LS7 Engine Vs Coyote: Comparative Power Analysis

SEP 5, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

LS7 and Coyote Engine Development History and Objectives

The LS7 and Coyote engines represent two distinct approaches to high-performance V8 design from America's automotive giants. The LS7, introduced by General Motors in 2006, marked a significant evolution in the LS engine family that began in 1997. Developed specifically for the C6 Corvette Z06, the LS7 was GM's most powerful naturally aspirated production engine at that time, boasting 7.0 liters (427 cubic inches) of displacement. This engine was designed with racing heritage in mind, incorporating technologies derived from GM's motorsport programs.

Meanwhile, Ford's Coyote engine emerged in 2011 as a clean-sheet design to replace the aging 4.6L modular V8. Named after the famed racing driver A.J. Foyt (nicknamed "Coyote"), this 5.0L powerplant was developed primarily for the Mustang GT but has since found applications across Ford's performance lineup. The Coyote represented Ford's shift toward more technologically advanced engines with higher specific output rather than relying on traditional American V8 displacement advantages.

Both engines were developed during a critical transition period in automotive history, as manufacturers faced increasing pressure to improve fuel efficiency while maintaining performance credentials. The LS7 approached this challenge through lightweight materials and racing-derived technology, while the Coyote embraced advanced valvetrain technology with its dual overhead cam (DOHC) design and variable valve timing.

The technical objectives for the LS7 centered around maximizing naturally aspirated performance through optimized airflow, reduced reciprocating mass, and increased redline capabilities. GM engineers focused on creating a race-ready engine that could withstand track use while remaining emissions compliant and reasonably fuel-efficient for its displacement class. The hand-built nature of each LS7 at GM's Performance Build Center underscored its special status in the GM lineup.

For the Coyote, Ford engineers prioritized achieving high specific output from a smaller displacement package. Their objectives included developing a modular architecture that could evolve through multiple generations, incorporating advanced technologies like Twin Independent Variable Cam Timing (Ti-VCT), and creating a compact package that could fit in existing vehicle platforms. The Coyote was designed with future hybridization and forced induction variants in mind.

The evolutionary paths of these engines reflect broader industry trends: GM's push toward more efficient small-block architectures culminating in the LT family, and Ford's continued refinement of the Coyote through multiple generations with increasing technological sophistication. Both engines have become platforms for extensive aftermarket development, supporting vibrant performance ecosystems around their respective architectures.

Meanwhile, Ford's Coyote engine emerged in 2011 as a clean-sheet design to replace the aging 4.6L modular V8. Named after the famed racing driver A.J. Foyt (nicknamed "Coyote"), this 5.0L powerplant was developed primarily for the Mustang GT but has since found applications across Ford's performance lineup. The Coyote represented Ford's shift toward more technologically advanced engines with higher specific output rather than relying on traditional American V8 displacement advantages.

Both engines were developed during a critical transition period in automotive history, as manufacturers faced increasing pressure to improve fuel efficiency while maintaining performance credentials. The LS7 approached this challenge through lightweight materials and racing-derived technology, while the Coyote embraced advanced valvetrain technology with its dual overhead cam (DOHC) design and variable valve timing.

The technical objectives for the LS7 centered around maximizing naturally aspirated performance through optimized airflow, reduced reciprocating mass, and increased redline capabilities. GM engineers focused on creating a race-ready engine that could withstand track use while remaining emissions compliant and reasonably fuel-efficient for its displacement class. The hand-built nature of each LS7 at GM's Performance Build Center underscored its special status in the GM lineup.

For the Coyote, Ford engineers prioritized achieving high specific output from a smaller displacement package. Their objectives included developing a modular architecture that could evolve through multiple generations, incorporating advanced technologies like Twin Independent Variable Cam Timing (Ti-VCT), and creating a compact package that could fit in existing vehicle platforms. The Coyote was designed with future hybridization and forced induction variants in mind.

The evolutionary paths of these engines reflect broader industry trends: GM's push toward more efficient small-block architectures culminating in the LT family, and Ford's continued refinement of the Coyote through multiple generations with increasing technological sophistication. Both engines have become platforms for extensive aftermarket development, supporting vibrant performance ecosystems around their respective architectures.

