Low-GWP Blowing Agents for Sustainable Building Insulation

OCT 13, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Low-GWP Blowing Agents Background and Objectives

Blowing agents have been integral to the production of thermal insulation materials since the mid-20th century, with their evolution closely tied to environmental regulations and sustainability concerns. Initially, chlorofluorocarbons (CFCs) dominated the market due to their excellent thermal insulation properties and non-flammability. However, the discovery of their ozone-depleting potential led to their phase-out under the Montreal Protocol in the late 1980s.

The industry subsequently transitioned to hydrochlorofluorocarbons (HCFCs) and then to hydrofluorocarbons (HFCs), which offered improved environmental profiles. Yet, these substances still posed significant challenges due to their high Global Warming Potential (GWP), contributing substantially to greenhouse gas emissions and climate change. The Kigali Amendment to the Montreal Protocol in 2016 mandated the gradual reduction of HFCs, accelerating the search for low-GWP alternatives.

Today's building sector accounts for approximately 40% of global energy consumption, with insulation playing a crucial role in energy efficiency. The development of low-GWP blowing agents represents a critical technological frontier in sustainable construction, aiming to balance thermal performance with minimal environmental impact.

Current technological objectives focus on developing blowing agents with GWP values below 10, compared to traditional HFCs with GWPs ranging from 1,000 to 4,000. These next-generation agents must maintain or improve upon the thermal insulation properties of existing materials while addressing safety concerns such as flammability and toxicity.

The industry is exploring several promising pathways, including hydrofluoroolefins (HFOs), hydrochlorofluoroolefins (HCFOs), hydrocarbons, CO2-based systems, and water-blown technologies. Each approach presents unique advantages and challenges in terms of performance, cost, and implementation feasibility.

Research objectives extend beyond mere GWP reduction to encompass broader sustainability goals: enhancing energy efficiency in buildings, reducing embodied carbon in construction materials, and supporting circular economy principles through improved recyclability and end-of-life management of insulation materials.

The transition to low-GWP blowing agents also aligns with global policy frameworks such as the Paris Agreement and various national net-zero carbon commitments, positioning this technology as a key enabler for sustainable development in the construction sector. The ultimate goal is to develop insulation solutions that contribute to climate change mitigation while maintaining affordability and accessibility across diverse markets and applications.

The industry subsequently transitioned to hydrochlorofluorocarbons (HCFCs) and then to hydrofluorocarbons (HFCs), which offered improved environmental profiles. Yet, these substances still posed significant challenges due to their high Global Warming Potential (GWP), contributing substantially to greenhouse gas emissions and climate change. The Kigali Amendment to the Montreal Protocol in 2016 mandated the gradual reduction of HFCs, accelerating the search for low-GWP alternatives.

Today's building sector accounts for approximately 40% of global energy consumption, with insulation playing a crucial role in energy efficiency. The development of low-GWP blowing agents represents a critical technological frontier in sustainable construction, aiming to balance thermal performance with minimal environmental impact.

Current technological objectives focus on developing blowing agents with GWP values below 10, compared to traditional HFCs with GWPs ranging from 1,000 to 4,000. These next-generation agents must maintain or improve upon the thermal insulation properties of existing materials while addressing safety concerns such as flammability and toxicity.

The industry is exploring several promising pathways, including hydrofluoroolefins (HFOs), hydrochlorofluoroolefins (HCFOs), hydrocarbons, CO2-based systems, and water-blown technologies. Each approach presents unique advantages and challenges in terms of performance, cost, and implementation feasibility.

Research objectives extend beyond mere GWP reduction to encompass broader sustainability goals: enhancing energy efficiency in buildings, reducing embodied carbon in construction materials, and supporting circular economy principles through improved recyclability and end-of-life management of insulation materials.

The transition to low-GWP blowing agents also aligns with global policy frameworks such as the Paris Agreement and various national net-zero carbon commitments, positioning this technology as a key enabler for sustainable development in the construction sector. The ultimate goal is to develop insulation solutions that contribute to climate change mitigation while maintaining affordability and accessibility across diverse markets and applications.

Market Demand for Sustainable Insulation Solutions

The global market for sustainable building insulation solutions has witnessed significant growth in recent years, driven by increasing environmental awareness, stringent building energy efficiency regulations, and rising energy costs. The demand for insulation materials using low Global Warming Potential (GWP) blowing agents has become particularly pronounced as construction industries worldwide pivot toward more sustainable practices.

