Low-GWP Blowing Agents for Appliance and Refrigeration Insulation

OCT 13, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Low-GWP Blowing Agents Background and Objectives

Blowing agents have been integral to the insulation industry since the mid-20th century, with their evolution closely tied to environmental regulations and technological advancements. Initially, Chlorofluorocarbons (CFCs) dominated the market due to their excellent insulating properties and non-flammability. However, the discovery of their ozone-depleting potential led to their phase-out under the Montreal Protocol in the late 1980s.

The industry subsequently transitioned to Hydrochlorofluorocarbons (HCFCs) and then to Hydrofluorocarbons (HFCs), which offered improved environmental profiles. Yet, despite having zero ozone depletion potential, HFCs possess high Global Warming Potential (GWP), contributing significantly to climate change. The Kigali Amendment to the Montreal Protocol in 2016 mandated the gradual reduction of HFCs, creating an urgent need for low-GWP alternatives.

This technological evolution reflects the industry's continuous adaptation to environmental imperatives while maintaining performance standards. The current research landscape is focused on developing blowing agents with GWP values below 150, which represents a significant reduction compared to traditional HFCs with GWP values often exceeding 1,000.

The primary objective of research on low-GWP blowing agents for appliance and refrigeration insulation is to develop solutions that balance environmental sustainability with technical performance. These agents must provide excellent thermal insulation properties while minimizing environmental impact throughout their lifecycle. Additionally, they must be cost-effective, compatible with existing manufacturing processes, and meet stringent safety requirements.

Specific technical goals include achieving thermal conductivity values comparable to or better than current HFC-based systems (typically around 0.020-0.022 W/m·K), ensuring dimensional stability over the product lifecycle, and maintaining appropriate mechanical properties of the foam. The development must also consider regional regulatory frameworks, which are increasingly stringent regarding GWP limits.

Another critical objective is addressing the trade-offs inherent in alternative blowing agents. For instance, while hydrocarbons offer very low GWP, they present flammability concerns. Hydrofluoroolefins (HFOs) show promise with ultra-low GWP values but may face challenges related to cost and long-term stability. Water-blown systems eliminate direct GWP concerns but may compromise insulation performance.

The research aims to establish a technological roadmap for the industry's transition to sustainable insulation solutions, identifying potential breakthrough technologies and addressing implementation barriers. This includes evaluating blowing agent mixtures that might offer synergistic benefits and developing novel foam formulations optimized for next-generation blowing agents.

The industry subsequently transitioned to Hydrochlorofluorocarbons (HCFCs) and then to Hydrofluorocarbons (HFCs), which offered improved environmental profiles. Yet, despite having zero ozone depletion potential, HFCs possess high Global Warming Potential (GWP), contributing significantly to climate change. The Kigali Amendment to the Montreal Protocol in 2016 mandated the gradual reduction of HFCs, creating an urgent need for low-GWP alternatives.

This technological evolution reflects the industry's continuous adaptation to environmental imperatives while maintaining performance standards. The current research landscape is focused on developing blowing agents with GWP values below 150, which represents a significant reduction compared to traditional HFCs with GWP values often exceeding 1,000.

The primary objective of research on low-GWP blowing agents for appliance and refrigeration insulation is to develop solutions that balance environmental sustainability with technical performance. These agents must provide excellent thermal insulation properties while minimizing environmental impact throughout their lifecycle. Additionally, they must be cost-effective, compatible with existing manufacturing processes, and meet stringent safety requirements.

Specific technical goals include achieving thermal conductivity values comparable to or better than current HFC-based systems (typically around 0.020-0.022 W/m·K), ensuring dimensional stability over the product lifecycle, and maintaining appropriate mechanical properties of the foam. The development must also consider regional regulatory frameworks, which are increasingly stringent regarding GWP limits.

Another critical objective is addressing the trade-offs inherent in alternative blowing agents. For instance, while hydrocarbons offer very low GWP, they present flammability concerns. Hydrofluoroolefins (HFOs) show promise with ultra-low GWP values but may face challenges related to cost and long-term stability. Water-blown systems eliminate direct GWP concerns but may compromise insulation performance.

