Low-GWP Blowing Agents for Flexible and Rigid Polyurethane Foams

OCT 13, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Low-GWP Blowing Agents Background and Objectives

Blowing agents have been integral to polyurethane foam manufacturing since the industry's inception in the 1940s. Initially, chlorofluorocarbons (CFCs) dominated the market due to their excellent thermal insulation properties, non-flammability, and low toxicity. However, the discovery of their ozone-depleting potential in the 1970s led to the Montreal Protocol in 1987, which mandated their phase-out.

The industry subsequently transitioned to hydrochlorofluorocarbons (HCFCs) as interim solutions, followed by hydrofluorocarbons (HFCs). While these alternatives addressed ozone depletion concerns, they presented another environmental challenge: high Global Warming Potential (GWP). HFCs can have GWP values thousands of times greater than carbon dioxide, contributing significantly to climate change when released into the atmosphere.

The Kigali Amendment to the Montreal Protocol in 2016 established a timeline for reducing HFC consumption by over 80% by 2047, creating urgent need for low-GWP alternatives. This regulatory pressure, combined with corporate sustainability initiatives and consumer demand for environmentally responsible products, has accelerated research into next-generation blowing agents.

Current technological evolution focuses on developing blowing agents with GWP values below 10, while maintaining or improving the performance characteristics of polyurethane foams. Hydrofluoroolefins (HFOs), hydrocarbons, water-blown systems, methyl formate, and liquid carbon dioxide represent the primary research directions, each with specific advantages for different foam applications.

The technical objectives of this research encompass several critical dimensions. First, identifying low-GWP blowing agents that maintain thermal insulation properties comparable to current solutions, particularly crucial for rigid foams used in construction and refrigeration. Second, ensuring these alternatives meet stringent flammability and safety standards across diverse applications. Third, developing formulations that maintain or enhance mechanical properties including compression strength, dimensional stability, and durability.

Additionally, the research aims to address processing challenges associated with new blowing agents, including compatibility with existing manufacturing equipment, stability during storage, and consistent cell structure formation. Cost-effectiveness represents another key objective, as any viable alternative must remain economically competitive to enable widespread industry adoption.

The ultimate goal is to establish a comprehensive portfolio of low-GWP blowing agent solutions tailored to specific polyurethane foam applications, enabling manufacturers to meet increasingly stringent environmental regulations while maintaining product performance and economic viability across both flexible and rigid foam markets.

The industry subsequently transitioned to hydrochlorofluorocarbons (HCFCs) as interim solutions, followed by hydrofluorocarbons (HFCs). While these alternatives addressed ozone depletion concerns, they presented another environmental challenge: high Global Warming Potential (GWP). HFCs can have GWP values thousands of times greater than carbon dioxide, contributing significantly to climate change when released into the atmosphere.

The Kigali Amendment to the Montreal Protocol in 2016 established a timeline for reducing HFC consumption by over 80% by 2047, creating urgent need for low-GWP alternatives. This regulatory pressure, combined with corporate sustainability initiatives and consumer demand for environmentally responsible products, has accelerated research into next-generation blowing agents.

Current technological evolution focuses on developing blowing agents with GWP values below 10, while maintaining or improving the performance characteristics of polyurethane foams. Hydrofluoroolefins (HFOs), hydrocarbons, water-blown systems, methyl formate, and liquid carbon dioxide represent the primary research directions, each with specific advantages for different foam applications.

The technical objectives of this research encompass several critical dimensions. First, identifying low-GWP blowing agents that maintain thermal insulation properties comparable to current solutions, particularly crucial for rigid foams used in construction and refrigeration. Second, ensuring these alternatives meet stringent flammability and safety standards across diverse applications. Third, developing formulations that maintain or enhance mechanical properties including compression strength, dimensional stability, and durability.

Additionally, the research aims to address processing challenges associated with new blowing agents, including compatibility with existing manufacturing equipment, stability during storage, and consistent cell structure formation. Cost-effectiveness represents another key objective, as any viable alternative must remain economically competitive to enable widespread industry adoption.

