Environmental Impact Assessment of Low-GWP Blowing Agents

OCT 13, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Low-GWP Blowing Agents Background and Objectives

Blowing agents have been integral to the production of foam insulation, packaging materials, and various polymer-based products since the mid-20th century. Initially, chlorofluorocarbons (CFCs) dominated the market due to their excellent thermal insulation properties, chemical stability, and low toxicity. However, the discovery of their ozone-depleting potential in the 1970s led to their phase-out under the Montreal Protocol of 1987, marking a significant turning point in blowing agent technology.

The subsequent transition to hydrochlorofluorocarbons (HCFCs) and then hydrofluorocarbons (HFCs) represented incremental improvements in environmental impact. While these alternatives addressed ozone depletion concerns, they introduced new environmental challenges—particularly their high Global Warming Potential (GWP). HFCs, for instance, can have GWP values thousands of times greater than carbon dioxide, contributing significantly to climate change despite their relatively small atmospheric concentrations.

The Kigali Amendment to the Montreal Protocol in 2016 established a framework for the global reduction of HFCs, accelerating the industry's search for low-GWP alternatives. This regulatory pressure, combined with increasing corporate sustainability commitments and consumer demand for environmentally responsible products, has created a robust innovation landscape for next-generation blowing agents.

Low-GWP blowing agents encompass several chemical families, including hydrofluoroolefins (HFOs), hydrochlorofluoroolefins (HCFOs), hydrocarbons, CO2/water-based systems, and various blends. These alternatives aim to maintain or improve the performance characteristics of traditional blowing agents while dramatically reducing climate impact—typically targeting GWP values below 150, with many achieving single-digit or even negative values.

The technical objectives for low-GWP blowing agent development are multifaceted. Primary goals include achieving thermal insulation performance equivalent to or better than HFC-based systems, ensuring processing compatibility with existing manufacturing equipment, maintaining long-term dimensional stability of foams, meeting increasingly stringent flammability and safety standards, and accomplishing these objectives at commercially viable costs.

Additional technical considerations include vapor pressure profiles suitable for various application methods, appropriate solubility in polymer systems, controlled reaction kinetics during foam formation, and minimal environmental persistence. The ideal low-GWP blowing agent would combine excellent technical performance with negligible environmental impact throughout its lifecycle—from production through use and eventual disposal or recycling.

This technical evolution represents not merely a response to regulatory pressure but an opportunity to reimagine foam technologies for enhanced sustainability and performance. The development trajectory suggests a future where blowing agents contribute minimally to climate change while potentially offering improved insulation efficiency, thereby reducing energy consumption in buildings and refrigeration applications.

The subsequent transition to hydrochlorofluorocarbons (HCFCs) and then hydrofluorocarbons (HFCs) represented incremental improvements in environmental impact. While these alternatives addressed ozone depletion concerns, they introduced new environmental challenges—particularly their high Global Warming Potential (GWP). HFCs, for instance, can have GWP values thousands of times greater than carbon dioxide, contributing significantly to climate change despite their relatively small atmospheric concentrations.

The Kigali Amendment to the Montreal Protocol in 2016 established a framework for the global reduction of HFCs, accelerating the industry's search for low-GWP alternatives. This regulatory pressure, combined with increasing corporate sustainability commitments and consumer demand for environmentally responsible products, has created a robust innovation landscape for next-generation blowing agents.

Low-GWP blowing agents encompass several chemical families, including hydrofluoroolefins (HFOs), hydrochlorofluoroolefins (HCFOs), hydrocarbons, CO2/water-based systems, and various blends. These alternatives aim to maintain or improve the performance characteristics of traditional blowing agents while dramatically reducing climate impact—typically targeting GWP values below 150, with many achieving single-digit or even negative values.