The research aims to establish a technological roadmap for the industry's transition to sustainable insulation solutions, identifying potential breakthrough technologies and addressing implementation barriers. This includes evaluating blowing agent mixtures that might offer synergistic benefits and developing novel foam formulations optimized for next-generation blowing agents.

Market Demand Analysis for Sustainable Insulation Solutions

The global market for sustainable insulation solutions is experiencing significant growth driven by stringent environmental regulations and increasing awareness of climate change impacts. The phase-out of high Global Warming Potential (GWP) blowing agents, particularly hydrofluorocarbons (HFCs), has created an urgent demand for low-GWP alternatives in appliance and refrigeration insulation. This transition is primarily motivated by international agreements such as the Kigali Amendment to the Montreal Protocol, which mandates the reduction of HFC consumption by more than 80% over the next 30 years.

Market research indicates that the global polyurethane foam insulation market, a key segment utilizing blowing agents, was valued at approximately $17.5 billion in 2022 and is projected to grow at a CAGR of 6.8% through 2030. The refrigeration and appliance sectors represent nearly 25% of this market, highlighting the substantial commercial opportunity for innovative low-GWP solutions.

Consumer preferences are increasingly favoring energy-efficient appliances with minimal environmental impact. A recent industry survey revealed that 73% of consumers in developed markets consider energy efficiency ratings when purchasing refrigerators and freezers. This consumer-driven demand is compelling manufacturers to adopt more sustainable insulation technologies, creating a market pull effect alongside regulatory push factors.

From a regional perspective, Europe leads in the adoption of low-GWP blowing agents due to its early implementation of F-gas regulations. North America follows closely behind, with the U.S. EPA's Significant New Alternatives Policy (SNAP) program accelerating the transition. The Asia-Pacific region, particularly China and India, represents the fastest-growing market for sustainable insulation solutions, driven by rapid urbanization and expanding middle-class populations.

The economic value proposition for low-GWP blowing agents extends beyond regulatory compliance. Enhanced thermal efficiency can reduce energy consumption in refrigerators and freezers by up to 15%, offering significant lifetime cost savings for consumers. Manufacturers capable of delivering superior insulation performance while meeting environmental standards can command premium pricing and gain market share.

Supply chain considerations are becoming increasingly important as the industry transitions. Raw material availability, production scalability, and cost competitiveness are critical factors influencing market adoption rates. Current price premiums for low-GWP alternatives range from 15-30% compared to traditional blowing agents, though economies of scale are expected to reduce this gap over time.

Market research indicates that the global polyurethane foam insulation market, a key segment utilizing blowing agents, was valued at approximately $17.5 billion in 2022 and is projected to grow at a CAGR of 6.8% through 2030. The refrigeration and appliance sectors represent nearly 25% of this market, highlighting the substantial commercial opportunity for innovative low-GWP solutions.

Consumer preferences are increasingly favoring energy-efficient appliances with minimal environmental impact. A recent industry survey revealed that 73% of consumers in developed markets consider energy efficiency ratings when purchasing refrigerators and freezers. This consumer-driven demand is compelling manufacturers to adopt more sustainable insulation technologies, creating a market pull effect alongside regulatory push factors.

From a regional perspective, Europe leads in the adoption of low-GWP blowing agents due to its early implementation of F-gas regulations. North America follows closely behind, with the U.S. EPA's Significant New Alternatives Policy (SNAP) program accelerating the transition. The Asia-Pacific region, particularly China and India, represents the fastest-growing market for sustainable insulation solutions, driven by rapid urbanization and expanding middle-class populations.

The economic value proposition for low-GWP blowing agents extends beyond regulatory compliance. Enhanced thermal efficiency can reduce energy consumption in refrigerators and freezers by up to 15%, offering significant lifetime cost savings for consumers. Manufacturers capable of delivering superior insulation performance while meeting environmental standards can command premium pricing and gain market share.

