Low-GWP Blowing Agents for Extruded Polystyrene (XPS) Foam

OCT 13, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

XPS Foam Blowing Agents Evolution and Objectives

Extruded Polystyrene (XPS) foam insulation has undergone significant evolution in blowing agent technology since its commercial introduction in the 1940s. Initially, chlorofluorocarbons (CFCs), particularly CFC-12, dominated as the primary blowing agents due to their excellent thermal insulation properties, non-flammability, and processing compatibility. However, the discovery of their ozone depletion potential (ODP) in the 1970s triggered a fundamental shift in the industry.

The Montreal Protocol of 1987 marked a pivotal moment, initiating the phase-out of CFCs and prompting manufacturers to transition to hydrochlorofluorocarbons (HCFCs), primarily HCFC-142b and HCFC-22. While these alternatives offered reduced ODP values, they still posed environmental concerns, leading to their subsequent phase-out under the same protocol's amendments.

By the early 2000s, the industry shifted toward hydrofluorocarbons (HFCs), particularly HFC-134a and HFC-152a, which eliminated ozone depletion concerns. However, the recognition of HFCs as potent greenhouse gases with high Global Warming Potential (GWP) values necessitated further innovation, especially following the Kigali Amendment to the Montreal Protocol in 2016, which mandated their gradual reduction.

The current technical landscape is characterized by a transition toward low-GWP alternatives, including hydrofluoroolefins (HFOs), hydrochlorofluoroolefins (HCFOs), hydrocarbons, CO2, and various blends. This evolution reflects the industry's response to increasingly stringent environmental regulations and sustainability demands across global markets.

The primary objective of current research is to develop blowing agent systems for XPS foam that maintain or enhance thermal insulation performance while minimizing environmental impact. Specifically, this entails identifying blowing agents with GWP values below 150, in compliance with regulations like the EU F-Gas Regulation and similar global initiatives.

Additional technical objectives include ensuring the new blowing agents provide adequate cell structure control, dimensional stability, and long-term thermal performance. Processing compatibility with existing manufacturing equipment represents another critical consideration, as manufacturers seek to minimize capital investment while transitioning to more sustainable technologies.

Safety considerations form another crucial objective, particularly regarding flammability management, as many low-GWP alternatives present increased flammability risks compared to their predecessors. Finally, cost-effectiveness remains paramount, as the industry aims to develop solutions that maintain economic viability while meeting increasingly stringent environmental standards.

The Montreal Protocol of 1987 marked a pivotal moment, initiating the phase-out of CFCs and prompting manufacturers to transition to hydrochlorofluorocarbons (HCFCs), primarily HCFC-142b and HCFC-22. While these alternatives offered reduced ODP values, they still posed environmental concerns, leading to their subsequent phase-out under the same protocol's amendments.

By the early 2000s, the industry shifted toward hydrofluorocarbons (HFCs), particularly HFC-134a and HFC-152a, which eliminated ozone depletion concerns. However, the recognition of HFCs as potent greenhouse gases with high Global Warming Potential (GWP) values necessitated further innovation, especially following the Kigali Amendment to the Montreal Protocol in 2016, which mandated their gradual reduction.

The current technical landscape is characterized by a transition toward low-GWP alternatives, including hydrofluoroolefins (HFOs), hydrochlorofluoroolefins (HCFOs), hydrocarbons, CO2, and various blends. This evolution reflects the industry's response to increasingly stringent environmental regulations and sustainability demands across global markets.

The primary objective of current research is to develop blowing agent systems for XPS foam that maintain or enhance thermal insulation performance while minimizing environmental impact. Specifically, this entails identifying blowing agents with GWP values below 150, in compliance with regulations like the EU F-Gas Regulation and similar global initiatives.

Additional technical objectives include ensuring the new blowing agents provide adequate cell structure control, dimensional stability, and long-term thermal performance. Processing compatibility with existing manufacturing equipment represents another critical consideration, as manufacturers seek to minimize capital investment while transitioning to more sustainable technologies.

Safety considerations form another crucial objective, particularly regarding flammability management, as many low-GWP alternatives present increased flammability risks compared to their predecessors. Finally, cost-effectiveness remains paramount, as the industry aims to develop solutions that maintain economic viability while meeting increasingly stringent environmental standards.