The technical objectives for low-GWP blowing agent development are multifaceted. Primary goals include achieving thermal insulation performance equivalent to or better than HFC-based systems, ensuring processing compatibility with existing manufacturing equipment, maintaining long-term dimensional stability of foams, meeting increasingly stringent flammability and safety standards, and accomplishing these objectives at commercially viable costs.

Additional technical considerations include vapor pressure profiles suitable for various application methods, appropriate solubility in polymer systems, controlled reaction kinetics during foam formation, and minimal environmental persistence. The ideal low-GWP blowing agent would combine excellent technical performance with negligible environmental impact throughout its lifecycle—from production through use and eventual disposal or recycling.

This technical evolution represents not merely a response to regulatory pressure but an opportunity to reimagine foam technologies for enhanced sustainability and performance. The development trajectory suggests a future where blowing agents contribute minimally to climate change while potentially offering improved insulation efficiency, thereby reducing energy consumption in buildings and refrigeration applications.

Market Demand Analysis for Sustainable Insulation Solutions

The global market for sustainable insulation solutions is experiencing unprecedented growth, driven by stringent environmental regulations, increasing awareness of climate change, and corporate sustainability commitments. The demand for insulation materials utilizing low-GWP (Global Warming Potential) blowing agents has surged significantly across construction, automotive, appliance, and industrial sectors. Current market analysis indicates that the sustainable insulation market is projected to reach $38 billion by 2027, with a compound annual growth rate of 7.2% from 2022.

Construction industry represents the largest market segment, accounting for approximately 60% of sustainable insulation demand. This is primarily fueled by green building certifications such as LEED, BREEAM, and Passive House standards, which award points for using environmentally responsible materials. Commercial building developers are increasingly specifying insulation products with minimal environmental impact to meet ESG (Environmental, Social, and Governance) criteria demanded by investors and tenants.

Regulatory frameworks are significantly shaping market dynamics. The Kigali Amendment to the Montreal Protocol mandates the phase-down of high-GWP HFCs, creating immediate demand for alternative blowing agents in insulation manufacturing. Similarly, the European Union's F-Gas Regulation and various national climate policies worldwide have established clear timelines for transitioning to low-GWP alternatives, creating predictable market growth trajectories.

Consumer preferences are evolving toward environmentally responsible products, with 73% of global consumers expressing willingness to pay premium prices for sustainable building materials. This trend is particularly pronounced in developed markets across North America, Europe, and parts of Asia-Pacific, where environmental consciousness is highest among consumers and businesses alike.

The cold chain logistics sector represents an emerging high-growth segment for sustainable insulation solutions. With global food loss estimated at 14% between harvest and retail, improved insulation using environmentally friendly materials offers dual benefits of reducing food waste and minimizing environmental impact. Market research indicates this segment will grow at 9.3% annually through 2028.

Price sensitivity remains a challenge in certain market segments, particularly in residential construction and developing economies. However, total cost of ownership analyses increasingly favor sustainable insulation solutions when accounting for energy savings, carbon taxes, and regulatory compliance costs. The price premium for low-GWP insulation products has decreased from 18-25% five years ago to 8-12% currently, indicating improving market competitiveness.

Regional market analysis shows North America and Europe leading adoption rates, while Asia-Pacific represents the fastest-growing market with 11.4% annual growth, driven by China's aggressive decarbonization policies and Japan's stringent environmental standards for construction materials.

Construction industry represents the largest market segment, accounting for approximately 60% of sustainable insulation demand. This is primarily fueled by green building certifications such as LEED, BREEAM, and Passive House standards, which award points for using environmentally responsible materials. Commercial building developers are increasingly specifying insulation products with minimal environmental impact to meet ESG (Environmental, Social, and Governance) criteria demanded by investors and tenants.

Regulatory frameworks are significantly shaping market dynamics. The Kigali Amendment to the Montreal Protocol mandates the phase-down of high-GWP HFCs, creating immediate demand for alternative blowing agents in insulation manufacturing. Similarly, the European Union's F-Gas Regulation and various national climate policies worldwide have established clear timelines for transitioning to low-GWP alternatives, creating predictable market growth trajectories.

