Low-GWP Blowing Agents for Thermal Insulation Foam Applications

OCT 13, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Low-GWP Blowing Agents Background and Objectives

Blowing agents have been integral to the production of thermal insulation foams since the mid-20th century, with their evolution closely tied to environmental regulations and technological advancements. Initially, Chlorofluorocarbons (CFCs) dominated the market due to their excellent thermal insulation properties and non-flammability. However, the discovery of their ozone-depleting potential led to their phase-out under the Montreal Protocol in the late 1980s.

This regulatory shift prompted the industry to transition to Hydrochlorofluorocarbons (HCFCs) as interim solutions, followed by Hydrofluorocarbons (HFCs). While these alternatives addressed ozone depletion concerns, they presented another environmental challenge: high Global Warming Potential (GWP). HFCs, with GWP values ranging from several hundred to thousands of times that of CO2, have become significant contributors to climate change.

The Kigali Amendment to the Montreal Protocol in 2016 established a global framework for the phase-down of HFCs, accelerating the search for low-GWP alternatives. This regulatory pressure, combined with increasing corporate sustainability commitments and consumer demand for environmentally friendly products, has intensified research into next-generation blowing agents.

Current technological trends in this field focus on developing blowing agents with GWP values below 10, while maintaining or improving the thermal insulation performance, safety profiles, and cost-effectiveness of foam products. Hydrofluoroolefins (HFOs), hydrocarbons, CO2/water systems, and various blends represent the forefront of this innovation wave.

The primary objectives of low-GWP blowing agent research encompass several critical dimensions. First, identifying compounds that minimize climate impact while delivering comparable or superior insulation performance to traditional agents. Second, ensuring these alternatives meet stringent safety requirements regarding flammability, toxicity, and chemical stability. Third, developing formulations that can be integrated into existing manufacturing processes without significant capital investment or productivity losses.

Additionally, research aims to address regional variations in regulatory frameworks and climate conditions, which influence the optimal choice of blowing agents. For instance, solutions suitable for cold-climate regions may differ from those ideal for tropical environments due to varying thermal performance requirements.

The ultimate goal is to establish a sustainable technological pathway that enables the thermal insulation foam industry to contribute to global climate mitigation efforts while continuing to improve energy efficiency in buildings and appliances – a critical factor in reducing overall greenhouse gas emissions from the built environment.

This regulatory shift prompted the industry to transition to Hydrochlorofluorocarbons (HCFCs) as interim solutions, followed by Hydrofluorocarbons (HFCs). While these alternatives addressed ozone depletion concerns, they presented another environmental challenge: high Global Warming Potential (GWP). HFCs, with GWP values ranging from several hundred to thousands of times that of CO2, have become significant contributors to climate change.

The Kigali Amendment to the Montreal Protocol in 2016 established a global framework for the phase-down of HFCs, accelerating the search for low-GWP alternatives. This regulatory pressure, combined with increasing corporate sustainability commitments and consumer demand for environmentally friendly products, has intensified research into next-generation blowing agents.

Current technological trends in this field focus on developing blowing agents with GWP values below 10, while maintaining or improving the thermal insulation performance, safety profiles, and cost-effectiveness of foam products. Hydrofluoroolefins (HFOs), hydrocarbons, CO2/water systems, and various blends represent the forefront of this innovation wave.

The primary objectives of low-GWP blowing agent research encompass several critical dimensions. First, identifying compounds that minimize climate impact while delivering comparable or superior insulation performance to traditional agents. Second, ensuring these alternatives meet stringent safety requirements regarding flammability, toxicity, and chemical stability. Third, developing formulations that can be integrated into existing manufacturing processes without significant capital investment or productivity losses.

Additionally, research aims to address regional variations in regulatory frameworks and climate conditions, which influence the optimal choice of blowing agents. For instance, solutions suitable for cold-climate regions may differ from those ideal for tropical environments due to varying thermal performance requirements.

The ultimate goal is to establish a sustainable technological pathway that enables the thermal insulation foam industry to contribute to global climate mitigation efforts while continuing to improve energy efficiency in buildings and appliances – a critical factor in reducing overall greenhouse gas emissions from the built environment.