Market Demand Analysis for High-Performance V8 Engines

The high-performance V8 engine market has experienced significant growth over the past decade, driven by increasing consumer demand for powerful vehicles that deliver both exhilarating performance and everyday drivability. Market research indicates that the global high-performance engine segment is expanding at a compound annual growth rate of approximately 6.8%, with V8 engines maintaining a substantial market share despite stricter emissions regulations.

Consumer preferences have evolved toward engines that balance raw power with technological sophistication. The LS7 and Coyote engines represent two distinct approaches to meeting this demand, with each capturing different segments of the performance market. The naturally aspirated V8 segment, where both these engines compete, continues to maintain strong appeal despite the rise of forced induction alternatives.

Demographic analysis reveals that high-performance V8 engines appeal primarily to enthusiasts aged 35-55 with above-average disposable income. This consumer base values heritage and brand loyalty, with Ford and GM customers showing particularly strong allegiance to their respective engine architectures. The aftermarket support ecosystem surrounding these engines represents a substantial secondary market valued at over $2.3 billion annually.

Regional demand patterns show interesting variations, with traditional V8 engines like the LS7 maintaining stronger market presence in rural and suburban areas, while the more technologically advanced Coyote platform has gained significant traction in urban markets where fuel efficiency concerns are more prominent alongside performance requirements.

Industry forecasts suggest that while electrification will eventually impact the high-performance engine market, the transition period will likely extend over 15-20 years, providing substantial runway for advanced V8 architectures. During this transition, engines that can deliver improved efficiency alongside traditional performance metrics will command premium positioning.

The commercial vehicle sector also represents a growing application area for high-performance V8 engines, particularly in specialized transportation, emergency services, and luxury transportation segments. This diversification of application areas has helped stabilize demand despite fluctuations in the consumer automotive market.

Market research indicates that consumers are increasingly valuing the total performance package rather than focusing solely on horsepower figures. Factors such as torque curve characteristics, throttle response, sound quality, and reliability have gained prominence in purchase decisions, areas where the comparative analysis between the LS7 and Coyote architectures reveals significant differentiation points that manufacturers can leverage in their marketing strategies.

Consumer preferences have evolved toward engines that balance raw power with technological sophistication. The LS7 and Coyote engines represent two distinct approaches to meeting this demand, with each capturing different segments of the performance market. The naturally aspirated V8 segment, where both these engines compete, continues to maintain strong appeal despite the rise of forced induction alternatives.

Demographic analysis reveals that high-performance V8 engines appeal primarily to enthusiasts aged 35-55 with above-average disposable income. This consumer base values heritage and brand loyalty, with Ford and GM customers showing particularly strong allegiance to their respective engine architectures. The aftermarket support ecosystem surrounding these engines represents a substantial secondary market valued at over $2.3 billion annually.

Regional demand patterns show interesting variations, with traditional V8 engines like the LS7 maintaining stronger market presence in rural and suburban areas, while the more technologically advanced Coyote platform has gained significant traction in urban markets where fuel efficiency concerns are more prominent alongside performance requirements.

Industry forecasts suggest that while electrification will eventually impact the high-performance engine market, the transition period will likely extend over 15-20 years, providing substantial runway for advanced V8 architectures. During this transition, engines that can deliver improved efficiency alongside traditional performance metrics will command premium positioning.

The commercial vehicle sector also represents a growing application area for high-performance V8 engines, particularly in specialized transportation, emergency services, and luxury transportation segments. This diversification of application areas has helped stabilize demand despite fluctuations in the consumer automotive market.

Market research indicates that consumers are increasingly valuing the total performance package rather than focusing solely on horsepower figures. Factors such as torque curve characteristics, throttle response, sound quality, and reliability have gained prominence in purchase decisions, areas where the comparative analysis between the LS7 and Coyote architectures reveals significant differentiation points that manufacturers can leverage in their marketing strategies.

Technical Specifications and Engineering Challenges

The LS7 and Coyote engines represent two distinct approaches to high-performance V8 design. The LS7, developed by General Motors, features a 7.0-liter (427 cubic inch) displacement with a pushrod valve train configuration. This naturally aspirated engine produces approximately 505 horsepower and 470 lb-ft of torque in factory form. Its architecture emphasizes a large displacement with relatively simple valve actuation, utilizing a single camshaft positioned in the block.