Consumer preferences are evolving toward environmentally responsible products, with 73% of global consumers expressing willingness to pay premium prices for sustainable building materials. This trend is particularly pronounced in developed markets across North America, Europe, and parts of Asia-Pacific, where environmental consciousness is highest among consumers and businesses alike.

The cold chain logistics sector represents an emerging high-growth segment for sustainable insulation solutions. With global food loss estimated at 14% between harvest and retail, improved insulation using environmentally friendly materials offers dual benefits of reducing food waste and minimizing environmental impact. Market research indicates this segment will grow at 9.3% annually through 2028.

Price sensitivity remains a challenge in certain market segments, particularly in residential construction and developing economies. However, total cost of ownership analyses increasingly favor sustainable insulation solutions when accounting for energy savings, carbon taxes, and regulatory compliance costs. The price premium for low-GWP insulation products has decreased from 18-25% five years ago to 8-12% currently, indicating improving market competitiveness.

Regional market analysis shows North America and Europe leading adoption rates, while Asia-Pacific represents the fastest-growing market with 11.4% annual growth, driven by China's aggressive decarbonization policies and Japan's stringent environmental standards for construction materials.

Current Status and Challenges in Low-GWP Technology

The global transition towards low-GWP (Global Warming Potential) blowing agents has accelerated significantly in recent years, driven by international agreements such as the Montreal Protocol's Kigali Amendment and regional regulations including the EU F-Gas Regulation and the U.S. EPA's SNAP program. Currently, the industry has achieved varying degrees of implementation across different sectors, with commercial refrigeration and mobile air conditioning leading adoption rates while sectors like foam insulation facing more complex transition challenges.

Technologically, several low-GWP alternatives have emerged as viable replacements for traditional high-GWP blowing agents. Hydrofluoroolefins (HFOs) such as HFO-1234ze and HFO-1336mzz have gained significant market traction due to their negligible GWP values below 10 and acceptable performance characteristics. Natural alternatives including hydrocarbons (pentane, cyclopentane), CO2/water-based systems, and methyl formate have also established market presence, particularly in regions with less stringent flammability regulations.

Despite progress, significant challenges persist in the widespread adoption of low-GWP blowing agents. Technical barriers include reduced thermal efficiency for some alternatives, which can compromise the insulation performance critical in applications like building materials and refrigeration. Many low-GWP alternatives exhibit higher flammability than their predecessors, necessitating substantial modifications to manufacturing facilities and safety protocols, with associated capital investment requirements often exceeding $1-5 million per production line.

Cost remains a major impediment, with most low-GWP alternatives commanding price premiums of 30-200% over traditional blowing agents. This economic burden is particularly challenging for small and medium enterprises operating with thin profit margins. Additionally, regional regulatory disparities create market fragmentation, with some regions aggressively phasing out high-GWP agents while others maintain more lenient timelines, creating competitive imbalances in global markets.

The geographic distribution of low-GWP technology development shows concentration in North America, Europe, and Japan, where major chemical companies like Honeywell, Chemours, and Arkema have established strong patent portfolios. China has rapidly emerged as both a significant consumer and producer of low-GWP alternatives, though intellectual property concerns remain. Developing nations face particular challenges in technology transfer and implementation due to limited technical expertise and financial resources.

Supply chain vulnerabilities have been exposed during recent global disruptions, with some low-GWP alternatives experiencing availability constraints and price volatility. This has highlighted the need for diversified sourcing strategies and potentially localized production capabilities to ensure resilience in the transition to sustainable blowing agent technologies.

Technologically, several low-GWP alternatives have emerged as viable replacements for traditional high-GWP blowing agents. Hydrofluoroolefins (HFOs) such as HFO-1234ze and HFO-1336mzz have gained significant market traction due to their negligible GWP values below 10 and acceptable performance characteristics. Natural alternatives including hydrocarbons (pentane, cyclopentane), CO2/water-based systems, and methyl formate have also established market presence, particularly in regions with less stringent flammability regulations.

