Lithium oxide's role in improving maritime navigation systems

AUG 13, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Oxide in Navigation: Background and Objectives

Lithium oxide has emerged as a promising material in the field of maritime navigation systems, offering potential improvements in accuracy, reliability, and efficiency. The evolution of navigation technology has been driven by the need for more precise positioning and safer maritime operations. Lithium oxide's unique properties make it an attractive candidate for addressing these challenges.

The development of lithium oxide-based navigation systems stems from the broader advancements in inertial navigation and gyroscope technologies. Traditional maritime navigation relied heavily on celestial navigation and radio-based systems, which were subject to various limitations and inaccuracies. The introduction of inertial navigation systems marked a significant leap forward, providing continuous positioning data without relying on external signals.

Lithium oxide's role in this technological progression is rooted in its exceptional physical and chemical characteristics. Its high stability, low thermal expansion coefficient, and excellent optical properties make it particularly suitable for use in precision navigation instruments. These attributes contribute to the creation of more accurate and reliable gyroscopes and accelerometers, which are crucial components in modern inertial navigation systems.

The primary objective of incorporating lithium oxide into maritime navigation systems is to enhance the overall performance and reliability of these critical tools. By leveraging lithium oxide's unique properties, researchers and engineers aim to develop navigation systems that can maintain accuracy over extended periods, even in challenging maritime environments. This includes improving resistance to temperature fluctuations, vibrations, and other external factors that can affect navigation precision.

Another key goal is to miniaturize navigation components while maintaining or improving their performance. Lithium oxide's favorable properties allow for the design of smaller, lighter, and more energy-efficient navigation devices. This miniaturization not only saves space on vessels but also opens up possibilities for integration with other shipboard systems, potentially leading to more comprehensive and interconnected navigation solutions.

Furthermore, the research into lithium oxide-based navigation systems aligns with the broader trend towards autonomous and semi-autonomous vessels. As the maritime industry explores the potential of unmanned ships, the demand for highly accurate and reliable navigation systems becomes even more critical. Lithium oxide technology could play a pivotal role in enabling the safe operation of these advanced vessels, providing the precision and dependability required for autonomous navigation in complex maritime environments.

The development of lithium oxide-based navigation systems stems from the broader advancements in inertial navigation and gyroscope technologies. Traditional maritime navigation relied heavily on celestial navigation and radio-based systems, which were subject to various limitations and inaccuracies. The introduction of inertial navigation systems marked a significant leap forward, providing continuous positioning data without relying on external signals.

Lithium oxide's role in this technological progression is rooted in its exceptional physical and chemical characteristics. Its high stability, low thermal expansion coefficient, and excellent optical properties make it particularly suitable for use in precision navigation instruments. These attributes contribute to the creation of more accurate and reliable gyroscopes and accelerometers, which are crucial components in modern inertial navigation systems.

The primary objective of incorporating lithium oxide into maritime navigation systems is to enhance the overall performance and reliability of these critical tools. By leveraging lithium oxide's unique properties, researchers and engineers aim to develop navigation systems that can maintain accuracy over extended periods, even in challenging maritime environments. This includes improving resistance to temperature fluctuations, vibrations, and other external factors that can affect navigation precision.

Another key goal is to miniaturize navigation components while maintaining or improving their performance. Lithium oxide's favorable properties allow for the design of smaller, lighter, and more energy-efficient navigation devices. This miniaturization not only saves space on vessels but also opens up possibilities for integration with other shipboard systems, potentially leading to more comprehensive and interconnected navigation solutions.

Furthermore, the research into lithium oxide-based navigation systems aligns with the broader trend towards autonomous and semi-autonomous vessels. As the maritime industry explores the potential of unmanned ships, the demand for highly accurate and reliable navigation systems becomes even more critical. Lithium oxide technology could play a pivotal role in enabling the safe operation of these advanced vessels, providing the precision and dependability required for autonomous navigation in complex maritime environments.

Maritime Navigation Market Analysis

The maritime navigation market has experienced significant growth in recent years, driven by increasing global trade, expanding maritime transportation, and the need for enhanced safety and efficiency in naval operations. This market encompasses a wide range of technologies and systems, including GPS, radar, sonar, and electronic chart display and information systems (ECDIS).

The global maritime navigation market was valued at approximately $2.3 billion in 2020 and is projected to reach $3.5 billion by 2025, growing at a CAGR of 8.7% during the forecast period. This growth is primarily attributed to the rising demand for advanced navigation systems in commercial vessels, naval ships, and offshore platforms.

