Low-GWP Blowing Agents for High-Performance Insulating Panels

OCT 13, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Low-GWP Blowing Agents Background and Objectives

Insulation materials play a crucial role in energy conservation across various sectors including construction, refrigeration, and transportation. Historically, the evolution of blowing agents for insulation panels has been driven by both technological advancements and environmental regulations. From the 1950s to the 1980s, chlorofluorocarbons (CFCs) dominated the market due to their excellent thermal insulation properties. However, the discovery of their ozone-depleting potential led to their phase-out under the Montreal Protocol in 1987.

Subsequently, hydrochlorofluorocarbons (HCFCs) and hydrofluorocarbons (HFCs) emerged as alternatives. While these compounds addressed ozone depletion concerns, they presented another environmental challenge: high Global Warming Potential (GWP). HFCs, in particular, can have GWP values thousands of times greater than carbon dioxide, contributing significantly to climate change when released into the atmosphere.

The Kigali Amendment to the Montreal Protocol in 2016 established a timeline for the reduction of HFCs, creating urgent market pressure for the development of low-GWP alternatives. This regulatory landscape has accelerated research into next-generation blowing agents that can maintain or improve insulation performance while minimizing environmental impact.

Current technological trends are moving toward hydrofluoroolefins (HFOs), hydrocarbon-based agents, CO2-based systems, and water-blown technologies. Each of these alternatives presents unique advantages and challenges in terms of thermal conductivity, flammability, cost, and processing requirements. The industry is particularly focused on achieving a balance between environmental sustainability and insulation performance.

The primary objective of this research is to identify and evaluate low-GWP blowing agents suitable for high-performance insulating panels. Specifically, we aim to investigate blowing agents with GWP values below 10, while maintaining or improving the thermal resistance (R-value) of current insulation systems. Additionally, the research seeks to address challenges related to cell structure optimization, long-term thermal performance stability, and manufacturing process compatibility.

Secondary objectives include assessing the economic feasibility of transitioning to these alternative blowing agents, analyzing their life-cycle environmental impact, and developing predictive models for long-term insulation performance. The research also aims to establish testing protocols for evaluating new blowing agent formulations under various environmental conditions and application scenarios.

By achieving these objectives, this research will contribute to the development of insulation technologies that align with global climate goals while meeting the increasing demand for energy-efficient building and industrial systems. The findings will provide valuable insights for manufacturers, policy makers, and researchers working toward sustainable thermal insulation solutions.

Subsequently, hydrochlorofluorocarbons (HCFCs) and hydrofluorocarbons (HFCs) emerged as alternatives. While these compounds addressed ozone depletion concerns, they presented another environmental challenge: high Global Warming Potential (GWP). HFCs, in particular, can have GWP values thousands of times greater than carbon dioxide, contributing significantly to climate change when released into the atmosphere.

The Kigali Amendment to the Montreal Protocol in 2016 established a timeline for the reduction of HFCs, creating urgent market pressure for the development of low-GWP alternatives. This regulatory landscape has accelerated research into next-generation blowing agents that can maintain or improve insulation performance while minimizing environmental impact.

Current technological trends are moving toward hydrofluoroolefins (HFOs), hydrocarbon-based agents, CO2-based systems, and water-blown technologies. Each of these alternatives presents unique advantages and challenges in terms of thermal conductivity, flammability, cost, and processing requirements. The industry is particularly focused on achieving a balance between environmental sustainability and insulation performance.

The primary objective of this research is to identify and evaluate low-GWP blowing agents suitable for high-performance insulating panels. Specifically, we aim to investigate blowing agents with GWP values below 10, while maintaining or improving the thermal resistance (R-value) of current insulation systems. Additionally, the research seeks to address challenges related to cell structure optimization, long-term thermal performance stability, and manufacturing process compatibility.

Secondary objectives include assessing the economic feasibility of transitioning to these alternative blowing agents, analyzing their life-cycle environmental impact, and developing predictive models for long-term insulation performance. The research also aims to establish testing protocols for evaluating new blowing agent formulations under various environmental conditions and application scenarios.