The ultimate goal is to establish a comprehensive portfolio of low-GWP blowing agent solutions tailored to specific polyurethane foam applications, enabling manufacturers to meet increasingly stringent environmental regulations while maintaining product performance and economic viability across both flexible and rigid foam markets.

Market Demand Analysis for Sustainable PU Foam Solutions

The global polyurethane (PU) foam market is experiencing significant transformation driven by environmental regulations and sustainability concerns. Current market analysis indicates a robust demand for sustainable PU foam solutions, with the global market valued at approximately $77.5 billion in 2022 and projected to reach $104.1 billion by 2027, growing at a CAGR of 6.1%. This growth is substantially influenced by the increasing pressure to adopt low Global Warming Potential (GWP) blowing agents.

Environmental regulations, particularly the Kigali Amendment to the Montreal Protocol and regional policies like the European F-Gas Regulation, are primary market drivers accelerating the transition away from high-GWP hydrofluorocarbons (HFCs). These regulations have created immediate market demand for alternative blowing agents in both flexible and rigid PU foam applications.

Construction and building insulation represent the largest market segment for rigid PU foams, accounting for nearly 40% of the total demand. This sector's growth is fueled by stringent building energy efficiency standards worldwide and the push for net-zero energy buildings. The automotive industry constitutes another significant market for both flexible and rigid foams, with demand for lightweight materials to improve fuel efficiency and reduce emissions.

Consumer preferences are increasingly favoring eco-friendly products, creating market pull for sustainable PU foam solutions. Major furniture and bedding manufacturers report 25-30% higher consumer interest in products marketed as environmentally responsible, despite premium pricing. This trend is particularly pronounced in developed markets across North America, Europe, and parts of Asia.

Regional analysis reveals varying adoption rates of sustainable blowing agents. Europe leads the transition with approximately 65% of the market already using low-GWP alternatives, followed by North America at 48%. Asia-Pacific, while currently at lower adoption rates (around 30%), represents the fastest-growing market for sustainable PU foam solutions with annual growth exceeding 8%.

Economic factors also influence market dynamics, with manufacturers balancing sustainability goals against cost considerations. The price premium for low-GWP blowing agents remains a challenge, though this gap is narrowing as production scales up and technologies mature. Current estimates suggest a 15-20% cost premium for foams produced with next-generation blowing agents compared to traditional HFC-based systems.

Supply chain resilience has emerged as a critical market factor following recent global disruptions. Manufacturers are increasingly prioritizing blowing agent solutions with diverse sourcing options and production pathways to mitigate future supply risks, creating opportunities for novel low-GWP alternatives with flexible manufacturing processes.

Environmental regulations, particularly the Kigali Amendment to the Montreal Protocol and regional policies like the European F-Gas Regulation, are primary market drivers accelerating the transition away from high-GWP hydrofluorocarbons (HFCs). These regulations have created immediate market demand for alternative blowing agents in both flexible and rigid PU foam applications.

Construction and building insulation represent the largest market segment for rigid PU foams, accounting for nearly 40% of the total demand. This sector's growth is fueled by stringent building energy efficiency standards worldwide and the push for net-zero energy buildings. The automotive industry constitutes another significant market for both flexible and rigid foams, with demand for lightweight materials to improve fuel efficiency and reduce emissions.

Consumer preferences are increasingly favoring eco-friendly products, creating market pull for sustainable PU foam solutions. Major furniture and bedding manufacturers report 25-30% higher consumer interest in products marketed as environmentally responsible, despite premium pricing. This trend is particularly pronounced in developed markets across North America, Europe, and parts of Asia.

Regional analysis reveals varying adoption rates of sustainable blowing agents. Europe leads the transition with approximately 65% of the market already using low-GWP alternatives, followed by North America at 48%. Asia-Pacific, while currently at lower adoption rates (around 30%), represents the fastest-growing market for sustainable PU foam solutions with annual growth exceeding 8%.

