considerations

The lifecycle assessment (LCA) of anode-free batteries for grid storage reveals significant sustainability advantages compared to conventional battery technologies. These systems eliminate the need for graphite or silicon anodes, reducing material consumption by approximately 20-25% while decreasing manufacturing complexity. This translates to lower embodied energy during production and diminished carbon footprints across the supply chain. Recent studies indicate that anode-free lithium metal batteries can achieve up to 30% reduction in greenhouse gas emissions during manufacturing compared to traditional lithium-ion counterparts.

Material sourcing considerations present both challenges and opportunities. While anode-free designs reduce dependence on graphite mining, they typically require higher-purity lithium metal, which carries its own environmental implications. The extraction of lithium remains environmentally intensive, particularly in water-stressed regions where brine extraction methods are employed. However, emerging direct lithium extraction technologies show promise for reducing water consumption by up to 70% compared to conventional methods.

End-of-life management represents a critical sustainability factor for grid-scale battery deployment. Anode-free batteries present unique recycling opportunities due to their simplified structure, potentially enabling more efficient recovery of critical materials. Current recycling processes can recover up to 95% of lithium and other valuable metals from these systems, compared to 50-70% recovery rates for conventional lithium-ion batteries. This circular economy potential significantly enhances the technology's overall sustainability profile.

Energy efficiency throughout the operational lifecycle must also be considered. Anode-free batteries demonstrate higher energy densities, which translates to more efficient use of materials per kWh of storage capacity. However, cycle life limitations in current designs may offset these benefits if premature replacement becomes necessary. Recent advancements using specialized electrolyte formulations have extended cycle life to 400-500 cycles at commercial scales, approaching the threshold needed for economic viability in grid applications.

Water consumption metrics reveal another sustainability advantage. Manufacturing processes for anode-free batteries consume approximately 40% less water than conventional lithium-ion production, primarily due to simplified electrode fabrication. This reduction becomes particularly significant when considering large-scale grid deployment scenarios where thousands of battery units may be required.

Regulatory frameworks increasingly emphasize lifecycle impacts, with the EU Battery Directive and similar emerging policies in North America establishing sustainability requirements that may accelerate anode-free adoption. These regulations typically mandate carbon footprint declarations, responsible material sourcing, and end-of-life management plans—areas where anode-free technologies demonstrate comparative advantages.

Material sourcing considerations present both challenges and opportunities. While anode-free designs reduce dependence on graphite mining, they typically require higher-purity lithium metal, which carries its own environmental implications. The extraction of lithium remains environmentally intensive, particularly in water-stressed regions where brine extraction methods are employed. However, emerging direct lithium extraction technologies show promise for reducing water consumption by up to 70% compared to conventional methods.

End-of-life management represents a critical sustainability factor for grid-scale battery deployment. Anode-free batteries present unique recycling opportunities due to their simplified structure, potentially enabling more efficient recovery of critical materials. Current recycling processes can recover up to 95% of lithium and other valuable metals from these systems, compared to 50-70% recovery rates for conventional lithium-ion batteries. This circular economy potential significantly enhances the technology's overall sustainability profile.

Energy efficiency throughout the operational lifecycle must also be considered. Anode-free batteries demonstrate higher energy densities, which translates to more efficient use of materials per kWh of storage capacity. However, cycle life limitations in current designs may offset these benefits if premature replacement becomes necessary. Recent advancements using specialized electrolyte formulations have extended cycle life to 400-500 cycles at commercial scales, approaching the threshold needed for economic viability in grid applications.

Water consumption metrics reveal another sustainability advantage. Manufacturing processes for anode-free batteries consume approximately 40% less water than conventional lithium-ion production, primarily due to simplified electrode fabrication. This reduction becomes particularly significant when considering large-scale grid deployment scenarios where thousands of battery units may be required.

Regulatory frameworks increasingly emphasize lifecycle impacts, with the EU Battery Directive and similar emerging policies in North America establishing sustainability requirements that may accelerate anode-free adoption. These regulations typically mandate carbon footprint declarations, responsible material sourcing, and end-of-life management plans—areas where anode-free technologies demonstrate comparative advantages.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!