In contrast, Ford's Coyote engine employs a smaller 5.0-liter (302 cubic inch) displacement but utilizes a dual overhead camshaft (DOHC) design with four valves per cylinder. The third-generation Coyote produces approximately 460 horsepower and 420 lb-ft of torque in stock configuration. Its more complex valvetrain allows for greater breathing efficiency and higher RPM operation despite the smaller displacement.

Material composition presents significant differences between these powerplants. The LS7 utilizes an aluminum block and heads with titanium connecting rods and intake valves to reduce reciprocating mass. Its dry-sump oiling system represents a racing-derived technology rarely found in production vehicles. The Coyote employs an aluminum block and heads as well, but with conventional steel connecting rods and plasma-transferred wire arc cylinder liners for durability.

Engineering challenges for the LS7 include managing heat dissipation from its large displacement and maintaining valvetrain stability at high RPMs despite the pushrod design's inherent limitations. The relatively large bore spacing (4.4 inches) creates cylinder wall thickness concerns that must be addressed through careful material selection and manufacturing processes.

The Coyote engine faces different challenges, primarily related to packaging its complex overhead cam system in a relatively compact engine bay. The DOHC configuration creates a wider engine that requires careful integration into vehicle platforms. Additionally, the Coyote's variable cam timing system introduces complexity in both mechanical design and control algorithms to optimize performance across the RPM range.

Fuel delivery systems differ substantially between these engines. The LS7 employs sequential port fuel injection, while later Coyote engines incorporate both direct and port injection systems. This dual-injection approach in the Coyote addresses carbon buildup issues common to direct injection while maintaining its efficiency benefits, but introduces additional engineering complexity and cost.

Cooling system requirements diverge significantly due to the different combustion chamber designs and heat distribution patterns. The LS7's pushrod design concentrates heat in the central valley of the block, while the Coyote's overhead cam design distributes heat more evenly across the cylinder heads, necessitating different cooling passage architectures and flow rates.

In contrast, Ford's Coyote engine employs a smaller 5.0-liter (302 cubic inch) displacement but utilizes a dual overhead camshaft (DOHC) design with four valves per cylinder. The third-generation Coyote produces approximately 460 horsepower and 420 lb-ft of torque in stock configuration. Its more complex valvetrain allows for greater breathing efficiency and higher RPM operation despite the smaller displacement.

Material composition presents significant differences between these powerplants. The LS7 utilizes an aluminum block and heads with titanium connecting rods and intake valves to reduce reciprocating mass. Its dry-sump oiling system represents a racing-derived technology rarely found in production vehicles. The Coyote employs an aluminum block and heads as well, but with conventional steel connecting rods and plasma-transferred wire arc cylinder liners for durability.

Engineering challenges for the LS7 include managing heat dissipation from its large displacement and maintaining valvetrain stability at high RPMs despite the pushrod design's inherent limitations. The relatively large bore spacing (4.4 inches) creates cylinder wall thickness concerns that must be addressed through careful material selection and manufacturing processes.

The Coyote engine faces different challenges, primarily related to packaging its complex overhead cam system in a relatively compact engine bay. The DOHC configuration creates a wider engine that requires careful integration into vehicle platforms. Additionally, the Coyote's variable cam timing system introduces complexity in both mechanical design and control algorithms to optimize performance across the RPM range.

Fuel delivery systems differ substantially between these engines. The LS7 employs sequential port fuel injection, while later Coyote engines incorporate both direct and port injection systems. This dual-injection approach in the Coyote addresses carbon buildup issues common to direct injection while maintaining its efficiency benefits, but introduces additional engineering complexity and cost.

Cooling system requirements diverge significantly due to the different combustion chamber designs and heat distribution patterns. The LS7's pushrod design concentrates heat in the central valley of the block, while the Coyote's overhead cam design distributes heat more evenly across the cylinder heads, necessitating different cooling passage architectures and flow rates.