Economic factors also influence market dynamics, with manufacturers balancing sustainability goals against cost considerations. The price premium for low-GWP blowing agents remains a challenge, though this gap is narrowing as production scales up and technologies mature. Current estimates suggest a 15-20% cost premium for foams produced with next-generation blowing agents compared to traditional HFC-based systems.

Supply chain resilience has emerged as a critical market factor following recent global disruptions. Manufacturers are increasingly prioritizing blowing agent solutions with diverse sourcing options and production pathways to mitigate future supply risks, creating opportunities for novel low-GWP alternatives with flexible manufacturing processes.

Technical Challenges in Low-GWP Blowing Agent Development

The development of low-GWP blowing agents for polyurethane foams faces several significant technical challenges that must be addressed to achieve widespread commercial adoption. One of the primary obstacles is achieving equivalent or superior thermal insulation properties compared to traditional high-GWP agents. Low-GWP alternatives often demonstrate reduced insulation efficiency, requiring thicker foam layers to achieve the same R-value, which impacts product dimensions and material costs.

Flammability presents another critical challenge, as many low-GWP alternatives exhibit higher flammability than their predecessors. This necessitates the incorporation of flame retardants, which can adversely affect foam properties and increase production costs. The development of inherently flame-resistant blowing agents without compromising other performance parameters remains a significant research focus.

Compatibility with existing polyurethane systems poses substantial difficulties. Low-GWP blowing agents may interact differently with catalysts, surfactants, and polyol components, potentially altering reaction kinetics, cell structure, and overall foam stability. Reformulation of entire foam systems is often necessary, requiring extensive testing and validation processes.

Processing challenges also emerge during manufacturing transitions. Many low-GWP alternatives have different boiling points and vapor pressures compared to traditional agents, necessitating modifications to processing equipment, mixing parameters, and curing conditions. These adjustments require significant capital investment and production downtime for implementation.

Long-term stability represents another technical hurdle. Some low-GWP blowing agents may gradually diffuse out of foam structures over time, leading to dimensional instability, reduced insulation performance, and potential structural issues. Developing effective cell-gas retention technologies is essential for ensuring product longevity.

Cost-effectiveness remains a persistent challenge. Many low-GWP alternatives are currently more expensive than traditional blowing agents, increasing production costs. The development of economically viable synthesis routes and scaling up production to achieve economies of scale are necessary to overcome this barrier.

Environmental and toxicological concerns must also be addressed. While reducing GWP is the primary goal, potential alternatives must be comprehensively evaluated for other environmental impacts, including ozone depletion potential, atmospheric lifetime, aquatic toxicity, and bioaccumulation. Additionally, workplace safety considerations regarding toxicity, irritation potential, and exposure limits must be thoroughly assessed.

Regulatory compliance across different regions presents a complex challenge, as manufacturers must navigate varying timelines and requirements for phasing out high-GWP blowing agents. Developing solutions that meet the most stringent global standards while remaining commercially viable is essential for international market access.

Flammability presents another critical challenge, as many low-GWP alternatives exhibit higher flammability than their predecessors. This necessitates the incorporation of flame retardants, which can adversely affect foam properties and increase production costs. The development of inherently flame-resistant blowing agents without compromising other performance parameters remains a significant research focus.

Compatibility with existing polyurethane systems poses substantial difficulties. Low-GWP blowing agents may interact differently with catalysts, surfactants, and polyol components, potentially altering reaction kinetics, cell structure, and overall foam stability. Reformulation of entire foam systems is often necessary, requiring extensive testing and validation processes.

Processing challenges also emerge during manufacturing transitions. Many low-GWP alternatives have different boiling points and vapor pressures compared to traditional agents, necessitating modifications to processing equipment, mixing parameters, and curing conditions. These adjustments require significant capital investment and production downtime for implementation.