Despite progress, significant challenges persist in the widespread adoption of low-GWP blowing agents. Technical barriers include reduced thermal efficiency for some alternatives, which can compromise the insulation performance critical in applications like building materials and refrigeration. Many low-GWP alternatives exhibit higher flammability than their predecessors, necessitating substantial modifications to manufacturing facilities and safety protocols, with associated capital investment requirements often exceeding $1-5 million per production line.

Cost remains a major impediment, with most low-GWP alternatives commanding price premiums of 30-200% over traditional blowing agents. This economic burden is particularly challenging for small and medium enterprises operating with thin profit margins. Additionally, regional regulatory disparities create market fragmentation, with some regions aggressively phasing out high-GWP agents while others maintain more lenient timelines, creating competitive imbalances in global markets.

The geographic distribution of low-GWP technology development shows concentration in North America, Europe, and Japan, where major chemical companies like Honeywell, Chemours, and Arkema have established strong patent portfolios. China has rapidly emerged as both a significant consumer and producer of low-GWP alternatives, though intellectual property concerns remain. Developing nations face particular challenges in technology transfer and implementation due to limited technical expertise and financial resources.

Supply chain vulnerabilities have been exposed during recent global disruptions, with some low-GWP alternatives experiencing availability constraints and price volatility. This has highlighted the need for diversified sourcing strategies and potentially localized production capabilities to ensure resilience in the transition to sustainable blowing agent technologies.

Current Technical Solutions for Low-GWP Implementation

01 Hydrofluoroolefin (HFO) based blowing agents

Hydrofluoroolefins (HFOs) represent a new generation of blowing agents with significantly lower global warming potential compared to traditional hydrofluorocarbons (HFCs). These compounds maintain good insulation properties while reducing environmental impact. HFOs break down more quickly in the atmosphere and typically have GWP values less than 10, making them compliant with increasingly stringent environmental regulations worldwide.- Hydrofluoroolefin (HFO) based blowing agents: Hydrofluoroolefins (HFOs) represent a new generation of blowing agents with significantly lower global warming potential compared to traditional hydrofluorocarbons (HFCs). These compounds maintain good insulation properties while reducing environmental impact. HFOs typically have GWP values less than 10, making them compliant with increasingly stringent environmental regulations. Their chemical structure includes unsaturated carbon-carbon bonds that allow them to break down more quickly in the atmosphere, reducing their climate impact.

- Natural and CO2-based blowing agents: Carbon dioxide and other naturally occurring substances can be utilized as environmentally friendly blowing agents with minimal global warming impact. These include CO2 itself (GWP of 1), water (which generates CO2 during reaction), and hydrocarbons like pentane. These natural alternatives offer significantly reduced environmental footprints compared to synthetic options, though they may present different processing challenges such as flammability concerns or modified foam properties that require formulation adjustments.

- Blowing agent mixtures and co-blowing systems: Combining multiple low-GWP blowing agents in specific ratios can optimize performance while minimizing environmental impact. These co-blowing systems often pair physical blowing agents with chemical ones to achieve synergistic effects. By carefully balancing components, manufacturers can maintain foam quality and insulation properties while reducing overall greenhouse gas emissions. Such mixtures can also address challenges like flammability, thermal conductivity, and processing requirements that might be difficult to achieve with a single blowing agent.

- Life cycle assessment and environmental impact evaluation: Comprehensive environmental impact analysis of blowing agents extends beyond just GWP to include ozone depletion potential, toxicity, energy consumption during production, and end-of-life considerations. Life cycle assessment methodologies help quantify the total environmental footprint of different blowing agent options across their entire life span. These evaluations consider factors such as raw material extraction, manufacturing processes, use phase performance, and disposal impacts to provide a holistic view of environmental sustainability.