Supply chain considerations are becoming increasingly important as the industry transitions. Raw material availability, production scalability, and cost competitiveness are critical factors influencing market adoption rates. Current price premiums for low-GWP alternatives range from 15-30% compared to traditional blowing agents, though economies of scale are expected to reduce this gap over time.

Current Status and Challenges in Low-GWP Technology

The global landscape of low-GWP (Global Warming Potential) blowing agents for insulation applications has undergone significant transformation in recent years. Currently, the industry is in a critical transition phase from high-GWP hydrofluorocarbons (HFCs) to more environmentally sustainable alternatives. In developed regions such as North America and Europe, regulatory frameworks including the EU F-Gas Regulation and the U.S. EPA SNAP Program have accelerated this transition, while developing nations are following suit under the Kigali Amendment to the Montreal Protocol.

Technologically, several low-GWP alternatives have emerged in the market. Hydrofluoroolefins (HFOs) like HFO-1234ze and HFO-1336mzz have gained significant traction, offering GWP values below 10 compared to traditional HFCs with GWPs often exceeding 1,000. Hydrocarbon-based agents, particularly cyclopentane and n-pentane, have established a strong presence in certain applications due to their negligible GWP and cost-effectiveness, despite flammability concerns.

Water-blown systems represent another growing segment, particularly in spray foam applications, though they face challenges in achieving thermal efficiency comparable to other blowing agents. CO2-based technologies, both directly applied and generated through chemical reactions, continue to evolve as zero-GWP options, albeit with limitations in insulation performance.

The geographical distribution of low-GWP technology adoption shows notable disparities. Japan and European countries lead in HFO adoption, while China dominates in hydrocarbon-based systems manufacturing. The United States presents a mixed landscape with regional variations in adoption rates based on state-level regulations.

Despite progress, significant technical challenges persist. Thermal conductivity remains a critical concern, as many low-GWP alternatives struggle to match the insulation performance of traditional HFCs. This is particularly problematic for refrigeration applications where space constraints demand maximum efficiency per unit thickness.

Flammability presents another major hurdle, especially for hydrocarbon-based agents, necessitating substantial modifications to manufacturing facilities and processes to ensure safety compliance. This has created a significant barrier to adoption for smaller manufacturers with limited capital resources.

Processing challenges also exist, as many low-GWP alternatives exhibit different solubility, reactivity, and flow characteristics compared to traditional blowing agents, requiring reformulation of polyol blends and adjustment of processing parameters. This has led to extended development cycles and increased costs for manufacturers.

Cost remains a persistent constraint, with HFO-based systems typically commanding a 15-30% premium over HFC-based formulations. This economic barrier is particularly pronounced in price-sensitive markets and developing economies, where environmental regulations may be less stringent.

Technologically, several low-GWP alternatives have emerged in the market. Hydrofluoroolefins (HFOs) like HFO-1234ze and HFO-1336mzz have gained significant traction, offering GWP values below 10 compared to traditional HFCs with GWPs often exceeding 1,000. Hydrocarbon-based agents, particularly cyclopentane and n-pentane, have established a strong presence in certain applications due to their negligible GWP and cost-effectiveness, despite flammability concerns.

Water-blown systems represent another growing segment, particularly in spray foam applications, though they face challenges in achieving thermal efficiency comparable to other blowing agents. CO2-based technologies, both directly applied and generated through chemical reactions, continue to evolve as zero-GWP options, albeit with limitations in insulation performance.

The geographical distribution of low-GWP technology adoption shows notable disparities. Japan and European countries lead in HFO adoption, while China dominates in hydrocarbon-based systems manufacturing. The United States presents a mixed landscape with regional variations in adoption rates based on state-level regulations.

Despite progress, significant technical challenges persist. Thermal conductivity remains a critical concern, as many low-GWP alternatives struggle to match the insulation performance of traditional HFCs. This is particularly problematic for refrigeration applications where space constraints demand maximum efficiency per unit thickness.