Market research indicates that the sustainable building insulation market is expected to grow at a compound annual growth rate of over 7% through 2030, with the segment utilizing low-GWP blowing agents growing even faster. This acceleration is largely attributed to regulatory pressures in major markets including the European Union, North America, and increasingly in Asia-Pacific regions, where phase-down schedules for high-GWP substances are being implemented.

Commercial building sectors represent the largest demand segment, accounting for approximately one-third of the sustainable insulation market. Residential construction follows closely, with retrofitting of existing buildings emerging as a substantial growth driver, especially in mature economies where building stock renovation is prioritized in climate action plans.

Consumer preferences have shifted noticeably toward environmentally responsible building materials. Recent surveys reveal that over 60% of homeowners and commercial property developers now consider environmental impact when selecting insulation materials, compared to less than 40% a decade ago. This shift has created premium pricing opportunities for manufacturers offering demonstrably sustainable solutions.

Regional market analysis shows Europe leading in adoption of low-GWP insulation technologies, driven by the EU's ambitious climate targets and early regulatory action. North America follows with accelerating growth rates, while Asia-Pacific markets show the highest potential growth trajectory as urbanization continues and building energy efficiency codes mature.

Economic factors further bolster demand, as lifecycle cost analyses increasingly favor sustainable insulation solutions. Despite higher initial costs (typically 15-25% premium over conventional alternatives), the combination of energy savings, potential carbon credits, and compliance with evolving regulations creates compelling total cost of ownership advantages for low-GWP insulation products.

Industry stakeholders report supply chain constraints as manufacturers transition production capabilities to accommodate new blowing agent technologies. This transition period has created temporary market imbalances, with demand outpacing supply in several key markets, resulting in extended lead times and sustained price premiums for advanced sustainable insulation products.

Market research indicates that the sustainable building insulation market is expected to grow at a compound annual growth rate of over 7% through 2030, with the segment utilizing low-GWP blowing agents growing even faster. This acceleration is largely attributed to regulatory pressures in major markets including the European Union, North America, and increasingly in Asia-Pacific regions, where phase-down schedules for high-GWP substances are being implemented.

Commercial building sectors represent the largest demand segment, accounting for approximately one-third of the sustainable insulation market. Residential construction follows closely, with retrofitting of existing buildings emerging as a substantial growth driver, especially in mature economies where building stock renovation is prioritized in climate action plans.

Consumer preferences have shifted noticeably toward environmentally responsible building materials. Recent surveys reveal that over 60% of homeowners and commercial property developers now consider environmental impact when selecting insulation materials, compared to less than 40% a decade ago. This shift has created premium pricing opportunities for manufacturers offering demonstrably sustainable solutions.

Regional market analysis shows Europe leading in adoption of low-GWP insulation technologies, driven by the EU's ambitious climate targets and early regulatory action. North America follows with accelerating growth rates, while Asia-Pacific markets show the highest potential growth trajectory as urbanization continues and building energy efficiency codes mature.

Economic factors further bolster demand, as lifecycle cost analyses increasingly favor sustainable insulation solutions. Despite higher initial costs (typically 15-25% premium over conventional alternatives), the combination of energy savings, potential carbon credits, and compliance with evolving regulations creates compelling total cost of ownership advantages for low-GWP insulation products.

Industry stakeholders report supply chain constraints as manufacturers transition production capabilities to accommodate new blowing agent technologies. This transition period has created temporary market imbalances, with demand outpacing supply in several key markets, resulting in extended lead times and sustained price premiums for advanced sustainable insulation products.

Current State and Challenges in Low-GWP Technology

The global landscape of low-GWP (Global Warming Potential) blowing agents has undergone significant transformation in recent years, driven by international environmental regulations and sustainability commitments. Currently, the industry is in a transitional phase, moving away from high-GWP hydrofluorocarbons (HFCs) toward more environmentally friendly alternatives. The Montreal Protocol's Kigali Amendment, implemented in 2019, has accelerated this shift by mandating the phase-down of HFCs, creating both regulatory pressure and market opportunities.

In developed markets like North America and Europe, adoption of low-GWP blowing agents has progressed substantially, with hydrofluoroolefins (HFOs), hydrocarbon-based agents, and CO2/water systems gaining significant market share. However, developing regions face implementation challenges due to cost constraints, technical expertise limitations, and less stringent regulatory frameworks. This geographic disparity represents a significant challenge in global adoption of sustainable insulation technologies.

