Low-GWP Blowing Agents for Sustainable Construction Materials

OCT 13, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Low-GWP Blowing Agents Background and Objectives

Blowing agents have been integral to the construction materials industry for decades, primarily used in the production of insulation foams that enhance energy efficiency in buildings. Historically, the evolution of these agents has been marked by significant transitions driven by environmental concerns. The first generation of blowing agents, chlorofluorocarbons (CFCs), were phased out in the 1990s due to their ozone-depleting properties following the Montreal Protocol. Subsequently, hydrochlorofluorocarbons (HCFCs) emerged as alternatives but were later recognized for their contribution to global warming.

The current technological landscape is dominated by hydrofluorocarbons (HFCs), which, while not ozone-depleting, possess high Global Warming Potential (GWP) values. HFC-134a, for instance, has a GWP of 1,430 times that of carbon dioxide over a 100-year period. This has prompted global initiatives such as the Kigali Amendment to the Montreal Protocol, which mandates the gradual reduction of HFCs by more than 80% over the next 30 years.

The construction sector accounts for approximately 40% of global energy consumption and 30% of greenhouse gas emissions, with insulation materials playing a crucial role in reducing building energy demands. The imperative to develop low-GWP blowing agents stems from this significant environmental footprint and aligns with broader sustainability goals in the construction industry.

Recent technological trends indicate a shift towards hydrofluoroolefins (HFOs), hydrocarbons, CO2, water-based systems, and methyl formate as promising low-GWP alternatives. These substances offer GWP values below 10, representing a dramatic improvement over conventional HFCs. However, each alternative presents unique challenges related to flammability, thermal efficiency, processing requirements, and cost-effectiveness.

The primary objective of research in this field is to develop blowing agents that combine minimal environmental impact with optimal technical performance. This includes achieving thermal insulation properties comparable to or better than current standards, ensuring compatibility with existing manufacturing processes, maintaining long-term stability, and meeting stringent safety requirements.

Additional goals include reducing the embodied carbon of construction materials, enhancing the recyclability of insulation products, and developing cost-effective solutions that can be widely adopted across different market segments. The research also aims to anticipate and address regulatory changes, as environmental policies worldwide increasingly favor low-GWP technologies.

The trajectory of this technological evolution suggests a future where blowing agents not only minimize direct climate impact through low GWP values but also contribute to broader sustainability objectives through improved energy efficiency, reduced material consumption, and enhanced end-of-life management of construction materials.

The current technological landscape is dominated by hydrofluorocarbons (HFCs), which, while not ozone-depleting, possess high Global Warming Potential (GWP) values. HFC-134a, for instance, has a GWP of 1,430 times that of carbon dioxide over a 100-year period. This has prompted global initiatives such as the Kigali Amendment to the Montreal Protocol, which mandates the gradual reduction of HFCs by more than 80% over the next 30 years.

The construction sector accounts for approximately 40% of global energy consumption and 30% of greenhouse gas emissions, with insulation materials playing a crucial role in reducing building energy demands. The imperative to develop low-GWP blowing agents stems from this significant environmental footprint and aligns with broader sustainability goals in the construction industry.

Recent technological trends indicate a shift towards hydrofluoroolefins (HFOs), hydrocarbons, CO2, water-based systems, and methyl formate as promising low-GWP alternatives. These substances offer GWP values below 10, representing a dramatic improvement over conventional HFCs. However, each alternative presents unique challenges related to flammability, thermal efficiency, processing requirements, and cost-effectiveness.

The primary objective of research in this field is to develop blowing agents that combine minimal environmental impact with optimal technical performance. This includes achieving thermal insulation properties comparable to or better than current standards, ensuring compatibility with existing manufacturing processes, maintaining long-term stability, and meeting stringent safety requirements.

Additional goals include reducing the embodied carbon of construction materials, enhancing the recyclability of insulation products, and developing cost-effective solutions that can be widely adopted across different market segments. The research also aims to anticipate and address regulatory changes, as environmental policies worldwide increasingly favor low-GWP technologies.

