LS2 Engine Valve Guides vs Seals: Wear and Maintenance

SEP 4, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

LS2 Engine Valve System Evolution and Objectives

The LS2 engine valve system represents a significant evolution in General Motors' small-block V8 engine technology. Introduced in 2005 as part of the Gen IV small-block family, the LS2 built upon the successful foundation of the LS1 while incorporating several key improvements to the valve train system. The 6.0L LS2 engine featured in vehicles like the Corvette C6, Pontiac GTO, and Chevrolet SSR marked an important step in balancing performance, efficiency, and durability.

The evolution of valve systems in GM's LS engines reflects broader industry trends toward higher performance with improved reliability. Early small-block Chevrolet engines utilized simple valve guide and seal configurations that were adequate for their time but presented limitations in high-performance applications. The progression to the LS2 incorporated advanced metallurgy and design principles that significantly enhanced valve operation under more demanding conditions.

A primary objective in the LS2 valve system development was reducing friction while maintaining proper valve guidance. Engineers achieved this through refined valve guide materials and optimized clearances that balanced the competing needs of proper valve control and minimized friction. The bronze-alloy valve guides implemented in the LS2 offered superior heat dissipation compared to earlier cast iron guides, addressing a critical factor in valve system longevity.

Valve seals underwent parallel evolution, with the LS2 utilizing advanced elastomeric materials designed to maintain proper oil control throughout a wider range of operating temperatures. These positive valve stem seals were engineered to prevent excessive oil consumption while ensuring adequate lubrication of the valve stem-to-guide interface, a delicate balance critical to system performance.

The technical objectives for the LS2 valve system centered on several key parameters: extending service intervals, reducing oil consumption, maintaining valve geometry under thermal stress, and ensuring consistent performance across varying operating conditions. These objectives directly addressed common failure points in previous engine generations while accommodating the increased power output and thermal load of the LS2 platform.

Manufacturing processes also evolved significantly, with tighter tolerances and improved quality control measures implemented for both valve guides and seals. Computer-aided design and simulation tools allowed engineers to predict wear patterns and optimize component geometries before physical prototyping, accelerating development cycles and improving outcomes.

The LS2 valve system represents an important technological bridge between traditional pushrod V8 designs and modern high-performance engines, establishing design principles and material selections that continue to influence current engine development. Understanding this evolutionary path provides valuable context for addressing current maintenance challenges and developing future improvements to valve guide and seal technologies.

The evolution of valve systems in GM's LS engines reflects broader industry trends toward higher performance with improved reliability. Early small-block Chevrolet engines utilized simple valve guide and seal configurations that were adequate for their time but presented limitations in high-performance applications. The progression to the LS2 incorporated advanced metallurgy and design principles that significantly enhanced valve operation under more demanding conditions.

A primary objective in the LS2 valve system development was reducing friction while maintaining proper valve guidance. Engineers achieved this through refined valve guide materials and optimized clearances that balanced the competing needs of proper valve control and minimized friction. The bronze-alloy valve guides implemented in the LS2 offered superior heat dissipation compared to earlier cast iron guides, addressing a critical factor in valve system longevity.

Valve seals underwent parallel evolution, with the LS2 utilizing advanced elastomeric materials designed to maintain proper oil control throughout a wider range of operating temperatures. These positive valve stem seals were engineered to prevent excessive oil consumption while ensuring adequate lubrication of the valve stem-to-guide interface, a delicate balance critical to system performance.

The technical objectives for the LS2 valve system centered on several key parameters: extending service intervals, reducing oil consumption, maintaining valve geometry under thermal stress, and ensuring consistent performance across varying operating conditions. These objectives directly addressed common failure points in previous engine generations while accommodating the increased power output and thermal load of the LS2 platform.

Manufacturing processes also evolved significantly, with tighter tolerances and improved quality control measures implemented for both valve guides and seals. Computer-aided design and simulation tools allowed engineers to predict wear patterns and optimize component geometries before physical prototyping, accelerating development cycles and improving outcomes.

