Innovative Borosilicate Glass Formulations in Industry

JUL 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Borosilicate Glass Evolution and Objectives

Borosilicate glass has a rich history dating back to its invention by Otto Schott in the late 19th century. This innovative material, characterized by its low thermal expansion coefficient and high chemical resistance, has since become a cornerstone in various industries. The evolution of borosilicate glass formulations has been driven by the ever-increasing demands for improved performance in diverse applications, from laboratory glassware to high-tech optics.

The development of borosilicate glass has seen several key milestones. Initially, it revolutionized the scientific community by enabling the production of durable laboratory equipment. As its potential became apparent, the material found its way into industrial applications, particularly in the chemical and pharmaceutical sectors. The mid-20th century saw a surge in borosilicate glass use in consumer products, most notably in kitchenware.

Recent decades have witnessed a shift towards more specialized formulations, tailored to meet the exacting requirements of emerging technologies. The semiconductor industry, for instance, has driven the development of ultra-high purity borosilicate glasses for photomask substrates. Similarly, the optical industry has spurred innovations in precision-molded borosilicate lenses for high-performance imaging systems.

The current technological landscape presents both challenges and opportunities for borosilicate glass innovation. The push for sustainability in manufacturing processes has led to research into more energy-efficient production methods and recycling techniques for borosilicate glass. Additionally, the growing demand for advanced materials in cutting-edge fields such as aerospace, renewable energy, and biomedical engineering is opening new avenues for borosilicate glass applications.

Looking ahead, the objectives for borosilicate glass research are multifaceted. One primary goal is to develop formulations with enhanced thermal and mechanical properties, pushing the boundaries of what is currently achievable. This includes creating glasses with even lower coefficients of thermal expansion, higher strength-to-weight ratios, and improved resistance to extreme environments.

Another key objective is to explore novel compositions that incorporate additional functional properties. This may involve integrating rare earth elements or nanoparticles to impart unique optical, electrical, or magnetic characteristics to the glass. Such innovations could lead to breakthrough applications in fields like photonics, energy storage, and smart materials.

Lastly, there is a growing emphasis on developing more sustainable and cost-effective production processes for borosilicate glass. This includes researching alternative raw materials, optimizing melting and forming techniques, and investigating new approaches to recycling and reprocessing borosilicate glass products. By addressing these objectives, the industry aims to ensure that borosilicate glass remains at the forefront of material science, continuing to enable technological advancements across various sectors.

The development of borosilicate glass has seen several key milestones. Initially, it revolutionized the scientific community by enabling the production of durable laboratory equipment. As its potential became apparent, the material found its way into industrial applications, particularly in the chemical and pharmaceutical sectors. The mid-20th century saw a surge in borosilicate glass use in consumer products, most notably in kitchenware.

Recent decades have witnessed a shift towards more specialized formulations, tailored to meet the exacting requirements of emerging technologies. The semiconductor industry, for instance, has driven the development of ultra-high purity borosilicate glasses for photomask substrates. Similarly, the optical industry has spurred innovations in precision-molded borosilicate lenses for high-performance imaging systems.

The current technological landscape presents both challenges and opportunities for borosilicate glass innovation. The push for sustainability in manufacturing processes has led to research into more energy-efficient production methods and recycling techniques for borosilicate glass. Additionally, the growing demand for advanced materials in cutting-edge fields such as aerospace, renewable energy, and biomedical engineering is opening new avenues for borosilicate glass applications.

Looking ahead, the objectives for borosilicate glass research are multifaceted. One primary goal is to develop formulations with enhanced thermal and mechanical properties, pushing the boundaries of what is currently achievable. This includes creating glasses with even lower coefficients of thermal expansion, higher strength-to-weight ratios, and improved resistance to extreme environments.

Another key objective is to explore novel compositions that incorporate additional functional properties. This may involve integrating rare earth elements or nanoparticles to impart unique optical, electrical, or magnetic characteristics to the glass. Such innovations could lead to breakthrough applications in fields like photonics, energy storage, and smart materials.

Lastly, there is a growing emphasis on developing more sustainable and cost-effective production processes for borosilicate glass. This includes researching alternative raw materials, optimizing melting and forming techniques, and investigating new approaches to recycling and reprocessing borosilicate glass products. By addressing these objectives, the industry aims to ensure that borosilicate glass remains at the forefront of material science, continuing to enable technological advancements across various sectors.

Market Demand Analysis for Advanced Borosilicate Glass

The market demand for advanced borosilicate glass has been steadily increasing across various industries due to its unique properties and versatile applications. This specialized glass formulation offers exceptional thermal resistance, chemical durability, and optical clarity, making it indispensable in numerous high-tech and industrial sectors.

In the laboratory and scientific equipment market, there is a growing need for borosilicate glass products. Research institutions, pharmaceutical companies, and academic laboratories require high-quality glassware that can withstand extreme temperatures and resist chemical corrosion. The global laboratory glassware market, largely dominated by borosilicate glass, is projected to experience significant growth in the coming years.

The electronics industry presents another substantial market for advanced borosilicate glass. With the rapid expansion of smart devices, touchscreens, and display technologies, there is an increasing demand for thin, durable, and optically clear glass substrates. Borosilicate glass meets these requirements, offering excellent thermal stability and scratch resistance for electronic displays and protective covers.