Market Demand Analysis for Sustainable Insulation Solutions

The global market for thermal insulation materials is experiencing a significant shift towards sustainable solutions, driven primarily by stringent environmental regulations and increasing awareness of climate change impacts. Traditional blowing agents used in foam insulation production, such as hydrofluorocarbons (HFCs), have high Global Warming Potential (GWP) values, contributing substantially to greenhouse gas emissions. This regulatory pressure has created an urgent market demand for low-GWP alternatives.

Market research indicates that the thermal insulation foam market is projected to grow at a compound annual growth rate of 5.2% through 2030, with the sustainable segment growing even faster at 7.8%. This acceleration is particularly evident in developed regions like Europe and North America, where building energy efficiency standards are becoming increasingly stringent. The European Union's F-Gas Regulation and the Kigali Amendment to the Montreal Protocol have established clear timelines for phasing down high-GWP substances, creating immediate market opportunities for compliant alternatives.

Consumer preferences are also evolving rapidly, with surveys showing that 68% of commercial building developers now prioritize sustainable insulation materials in new construction projects. This represents a 23% increase from just five years ago. The residential sector is following suit, with homeowners increasingly willing to pay premium prices for environmentally responsible building materials that offer improved energy efficiency and reduced carbon footprints.

From an economic perspective, the total addressable market for low-GWP blowing agents in thermal insulation applications is estimated at 3.2 billion USD in 2023, with projections suggesting it could reach 5.7 billion USD by 2028. This growth is supported by favorable payback periods for building owners, as energy savings from high-performance insulation typically offset the initial investment within 3-5 years.

Regional analysis reveals varying adoption rates and market maturity. Europe leads in regulatory stringency and market adoption of sustainable insulation solutions, followed by North America. The Asia-Pacific region represents the fastest-growing market, driven by rapid urbanization, increasing disposable incomes, and emerging environmental regulations in countries like China and India.

Industry stakeholders across the value chain are responding to these market signals. Chemical manufacturers are investing heavily in R&D for next-generation blowing agents, while foam producers are reformulating their products to maintain performance while reducing environmental impact. End-users, including construction companies and appliance manufacturers, are increasingly specifying low-GWP insulation in their procurement requirements, further accelerating market transformation.

Market research indicates that the thermal insulation foam market is projected to grow at a compound annual growth rate of 5.2% through 2030, with the sustainable segment growing even faster at 7.8%. This acceleration is particularly evident in developed regions like Europe and North America, where building energy efficiency standards are becoming increasingly stringent. The European Union's F-Gas Regulation and the Kigali Amendment to the Montreal Protocol have established clear timelines for phasing down high-GWP substances, creating immediate market opportunities for compliant alternatives.

Consumer preferences are also evolving rapidly, with surveys showing that 68% of commercial building developers now prioritize sustainable insulation materials in new construction projects. This represents a 23% increase from just five years ago. The residential sector is following suit, with homeowners increasingly willing to pay premium prices for environmentally responsible building materials that offer improved energy efficiency and reduced carbon footprints.

From an economic perspective, the total addressable market for low-GWP blowing agents in thermal insulation applications is estimated at 3.2 billion USD in 2023, with projections suggesting it could reach 5.7 billion USD by 2028. This growth is supported by favorable payback periods for building owners, as energy savings from high-performance insulation typically offset the initial investment within 3-5 years.

Regional analysis reveals varying adoption rates and market maturity. Europe leads in regulatory stringency and market adoption of sustainable insulation solutions, followed by North America. The Asia-Pacific region represents the fastest-growing market, driven by rapid urbanization, increasing disposable incomes, and emerging environmental regulations in countries like China and India.

Industry stakeholders across the value chain are responding to these market signals. Chemical manufacturers are investing heavily in R&D for next-generation blowing agents, while foam producers are reformulating their products to maintain performance while reducing environmental impact. End-users, including construction companies and appliance manufacturers, are increasingly specifying low-GWP insulation in their procurement requirements, further accelerating market transformation.

Current Status and Challenges in Low-GWP Technology

The global landscape of low-GWP (Global Warming Potential) blowing agents for thermal insulation foam has undergone significant transformation in recent years. Currently, the industry is in a transitional phase, moving away from high-GWP hydrofluorocarbons (HFCs) toward more environmentally sustainable alternatives. Leading markets including Europe, North America, and Japan have already implemented stringent regulations phasing out high-GWP blowing agents, while developing economies are following with varying implementation timelines.