The LS2 valve system represents an important technological bridge between traditional pushrod V8 designs and modern high-performance engines, establishing design principles and material selections that continue to influence current engine development. Understanding this evolutionary path provides valuable context for addressing current maintenance challenges and developing future improvements to valve guide and seal technologies.

Market Demand Analysis for LS2 Engine Components

The global market for LS2 engine components has shown significant growth over the past decade, driven primarily by the aftermarket sector and performance enhancement demands. The valve guides and seals segment specifically represents approximately 8% of the total LS2 engine components market, with annual growth rates consistently between 3-5% since 2018.

Consumer behavior analysis indicates two distinct market segments: professional mechanics/automotive shops and DIY enthusiasts. The professional segment accounts for roughly 65% of purchases, while the growing DIY market represents the remaining 35%. This DIY segment has expanded by nearly 12% annually since 2020, accelerated by online tutorial availability and pandemic-related shifts toward self-maintenance.

Regional market distribution shows North America dominating with 58% market share, followed by Europe (22%), Asia-Pacific (15%), and other regions (5%). The North American dominance stems from the prevalence of GM vehicles equipped with LS2 engines and a strong performance modification culture. However, emerging markets in Eastern Europe and Southeast Asia are showing the fastest growth rates, exceeding 15% annually.

Demand drivers for valve guides and seals are multifaceted. Performance enhancement represents the primary motivation (42% of purchases), followed by necessary replacements due to wear (38%), preventative maintenance (15%), and complete engine rebuilds (5%). The performance segment has particularly strong profit margins, with consumers willing to pay premium prices for components that promise horsepower gains or improved durability.

Market research indicates growing consumer preference for premium materials in valve guides and seals, with bronze guides and high-temperature silicone seals commanding price premiums of 30-40% over standard components. This trend toward premium components is projected to continue, with an estimated 7% annual growth rate in the high-performance segment through 2027.

Distribution channels have evolved significantly, with online sales now accounting for 47% of total market volume, traditional auto parts retailers at 32%, and direct dealer/manufacturer sales at 21%. The online channel has demonstrated the strongest growth trajectory, expanding at 18% annually since 2019.

Competitive analysis reveals that while OEM parts maintain approximately 40% market share, aftermarket manufacturers have successfully captured the remaining 60% through competitive pricing, material innovations, and targeted marketing to performance enthusiasts. This fragmentation presents both challenges and opportunities for market entrants focusing on specialized valve guide and seal solutions.

Consumer behavior analysis indicates two distinct market segments: professional mechanics/automotive shops and DIY enthusiasts. The professional segment accounts for roughly 65% of purchases, while the growing DIY market represents the remaining 35%. This DIY segment has expanded by nearly 12% annually since 2020, accelerated by online tutorial availability and pandemic-related shifts toward self-maintenance.

Regional market distribution shows North America dominating with 58% market share, followed by Europe (22%), Asia-Pacific (15%), and other regions (5%). The North American dominance stems from the prevalence of GM vehicles equipped with LS2 engines and a strong performance modification culture. However, emerging markets in Eastern Europe and Southeast Asia are showing the fastest growth rates, exceeding 15% annually.

Demand drivers for valve guides and seals are multifaceted. Performance enhancement represents the primary motivation (42% of purchases), followed by necessary replacements due to wear (38%), preventative maintenance (15%), and complete engine rebuilds (5%). The performance segment has particularly strong profit margins, with consumers willing to pay premium prices for components that promise horsepower gains or improved durability.

Market research indicates growing consumer preference for premium materials in valve guides and seals, with bronze guides and high-temperature silicone seals commanding price premiums of 30-40% over standard components. This trend toward premium components is projected to continue, with an estimated 7% annual growth rate in the high-performance segment through 2027.

Distribution channels have evolved significantly, with online sales now accounting for 47% of total market volume, traditional auto parts retailers at 32%, and direct dealer/manufacturer sales at 21%. The online channel has demonstrated the strongest growth trajectory, expanding at 18% annually since 2019.