Flammability presents another major hurdle, especially for hydrocarbon-based agents, necessitating substantial modifications to manufacturing facilities and processes to ensure safety compliance. This has created a significant barrier to adoption for smaller manufacturers with limited capital resources.

Processing challenges also exist, as many low-GWP alternatives exhibit different solubility, reactivity, and flow characteristics compared to traditional blowing agents, requiring reformulation of polyol blends and adjustment of processing parameters. This has led to extended development cycles and increased costs for manufacturers.

Cost remains a persistent constraint, with HFO-based systems typically commanding a 15-30% premium over HFC-based formulations. This economic barrier is particularly pronounced in price-sensitive markets and developing economies, where environmental regulations may be less stringent.

Current Low-GWP Blowing Agent Technical Solutions

01 Hydrofluoroolefin (HFO) based blowing agents

Hydrofluoroolefins (HFOs) represent a new generation of blowing agents with significantly lower Global Warming Potential compared to traditional hydrofluorocarbons (HFCs). These compounds, such as HFO-1234ze and HFO-1234yf, offer GWP values less than 10, making them environmentally preferable alternatives. HFOs maintain good thermal insulation properties while reducing climate impact, and can be used in various foam applications including polyurethane, polystyrene, and polyisocyanurate foams.- Hydrofluoroolefin (HFO) based blowing agents: Hydrofluoroolefins (HFOs) represent a significant advancement in low-GWP blowing agent technology. These compounds maintain excellent insulating properties while dramatically reducing global warming potential compared to traditional HFCs. HFOs like HFO-1234ze and HFO-1234yf have GWP values below 10, making them environmentally preferable alternatives. These compounds offer good thermal insulation properties, low toxicity, and compatibility with existing foam production equipment, allowing manufacturers to transition to more sustainable options without significant process modifications.

- Hydrocarbon-based blowing agents: Hydrocarbon-based blowing agents such as pentane, cyclopentane, and isopentane offer extremely low GWP values (typically less than 20) compared to traditional fluorocarbon alternatives. These natural compounds are cost-effective and provide good insulation properties in foam applications. While flammability remains a concern, manufacturers have developed specialized handling procedures and formulations to mitigate risks. Hydrocarbon blowing agents are particularly suitable for applications where thermal insulation is critical, such as refrigeration and building insulation, offering an environmentally responsible alternative with minimal ozone depletion potential.

- CO2/water-based blowing systems: Carbon dioxide and water-based blowing systems represent some of the lowest possible GWP options available, with CO2 having a GWP of 1 by definition. These systems generate CO2 through chemical reactions during the foaming process or use directly injected CO2. Water reacts with isocyanates in polyurethane systems to release CO2 as a blowing agent. While these systems offer excellent environmental credentials with zero ozone depletion potential, they typically result in foams with slightly lower insulation performance compared to other blowing agents. Manufacturers have developed specialized formulations and processing techniques to optimize thermal performance while maintaining the environmental benefits.

- Blends and co-blowing agent systems: Blended and co-blowing agent systems combine multiple low-GWP compounds to achieve optimal performance characteristics while maintaining environmental benefits. These formulations typically mix HFOs, hydrocarbons, CO2, or other low-GWP agents in specific ratios to balance thermal efficiency, processability, and safety considerations. By leveraging the strengths of different blowing agents, manufacturers can create customized solutions for specific applications and processing conditions. These blended systems often allow for easier transition from high-GWP blowing agents by mimicking their performance characteristics while significantly reducing environmental impact.

- Methyl formate and other oxygenated hydrocarbon blowing agents: Methyl formate and other oxygenated hydrocarbons represent an emerging class of low-GWP blowing agents with GWP values typically below 25. These compounds offer reduced flammability compared to pure hydrocarbons while maintaining good insulating properties. Methyl formate, in particular, has gained attention for its favorable environmental profile and performance characteristics in polyurethane foam applications. Other oxygenated hydrocarbons like methylal and dimethoxymethane are also being explored as sustainable alternatives. These compounds generally offer good compatibility with common foam formulations and can be processed using conventional equipment with appropriate safety modifications.