Hydrofluoroolefins (HFOs) represent the most promising new generation of blowing agents, with HFO-1234ze and HFO-1336mzz-Z gaining significant market adoption. These compounds offer GWP values below 10, compared to traditional HFCs with GWPs often exceeding 1,000. Hydrocarbon-based agents, particularly cyclopentane and n-pentane, have established strong positions in certain applications due to their zero ODP (Ozone Depletion Potential) and negligible GWP, though flammability concerns limit their use in some contexts.

Water-blown systems have also gained traction, particularly in rigid polyurethane applications, offering a completely natural alternative with zero GWP. However, these systems typically result in lower insulation performance compared to fluorinated alternatives, creating a significant technical challenge for manufacturers seeking optimal environmental and performance characteristics.

The geographic distribution of low-GWP technology development shows concentration in chemical manufacturing hubs across the United States, Western Europe, Japan, and increasingly China. Research institutions in these regions have established collaborative networks with industry partners to accelerate innovation in this field.

Despite progress, significant technical challenges persist. Thermal conductivity remains a critical issue, as many low-GWP alternatives demonstrate 5-15% poorer insulation performance than their high-GWP predecessors. This efficiency gap represents a major hurdle for industries where space constraints and energy efficiency are paramount concerns.

Flammability management continues to pose safety challenges, particularly with hydrocarbon-based blowing agents. This necessitates additional fire retardants and safety systems, increasing production complexity and costs. Process compatibility issues also arise when retrofitting existing manufacturing lines for new blowing agent systems, requiring significant capital investment and technical expertise.

Long-term stability and aging performance of foams produced with newer blowing agents remain inadequately characterized, creating uncertainty about product lifespans and long-term insulation efficiency. Additionally, cost premiums for next-generation blowing agents—often 30-200% higher than traditional options—create market adoption barriers, particularly in price-sensitive applications and regions without strict regulatory frameworks.

Hydrofluoroolefins (HFOs) represent the most promising new generation of blowing agents, with HFO-1234ze and HFO-1336mzz-Z gaining significant market adoption. These compounds offer GWP values below 10, compared to traditional HFCs with GWPs often exceeding 1,000. Hydrocarbon-based agents, particularly cyclopentane and n-pentane, have established strong positions in certain applications due to their zero ODP (Ozone Depletion Potential) and negligible GWP, though flammability concerns limit their use in some contexts.

Water-blown systems have also gained traction, particularly in rigid polyurethane applications, offering a completely natural alternative with zero GWP. However, these systems typically result in lower insulation performance compared to fluorinated alternatives, creating a significant technical challenge for manufacturers seeking optimal environmental and performance characteristics.

The geographic distribution of low-GWP technology development shows concentration in chemical manufacturing hubs across the United States, Western Europe, Japan, and increasingly China. Research institutions in these regions have established collaborative networks with industry partners to accelerate innovation in this field.

Despite progress, significant technical challenges persist. Thermal conductivity remains a critical issue, as many low-GWP alternatives demonstrate 5-15% poorer insulation performance than their high-GWP predecessors. This efficiency gap represents a major hurdle for industries where space constraints and energy efficiency are paramount concerns.

Flammability management continues to pose safety challenges, particularly with hydrocarbon-based blowing agents. This necessitates additional fire retardants and safety systems, increasing production complexity and costs. Process compatibility issues also arise when retrofitting existing manufacturing lines for new blowing agent systems, requiring significant capital investment and technical expertise.

Long-term stability and aging performance of foams produced with newer blowing agents remain inadequately characterized, creating uncertainty about product lifespans and long-term insulation efficiency. Additionally, cost premiums for next-generation blowing agents—often 30-200% higher than traditional options—create market adoption barriers, particularly in price-sensitive applications and regions without strict regulatory frameworks.