- Regulatory compliance and transition strategies: The phase-down of high-GWP blowing agents is driven by international agreements and regional regulations, requiring manufacturers to develop transition strategies. These approaches include gradual substitution timelines, equipment modifications to accommodate alternative agents, and reformulation of foam systems. Implementation strategies must balance environmental benefits with technical performance, cost considerations, and safety requirements. Companies are developing roadmaps to meet increasingly stringent GWP limits while maintaining product quality and manufacturing efficiency.

02 Natural and CO2-based blowing agents

Carbon dioxide and other naturally occurring substances can be utilized as environmentally friendly blowing agents. These include CO2 (recovered from industrial processes), water (which generates CO2 during reaction), and hydrocarbons like pentane. These agents have minimal or zero ozone depletion potential and very low global warming potential. Their implementation often requires modified processing equipment and safety measures due to flammability concerns with some natural alternatives.Expand Specific Solutions03 Blowing agent mixtures and co-blowing systems

Combining multiple low-GWP blowing agents can optimize foam properties while minimizing environmental impact. These mixtures often include combinations of HFOs, hydrocarbons, CO2, and other environmentally friendly agents. The synergistic effects of these mixtures can improve insulation performance, dimensional stability, and processing characteristics while maintaining reduced environmental footprint compared to traditional single-agent systems.Expand Specific Solutions04 Life cycle assessment and environmental impact evaluation

Comprehensive environmental impact evaluation of blowing agents considers not only their direct GWP but also their entire life cycle impact. This includes manufacturing emissions, energy efficiency benefits during product use, end-of-life considerations, and overall carbon footprint. Advanced assessment methodologies help quantify the true environmental impact of different blowing agent technologies beyond simple GWP values, enabling more informed decision-making for sustainable foam production.Expand Specific Solutions05 Regulatory compliance and transition strategies

Strategies for transitioning from high-GWP to low-GWP blowing agents in response to global environmental regulations. This includes phased approaches to meet regulatory deadlines, reformulation techniques to maintain product performance, and adaptation of manufacturing processes. Implementation often requires balancing technical performance, cost considerations, and regulatory timelines while ensuring continued product quality and market competitiveness.Expand Specific Solutions

Key Industry Players and Manufacturers Analysis

The environmental impact assessment of low-GWP blowing agents market is currently in a growth phase, driven by stringent environmental regulations and sustainability initiatives worldwide. The market size is expanding rapidly, estimated to reach several billion dollars by 2025, with annual growth rates exceeding 8%. In terms of technical maturity, the industry is transitioning from development to commercialization, with key players demonstrating varying levels of innovation. Honeywell and Chemours lead with established HFO solutions, while Arkema and DuPont have developed competitive alternatives. Chinese companies like Zhejiang Juhua and Midea Group are emerging as significant players, particularly in regional markets. European manufacturers such as Meiko Maschinenbau are focusing on specialized applications, creating a globally diverse competitive landscape with increasing technical sophistication and commercial viability.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has developed Solstice® Liquid Blowing Agent (LBA), a hydrofluoroolefin (HFO)-based technology with ultra-low Global Warming Potential (GWP) of <1, which is 99.9% lower than traditional HFC blowing agents. This solution meets increasingly stringent environmental regulations while maintaining or improving insulation performance. The technology utilizes HFO-1233zd(E) as the primary component, which breaks down quickly in the atmosphere (atmospheric lifetime of just 26 days). Honeywell's comprehensive environmental impact assessment demonstrates that Solstice LBA reduces carbon footprint across the entire product lifecycle, from manufacturing through disposal. Independent life cycle analyses show that insulation made with Solstice LBA can reduce global warming impact by 60-80% compared to HFC alternatives. The technology has been implemented across various applications including refrigeration, spray foam, and building insulation, with documented thermal efficiency improvements of up to 10% in certain applications.