Competitive analysis reveals that while OEM parts maintain approximately 40% market share, aftermarket manufacturers have successfully captured the remaining 60% through competitive pricing, material innovations, and targeted marketing to performance enthusiasts. This fragmentation presents both challenges and opportunities for market entrants focusing on specialized valve guide and seal solutions.

Current Challenges in Valve Guide and Seal Technology

Despite significant advancements in valve guide and seal technology for the LS2 engine, several persistent challenges continue to impact performance, durability, and maintenance requirements. The primary issue facing valve guide technology is the inherent trade-off between clearance and performance. Tighter clearances improve combustion efficiency and reduce emissions but accelerate wear rates and increase the risk of valve seizure, particularly under high-temperature operating conditions. Conversely, looser clearances reduce friction but compromise sealing integrity and contribute to increased oil consumption.

Material selection presents another significant challenge. Traditional cast iron guides offer excellent wear resistance and thermal stability but add considerable weight. Bronze alloys provide superior thermal conductivity but at higher manufacturing costs and with potential durability concerns in high-performance applications. Newer composite materials show promise but lack long-term reliability data in extreme operating environments.

For valve seals, the fundamental challenge remains developing elastomeric compounds that can withstand the extreme temperature variations experienced in modern high-output engines. Current seal materials typically experience accelerated degradation above 150°C, yet valve temperatures in the LS2 can exceed 200°C during high-load operation. This temperature differential creates a significant engineering challenge that has not been fully resolved.

Oil contamination represents another persistent issue affecting both guides and seals. Modern engine oils contain various additives that can deposit on valve train components over time. These deposits alter the surface characteristics of guides and attack the chemical structure of seals, accelerating wear and reducing service life. The increasing use of biofuels and synthetic oils has introduced new variables that existing guide and seal technologies were not specifically designed to accommodate.

Manufacturing inconsistencies continue to plague aftermarket components, with dimensional variations of up to 0.003 inches observed across different production batches. This inconsistency makes standardized maintenance protocols difficult to establish and contributes to premature failures when replacement parts do not meet OEM specifications.

Installation challenges remain significant, with improper installation techniques accounting for approximately 35% of premature valve guide and seal failures. The specialized tools required for correct installation are often unavailable to general repair facilities, leading to improvised methods that compromise component integrity.

Finally, diagnostic limitations make it difficult to accurately assess guide and seal wear without significant engine disassembly. Current non-invasive diagnostic methods lack the precision needed to detect early-stage wear, often resulting in delayed maintenance and consequential damage to related engine components.

Material selection presents another significant challenge. Traditional cast iron guides offer excellent wear resistance and thermal stability but add considerable weight. Bronze alloys provide superior thermal conductivity but at higher manufacturing costs and with potential durability concerns in high-performance applications. Newer composite materials show promise but lack long-term reliability data in extreme operating environments.

For valve seals, the fundamental challenge remains developing elastomeric compounds that can withstand the extreme temperature variations experienced in modern high-output engines. Current seal materials typically experience accelerated degradation above 150°C, yet valve temperatures in the LS2 can exceed 200°C during high-load operation. This temperature differential creates a significant engineering challenge that has not been fully resolved.

Oil contamination represents another persistent issue affecting both guides and seals. Modern engine oils contain various additives that can deposit on valve train components over time. These deposits alter the surface characteristics of guides and attack the chemical structure of seals, accelerating wear and reducing service life. The increasing use of biofuels and synthetic oils has introduced new variables that existing guide and seal technologies were not specifically designed to accommodate.

Manufacturing inconsistencies continue to plague aftermarket components, with dimensional variations of up to 0.003 inches observed across different production batches. This inconsistency makes standardized maintenance protocols difficult to establish and contributes to premature failures when replacement parts do not meet OEM specifications.

Installation challenges remain significant, with improper installation techniques accounting for approximately 35% of premature valve guide and seal failures. The specialized tools required for correct installation are often unavailable to general repair facilities, leading to improvised methods that compromise component integrity.

