Low-GWP Blowing Agents for Polyurethane Foam Manufacturing

OCT 13, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Low-GWP Blowing Agents Background and Objectives

Blowing agents have been integral to polyurethane foam manufacturing since the industry's inception in the 1940s. Initially, chlorofluorocarbons (CFCs) dominated the market due to their excellent thermal insulation properties, non-flammability, and low toxicity. However, the discovery of their ozone-depleting potential in the 1970s led to the Montreal Protocol in 1987, which mandated their phase-out.

The industry subsequently transitioned to hydrochlorofluorocarbons (HCFCs) as interim substitutes, followed by hydrofluorocarbons (HFCs). While these alternatives addressed ozone depletion concerns, they presented a new environmental challenge: high Global Warming Potential (GWP). HFCs can have GWP values thousands of times greater than carbon dioxide, significantly contributing to climate change when released into the atmosphere.

The Kigali Amendment to the Montreal Protocol in 2016 established a global framework for reducing HFC consumption by over 80% by 2047. This regulatory evolution has created urgent market pressure for developing and implementing low-GWP alternatives that maintain the performance characteristics required for polyurethane foam applications.

Low-GWP blowing agents are defined as substances with GWP values typically below 150, representing a dramatic reduction compared to conventional HFCs with GWPs ranging from 1,000 to 10,000. The technical evolution in this field has accelerated in the past decade, with hydrofluoroolefins (HFOs), hydrochlorofluoroolefins (HCFOs), hydrocarbons, CO2/water, and methyl formate emerging as promising alternatives.

The primary objective of research in this field is to develop blowing agents that simultaneously satisfy multiple critical requirements: minimal environmental impact (low GWP and zero ozone depletion potential), excellent thermal insulation properties, appropriate physical characteristics for processing, compliance with safety standards regarding flammability and toxicity, and economic viability for large-scale industrial adoption.

Secondary objectives include optimizing formulations to maintain or improve the mechanical properties of polyurethane foams, ensuring long-term stability of the foam structure, and developing appropriate handling protocols and equipment modifications for safe implementation in manufacturing environments. The research also aims to establish comprehensive life cycle assessments to verify the overall environmental benefits of these alternatives.

The technological trajectory is moving toward blended solutions that combine multiple blowing agents to achieve an optimal balance of properties, as no single alternative has yet matched the comprehensive performance profile of traditional high-GWP agents. This represents both a challenge and an opportunity for innovation in polyurethane chemistry and manufacturing processes.

The industry subsequently transitioned to hydrochlorofluorocarbons (HCFCs) as interim substitutes, followed by hydrofluorocarbons (HFCs). While these alternatives addressed ozone depletion concerns, they presented a new environmental challenge: high Global Warming Potential (GWP). HFCs can have GWP values thousands of times greater than carbon dioxide, significantly contributing to climate change when released into the atmosphere.

The Kigali Amendment to the Montreal Protocol in 2016 established a global framework for reducing HFC consumption by over 80% by 2047. This regulatory evolution has created urgent market pressure for developing and implementing low-GWP alternatives that maintain the performance characteristics required for polyurethane foam applications.

Low-GWP blowing agents are defined as substances with GWP values typically below 150, representing a dramatic reduction compared to conventional HFCs with GWPs ranging from 1,000 to 10,000. The technical evolution in this field has accelerated in the past decade, with hydrofluoroolefins (HFOs), hydrochlorofluoroolefins (HCFOs), hydrocarbons, CO2/water, and methyl formate emerging as promising alternatives.

The primary objective of research in this field is to develop blowing agents that simultaneously satisfy multiple critical requirements: minimal environmental impact (low GWP and zero ozone depletion potential), excellent thermal insulation properties, appropriate physical characteristics for processing, compliance with safety standards regarding flammability and toxicity, and economic viability for large-scale industrial adoption.

Secondary objectives include optimizing formulations to maintain or improve the mechanical properties of polyurethane foams, ensuring long-term stability of the foam structure, and developing appropriate handling protocols and equipment modifications for safe implementation in manufacturing environments. The research also aims to establish comprehensive life cycle assessments to verify the overall environmental benefits of these alternatives.

The technological trajectory is moving toward blended solutions that combine multiple blowing agents to achieve an optimal balance of properties, as no single alternative has yet matched the comprehensive performance profile of traditional high-GWP agents. This represents both a challenge and an opportunity for innovation in polyurethane chemistry and manufacturing processes.