02 Hydrocarbon-based blowing agents

Hydrocarbon-based blowing agents such as pentane, cyclopentane, and isopentane offer very low GWP values (typically less than 20) compared to traditional fluorinated compounds. These natural substances are cost-effective alternatives that provide good insulation properties while minimizing environmental impact. Formulations often require optimization to address flammability concerns, but their excellent environmental profile makes them increasingly popular in rigid foam applications for construction and refrigeration industries.Expand Specific Solutions03 CO2/water-based blowing systems

Carbon dioxide generated through water reaction with isocyanates represents one of the lowest GWP blowing options available, with CO2 having a GWP of 1. These systems utilize water as a chemical blowing agent that reacts during the foam formation process to generate CO2 in-situ. While offering excellent environmental credentials, these systems require careful formulation to manage cell structure, dimensional stability, and thermal conductivity properties. They are particularly suitable for applications where ultimate environmental performance takes priority over maximum insulation efficiency.Expand Specific Solutions04 Blends and co-blowing agent systems

Blended systems combining multiple low-GWP blowing agents can optimize performance while maintaining environmental benefits. These formulations typically mix hydrofluoroolefins (HFOs) with hydrocarbons or CO2/water systems to balance thermal efficiency, processing characteristics, and environmental impact. The synergistic effects of blended systems allow manufacturers to fine-tune properties like thermal conductivity, dimensional stability, and mechanical strength while keeping overall GWP values significantly lower than traditional blowing agents.Expand Specific Solutions05 Methyl formate and other oxygenated hydrocarbon alternatives

Methyl formate and other oxygenated hydrocarbons represent emerging low-GWP blowing agent options with GWP values near zero. These compounds offer reduced flammability compared to pure hydrocarbons while maintaining excellent environmental credentials. They can be used either as primary blowing agents or as co-blowing agents in formulations. Their unique solubility characteristics and boiling points provide formulators with additional tools to optimize foam properties while meeting increasingly stringent environmental regulations targeting global warming potential reduction.Expand Specific Solutions

Key Industry Players in Low-GWP Blowing Agent Development

The low-GWP blowing agents market for appliance and refrigeration insulation is in a transitional growth phase, driven by global regulations phasing out high-GWP alternatives. The market is projected to reach approximately $1.5 billion by 2027, growing at 8-10% CAGR. Leading chemical manufacturers like Arkema, Chemours, Honeywell, and DuPont are at the forefront of developing next-generation blowing agents, while major appliance manufacturers including Midea Group, Gree Electric, DAIKIN, and BSH are rapidly adopting these solutions. The technology has reached commercial maturity for hydrofluoroolefins (HFOs) and hydrocarbon-based alternatives, though cost optimization and performance enhancement continue. Academic-industry partnerships, particularly involving Huazhong University of Science & Technology and Shandong University of Technology, are accelerating innovation in this environmentally critical sector.

The Chemours Co.

Technical Solution: Chemours has developed Opteon™ 1100, a hydrofluoroolefin (HFO)-based blowing agent specifically engineered for polyurethane foam insulation in refrigeration applications. This technology features a GWP of less than 2, representing a 99.9% reduction compared to legacy HFC blowing agents. The Opteon™ solution utilizes a proprietary molecular structure that optimizes thermal conductivity while maintaining excellent dimensional stability in foam applications. Chemours' research has demonstrated that their blowing agent technology can achieve lambda values as low as 0.019 W/m·K in optimized formulations, providing superior insulation performance. The company has also developed specialized catalyst systems that work synergistically with their blowing agents to control reaction profiles and cell structure formation. Their technology includes innovative stabilizer packages that enhance the long-term thermal performance retention of the insulation, addressing a critical industry challenge. Chemours has conducted extensive aging studies showing that foams produced with their technology maintain over 95% of their initial insulation value after accelerated aging tests equivalent to 10 years of service.