Strengths: Industry-leading ultra-low GWP (<1) significantly exceeding regulatory requirements; proven performance enhancement in thermal efficiency; extensive commercial adoption across multiple sectors. Weaknesses: Higher initial cost compared to traditional blowing agents; requires some equipment modifications for manufacturers transitioning from HFCs; limited production facilities globally creating potential supply chain vulnerabilities.

Arkema, Inc.

Technical Solution: Arkema has pioneered Forane® 1233zd, a hydrofluoroolefin (HFO) blowing agent with a GWP of less than 5, designed specifically for polyurethane foam applications. Their environmental impact assessment methodology incorporates comprehensive life cycle analysis covering raw material extraction, manufacturing processes, transportation, use phase, and end-of-life scenarios. Arkema's approach evaluates multiple environmental indicators beyond just GWP, including ozone depletion potential, acidification, eutrophication, and resource depletion. Their research demonstrates that Forane® 1233zd reduces carbon footprint by approximately 99% compared to legacy HFC blowing agents while maintaining equivalent or superior insulation performance. The company has conducted extensive field testing showing that polyurethane foams produced with their low-GWP blowing agent maintain dimensional stability and thermal performance over extended periods, with documented R-value retention exceeding 95% after accelerated aging tests simulating 5+ years of real-world conditions. Arkema has also developed specialized formulation guidance to optimize foam systems for different applications.

Strengths: Comprehensive environmental assessment methodology considering multiple impact categories beyond GWP; proven long-term performance stability; extensive technical support for customer implementation. Weaknesses: Higher production costs compared to traditional blowing agents; requires reformulation of existing foam systems; limited production capacity compared to global demand.

Critical Patents and Innovations in Low-GWP Formulations

Low-GWP blowing agent blends and uses thereof

PatentWO2025096186A1

Innovation

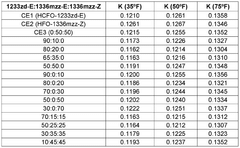

- The use of blends comprising E-1-chloro-3,3,3-trifluoropropene (HCFO-1233zd-E) combined with either E-1,1,1,4,4,4-hexafluoro-2-butene (HFO-1336mzz-E) or Z-1,1,1,4,4,4-hexafluoro-2-butene (HFO-1336mzz-Z) as blowing agents for polyurethane foam formulations, which results in high-quality foams with improved thermal insulation and reduced environmental impact.

Blowing agent compositions of hydrofluoroolefins and hydrochlorofluoroolefins

PatentWO2008121778A1

Innovation

- The use of blowing agent compositions comprising hydrofluoroolefins (HFOs) and hydrochlorofluoroolefins (HCFOs), specifically 3,3,3-trifluoropropene, (cis and/or trans)-1,3,3-tetrafluoropropene, and 2,3,3-tetrafluoropropene as HFOs, and (cis and/or trans)-1-chloro-3,3-trifluoropropene, 2-chloro-3,3-trifluoropropene, and dichlorofluorinated propenes as HCFOs, which are blended with foamable polymer compositions to produce foams with reduced density and enhanced k-factor for thermal insulation.

Regulatory Framework and Global Policy Landscape

The global regulatory landscape for blowing agents has undergone significant transformation in recent decades, primarily driven by environmental concerns related to ozone depletion and global warming. The Montreal Protocol, established in 1987, marked the first major international agreement to phase out ozone-depleting substances, including chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs) commonly used as blowing agents. This landmark treaty has been universally ratified and has successfully reduced the production and consumption of these harmful substances.

The Kigali Amendment to the Montreal Protocol, adopted in 2016, expanded the scope to include hydrofluorocarbons (HFCs), targeting substances with high global warming potential (GWP). This amendment requires developed countries to begin phasing down HFCs by 2019, while developing nations have a more gradual timeline extending to 2024 or 2028, depending on their classification. The amendment aims to prevent up to 0.5°C of global warming by the end of the century.