Market Demand Analysis for Sustainable PU Foam Solutions

The global polyurethane (PU) foam market is experiencing a significant shift towards sustainable solutions, primarily driven by stringent environmental regulations targeting high Global Warming Potential (GWP) blowing agents. Market research indicates that the sustainable PU foam segment is growing at nearly twice the rate of conventional PU foam products, reflecting increasing consumer and industrial demand for environmentally responsible materials.

Environmental legislation, particularly the Kigali Amendment to the Montreal Protocol and regional regulations like the European F-Gas Regulation, has created immediate market pressure for low-GWP alternatives. These regulations have established clear phase-down schedules for hydrofluorocarbons (HFCs), creating a regulatory-driven demand that is reshaping the industry landscape.

Construction and building insulation represents the largest application segment for sustainable PU foam, accounting for approximately 40% of market demand. This sector's growth is further amplified by green building certifications such as LEED and BREEAM, which award points for using materials with reduced environmental impact. Energy efficiency requirements in building codes worldwide are simultaneously driving demand for high-performance insulation materials that can maintain thermal properties while using environmentally preferable blowing agents.

The automotive industry constitutes another significant market segment, where lightweight materials that contribute to fuel efficiency are increasingly valued. Manufacturers are seeking PU foam solutions that not only reduce vehicle weight but also demonstrate improved environmental credentials throughout their lifecycle. This dual requirement has accelerated interest in bio-based and low-GWP foam technologies.

Consumer goods manufacturers are responding to growing consumer awareness regarding product sustainability. Furniture, bedding, and packaging producers are actively seeking PU foam alternatives with reduced environmental impact as part of broader corporate sustainability initiatives. This trend is particularly pronounced in premium market segments where environmental attributes serve as product differentiators.

Regional market analysis reveals varying adoption rates for sustainable PU foam solutions. Europe leads in market penetration due to its stringent regulatory framework, while North America shows rapid growth driven by corporate sustainability commitments. The Asia-Pacific region represents the largest growth opportunity, with increasing environmental awareness and strengthening regulatory frameworks in countries like China, Japan, and South Korea.

Price sensitivity remains a significant market factor, with sustainable solutions typically commanding a 15-30% premium over conventional alternatives. However, this price gap is narrowing as production scales up and technology matures. Market forecasts suggest that achieving price parity will be a critical inflection point for widespread adoption across all industry segments.

Environmental legislation, particularly the Kigali Amendment to the Montreal Protocol and regional regulations like the European F-Gas Regulation, has created immediate market pressure for low-GWP alternatives. These regulations have established clear phase-down schedules for hydrofluorocarbons (HFCs), creating a regulatory-driven demand that is reshaping the industry landscape.

Construction and building insulation represents the largest application segment for sustainable PU foam, accounting for approximately 40% of market demand. This sector's growth is further amplified by green building certifications such as LEED and BREEAM, which award points for using materials with reduced environmental impact. Energy efficiency requirements in building codes worldwide are simultaneously driving demand for high-performance insulation materials that can maintain thermal properties while using environmentally preferable blowing agents.

The automotive industry constitutes another significant market segment, where lightweight materials that contribute to fuel efficiency are increasingly valued. Manufacturers are seeking PU foam solutions that not only reduce vehicle weight but also demonstrate improved environmental credentials throughout their lifecycle. This dual requirement has accelerated interest in bio-based and low-GWP foam technologies.

Consumer goods manufacturers are responding to growing consumer awareness regarding product sustainability. Furniture, bedding, and packaging producers are actively seeking PU foam alternatives with reduced environmental impact as part of broader corporate sustainability initiatives. This trend is particularly pronounced in premium market segments where environmental attributes serve as product differentiators.

Regional market analysis reveals varying adoption rates for sustainable PU foam solutions. Europe leads in market penetration due to its stringent regulatory framework, while North America shows rapid growth driven by corporate sustainability commitments. The Asia-Pacific region represents the largest growth opportunity, with increasing environmental awareness and strengthening regulatory frameworks in countries like China, Japan, and South Korea.

Price sensitivity remains a significant market factor, with sustainable solutions typically commanding a 15-30% premium over conventional alternatives. However, this price gap is narrowing as production scales up and technology matures. Market forecasts suggest that achieving price parity will be a critical inflection point for widespread adoption across all industry segments.