Current Technical Solutions for Low-GWP Foam Applications

01 Hydrofluoroolefin (HFO) based blowing agents

Hydrofluoroolefins (HFOs) represent a new generation of blowing agents with significantly lower global warming potential compared to traditional hydrofluorocarbons (HFCs). These compounds maintain good insulation properties while reducing environmental impact. HFOs like HFO-1234ze and HFO-1234yf have GWP values close to 1, making them environmentally preferable alternatives for foam production in various applications including construction materials and appliance insulation.- Hydrofluoroolefin (HFO) based blowing agents: Hydrofluoroolefins (HFOs) represent a significant advancement in low-GWP blowing agent technology. These compounds maintain excellent insulating properties while dramatically reducing global warming potential compared to traditional HFCs. HFOs feature unsaturated carbon-carbon bonds that make them more reactive in the atmosphere, resulting in shorter atmospheric lifetimes and consequently lower GWP values. These agents are particularly suitable for polyurethane foam applications and can be used either alone or in blends to optimize performance characteristics.

- Hydrocarbon-based blowing agents: Hydrocarbon-based blowing agents such as pentane, cyclopentane, and isopentane offer significantly lower GWP values compared to traditional fluorinated compounds. These agents are particularly effective in rigid foam applications and provide good thermal insulation properties. While they present flammability concerns that require special handling and safety measures, their environmental profile makes them attractive alternatives. Formulations often include flame retardants and other additives to mitigate safety risks while maintaining performance characteristics.

- CO2 and water-based blowing systems: Carbon dioxide and water-based blowing systems represent some of the lowest possible GWP options available. In water-blown systems, the reaction between water and isocyanate generates CO2 in-situ, which serves as the blowing agent. These systems eliminate the need for external blowing agents with higher GWP values. While these approaches may have some limitations regarding insulation efficiency compared to other blowing agents, they offer significant environmental advantages with essentially zero contribution to global warming potential.

- Blended blowing agent systems: Blended blowing agent systems combine multiple low-GWP compounds to achieve optimal performance characteristics while minimizing environmental impact. These formulations typically include combinations of HFOs, hydrocarbons, HFCs in reduced quantities, and sometimes CO2. The blends are carefully designed to balance factors such as thermal efficiency, dimensional stability, and processing parameters. This approach allows manufacturers to fine-tune properties while meeting increasingly stringent environmental regulations regarding global warming potential.

- Novel low-GWP blowing agent technologies: Emerging technologies in low-GWP blowing agents include novel chemical structures, manufacturing processes, and application methods designed specifically to address global warming concerns. These innovations focus on developing compounds with minimal atmospheric lifetimes while maintaining or improving foam performance characteristics. Research areas include methylformate-based systems, new HFO isomers with optimized properties, and alternative physical blowing mechanisms. These technologies aim to further reduce the environmental impact of insulation and other foam applications while meeting performance requirements.

02 Hydrocarbon-based low-GWP blowing agents

Hydrocarbon-based blowing agents such as pentane, cyclopentane, and isopentane offer very low global warming potential alternatives to traditional blowing agents. These compounds have GWP values close to zero and provide good insulation properties. While flammability is a concern, various formulations and manufacturing processes have been developed to address safety issues. These agents are particularly useful in rigid polyurethane foam applications for construction and refrigeration industries.Expand Specific Solutions03 CO2/water-based blowing systems

Carbon dioxide generated from water reactions or directly used as a blowing agent represents one of the lowest GWP options available. These systems utilize the reaction between isocyanates and water to produce CO2 in-situ, or incorporate liquid CO2 directly into formulations. With a GWP of 1, CO2 is environmentally favorable, though it may require adjustments to foam formulations to maintain desired physical properties. These systems are particularly valuable for applications where flammability concerns preclude the use of hydrocarbon blowing agents.Expand Specific Solutions04 Blends and co-blowing agent systems

Blended blowing agent systems combine multiple low-GWP compounds to achieve optimal performance characteristics while minimizing environmental impact. These formulations typically mix HFOs, hydrocarbons, CO2, or other low-GWP agents to balance thermal efficiency, dimensional stability, and environmental considerations. By carefully selecting blend components, manufacturers can tailor foam properties while maintaining low overall global warming impact. These systems often provide a practical transition path from high-GWP blowing agents to more environmentally sustainable alternatives.Expand Specific Solutions05 Testing and measurement methods for GWP evaluation

Specialized testing and measurement methodologies have been developed to accurately evaluate the global warming potential of blowing agents. These methods include atmospheric lifetime assessment, radiative forcing measurement, and comparative analysis against reference compounds like CO2. Advanced analytical techniques help quantify emissions during foam production, use, and disposal phases. Standardized protocols ensure consistent GWP reporting across different blowing agent technologies, enabling manufacturers and regulators to make informed decisions regarding environmental impact.Expand Specific Solutions