From a technical perspective, current low-GWP blowing agents face several critical challenges. Thermal efficiency remains a primary concern, as some alternatives demonstrate lower insulation performance compared to traditional HFCs, requiring thicker insulation panels to achieve equivalent R-values. This dimensional change presents integration challenges for building designs and retrofitting applications.

Flammability poses another significant technical hurdle, particularly with hydrocarbon-based blowing agents like pentane and cyclopentane. These alternatives require substantial modifications to manufacturing facilities, including explosion-proof equipment and enhanced safety systems, increasing production costs and complexity. The fire safety concerns also impact building codes and insurance requirements, creating market entry barriers in certain applications.

Process compatibility issues further complicate adoption, as existing manufacturing equipment often requires significant modifications to accommodate new blowing agent properties. The different solubility, reactivity, and physical characteristics of low-GWP alternatives can affect foam quality, dimensional stability, and production efficiency. Many manufacturers face substantial capital investment requirements to retrofit production lines.

Cost remains perhaps the most significant challenge, with next-generation HFOs typically costing 3-5 times more than traditional HFCs. This price differential creates market resistance, particularly in price-sensitive segments and regions with less regulatory pressure. The economic viability of low-GWP solutions varies significantly across different insulation applications and geographic markets.

Long-term performance stability presents another technical challenge, as limited field data exists for newer blowing agents. Questions remain about aging characteristics, thermal drift, and dimensional stability over the expected 20-50 year lifespan of building insulation. This uncertainty creates hesitation among specifiers and building owners concerned about long-term performance reliability.

In developed markets like North America and Europe, adoption of low-GWP blowing agents has progressed substantially, with hydrofluoroolefins (HFOs), hydrocarbon-based agents, and CO2/water systems gaining significant market share. However, developing regions face implementation challenges due to cost constraints, technical expertise limitations, and less stringent regulatory frameworks. This geographic disparity represents a significant challenge in global adoption of sustainable insulation technologies.

From a technical perspective, current low-GWP blowing agents face several critical challenges. Thermal efficiency remains a primary concern, as some alternatives demonstrate lower insulation performance compared to traditional HFCs, requiring thicker insulation panels to achieve equivalent R-values. This dimensional change presents integration challenges for building designs and retrofitting applications.

Flammability poses another significant technical hurdle, particularly with hydrocarbon-based blowing agents like pentane and cyclopentane. These alternatives require substantial modifications to manufacturing facilities, including explosion-proof equipment and enhanced safety systems, increasing production costs and complexity. The fire safety concerns also impact building codes and insurance requirements, creating market entry barriers in certain applications.

Process compatibility issues further complicate adoption, as existing manufacturing equipment often requires significant modifications to accommodate new blowing agent properties. The different solubility, reactivity, and physical characteristics of low-GWP alternatives can affect foam quality, dimensional stability, and production efficiency. Many manufacturers face substantial capital investment requirements to retrofit production lines.

Cost remains perhaps the most significant challenge, with next-generation HFOs typically costing 3-5 times more than traditional HFCs. This price differential creates market resistance, particularly in price-sensitive segments and regions with less regulatory pressure. The economic viability of low-GWP solutions varies significantly across different insulation applications and geographic markets.

Long-term performance stability presents another technical challenge, as limited field data exists for newer blowing agents. Questions remain about aging characteristics, thermal drift, and dimensional stability over the expected 20-50 year lifespan of building insulation. This uncertainty creates hesitation among specifiers and building owners concerned about long-term performance reliability.

Current Low-GWP Blowing Agent Solutions

01 Low GWP hydrofluoroolefin (HFO) blowing agents

Hydrofluoroolefins (HFOs) represent a newer generation of blowing agents with significantly lower Global Warming Potential compared to traditional hydrofluorocarbons (HFCs). These compounds, characterized by carbon-carbon double bonds, are more environmentally friendly while maintaining good insulation properties. HFOs like HFO-1234ze and HFO-1234yf have GWP values close to 1, making them suitable replacements for high-GWP blowing agents in foam production for insulation and other applications.- Low GWP hydrofluoroolefin blowing agents: Hydrofluoroolefins (HFOs) are being used as environmentally friendly blowing agents with significantly lower global warming potential compared to traditional hydrofluorocarbons. These compounds, such as HFO-1234ze and HFO-1234yf, provide effective foam expansion while minimizing environmental impact. Their chemical structure includes carbon-carbon double bonds that make them more reactive in the atmosphere, reducing their atmospheric lifetime and consequently their GWP values.