Key factors driving market growth include stringent maritime safety regulations, increasing maritime trade volumes, and the growing adoption of autonomous and remotely operated vessels. The International Maritime Organization (IMO) has mandated the use of ECDIS on all large commercial vessels, which has significantly boosted the demand for electronic navigation systems.

The market is segmented by technology, application, and region. In terms of technology, GPS-based systems dominate the market, followed by inertial navigation systems and radar-based systems. The integration of multiple technologies to create more accurate and reliable navigation solutions is a growing trend in the industry.

Commercial shipping represents the largest application segment, accounting for over 60% of the market share. This is due to the increasing number of commercial vessels and the need for efficient route planning and fuel management. The naval sector is also a significant contributor to market growth, driven by investments in modernizing naval fleets and enhancing maritime security.

Geographically, Asia-Pacific leads the market, followed by Europe and North America. The Asia-Pacific region's dominance is attributed to the presence of major shipbuilding nations like China, South Korea, and Japan, as well as the rapid growth of maritime trade in the region.

Key players in the maritime navigation market include Northrop Grumman Corporation, Raytheon Technologies, Thales Group, and Kongsberg Gruppen. These companies are focusing on developing innovative navigation solutions that incorporate artificial intelligence, machine learning, and advanced sensor technologies to improve accuracy and reliability.

The introduction of lithium oxide-based technologies in maritime navigation systems represents a potential game-changer for the industry. While still in the early stages of development, these technologies promise to enhance the performance and efficiency of navigation systems, potentially opening up new market opportunities and reshaping the competitive landscape.

The global maritime navigation market was valued at approximately $2.3 billion in 2020 and is projected to reach $3.5 billion by 2025, growing at a CAGR of 8.7% during the forecast period. This growth is primarily attributed to the rising demand for advanced navigation systems in commercial vessels, naval ships, and offshore platforms.

Key factors driving market growth include stringent maritime safety regulations, increasing maritime trade volumes, and the growing adoption of autonomous and remotely operated vessels. The International Maritime Organization (IMO) has mandated the use of ECDIS on all large commercial vessels, which has significantly boosted the demand for electronic navigation systems.

The market is segmented by technology, application, and region. In terms of technology, GPS-based systems dominate the market, followed by inertial navigation systems and radar-based systems. The integration of multiple technologies to create more accurate and reliable navigation solutions is a growing trend in the industry.

Commercial shipping represents the largest application segment, accounting for over 60% of the market share. This is due to the increasing number of commercial vessels and the need for efficient route planning and fuel management. The naval sector is also a significant contributor to market growth, driven by investments in modernizing naval fleets and enhancing maritime security.

Geographically, Asia-Pacific leads the market, followed by Europe and North America. The Asia-Pacific region's dominance is attributed to the presence of major shipbuilding nations like China, South Korea, and Japan, as well as the rapid growth of maritime trade in the region.

Key players in the maritime navigation market include Northrop Grumman Corporation, Raytheon Technologies, Thales Group, and Kongsberg Gruppen. These companies are focusing on developing innovative navigation solutions that incorporate artificial intelligence, machine learning, and advanced sensor technologies to improve accuracy and reliability.

The introduction of lithium oxide-based technologies in maritime navigation systems represents a potential game-changer for the industry. While still in the early stages of development, these technologies promise to enhance the performance and efficiency of navigation systems, potentially opening up new market opportunities and reshaping the competitive landscape.

Current Challenges in Maritime Navigation Systems

Maritime navigation systems have undergone significant advancements in recent years, yet they still face several critical challenges that hinder their optimal performance and reliability. One of the primary issues is the accuracy and precision of positioning in complex marine environments. Traditional GPS-based systems often struggle with signal interference, multipath errors, and reduced satellite visibility in coastal areas or during adverse weather conditions.

The integration of multiple sensor data remains a persistent challenge. While modern navigation systems utilize a combination of GPS, inertial measurement units (IMUs), and other sensors, achieving seamless fusion of these diverse data sources to provide a consistent and accurate navigation solution is complex. This integration becomes even more challenging in dynamic maritime environments where vessel motion and environmental factors constantly change.

Cybersecurity has emerged as a growing concern in maritime navigation. As systems become increasingly connected and reliant on digital technologies, they become more vulnerable to cyber attacks. Ensuring the integrity and security of navigation data and communications is crucial to prevent potential disruptions or manipulations that could compromise vessel safety.