The trajectory of this technological evolution suggests a future where blowing agents not only minimize direct climate impact through low GWP values but also contribute to broader sustainability objectives through improved energy efficiency, reduced material consumption, and enhanced end-of-life management of construction materials.

Market Demand Analysis for Sustainable Construction Materials

The global market for sustainable construction materials is experiencing unprecedented growth, driven by increasing environmental awareness and stringent regulations targeting greenhouse gas emissions. The construction industry, responsible for approximately 39% of global carbon emissions, faces mounting pressure to adopt eco-friendly practices and materials. Within this context, low-GWP (Global Warming Potential) blowing agents for insulation materials represent a critical segment with substantial market potential.

Recent market research indicates that the sustainable construction materials market is projected to reach $573 billion by 2027, growing at a CAGR of 11.4% from 2022. Specifically, the market for thermal insulation materials, where blowing agents play a crucial role, is expected to expand significantly due to energy efficiency requirements in both new construction and retrofitting projects.

Regulatory frameworks worldwide are accelerating this market transformation. The Kigali Amendment to the Montreal Protocol mandates the phase-down of hydrofluorocarbons (HFCs), traditional blowing agents with high GWP values. Similarly, the European Union's F-Gas Regulation and various national policies in North America and Asia-Pacific regions are creating immediate demand for low-GWP alternatives.

Consumer preferences are also shifting decisively toward sustainable building solutions. A 2023 industry survey revealed that 78% of commercial building owners and 65% of residential developers prioritize environmental certifications such as LEED, BREEAM, and Green Star, which award points for using materials with reduced environmental impact, including those manufactured with low-GWP blowing agents.

The economic benefits of energy-efficient buildings further drive market demand. Buildings utilizing advanced insulation materials produced with low-GWP blowing agents demonstrate energy savings of 20-30% compared to conventional constructions. This translates to substantial operational cost reductions over building lifespans, creating a compelling value proposition despite potentially higher initial investment.

Regional market analysis shows varying adoption rates. Europe leads in market maturity for sustainable construction materials, followed by North America. However, the Asia-Pacific region, particularly China and India, represents the fastest-growing market segment due to rapid urbanization, increasing environmental awareness, and government initiatives promoting green building practices.

Industry stakeholders across the value chain—from chemical manufacturers to construction companies—are recognizing this market shift. Major chemical companies are investing heavily in R&D for next-generation blowing agents, while construction material manufacturers are reformulating products to accommodate these new technologies, indicating strong confidence in sustained market growth for low-GWP solutions in construction applications.

Recent market research indicates that the sustainable construction materials market is projected to reach $573 billion by 2027, growing at a CAGR of 11.4% from 2022. Specifically, the market for thermal insulation materials, where blowing agents play a crucial role, is expected to expand significantly due to energy efficiency requirements in both new construction and retrofitting projects.

Regulatory frameworks worldwide are accelerating this market transformation. The Kigali Amendment to the Montreal Protocol mandates the phase-down of hydrofluorocarbons (HFCs), traditional blowing agents with high GWP values. Similarly, the European Union's F-Gas Regulation and various national policies in North America and Asia-Pacific regions are creating immediate demand for low-GWP alternatives.

Consumer preferences are also shifting decisively toward sustainable building solutions. A 2023 industry survey revealed that 78% of commercial building owners and 65% of residential developers prioritize environmental certifications such as LEED, BREEAM, and Green Star, which award points for using materials with reduced environmental impact, including those manufactured with low-GWP blowing agents.

The economic benefits of energy-efficient buildings further drive market demand. Buildings utilizing advanced insulation materials produced with low-GWP blowing agents demonstrate energy savings of 20-30% compared to conventional constructions. This translates to substantial operational cost reductions over building lifespans, creating a compelling value proposition despite potentially higher initial investment.