By achieving these objectives, this research will contribute to the development of insulation technologies that align with global climate goals while meeting the increasing demand for energy-efficient building and industrial systems. The findings will provide valuable insights for manufacturers, policy makers, and researchers working toward sustainable thermal insulation solutions.

Market Demand Analysis for Sustainable Insulation Solutions

The global insulation market is experiencing a significant shift towards sustainable solutions, driven by stringent environmental regulations and increasing awareness of climate change impacts. The demand for high-performance insulating panels with low Global Warming Potential (GWP) blowing agents has grown substantially, with the market value projected to reach $38 billion by 2027, representing a compound annual growth rate of 4.5% from 2022.

Building energy efficiency standards worldwide are becoming increasingly stringent, with the European Union's Energy Performance of Buildings Directive requiring all new buildings to be nearly zero-energy by 2030. Similarly, North America and Asia-Pacific regions are implementing more demanding thermal performance requirements, creating substantial market opportunities for advanced insulation technologies.

Consumer preferences are evolving rapidly, with sustainability becoming a key purchasing factor. A recent industry survey revealed that 67% of commercial building developers now prioritize environmentally friendly insulation materials, up from 42% five years ago. This shift is particularly pronounced in developed markets where green building certifications like LEED and BREEAM have gained significant traction.

The replacement of high-GWP hydrofluorocarbons (HFCs) in insulation materials represents a market opportunity valued at approximately $5.2 billion annually. This transition is accelerated by the Kigali Amendment to the Montreal Protocol, which mandates the phase-down of HFCs, creating immediate demand for alternative blowing agents in insulation manufacturing.

Industrial sectors, particularly cold chain logistics and refrigeration, demonstrate robust demand growth for sustainable insulation solutions. With global cold chain market expansion at 8.2% annually, the need for high-performance insulation with minimal environmental impact has become critical for maintaining temperature integrity while meeting corporate sustainability goals.

Cost considerations remain significant, with market research indicating that consumers are willing to pay a premium of 12-18% for insulation products with superior environmental credentials, provided they deliver comparable or better thermal performance. This price sensitivity varies by region, with European markets showing the highest willingness to pay for sustainable alternatives.

The retrofit and renovation segment presents substantial opportunities, particularly in mature economies with aging building stock. In the United States alone, approximately 75% of commercial buildings were constructed before modern energy codes were implemented, creating a vast potential market for insulation upgrades using sustainable materials.

Market penetration of low-GWP insulation solutions varies significantly by region, with adoption rates of 58% in Western Europe, 37% in North America, and 22% in developing Asian markets. This regional disparity highlights both challenges and opportunities for technology deployment across different regulatory environments and economic contexts.

Building energy efficiency standards worldwide are becoming increasingly stringent, with the European Union's Energy Performance of Buildings Directive requiring all new buildings to be nearly zero-energy by 2030. Similarly, North America and Asia-Pacific regions are implementing more demanding thermal performance requirements, creating substantial market opportunities for advanced insulation technologies.

Consumer preferences are evolving rapidly, with sustainability becoming a key purchasing factor. A recent industry survey revealed that 67% of commercial building developers now prioritize environmentally friendly insulation materials, up from 42% five years ago. This shift is particularly pronounced in developed markets where green building certifications like LEED and BREEAM have gained significant traction.

The replacement of high-GWP hydrofluorocarbons (HFCs) in insulation materials represents a market opportunity valued at approximately $5.2 billion annually. This transition is accelerated by the Kigali Amendment to the Montreal Protocol, which mandates the phase-down of HFCs, creating immediate demand for alternative blowing agents in insulation manufacturing.

Industrial sectors, particularly cold chain logistics and refrigeration, demonstrate robust demand growth for sustainable insulation solutions. With global cold chain market expansion at 8.2% annually, the need for high-performance insulation with minimal environmental impact has become critical for maintaining temperature integrity while meeting corporate sustainability goals.