Regional policies have further accelerated the transition to low-GWP alternatives. The European Union's F-Gas Regulation, implemented in 2015 and revised in 2023, establishes a quota system for HFCs and prohibits specific applications based on GWP thresholds. This regulation has been particularly impactful in the foam insulation sector, pushing manufacturers toward low-GWP blowing agents ahead of global requirements.

In North America, the United States Environmental Protection Agency's Significant New Alternatives Policy (SNAP) program evaluates substitutes for ozone-depleting substances, including blowing agents. Recent SNAP rules have delisted certain high-GWP HFCs for specific applications, though implementation has faced legal challenges. Canada has aligned with these efforts through its own HFC phase-down schedule, while Mexico follows the Montreal Protocol timeline.

Asian markets present a diverse regulatory landscape. Japan has implemented its Act on Rational Use and Proper Management of Fluorocarbons, targeting emissions reduction throughout the lifecycle of fluorocarbons. China, as the world's largest producer of HFCs, has committed to freezing HFC production by 2024 and reducing it by 80% by 2045 under the Kigali Amendment.

Developing nations face unique challenges in transitioning to low-GWP alternatives, including technology access, cost barriers, and safety concerns in high-ambient temperature environments. The Multilateral Fund for the Implementation of the Montreal Protocol provides financial and technical assistance to support these countries in meeting their phase-down obligations.

Compliance mechanisms vary globally, with some regions implementing reporting requirements, labeling standards, and financial penalties for non-compliance. These regulatory frameworks collectively create market pressure for innovation in low-GWP blowing agent technologies while establishing timelines for industry adaptation.

The Kigali Amendment to the Montreal Protocol, adopted in 2016, expanded the scope to include hydrofluorocarbons (HFCs), targeting substances with high global warming potential (GWP). This amendment requires developed countries to begin phasing down HFCs by 2019, while developing nations have a more gradual timeline extending to 2024 or 2028, depending on their classification. The amendment aims to prevent up to 0.5°C of global warming by the end of the century.

Regional policies have further accelerated the transition to low-GWP alternatives. The European Union's F-Gas Regulation, implemented in 2015 and revised in 2023, establishes a quota system for HFCs and prohibits specific applications based on GWP thresholds. This regulation has been particularly impactful in the foam insulation sector, pushing manufacturers toward low-GWP blowing agents ahead of global requirements.

In North America, the United States Environmental Protection Agency's Significant New Alternatives Policy (SNAP) program evaluates substitutes for ozone-depleting substances, including blowing agents. Recent SNAP rules have delisted certain high-GWP HFCs for specific applications, though implementation has faced legal challenges. Canada has aligned with these efforts through its own HFC phase-down schedule, while Mexico follows the Montreal Protocol timeline.

Asian markets present a diverse regulatory landscape. Japan has implemented its Act on Rational Use and Proper Management of Fluorocarbons, targeting emissions reduction throughout the lifecycle of fluorocarbons. China, as the world's largest producer of HFCs, has committed to freezing HFC production by 2024 and reducing it by 80% by 2045 under the Kigali Amendment.

Developing nations face unique challenges in transitioning to low-GWP alternatives, including technology access, cost barriers, and safety concerns in high-ambient temperature environments. The Multilateral Fund for the Implementation of the Montreal Protocol provides financial and technical assistance to support these countries in meeting their phase-down obligations.

Compliance mechanisms vary globally, with some regions implementing reporting requirements, labeling standards, and financial penalties for non-compliance. These regulatory frameworks collectively create market pressure for innovation in low-GWP blowing agent technologies while establishing timelines for industry adaptation.

Life Cycle Assessment Methodologies and Standards

Life Cycle Assessment (LCA) provides a comprehensive framework for evaluating the environmental impacts of low-GWP blowing agents throughout their entire life cycle. The ISO 14040 and 14044 standards establish the fundamental principles and requirements for conducting LCAs, offering a structured approach that includes goal and scope definition, inventory analysis, impact assessment, and interpretation phases. These standards ensure consistency and comparability across different studies, which is crucial when evaluating alternative blowing agents.