Regional market analysis shows varying adoption rates. Europe leads in market maturity for sustainable construction materials, followed by North America. However, the Asia-Pacific region, particularly China and India, represents the fastest-growing market segment due to rapid urbanization, increasing environmental awareness, and government initiatives promoting green building practices.

Industry stakeholders across the value chain—from chemical manufacturers to construction companies—are recognizing this market shift. Major chemical companies are investing heavily in R&D for next-generation blowing agents, while construction material manufacturers are reformulating products to accommodate these new technologies, indicating strong confidence in sustained market growth for low-GWP solutions in construction applications.

Current Status and Challenges in Low-GWP Blowing Agent Technology

The global landscape of blowing agent technology has undergone significant transformation in recent years, primarily driven by environmental regulations targeting high Global Warming Potential (GWP) substances. Currently, the industry is in a transitional phase, moving away from hydrofluorocarbons (HFCs) with GWPs ranging from 700 to 3,800 toward more sustainable alternatives. The Montreal Protocol's Kigali Amendment, implemented in 2019, has accelerated this shift by mandating an 85% reduction in HFC consumption by 2036 in developed countries.

Domestically and internationally, research institutions and manufacturers have made substantial progress in developing low-GWP alternatives. Hydrofluoroolefins (HFOs), particularly HFO-1234ze and HFO-1336mzz, have emerged as promising candidates with GWPs below 10. However, their widespread adoption faces challenges related to cost-effectiveness, with prices typically 3-5 times higher than traditional blowing agents.

Technical challenges persist in formulation stability and compatibility with existing manufacturing processes. Low-GWP alternatives often exhibit different solubility parameters and reaction kinetics compared to their high-GWP predecessors, necessitating significant reformulation efforts. Manufacturers report increased curing times and inconsistent cell structures when implementing direct substitutions without process modifications.

Performance trade-offs represent another significant hurdle. Many low-GWP alternatives demonstrate reduced thermal insulation properties, with thermal conductivity increases of 5-15% compared to HFC-based systems. This performance gap is particularly problematic for construction applications where energy efficiency standards continue to become more stringent.

Geographically, technology development shows distinct regional patterns. European countries lead in regulatory implementation and commercial adoption of low-GWP solutions, with approximately 65% market penetration in new construction materials. North America follows with roughly 40% adoption, while developing markets in Asia and Africa remain predominantly reliant on transitional technologies with moderate GWP values.

Safety considerations introduce additional complexity, as some promising low-GWP alternatives exhibit mild flammability (ASHRAE A2L classification) compared to the non-flammable profile of traditional HFCs. This characteristic necessitates modifications to manufacturing facilities and handling protocols, creating barriers to adoption particularly for smaller manufacturers with limited capital resources.

The supply chain for next-generation blowing agents remains underdeveloped, with production capacity meeting only about 60% of potential global demand. This limitation has created market uncertainty and price volatility, complicating long-term planning for construction material manufacturers seeking to transition their product lines to more sustainable formulations.

Domestically and internationally, research institutions and manufacturers have made substantial progress in developing low-GWP alternatives. Hydrofluoroolefins (HFOs), particularly HFO-1234ze and HFO-1336mzz, have emerged as promising candidates with GWPs below 10. However, their widespread adoption faces challenges related to cost-effectiveness, with prices typically 3-5 times higher than traditional blowing agents.

Technical challenges persist in formulation stability and compatibility with existing manufacturing processes. Low-GWP alternatives often exhibit different solubility parameters and reaction kinetics compared to their high-GWP predecessors, necessitating significant reformulation efforts. Manufacturers report increased curing times and inconsistent cell structures when implementing direct substitutions without process modifications.

Performance trade-offs represent another significant hurdle. Many low-GWP alternatives demonstrate reduced thermal insulation properties, with thermal conductivity increases of 5-15% compared to HFC-based systems. This performance gap is particularly problematic for construction applications where energy efficiency standards continue to become more stringent.