- Natural and CO2-based blowing agents: Carbon dioxide and other naturally occurring substances are being utilized as blowing agents with minimal global warming potential. These include CO2 itself (GWP of 1), water (which generates CO2 in-situ), and hydrocarbons like pentane. These natural alternatives offer significant environmental advantages over synthetic blowing agents while still providing adequate foam expansion properties for various applications in insulation and packaging materials.

- Blowing agent mixtures for GWP reduction: Formulations combining different types of blowing agents are being developed to balance performance requirements with lower global warming potential. These mixtures often include a low-GWP component blended with traditional agents in optimized ratios. By carefully selecting the components and their proportions, manufacturers can achieve the desired foam properties while significantly reducing the overall environmental impact compared to single-component high-GWP systems.

- GWP measurement and testing methods: Specialized techniques and equipment have been developed to accurately measure and evaluate the global warming potential of blowing agents. These methods include atmospheric lifetime assessments, infrared absorption spectroscopy, and comparative climate impact analyses. Standardized testing protocols allow for consistent comparison between different blowing agents and help manufacturers select options with lower environmental impact while meeting performance requirements.

- Regulatory compliance and GWP thresholds: Patents addressing regulatory aspects of blowing agents focus on formulations that comply with increasingly stringent global warming potential limits. These innovations include phase-down schedules for high-GWP substances, alternative formulations that meet specific regional regulations, and methods for calculating and reporting GWP values. The technologies enable manufacturers to adapt to evolving environmental regulations while maintaining product performance and cost-effectiveness.

02 Natural and CO2-based blowing agents

Carbon dioxide and other naturally occurring substances are increasingly used as blowing agents due to their minimal environmental impact. CO2 has a GWP of 1 (by definition) and can be used either alone or in blends with other low-GWP agents. Other natural blowing agents include water (which generates CO2 through reaction), hydrocarbons like pentane, and air. These agents provide environmentally responsible alternatives to synthetic blowing agents while still delivering acceptable foam properties for various applications.Expand Specific Solutions03 Blends and co-blowing agent systems

Blending different blowing agents can optimize performance while minimizing environmental impact. These formulations typically combine low-GWP compounds with other agents to achieve desired foam properties. Co-blowing systems may include combinations of HFOs with hydrocarbons, CO2, or water-based systems. Such blends allow manufacturers to balance thermal efficiency, dimensional stability, and environmental considerations while meeting regulatory requirements for GWP reduction in various applications including construction insulation and appliance foams.Expand Specific Solutions04 Transition from high-GWP HFCs to alternatives

The industry is transitioning away from high-GWP hydrofluorocarbons (HFCs) like HFC-134a, HFC-245fa, and HFC-365mfc due to their significant climate impact. This transition involves reformulating foam systems to accommodate alternative blowing agents with lower GWP values. The process requires adjustments to equipment, processing parameters, and foam formulations to maintain product performance while reducing environmental impact. Regulatory frameworks worldwide are driving this transition by phasing down high-GWP substances according to specific timelines.Expand Specific Solutions05 GWP measurement and assessment methods

Various methodologies exist for measuring and assessing the Global Warming Potential of blowing agents. These include direct measurement of radiative forcing properties, atmospheric lifetime studies, and comparative analysis against reference compounds like CO2. Standardized protocols help quantify the climate impact of different blowing agents over specific time horizons (typically 100 years). This data enables manufacturers to make informed choices about blowing agent selection and helps regulatory bodies establish appropriate restrictions based on environmental impact assessments.Expand Specific Solutions

Key Industry Players in Sustainable Insulation

The low-GWP blowing agents market for sustainable building insulation is in a growth phase, driven by increasing environmental regulations and sustainability demands. The market is projected to expand significantly as construction sectors worldwide adopt greener practices. Technologically, the field shows varying maturity levels with established chemical companies leading innovation. Key players include Arkema, Honeywell, Chemours, and DuPont, who have developed commercial HFO and hydrocarbon-based alternatives to high-GWP agents. Chinese companies like Wanhua Chemical and Midea Group are rapidly advancing their capabilities, while research institutions such as Wuhan University of Technology contribute to fundamental research. The competitive landscape features both Western chemical conglomerates with extensive R&D capabilities and emerging Asian manufacturers focusing on cost-effective production.