Long-term stability represents another technical hurdle. Some low-GWP blowing agents may gradually diffuse out of foam structures over time, leading to dimensional instability, reduced insulation performance, and potential structural issues. Developing effective cell-gas retention technologies is essential for ensuring product longevity.

Cost-effectiveness remains a persistent challenge. Many low-GWP alternatives are currently more expensive than traditional blowing agents, increasing production costs. The development of economically viable synthesis routes and scaling up production to achieve economies of scale are necessary to overcome this barrier.

Environmental and toxicological concerns must also be addressed. While reducing GWP is the primary goal, potential alternatives must be comprehensively evaluated for other environmental impacts, including ozone depletion potential, atmospheric lifetime, aquatic toxicity, and bioaccumulation. Additionally, workplace safety considerations regarding toxicity, irritation potential, and exposure limits must be thoroughly assessed.

Regulatory compliance across different regions presents a complex challenge, as manufacturers must navigate varying timelines and requirements for phasing out high-GWP blowing agents. Developing solutions that meet the most stringent global standards while remaining commercially viable is essential for international market access.

Current Low-GWP Solutions for PU Foam Applications

01 Hydrofluoroolefin (HFO) based blowing agents

Hydrofluoroolefins (HFOs) represent a new generation of blowing agents with significantly lower global warming potential compared to traditional hydrofluorocarbons (HFCs). These compounds maintain good thermal insulation properties while having minimal environmental impact. HFOs like HFO-1234ze and HFO-1234yf have GWP values close to 1, making them environmentally preferable alternatives for foam production in various applications including construction materials and appliance insulation.- Hydrofluoroolefin (HFO) based blowing agents: Hydrofluoroolefins (HFOs) represent a significant advancement in low-GWP blowing agent technology. These compounds maintain excellent insulation properties while dramatically reducing global warming potential compared to traditional HFCs. HFOs feature carbon-carbon double bonds that make them more reactive in the atmosphere, resulting in shorter atmospheric lifetimes and consequently lower GWP values. These agents are particularly suitable for polyurethane foam applications and can be used either alone or in blends to optimize performance characteristics.

- Hydrocarbon-based blowing agents: Hydrocarbon-based blowing agents such as pentane, cyclopentane, and isopentane offer significantly lower GWP values compared to traditional fluorinated compounds. These agents are derived from petroleum resources and contain no ozone-depleting substances. While they present flammability concerns that require special handling and equipment modifications, their extremely low GWP (typically less than 25) makes them attractive alternatives for various foam applications. Hydrocarbon blowing agents are particularly effective in rigid polyurethane foam insulation for refrigeration and construction applications.

- CO2/water-based blowing systems: Carbon dioxide generated through water reaction with isocyanates represents one of the lowest GWP blowing options available. This approach utilizes the natural reaction between water and isocyanate components in polyurethane formulations to generate CO2 in-situ, which acts as the primary blowing agent. While these systems may result in foams with slightly different physical properties compared to traditional blowing agents, they offer significant environmental benefits with GWP values approaching 1. The technology can be enhanced through the use of specialized catalysts and additives to improve foam quality and performance characteristics.

- Blended blowing agent systems: Blended blowing agent systems combine multiple low-GWP compounds to achieve optimal performance characteristics while maintaining reduced environmental impact. These blends typically incorporate combinations of HFOs, hydrocarbons, HFCs in reduced quantities, and sometimes CO2 or other inert gases. The synergistic effects of these blends allow manufacturers to balance thermal efficiency, dimensional stability, and environmental considerations. Careful formulation of these blends enables customization for specific application requirements while meeting increasingly stringent environmental regulations.

- Testing and measurement methods for GWP: Specialized testing and measurement methodologies have been developed to accurately assess the global warming potential of blowing agents. These methods include atmospheric lifetime studies, infrared absorption analysis, and comparative climate impact assessments. Advanced analytical techniques allow for precise determination of a compound's radiative forcing and atmospheric degradation pathways, which are critical factors in calculating GWP values. Standardized testing protocols ensure consistent evaluation across different blowing agent technologies, enabling manufacturers and regulators to make informed decisions regarding environmental impact.