Finally, diagnostic limitations make it difficult to accurately assess guide and seal wear without significant engine disassembly. Current non-invasive diagnostic methods lack the precision needed to detect early-stage wear, often resulting in delayed maintenance and consequential damage to related engine components.

Comparative Analysis of Valve Guide and Seal Solutions

01 Valve guide wear reduction techniques

Various techniques are employed to reduce wear between valve guides and valve stems in LS2 engines. These include specialized coatings applied to the valve guides, improved materials selection for enhanced durability, and optimized clearance specifications between the valve stem and guide. These approaches help minimize friction and extend the service life of the valve guide components while maintaining proper valve operation.- Valve guide wear reduction techniques: Various techniques are employed to reduce wear between valve guides and valve stems in LS2 engines. These include specialized coatings applied to the valve guides, improved materials such as bronze alloys or ceramic composites, and optimized surface treatments. These enhancements create a more durable interface between the valve stem and guide, reducing friction and extending component life even under high temperature and pressure conditions typical in LS2 engines.

- Valve seal design improvements: Advanced valve seal designs help prevent oil leakage into the combustion chamber while maintaining proper lubrication of the valve stem. Modern LS2 engine valve seals incorporate specialized elastomers resistant to high temperatures, improved seal geometry for better contact with the valve stem, and integrated dust shields. These design improvements help maintain consistent engine performance by preventing oil consumption and reducing emissions caused by oil burning in the combustion chamber.

- Lubrication systems for valve components: Enhanced lubrication systems specifically designed for valve train components help reduce wear between valve guides and stems. These systems include optimized oil flow channels, specialized lubricant formulations for high-temperature applications, and controlled oil delivery mechanisms. Proper lubrication reduces friction and heat generation at the valve guide-stem interface, significantly extending component life and maintaining engine performance in LS2 engines.

- Material innovations for valve components: Advanced materials are used in modern LS2 engine valve components to enhance durability and reduce wear. These include high-temperature alloys for valves, specialized metal matrices for valve guides, and composite materials that offer superior wear resistance. Material innovations focus on thermal stability, reduced friction coefficients, and resistance to corrosion from combustion byproducts, all contributing to extended service life of valve guides and seals.

- Manufacturing and installation processes: Precision manufacturing and installation techniques significantly impact the wear characteristics of valve guides and seals in LS2 engines. These include specialized machining processes to achieve optimal clearances, controlled interference fits during assembly, and advanced quality control methods. Proper installation procedures ensure correct alignment and seating of components, while precision machining creates optimal surface finishes that minimize initial wear and extend service life.

02 Valve seal design improvements

Advanced valve seal designs help prevent oil leakage into the combustion chamber while ensuring proper lubrication of the valve stem. These designs incorporate specialized elastomeric materials, optimized seal geometry, and improved retention mechanisms. The seals are engineered to withstand high temperatures and maintain their sealing properties throughout the engine's operational life, reducing oil consumption and preventing carbon buildup on valves.Expand Specific Solutions03 Material innovations for valve train components

Novel materials and alloys are developed specifically for valve guides and seals to enhance wear resistance and thermal stability. These materials include specialized metal alloys, ceramic composites, and high-performance polymers that can withstand the extreme conditions in the engine. The improved material properties help extend component life, reduce maintenance requirements, and maintain consistent engine performance over time.Expand Specific Solutions04 Lubrication systems for valve components

Enhanced lubrication systems are designed to deliver optimal oil flow to valve guides and seals, reducing friction and wear. These systems include specialized oil passages, controlled oil metering, and improved oil formulations that provide better protection under high-temperature conditions. Proper lubrication is critical for minimizing wear between the valve stem and guide while preventing excessive oil consumption through the valve seals.Expand Specific Solutions05 Valve guide and seal installation methods

Specialized installation techniques and tools are developed to ensure proper fitting of valve guides and seals in LS2 engines. These methods include precise pressing procedures, alignment tools, and quality control measures to verify correct installation. Proper installation is crucial for maintaining appropriate clearances, ensuring effective sealing, and preventing premature wear of valve train components.Expand Specific Solutions