For blowing agents specifically, the UNEP TEAP (Technology and Economic Assessment Panel) has developed specialized methodologies that focus on ozone depletion potential and global warming impact. These methodologies incorporate considerations unique to foam production processes and end-of-life scenarios for insulation materials. Additionally, the Environmental Protection Agency's SNAP (Significant New Alternatives Policy) program provides assessment frameworks specifically designed for evaluating substitutes for ozone-depleting substances.

Recent advancements in LCA methodologies have introduced dynamic assessment approaches that account for the time-dependent nature of emissions and their impacts. This is particularly relevant for blowing agents, as their release patterns can vary significantly over the lifetime of foam products. The Product Environmental Footprint (PEF) methodology developed by the European Commission offers a standardized approach that includes 16 environmental impact categories, providing a more holistic assessment beyond just climate impact.

Boundary definition represents a critical aspect of LCA for blowing agents, with cradle-to-grave assessments capturing raw material extraction, manufacturing, use phase, and end-of-life management. The allocation of environmental impacts between co-products and recycled materials follows specific rules outlined in ISO 14044, with sensitivity analyses often employed to evaluate the impact of different allocation approaches on the final results.

Data quality and uncertainty management are addressed through the ILCD (International Reference Life Cycle Data System) Handbook, which provides guidelines for data collection, validation, and uncertainty assessment. For blowing agents specifically, the Greenhouse Gas Protocol offers sector-specific guidance on accounting for fugitive emissions during manufacturing and use phases.

Comparative LCAs between traditional high-GWP blowing agents and newer low-GWP alternatives typically follow the ISO 14045 standard for eco-efficiency assessment, ensuring fair comparison through equivalent functional units and system boundaries. The emerging concept of handprint assessment complements traditional LCA by quantifying the positive environmental benefits of switching to low-GWP alternatives, providing a more balanced view of technological transitions in the insulation industry.

For blowing agents specifically, the UNEP TEAP (Technology and Economic Assessment Panel) has developed specialized methodologies that focus on ozone depletion potential and global warming impact. These methodologies incorporate considerations unique to foam production processes and end-of-life scenarios for insulation materials. Additionally, the Environmental Protection Agency's SNAP (Significant New Alternatives Policy) program provides assessment frameworks specifically designed for evaluating substitutes for ozone-depleting substances.

Recent advancements in LCA methodologies have introduced dynamic assessment approaches that account for the time-dependent nature of emissions and their impacts. This is particularly relevant for blowing agents, as their release patterns can vary significantly over the lifetime of foam products. The Product Environmental Footprint (PEF) methodology developed by the European Commission offers a standardized approach that includes 16 environmental impact categories, providing a more holistic assessment beyond just climate impact.

Boundary definition represents a critical aspect of LCA for blowing agents, with cradle-to-grave assessments capturing raw material extraction, manufacturing, use phase, and end-of-life management. The allocation of environmental impacts between co-products and recycled materials follows specific rules outlined in ISO 14044, with sensitivity analyses often employed to evaluate the impact of different allocation approaches on the final results.

Data quality and uncertainty management are addressed through the ILCD (International Reference Life Cycle Data System) Handbook, which provides guidelines for data collection, validation, and uncertainty assessment. For blowing agents specifically, the Greenhouse Gas Protocol offers sector-specific guidance on accounting for fugitive emissions during manufacturing and use phases.

Comparative LCAs between traditional high-GWP blowing agents and newer low-GWP alternatives typically follow the ISO 14045 standard for eco-efficiency assessment, ensuring fair comparison through equivalent functional units and system boundaries. The emerging concept of handprint assessment complements traditional LCA by quantifying the positive environmental benefits of switching to low-GWP alternatives, providing a more balanced view of technological transitions in the insulation industry.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!