02 Hydrocarbon-based low-GWP blowing agents

Hydrocarbon-based blowing agents such as pentane, cyclopentane, and isopentane offer extremely low global warming potential alternatives to traditional blowing agents. These compounds have GWP values close to zero and provide good insulation properties. While flammability is a concern, various formulations and manufacturing processes have been developed to safely incorporate these hydrocarbon blowing agents into polyurethane and polystyrene foam production, significantly reducing the environmental impact of insulation materials.Expand Specific Solutions03 CO2 and water-based blowing systems

Carbon dioxide and water-based blowing systems represent some of the lowest GWP options available for foam production. These systems utilize either direct CO2 injection or water reactions with isocyanates to generate CO2 in-situ during the foaming process. While these systems have minimal global warming impact, they often require formulation adjustments to achieve optimal foam properties. Recent innovations have improved the insulation performance and structural stability of foams produced using these environmentally friendly blowing mechanisms.Expand Specific Solutions04 Blends and co-blowing agent systems

Blended blowing agent systems combine multiple low-GWP compounds to achieve optimal performance characteristics while minimizing environmental impact. These formulations typically incorporate combinations of HFOs, hydrocarbons, CO2, or other environmentally friendly blowing agents in specific ratios. The blended approach allows manufacturers to balance thermal efficiency, dimensional stability, and environmental considerations. Advanced co-blowing systems can achieve performance comparable to traditional high-GWP blowing agents while significantly reducing climate impact.Expand Specific Solutions05 Measurement and evaluation methods for GWP

Specialized methods and equipment have been developed to accurately measure and evaluate the global warming potential of blowing agents. These techniques include gas chromatography, mass spectrometry, and atmospheric lifetime assessments that help quantify the environmental impact of various compounds. Standardized testing protocols allow for consistent comparison between different blowing agents and foam systems. These measurement approaches are crucial for regulatory compliance and for the development of new low-GWP alternatives that meet both performance and environmental requirements.Expand Specific Solutions

Key Industry Players in Low-GWP Blowing Agent Market

The low-GWP blowing agents market for polyurethane foams is in a transitional growth phase, driven by global regulations phasing out high-GWP alternatives. The market is projected to reach $2.1 billion by 2027, growing at 8.5% CAGR as industries shift toward sustainable solutions. Technologically, hydrofluoroolefins (HFOs) and hydrocarbon-based agents are gaining maturity, with BASF, Honeywell, Chemours, and Arkema leading innovation in this space. Chemical giants like Covestro, Dow, and Wanhua are developing integrated systems optimizing these agents for various applications, while appliance manufacturers including Midea and Samsung are implementing these technologies in their production processes. The competitive landscape features strategic partnerships between chemical suppliers and end-users to accelerate commercial adoption of these environmentally friendly alternatives.

BASF Corp.

Technical Solution: BASF has developed a comprehensive portfolio of low-GWP blowing agents for polyurethane foams, focusing on hydrofluoroolefins (HFOs) and methylal-based solutions. Their Elastocool® technology specifically targets flexible polyurethane applications with GWP values below 5, representing a 99% reduction compared to traditional HFC blowing agents[1]. For rigid foams, BASF's Elastopir® system incorporates pentane-based blowing agents optimized through proprietary cell stabilization technology that maintains thermal insulation properties while addressing the flammability concerns typically associated with hydrocarbon blowing agents[3]. The company has also pioneered water-blown systems that generate CO2 as the blowing agent through reaction with isocyanates, eliminating the need for external physical blowing agents in certain applications[5]. BASF's approach includes comprehensive formulation adjustments to maintain or improve foam properties despite the transition to lower-GWP alternatives.

