Investigating Carbon Footprint Reduction via Polypropylene Innovations

JUL 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Polypropylene Carbon Footprint Reduction Goals

Polypropylene, a versatile thermoplastic polymer, has become a focal point in the global effort to reduce carbon footprints across various industries. The primary goal in this endeavor is to significantly decrease the greenhouse gas emissions associated with polypropylene production, use, and disposal throughout its lifecycle. This objective aligns with broader sustainability targets set by international agreements and corporate commitments to combat climate change.

One of the key aims is to reduce the carbon intensity of polypropylene manufacturing processes. This involves optimizing energy efficiency in production facilities, transitioning to renewable energy sources, and implementing advanced process technologies that minimize waste and emissions. The industry is targeting a substantial reduction in CO2 emissions per ton of polypropylene produced, with some companies aiming for carbon-neutral production by 2050.

Another critical goal is to increase the use of recycled and bio-based feedstocks in polypropylene production. By incorporating post-consumer recycled materials and developing bio-based alternatives, manufacturers seek to decrease reliance on fossil fuel-derived raw materials, thereby lowering the overall carbon footprint of the polymer. The industry is setting ambitious targets to increase the percentage of recycled content in polypropylene products, with some aiming for up to 30% by 2030.

Improving the end-of-life management of polypropylene products is also a crucial objective. This includes enhancing recyclability through innovative product design, establishing more efficient collection and sorting systems, and developing advanced recycling technologies. The goal is to create a circular economy for polypropylene, where materials are continuously reused and recycled, minimizing waste and reducing the need for virgin material production.

Furthermore, the industry aims to extend the lifespan of polypropylene products through improved durability and repairability. By creating longer-lasting products, the overall demand for new polypropylene can be reduced, leading to fewer emissions associated with production and disposal. This goal also encompasses the development of new applications that leverage polypropylene's properties to replace more carbon-intensive materials in various sectors.

Collaboration across the value chain is essential to achieve these carbon footprint reduction goals. The industry is working towards establishing partnerships between raw material suppliers, manufacturers, retailers, and waste management companies to create a more sustainable and integrated approach to polypropylene use and recycling. This collaborative effort aims to drive innovation, share best practices, and accelerate the transition to low-carbon polypropylene solutions.

One of the key aims is to reduce the carbon intensity of polypropylene manufacturing processes. This involves optimizing energy efficiency in production facilities, transitioning to renewable energy sources, and implementing advanced process technologies that minimize waste and emissions. The industry is targeting a substantial reduction in CO2 emissions per ton of polypropylene produced, with some companies aiming for carbon-neutral production by 2050.

Another critical goal is to increase the use of recycled and bio-based feedstocks in polypropylene production. By incorporating post-consumer recycled materials and developing bio-based alternatives, manufacturers seek to decrease reliance on fossil fuel-derived raw materials, thereby lowering the overall carbon footprint of the polymer. The industry is setting ambitious targets to increase the percentage of recycled content in polypropylene products, with some aiming for up to 30% by 2030.

Improving the end-of-life management of polypropylene products is also a crucial objective. This includes enhancing recyclability through innovative product design, establishing more efficient collection and sorting systems, and developing advanced recycling technologies. The goal is to create a circular economy for polypropylene, where materials are continuously reused and recycled, minimizing waste and reducing the need for virgin material production.

Furthermore, the industry aims to extend the lifespan of polypropylene products through improved durability and repairability. By creating longer-lasting products, the overall demand for new polypropylene can be reduced, leading to fewer emissions associated with production and disposal. This goal also encompasses the development of new applications that leverage polypropylene's properties to replace more carbon-intensive materials in various sectors.

Collaboration across the value chain is essential to achieve these carbon footprint reduction goals. The industry is working towards establishing partnerships between raw material suppliers, manufacturers, retailers, and waste management companies to create a more sustainable and integrated approach to polypropylene use and recycling. This collaborative effort aims to drive innovation, share best practices, and accelerate the transition to low-carbon polypropylene solutions.

Market Demand for Sustainable Plastics

The demand for sustainable plastics, particularly in the context of polypropylene innovations for carbon footprint reduction, has seen a significant surge in recent years. This trend is driven by increasing environmental awareness, stringent regulations, and consumer preferences for eco-friendly products. The global market for sustainable plastics is experiencing robust growth, with polypropylene playing a crucial role due to its versatility and potential for recycling.