Strengths: Exceptional thermal insulation properties that translate to improved energy efficiency in refrigeration applications; Excellent compatibility with existing polyurethane systems requiring minimal reformulation; Non-flammable formulation enhances safety throughout the value chain. Weaknesses: Higher cost compared to traditional blowing agents impacts product economics; Requires specialized handling and storage conditions; Limited production capacity could affect widespread adoption in high-volume applications.

Dow Global Technologies LLC

Technical Solution: Dow has developed PASCAL™ technology, a comprehensive solution for low-GWP polyurethane foam insulation in refrigeration applications. Their approach integrates specially formulated hydrofluoroolefin (HFO) blowing agents with proprietary polyol formulations to create high-performance insulation systems. Dow's technology utilizes a co-blowing approach that combines HFO-1233zd(E) with carefully selected hydrocarbons in optimized ratios, achieving a system GWP below 5 while maintaining superior insulation performance. Their research has demonstrated thermal conductivity values consistently below 0.020 W/m·K in laboratory testing. A key innovation in Dow's approach is their cell stabilization technology, which creates a highly uniform closed-cell structure that minimizes thermal bridging and enhances long-term performance. The company has also developed specialized surfactant packages that improve compatibility between the various components, resulting in enhanced processing characteristics and dimensional stability. Dow's solution includes comprehensive formulation guidance that allows manufacturers to optimize the balance between environmental performance, insulation efficiency, and production economics based on specific regional requirements and equipment configurations.

Strengths: Integrated system approach ensures compatibility between all components for optimal performance; Flexible formulation options allow customization for different manufacturing processes and regional requirements; Excellent dimensional stability and adhesion properties improve overall product quality. Weaknesses: Complex formulation may require more technical support during implementation; Performance can be sensitive to processing conditions, requiring tighter manufacturing controls; Higher system cost compared to traditional HFC-based solutions.

Core Patents and Innovations in Low-GWP Insulation Technology

Low-GWP blowing agent blends and uses thereof

PatentWO2025096186A1

Innovation

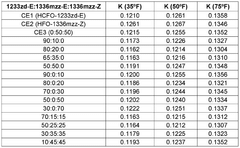

- The use of blends comprising E-1-chloro-3,3,3-trifluoropropene (HCFO-1233zd-E) combined with either E-1,1,1,4,4,4-hexafluoro-2-butene (HFO-1336mzz-E) or Z-1,1,1,4,4,4-hexafluoro-2-butene (HFO-1336mzz-Z) as blowing agents for polyurethane foam formulations, which results in high-quality foams with improved thermal insulation and reduced environmental impact.

Low GWP refrigerant blends

PatentWO2019102003A1

Innovation

- The development of refrigerant blends comprising carbon dioxide and HFOs (such as R1234yf and R1234ze(E)) along with R32, R125, and R227ea, which offer lower GWP values, are non-ozone depleting, and have safety classifications that allow them to replace R404A, R507, and R410A in existing and new systems, providing energy efficiencies and cooling capacities comparable to the originals while minimizing modifications and costs.

Environmental Regulations and Compliance Requirements

The global regulatory landscape for blowing agents has undergone significant transformation in recent decades, primarily driven by environmental concerns related to ozone depletion and global warming. The Montreal Protocol, established in 1987, initiated the phase-out of chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs) due to their ozone-depleting properties. This landmark agreement has been amended multiple times, most notably through the Kigali Amendment in 2016, which expanded its scope to include hydrofluorocarbons (HFCs) despite their zero ozone depletion potential, due to their high global warming potential (GWP).

Regional implementation of these international frameworks varies considerably. The European Union has taken a particularly aggressive stance through its F-Gas Regulation, which mandates a 79% reduction in HFC consumption by 2030 compared to 2015 levels. This regulation specifically impacts the appliance and refrigeration insulation sector by restricting HFCs with GWP values above 150 in many applications. Similarly, the United States Environmental Protection Agency's Significant New Alternatives Policy (SNAP) program has delisted numerous high-GWP blowing agents for various applications, creating a regulatory push toward low-GWP alternatives.