Geographically, technology development shows distinct regional patterns. European countries lead in regulatory implementation and commercial adoption of low-GWP solutions, with approximately 65% market penetration in new construction materials. North America follows with roughly 40% adoption, while developing markets in Asia and Africa remain predominantly reliant on transitional technologies with moderate GWP values.

Safety considerations introduce additional complexity, as some promising low-GWP alternatives exhibit mild flammability (ASHRAE A2L classification) compared to the non-flammable profile of traditional HFCs. This characteristic necessitates modifications to manufacturing facilities and handling protocols, creating barriers to adoption particularly for smaller manufacturers with limited capital resources.

The supply chain for next-generation blowing agents remains underdeveloped, with production capacity meeting only about 60% of potential global demand. This limitation has created market uncertainty and price volatility, complicating long-term planning for construction material manufacturers seeking to transition their product lines to more sustainable formulations.

Current Low-GWP Blowing Agent Solutions

01 Hydrofluoroolefin (HFO) based blowing agents

Hydrofluoroolefins (HFOs) represent a significant advancement in low-GWP blowing agent technology. These compounds maintain excellent thermal insulation properties while dramatically reducing global warming potential compared to traditional HFCs. HFOs feature unsaturated carbon-carbon bonds that make them more reactive in the atmosphere, resulting in shorter atmospheric lifetimes and consequently lower GWP values. Common HFO blowing agents include HFO-1234ze, HFO-1234yf, and HFO-1336mzz, which offer GWP values typically below 10, making them environmentally preferable alternatives for foam insulation applications.- Hydrofluoroolefin (HFO) based blowing agents: Hydrofluoroolefins (HFOs) represent a significant advancement in low-GWP blowing agent technology. These compounds maintain excellent insulating properties while dramatically reducing global warming potential compared to traditional HFCs. HFOs feature carbon-carbon double bonds that make them more reactive in the atmosphere, resulting in shorter atmospheric lifetimes and consequently lower GWP values. These agents are particularly suitable for polyurethane foam applications and can be used either alone or in blends to optimize performance characteristics.

- Hydrocarbon-based blowing agents: Hydrocarbon-based blowing agents such as pentane, cyclopentane, and isopentane offer significantly lower GWP values compared to traditional fluorocarbon blowing agents. These compounds contain no halogens, resulting in minimal ozone depletion potential and very low global warming impact. While highly effective as blowing agents for various foam applications, their flammability presents certain manufacturing challenges that require specialized equipment and safety measures. Manufacturers have developed optimized formulations and processing techniques to safely harness the environmental benefits of these agents.

- CO2 and water-based blowing systems: Carbon dioxide and water-based blowing systems represent some of the lowest possible GWP options available. In these systems, CO2 is either directly used as a physical blowing agent or generated through chemical reactions (as in the case of water reacting with isocyanates in polyurethane foam production). These systems have near-zero GWP impact and no ozone depletion potential. While they may present challenges regarding insulation efficiency compared to some synthetic blowing agents, technological advancements have improved their performance characteristics through optimized formulations and processing techniques.

- Blended blowing agent systems: Blended blowing agent systems combine multiple low-GWP compounds to achieve optimal performance characteristics while maintaining reduced environmental impact. These blends typically incorporate combinations of HFOs, hydrocarbons, HFCs (in reduced quantities), and sometimes CO2 to balance factors such as insulation performance, dimensional stability, and environmental impact. The synergistic effects of these blends allow manufacturers to fine-tune properties while meeting increasingly stringent environmental regulations. Careful formulation of these blends enables optimization of thermal efficiency, cell structure, and overall foam quality.

- Regulatory frameworks and GWP measurement standards: Regulatory frameworks and standardized methods for measuring and reporting global warming potential have become increasingly important in the development of low-GWP blowing agents. These frameworks establish consistent metrics for evaluating environmental impact and guide industry transition away from high-GWP substances. Testing protocols ensure accurate assessment of a blowing agent's atmospheric lifetime and radiative forcing potential, which together determine its GWP value. International agreements and regional regulations have established phase-down schedules for high-GWP substances, driving innovation in the development of environmentally preferable alternatives that maintain necessary performance characteristics.