Global Technical Status and Regulatory Challenges

The global landscape for low-GWP blowing agents in polyurethane foam manufacturing has undergone significant transformation over the past decade. Currently, developed regions such as North America, Europe, and Japan have made substantial progress in transitioning away from high-GWP substances, with hydrofluoroolefins (HFOs) and hydrocarbon-based agents gaining prominence in commercial applications. These regions have established manufacturing facilities capable of producing next-generation blowing agents at industrial scale, though production capacity remains limited relative to global demand.

In contrast, developing economies, particularly in Asia and Latin America, continue to rely heavily on transitional substances like hydrochlorofluorocarbons (HCFCs) and hydrofluorocarbons (HFCs), creating a technological divide in global implementation. China has emerged as a significant player, developing indigenous technologies for cyclopentane and HFO production, though quality consistency remains a challenge in some manufacturing facilities.

Regulatory frameworks have become increasingly stringent worldwide, creating a complex compliance landscape for multinational manufacturers. The Kigali Amendment to the Montreal Protocol mandates the phase-down of HFCs globally, with developed countries required to reduce consumption by 85% by 2036 and developing countries following later timelines. The European Union has implemented the F-Gas Regulation, which imposes even stricter controls, banning HFCs with GWP above 150 in many polyurethane applications since 2020.

In the United States, the American Innovation and Manufacturing (AIM) Act directs the EPA to phase down HFC production and consumption by 85% over 15 years, while individual states like California have enacted more aggressive timelines. These regulatory pressures have accelerated innovation but created significant challenges for global supply chains and technology transfer.

Technical barriers persist across regions, particularly regarding flammability management for hydrocarbon-based agents and performance optimization for newer HFOs. The cost differential between traditional and low-GWP alternatives remains substantial, with HFOs typically commanding a 3-5x price premium over HFCs. This economic hurdle has slowed adoption, especially in price-sensitive markets and applications.

Infrastructure limitations present additional challenges, as many existing manufacturing facilities require significant retrofitting to safely handle flammable alternatives or accommodate the different processing parameters of HFOs. The COVID-19 pandemic further disrupted global supply chains for specialty chemicals, creating shortages of certain low-GWP agents and delaying implementation timelines in multiple regions.

Knowledge transfer between developed and developing markets has been inconsistent, with intellectual property protections sometimes limiting technology diffusion. International organizations have established programs to facilitate transition in developing economies, though funding gaps remain a significant obstacle to widespread implementation.

In contrast, developing economies, particularly in Asia and Latin America, continue to rely heavily on transitional substances like hydrochlorofluorocarbons (HCFCs) and hydrofluorocarbons (HFCs), creating a technological divide in global implementation. China has emerged as a significant player, developing indigenous technologies for cyclopentane and HFO production, though quality consistency remains a challenge in some manufacturing facilities.

Regulatory frameworks have become increasingly stringent worldwide, creating a complex compliance landscape for multinational manufacturers. The Kigali Amendment to the Montreal Protocol mandates the phase-down of HFCs globally, with developed countries required to reduce consumption by 85% by 2036 and developing countries following later timelines. The European Union has implemented the F-Gas Regulation, which imposes even stricter controls, banning HFCs with GWP above 150 in many polyurethane applications since 2020.

In the United States, the American Innovation and Manufacturing (AIM) Act directs the EPA to phase down HFC production and consumption by 85% over 15 years, while individual states like California have enacted more aggressive timelines. These regulatory pressures have accelerated innovation but created significant challenges for global supply chains and technology transfer.

Technical barriers persist across regions, particularly regarding flammability management for hydrocarbon-based agents and performance optimization for newer HFOs. The cost differential between traditional and low-GWP alternatives remains substantial, with HFOs typically commanding a 3-5x price premium over HFCs. This economic hurdle has slowed adoption, especially in price-sensitive markets and applications.

Infrastructure limitations present additional challenges, as many existing manufacturing facilities require significant retrofitting to safely handle flammable alternatives or accommodate the different processing parameters of HFOs. The COVID-19 pandemic further disrupted global supply chains for specialty chemicals, creating shortages of certain low-GWP agents and delaying implementation timelines in multiple regions.

Knowledge transfer between developed and developing markets has been inconsistent, with intellectual property protections sometimes limiting technology diffusion. International organizations have established programs to facilitate transition in developing economies, though funding gaps remain a significant obstacle to widespread implementation.