Strengths: Extensive R&D capabilities allow for customized solutions across diverse applications; strong integration with their broader polyurethane raw materials portfolio enables system-level optimization. Weaknesses: Water-blown systems typically result in higher thermal conductivity compared to physical blowing agents; pentane-based solutions require significant safety investments in manufacturing facilities.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has pioneered the development of Solstice® Liquid Blowing Agent (LBA), a hydrofluoroolefin-based solution with a GWP of less than 1, representing a 99.9% reduction compared to HFC-141b[2]. This fourth-generation blowing agent technology features a molecular structure that breaks down quickly in the atmosphere, resulting in an atmospheric lifetime of just 26 days versus 9.3 years for HFC-245fa[4]. Solstice LBA is non-ozone depleting and has received approval under significant regulatory frameworks including the EPA's SNAP program. For rigid polyurethane applications, Honeywell's technology delivers thermal insulation performance equivalent or superior to HFC-based systems, with testing demonstrating lambda values as low as 19-20 mW/m·K in optimized formulations[6]. The company has also developed specialized formulation guidance to address the slightly higher boiling point of Solstice LBA compared to traditional blowing agents, ensuring proper cell structure formation during the foaming process. Honeywell has conducted extensive compatibility testing with common polyurethane catalysts, surfactants, and flame retardants to facilitate drop-in replacement capabilities.

Strengths: Industry-leading ultra-low GWP performance combined with excellent insulation properties; global manufacturing capacity ensures reliable supply chain; extensive technical support for customer transitions. Weaknesses: Higher initial cost compared to hydrocarbon alternatives; requires some formulation adjustments when transitioning from HFCs; slightly higher boiling point necessitates processing modifications in some applications.

Critical Patents and Innovations in Low-GWP Technology

Low-GWP blowing agent blends and uses thereof

PatentWO2025096186A1

Innovation

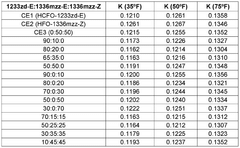

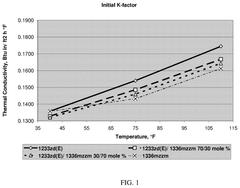

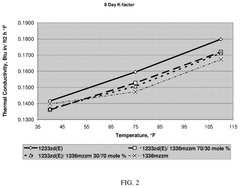

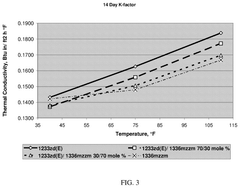

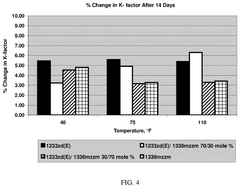

- The use of blends comprising E-1-chloro-3,3,3-trifluoropropene (HCFO-1233zd-E) combined with either E-1,1,1,4,4,4-hexafluoro-2-butene (HFO-1336mzz-E) or Z-1,1,1,4,4,4-hexafluoro-2-butene (HFO-1336mzz-Z) as blowing agents for polyurethane foam formulations, which results in high-quality foams with improved thermal insulation and reduced environmental impact.

Mixtures containing 1.1.1.4.4.4.- hexafluorobutene and 1-chloro-3.3.3-trifluoropropene

PatentPendingUS20250223414A1

Innovation

- A mixture of 1,1,1,4,4-hexafluorobutene (1336mzzm) and 1-chloro-3,3,3-trifluoropropene (1233zd) is used, with varying mole percentages, optionally including co-blowing agents and other additives, to create a foamable composition that achieves low k-factor values and improved thermal performance across a wide temperature range.

Environmental Regulations Impact on Blowing Agent Selection

Environmental regulations have become a primary driver in the evolution of blowing agent technologies for polyurethane foams. The Montreal Protocol of 1987 marked the first significant global regulatory impact, mandating the phase-out of chlorofluorocarbons (CFCs) due to their ozone depletion potential. This initiated a cascade of regulatory changes that continues to reshape the industry landscape.