Cost considerations remain significant, with market research indicating that consumers are willing to pay a premium of 12-18% for insulation products with superior environmental credentials, provided they deliver comparable or better thermal performance. This price sensitivity varies by region, with European markets showing the highest willingness to pay for sustainable alternatives.

The retrofit and renovation segment presents substantial opportunities, particularly in mature economies with aging building stock. In the United States alone, approximately 75% of commercial buildings were constructed before modern energy codes were implemented, creating a vast potential market for insulation upgrades using sustainable materials.

Market penetration of low-GWP insulation solutions varies significantly by region, with adoption rates of 58% in Western Europe, 37% in North America, and 22% in developing Asian markets. This regional disparity highlights both challenges and opportunities for technology deployment across different regulatory environments and economic contexts.

Current Status and Challenges in Low-GWP Technology

The global landscape of low-GWP (Global Warming Potential) blowing agents for insulation panels has undergone significant transformation in recent years. Currently, the industry is in a transitional phase, moving away from high-GWP hydrofluorocarbons (HFCs) toward more environmentally sustainable alternatives. Leading markets including Europe, North America, and Japan have already implemented regulatory frameworks that restrict or phase out high-GWP blowing agents, while developing economies are following suit at varying paces.

Technologically, several low-GWP alternatives have emerged in the commercial space. Hydrofluoroolefins (HFOs), particularly HFO-1234ze and HFO-1336mzz, represent the newest generation with GWP values below 10. These compounds offer thermal conductivity properties comparable to traditional HFCs but face challenges related to cost-effectiveness and global supply chain stability. Their market penetration remains limited to premium applications where performance justifies the higher cost.

Hydrocarbon-based blowing agents, primarily cyclopentane and n-pentane, have achieved widespread adoption due to their negligible GWP and cost advantages. However, their flammability presents significant manufacturing safety concerns and requires substantial capital investment in explosion-proof facilities. This has limited their adoption particularly among smaller manufacturers and in regions with less stringent safety protocols.

Water-blown systems represent another commercially viable approach, utilizing the carbon dioxide generated from water-isocyanate reactions. While offering the lowest possible GWP, these systems typically result in higher thermal conductivity values and reduced insulation performance compared to other alternatives. Recent advancements in cell structure control have improved their performance, but a significant gap remains when ultra-high insulation values are required.

The primary technical challenges facing low-GWP technology development include balancing thermal performance with environmental impact. Most alternatives currently involve trade-offs between insulation efficiency, cost, safety, and environmental footprint. Research indicates that achieving thermal conductivity values below 0.018 W/m·K while maintaining zero ozone depletion potential and GWP below 5 remains technically challenging with existing commercial options.

Manufacturing process adaptation represents another significant hurdle. Production lines optimized for traditional blowing agents require substantial modification to accommodate the different physical properties of low-GWP alternatives. This includes changes to mixing equipment, curing conditions, and quality control parameters, creating significant barriers to rapid industry transition.

Long-term stability and aging performance of insulation panels using new blowing agents remains inadequately characterized. Accelerated aging tests suggest potential concerns regarding cell gas retention and dimensional stability with some low-GWP alternatives, particularly in extreme temperature applications. This uncertainty has slowed adoption in critical applications such as refrigeration and construction where long service life is essential.

Technologically, several low-GWP alternatives have emerged in the commercial space. Hydrofluoroolefins (HFOs), particularly HFO-1234ze and HFO-1336mzz, represent the newest generation with GWP values below 10. These compounds offer thermal conductivity properties comparable to traditional HFCs but face challenges related to cost-effectiveness and global supply chain stability. Their market penetration remains limited to premium applications where performance justifies the higher cost.

Hydrocarbon-based blowing agents, primarily cyclopentane and n-pentane, have achieved widespread adoption due to their negligible GWP and cost advantages. However, their flammability presents significant manufacturing safety concerns and requires substantial capital investment in explosion-proof facilities. This has limited their adoption particularly among smaller manufacturers and in regions with less stringent safety protocols.