Major industries, including packaging, automotive, and consumer goods, are actively seeking sustainable alternatives to traditional plastics. Polypropylene, being one of the most widely used plastics, is at the forefront of this transition. The market demand is particularly strong for polypropylene innovations that can reduce carbon footprint throughout the product lifecycle, from production to disposal or recycling.

In the packaging sector, which accounts for a substantial portion of plastic use, there is a growing demand for polypropylene solutions that offer improved recyclability and reduced environmental impact. Food and beverage companies are increasingly adopting sustainable polypropylene packaging to meet consumer expectations and comply with evolving regulations.

The automotive industry is another significant driver of demand for sustainable polypropylene. As automakers strive to reduce vehicle weight and improve fuel efficiency, they are turning to innovative polypropylene composites that offer both strength and reduced carbon footprint. This trend is further accelerated by the shift towards electric vehicles, where lightweight materials are crucial for extending range and performance.

Consumer goods manufacturers are also responding to market demand by incorporating sustainable polypropylene into their products. From household items to electronics, there is a growing preference for products made from materials that have a lower environmental impact. This shift is not only driven by consumer awareness but also by corporate sustainability goals and brand positioning strategies.

The construction industry is emerging as another key market for sustainable polypropylene innovations. As green building practices gain traction, there is an increasing demand for construction materials that offer durability, energy efficiency, and a reduced carbon footprint. Polypropylene-based materials that can contribute to LEED certification or similar green building standards are particularly sought after.

Market analysis indicates that the demand for sustainable polypropylene is not limited to developed economies. Emerging markets, particularly in Asia and Latin America, are showing rapid growth in adoption of eco-friendly plastics. This global demand is driving innovation in polypropylene production techniques, recycling technologies, and the development of bio-based alternatives.

The market is also seeing a shift towards circular economy models, where polypropylene products are designed for easy recycling and reuse. This trend is creating new opportunities for innovations in polypropylene that facilitate closed-loop systems, further driving demand for sustainable solutions in this space.

Major industries, including packaging, automotive, and consumer goods, are actively seeking sustainable alternatives to traditional plastics. Polypropylene, being one of the most widely used plastics, is at the forefront of this transition. The market demand is particularly strong for polypropylene innovations that can reduce carbon footprint throughout the product lifecycle, from production to disposal or recycling.

In the packaging sector, which accounts for a substantial portion of plastic use, there is a growing demand for polypropylene solutions that offer improved recyclability and reduced environmental impact. Food and beverage companies are increasingly adopting sustainable polypropylene packaging to meet consumer expectations and comply with evolving regulations.

The automotive industry is another significant driver of demand for sustainable polypropylene. As automakers strive to reduce vehicle weight and improve fuel efficiency, they are turning to innovative polypropylene composites that offer both strength and reduced carbon footprint. This trend is further accelerated by the shift towards electric vehicles, where lightweight materials are crucial for extending range and performance.

Consumer goods manufacturers are also responding to market demand by incorporating sustainable polypropylene into their products. From household items to electronics, there is a growing preference for products made from materials that have a lower environmental impact. This shift is not only driven by consumer awareness but also by corporate sustainability goals and brand positioning strategies.

The construction industry is emerging as another key market for sustainable polypropylene innovations. As green building practices gain traction, there is an increasing demand for construction materials that offer durability, energy efficiency, and a reduced carbon footprint. Polypropylene-based materials that can contribute to LEED certification or similar green building standards are particularly sought after.

Market analysis indicates that the demand for sustainable polypropylene is not limited to developed economies. Emerging markets, particularly in Asia and Latin America, are showing rapid growth in adoption of eco-friendly plastics. This global demand is driving innovation in polypropylene production techniques, recycling technologies, and the development of bio-based alternatives.

The market is also seeing a shift towards circular economy models, where polypropylene products are designed for easy recycling and reuse. This trend is creating new opportunities for innovations in polypropylene that facilitate closed-loop systems, further driving demand for sustainable solutions in this space.

Current State of Polypropylene Production

Polypropylene production has become a cornerstone of the global plastics industry, with an annual output exceeding 75 million metric tons. This versatile thermoplastic polymer, known for its low density, high tensile strength, and chemical resistance, finds applications across various sectors, including packaging, automotive, and consumer goods. The current state of polypropylene production is characterized by a complex interplay of technological advancements, market demands, and environmental considerations.