02 Hydrocarbon-based blowing agents

Hydrocarbon-based blowing agents such as pentane, cyclopentane, and isopentane offer extremely low global warming potential values, often less than 20. These compounds are particularly effective in polyurethane and polystyrene foam applications, providing good thermal insulation properties while minimizing environmental impact. Despite their flammability concerns, which require specific safety measures during manufacturing, hydrocarbon blowing agents have gained significant market share due to their cost-effectiveness and minimal environmental footprint. Their implementation often requires process modifications and specialized equipment to address safety considerations.Expand Specific Solutions03 CO2/water-based blowing systems

Carbon dioxide and water-based blowing systems represent one of the most environmentally friendly approaches to foam production with minimal global warming impact. In these systems, water reacts with isocyanates to generate carbon dioxide in-situ, which serves as the primary blowing agent. While CO2 is technically a greenhouse gas, its use as a blowing agent represents a closed carbon loop when derived from industrial processes, resulting in negligible additional climate impact. These systems are particularly valuable in applications where thermal insulation requirements are moderate and where regulatory pressures against higher-GWP alternatives are strongest.Expand Specific Solutions04 Blends and co-blowing agent systems

Blended blowing agent systems combine multiple low-GWP compounds to achieve optimal performance characteristics while maintaining reduced environmental impact. These formulations typically incorporate combinations of HFOs, hydrocarbons, CO2, and other low-GWP agents to balance factors such as insulation value, dimensional stability, and processing parameters. By carefully engineering these blends, manufacturers can achieve the specific physical properties required for different applications while meeting increasingly stringent environmental regulations. This approach allows for customization of foam properties while maintaining GWP values significantly lower than traditional blowing agents.Expand Specific Solutions05 Methyl formate and other oxygenated hydrocarbon alternatives

Methyl formate and other oxygenated hydrocarbons represent an emerging class of low-GWP blowing agents that offer unique advantages in specific foam applications. These compounds feature oxygen atoms within their molecular structure, which reduces flammability concerns compared to pure hydrocarbons while maintaining very low global warming potential values. Methyl formate in particular has gained attention for its GWP value near zero and its effectiveness in polyurethane foam systems. Other oxygenated alternatives include methylal and certain acetates, which provide formulators with additional options for balancing performance requirements with environmental considerations.Expand Specific Solutions

Key Industry Players in Sustainable Construction Materials

The low-GWP blowing agents market for sustainable construction materials is in a growth phase, with increasing regulatory pressure driving innovation. The market is expanding rapidly as construction industries worldwide shift toward environmentally friendly alternatives, estimated to reach several billion dollars by 2030. Leading chemical companies including Arkema, The Chemours Co., DuPont, and Honeywell International Technologies are at the forefront of technological development, with varying degrees of commercial readiness. Wanhua Chemical Group and Dow Global Technologies are advancing proprietary formulations, while academic institutions like Shandong University of Technology contribute to fundamental research. The technology maturity ranges from commercially available HFO-based solutions to experimental bio-based alternatives still in development stages.

The Chemours Co.

Technical Solution: Chemours has developed Opteon™ 1100, a hydrofluoroolefin (HFO) blowing agent with a GWP of less than 2, specifically engineered for rigid polyurethane foam insulation in construction applications. Their technology incorporates proprietary stabilizers that address the unique solubility characteristics of HFOs in polyol systems. Chemours' innovation includes specialized formulation techniques that optimize the cell structure when using Opteon™ blowing agents, achieving thermal conductivity values as low as 0.019 W/m·K in rigid foam applications. Their research has demonstrated that their HFO-based systems can maintain dimensional stability even under challenging temperature and humidity conditions, addressing a key concern for construction materials. Chemours has also pioneered blends of HFOs with other low-GWP components to optimize cost-performance ratios while maintaining regulatory compliance across global markets. Their life cycle analysis shows that buildings insulated with Opteon™-based foams can reduce carbon emissions by up to 25% compared to traditional HFC-based insulation over a 50-year building lifespan.