Market Demand Analysis for Low-GWP XPS Solutions

The global market for extruded polystyrene (XPS) foam is experiencing significant transformation driven by environmental regulations targeting high Global Warming Potential (GWP) blowing agents. Current market size for XPS foam is valued at approximately USD 5.7 billion in 2023, with projections indicating growth to reach USD 7.9 billion by 2028, representing a compound annual growth rate (CAGR) of 6.8%.

Regulatory pressures serve as the primary market driver, with the Kigali Amendment to the Montreal Protocol mandating the phase-down of hydrofluorocarbons (HFCs) with high GWP values. The European Union's F-Gas Regulation has already implemented strict controls, while the United States Environmental Protection Agency (EPA) has established similar phase-down schedules through the American Innovation and Manufacturing (AIM) Act.

Construction industry demand constitutes over 75% of the XPS foam market, particularly in building insulation applications where energy efficiency requirements continue to tighten globally. The push toward net-zero buildings in developed economies has intensified the need for high-performance insulation materials that meet both thermal efficiency and environmental sustainability criteria.

Consumer awareness regarding environmental impacts has created market pull factors complementing regulatory push. Major construction material suppliers and building certification programs increasingly prioritize materials with lower environmental footprints, creating premium market segments for low-GWP XPS products.

Regional market analysis reveals varying adoption rates of low-GWP solutions. Europe leads implementation due to stringent regulations, with market penetration of low-GWP XPS solutions exceeding 60%. North America follows with accelerating transition rates, while Asia-Pacific markets show more gradual adoption curves with significant growth potential as regulations tighten.

Economic analysis indicates initial cost premiums of 15-25% for low-GWP XPS products compared to traditional HFC-based alternatives. However, this gap is narrowing as production scales increase and manufacturers optimize formulations. Market forecasts suggest price parity could be achieved within 3-5 years in mature markets.

Industry stakeholders report technical performance challenges with some low-GWP alternatives, particularly regarding thermal conductivity, dimensional stability, and processing parameters. These technical barriers represent significant market opportunities for innovative solutions that can deliver environmental benefits without compromising performance characteristics.

The competitive landscape shows increasing investment in R&D for novel blowing agent technologies, with major chemical suppliers developing proprietary blends to address the technical-economic-environmental balance required by XPS manufacturers. This innovation pipeline suggests continued market evolution and segmentation based on performance-sustainability profiles.

Regulatory pressures serve as the primary market driver, with the Kigali Amendment to the Montreal Protocol mandating the phase-down of hydrofluorocarbons (HFCs) with high GWP values. The European Union's F-Gas Regulation has already implemented strict controls, while the United States Environmental Protection Agency (EPA) has established similar phase-down schedules through the American Innovation and Manufacturing (AIM) Act.

Construction industry demand constitutes over 75% of the XPS foam market, particularly in building insulation applications where energy efficiency requirements continue to tighten globally. The push toward net-zero buildings in developed economies has intensified the need for high-performance insulation materials that meet both thermal efficiency and environmental sustainability criteria.

Consumer awareness regarding environmental impacts has created market pull factors complementing regulatory push. Major construction material suppliers and building certification programs increasingly prioritize materials with lower environmental footprints, creating premium market segments for low-GWP XPS products.

Regional market analysis reveals varying adoption rates of low-GWP solutions. Europe leads implementation due to stringent regulations, with market penetration of low-GWP XPS solutions exceeding 60%. North America follows with accelerating transition rates, while Asia-Pacific markets show more gradual adoption curves with significant growth potential as regulations tighten.

Economic analysis indicates initial cost premiums of 15-25% for low-GWP XPS products compared to traditional HFC-based alternatives. However, this gap is narrowing as production scales increase and manufacturers optimize formulations. Market forecasts suggest price parity could be achieved within 3-5 years in mature markets.

Industry stakeholders report technical performance challenges with some low-GWP alternatives, particularly regarding thermal conductivity, dimensional stability, and processing parameters. These technical barriers represent significant market opportunities for innovative solutions that can deliver environmental benefits without compromising performance characteristics.

The competitive landscape shows increasing investment in R&D for novel blowing agent technologies, with major chemical suppliers developing proprietary blends to address the technical-economic-environmental balance required by XPS manufacturers. This innovation pipeline suggests continued market evolution and segmentation based on performance-sustainability profiles.