Water-blown systems represent another commercially viable approach, utilizing the carbon dioxide generated from water-isocyanate reactions. While offering the lowest possible GWP, these systems typically result in higher thermal conductivity values and reduced insulation performance compared to other alternatives. Recent advancements in cell structure control have improved their performance, but a significant gap remains when ultra-high insulation values are required.

The primary technical challenges facing low-GWP technology development include balancing thermal performance with environmental impact. Most alternatives currently involve trade-offs between insulation efficiency, cost, safety, and environmental footprint. Research indicates that achieving thermal conductivity values below 0.018 W/m·K while maintaining zero ozone depletion potential and GWP below 5 remains technically challenging with existing commercial options.

Manufacturing process adaptation represents another significant hurdle. Production lines optimized for traditional blowing agents require substantial modification to accommodate the different physical properties of low-GWP alternatives. This includes changes to mixing equipment, curing conditions, and quality control parameters, creating significant barriers to rapid industry transition.

Long-term stability and aging performance of insulation panels using new blowing agents remains inadequately characterized. Accelerated aging tests suggest potential concerns regarding cell gas retention and dimensional stability with some low-GWP alternatives, particularly in extreme temperature applications. This uncertainty has slowed adoption in critical applications such as refrigeration and construction where long service life is essential.

Current Low-GWP Blowing Agent Solutions

01 Hydrofluoroolefin (HFO) based blowing agents

Hydrofluoroolefins (HFOs) represent a significant advancement in low-GWP blowing agents. These compounds maintain excellent thermal insulation properties while dramatically reducing global warming potential compared to traditional HFCs. HFOs feature unsaturated carbon-carbon bonds that make them more reactive in the atmosphere, resulting in shorter atmospheric lifetimes and consequently lower GWP values. Common examples include HFO-1234ze and HFO-1336mzz, which offer GWP values below 10, making them environmentally preferable alternatives for foam insulation applications.- Hydrofluoroolefin (HFO) based blowing agents: Hydrofluoroolefins (HFOs) represent a significant advancement in low-GWP blowing agent technology. These compounds maintain excellent thermal insulation properties while dramatically reducing global warming potential compared to traditional HFCs. HFOs feature carbon-carbon double bonds that make them more reactive in the atmosphere, resulting in shorter atmospheric lifetimes and consequently lower GWP values. These agents are particularly suitable for polyurethane foam applications and can be used either alone or in blends to optimize performance characteristics.

- Hydrocarbon-based blowing agents: Hydrocarbon-based blowing agents such as pentane, cyclopentane, and isopentane offer significantly lower GWP values compared to traditional fluorinated compounds. These agents are particularly effective in rigid foam applications and provide good thermal insulation properties. While flammability remains a concern, various formulation techniques and safety measures have been developed to mitigate these risks. Hydrocarbon blowing agents are cost-effective alternatives that deliver comparable performance to higher-GWP options while minimizing environmental impact.

- CO2 and water-based blowing systems: Carbon dioxide and water-based blowing systems represent some of the lowest possible GWP options available. In these systems, CO2 is either directly used as a physical blowing agent or generated through chemical reactions (such as water reacting with isocyanates in polyurethane foam production). These systems offer near-zero GWP values and eliminate concerns related to ozone depletion. While thermal insulation properties may be slightly compromised compared to some alternatives, advancements in formulation technology have significantly improved performance characteristics.

- Blends and co-blowing agent systems: Blended and co-blowing agent systems combine multiple low-GWP compounds to achieve optimal performance characteristics while maintaining reduced environmental impact. These systems typically incorporate combinations of HFOs, hydrocarbons, CO2, or other low-GWP agents in specific ratios. The blended approach allows formulators to balance critical properties such as thermal conductivity, dimensional stability, and processing parameters while minimizing GWP. This strategy has proven particularly effective in transitioning from high-GWP blowing agents without compromising product performance.