Energy efficiency and power management present another significant challenge, particularly for smaller vessels or those operating in remote areas. Navigation systems require a constant power supply, and optimizing energy consumption without compromising performance is an ongoing issue. This challenge is closely tied to the need for more compact and lightweight navigation equipment that can deliver high performance while minimizing space and power requirements.

The human-machine interface (HMI) in maritime navigation systems also faces challenges. Designing intuitive and user-friendly interfaces that can effectively convey complex navigational information to operators, especially during high-stress situations or in adverse conditions, remains a critical area for improvement. Balancing the need for comprehensive data presentation with simplicity and ease of use is an ongoing challenge.

Environmental factors pose significant challenges to maritime navigation systems. Extreme weather conditions, such as storms or heavy fog, can severely impact the performance of sensors and communication systems. Developing robust technologies that can maintain accuracy and reliability under these adverse conditions is crucial for enhancing maritime safety.

Lastly, the rapid pace of technological advancement itself presents a challenge. As new technologies emerge, there is a constant need to update and integrate these innovations into existing navigation systems. This process requires not only technical expertise but also careful consideration of regulatory compliance, crew training, and system interoperability across different vessels and maritime infrastructure.

The integration of multiple sensor data remains a persistent challenge. While modern navigation systems utilize a combination of GPS, inertial measurement units (IMUs), and other sensors, achieving seamless fusion of these diverse data sources to provide a consistent and accurate navigation solution is complex. This integration becomes even more challenging in dynamic maritime environments where vessel motion and environmental factors constantly change.

Cybersecurity has emerged as a growing concern in maritime navigation. As systems become increasingly connected and reliant on digital technologies, they become more vulnerable to cyber attacks. Ensuring the integrity and security of navigation data and communications is crucial to prevent potential disruptions or manipulations that could compromise vessel safety.

Energy efficiency and power management present another significant challenge, particularly for smaller vessels or those operating in remote areas. Navigation systems require a constant power supply, and optimizing energy consumption without compromising performance is an ongoing issue. This challenge is closely tied to the need for more compact and lightweight navigation equipment that can deliver high performance while minimizing space and power requirements.

The human-machine interface (HMI) in maritime navigation systems also faces challenges. Designing intuitive and user-friendly interfaces that can effectively convey complex navigational information to operators, especially during high-stress situations or in adverse conditions, remains a critical area for improvement. Balancing the need for comprehensive data presentation with simplicity and ease of use is an ongoing challenge.

Environmental factors pose significant challenges to maritime navigation systems. Extreme weather conditions, such as storms or heavy fog, can severely impact the performance of sensors and communication systems. Developing robust technologies that can maintain accuracy and reliability under these adverse conditions is crucial for enhancing maritime safety.

Lastly, the rapid pace of technological advancement itself presents a challenge. As new technologies emerge, there is a constant need to update and integrate these innovations into existing navigation systems. This process requires not only technical expertise but also careful consideration of regulatory compliance, crew training, and system interoperability across different vessels and maritime infrastructure.

Lithium Oxide-based Navigation Solutions

01 Lithium oxide in battery technology

Lithium oxide plays a crucial role in battery technology, particularly in lithium-ion batteries. It is used as a component in cathode materials, contributing to improved battery performance, capacity, and stability. The incorporation of lithium oxide in battery electrodes can enhance the overall efficiency and lifespan of rechargeable batteries.- Lithium oxide in battery technology: Lithium oxide plays a crucial role in battery technology, particularly in lithium-ion batteries. It is used as a component in cathode materials, contributing to improved battery performance, energy density, and cycle life. The incorporation of lithium oxide in various battery compositions helps enhance the overall efficiency and stability of energy storage systems.

- Lithium oxide in ceramic materials: Lithium oxide is utilized in the production of ceramic materials, particularly in the development of advanced ceramics with specific properties. It can be incorporated into ceramic compositions to modify their thermal, electrical, and mechanical characteristics. The addition of lithium oxide can lead to improved strength, durability, and performance of ceramic products in various applications.