Global Status and Challenges in Low-GWP Blowing Technology

The global landscape of low-GWP blowing agents for XPS foam production has undergone significant transformation in recent years, primarily driven by international environmental regulations. Developed regions including the European Union, United States, and Japan have already implemented strict regulations phasing out high-GWP blowing agents, while developing nations are following with varying implementation timelines under the Kigali Amendment to the Montreal Protocol.

Currently, the industry has achieved notable progress in transitioning from traditional high-GWP agents like HFC-134a and HCFC-142b (with GWP values of 1,430 and 2,310 respectively) to alternatives with substantially lower environmental impact. Hydrofluoroolefins (HFOs) such as HFO-1234ze(E) with a GWP below 1 represent the cutting edge of this transition, alongside natural alternatives like CO2 and hydrocarbons.

Despite these advances, significant technical challenges persist across different geographical regions. In North America and Europe, manufacturers face difficulties in maintaining the superior thermal insulation properties of XPS foam when using low-GWP alternatives. The thermal conductivity of foams produced with newer blowing agents is typically 5-10% higher than those made with traditional HFCs, resulting in reduced energy efficiency performance.

Asian markets, particularly China as the world's largest XPS producer, confront unique challenges related to production equipment compatibility. Most existing manufacturing lines were designed for HCFC-142b and transitioning to low-GWP alternatives often requires substantial capital investment in equipment modifications or replacements to handle different pressure profiles and chemical characteristics.

Fire safety remains a universal concern, especially when considering hydrocarbon-based blowing agents. Their flammability introduces significant risks during both manufacturing and the end-use phase of XPS products, necessitating advanced fire retardant systems and safety protocols that add complexity and cost to production processes.

Cost effectiveness presents another major hurdle, with next-generation HFOs typically costing 3-5 times more than traditional blowing agents. This price differential creates market resistance, particularly in price-sensitive developing economies where environmental regulations may be less stringent or enforcement less rigorous.

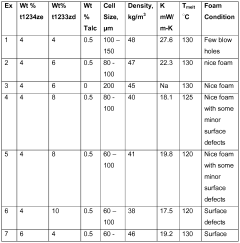

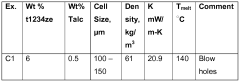

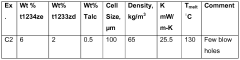

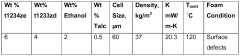

Processing challenges further complicate adoption, as low-GWP alternatives often exhibit different solubility in polystyrene matrices, affecting foam cell structure uniformity and dimensional stability. This necessitates extensive reformulation of XPS systems, including adjustments to nucleating agents, processing temperatures, and extrusion parameters.

Currently, the industry has achieved notable progress in transitioning from traditional high-GWP agents like HFC-134a and HCFC-142b (with GWP values of 1,430 and 2,310 respectively) to alternatives with substantially lower environmental impact. Hydrofluoroolefins (HFOs) such as HFO-1234ze(E) with a GWP below 1 represent the cutting edge of this transition, alongside natural alternatives like CO2 and hydrocarbons.

Despite these advances, significant technical challenges persist across different geographical regions. In North America and Europe, manufacturers face difficulties in maintaining the superior thermal insulation properties of XPS foam when using low-GWP alternatives. The thermal conductivity of foams produced with newer blowing agents is typically 5-10% higher than those made with traditional HFCs, resulting in reduced energy efficiency performance.

Asian markets, particularly China as the world's largest XPS producer, confront unique challenges related to production equipment compatibility. Most existing manufacturing lines were designed for HCFC-142b and transitioning to low-GWP alternatives often requires substantial capital investment in equipment modifications or replacements to handle different pressure profiles and chemical characteristics.

Fire safety remains a universal concern, especially when considering hydrocarbon-based blowing agents. Their flammability introduces significant risks during both manufacturing and the end-use phase of XPS products, necessitating advanced fire retardant systems and safety protocols that add complexity and cost to production processes.

Cost effectiveness presents another major hurdle, with next-generation HFOs typically costing 3-5 times more than traditional blowing agents. This price differential creates market resistance, particularly in price-sensitive developing economies where environmental regulations may be less stringent or enforcement less rigorous.

Processing challenges further complicate adoption, as low-GWP alternatives often exhibit different solubility in polystyrene matrices, affecting foam cell structure uniformity and dimensional stability. This necessitates extensive reformulation of XPS systems, including adjustments to nucleating agents, processing temperatures, and extrusion parameters.