- Novel chemical structures and emerging technologies: Research into novel chemical structures and emerging technologies continues to expand the portfolio of low-GWP blowing agent options. These include modified hydrofluorocarbons with reduced atmospheric lifetimes, naturally derived compounds, and innovative physical blowing processes. Development efforts focus on maintaining or improving foam performance characteristics while further reducing environmental impact. These next-generation blowing agents aim to address specific application challenges in sectors ranging from construction insulation to appliance manufacturing, offering tailored solutions with minimal climate impact.

02 Hydrocarbon-based blowing agents

Hydrocarbon-based blowing agents such as pentane, cyclopentane, and isopentane offer extremely low GWP values (typically less than 20) compared to traditional fluorocarbon alternatives. These compounds are particularly effective in polyurethane and polystyrene foam applications, providing good insulation properties while minimizing environmental impact. Despite their flammability concerns, which require additional safety measures during manufacturing, their excellent environmental profile and cost-effectiveness have made them increasingly popular in regions with strict environmental regulations.Expand Specific Solutions03 CO2/water-based blowing systems

Carbon dioxide and water-based blowing systems represent one of the most environmentally friendly approaches to foam production with minimal global warming impact. In these systems, water reacts with isocyanates to generate carbon dioxide in-situ, which serves as the blowing agent. While CO2 is a greenhouse gas, its use as a blowing agent represents a closed carbon cycle when derived from industrial processes, resulting in negligible additional GWP contribution. These systems are particularly valuable in applications where thermal insulation requirements are moderate and environmental considerations are paramount.Expand Specific Solutions04 Blends and co-blowing agent systems

Blended and co-blowing agent systems combine multiple low-GWP compounds to achieve optimal performance characteristics while maintaining reduced environmental impact. These formulations typically incorporate combinations of HFOs, hydrocarbons, CO2, or other environmentally friendly agents in specific ratios to balance thermal efficiency, dimensional stability, and environmental considerations. By leveraging the complementary properties of different blowing agents, these systems can achieve performance comparable to traditional high-GWP agents while significantly reducing overall climate impact.Expand Specific Solutions05 Methyl formate and other oxygenated hydrocarbon alternatives

Methyl formate and other oxygenated hydrocarbons represent emerging alternatives in the low-GWP blowing agent market. These compounds offer GWP values close to zero while providing acceptable insulation performance in various foam applications. The oxygen content in these molecules reduces flammability concerns compared to pure hydrocarbons while maintaining environmental benefits. Additionally, these compounds often exhibit good solubility in common foam systems, enabling easier processing and more uniform cell structures. Their increasing adoption reflects the industry's commitment to finding balanced solutions that address both performance and environmental requirements.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The low-GWP blowing agents market for high-performance insulating panels is in a growth phase, driven by stringent environmental regulations phasing out high-GWP alternatives. The market is expanding at approximately 8-10% annually, with global valuation exceeding $1.5 billion. Technologically, the field shows varying maturity levels, with companies at different development stages. Industry leaders like Chemours, DuPont, Arkema, and Honeywell have established commercial-scale production of hydrofluoroolefins (HFOs) and hydrochlorofluoroolefins (HCFOs), while BASF and Dow focus on non-fluorinated alternatives. Chinese manufacturers including Midea Group and Hisense are rapidly advancing their technologies, particularly in appliance applications. Academic institutions like Shandong University and Wuhan University of Technology are contributing fundamental research, creating a competitive landscape balanced between established chemical corporations and emerging specialized material companies.

The Chemours Co.