Compliance requirements for manufacturers extend beyond simply selecting approved blowing agents. Companies must maintain detailed records of blowing agent usage, implement leak detection and repair protocols, and ensure proper end-of-life management of insulation materials. These requirements necessitate substantial investments in monitoring equipment, staff training, and reporting systems. Non-compliance penalties can be severe, including substantial fines and potential market exclusion.

Emerging economies are increasingly adopting similar regulatory frameworks, albeit with extended timelines. China's Green and High-Efficiency Cooling Action Plan and India's implementation of the Kigali Amendment are creating a global convergence of standards, though with regional variations in implementation schedules and enforcement mechanisms. This global trend creates both challenges and opportunities for multinational manufacturers seeking to standardize their insulation technologies across markets.

Safety standards represent another critical compliance dimension. Many low-GWP alternatives exhibit different flammability profiles compared to traditional blowing agents. Standards such as ISO 5149, ASHRAE 15, and IEC 60335-2-40 establish safety requirements for flammable refrigerants and blowing agents. Manufacturers must demonstrate compliance with these standards through rigorous testing and certification processes, adding another layer of complexity to the transition toward environmentally sustainable insulation solutions.

Regional implementation of these international frameworks varies considerably. The European Union has taken a particularly aggressive stance through its F-Gas Regulation, which mandates a 79% reduction in HFC consumption by 2030 compared to 2015 levels. This regulation specifically impacts the appliance and refrigeration insulation sector by restricting HFCs with GWP values above 150 in many applications. Similarly, the United States Environmental Protection Agency's Significant New Alternatives Policy (SNAP) program has delisted numerous high-GWP blowing agents for various applications, creating a regulatory push toward low-GWP alternatives.

Compliance requirements for manufacturers extend beyond simply selecting approved blowing agents. Companies must maintain detailed records of blowing agent usage, implement leak detection and repair protocols, and ensure proper end-of-life management of insulation materials. These requirements necessitate substantial investments in monitoring equipment, staff training, and reporting systems. Non-compliance penalties can be severe, including substantial fines and potential market exclusion.

Emerging economies are increasingly adopting similar regulatory frameworks, albeit with extended timelines. China's Green and High-Efficiency Cooling Action Plan and India's implementation of the Kigali Amendment are creating a global convergence of standards, though with regional variations in implementation schedules and enforcement mechanisms. This global trend creates both challenges and opportunities for multinational manufacturers seeking to standardize their insulation technologies across markets.

Safety standards represent another critical compliance dimension. Many low-GWP alternatives exhibit different flammability profiles compared to traditional blowing agents. Standards such as ISO 5149, ASHRAE 15, and IEC 60335-2-40 establish safety requirements for flammable refrigerants and blowing agents. Manufacturers must demonstrate compliance with these standards through rigorous testing and certification processes, adding another layer of complexity to the transition toward environmentally sustainable insulation solutions.

Thermal Performance Comparison Across Blowing Agent Types

Thermal performance is a critical factor in evaluating the effectiveness of insulation systems in appliances and refrigeration units. The transition from high-GWP blowing agents to low-GWP alternatives necessitates comprehensive thermal performance analysis to ensure that energy efficiency is not compromised while meeting environmental objectives.

Traditional high-GWP blowing agents such as HFC-245fa and HFC-365mfc have established excellent thermal insulation properties with k-factors typically ranging from 0.019 to 0.022 W/m·K. These agents create fine, closed-cell structures that effectively minimize heat transfer through conduction and convection mechanisms, resulting in superior insulation performance.

Hydrocarbon-based alternatives, including cyclopentane and n-pentane, demonstrate slightly higher k-factors (0.022-0.025 W/m·K) compared to HFCs. This represents approximately 5-8% reduction in thermal efficiency. However, long-term studies indicate that hydrocarbon-blown foams maintain their thermal performance more consistently over time, with less thermal drift than HFC alternatives.