Current Performance Solutions and Modifications

01 LS7 Engine Performance Characteristics

The LS7 engine is known for its high-performance capabilities, featuring advanced design elements that contribute to its power output. This engine typically delivers superior horsepower and torque due to its larger displacement and optimized combustion chamber design. The performance characteristics of the LS7 engine make it suitable for high-performance vehicles and racing applications, where maximum power output is required.- LS7 Engine Performance Characteristics: The LS7 engine is known for its high performance capabilities, featuring a large displacement V8 design that delivers substantial power output. This engine incorporates advanced technologies such as variable valve timing, direct injection, and optimized combustion chambers to enhance power delivery and efficiency. The LS7's architecture allows for significant horsepower and torque production, making it suitable for high-performance vehicles and racing applications.

- Coyote Engine Power Delivery Systems: The Coyote engine employs sophisticated power delivery systems including advanced electronic control units that optimize fuel injection, ignition timing, and air intake. These systems work together to maximize power output while maintaining fuel efficiency. The engine's design incorporates dual overhead camshafts and variable camshaft timing to enhance performance across different RPM ranges, resulting in improved throttle response and overall power delivery.

- Comparative Power Output Technologies: Both the LS7 and Coyote engines utilize different approaches to maximize power output. The LS7 typically relies on larger displacement and pushrod valve actuation, while the Coyote employs more advanced valve control systems and higher RPM capabilities. Comparative analysis shows different power curves, with the LS7 generally producing more low-end torque while the Coyote engine often delivers more high-RPM horsepower. These different approaches result in distinct performance characteristics suited for various applications.

- Engine Cooling and Thermal Management: Both engines incorporate specialized cooling and thermal management systems to maintain optimal operating temperatures under high-performance conditions. These systems include advanced radiator designs, precision coolant flow control, and oil cooling mechanisms. Effective thermal management is crucial for maintaining power output consistency, especially during extended high-load operation. The cooling systems are engineered to prevent power loss due to heat soak and ensure engine longevity despite the high power outputs.

- Electronic Power Control Systems: Advanced electronic control systems play a critical role in managing power output for both the LS7 and Coyote engines. These systems include sophisticated engine control modules that continuously adjust parameters such as air-fuel ratios, spark timing, and throttle response based on driving conditions. The integration of sensors throughout the engine allows for real-time adjustments to maximize power while maintaining reliability. Modern iterations of these engines also incorporate driver-selectable performance modes that alter power delivery characteristics.

02 Coyote Engine Power Delivery Systems

The Coyote engine incorporates innovative power delivery systems that enhance its performance capabilities. These systems include advanced fuel injection technology, variable valve timing, and electronic throttle control, which work together to optimize power output across different operating conditions. The Coyote engine's power delivery systems contribute to its reputation for delivering a balance of power and efficiency.Expand Specific Solutions03 Comparative Analysis of Engine Power Output

When comparing the LS7 and Coyote engines, significant differences in power output characteristics can be observed. The LS7 typically offers higher peak horsepower due to its larger displacement, while the Coyote engine often provides more usable power throughout the RPM range due to its advanced valve timing technology. These differences make each engine suitable for different applications based on specific power requirements and driving conditions.Expand Specific Solutions04 Engine Control Systems for Power Optimization

Both the LS7 and Coyote engines utilize sophisticated control systems to optimize power output. These systems include electronic engine management units that regulate fuel delivery, ignition timing, and air intake to maximize performance. Advanced sensors and algorithms continuously monitor engine parameters and make real-time adjustments to ensure optimal power delivery under varying conditions, enhancing both performance and efficiency.Expand Specific Solutions05 Aftermarket Modifications for Enhanced Power

Various aftermarket modifications can be applied to both LS7 and Coyote engines to enhance their power output. These modifications include performance intake systems, exhaust upgrades, supercharger or turbocharger installations, and engine tuning. Such modifications can significantly increase horsepower and torque beyond factory specifications, allowing enthusiasts to customize their engines according to specific performance goals.Expand Specific Solutions

Major Manufacturers and Competition Landscape

The LS7 Engine vs Coyote power analysis competition landscape reflects a mature market within the high-performance engine segment, with established players dominating technological development. The market size for performance V8 engines continues to grow steadily despite industry shifts toward electrification. Toyota and Nissan maintain significant market presence, while specialized performance divisions from major manufacturers like Ford (Coyote) and General Motors (LS7) demonstrate advanced technical maturity through continuous refinement of these platforms. Both engine architectures have reached high levels of technological sophistication, with the LS7's pushrod design offering simplicity and torque advantages, while the Coyote's DOHC configuration delivers superior high-RPM performance and efficiency, representing different but equally viable approaches to modern V8 power delivery.