Current Low-GWP Solutions for XPS Foam Production

01 Hydrofluoroolefin (HFO) based blowing agents

Hydrofluoroolefins (HFOs) represent a significant advancement in low-GWP blowing agent technology. These compounds maintain excellent thermal insulation properties while dramatically reducing global warming potential compared to traditional HFCs. HFOs feature unsaturated carbon-carbon bonds that make them more reactive in the atmosphere, resulting in shorter atmospheric lifetimes and consequently lower GWP values. These agents are particularly suitable for polyurethane foam applications and can be used either alone or in blends to optimize performance characteristics.- Hydrofluoroolefin (HFO) based blowing agents: Hydrofluoroolefins (HFOs) represent a significant advancement in low-GWP blowing agent technology. These compounds maintain excellent insulating properties while dramatically reducing global warming potential compared to traditional HFCs. HFOs feature unsaturated carbon-carbon bonds that make them more reactive in the atmosphere, resulting in shorter atmospheric lifetimes and consequently lower GWP values. These agents are particularly suitable for polyurethane foam applications and can be used either alone or in blends to optimize performance characteristics.

- Hydrocarbon-based blowing agents: Hydrocarbon-based blowing agents such as pentane, cyclopentane, and isopentane offer significantly lower GWP values compared to traditional fluorocarbon alternatives. These agents are particularly effective in rigid foam applications and provide good thermal insulation properties. While they present flammability concerns that require special handling and safety measures, their environmental profile makes them attractive options for manufacturers seeking to reduce their carbon footprint. Various formulations and blends have been developed to optimize performance while maintaining safety standards.

- CO2 and water-based blowing systems: Carbon dioxide and water-based blowing systems represent some of the lowest GWP options available, with CO2 having a GWP of 1 by definition. In these systems, water reacts with isocyanate components to generate CO2 in-situ, which serves as the blowing agent. While these systems may have some limitations regarding insulation efficiency compared to other blowing agents, they offer significant environmental advantages. Technological advancements have improved their performance characteristics, making them viable options for many foam applications, particularly in sectors where environmental considerations are paramount.

- Blowing agent blends and co-blowing systems: Blending different types of blowing agents creates synergistic formulations that balance performance requirements with environmental considerations. These blends typically combine low-GWP components with other agents to optimize foam properties while maintaining reduced environmental impact. Co-blowing systems may incorporate physical blowing agents alongside chemical ones to achieve desired foam characteristics. Such approaches allow manufacturers to fine-tune properties like thermal conductivity, dimensional stability, and mechanical strength while progressively reducing overall GWP values of their formulations.

- Regulatory and testing frameworks for GWP evaluation: Comprehensive regulatory frameworks and standardized testing methodologies have been developed to evaluate and classify blowing agents based on their global warming potential. These frameworks establish thresholds for what constitutes a low-GWP blowing agent and provide guidance for industry transition away from high-GWP alternatives. Testing protocols measure not only direct GWP values but also consider lifecycle assessments that account for energy efficiency contributions of the resulting foam products. These regulatory approaches vary by region but generally align with international climate agreements and environmental protection goals.

02 Hydrocarbon-based blowing agents

Hydrocarbon-based blowing agents offer naturally low GWP alternatives to traditional fluorinated compounds. These include substances like pentane, cyclopentane, and isopentane, which have minimal impact on global warming. While these agents present flammability concerns that require special handling and safety measures, they provide excellent insulation properties and are cost-effective. Formulations often incorporate flame retardants and specialized processing techniques to mitigate safety risks while maintaining environmental benefits. These blowing agents are particularly prevalent in rigid foam insulation applications.Expand Specific Solutions03 CO2/water-based blowing systems

Carbon dioxide and water-based blowing systems represent one of the most environmentally friendly approaches to foam production. These systems utilize the reaction between isocyanates and water to generate CO2 in-situ as the blowing agent. With a GWP of 1, CO2 offers the lowest possible global warming impact among viable blowing agents. While these systems may present challenges in achieving optimal thermal insulation properties compared to some alternatives, they excel in applications where environmental considerations are paramount. Advanced formulations incorporate additives to enhance cell structure and thermal performance.Expand Specific Solutions04 Blends and co-blowing agent systems

Blended and co-blowing agent systems combine multiple low-GWP substances to achieve optimal performance characteristics while minimizing environmental impact. These formulations typically pair HFOs or HCFOs with hydrocarbons or CO2 to balance thermal efficiency, physical properties, and environmental considerations. The synergistic effects of these blends often allow for reduced overall blowing agent usage while maintaining or improving foam quality. These systems can be tailored to specific application requirements and manufacturing constraints, providing flexibility in addressing both technical and environmental challenges.Expand Specific Solutions05 Next-generation specialty blowing agents