Strengths: Strong fluorochemistry expertise; extensive testing capabilities; global regulatory compliance knowledge. Weaknesses: Higher cost structure compared to hydrocarbon alternatives; requires modifications to existing manufacturing equipment; limited performance in some high-humidity applications.

Owens Corning Intellectual Capital LLC

Technical Solution: Owens Corning has developed FOAMULAR® NGX™ (Next Generation Extruded) polystyrene foam insulation utilizing proprietary low-GWP blowing agent technology. Their innovation focuses on optimizing the extrusion process for alternative blowing agents, achieving a 90% reduction in GWP compared to traditional XPS products. Their technology incorporates specialized nucleating agents and process modifications that maintain the closed-cell structure critical for moisture resistance and long-term R-value retention. Owens Corning's research has demonstrated that their NGX™ technology can achieve thermal resistance values of R-5 per inch while meeting increasingly stringent environmental regulations. Their approach includes proprietary additive packages that enhance the solubility and distribution of low-GWP agents throughout the polymer matrix, ensuring consistent cell structure and dimensional stability. Additionally, they've developed specialized manufacturing techniques that optimize the processing window for these more challenging blowing agents, maintaining production efficiency while reducing environmental impact.

Strengths: Extensive experience in foam insulation manufacturing; strong integration with construction industry; comprehensive testing facilities for long-term performance validation. Weaknesses: Technology primarily focused on polystyrene rather than polyurethane applications; higher manufacturing complexity compared to traditional systems; requires specialized equipment modifications.

Critical Patents and Technical Innovations in Low-GWP Agents

Low-GWP blowing agent blends and uses thereof

PatentWO2025096186A1

Innovation

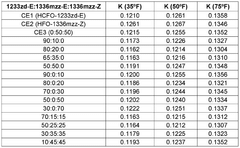

- The use of blends comprising E-1-chloro-3,3,3-trifluoropropene (HCFO-1233zd-E) combined with either E-1,1,1,4,4,4-hexafluoro-2-butene (HFO-1336mzz-E) or Z-1,1,1,4,4,4-hexafluoro-2-butene (HFO-1336mzz-Z) as blowing agents for polyurethane foam formulations, which results in high-quality foams with improved thermal insulation and reduced environmental impact.

Blowing agent compositions of hydrofluoroolefins and hydrochlorofluoroolefins

PatentActiveEP2129711A1

Innovation

- The use of blowing agent compositions comprising hydrofluoroolefins (HFOs) and hydrochlorofluoroolefins (HCFOs), specifically combinations like 3,3,3-trifluoropropene (HFO-1243zf), (cis/trans)-1,3,3,3-tetrafluoropropene (HFO-1234ze), and (cis/trans)-1-chloro-3,3,3-trifluoropropene (HCFO-1233zd), which are blended with foamable polymer resins to produce foams with reduced density and enhanced k-factor for thermal insulation.

Environmental Regulations and Policy Impacts

The global regulatory landscape for blowing agents has undergone significant transformation in recent decades, primarily driven by environmental concerns related to ozone depletion and global warming. The Montreal Protocol of 1987 marked the first major international agreement targeting the phase-out of ozone-depleting substances, including chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs) commonly used as blowing agents in construction materials. This agreement has been amended multiple times, most notably by the Kigali Amendment in 2016, which expanded its scope to include hydrofluorocarbons (HFCs) with high global warming potential (GWP).