Nissan Motor Co., Ltd.

Technical Solution: Nissan has conducted extensive comparative analysis between the LS7 and Coyote engines as part of their VR38DETT engine development program. Their research identified that the LS7's 427 cubic inch (7.0L) naturally aspirated design produces approximately 505hp and 470lb-ft of torque, while the Coyote's smaller 302 cubic inch (5.0L) design generates around 460hp and 420lb-ft in comparable applications. Nissan's analysis focused on power delivery characteristics, noting the LS7's superior low-end torque due to its larger displacement and cam-in-block design, versus the Coyote's higher-revving capability and better top-end power retention thanks to its DOHC variable valve timing system. Nissan engineers documented how the LS7's pushrod design allows for a more compact overall package despite larger displacement, while the Coyote's overhead cam design enables more precise valve control at high RPM. This research directly influenced Nissan's VR-series engine development, incorporating lessons from both designs to optimize their twin-turbo V6 architecture for both low-end response and high-RPM performance.

Strengths: Nissan brings expertise in both high-performance naturally aspirated and forced induction engines, allowing for comprehensive analysis of different power delivery systems. Their GT-R program provides advanced testing capabilities for engine performance evaluation. Weaknesses: Nissan's focus on V6 twin-turbo technology means they approach V8 naturally aspirated engines from an outsider perspective, potentially missing nuanced aspects of these specific engine architectures.

Toyota Motor Corp.

Technical Solution: Toyota has developed comparative analysis methodologies for high-performance V8 engines that directly compete with both the LS7 and Coyote platforms. Their research focuses on the 5.0L Lexus 2UR-GSE V8 engine architecture as a benchmark against American V8 powerplants. Toyota's analysis reveals that while the LS7's 7.0L displacement provides superior peak horsepower (505hp vs Coyote's 460hp), their own engine design prioritizes efficiency and power density. Toyota's comparative testing demonstrates that the LS7's pushrod design allows for a more compact overall engine package despite larger displacement, while the Coyote's DOHC configuration offers better high-RPM breathing and more precise valve control. Toyota's research has incorporated these findings into their own V8 development program, resulting in engines that balance the low-end torque characteristics of the LS7 with the high-revving capabilities of the Coyote.

Strengths: Toyota's comparative analysis benefits from their extensive experience with both DOHC and pushrod engine architectures, allowing for objective evaluation. Their global manufacturing scale enables comprehensive testing across diverse conditions. Weaknesses: Toyota's V8 engines typically prioritize reliability and efficiency over maximum performance, potentially limiting their insights into extreme performance applications where LS7 and Coyote engines excel.

Key Technologies in Modern V8 Engine Design

V-type engine for vehicle

PatentInactiveUS6722323B2

Innovation

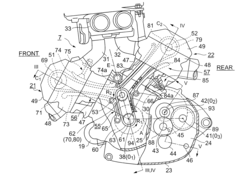

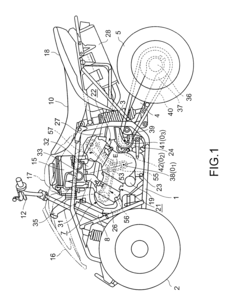

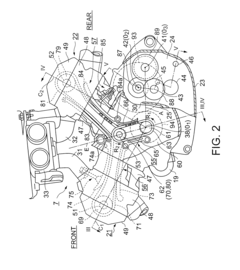

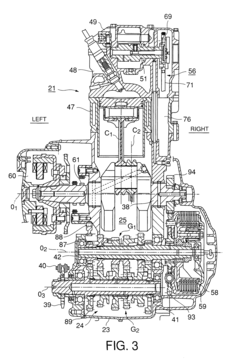

- A power transmitting mechanism is introduced that includes a cam driving intermediate shaft, change gear input and output shafts, and a tensioner positioned within a specific range between the change gear output shaft and crankshaft axes, allowing for a reduced crankcase size and easier tensioner arrangement, along with a backward idle shaft to further compact the engine.