Current Low-GWP Technical Solutions for PU Foam

01 Hydrofluoroolefin (HFO) based blowing agents

Hydrofluoroolefins (HFOs) represent a significant advancement in low-GWP blowing agents. These compounds maintain excellent insulation properties while dramatically reducing global warming potential compared to traditional HFCs. HFOs feature carbon-carbon double bonds that make them more reactive in the atmosphere, resulting in shorter atmospheric lifetimes and consequently lower GWP values. These agents are particularly suitable for polyurethane foam applications where thermal efficiency is critical.- Hydrofluoroolefin (HFO) based blowing agents: Hydrofluoroolefins (HFOs) represent a significant advancement in low-GWP blowing agent technology. These compounds maintain excellent insulating properties while dramatically reducing global warming potential compared to traditional HFCs. HFOs feature carbon-carbon double bonds that make them more reactive in the atmosphere, resulting in shorter atmospheric lifetimes and consequently lower GWP values. These agents are particularly suitable for polyurethane foam applications where thermal efficiency is critical.

- Hydrocarbon-based blowing agents: Hydrocarbon-based blowing agents such as pentane, cyclopentane, and isopentane offer significantly lower GWP values compared to traditional fluorocarbon alternatives. These agents are particularly effective in rigid foam applications and provide good thermal insulation properties. While flammability remains a concern, various formulation techniques and additives can mitigate these risks. The low cost and wide availability of hydrocarbon blowing agents make them commercially attractive options for manufacturers seeking to reduce the environmental impact of their products.

- CO2/water-based blowing systems: Carbon dioxide generated through water reaction with isocyanates represents one of the lowest GWP blowing options available. These systems utilize the reaction between water and isocyanate components to produce CO2 in-situ, which acts as the primary blowing agent. While these systems may have some limitations regarding thermal insulation properties compared to other alternatives, they offer significant environmental advantages with near-zero GWP. The technology is particularly suitable for applications where ultimate thermal performance can be slightly compromised in favor of environmental benefits.

- Blends and co-blowing agent systems: Combining multiple low-GWP blowing agents in specific ratios can optimize performance while maintaining reduced environmental impact. These blended systems often incorporate HFOs with hydrocarbons or CO2 to balance thermal efficiency, cost, and environmental considerations. The synergistic effects between different blowing agents can help overcome individual limitations of each component. Carefully formulated blends allow manufacturers to fine-tune properties such as thermal conductivity, dimensional stability, and processing characteristics while still achieving significant GWP reductions.

- Methyl formate and other oxygenated hydrocarbon alternatives: Methyl formate and similar oxygenated hydrocarbons provide viable low-GWP alternatives with unique advantages. These compounds offer good solubility in polyol systems, relatively low flammability compared to pure hydrocarbons, and excellent environmental profiles with minimal ozone depletion potential and very low GWP values. The incorporation of oxygen atoms in the molecular structure helps reduce flammability while maintaining effective blowing performance. These agents are particularly suitable for spray foam applications and systems where processing safety is a significant concern.

02 Hydrocarbon-based blowing agents

Hydrocarbon-based blowing agents such as pentane, cyclopentane, and isopentane offer significantly lower GWP values compared to traditional fluorocarbon alternatives. These agents are derived from petroleum sources and contain no ozone-depleting substances. While they present flammability concerns that require special handling and equipment modifications, their environmental profile makes them increasingly popular in various foam applications, particularly in regions with strict environmental regulations.Expand Specific Solutions03 CO2/water-based blowing systems

Carbon dioxide generated through water reaction with isocyanates represents one of the lowest GWP blowing options available. This approach utilizes the natural reaction between water and isocyanate components in polyurethane systems to generate CO2 in-situ, which acts as the primary blowing agent. While these systems may result in foams with slightly different physical properties compared to traditional blowing agents, they offer significant environmental advantages with GWP values approaching zero. Enhanced formulations often incorporate additional components to optimize thermal insulation properties.Expand Specific Solutions04 Blends and co-blowing agent systems

Blended blowing agent systems combine multiple low-GWP compounds to achieve optimal performance characteristics while maintaining reduced environmental impact. These formulations typically incorporate combinations of HFOs, hydrocarbons, HFCs in reduced quantities, and sometimes CO2/water components. The synergistic effects of these blends allow manufacturers to balance crucial foam properties such as thermal conductivity, dimensional stability, and mechanical strength while meeting increasingly stringent environmental regulations regarding global warming potential.Expand Specific Solutions05 Methyl formate and other oxygenated hydrocarbon alternatives