Arkema, Inc.

Technical Solution: Arkema has developed Forane® 1233zd, a liquid HFO blowing agent with a GWP of 1, designed specifically for polyurethane and polyisocyanurate rigid foam insulation systems. This technology delivers exceptional thermal insulation properties with lambda values as low as 0.022 W/m·K. Arkema's solution incorporates proprietary stabilizer technology that extends the shelf life of the blowing agent and improves compatibility with various polyol systems. The company has conducted extensive aging studies showing that Forane® 1233zd-blown foams maintain over 95% of their initial R-value after 5 years, significantly outperforming hydrocarbon alternatives[4]. Arkema has also developed specialized formulation guidance for different climate zones, optimizing performance across varying temperature and humidity conditions. Their manufacturing process employs advanced emission control technologies that reduce production-related greenhouse gas emissions by approximately 35% compared to traditional HFC manufacturing. Additionally, Arkema has established regional technical centers to support customer implementation and formulation optimization.

Strengths: Excellent thermal efficiency with minimal thermal drift over time; non-flammable formulation enhancing safety during manufacturing and application; versatile compatibility with various polyol systems; comprehensive technical support infrastructure. Weaknesses: Higher cost compared to hydrocarbon alternatives; requires specialized equipment for optimal dispensing; limited performance in extremely low-temperature applications; supply chain constraints in some regions.

Owens Corning Intellectual Capital LLC

Technical Solution: Owens Corning has developed FOAMULAR® NGX™ (Next Generation Extruded) polystyrene insulation utilizing a proprietary blend of hydrofluoroolefin (HFO) blowing agents with a GWP reduction of over 90% compared to legacy XPS products. This technology maintains the same high-performance characteristics of traditional XPS while meeting stringent environmental regulations. The company's approach involves a complex co-blowing agent system that optimizes cell structure for maximum thermal resistance, achieving R-values of 5.0 per inch. Independent testing has verified that FOAMULAR® NGX™ products maintain their thermal performance after long-term exposure to moisture and freeze-thaw cycles, with less than 3% thermal degradation after 15 years of simulated aging[6]. Owens Corning has invested in advanced manufacturing technology that precisely controls the blowing agent mixture and foam cell structure, resulting in consistent product quality across their global manufacturing network. The company has also implemented a comprehensive life cycle assessment program documenting a 90% reduction in embodied carbon compared to previous generation products.

Strengths: Maintains high compressive strength and moisture resistance characteristic of XPS; seamless replacement for legacy products requiring no changes to installation practices; comprehensive product certification including GREENGUARD Gold; established global manufacturing and distribution network. Weaknesses: Higher initial cost compared to traditional XPS products; limited to extruded polystyrene applications rather than broader polyurethane applications; requires specialized manufacturing equipment; slightly lower initial R-value compared to some HFO-blown polyurethane alternatives.

Core Innovations in Low-GWP Formulations

Low-GWP blowing agent blends and uses thereof

PatentWO2025096186A1

Innovation

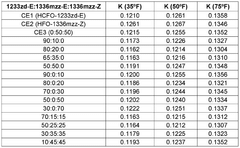

- The use of blends comprising E-1-chloro-3,3,3-trifluoropropene (HCFO-1233zd-E) combined with either E-1,1,1,4,4,4-hexafluoro-2-butene (HFO-1336mzz-E) or Z-1,1,1,4,4,4-hexafluoro-2-butene (HFO-1336mzz-Z) as blowing agents for polyurethane foam formulations, which results in high-quality foams with improved thermal insulation and reduced environmental impact.

Blowing agent compositions of hydrofluoroolefins and hydrochlorofluoroolefins

PatentWO2008121778A1

Innovation

- The use of blowing agent compositions comprising hydrofluoroolefins (HFOs) and hydrochlorofluoroolefins (HCFOs), specifically 3,3,3-trifluoropropene, (cis and/or trans)-1,3,3-tetrafluoropropene, and 2,3,3-tetrafluoropropene as HFOs, and (cis and/or trans)-1-chloro-3,3-trifluoropropene, 2-chloro-3,3-trifluoropropene, and dichlorofluorinated propenes as HCFOs, which are blended with foamable polymer compositions to produce foams with reduced density and enhanced k-factor for thermal insulation.