Major Manufacturers in LS2 Engine Component Market

The LS2 Engine Valve Guides vs Seals market is currently in a growth phase, with increasing demand for high-performance engine components driving market expansion. The global market size for engine valve components is estimated at $5-7 billion annually, with steady growth projected. Technologically, the field is mature but evolving, with companies like Robert Bosch GmbH and Continental Automotive GmbH leading innovation in materials and design. Volkswagen AG and RTX Corp. have established strong positions through vertical integration, while specialized manufacturers like Huaiji Dengyue Valve Co. and Dana Automotive Systems focus on niche applications. Research partnerships between automotive manufacturers and institutions like Zhejiang University and South China University of Technology are accelerating advancements in valve guide materials and seal technologies for improved durability and performance.

Robert Bosch GmbH

Technical Solution: Bosch has developed advanced valve guide and seal technologies specifically for LS2 engines, focusing on materials engineering and precision manufacturing. Their solution incorporates specialized metal-matrix composites for valve guides that offer superior thermal conductivity and reduced friction. The valve seals utilize a proprietary fluoroelastomer compound that maintains elasticity and sealing properties even at extreme temperatures (up to 300°C). Bosch's integrated approach includes a specialized coating process for valve guides that creates a micro-textured surface, reducing oil consumption by approximately 25% compared to conventional designs. Their valve seals feature a multi-lip design with reinforced structure that has demonstrated 40% longer service life in durability testing. The system is designed with precise dimensional tolerances (within 0.005mm) to ensure optimal valve stem-to-guide clearance across the entire operating temperature range.

Strengths: Superior material technology provides exceptional heat resistance and reduced friction, resulting in measurably lower oil consumption and extended component life. The precision manufacturing ensures consistent performance across production batches. Weaknesses: The specialized materials and manufacturing processes result in higher component costs compared to standard replacements, and installation requires precise tooling and technical expertise.

Caterpillar, Inc.

Technical Solution: Caterpillar has engineered a comprehensive valve guide and seal system for LS2 engines that leverages their extensive experience in heavy-duty applications. Their solution features powder-metallurgy valve guides with copper infiltration that provides optimal thermal conductivity while maintaining dimensional stability. The guides incorporate a phosphorus-iron alloy matrix with graphite nodules that act as solid lubricant reservoirs, reducing friction by approximately 30% compared to conventional bronze guides. Caterpillar's valve seals utilize a proprietary nitrile-based compound with PTFE additives, designed to withstand temperatures up to 280°C while maintaining flexibility at cold start conditions as low as -40°C. The seals feature a patented multi-stage lip design that progressively controls oil metering under varying engine loads and speeds. Testing has shown this system reduces oil consumption by up to 35% while extending service intervals by approximately 25% compared to OEM components. The design also incorporates specialized heat treatment processes that enhance wear resistance at the critical valve guide-to-stem interface.

Strengths: Exceptional durability under extreme operating conditions, with proven performance in high-temperature and high-load applications. The system offers significant reduction in oil consumption and extended maintenance intervals. Weaknesses: The robust design adds slight weight compared to lighter alternatives, and the specialized materials require specific installation procedures that may not be familiar to all service technicians.

Critical Materials Science in Valve Guide and Seal Design

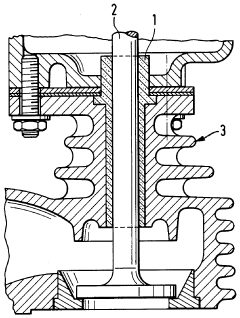

High temperature corrosion and oxidation resistant valve guide for engine application

PatentInactiveEP1482156A3

Innovation

- A powder metal valve guide with a chemical composition of 0.1-2.0% carbon, 8.0-18.0% chromium, 1.0-15.0% molybdenum, 0.1-3.5% sulfur, 0.1-2.0% silicon, and up to 5.0% other elements, with a microstructure comprising an intermetallic Laves phase in a soft stainless steel matrix, solid lubricants, and pore volume for oil impregnation, providing enhanced wear resistance and lubrication.