Key Industry Players in Low-GWP Blowing Agent Development

The low-GWP blowing agents market for thermal insulation foam is in a transitional growth phase, driven by global regulations phasing out high-GWP alternatives. The market is projected to reach approximately $2.5 billion by 2027, expanding at a CAGR of 8-10%. Leading chemical manufacturers including Honeywell, Chemours, Arkema, and DuPont are competing through innovation in hydrofluoroolefins (HFOs) and hydrocarbon-based alternatives. Major foam manufacturers like Kingspan and appliance producers such as Midea Group, Haier Smart Home, and Hefei Hualing are rapidly adopting these solutions. The technology has reached commercial maturity for refrigeration applications but continues evolving for construction insulation, with companies like Wanhua Chemical and Nanjing Hongbaoli developing specialized formulations to optimize thermal performance while meeting increasingly stringent environmental regulations.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has developed Solstice® Liquid Blowing Agent (LBA), a hydrofluoroolefin (HFO)-based blowing agent with ultra-low Global Warming Potential (GWP) of <1, which is 99.9% lower than traditional HFC blowing agents. The technology utilizes HFO-1233zd(E) as the primary component, offering thermal conductivity values as low as 0.158 W/m·K in polyurethane foam applications. Honeywell's solution maintains or improves insulation performance while meeting stringent environmental regulations worldwide. The company has invested in dedicated manufacturing facilities to ensure reliable supply chains for this technology, with production capacity exceeding 30,000 metric tons annually. Solstice LBA has been commercially implemented across refrigeration, construction, and automotive sectors, demonstrating consistent performance across varying climate conditions and manufacturing processes.

Strengths: Industry-leading ultra-low GWP (<1) with excellent thermal insulation properties; non-flammable formulation enhancing safety; global manufacturing infrastructure ensuring supply reliability. Weaknesses: Higher initial cost compared to traditional blowing agents; requires some process modifications for manufacturers transitioning from HFCs; performance may vary slightly in extreme temperature applications.

The Chemours Co.

Technical Solution: Chemours has pioneered Opteon™ 1100, a hydrofluoroolefin (HFO)-based blowing agent specifically engineered for polyurethane foam applications with a GWP of <5. This technology delivers thermal conductivity improvements of up to 10% compared to hydrocarbon alternatives while maintaining dimensional stability in rigid foam applications. The Opteon™ platform incorporates proprietary cell structure control technology that creates uniform, fine-celled foam morphology, enhancing long-term insulation performance and structural integrity. Chemours has developed specialized formulation packages that enable manufacturers to achieve optimal foam properties with minimal process adjustments. The company has established regional technical service centers to support customer implementation and has secured EPA SNAP approval and global regulatory compliance for its blowing agent solutions. Chemours has documented case studies showing energy efficiency improvements of 5-8% in refrigeration applications using their low-GWP technology.

Strengths: Excellent thermal insulation properties with minimal process modifications required; non-flammable formulation enhancing manufacturing safety; comprehensive technical support infrastructure. Weaknesses: Slightly higher GWP than some competing HFO solutions; premium pricing compared to hydrocarbon alternatives; requires specialized handling equipment for optimal performance.

Critical Patents and Innovations in Low-GWP Blowing Agents

Low-GWP blowing agent blends and uses thereof

PatentWO2025096186A1

Innovation

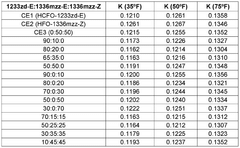

- The use of blends comprising E-1-chloro-3,3,3-trifluoropropene (HCFO-1233zd-E) combined with either E-1,1,1,4,4,4-hexafluoro-2-butene (HFO-1336mzz-E) or Z-1,1,1,4,4,4-hexafluoro-2-butene (HFO-1336mzz-Z) as blowing agents for polyurethane foam formulations, which results in high-quality foams with improved thermal insulation and reduced environmental impact.