Emerging specialty blowing agents represent the cutting edge of low-GWP technology. These include novel chemical structures specifically designed to minimize environmental impact while maximizing performance. Some utilize innovative molecular designs that ensure rapid atmospheric breakdown while maintaining stability during the foam manufacturing process. Others incorporate renewable or bio-based components to further reduce carbon footprint. These specialty agents often target niche applications with demanding performance requirements that cannot be adequately addressed by more conventional low-GWP alternatives. Research continues to expand the range of available options and improve their commercial viability.Expand Specific Solutions

Leading Manufacturers and Research Institutions Analysis

The low-GWP blowing agents for XPS foam market is currently in a transitional growth phase, driven by global regulations phasing out high-GWP alternatives. The market size is expanding rapidly, projected to reach significant value as construction industries increasingly adopt sustainable insulation solutions. Technologically, the sector shows moderate maturity with several viable alternatives emerging. Leading chemical manufacturers like BASF, Chemours, Honeywell, and Dow Global Technologies are at the forefront of innovation, developing HFO/HCFO-based solutions. Meanwhile, academic institutions such as Beijing University of Chemical Technology and Zhejiang University are collaborating with industrial players like Owens Corning and DuPont to advance CO2-based and other environmentally friendly alternatives. Chinese manufacturers including Fujian Xinrui and Jiangsu Lvyu are rapidly gaining market share with cost-effective solutions.

BASF Corp.

Technical Solution: BASF has developed a comprehensive portfolio of low-GWP blowing agents for XPS foam, focusing on hydrofluoroolefins (HFOs) and methylal as primary alternatives. Their proprietary Neopor® and Styrodur® technologies incorporate these eco-friendly blowing agents while maintaining thermal insulation properties. BASF's approach combines HFO-1234ze with CO2 in specific ratios to achieve optimal cell structure and thermal conductivity values below 0.030 W/mK. Their research has demonstrated that methylal-based formulations can achieve up to 40% reduction in thermal conductivity compared to CO2-only systems while maintaining mechanical strength. BASF has also pioneered solubility enhancers that improve the compatibility between polymer matrices and low-GWP blowing agents, addressing one of the key challenges in XPS foam production[1][3].

Strengths: Extensive polymer chemistry expertise allows for customized formulations; global manufacturing capacity enables rapid commercialization; comprehensive testing facilities for thermal and mechanical properties. Weaknesses: Higher production costs compared to traditional blowing agents; requires modifications to existing production equipment; some formulations show slightly reduced flame retardancy properties.

The Chemours Co.

Technical Solution: Chemours has developed Opteon™ 1100, a hydrofluoroolefin (HFO) blowing agent specifically engineered for XPS foam applications with a GWP of less than 5. Their technology utilizes a proprietary blend of HFO-1336mzz(Z) with performance-enhancing co-blowing agents to achieve optimal foam properties. Chemours' research demonstrates that Opteon™ 1100 can reduce the thermal conductivity of XPS boards by up to 15% compared to hydrocarbon alternatives while maintaining dimensional stability. Their formulation addresses the critical challenge of maintaining insulation performance throughout the product lifecycle, with accelerated aging tests showing less than 5% degradation in R-value over simulated 10-year periods. Chemours has also developed specialized nucleating agents that work synergistically with their blowing agents to create uniform cell structures with over 90% closed-cell content[2][4].

Strengths: Exceptional thermal insulation properties; non-flammable formulation enhances safety; drop-in replacement requiring minimal equipment modifications. Weaknesses: Higher initial cost compared to traditional blowing agents; limited production capacity during initial commercialization phase; requires precise processing temperature control.

Key Patents and Innovations in Low-GWP Blowing Technology

Blowing agents for extruded polystyrene foam and extruded polystyrene foam and methods of foaming

PatentWO2014015315A1

Innovation

- A blowing agent composition comprising trans-HFO-1234ze and trans-HCFO-1233zd, within specific weight percentages, is used to form extruded polystyrene foams, achieving low density and improved thermal insulation with reduced global warming and ozone depletion potential, and enhanced processability.