The production process predominantly relies on the polymerization of propylene monomers, utilizing either gas-phase, bulk, or slurry technologies. Ziegler-Natta catalysts remain the industry standard, accounting for approximately 70% of global polypropylene production. However, metallocene and other single-site catalysts are gaining traction due to their ability to produce polymers with enhanced properties and more precise molecular weight distribution.

In recent years, the industry has witnessed a shift towards more energy-efficient and environmentally friendly production methods. Advanced process control systems and heat integration techniques have been implemented to optimize energy consumption and reduce waste. Additionally, there is a growing focus on developing bio-based polypropylene alternatives, although these currently represent a small fraction of total production.

The global polypropylene market is highly competitive, with major players including LyondellBasell, SABIC, and ExxonMobil Chemical. These companies are investing heavily in research and development to improve production efficiency and product quality. The Asia-Pacific region, particularly China, dominates global production capacity, accounting for over 50% of the total output.

Environmental concerns, particularly regarding carbon emissions and plastic waste, are increasingly shaping the industry landscape. Manufacturers are under pressure to reduce their carbon footprint and improve the recyclability of their products. This has led to innovations in production processes, such as the development of circular economy initiatives and the integration of recycled content into new polypropylene products.

The current state of polypropylene production also reflects a growing demand for specialty grades with enhanced properties. These include high-impact copolymers, long-chain branched polypropylene, and nanocomposites. Such innovations are driven by the need for materials with improved performance in specific applications, such as lightweight automotive components or high-barrier packaging.

As the industry evolves, challenges persist in balancing production costs, environmental sustainability, and meeting diverse market demands. The volatility of raw material prices, particularly propylene, continues to impact production economics. Moreover, the industry faces increasing regulatory scrutiny, with policies aimed at reducing plastic waste and promoting circular economy principles influencing production strategies and investment decisions.

The production process predominantly relies on the polymerization of propylene monomers, utilizing either gas-phase, bulk, or slurry technologies. Ziegler-Natta catalysts remain the industry standard, accounting for approximately 70% of global polypropylene production. However, metallocene and other single-site catalysts are gaining traction due to their ability to produce polymers with enhanced properties and more precise molecular weight distribution.

In recent years, the industry has witnessed a shift towards more energy-efficient and environmentally friendly production methods. Advanced process control systems and heat integration techniques have been implemented to optimize energy consumption and reduce waste. Additionally, there is a growing focus on developing bio-based polypropylene alternatives, although these currently represent a small fraction of total production.

The global polypropylene market is highly competitive, with major players including LyondellBasell, SABIC, and ExxonMobil Chemical. These companies are investing heavily in research and development to improve production efficiency and product quality. The Asia-Pacific region, particularly China, dominates global production capacity, accounting for over 50% of the total output.

Environmental concerns, particularly regarding carbon emissions and plastic waste, are increasingly shaping the industry landscape. Manufacturers are under pressure to reduce their carbon footprint and improve the recyclability of their products. This has led to innovations in production processes, such as the development of circular economy initiatives and the integration of recycled content into new polypropylene products.

The current state of polypropylene production also reflects a growing demand for specialty grades with enhanced properties. These include high-impact copolymers, long-chain branched polypropylene, and nanocomposites. Such innovations are driven by the need for materials with improved performance in specific applications, such as lightweight automotive components or high-barrier packaging.

As the industry evolves, challenges persist in balancing production costs, environmental sustainability, and meeting diverse market demands. The volatility of raw material prices, particularly propylene, continues to impact production economics. Moreover, the industry faces increasing regulatory scrutiny, with policies aimed at reducing plastic waste and promoting circular economy principles influencing production strategies and investment decisions.

Existing Carbon Reduction Solutions

01 Carbon footprint assessment of polypropylene production

Methods and systems for assessing the carbon footprint of polypropylene production processes. This includes analyzing various stages of the production lifecycle, from raw material extraction to final product manufacturing, to quantify greenhouse gas emissions and environmental impact.- Carbon footprint assessment of polypropylene production: Methods and systems for assessing the carbon footprint of polypropylene production processes. This includes analyzing various stages of the production lifecycle, from raw material extraction to final product manufacturing, to quantify greenhouse gas emissions and environmental impact.

- Recycling and upcycling of polypropylene to reduce carbon footprint: Techniques for recycling and upcycling polypropylene products to minimize waste and reduce the overall carbon footprint. This involves developing efficient recycling processes, improving the quality of recycled polypropylene, and finding new applications for recycled materials.