Technical Solution: Chemours has developed Opteon™ 1100, a hydrofluoroolefin (HFO)-based blowing agent with a GWP of less than 2, specifically designed for high-performance insulation applications. Their technology utilizes trans-1-chloro-3,3,3-trifluoropropene (HCFO-1233zd) which delivers exceptional thermal insulation properties while meeting stringent environmental regulations. Chemours' solution achieves thermal conductivity values as low as 0.019 W/m·K in rigid polyurethane foam applications. The company has invested in dedicated manufacturing facilities in Texas and China to ensure reliable global supply. Their blowing agent technology is compatible with existing foam manufacturing equipment and processes, facilitating adoption without significant capital investment. Chemours has developed specialized formulation guidelines and technical support packages to help manufacturers optimize foam systems when transitioning from high-GWP alternatives. Their solution maintains excellent dimensional stability and mechanical properties throughout the insulation panel lifecycle.

Strengths: Very low GWP (<2) meeting current and anticipated regulations; Excellent thermal insulation performance; Non-flammable formulation enhancing manufacturing safety; Established global production capacity ensuring supply reliability. Weaknesses: Higher cost compared to hydrocarbon alternatives; Requires some process optimization when transitioning from HFCs; Limited long-term aging data compared to more established technologies.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has developed Solstice® Liquid Blowing Agent (LBA), a hydrofluoroolefin (HFO)-based technology with ultra-low GWP (<1) that serves as a replacement for HFC blowing agents. Their solution incorporates HFO-1233zd(E) which delivers superior thermal insulation properties while meeting stringent environmental regulations. Honeywell's technology enables foam manufacturers to achieve up to 10-12% better insulation performance compared to hydrocarbon-based alternatives. The company has invested significantly in manufacturing facilities to ensure global supply chain reliability, with production sites in Louisiana (USA) and China. Their blowing agents are compatible with existing polyurethane and polyisocyanurate foam manufacturing equipment, requiring minimal process modifications for implementation. Honeywell has conducted extensive life cycle assessments showing their solution reduces overall carbon footprint by up to 8% compared to traditional blowing agents.

Strengths: Industry-leading ultra-low GWP (<1) significantly below regulatory requirements; Superior thermal insulation performance; Established global manufacturing infrastructure; Non-flammable formulation enhancing safety. Weaknesses: Higher initial cost compared to hydrocarbon alternatives; Requires specialized handling procedures; Limited performance data in extreme temperature conditions.

Critical Patents and Technical Literature Review

Low-GWP blowing agent blends and uses thereof

PatentWO2025096186A1

Innovation

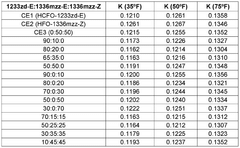

- The use of blends comprising E-1-chloro-3,3,3-trifluoropropene (HCFO-1233zd-E) combined with either E-1,1,1,4,4,4-hexafluoro-2-butene (HFO-1336mzz-E) or Z-1,1,1,4,4,4-hexafluoro-2-butene (HFO-1336mzz-Z) as blowing agents for polyurethane foam formulations, which results in high-quality foams with improved thermal insulation and reduced environmental impact.

Blowing agent compositions of hydrofluoroolefins and hydrochlorofluoroolefins

PatentWO2008121778A1

Innovation

- The use of blowing agent compositions comprising hydrofluoroolefins (HFOs) and hydrochlorofluoroolefins (HCFOs), specifically 3,3,3-trifluoropropene, (cis and/or trans)-1,3,3-tetrafluoropropene, and 2,3,3-tetrafluoropropene as HFOs, and (cis and/or trans)-1-chloro-3,3-trifluoropropene, 2-chloro-3,3-trifluoropropene, and dichlorofluorinated propenes as HCFOs, which are blended with foamable polymer compositions to produce foams with reduced density and enhanced k-factor for thermal insulation.

Environmental Regulations and Compliance Framework

The global regulatory landscape for blowing agents has undergone significant transformation in recent decades, primarily driven by environmental concerns related to ozone depletion and global warming. The Montreal Protocol, established in 1987, initiated the phase-out of chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs) due to their ozone-depleting properties. This was followed by the Kigali Amendment in 2016, which expanded regulations to include hydrofluorocarbons (HFCs) based on their high global warming potential (GWP).