Blowing agent compositions of hydrofluoroolefins and hydrochlorofluoroolefins

PatentActiveEP2129711A1

Innovation

- The use of blowing agent compositions comprising hydrofluoroolefins (HFOs) and hydrochlorofluoroolefins (HCFOs), specifically combinations like 3,3,3-trifluoropropene (HFO-1243zf), (cis/trans)-1,3,3,3-tetrafluoropropene (HFO-1234ze), and (cis/trans)-1-chloro-3,3,3-trifluoropropene (HCFO-1233zd), which are blended with foamable polymer resins to produce foams with reduced density and enhanced k-factor for thermal insulation.

Environmental Impact Assessment and Carbon Footprint Analysis

The environmental impact of blowing agents used in thermal insulation foams has become a critical consideration in the industry's sustainability efforts. Traditional blowing agents such as chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs) have been phased out due to their ozone depletion potential, while hydrofluorocarbons (HFCs) are being regulated because of their high global warming potential (GWP). This transition necessitates a comprehensive environmental impact assessment and carbon footprint analysis of low-GWP alternatives.

Life cycle assessment (LCA) studies reveal that the environmental benefits of low-GWP blowing agents extend beyond their direct emissions. When comparing hydrofluoroolefins (HFOs) with traditional HFCs, the carbon footprint reduction can range from 90% to 99% in direct emissions. However, the manufacturing processes for some newer alternatives may require more energy or resources, potentially offsetting some environmental gains.

The carbon footprint analysis must consider both the embodied carbon in production and the operational carbon savings through improved insulation performance. Research indicates that high-performance insulation foams using low-GWP agents can reduce building energy consumption by 20-30% compared to conventional insulation materials, resulting in significant lifetime carbon emission reductions that far outweigh the initial manufacturing impact.

Regulatory frameworks worldwide are increasingly incorporating carbon footprint metrics into compliance requirements. The European Union's F-Gas Regulation and the Kigali Amendment to the Montreal Protocol have established clear timelines for phasing down high-GWP substances, creating market pressure for alternatives with verified environmental credentials. Companies must now document the full environmental impact of their insulation products, including raw material extraction, manufacturing, transportation, installation, use phase, and end-of-life disposal.

Emerging methodologies for environmental assessment include the consideration of circular economy principles. The recyclability and biodegradability of foam insulation materials containing low-GWP blowing agents are becoming important factors in their overall environmental evaluation. Some newer water-based and CO2-based blowing agents show promising results in this regard, with potential for closed-loop recycling systems.

Regional variations in environmental impact must also be considered. The carbon intensity of local energy grids significantly affects the manufacturing footprint of blowing agents and foam products. For instance, production in regions with high renewable energy penetration can reduce the carbon footprint by up to 40% compared to fossil fuel-dependent regions, highlighting the importance of geographical considerations in environmental impact assessments.

Life cycle assessment (LCA) studies reveal that the environmental benefits of low-GWP blowing agents extend beyond their direct emissions. When comparing hydrofluoroolefins (HFOs) with traditional HFCs, the carbon footprint reduction can range from 90% to 99% in direct emissions. However, the manufacturing processes for some newer alternatives may require more energy or resources, potentially offsetting some environmental gains.

The carbon footprint analysis must consider both the embodied carbon in production and the operational carbon savings through improved insulation performance. Research indicates that high-performance insulation foams using low-GWP agents can reduce building energy consumption by 20-30% compared to conventional insulation materials, resulting in significant lifetime carbon emission reductions that far outweigh the initial manufacturing impact.

Regulatory frameworks worldwide are increasingly incorporating carbon footprint metrics into compliance requirements. The European Union's F-Gas Regulation and the Kigali Amendment to the Montreal Protocol have established clear timelines for phasing down high-GWP substances, creating market pressure for alternatives with verified environmental credentials. Companies must now document the full environmental impact of their insulation products, including raw material extraction, manufacturing, transportation, installation, use phase, and end-of-life disposal.

Emerging methodologies for environmental assessment include the consideration of circular economy principles. The recyclability and biodegradability of foam insulation materials containing low-GWP blowing agents are becoming important factors in their overall environmental evaluation. Some newer water-based and CO2-based blowing agents show promising results in this regard, with potential for closed-loop recycling systems.

Regional variations in environmental impact must also be considered. The carbon intensity of local energy grids significantly affects the manufacturing footprint of blowing agents and foam products. For instance, production in regions with high renewable energy penetration can reduce the carbon footprint by up to 40% compared to fossil fuel-dependent regions, highlighting the importance of geographical considerations in environmental impact assessments.