In the European Union, Regulation (EU) No 517/2014 (F-gas Regulation) has established a comprehensive framework for reducing emissions of fluorinated greenhouse gases, including those used as blowing agents. This regulation mandates a gradual phase-down of HFCs by 79% by 2030 compared to 2015 levels, creating strong market pressure for low-GWP alternatives in construction materials. Similarly, the United States has implemented significant policy changes through the American Innovation and Manufacturing (AIM) Act of 2020, which authorizes the Environmental Protection Agency to phase down HFC production and consumption by 85% over 15 years.

Regional variations in regulatory approaches create complex compliance challenges for global manufacturers of construction materials. Japan's Act on Rational Use and Proper Management of Fluorocarbons and China's HCFC Phase-out Management Plan represent different implementation timelines and technical requirements that companies must navigate. These regulatory differences can create market fragmentation and increase compliance costs for multinational corporations.

Financial incentives and market-based mechanisms have emerged as complementary policy tools to direct regulation. Carbon pricing schemes, tax incentives for sustainable building materials, and green building certification programs like LEED and BREEAM have created economic advantages for construction materials utilizing low-GWP blowing agents. These market signals have accelerated research and development investments in sustainable alternatives.

The regulatory landscape continues to evolve, with increasing focus on life-cycle assessment approaches that consider the total environmental impact of construction materials beyond just the GWP of blowing agents. Future policy developments are likely to emphasize circular economy principles, encouraging not only low-GWP blowing agents but also improved end-of-life management and recyclability of insulation materials. This holistic regulatory approach will require manufacturers to consider environmental impacts across the entire product lifecycle, from raw material extraction to disposal or reuse.

In the European Union, Regulation (EU) No 517/2014 (F-gas Regulation) has established a comprehensive framework for reducing emissions of fluorinated greenhouse gases, including those used as blowing agents. This regulation mandates a gradual phase-down of HFCs by 79% by 2030 compared to 2015 levels, creating strong market pressure for low-GWP alternatives in construction materials. Similarly, the United States has implemented significant policy changes through the American Innovation and Manufacturing (AIM) Act of 2020, which authorizes the Environmental Protection Agency to phase down HFC production and consumption by 85% over 15 years.

Regional variations in regulatory approaches create complex compliance challenges for global manufacturers of construction materials. Japan's Act on Rational Use and Proper Management of Fluorocarbons and China's HCFC Phase-out Management Plan represent different implementation timelines and technical requirements that companies must navigate. These regulatory differences can create market fragmentation and increase compliance costs for multinational corporations.

Financial incentives and market-based mechanisms have emerged as complementary policy tools to direct regulation. Carbon pricing schemes, tax incentives for sustainable building materials, and green building certification programs like LEED and BREEAM have created economic advantages for construction materials utilizing low-GWP blowing agents. These market signals have accelerated research and development investments in sustainable alternatives.

The regulatory landscape continues to evolve, with increasing focus on life-cycle assessment approaches that consider the total environmental impact of construction materials beyond just the GWP of blowing agents. Future policy developments are likely to emphasize circular economy principles, encouraging not only low-GWP blowing agents but also improved end-of-life management and recyclability of insulation materials. This holistic regulatory approach will require manufacturers to consider environmental impacts across the entire product lifecycle, from raw material extraction to disposal or reuse.

Life Cycle Assessment of Low-GWP Blowing Agents

Life Cycle Assessment (LCA) of low-GWP blowing agents represents a critical analytical framework for evaluating the comprehensive environmental impacts of these substances throughout their entire existence. The assessment typically encompasses four distinct phases: raw material extraction, manufacturing processes, usage period, and end-of-life disposal or recycling. For construction materials utilizing blowing agents, this evaluation becomes particularly significant due to their prolonged service life and substantial environmental footprint.

Recent LCA studies have demonstrated that traditional high-GWP blowing agents like HFCs contribute significantly to climate change impacts during their lifecycle, with emissions occurring primarily during manufacturing and gradual leakage during product use. In contrast, emerging low-GWP alternatives such as hydrofluoroolefins (HFOs), hydrocarbon-based agents, and CO2-based systems show markedly reduced climate impacts, often by 90-99% compared to their predecessors.