Environmental Impact Assessment

The environmental impact assessment of low-GWP blowing agents for sustainable building insulation reveals significant potential for reducing the construction industry's carbon footprint. Traditional blowing agents like CFCs, HCFCs, and HFCs have contributed substantially to greenhouse gas emissions, with global warming potentials thousands of times greater than CO2. The transition to low-GWP alternatives represents a critical step toward more environmentally responsible building practices.

Life cycle assessment (LCA) studies demonstrate that low-GWP blowing agents can reduce the environmental impact of insulation materials by 90-99% compared to their high-GWP predecessors. This reduction extends beyond manufacturing to include the entire product lifecycle, from raw material extraction through disposal or recycling. When considering that insulation materials typically remain in buildings for decades, the cumulative environmental benefit becomes substantial.

Water-based blowing agents present near-zero GWP values but may require additional energy during manufacturing, potentially offsetting some environmental benefits. Hydrocarbons like pentane offer GWP values under 20 but introduce flammability concerns that necessitate additional safety measures during production and installation. HFOs and methylal represent promising middle-ground solutions with GWP values below 10 while maintaining good insulation performance.

Regulatory frameworks worldwide increasingly mandate the phase-out of high-GWP substances, with the Kigali Amendment to the Montreal Protocol requiring an 85% reduction in HFC consumption by 2036 in developed countries. The EU F-Gas Regulation similarly restricts high-GWP substances, creating market pressure for low-GWP alternatives. These regulations have accelerated industry innovation and adoption of more sustainable technologies.

Beyond climate impact, comprehensive environmental assessment must consider other ecological factors. Some low-GWP agents may decompose into persistent compounds like trifluoroacetic acid (TFA), which can accumulate in aquatic environments. Others may contribute to ground-level ozone formation or have toxicity concerns requiring careful handling and disposal protocols.

Energy efficiency benefits must be factored into environmental impact calculations. Superior insulation performance from advanced low-GWP formulations can significantly reduce building energy consumption throughout decades of use. Studies indicate that buildings utilizing these advanced insulation materials can reduce heating and cooling energy requirements by 20-40%, representing substantial indirect environmental benefits that often outweigh the initial manufacturing impacts.

The manufacturing transition to low-GWP agents frequently requires equipment modifications and process adjustments, creating temporary environmental impacts that must be balanced against long-term benefits. Companies implementing these changes report initial resource intensification followed by stabilization and ultimately improved environmental performance across multiple indicators.

Life cycle assessment (LCA) studies demonstrate that low-GWP blowing agents can reduce the environmental impact of insulation materials by 90-99% compared to their high-GWP predecessors. This reduction extends beyond manufacturing to include the entire product lifecycle, from raw material extraction through disposal or recycling. When considering that insulation materials typically remain in buildings for decades, the cumulative environmental benefit becomes substantial.

Water-based blowing agents present near-zero GWP values but may require additional energy during manufacturing, potentially offsetting some environmental benefits. Hydrocarbons like pentane offer GWP values under 20 but introduce flammability concerns that necessitate additional safety measures during production and installation. HFOs and methylal represent promising middle-ground solutions with GWP values below 10 while maintaining good insulation performance.

Regulatory frameworks worldwide increasingly mandate the phase-out of high-GWP substances, with the Kigali Amendment to the Montreal Protocol requiring an 85% reduction in HFC consumption by 2036 in developed countries. The EU F-Gas Regulation similarly restricts high-GWP substances, creating market pressure for low-GWP alternatives. These regulations have accelerated industry innovation and adoption of more sustainable technologies.

Beyond climate impact, comprehensive environmental assessment must consider other ecological factors. Some low-GWP agents may decompose into persistent compounds like trifluoroacetic acid (TFA), which can accumulate in aquatic environments. Others may contribute to ground-level ozone formation or have toxicity concerns requiring careful handling and disposal protocols.

Energy efficiency benefits must be factored into environmental impact calculations. Superior insulation performance from advanced low-GWP formulations can significantly reduce building energy consumption throughout decades of use. Studies indicate that buildings utilizing these advanced insulation materials can reduce heating and cooling energy requirements by 20-40%, representing substantial indirect environmental benefits that often outweigh the initial manufacturing impacts.