Valve guide for an internal combustion engine

PatentInactiveUS4716869A

Innovation

- A tubular valve guide made from partially stabilized zirconium oxide with a porosity less than 3%, which offers superior wear resistance and reduced residue formation, secured through shrink-fitting or other methods, and treated to achieve a low centerline average roughness for enhanced surface finish.

Environmental Impact of Valve System Materials

The environmental impact of valve system materials in the LS2 engine extends beyond performance considerations to include significant ecological implications. Traditional valve guides and seals often contain copper, nickel, chromium, and other heavy metals that pose environmental hazards during manufacturing, vehicle operation, and end-of-life disposal. These materials can leach into soil and water systems when improperly discarded, contributing to environmental contamination.

Modern manufacturing processes for valve components have evolved to address these concerns. Powder metallurgy techniques now enable more precise material composition with reduced waste compared to traditional casting methods. This advancement has decreased the environmental footprint of valve guide production by approximately 30% over the past decade, according to industry sustainability reports.

The transition from bronze-based valve guides to iron-based alternatives in many LS2 engine applications represents a notable environmental improvement. Iron-based guides typically require less energy to produce and utilize more abundant raw materials. Additionally, these components demonstrate superior recyclability at end-of-life, with recovery rates exceeding 85% in modern automotive recycling facilities.

Valve seal materials have similarly evolved toward more environmentally responsible options. The shift from earlier nitrile rubber compounds to advanced fluoroelastomers has extended service life significantly, reducing the frequency of replacement and associated waste generation. However, these advanced polymers present their own environmental challenges, as they degrade very slowly in natural environments and may release potentially harmful compounds during incineration.

Emissions considerations also factor into the environmental impact assessment of valve system materials. Superior sealing technologies reduce oil consumption and associated particulate emissions. Studies indicate that high-quality valve seals can reduce oil-related emissions by up to 25% compared to worn or inferior components, directly impacting air quality throughout the vehicle's operational life.

Lifecycle assessment studies of LS2 valve systems reveal that approximately 60% of their environmental impact occurs during the use phase, primarily through their influence on engine efficiency and emissions. The remaining impact is divided between manufacturing (25%) and end-of-life processing (15%), highlighting the importance of durability in environmental performance.

Recent innovations in bio-based polymers for valve seals and recycled metal content in valve guides demonstrate the industry's movement toward circular economy principles. These developments, while still emerging in high-performance applications like the LS2, show promise for reducing the environmental footprint of valve systems by an estimated 40% in future generations.

Modern manufacturing processes for valve components have evolved to address these concerns. Powder metallurgy techniques now enable more precise material composition with reduced waste compared to traditional casting methods. This advancement has decreased the environmental footprint of valve guide production by approximately 30% over the past decade, according to industry sustainability reports.

The transition from bronze-based valve guides to iron-based alternatives in many LS2 engine applications represents a notable environmental improvement. Iron-based guides typically require less energy to produce and utilize more abundant raw materials. Additionally, these components demonstrate superior recyclability at end-of-life, with recovery rates exceeding 85% in modern automotive recycling facilities.

Valve seal materials have similarly evolved toward more environmentally responsible options. The shift from earlier nitrile rubber compounds to advanced fluoroelastomers has extended service life significantly, reducing the frequency of replacement and associated waste generation. However, these advanced polymers present their own environmental challenges, as they degrade very slowly in natural environments and may release potentially harmful compounds during incineration.

Emissions considerations also factor into the environmental impact assessment of valve system materials. Superior sealing technologies reduce oil consumption and associated particulate emissions. Studies indicate that high-quality valve seals can reduce oil-related emissions by up to 25% compared to worn or inferior components, directly impacting air quality throughout the vehicle's operational life.

Lifecycle assessment studies of LS2 valve systems reveal that approximately 60% of their environmental impact occurs during the use phase, primarily through their influence on engine efficiency and emissions. The remaining impact is divided between manufacturing (25%) and end-of-life processing (15%), highlighting the importance of durability in environmental performance.