Methyl formate and other oxygenated hydrocarbons represent emerging alternatives in the low-GWP blowing agent market. These compounds offer significantly reduced global warming potential compared to traditional agents while providing acceptable foam properties. The oxygen content in these molecules contributes to reduced flammability compared to pure hydrocarbon alternatives, addressing some safety concerns. These blowing agents are particularly suitable for certain spray foam applications and flexible foam systems where their unique properties can be leveraged effectively.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The low-GWP blowing agents market for polyurethane foam manufacturing is in a transitional growth phase, driven by global regulations phasing out high-GWP alternatives. The market is projected to reach $2.1 billion by 2027, growing at 5.8% CAGR as industries shift toward sustainable solutions. Technologically, hydrofluoroolefins (HFOs) represent the cutting edge, with companies like Chemours, Arkema, and Honeywell leading innovation through significant patent portfolios. BASF, Covestro, and Dow are advancing polyurethane systems compatible with these agents, while Chinese manufacturers including Wanhua Chemical and Hongbaoli are rapidly developing competitive alternatives. Academic-industrial partnerships, exemplified by Shandong University of Technology's collaborations, are accelerating commercialization of next-generation blowing agents with improved performance-to-cost ratios.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has developed Solstice® Liquid Blowing Agent (LBA), a hydrofluoroolefin (HFO)-based blowing agent with ultra-low GWP of <1, which is 99.9% lower than traditional HFC blowing agents. The technology utilizes HFO-1233zd(E) as the primary component, offering thermal insulation performance improvements of up to 10-12% compared to hydrocarbon-based alternatives. Honeywell's solution maintains dimensional stability while meeting stringent environmental regulations worldwide, including the EU F-Gas Regulation and US EPA SNAP program. The company has invested in dedicated manufacturing facilities to ensure global supply chain reliability, with production sites in Louisiana (USA) and China to serve international markets[1][2]. Their fourth-generation blowing agent technology has been commercially implemented across various polyurethane applications including refrigeration, spray foam insulation, and panel manufacturing.

Strengths: Industry-leading ultra-low GWP (<1) with superior thermal insulation properties; non-flammable formulation enhancing safety; global manufacturing capacity ensuring supply reliability. Weaknesses: Higher initial cost compared to hydrocarbon alternatives; requires some processing modifications for manufacturers transitioning from HFCs; limited long-term performance data compared to traditional agents.

BASF Corp.

Technical Solution: BASF has pioneered the development of Elastocool® and Elastopir® polyurethane systems incorporating their proprietary low-GWP blowing agent technology. Their approach combines methylformate-based blowing agents with optimized catalytic systems to achieve foam structures with fine cell morphology and enhanced thermal insulation properties. BASF's technology focuses on maintaining processing parameters similar to traditional systems while reducing GWP by over 99%. The company has developed specialized polyol formulations that work synergistically with their blowing agents to counteract the challenges typically associated with alternative blowing agents, such as dimensional stability issues and thermal conductivity concerns. Their comprehensive solution includes tailored stabilizers and catalysts that enable manufacturers to maintain production efficiency while meeting environmental regulations[3]. BASF has also invested in application development centers globally to help customers transition to these new systems with minimal disruption to existing manufacturing processes.

Strengths: Comprehensive systems approach integrating blowing agents with optimized polyols and additives; minimal production process modifications required; strong global technical support network. Weaknesses: Performance in extreme temperature conditions may be less consistent than traditional systems; requires careful handling of methylformate components due to flammability concerns; slightly higher system costs compared to conventional options.

Critical Patents and Innovations in Low-GWP Agents

Low-GWP blowing agent blends and uses thereof

PatentWO2025096186A1

Innovation

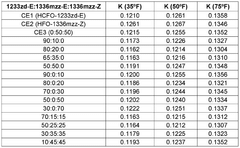

- The use of blends comprising E-1-chloro-3,3,3-trifluoropropene (HCFO-1233zd-E) combined with either E-1,1,1,4,4,4-hexafluoro-2-butene (HFO-1336mzz-E) or Z-1,1,1,4,4,4-hexafluoro-2-butene (HFO-1336mzz-Z) as blowing agents for polyurethane foam formulations, which results in high-quality foams with improved thermal insulation and reduced environmental impact.