Extruded polystyrene foam and method for producing same

PatentActiveUS10017618B2

Innovation

- The use of a specific mixed foaming agent comprising hydrofluoroolefin (HFO) and another organic foaming agent, along with a flame retardant, in a styrene resin composition to produce an extruded polystyrene foam with a high closed cell ratio and controlled density, ensuring excellent heat insulation and flame retardancy.

Environmental Regulations Impact on XPS Manufacturing

The global regulatory landscape for extruded polystyrene (XPS) foam manufacturing has undergone significant transformation in recent decades, primarily driven by environmental concerns related to blowing agents. The Montreal Protocol of 1987 marked the first major international agreement affecting XPS production, mandating the phase-out of chlorofluorocarbons (CFCs) due to their ozone-depleting potential. This initial regulation forced manufacturers to transition to hydrochlorofluorocarbons (HCFCs) as alternative blowing agents.

Subsequently, the Kigali Amendment to the Montreal Protocol in 2016 established a timeline for reducing hydrofluorocarbons (HFCs), which had become common replacements for HCFCs but possessed high global warming potential (GWP). This amendment requires developed countries to begin HFC reductions by 2019, with developing nations following suit between 2024 and 2028, creating a phased approach to minimize economic disruption while maximizing environmental benefits.

Regional regulations have further accelerated these transitions. The European Union's F-Gas Regulation, implemented in 2015 and revised in 2022, established one of the world's most stringent frameworks for fluorinated gases, including many XPS blowing agents. This regulation mandates a 79% reduction in HFC consumption by 2030 compared to 2015 levels, significantly impacting XPS manufacturing processes across Europe.

In North America, the United States Environmental Protection Agency's Significant New Alternatives Policy (SNAP) program has progressively restricted high-GWP blowing agents. Canada has aligned with these efforts through its own Canadian Environmental Protection Act regulations, creating a coordinated North American approach to blowing agent restrictions.

Asian markets present a more varied regulatory landscape. Japan and South Korea have implemented strict controls similar to European standards, while China—the world's largest XPS producer—has committed to freezing HFC consumption by 2024 and reducing it thereafter, though with longer transition periods than developed economies.

These regulations have created substantial technical and economic challenges for XPS manufacturers. The industry has faced increased production costs associated with reformulation, equipment modifications, and compliance documentation. Many manufacturers report 15-30% higher production costs when transitioning to low-GWP alternatives, with smaller producers particularly vulnerable to these financial pressures.

The regulatory timeline disparities between regions have created competitive imbalances, with manufacturers in regions with later implementation dates temporarily enjoying cost advantages. This has prompted industry associations to advocate for harmonized global implementation schedules to maintain fair competition while achieving environmental objectives.

Subsequently, the Kigali Amendment to the Montreal Protocol in 2016 established a timeline for reducing hydrofluorocarbons (HFCs), which had become common replacements for HCFCs but possessed high global warming potential (GWP). This amendment requires developed countries to begin HFC reductions by 2019, with developing nations following suit between 2024 and 2028, creating a phased approach to minimize economic disruption while maximizing environmental benefits.

Regional regulations have further accelerated these transitions. The European Union's F-Gas Regulation, implemented in 2015 and revised in 2022, established one of the world's most stringent frameworks for fluorinated gases, including many XPS blowing agents. This regulation mandates a 79% reduction in HFC consumption by 2030 compared to 2015 levels, significantly impacting XPS manufacturing processes across Europe.

In North America, the United States Environmental Protection Agency's Significant New Alternatives Policy (SNAP) program has progressively restricted high-GWP blowing agents. Canada has aligned with these efforts through its own Canadian Environmental Protection Act regulations, creating a coordinated North American approach to blowing agent restrictions.

Asian markets present a more varied regulatory landscape. Japan and South Korea have implemented strict controls similar to European standards, while China—the world's largest XPS producer—has committed to freezing HFC consumption by 2024 and reducing it thereafter, though with longer transition periods than developed economies.

These regulations have created substantial technical and economic challenges for XPS manufacturers. The industry has faced increased production costs associated with reformulation, equipment modifications, and compliance documentation. Many manufacturers report 15-30% higher production costs when transitioning to low-GWP alternatives, with smaller producers particularly vulnerable to these financial pressures.

The regulatory timeline disparities between regions have created competitive imbalances, with manufacturers in regions with later implementation dates temporarily enjoying cost advantages. This has prompted industry associations to advocate for harmonized global implementation schedules to maintain fair competition while achieving environmental objectives.