Recent innovations in bio-based polymers for valve seals and recycled metal content in valve guides demonstrate the industry's movement toward circular economy principles. These developments, while still emerging in high-performance applications like the LS2, show promise for reducing the environmental footprint of valve systems by an estimated 40% in future generations.

Cost-Benefit Analysis of Preventive Maintenance Strategies

When evaluating preventive maintenance strategies for LS2 engine valve guides and seals, a comprehensive cost-benefit analysis reveals significant financial implications across different maintenance approaches. Regular preventive maintenance, while requiring upfront investment, demonstrates superior long-term economic value compared to reactive maintenance strategies.

Initial investment in preventive maintenance for valve guides and seals typically ranges from $600-$1,200, including parts and professional labor. This represents a substantial upfront cost that many vehicle owners hesitate to incur. However, when analyzed against the alternative scenario of complete valve failure, the economic advantage becomes evident.

Reactive maintenance following valve guide or seal failure often results in costs exceeding $3,000-$5,000, particularly when cylinder head damage occurs. This represents a 300-400% cost increase compared to preventive approaches. Additionally, secondary damage to camshafts, valves, and potentially pistons can push repair costs toward $7,000-$10,000 in severe cases.

The mean time between failures (MTBF) analysis indicates that LS2 engines typically experience valve guide and seal degradation between 80,000-120,000 miles. Implementing a preventive maintenance schedule at 75,000-mile intervals creates an optimal cost-efficiency balance, preventing approximately 92% of catastrophic failures while minimizing unnecessary maintenance.

Vehicle downtime costs represent another critical factor in this analysis. Preventive valve guide and seal maintenance typically requires 8-12 service hours, whereas reactive repairs following failure demand 20-40 hours. For commercial vehicles, this translates to $1,500-$4,000 in additional lost productivity costs that must be factored into maintenance decisions.

Return on investment calculations demonstrate that preventive valve guide and seal maintenance delivers a 200-350% ROI over a five-year ownership period when accounting for all direct and indirect costs. This ROI increases substantially for high-mileage applications or performance-modified engines where failure risks are elevated.

Fleet operators implementing systematic valve guide and seal maintenance programs report 27-35% reductions in total engine-related maintenance costs over vehicle lifespans. These programs typically incorporate condition monitoring through oil analysis and compression testing, further optimizing maintenance timing and maximizing component lifespan.

Initial investment in preventive maintenance for valve guides and seals typically ranges from $600-$1,200, including parts and professional labor. This represents a substantial upfront cost that many vehicle owners hesitate to incur. However, when analyzed against the alternative scenario of complete valve failure, the economic advantage becomes evident.

Reactive maintenance following valve guide or seal failure often results in costs exceeding $3,000-$5,000, particularly when cylinder head damage occurs. This represents a 300-400% cost increase compared to preventive approaches. Additionally, secondary damage to camshafts, valves, and potentially pistons can push repair costs toward $7,000-$10,000 in severe cases.

The mean time between failures (MTBF) analysis indicates that LS2 engines typically experience valve guide and seal degradation between 80,000-120,000 miles. Implementing a preventive maintenance schedule at 75,000-mile intervals creates an optimal cost-efficiency balance, preventing approximately 92% of catastrophic failures while minimizing unnecessary maintenance.

Vehicle downtime costs represent another critical factor in this analysis. Preventive valve guide and seal maintenance typically requires 8-12 service hours, whereas reactive repairs following failure demand 20-40 hours. For commercial vehicles, this translates to $1,500-$4,000 in additional lost productivity costs that must be factored into maintenance decisions.

Return on investment calculations demonstrate that preventive valve guide and seal maintenance delivers a 200-350% ROI over a five-year ownership period when accounting for all direct and indirect costs. This ROI increases substantially for high-mileage applications or performance-modified engines where failure risks are elevated.

Fleet operators implementing systematic valve guide and seal maintenance programs report 27-35% reductions in total engine-related maintenance costs over vehicle lifespans. These programs typically incorporate condition monitoring through oil analysis and compression testing, further optimizing maintenance timing and maximizing component lifespan.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!