Improved polyurethane foaming processes and foam properties using halogenated olefin blowing agent

PatentInactiveEP2475803A1

Innovation

- The use of unsaturated halogenated hydroolefins, particularly HCFO-1233zd, in combination with polyol, silicone surfactants, and carbon dioxide generating agents, for high-pressure mixing and dispensing in polyurethane foam production, leading to uniform density distribution and improved thermal insulation properties.

Environmental Impact Assessment and Life Cycle Analysis

The environmental impact of blowing agents used in polyurethane foam manufacturing extends far beyond their immediate application. Traditional blowing agents such as chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs) have been phased out due to their ozone depletion potential, while hydrofluorocarbons (HFCs) are being regulated because of their high Global Warming Potential (GWP).

Life Cycle Analysis (LCA) of low-GWP blowing agents reveals significant environmental advantages compared to their high-GWP counterparts. When examining the entire lifecycle - from raw material extraction through manufacturing, use, and disposal - low-GWP alternatives such as hydrofluoroolefins (HFOs), hydrocarbons, and CO2/water-based systems demonstrate substantially reduced climate impacts. For instance, HFO-1234ze has a GWP of less than 1, compared to HFC-245fa with a GWP of approximately 1,030.

The environmental benefits extend beyond direct emissions. Energy efficiency during the foam's service life must be considered, as this represents a significant portion of the total environmental impact. Studies indicate that while some low-GWP alternatives may have slightly lower initial insulation performance, the difference in lifetime energy consumption is often negligible when compared to the substantial reduction in direct GWP impact.

Water consumption and ecotoxicity assessments reveal varying profiles among low-GWP alternatives. Hydrocarbon-based blowing agents typically show lower water footprints in production compared to HFOs, but may present higher volatile organic compound (VOC) emissions. CO2/water systems demonstrate excellent ecotoxicity profiles but may require additional raw materials to achieve comparable insulation properties.

Regional environmental impact variations are significant due to differences in energy grids, manufacturing practices, and end-of-life scenarios. In regions with carbon-intensive electricity generation, the embodied carbon in foam production becomes more significant, potentially offsetting some benefits of low-GWP blowing agents.

Regulatory frameworks increasingly incorporate LCA perspectives, with the European Union's F-Gas Regulation and the Kigali Amendment to the Montreal Protocol driving global transitions to low-GWP alternatives. These regulations often consider not just the direct GWP of blowing agents, but also their contribution to energy efficiency and overall climate impact throughout the product lifecycle.

Future environmental assessment methodologies are evolving to include broader sustainability metrics beyond GWP, such as resource depletion, land use change, and social impacts associated with chemical production and use, providing a more comprehensive understanding of the environmental implications of blowing agent selection in polyurethane foam manufacturing.

Life Cycle Analysis (LCA) of low-GWP blowing agents reveals significant environmental advantages compared to their high-GWP counterparts. When examining the entire lifecycle - from raw material extraction through manufacturing, use, and disposal - low-GWP alternatives such as hydrofluoroolefins (HFOs), hydrocarbons, and CO2/water-based systems demonstrate substantially reduced climate impacts. For instance, HFO-1234ze has a GWP of less than 1, compared to HFC-245fa with a GWP of approximately 1,030.

The environmental benefits extend beyond direct emissions. Energy efficiency during the foam's service life must be considered, as this represents a significant portion of the total environmental impact. Studies indicate that while some low-GWP alternatives may have slightly lower initial insulation performance, the difference in lifetime energy consumption is often negligible when compared to the substantial reduction in direct GWP impact.

Water consumption and ecotoxicity assessments reveal varying profiles among low-GWP alternatives. Hydrocarbon-based blowing agents typically show lower water footprints in production compared to HFOs, but may present higher volatile organic compound (VOC) emissions. CO2/water systems demonstrate excellent ecotoxicity profiles but may require additional raw materials to achieve comparable insulation properties.

Regional environmental impact variations are significant due to differences in energy grids, manufacturing practices, and end-of-life scenarios. In regions with carbon-intensive electricity generation, the embodied carbon in foam production becomes more significant, potentially offsetting some benefits of low-GWP blowing agents.