Regulatory Compliance and Global Phase-Down Schedules

The global regulatory landscape for blowing agents has undergone significant transformation in recent decades, driven primarily by environmental concerns related to ozone depletion and global warming. The Montreal Protocol, established in 1987, initiated the phase-out of ozone-depleting substances (ODS), including chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs) that were commonly used as blowing agents in thermal insulation foam applications.

Building upon this foundation, the Kigali Amendment to the Montreal Protocol, adopted in 2016, specifically targets hydrofluorocarbons (HFCs) with high global warming potential (GWP). This amendment establishes a clear timeline for the reduction of HFC consumption, with developed countries beginning reductions in 2019 and developing countries following suit between 2024 and 2028. The amendment aims to achieve an 80-85% reduction in HFC consumption by the 2040s.

In the European Union, Regulation (EU) No 517/2014 (F-Gas Regulation) implements a phase-down schedule for HFCs, targeting a 79% reduction by 2030 compared to the 2009-2012 baseline. The regulation also includes specific bans on HFCs in various applications, including extruded polystyrene (XPS) foams with GWP above 150 since January 2020.

The United States has implemented its own regulatory framework through the American Innovation and Manufacturing (AIM) Act of 2020, which authorizes the Environmental Protection Agency (EPA) to phase down HFC production and consumption by 85% over 15 years. The Significant New Alternatives Policy (SNAP) program further regulates the transition to lower-GWP alternatives in specific applications.

In Asia, Japan has established the Act on Rational Use and Proper Management of Fluorocarbons, which includes measures to promote low-GWP alternatives. China, as the world's largest producer of HFCs, has committed to freezing HFC production and consumption by 2024 and reducing them by 80% by 2045 under the Kigali Amendment.

These regulatory frameworks have created a complex global compliance landscape for manufacturers of thermal insulation foams. Companies must navigate varying timelines and requirements across different regions, often necessitating the development of multiple formulations to meet regional standards. This regulatory pressure has accelerated research into low-GWP blowing agents, with hydrofluoroolefins (HFOs), hydrocarbons, CO2, and water emerging as leading alternatives.

The economic implications of these phase-down schedules are substantial, with the foam insulation industry facing increased costs for research, development, and reformulation. However, these regulations also drive innovation and create market opportunities for companies that can develop effective, environmentally sustainable blowing agent solutions.

Building upon this foundation, the Kigali Amendment to the Montreal Protocol, adopted in 2016, specifically targets hydrofluorocarbons (HFCs) with high global warming potential (GWP). This amendment establishes a clear timeline for the reduction of HFC consumption, with developed countries beginning reductions in 2019 and developing countries following suit between 2024 and 2028. The amendment aims to achieve an 80-85% reduction in HFC consumption by the 2040s.

In the European Union, Regulation (EU) No 517/2014 (F-Gas Regulation) implements a phase-down schedule for HFCs, targeting a 79% reduction by 2030 compared to the 2009-2012 baseline. The regulation also includes specific bans on HFCs in various applications, including extruded polystyrene (XPS) foams with GWP above 150 since January 2020.

The United States has implemented its own regulatory framework through the American Innovation and Manufacturing (AIM) Act of 2020, which authorizes the Environmental Protection Agency (EPA) to phase down HFC production and consumption by 85% over 15 years. The Significant New Alternatives Policy (SNAP) program further regulates the transition to lower-GWP alternatives in specific applications.

In Asia, Japan has established the Act on Rational Use and Proper Management of Fluorocarbons, which includes measures to promote low-GWP alternatives. China, as the world's largest producer of HFCs, has committed to freezing HFC production and consumption by 2024 and reducing them by 80% by 2045 under the Kigali Amendment.

These regulatory frameworks have created a complex global compliance landscape for manufacturers of thermal insulation foams. Companies must navigate varying timelines and requirements across different regions, often necessitating the development of multiple formulations to meet regional standards. This regulatory pressure has accelerated research into low-GWP blowing agents, with hydrofluoroolefins (HFOs), hydrocarbons, CO2, and water emerging as leading alternatives.

The economic implications of these phase-down schedules are substantial, with the foam insulation industry facing increased costs for research, development, and reformulation. However, these regulations also drive innovation and create market opportunities for companies that can develop effective, environmentally sustainable blowing agent solutions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!