The subsequent Kyoto Protocol in 1997 expanded environmental concerns beyond ozone depletion to include greenhouse gas emissions, introducing Global Warming Potential (GWP) as a critical metric for evaluating blowing agents. This shift prompted the industry to transition from hydrochlorofluorocarbons (HCFCs) to hydrofluorocarbons (HFCs), which offered zero ozone depletion but still possessed significant GWP values.

Recent regulatory frameworks have become increasingly stringent, with the Kigali Amendment to the Montreal Protocol in 2016 establishing a global schedule for HFC phase-down. The European Union's F-Gas Regulation has implemented one of the most aggressive timelines, with bans on HFCs with GWP above certain thresholds in various applications, including rigid polyurethane foams.

In the United States, the Environmental Protection Agency's Significant New Alternatives Policy (SNAP) program has undergone several revisions, creating a complex regulatory environment where certain high-GWP HFCs are being delisted as acceptable alternatives. California has adopted even more stringent regulations through its Short-Lived Climate Pollutant Strategy, influencing national manufacturing standards due to the state's market size.

Asian markets present a varied regulatory landscape, with Japan and South Korea implementing progressive phase-down schedules, while China—the world's largest producer of polyurethane foams—has committed to HFC production caps by 2024 and subsequent reductions, creating significant implications for global supply chains.

These regulations have created distinct regional compliance requirements, forcing multinational manufacturers to develop formulation strategies that can adapt to different regulatory timelines. The economic impact has been substantial, with investments in research and development of low-GWP alternatives accelerating, but also creating cost pressures throughout the value chain.

The regulatory push has effectively created a technology roadmap for the industry, with clear GWP targets driving innovation toward hydrofluoroolefins (HFOs), hydrochlorofluoroolefins (HCFOs), hydrocarbons, and other alternative blowing agents. This regulatory-driven innovation cycle has become a defining characteristic of the polyurethane foam industry, with environmental compliance now inseparable from product development strategies.

The subsequent Kyoto Protocol in 1997 expanded environmental concerns beyond ozone depletion to include greenhouse gas emissions, introducing Global Warming Potential (GWP) as a critical metric for evaluating blowing agents. This shift prompted the industry to transition from hydrochlorofluorocarbons (HCFCs) to hydrofluorocarbons (HFCs), which offered zero ozone depletion but still possessed significant GWP values.

Recent regulatory frameworks have become increasingly stringent, with the Kigali Amendment to the Montreal Protocol in 2016 establishing a global schedule for HFC phase-down. The European Union's F-Gas Regulation has implemented one of the most aggressive timelines, with bans on HFCs with GWP above certain thresholds in various applications, including rigid polyurethane foams.

In the United States, the Environmental Protection Agency's Significant New Alternatives Policy (SNAP) program has undergone several revisions, creating a complex regulatory environment where certain high-GWP HFCs are being delisted as acceptable alternatives. California has adopted even more stringent regulations through its Short-Lived Climate Pollutant Strategy, influencing national manufacturing standards due to the state's market size.

Asian markets present a varied regulatory landscape, with Japan and South Korea implementing progressive phase-down schedules, while China—the world's largest producer of polyurethane foams—has committed to HFC production caps by 2024 and subsequent reductions, creating significant implications for global supply chains.

These regulations have created distinct regional compliance requirements, forcing multinational manufacturers to develop formulation strategies that can adapt to different regulatory timelines. The economic impact has been substantial, with investments in research and development of low-GWP alternatives accelerating, but also creating cost pressures throughout the value chain.

The regulatory push has effectively created a technology roadmap for the industry, with clear GWP targets driving innovation toward hydrofluoroolefins (HFOs), hydrochlorofluoroolefins (HCFOs), hydrocarbons, and other alternative blowing agents. This regulatory-driven innovation cycle has become a defining characteristic of the polyurethane foam industry, with environmental compliance now inseparable from product development strategies.

Performance Comparison Across Different Blowing Agent Classes

The performance comparison across different blowing agent classes reveals significant variations in technical parameters critical for polyurethane foam applications. Hydrofluorocarbons (HFCs) historically demonstrated excellent insulation properties with thermal conductivity values typically ranging from 10-12 mW/m·K, but their high Global Warming Potential (GWP) values of 1,000-4,000 have triggered regulatory phase-outs globally. This has accelerated the transition toward more environmentally sustainable alternatives.