- Eco-friendly additives and fillers for polypropylene: Incorporation of environmentally friendly additives and fillers in polypropylene to enhance its properties while reducing the carbon footprint. This includes the use of bio-based materials, natural fibers, and other sustainable components to improve the environmental profile of polypropylene products.

- Energy-efficient manufacturing processes for polypropylene: Development of energy-efficient manufacturing processes for polypropylene production to reduce energy consumption and associated carbon emissions. This involves optimizing production parameters, implementing advanced process control systems, and utilizing renewable energy sources in manufacturing facilities.

- Life cycle analysis and carbon footprint tracking for polypropylene products: Implementation of comprehensive life cycle analysis and carbon footprint tracking systems for polypropylene products. This includes developing software tools and methodologies to assess and monitor the environmental impact of polypropylene throughout its entire lifecycle, from production to disposal or recycling.

02 Recycling and upcycling of polypropylene to reduce carbon footprint

Techniques for recycling and upcycling polypropylene products to minimize waste and reduce the overall carbon footprint. This involves developing efficient recycling processes, improving the quality of recycled polypropylene, and finding new applications for recycled materials.Expand Specific Solutions03 Bio-based alternatives to traditional polypropylene

Development of bio-based alternatives to traditional petroleum-derived polypropylene. These alternatives aim to reduce the carbon footprint by utilizing renewable resources and potentially offering biodegradable options, while maintaining similar properties to conventional polypropylene.Expand Specific Solutions04 Energy-efficient manufacturing processes for polypropylene

Innovations in energy-efficient manufacturing processes for polypropylene production. This includes optimizing reactor designs, improving catalysts, and implementing advanced process control systems to reduce energy consumption and associated carbon emissions during production.Expand Specific Solutions05 Life cycle analysis and carbon footprint tracking tools

Development of sophisticated life cycle analysis tools and carbon footprint tracking systems specific to polypropylene products. These tools help manufacturers and consumers understand the environmental impact of polypropylene throughout its lifecycle, from production to disposal or recycling.Expand Specific Solutions

Key Players in Sustainable Polymer Industry

The carbon footprint reduction via polypropylene innovations market is in a growth phase, driven by increasing environmental concerns and regulatory pressures. The market size is expanding, with major players like SABIC, Braskem, and ExxonMobil Chemical investing heavily in research and development. Technologically, the field is advancing rapidly, with companies at different stages of maturity. SABIC and Braskem are leading in bio-based polypropylene, while others like Kingfa and LG Chem focus on recycling technologies. Emerging players such as Japan Polypropylene Corp and Prime Polymer are also making significant strides, indicating a competitive and dynamic landscape with diverse approaches to sustainability.

SABIC Global Technologies BV

Technical Solution: SABIC has developed innovative polypropylene (PP) solutions to reduce carbon footprint in various applications. Their TRUCIRCLE™ portfolio includes certified circular PP made from recycled plastic waste and certified renewable PP from bio-based feedstock[1]. These materials offer up to 2 kg of CO2 equivalent reduction per kg of polymer compared to fossil-based alternatives[2]. SABIC has also introduced SABIC® PP compounds with improved mechanical properties, allowing for thinner, lighter parts in automotive applications, contributing to vehicle weight reduction and improved fuel efficiency[3].

Strengths: Wide range of sustainable PP solutions, significant CO2 reduction potential, improved mechanical properties. Weaknesses: May require changes in existing manufacturing processes, potentially higher initial costs compared to traditional PP.

Braskem SA

Technical Solution: Braskem has pioneered the development of bio-based polypropylene, branded as I'm green™ PP, derived from sugarcane ethanol. This innovative approach reduces carbon footprint by up to 80% compared to fossil-based PP[4]. The company has also invested in advanced recycling technologies to produce post-consumer recycled (PCR) PP, further reducing environmental impact. Braskem's PP innovations extend to improved catalyst systems that enhance polymer performance while reducing energy consumption during production[5]. Their commitment to a circular economy is evident in their goal to expand biopolymer capacity to 1 million tons by 2030[6].

Strengths: Leader in bio-based PP, significant carbon footprint reduction, commitment to circular economy. Weaknesses: Limited availability of bio-based feedstock, potential competition with food crops.