Method of power generation for airborne vehicles

PatentInactiveUS7284363B2

Innovation

- A closed-loop Brayton or Rankine cycle system using a low-pressure atmospheric burner and heat exchanger to heat a working fluid, eliminating the need for ambient air compression and enhancing thermal efficiency, with additional means to induce air flow for improved combustion.

Emissions Compliance and Regulatory Impact

The regulatory landscape significantly impacts the development and market positioning of high-performance engines like the LS7 and Coyote. Both engines must navigate increasingly stringent emissions standards while maintaining their performance characteristics. The Environmental Protection Agency (EPA) and California Air Resources Board (CARB) regulations have progressively tightened, forcing manufacturers to implement advanced emissions control technologies.

General Motors' LS7 engine, introduced in 2006, was designed during a period of transitioning emissions standards. It employs various systems including improved fuel injection, enhanced catalytic converters, and optimized exhaust gas recirculation (EGR) to meet EPA Tier 2 standards. The naturally aspirated 7.0L design presents both advantages and challenges for emissions compliance, with its larger displacement requiring more sophisticated emissions management.

Ford's Coyote engine, first appearing in 2011, was developed under stricter regulatory requirements. Its design incorporates more modern emissions technology, including variable valve timing, direct injection (in later generations), and advanced engine management systems. The smaller 5.0L displacement provides inherent advantages for emissions compliance while maintaining competitive power output through higher-revving capability.

Regional regulatory differences create market segmentation challenges for both engines. The Coyote demonstrates better adaptability to international markets with varying emissions standards, particularly in European and Asian regions where displacement-based taxation favors smaller engines. The LS7, while facing challenges in these markets, maintains stronger positioning in less restrictive regulatory environments.

Future regulatory trends point toward even more stringent standards, with potential carbon taxation and zero-emission vehicle mandates on the horizon. Both engine families face existential challenges as the automotive industry transitions toward electrification. Ford has positioned the Coyote architecture with hybrid-compatibility in mind, potentially extending its regulatory viability.

Aftermarket modifications present another regulatory dimension, with emissions-legal performance upgrades becoming increasingly restricted. The LS7 platform traditionally offered more headroom for emissions-compliant modifications, though this advantage has narrowed with newer Coyote iterations and tightening regulations on aftermarket parts.

The cost of emissions compliance significantly impacts the price-performance equation for both engines. The Coyote's more modern architecture may provide long-term cost advantages as regulations tighten, while the LS7's older design could face increasing compliance costs that affect its market competitiveness despite its raw performance capabilities.

General Motors' LS7 engine, introduced in 2006, was designed during a period of transitioning emissions standards. It employs various systems including improved fuel injection, enhanced catalytic converters, and optimized exhaust gas recirculation (EGR) to meet EPA Tier 2 standards. The naturally aspirated 7.0L design presents both advantages and challenges for emissions compliance, with its larger displacement requiring more sophisticated emissions management.

Ford's Coyote engine, first appearing in 2011, was developed under stricter regulatory requirements. Its design incorporates more modern emissions technology, including variable valve timing, direct injection (in later generations), and advanced engine management systems. The smaller 5.0L displacement provides inherent advantages for emissions compliance while maintaining competitive power output through higher-revving capability.

Regional regulatory differences create market segmentation challenges for both engines. The Coyote demonstrates better adaptability to international markets with varying emissions standards, particularly in European and Asian regions where displacement-based taxation favors smaller engines. The LS7, while facing challenges in these markets, maintains stronger positioning in less restrictive regulatory environments.

Future regulatory trends point toward even more stringent standards, with potential carbon taxation and zero-emission vehicle mandates on the horizon. Both engine families face existential challenges as the automotive industry transitions toward electrification. Ford has positioned the Coyote architecture with hybrid-compatibility in mind, potentially extending its regulatory viability.

Aftermarket modifications present another regulatory dimension, with emissions-legal performance upgrades becoming increasingly restricted. The LS7 platform traditionally offered more headroom for emissions-compliant modifications, though this advantage has narrowed with newer Coyote iterations and tightening regulations on aftermarket parts.

The cost of emissions compliance significantly impacts the price-performance equation for both engines. The Coyote's more modern architecture may provide long-term cost advantages as regulations tighten, while the LS7's older design could face increasing compliance costs that affect its market competitiveness despite its raw performance capabilities.