Current regulatory frameworks vary by region but share common objectives of reducing environmental impact. The European Union's F-Gas Regulation (EU No 517/2014) implements a quota system for HFCs, with progressive reductions targeting 79% by 2030 compared to 2015 levels. This regulation specifically impacts insulation panel manufacturing by restricting HFCs with GWP above 150 in various applications, including extruded polystyrene (XPS) foam.

In the United States, the Environmental Protection Agency's Significant New Alternatives Policy (SNAP) program evaluates and regulates substitutes for ozone-depleting substances. Recent SNAP rules have delisted several high-GWP HFCs from acceptable use in foam blowing applications, pushing manufacturers toward low-GWP alternatives. California has implemented even stricter regulations through its Short-Lived Climate Pollutant Reduction Strategy.

Asian markets present a more varied regulatory landscape. Japan follows the Act on Rational Use and Proper Management of Fluorocarbons, which promotes low-GWP alternatives. China, as the world's largest producer of insulation materials, has committed to HFC phase-down under the Kigali Amendment, with implementation plans affecting foam manufacturing sectors.

Compliance requirements for manufacturers include detailed record-keeping of blowing agent usage, emissions reporting, leak detection systems, and end-of-life recovery protocols. These requirements necessitate significant investments in monitoring equipment and staff training. Additionally, product labeling regulations increasingly mandate disclosure of GWP values and environmental impact information.

The regulatory trend clearly points toward increasingly stringent limitations on high-GWP substances. Industry forecasts suggest that blowing agents with GWP values above 150 will face complete phase-out in developed markets by 2030, with developing markets following by 2040. This creates urgency for research into low-GWP alternatives that can maintain the thermal performance requirements of high-performance insulating panels while meeting evolving compliance standards.

Current regulatory frameworks vary by region but share common objectives of reducing environmental impact. The European Union's F-Gas Regulation (EU No 517/2014) implements a quota system for HFCs, with progressive reductions targeting 79% by 2030 compared to 2015 levels. This regulation specifically impacts insulation panel manufacturing by restricting HFCs with GWP above 150 in various applications, including extruded polystyrene (XPS) foam.

In the United States, the Environmental Protection Agency's Significant New Alternatives Policy (SNAP) program evaluates and regulates substitutes for ozone-depleting substances. Recent SNAP rules have delisted several high-GWP HFCs from acceptable use in foam blowing applications, pushing manufacturers toward low-GWP alternatives. California has implemented even stricter regulations through its Short-Lived Climate Pollutant Reduction Strategy.

Asian markets present a more varied regulatory landscape. Japan follows the Act on Rational Use and Proper Management of Fluorocarbons, which promotes low-GWP alternatives. China, as the world's largest producer of insulation materials, has committed to HFC phase-down under the Kigali Amendment, with implementation plans affecting foam manufacturing sectors.

Compliance requirements for manufacturers include detailed record-keeping of blowing agent usage, emissions reporting, leak detection systems, and end-of-life recovery protocols. These requirements necessitate significant investments in monitoring equipment and staff training. Additionally, product labeling regulations increasingly mandate disclosure of GWP values and environmental impact information.

The regulatory trend clearly points toward increasingly stringent limitations on high-GWP substances. Industry forecasts suggest that blowing agents with GWP values above 150 will face complete phase-out in developed markets by 2030, with developing markets following by 2040. This creates urgency for research into low-GWP alternatives that can maintain the thermal performance requirements of high-performance insulating panels while meeting evolving compliance standards.

Thermal Performance Benchmarking Methodologies

Thermal performance benchmarking methodologies are essential for evaluating the effectiveness of low-GWP blowing agents in high-performance insulating panels. These methodologies provide standardized approaches to measure, compare, and validate thermal insulation properties across different formulations and manufacturing processes.

The primary thermal performance metric for insulating panels is thermal conductivity (λ-value), typically measured in W/m·K. Industry-standard testing methods include the guarded hot plate method (ASTM C177, ISO 8302) and heat flow meter method (ASTM C518, ISO 8301). These methods measure steady-state heat transfer through materials under controlled temperature differentials, providing reliable data for comparing different blowing agent formulations.