Life Cycle Assessment of Low-GWP XPS Foam Products

Life cycle assessment (LCA) of low-GWP XPS foam products provides a comprehensive evaluation of environmental impacts throughout the entire product lifecycle, from raw material extraction to end-of-life disposal. This assessment is particularly crucial for XPS foam products as the industry transitions from high-GWP blowing agents to more environmentally friendly alternatives.

The LCA methodology for XPS foam typically encompasses four main phases: raw material acquisition, manufacturing process, use phase, and end-of-life management. For low-GWP XPS foam products, special attention is given to the environmental impacts associated with alternative blowing agents such as hydrofluoroolefins (HFOs), hydrocarbons, CO2, and their blends.

Recent LCA studies have demonstrated significant environmental benefits when transitioning from traditional HFC blowing agents to low-GWP alternatives. For instance, XPS foam produced with HFO-1234ze has shown a reduction of up to 99% in global warming potential compared to HFC-134a based products, while maintaining comparable thermal insulation performance. This substantial reduction primarily stems from decreased direct emissions during manufacturing and throughout the product's lifetime.

Manufacturing energy consumption represents another critical aspect of the LCA. While some low-GWP blowing agents may require process modifications that could potentially increase energy usage, the overall climate impact remains substantially lower due to the reduced GWP of the blowing agent itself. Research indicates that optimized manufacturing processes for low-GWP XPS foam can achieve energy efficiency comparable to conventional systems.

The use phase of XPS foam products, typically spanning 50+ years in building applications, demonstrates the long-term environmental benefits of low-GWP alternatives. The thermal insulation properties directly influence building energy consumption, with low-GWP XPS foam products showing equivalent or sometimes superior thermal resistance compared to traditional products, thus maintaining energy-saving benefits throughout the building's lifetime.

End-of-life considerations reveal additional advantages of low-GWP XPS foam products. Many newer blowing agents decompose more rapidly in the atmosphere if released during disposal, further reducing their long-term climate impact. Additionally, some low-GWP XPS formulations show improved recyclability potential, contributing to circular economy objectives.

Economic analysis integrated with LCA indicates that while low-GWP XPS foam products may currently have slightly higher production costs, the price differential is decreasing as production scales up and technology matures. When considering the full life cycle costs, including potential carbon taxes and energy savings, low-GWP alternatives often present a more economically viable option in the long term.

The LCA methodology for XPS foam typically encompasses four main phases: raw material acquisition, manufacturing process, use phase, and end-of-life management. For low-GWP XPS foam products, special attention is given to the environmental impacts associated with alternative blowing agents such as hydrofluoroolefins (HFOs), hydrocarbons, CO2, and their blends.

Recent LCA studies have demonstrated significant environmental benefits when transitioning from traditional HFC blowing agents to low-GWP alternatives. For instance, XPS foam produced with HFO-1234ze has shown a reduction of up to 99% in global warming potential compared to HFC-134a based products, while maintaining comparable thermal insulation performance. This substantial reduction primarily stems from decreased direct emissions during manufacturing and throughout the product's lifetime.

Manufacturing energy consumption represents another critical aspect of the LCA. While some low-GWP blowing agents may require process modifications that could potentially increase energy usage, the overall climate impact remains substantially lower due to the reduced GWP of the blowing agent itself. Research indicates that optimized manufacturing processes for low-GWP XPS foam can achieve energy efficiency comparable to conventional systems.

The use phase of XPS foam products, typically spanning 50+ years in building applications, demonstrates the long-term environmental benefits of low-GWP alternatives. The thermal insulation properties directly influence building energy consumption, with low-GWP XPS foam products showing equivalent or sometimes superior thermal resistance compared to traditional products, thus maintaining energy-saving benefits throughout the building's lifetime.

End-of-life considerations reveal additional advantages of low-GWP XPS foam products. Many newer blowing agents decompose more rapidly in the atmosphere if released during disposal, further reducing their long-term climate impact. Additionally, some low-GWP XPS formulations show improved recyclability potential, contributing to circular economy objectives.

Economic analysis integrated with LCA indicates that while low-GWP XPS foam products may currently have slightly higher production costs, the price differential is decreasing as production scales up and technology matures. When considering the full life cycle costs, including potential carbon taxes and energy savings, low-GWP alternatives often present a more economically viable option in the long term.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!