HFO-based blowing agents, particularly HFO-1234ze and HFO-1336mzz, have emerged as promising low-GWP options with initial thermal performance closely matching that of HFCs. Laboratory testing shows k-factors of 0.020-0.023 W/m·K, with excellent cell structure and dimensional stability. Accelerated aging tests suggest that HFO-blown foams may experience less thermal conductivity increase over time compared to hydrocarbon alternatives.

Methyl formate and methylal, as oxygenated hydrocarbon alternatives, demonstrate moderate thermal performance with k-factors of 0.023-0.026 W/m·K. While not matching HFC performance, they offer acceptable insulation properties for less demanding applications and can be blended with other blowing agents to optimize performance.

CO2 (LCD) systems show the highest k-factors among common alternatives (0.026-0.030 W/m·K), representing a 15-20% reduction in insulation efficiency compared to HFCs. This significant difference often necessitates increased insulation thickness to maintain equivalent energy performance, potentially reducing internal storage volume in appliances.

Field testing in actual refrigeration units reveals that energy consumption increases of 3-7% are typical when transitioning from HFC to hydrocarbon blowing agents without design modifications. However, manufacturers have successfully mitigated these differences through optimization of foam formulations, processing conditions, and strategic design adjustments.

The thermal performance gap between high-GWP and low-GWP blowing agents continues to narrow as formulation technology advances. Recent developments in nucleating agents, cell stabilizers, and catalyst systems have enabled significant improvements in the insulation efficiency of low-GWP alternatives, bringing their performance increasingly closer to traditional HFC standards.

Traditional high-GWP blowing agents such as HFC-245fa and HFC-365mfc have established excellent thermal insulation properties with k-factors typically ranging from 0.019 to 0.022 W/m·K. These agents create fine, closed-cell structures that effectively minimize heat transfer through conduction and convection mechanisms, resulting in superior insulation performance.

Hydrocarbon-based alternatives, including cyclopentane and n-pentane, demonstrate slightly higher k-factors (0.022-0.025 W/m·K) compared to HFCs. This represents approximately 5-8% reduction in thermal efficiency. However, long-term studies indicate that hydrocarbon-blown foams maintain their thermal performance more consistently over time, with less thermal drift than HFC alternatives.

HFO-based blowing agents, particularly HFO-1234ze and HFO-1336mzz, have emerged as promising low-GWP options with initial thermal performance closely matching that of HFCs. Laboratory testing shows k-factors of 0.020-0.023 W/m·K, with excellent cell structure and dimensional stability. Accelerated aging tests suggest that HFO-blown foams may experience less thermal conductivity increase over time compared to hydrocarbon alternatives.

Methyl formate and methylal, as oxygenated hydrocarbon alternatives, demonstrate moderate thermal performance with k-factors of 0.023-0.026 W/m·K. While not matching HFC performance, they offer acceptable insulation properties for less demanding applications and can be blended with other blowing agents to optimize performance.

CO2 (LCD) systems show the highest k-factors among common alternatives (0.026-0.030 W/m·K), representing a 15-20% reduction in insulation efficiency compared to HFCs. This significant difference often necessitates increased insulation thickness to maintain equivalent energy performance, potentially reducing internal storage volume in appliances.

Field testing in actual refrigeration units reveals that energy consumption increases of 3-7% are typical when transitioning from HFC to hydrocarbon blowing agents without design modifications. However, manufacturers have successfully mitigated these differences through optimization of foam formulations, processing conditions, and strategic design adjustments.

The thermal performance gap between high-GWP and low-GWP blowing agents continues to narrow as formulation technology advances. Recent developments in nucleating agents, cell stabilizers, and catalyst systems have enabled significant improvements in the insulation efficiency of low-GWP alternatives, bringing their performance increasingly closer to traditional HFC standards.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!