The manufacturing phase analysis reveals that while some low-GWP alternatives may require more energy-intensive production processes, this initial environmental debt is typically offset by their superior performance during the use phase. For instance, HFO-1234ze requires approximately 15-20% more energy to produce than HFC-134a but delivers a GWP reduction of over 99%, resulting in a net positive environmental outcome over the complete lifecycle.

Use-phase assessment demonstrates that low-GWP blowing agents in construction materials deliver comparable or superior thermal insulation properties, maintaining energy efficiency benefits while drastically reducing potential greenhouse gas emissions from leakage. This dual benefit significantly enhances their lifecycle performance profile compared to conventional alternatives.

End-of-life considerations reveal varying challenges among different low-GWP options. Hydrocarbon-based agents present fewer disposal concerns but require careful handling due to flammability issues. HFOs decompose more rapidly in the atmosphere but may produce trifluoroacetic acid (TFA) as a breakdown product, necessitating further environmental monitoring. CO2-based systems offer the simplest end-of-life profile but may present manufacturing and performance challenges.

Comparative LCA studies indicate that the selection of optimal low-GWP blowing agents should be application-specific, considering factors beyond just GWP values. For rigid polyurethane insulation in buildings, HFO-1233zd has demonstrated the most favorable overall environmental profile when considering energy efficiency, durability, and end-of-life scenarios. For spray foam applications, water-blown systems show promising results despite slightly lower initial insulation values.

Economic considerations within LCA frameworks suggest that while low-GWP alternatives currently carry premium costs, their price differential is narrowing as production scales increase and regulatory pressures on high-GWP substances intensify. This economic trajectory supports the transition toward these more sustainable alternatives across the construction materials sector.

Recent LCA studies have demonstrated that traditional high-GWP blowing agents like HFCs contribute significantly to climate change impacts during their lifecycle, with emissions occurring primarily during manufacturing and gradual leakage during product use. In contrast, emerging low-GWP alternatives such as hydrofluoroolefins (HFOs), hydrocarbon-based agents, and CO2-based systems show markedly reduced climate impacts, often by 90-99% compared to their predecessors.

The manufacturing phase analysis reveals that while some low-GWP alternatives may require more energy-intensive production processes, this initial environmental debt is typically offset by their superior performance during the use phase. For instance, HFO-1234ze requires approximately 15-20% more energy to produce than HFC-134a but delivers a GWP reduction of over 99%, resulting in a net positive environmental outcome over the complete lifecycle.

Use-phase assessment demonstrates that low-GWP blowing agents in construction materials deliver comparable or superior thermal insulation properties, maintaining energy efficiency benefits while drastically reducing potential greenhouse gas emissions from leakage. This dual benefit significantly enhances their lifecycle performance profile compared to conventional alternatives.

End-of-life considerations reveal varying challenges among different low-GWP options. Hydrocarbon-based agents present fewer disposal concerns but require careful handling due to flammability issues. HFOs decompose more rapidly in the atmosphere but may produce trifluoroacetic acid (TFA) as a breakdown product, necessitating further environmental monitoring. CO2-based systems offer the simplest end-of-life profile but may present manufacturing and performance challenges.

Comparative LCA studies indicate that the selection of optimal low-GWP blowing agents should be application-specific, considering factors beyond just GWP values. For rigid polyurethane insulation in buildings, HFO-1233zd has demonstrated the most favorable overall environmental profile when considering energy efficiency, durability, and end-of-life scenarios. For spray foam applications, water-blown systems show promising results despite slightly lower initial insulation values.

Economic considerations within LCA frameworks suggest that while low-GWP alternatives currently carry premium costs, their price differential is narrowing as production scales increase and regulatory pressures on high-GWP substances intensify. This economic trajectory supports the transition toward these more sustainable alternatives across the construction materials sector.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!