Accelerated aging protocols represent another critical benchmarking methodology. Since insulating panels experience performance degradation over time due to gas diffusion and cell structure changes, standardized aging tests (ASTM C1303, EN 13165) simulate long-term performance under controlled conditions. These tests typically expose samples to elevated temperatures for predetermined periods, allowing researchers to predict long-term thermal performance and compare the stability of different blowing agent systems.

Dynamic thermal performance testing evaluates insulation behavior under fluctuating temperature conditions, more closely resembling real-world applications. Methods such as the transient plane source technique (ISO 22007-2) and laser flash analysis provide insights into thermal diffusivity and specific heat capacity, complementing steady-state measurements.

Field performance validation constitutes the final benchmarking approach, involving the installation of instrumented test panels in actual buildings or climate chambers. These tests measure energy consumption, temperature gradients, and moisture behavior under realistic conditions, validating laboratory findings and demonstrating practical benefits of low-GWP formulations.

Comparative benchmarking frameworks enable systematic evaluation against established reference materials or previous-generation products. This approach typically includes multi-parameter assessment matrices that consider not only thermal conductivity but also dimensional stability, mechanical properties, fire performance, and environmental impact metrics.

Statistical analysis methodologies ensure reliability and reproducibility of thermal performance data. These include uncertainty analysis, measurement error quantification, and statistical significance testing when comparing different blowing agent formulations. Monte Carlo simulations may also be employed to model performance variability across manufacturing conditions and service environments.

Standardization of testing conditions is paramount for meaningful benchmarking. Parameters including sample preparation, conditioning, temperature setpoints, and measurement protocols must be rigorously controlled to enable valid comparisons between different research groups and manufacturing facilities working on low-GWP blowing agent technologies.

The primary thermal performance metric for insulating panels is thermal conductivity (λ-value), typically measured in W/m·K. Industry-standard testing methods include the guarded hot plate method (ASTM C177, ISO 8302) and heat flow meter method (ASTM C518, ISO 8301). These methods measure steady-state heat transfer through materials under controlled temperature differentials, providing reliable data for comparing different blowing agent formulations.

Accelerated aging protocols represent another critical benchmarking methodology. Since insulating panels experience performance degradation over time due to gas diffusion and cell structure changes, standardized aging tests (ASTM C1303, EN 13165) simulate long-term performance under controlled conditions. These tests typically expose samples to elevated temperatures for predetermined periods, allowing researchers to predict long-term thermal performance and compare the stability of different blowing agent systems.

Dynamic thermal performance testing evaluates insulation behavior under fluctuating temperature conditions, more closely resembling real-world applications. Methods such as the transient plane source technique (ISO 22007-2) and laser flash analysis provide insights into thermal diffusivity and specific heat capacity, complementing steady-state measurements.

Field performance validation constitutes the final benchmarking approach, involving the installation of instrumented test panels in actual buildings or climate chambers. These tests measure energy consumption, temperature gradients, and moisture behavior under realistic conditions, validating laboratory findings and demonstrating practical benefits of low-GWP formulations.

Comparative benchmarking frameworks enable systematic evaluation against established reference materials or previous-generation products. This approach typically includes multi-parameter assessment matrices that consider not only thermal conductivity but also dimensional stability, mechanical properties, fire performance, and environmental impact metrics.

Statistical analysis methodologies ensure reliability and reproducibility of thermal performance data. These include uncertainty analysis, measurement error quantification, and statistical significance testing when comparing different blowing agent formulations. Monte Carlo simulations may also be employed to model performance variability across manufacturing conditions and service environments.

Standardization of testing conditions is paramount for meaningful benchmarking. Parameters including sample preparation, conditioning, temperature setpoints, and measurement protocols must be rigorously controlled to enable valid comparisons between different research groups and manufacturing facilities working on low-GWP blowing agent technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!