Core Innovations in Green Polypropylene

Mitigating or eliminating the carbon footprint of human activities

PatentWO2009140478A2

Innovation

- A method involving the capture and chemical recycling of carbon dioxide to form new, inexhaustible supplies of carbon-containing compounds like synthetic hydrocarbons or methanol, which can be used without increasing atmospheric carbon dioxide levels, allowing continued use of carbon-based fuels without environmental harm.

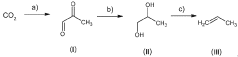

Process for preparing propylene and polypropylene from co 2

PatentWO2024017563A2

Innovation

- A process involving electrocatalytic reduction of CO2 to methylglyoxal, followed by reduction with a 1,2-diol and elimination to produce propylene, using nickel phosphide catalysts and sodium borohydride, with subsequent polymerization to achieve polypropylene with controlled molecular weight and distribution.

Environmental Regulations Impact

Environmental regulations play a crucial role in shaping the landscape of polypropylene innovations aimed at reducing carbon footprints. These regulations, implemented at various levels - local, national, and international - create a framework that drives industry efforts towards more sustainable practices.

The Paris Agreement, signed in 2015, has been a significant catalyst for change in the polypropylene industry. It set global targets for reducing greenhouse gas emissions, prompting many countries to introduce stricter environmental policies. These policies often include carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems, which directly impact the cost structure of polypropylene production.

In the European Union, the Emissions Trading System (EU ETS) has been particularly influential. It caps the total amount of greenhouse gases that can be emitted by energy-intensive industries, including those involved in polypropylene production. This system creates a financial incentive for companies to reduce their emissions, driving innovation in more energy-efficient production processes and cleaner technologies.

The United States, while not part of the Paris Agreement at the federal level, has seen significant action at the state level. California's Global Warming Solutions Act, for instance, sets aggressive targets for reducing greenhouse gas emissions. This has spurred innovation in the polypropylene industry within the state, with companies exploring novel production methods and recycling technologies to comply with these stringent regulations.

In Asia, China's commitment to achieving carbon neutrality by 2060 has led to the implementation of a national emissions trading scheme. This has profound implications for the polypropylene industry, given China's significant role in global plastics production. The regulations are pushing Chinese manufacturers to invest heavily in research and development of low-carbon polypropylene technologies.

These environmental regulations are not only creating challenges but also opening up new opportunities. They are driving investment in circular economy initiatives, encouraging the development of bio-based polypropylene, and promoting the use of renewable energy in production processes. Companies that can innovate effectively in response to these regulations are likely to gain a competitive edge in the evolving market landscape.

However, the impact of environmental regulations is not uniform across all regions. Differences in regulatory approaches and enforcement levels create a complex global landscape for polypropylene producers. This variability can lead to challenges in terms of competitiveness and may result in carbon leakage, where production shifts to regions with less stringent regulations.

As environmental concerns continue to grow, it is likely that regulations will become increasingly stringent. This trend underscores the importance of ongoing innovation in the polypropylene industry to reduce carbon footprints and meet evolving regulatory requirements.

The Paris Agreement, signed in 2015, has been a significant catalyst for change in the polypropylene industry. It set global targets for reducing greenhouse gas emissions, prompting many countries to introduce stricter environmental policies. These policies often include carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems, which directly impact the cost structure of polypropylene production.

In the European Union, the Emissions Trading System (EU ETS) has been particularly influential. It caps the total amount of greenhouse gases that can be emitted by energy-intensive industries, including those involved in polypropylene production. This system creates a financial incentive for companies to reduce their emissions, driving innovation in more energy-efficient production processes and cleaner technologies.

The United States, while not part of the Paris Agreement at the federal level, has seen significant action at the state level. California's Global Warming Solutions Act, for instance, sets aggressive targets for reducing greenhouse gas emissions. This has spurred innovation in the polypropylene industry within the state, with companies exploring novel production methods and recycling technologies to comply with these stringent regulations.

In Asia, China's commitment to achieving carbon neutrality by 2060 has led to the implementation of a national emissions trading scheme. This has profound implications for the polypropylene industry, given China's significant role in global plastics production. The regulations are pushing Chinese manufacturers to invest heavily in research and development of low-carbon polypropylene technologies.

These environmental regulations are not only creating challenges but also opening up new opportunities. They are driving investment in circular economy initiatives, encouraging the development of bio-based polypropylene, and promoting the use of renewable energy in production processes. Companies that can innovate effectively in response to these regulations are likely to gain a competitive edge in the evolving market landscape.