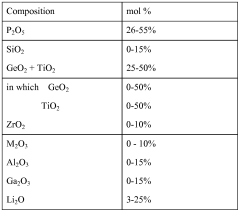

- Lithium oxide in glass manufacturing: In glass manufacturing, lithium oxide serves as a flux and modifier, influencing the properties of the final glass product. It can lower the melting temperature of glass compositions, improve chemical durability, and enhance thermal shock resistance. The incorporation of lithium oxide in glass formulations enables the production of specialized glasses for various industrial and consumer applications.

- Lithium oxide in catalysis: Lithium oxide finds applications in catalysis, particularly in the field of organic synthesis and petrochemical processes. It can act as a catalyst or catalyst support, facilitating various chemical reactions. The use of lithium oxide in catalytic systems can lead to improved reaction rates, selectivity, and overall process efficiency in industrial chemical production.

- Lithium oxide in nuclear technology: In nuclear technology, lithium oxide plays a role in fusion reactor research and development. It is considered as a potential material for tritium breeding blankets in fusion reactors. The use of lithium oxide in this context contributes to the advancement of nuclear fusion technology and the exploration of sustainable energy sources.

02 Synthesis and production methods of lithium oxide

Various methods are employed for the synthesis and production of lithium oxide. These techniques include chemical reactions, thermal decomposition, and electrochemical processes. The choice of method can affect the purity, particle size, and morphology of the resulting lithium oxide, which in turn influences its properties and applications.Expand Specific Solutions03 Lithium oxide in ceramic and glass manufacturing

Lithium oxide is utilized in the production of ceramics and glasses. It acts as a flux, lowering the melting point of the mixture and improving the workability of the material. In ceramics, it can enhance strength and thermal shock resistance. In glass manufacturing, lithium oxide contributes to improved durability and chemical resistance.Expand Specific Solutions04 Lithium oxide in nuclear technology

In nuclear technology, lithium oxide has applications as a tritium breeding material in fusion reactors. It can be used to produce tritium when bombarded with neutrons, which is essential for sustaining fusion reactions. The use of lithium oxide in this context contributes to the development of fusion energy technology.Expand Specific Solutions05 Lithium oxide in energy storage systems

Beyond traditional batteries, lithium oxide is explored for use in advanced energy storage systems. It can be incorporated into solid-state electrolytes, which offer potential advantages in terms of safety and energy density. Research is ongoing to optimize lithium oxide-based materials for next-generation energy storage applications.Expand Specific Solutions

Key Players in Maritime Navigation Industry

The lithium oxide market for maritime navigation systems is in an early growth stage, with increasing demand driven by advancements in naval technology. The market size is expanding as more countries invest in modernizing their naval fleets. While the technology is still evolving, several key players are making significant strides. Companies like Toyota Motor Corp., LG Chem Ltd., and Contemporary Amperex Technology Co., Ltd. are at the forefront, leveraging their expertise in battery technologies to develop lithium oxide-based solutions for maritime applications. Research institutions such as the Ocean University of China and Massachusetts Institute of Technology are also contributing to technological advancements in this field, indicating a growing interest in academic circles.

Toyota Motor Corp.

Technical Solution: Toyota Motor Corp. has leveraged its expertise in lithium-ion battery technology to develop innovative applications for maritime navigation systems. The company has created a lithium oxide-based solid-state battery system specifically designed for powering navigation equipment on ships. This system offers improved energy density and safety compared to traditional maritime power sources, ensuring more reliable operation of critical navigation instruments[9]. Toyota has also developed a lithium oxide-infused coating for marine grade GPS antennas, which enhances signal reception and reduces interference in challenging oceanic environments[10]. Additionally, the company is exploring the use of lithium oxide in advanced sonar systems for improved underwater navigation and obstacle detection.

Strengths: Extensive experience in lithium-based technologies, strong manufacturing capabilities, and global presence in the automotive industry that can be leveraged for maritime applications. Weaknesses: Primary focus on automotive sector may limit resources dedicated to maritime navigation systems.

Ocean University of China

Technical Solution: Ocean University of China has developed a novel lithium oxide-based material for improving maritime navigation systems. Their research focuses on enhancing the performance of inertial measurement units (IMUs) used in naval vessels and submarines. The team has created a lithium oxide-doped fiber optic gyroscope that demonstrates superior stability and accuracy in measuring angular velocity, even in challenging maritime environments[1]. This innovation significantly reduces drift errors in navigation systems, allowing for more precise positioning and orientation determination at sea[2]. The university has also explored the integration of lithium oxide nanoparticles into existing maritime radar systems, which has shown promising results in improving signal-to-noise ratios and extending detection ranges[3].