Hydrofluoroolefins (HFOs) represent the newest generation of blowing agents with ultra-low GWP values below 10. HFO-1234ze and HFO-1336mzz-Z exhibit thermal conductivity performance comparable to HFCs (11-13 mW/m·K) while maintaining excellent dimensional stability in rigid foam applications. However, their relatively high production costs—approximately 3-5 times that of hydrocarbon alternatives—present significant commercialization challenges, particularly in price-sensitive markets.

Hydrocarbon-based blowing agents (pentane isomers, cyclopentane) offer the most cost-effective solution at 1-2 USD/kg compared to 8-15 USD/kg for HFOs. Their thermal conductivity values (13-15 mW/m·K) are marginally inferior to HFCs and HFOs, but their negligible GWP (<20) makes them environmentally attractive. The primary limitation remains their flammability, necessitating significant capital investment in safety equipment for manufacturing facilities.

Water-blown systems generate CO₂ as the blowing agent through reaction with isocyanates. This approach offers the lowest direct material cost and minimal environmental impact but results in foams with higher thermal conductivity (18-22 mW/m·K) and potentially compromised dimensional stability due to CO₂'s rapid diffusion rate through cell walls.

Methyl formate and methylal represent emerging alternatives with moderate GWP values (approximately 25-30) and thermal conductivity performance (14-16 mW/m·K) positioned between hydrocarbons and HFOs. Their moderate flammability profile presents fewer handling challenges than pure hydrocarbons, though still requires safety considerations.

Blends of different blowing agent classes have emerged as practical solutions that balance performance, cost, and environmental impact. HFO/hydrocarbon blends, for instance, can achieve thermal conductivity values of 12-14 mW/m·K while reducing formulation costs by 30-50% compared to pure HFO systems. These blends represent the fastest-growing segment in commercial applications, particularly in rigid foam insulation for construction and refrigeration.

Hydrofluoroolefins (HFOs) represent the newest generation of blowing agents with ultra-low GWP values below 10. HFO-1234ze and HFO-1336mzz-Z exhibit thermal conductivity performance comparable to HFCs (11-13 mW/m·K) while maintaining excellent dimensional stability in rigid foam applications. However, their relatively high production costs—approximately 3-5 times that of hydrocarbon alternatives—present significant commercialization challenges, particularly in price-sensitive markets.

Hydrocarbon-based blowing agents (pentane isomers, cyclopentane) offer the most cost-effective solution at 1-2 USD/kg compared to 8-15 USD/kg for HFOs. Their thermal conductivity values (13-15 mW/m·K) are marginally inferior to HFCs and HFOs, but their negligible GWP (<20) makes them environmentally attractive. The primary limitation remains their flammability, necessitating significant capital investment in safety equipment for manufacturing facilities.

Water-blown systems generate CO₂ as the blowing agent through reaction with isocyanates. This approach offers the lowest direct material cost and minimal environmental impact but results in foams with higher thermal conductivity (18-22 mW/m·K) and potentially compromised dimensional stability due to CO₂'s rapid diffusion rate through cell walls.

Methyl formate and methylal represent emerging alternatives with moderate GWP values (approximately 25-30) and thermal conductivity performance (14-16 mW/m·K) positioned between hydrocarbons and HFOs. Their moderate flammability profile presents fewer handling challenges than pure hydrocarbons, though still requires safety considerations.

Blends of different blowing agent classes have emerged as practical solutions that balance performance, cost, and environmental impact. HFO/hydrocarbon blends, for instance, can achieve thermal conductivity values of 12-14 mW/m·K while reducing formulation costs by 30-50% compared to pure HFO systems. These blends represent the fastest-growing segment in commercial applications, particularly in rigid foam insulation for construction and refrigeration.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!