Regulatory frameworks increasingly incorporate LCA perspectives, with the European Union's F-Gas Regulation and the Kigali Amendment to the Montreal Protocol driving global transitions to low-GWP alternatives. These regulations often consider not just the direct GWP of blowing agents, but also their contribution to energy efficiency and overall climate impact throughout the product lifecycle.

Future environmental assessment methodologies are evolving to include broader sustainability metrics beyond GWP, such as resource depletion, land use change, and social impacts associated with chemical production and use, providing a more comprehensive understanding of the environmental implications of blowing agent selection in polyurethane foam manufacturing.

Cost-Performance Trade-offs in Implementation

The implementation of low-GWP blowing agents in polyurethane foam manufacturing presents significant cost-performance trade-offs that manufacturers must carefully navigate. Initial capital expenditures for transitioning to newer, environmentally friendly blowing agents typically range from $500,000 to $2 million, depending on production scale and existing infrastructure. These costs encompass equipment modifications, storage facilities, safety systems, and staff training programs.

Operational expenses also increase substantially, with low-GWP alternatives generally commanding 15-30% price premiums over traditional HFCs. For instance, HFO-1234ze currently costs approximately $15-20 per kilogram compared to $8-12 for HFC-245fa. This price differential directly impacts product margins and may necessitate price adjustments downstream.

Performance considerations further complicate implementation decisions. While hydrocarbons offer excellent cost efficiency (typically $3-5 per kilogram), their flammability requires substantial safety investments and may limit application in certain sectors. Conversely, HFOs provide superior insulation properties but at significantly higher costs, creating a direct trade-off between thermal efficiency and production economics.

Manufacturing process adaptations represent another critical consideration. Low-GWP agents often require different mixing parameters, curing conditions, and quality control protocols. Companies report transition periods of 3-6 months before achieving optimal production efficiency with new blowing agents, during which rejection rates may increase by 5-15%.

Energy consumption patterns also shift with alternative blowing agents. Water-blown systems typically require 10-20% more energy during curing, while hydrocarbon-based systems may offer slight energy savings but necessitate explosion-proof equipment investments. These operational changes must be factored into long-term cost projections.

Market positioning considerations cannot be overlooked. Premium manufacturers have successfully leveraged low-GWP formulations as product differentiators, commanding 5-10% price premiums in environmentally conscious markets. However, mass-market producers face greater challenges in absorbing transition costs without compromising competitive pricing.

Regulatory compliance timelines significantly impact implementation strategies. Companies in regions with aggressive phase-down schedules (EU, Japan) report 30-40% higher transition costs compared to those in markets with more gradual implementation timelines, highlighting the importance of strategic planning and regulatory foresight in minimizing economic disruption.

Operational expenses also increase substantially, with low-GWP alternatives generally commanding 15-30% price premiums over traditional HFCs. For instance, HFO-1234ze currently costs approximately $15-20 per kilogram compared to $8-12 for HFC-245fa. This price differential directly impacts product margins and may necessitate price adjustments downstream.

Performance considerations further complicate implementation decisions. While hydrocarbons offer excellent cost efficiency (typically $3-5 per kilogram), their flammability requires substantial safety investments and may limit application in certain sectors. Conversely, HFOs provide superior insulation properties but at significantly higher costs, creating a direct trade-off between thermal efficiency and production economics.

Manufacturing process adaptations represent another critical consideration. Low-GWP agents often require different mixing parameters, curing conditions, and quality control protocols. Companies report transition periods of 3-6 months before achieving optimal production efficiency with new blowing agents, during which rejection rates may increase by 5-15%.

Energy consumption patterns also shift with alternative blowing agents. Water-blown systems typically require 10-20% more energy during curing, while hydrocarbon-based systems may offer slight energy savings but necessitate explosion-proof equipment investments. These operational changes must be factored into long-term cost projections.

Market positioning considerations cannot be overlooked. Premium manufacturers have successfully leveraged low-GWP formulations as product differentiators, commanding 5-10% price premiums in environmentally conscious markets. However, mass-market producers face greater challenges in absorbing transition costs without compromising competitive pricing.

Regulatory compliance timelines significantly impact implementation strategies. Companies in regions with aggressive phase-down schedules (EU, Japan) report 30-40% higher transition costs compared to those in markets with more gradual implementation timelines, highlighting the importance of strategic planning and regulatory foresight in minimizing economic disruption.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!