However, the impact of environmental regulations is not uniform across all regions. Differences in regulatory approaches and enforcement levels create a complex global landscape for polypropylene producers. This variability can lead to challenges in terms of competitiveness and may result in carbon leakage, where production shifts to regions with less stringent regulations.

As environmental concerns continue to grow, it is likely that regulations will become increasingly stringent. This trend underscores the importance of ongoing innovation in the polypropylene industry to reduce carbon footprints and meet evolving regulatory requirements.

Life Cycle Assessment of PP Products

Life Cycle Assessment (LCA) of polypropylene (PP) products is a crucial tool for evaluating and reducing the carbon footprint associated with these materials. This comprehensive approach examines the environmental impacts of PP products throughout their entire lifecycle, from raw material extraction to end-of-life disposal or recycling.

The LCA process for PP products typically begins with the extraction and processing of raw materials, primarily crude oil and natural gas. These fossil fuels undergo refining processes to produce propylene, which is then polymerized to create polypropylene. Each step in this production chain contributes to the overall carbon footprint, with energy consumption and emissions being key factors.

Manufacturing of PP products is the next significant phase in the lifecycle. This stage involves various processes such as injection molding, extrusion, or blow molding, depending on the final product. The energy requirements and efficiency of these manufacturing processes play a crucial role in determining the carbon footprint of the product. Additionally, the use of additives, colorants, and other materials during manufacturing must be considered in the assessment.

The use phase of PP products varies widely depending on the application. For instance, PP packaging may have a relatively short use phase, while PP components in durable goods like automobiles or appliances may have extended lifespans. The environmental impact during this phase is often minimal for PP products themselves, but associated factors such as transportation or energy consumption in product use must be accounted for.

End-of-life management is a critical aspect of the LCA for PP products. This phase includes various scenarios such as landfilling, incineration, or recycling. Each of these options has different environmental implications. Recycling, in particular, offers significant potential for reducing the overall carbon footprint by decreasing the need for virgin material production.

To conduct an effective LCA for PP products, it is essential to gather accurate data on energy consumption, material flows, and emissions at each stage of the lifecycle. This data collection process often involves collaboration with suppliers, manufacturers, and waste management facilities. Advanced LCA software tools are typically employed to process this data and model the environmental impacts.

The results of an LCA can provide valuable insights into the areas of greatest environmental impact within the PP product lifecycle. This information can guide innovation efforts aimed at reducing carbon footprint. For example, it may highlight opportunities for improving energy efficiency in manufacturing, optimizing product design for recyclability, or exploring alternative raw materials such as bio-based or recycled feedstocks.

The LCA process for PP products typically begins with the extraction and processing of raw materials, primarily crude oil and natural gas. These fossil fuels undergo refining processes to produce propylene, which is then polymerized to create polypropylene. Each step in this production chain contributes to the overall carbon footprint, with energy consumption and emissions being key factors.

Manufacturing of PP products is the next significant phase in the lifecycle. This stage involves various processes such as injection molding, extrusion, or blow molding, depending on the final product. The energy requirements and efficiency of these manufacturing processes play a crucial role in determining the carbon footprint of the product. Additionally, the use of additives, colorants, and other materials during manufacturing must be considered in the assessment.

The use phase of PP products varies widely depending on the application. For instance, PP packaging may have a relatively short use phase, while PP components in durable goods like automobiles or appliances may have extended lifespans. The environmental impact during this phase is often minimal for PP products themselves, but associated factors such as transportation or energy consumption in product use must be accounted for.

End-of-life management is a critical aspect of the LCA for PP products. This phase includes various scenarios such as landfilling, incineration, or recycling. Each of these options has different environmental implications. Recycling, in particular, offers significant potential for reducing the overall carbon footprint by decreasing the need for virgin material production.

To conduct an effective LCA for PP products, it is essential to gather accurate data on energy consumption, material flows, and emissions at each stage of the lifecycle. This data collection process often involves collaboration with suppliers, manufacturers, and waste management facilities. Advanced LCA software tools are typically employed to process this data and model the environmental impacts.

The results of an LCA can provide valuable insights into the areas of greatest environmental impact within the PP product lifecycle. This information can guide innovation efforts aimed at reducing carbon footprint. For example, it may highlight opportunities for improving energy efficiency in manufacturing, optimizing product design for recyclability, or exploring alternative raw materials such as bio-based or recycled feedstocks.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!