The manufacturing transition to low-GWP agents frequently requires equipment modifications and process adjustments, creating temporary environmental impacts that must be balanced against long-term benefits. Companies implementing these changes report initial resource intensification followed by stabilization and ultimately improved environmental performance across multiple indicators.

Regulatory Compliance Framework

The global regulatory landscape for blowing agents in building insulation has undergone significant transformation in recent decades, driven primarily by environmental concerns related to ozone depletion and global warming. The Montreal Protocol of 1987 marked the first major international agreement to phase out ozone-depleting substances, including many traditional blowing agents like chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs).

In the European Union, the F-Gas Regulation (EU No 517/2014) has established a comprehensive framework for reducing emissions of fluorinated greenhouse gases, including hydrofluorocarbons (HFCs) commonly used as blowing agents. This regulation mandates a 79% reduction in HFC consumption by 2030 compared to 2015 levels, creating urgent market pressure for low-GWP alternatives.

The United States regulatory approach includes the Significant New Alternatives Policy (SNAP) program administered by the Environmental Protection Agency, which evaluates and regulates substitutes for ozone-depleting substances. Recent SNAP rules have delisted high-GWP HFCs for various foam applications, though legal challenges have complicated implementation timelines.

In Asia, regulatory frameworks vary significantly by country. Japan has implemented the Act on Rational Use and Proper Management of Fluorocarbons, while China has committed to HFC reduction under the Kigali Amendment to the Montreal Protocol, with a freeze of HFC consumption scheduled for 2024 and subsequent phased reductions.

Building codes and standards represent another critical regulatory dimension. The International Building Code (IBC) and regional variants like Eurocodes incorporate requirements for insulation materials that indirectly impact blowing agent selection. These codes increasingly emphasize both energy efficiency and environmental impact metrics.

Industry certification programs such as LEED, BREEAM, and Passive House have established voluntary standards that reward the use of insulation materials with lower environmental impacts, including those manufactured with low-GWP blowing agents. These certification systems often provide points or credits for using materials with reduced global warming potential.

Compliance timelines create significant challenges for manufacturers. The staggered implementation of regulations across different regions necessitates careful product portfolio management and regional adaptation strategies. Many manufacturers must simultaneously maintain multiple formulations to meet varying regional requirements during transition periods.

Emerging regulatory trends indicate continued tightening of GWP thresholds globally. The Kigali Amendment to the Montreal Protocol, which entered into force in 2019, establishes a global framework for phasing down HFCs, potentially affecting over 80% of blowing agent applications in building insulation over the next decade.

In the European Union, the F-Gas Regulation (EU No 517/2014) has established a comprehensive framework for reducing emissions of fluorinated greenhouse gases, including hydrofluorocarbons (HFCs) commonly used as blowing agents. This regulation mandates a 79% reduction in HFC consumption by 2030 compared to 2015 levels, creating urgent market pressure for low-GWP alternatives.

The United States regulatory approach includes the Significant New Alternatives Policy (SNAP) program administered by the Environmental Protection Agency, which evaluates and regulates substitutes for ozone-depleting substances. Recent SNAP rules have delisted high-GWP HFCs for various foam applications, though legal challenges have complicated implementation timelines.

In Asia, regulatory frameworks vary significantly by country. Japan has implemented the Act on Rational Use and Proper Management of Fluorocarbons, while China has committed to HFC reduction under the Kigali Amendment to the Montreal Protocol, with a freeze of HFC consumption scheduled for 2024 and subsequent phased reductions.

Building codes and standards represent another critical regulatory dimension. The International Building Code (IBC) and regional variants like Eurocodes incorporate requirements for insulation materials that indirectly impact blowing agent selection. These codes increasingly emphasize both energy efficiency and environmental impact metrics.

Industry certification programs such as LEED, BREEAM, and Passive House have established voluntary standards that reward the use of insulation materials with lower environmental impacts, including those manufactured with low-GWP blowing agents. These certification systems often provide points or credits for using materials with reduced global warming potential.

Compliance timelines create significant challenges for manufacturers. The staggered implementation of regulations across different regions necessitates careful product portfolio management and regional adaptation strategies. Many manufacturers must simultaneously maintain multiple formulations to meet varying regional requirements during transition periods.

Emerging regulatory trends indicate continued tightening of GWP thresholds globally. The Kigali Amendment to the Montreal Protocol, which entered into force in 2019, establishes a global framework for phasing down HFCs, potentially affecting over 80% of blowing agent applications in building insulation over the next decade.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!