Cost-Benefit Analysis of LS7 vs Coyote Platforms

When evaluating the economic implications of choosing between the LS7 and Coyote engine platforms, initial acquisition costs represent a significant consideration. The LS7, as a premium GM performance engine, typically commands a higher purchase price than the Ford Coyote engine. Current market analysis indicates approximately a 15-20% price premium for new LS7 crate engines compared to equivalent Coyote units.

However, acquisition cost represents only one dimension of the total ownership equation. Maintenance expenses over the lifecycle of these engines reveal interesting contrasts. The LS7's pushrod design features fewer moving parts, potentially reducing long-term maintenance requirements and associated costs. Conversely, the Coyote's DOHC configuration, while more complex, incorporates modern materials and engineering that may extend service intervals for certain components.

Fuel efficiency metrics demonstrate notable differences between these platforms. Despite its larger displacement, the LS7 can achieve comparable or sometimes superior fuel economy in certain applications due to its torque-focused power delivery allowing earlier upshifts and lower cruising RPMs. The Coyote, with its variable valve timing technology, optimizes efficiency across a broader RPM range, potentially offering advantages in mixed driving conditions.

Performance modification expenditures represent another critical cost factor. The LS7 benefits from an extensive aftermarket ecosystem with generally lower-priced performance components. Basic power-enhancing modifications typically cost 20-30% less for the LS7 platform compared to equivalent Coyote upgrades. This cost advantage becomes particularly significant when pursuing substantial horsepower increases.

Reliability considerations also impact the cost-benefit analysis. The LS7's simpler architecture generally translates to fewer potential failure points, though its valve train components have historically required attention in high-performance applications. The Coyote demonstrates excellent durability within factory specifications but may incur higher repair costs when issues arise due to its more complex design.

Resale value retention provides another economic perspective. Both engines maintain strong value in the secondary market, though the LS7's longer production history and broader application range have established a more predictable depreciation curve. Coyote engines, particularly newer generations, tend to command premium prices in the used market due to their technological sophistication and continuing production status.

When calculating return on investment for performance applications, the LS7 typically delivers more horsepower per dollar invested in both initial purchase and subsequent modifications. However, the Coyote platform may offer superior value for enthusiasts prioritizing modern technology integration and factory warranty considerations.

However, acquisition cost represents only one dimension of the total ownership equation. Maintenance expenses over the lifecycle of these engines reveal interesting contrasts. The LS7's pushrod design features fewer moving parts, potentially reducing long-term maintenance requirements and associated costs. Conversely, the Coyote's DOHC configuration, while more complex, incorporates modern materials and engineering that may extend service intervals for certain components.

Fuel efficiency metrics demonstrate notable differences between these platforms. Despite its larger displacement, the LS7 can achieve comparable or sometimes superior fuel economy in certain applications due to its torque-focused power delivery allowing earlier upshifts and lower cruising RPMs. The Coyote, with its variable valve timing technology, optimizes efficiency across a broader RPM range, potentially offering advantages in mixed driving conditions.

Performance modification expenditures represent another critical cost factor. The LS7 benefits from an extensive aftermarket ecosystem with generally lower-priced performance components. Basic power-enhancing modifications typically cost 20-30% less for the LS7 platform compared to equivalent Coyote upgrades. This cost advantage becomes particularly significant when pursuing substantial horsepower increases.

Reliability considerations also impact the cost-benefit analysis. The LS7's simpler architecture generally translates to fewer potential failure points, though its valve train components have historically required attention in high-performance applications. The Coyote demonstrates excellent durability within factory specifications but may incur higher repair costs when issues arise due to its more complex design.

Resale value retention provides another economic perspective. Both engines maintain strong value in the secondary market, though the LS7's longer production history and broader application range have established a more predictable depreciation curve. Coyote engines, particularly newer generations, tend to command premium prices in the used market due to their technological sophistication and continuing production status.

When calculating return on investment for performance applications, the LS7 typically delivers more horsepower per dollar invested in both initial purchase and subsequent modifications. However, the Coyote platform may offer superior value for enthusiasts prioritizing modern technology integration and factory warranty considerations.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!