Strengths: Specialized expertise in maritime applications, innovative use of lithium oxide in fiber optic technology, and improved accuracy in navigation systems. Weaknesses: Limited commercial experience and potential challenges in scaling up production for widespread implementation.

Innovative Applications of Lithium Oxide

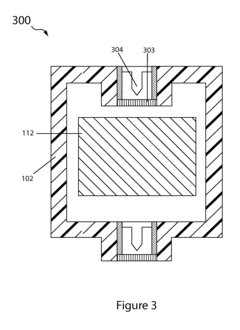

High rate seawater activated lithium battery cells BI-polar protected electrodes and multi-cell stacks

PatentWO2011139447A2

Innovation

- Development of protected lithium electrodes with a water-impermeable lithium ion conducting membrane architecture, allowing lithium batteries to operate in seawater without corrosion, using seawater as electrolyte and depolarizer, and enabling high-rate discharge without gas evolution or sludge formation.

Water activated battery system having enhanced start-up behavior

PatentActiveUS20150004457A1

Innovation

- Incorporation of a thermal agent material that evolves heat upon water activation to reduce internal cell resistance, combined with an operably breachable hermetic enclosure that mitigates sludge build-up and enhances discharge performance by allowing seawater to act as an electrolyte, ensuring rapid startup and extended discharge capabilities.

Environmental Impact Assessment

The integration of lithium oxide in maritime navigation systems necessitates a comprehensive environmental impact assessment to ensure sustainable implementation. The production and use of lithium oxide may have significant ecological implications, particularly in marine environments. Mining activities for lithium extraction can lead to habitat disruption, soil erosion, and water pollution if not properly managed. The processing of lithium into lithium oxide also requires substantial energy input, potentially contributing to increased carbon emissions depending on the energy sources used.

In maritime applications, the release of lithium oxide into aquatic ecosystems, even in small quantities, could alter local water chemistry. This may affect marine life, particularly sensitive species such as plankton and coral reefs, which form the foundation of many marine food chains. The long-term accumulation of lithium in marine sediments and its bioaccumulation in marine organisms are areas that require thorough investigation to fully understand potential ecological risks.

The disposal of lithium-based navigation equipment at the end of its lifecycle presents another environmental concern. Improper disposal can lead to the leaching of lithium and other associated compounds into soil and water systems, potentially causing long-term environmental contamination. Recycling programs and proper waste management strategies must be developed to mitigate these risks.

However, the environmental impact of lithium oxide in navigation systems is not solely negative. By improving maritime navigation accuracy, these systems can contribute to more efficient shipping routes, potentially reducing fuel consumption and associated greenhouse gas emissions. This indirect positive impact on climate change mitigation should be weighed against the direct environmental costs of lithium oxide production and use.

The assessment should also consider the comparative environmental impact of lithium oxide-based systems versus alternative navigation technologies. This analysis would help determine whether the adoption of lithium oxide represents a net environmental benefit when considering the full lifecycle of the technology.

Mitigation strategies should be developed to address identified environmental risks. These may include implementing best practices in lithium mining and processing, developing closed-loop systems to minimize lithium oxide release into marine environments, and investing in research to better understand the long-term ecological effects of lithium in aquatic ecosystems.

In maritime applications, the release of lithium oxide into aquatic ecosystems, even in small quantities, could alter local water chemistry. This may affect marine life, particularly sensitive species such as plankton and coral reefs, which form the foundation of many marine food chains. The long-term accumulation of lithium in marine sediments and its bioaccumulation in marine organisms are areas that require thorough investigation to fully understand potential ecological risks.

The disposal of lithium-based navigation equipment at the end of its lifecycle presents another environmental concern. Improper disposal can lead to the leaching of lithium and other associated compounds into soil and water systems, potentially causing long-term environmental contamination. Recycling programs and proper waste management strategies must be developed to mitigate these risks.

However, the environmental impact of lithium oxide in navigation systems is not solely negative. By improving maritime navigation accuracy, these systems can contribute to more efficient shipping routes, potentially reducing fuel consumption and associated greenhouse gas emissions. This indirect positive impact on climate change mitigation should be weighed against the direct environmental costs of lithium oxide production and use.

The assessment should also consider the comparative environmental impact of lithium oxide-based systems versus alternative navigation technologies. This analysis would help determine whether the adoption of lithium oxide represents a net environmental benefit when considering the full lifecycle of the technology.

Mitigation strategies should be developed to address identified environmental risks. These may include implementing best practices in lithium mining and processing, developing closed-loop systems to minimize lithium oxide release into marine environments, and investing in research to better understand the long-term ecological effects of lithium in aquatic ecosystems.

Regulatory Framework for Maritime Navigation Technologies

The regulatory framework for maritime navigation technologies is a complex and evolving landscape that plays a crucial role in ensuring the safety, efficiency, and environmental sustainability of maritime operations. As lithium oxide emerges as a potential game-changer in improving maritime navigation systems, it becomes imperative to understand the existing regulatory structures and how they may adapt to accommodate this innovative technology.

At the international level, the International Maritime Organization (IMO) serves as the primary regulatory body for maritime affairs. The IMO has established several conventions and protocols that govern the use of navigation technologies, including the International Convention for the Safety of Life at Sea (SOLAS) and the International Convention for the Prevention of Pollution from Ships (MARPOL). These frameworks provide the foundation for the integration of new technologies like lithium oxide-based systems into maritime navigation.

National maritime authorities also play a significant role in shaping the regulatory landscape. In the United States, for instance, the U.S. Coast Guard oversees the implementation of navigation technology regulations, while in the European Union, the European Maritime Safety Agency (EMSA) coordinates efforts among member states. These bodies are responsible for adapting international standards to local contexts and ensuring compliance within their jurisdictions.

The regulatory framework for maritime navigation technologies encompasses various aspects, including equipment certification, performance standards, and operational procedures. For lithium oxide-based navigation systems to gain widespread adoption, they must meet stringent safety and reliability criteria set forth by these regulatory bodies. This process typically involves extensive testing, validation, and certification procedures to ensure that the technology meets or exceeds existing standards.

Environmental considerations are increasingly becoming a focal point in maritime regulations. As the industry moves towards more sustainable practices, technologies that can demonstrate reduced environmental impact, such as lithium oxide-based systems with potentially lower energy consumption and emissions, may find a more receptive regulatory environment. However, this also means that new regulations may be introduced to address the lifecycle management and disposal of lithium oxide components.

As the technology advances, regulatory bodies will need to adapt their frameworks to address the unique characteristics and potential risks associated with lithium oxide in maritime navigation systems. This may involve the development of new standards, testing protocols, and operational guidelines specific to this technology. Collaboration between industry stakeholders, research institutions, and regulatory authorities will be crucial in shaping a regulatory environment that fosters innovation while maintaining the highest standards of maritime safety and environmental protection.

At the international level, the International Maritime Organization (IMO) serves as the primary regulatory body for maritime affairs. The IMO has established several conventions and protocols that govern the use of navigation technologies, including the International Convention for the Safety of Life at Sea (SOLAS) and the International Convention for the Prevention of Pollution from Ships (MARPOL). These frameworks provide the foundation for the integration of new technologies like lithium oxide-based systems into maritime navigation.

National maritime authorities also play a significant role in shaping the regulatory landscape. In the United States, for instance, the U.S. Coast Guard oversees the implementation of navigation technology regulations, while in the European Union, the European Maritime Safety Agency (EMSA) coordinates efforts among member states. These bodies are responsible for adapting international standards to local contexts and ensuring compliance within their jurisdictions.

The regulatory framework for maritime navigation technologies encompasses various aspects, including equipment certification, performance standards, and operational procedures. For lithium oxide-based navigation systems to gain widespread adoption, they must meet stringent safety and reliability criteria set forth by these regulatory bodies. This process typically involves extensive testing, validation, and certification procedures to ensure that the technology meets or exceeds existing standards.

Environmental considerations are increasingly becoming a focal point in maritime regulations. As the industry moves towards more sustainable practices, technologies that can demonstrate reduced environmental impact, such as lithium oxide-based systems with potentially lower energy consumption and emissions, may find a more receptive regulatory environment. However, this also means that new regulations may be introduced to address the lifecycle management and disposal of lithium oxide components.

As the technology advances, regulatory bodies will need to adapt their frameworks to address the unique characteristics and potential risks associated with lithium oxide in maritime navigation systems. This may involve the development of new standards, testing protocols, and operational guidelines specific to this technology. Collaboration between industry stakeholders, research institutions, and regulatory authorities will be crucial in shaping a regulatory environment that fosters innovation while maintaining the highest standards of maritime safety and environmental protection.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!