In the solar energy sector, borosilicate glass is gaining traction as a key material for solar thermal collectors and concentrated solar power systems. Its low thermal expansion coefficient and high transmittance of solar radiation make it an ideal choice for these applications. As renewable energy initiatives continue to grow worldwide, the demand for specialized borosilicate glass in this sector is expected to rise significantly.

The automotive industry is another emerging market for advanced borosilicate glass. With the trend towards electric and autonomous vehicles, there is an increasing need for lightweight, durable, and heat-resistant materials. Borosilicate glass is being explored for use in battery enclosures, sensor housings, and advanced lighting systems, offering potential weight reduction and improved safety features.

In the medical and pharmaceutical industries, borosilicate glass remains the material of choice for packaging and delivery systems. Its chemical inertness and ability to withstand sterilization processes make it crucial for storing and transporting sensitive medications and vaccines. The ongoing global health challenges have further emphasized the importance of reliable pharmaceutical packaging, driving demand for high-quality borosilicate glass products.

The food and beverage industry also contributes to the growing market for borosilicate glass. Consumer preferences for sustainable and reusable packaging solutions have led to increased adoption of borosilicate glass containers for food storage and beverage packaging. Its resistance to thermal shock and ability to preserve flavors make it an attractive option for both manufacturers and consumers.

As industries continue to innovate and seek advanced materials, the market demand for borosilicate glass is expected to expand further. The development of new formulations and manufacturing techniques to enhance its properties and reduce production costs will be crucial in meeting this growing demand across diverse sectors.

In the laboratory and scientific equipment market, there is a growing need for borosilicate glass products. Research institutions, pharmaceutical companies, and academic laboratories require high-quality glassware that can withstand extreme temperatures and resist chemical corrosion. The global laboratory glassware market, largely dominated by borosilicate glass, is projected to experience significant growth in the coming years.

The electronics industry presents another substantial market for advanced borosilicate glass. With the rapid expansion of smart devices, touchscreens, and display technologies, there is an increasing demand for thin, durable, and optically clear glass substrates. Borosilicate glass meets these requirements, offering excellent thermal stability and scratch resistance for electronic displays and protective covers.

In the solar energy sector, borosilicate glass is gaining traction as a key material for solar thermal collectors and concentrated solar power systems. Its low thermal expansion coefficient and high transmittance of solar radiation make it an ideal choice for these applications. As renewable energy initiatives continue to grow worldwide, the demand for specialized borosilicate glass in this sector is expected to rise significantly.

The automotive industry is another emerging market for advanced borosilicate glass. With the trend towards electric and autonomous vehicles, there is an increasing need for lightweight, durable, and heat-resistant materials. Borosilicate glass is being explored for use in battery enclosures, sensor housings, and advanced lighting systems, offering potential weight reduction and improved safety features.

In the medical and pharmaceutical industries, borosilicate glass remains the material of choice for packaging and delivery systems. Its chemical inertness and ability to withstand sterilization processes make it crucial for storing and transporting sensitive medications and vaccines. The ongoing global health challenges have further emphasized the importance of reliable pharmaceutical packaging, driving demand for high-quality borosilicate glass products.

The food and beverage industry also contributes to the growing market for borosilicate glass. Consumer preferences for sustainable and reusable packaging solutions have led to increased adoption of borosilicate glass containers for food storage and beverage packaging. Its resistance to thermal shock and ability to preserve flavors make it an attractive option for both manufacturers and consumers.

As industries continue to innovate and seek advanced materials, the market demand for borosilicate glass is expected to expand further. The development of new formulations and manufacturing techniques to enhance its properties and reduce production costs will be crucial in meeting this growing demand across diverse sectors.

Current Challenges in Borosilicate Glass Formulations

Borosilicate glass formulations face several significant challenges in the current industrial landscape. One of the primary issues is the need for improved thermal shock resistance. While borosilicate glass is known for its low thermal expansion coefficient, there is a growing demand for even better performance in high-temperature applications, particularly in industries such as aerospace and advanced manufacturing.

Another challenge lies in enhancing the chemical durability of borosilicate glass. Although it already possesses superior resistance to chemical attacks compared to soda-lime glass, certain aggressive environments still pose threats to its longevity. Researchers are striving to develop formulations that can withstand exposure to strong acids, bases, and corrosive substances for extended periods without compromising the glass's structural integrity or optical properties.

The optical clarity and transmission properties of borosilicate glass also present ongoing challenges. While it offers good transparency, there is a constant push for formulations that can provide even higher light transmission across a broader spectrum, especially in the ultraviolet and infrared ranges. This is particularly crucial for applications in optics, photonics, and solar energy technologies.

Mechanical strength is another area where improvements are sought. Despite its relatively good strength-to-weight ratio, there is a need for borosilicate glass formulations that offer enhanced impact resistance and flexural strength without sacrificing other desirable properties. This is especially important in applications where the glass is subjected to mechanical stress or potential impacts.

The manufacturing process of borosilicate glass also presents challenges. The high melting temperature required for its production leads to increased energy consumption and production costs. Researchers are exploring ways to optimize the melting and forming processes to reduce energy requirements and improve production efficiency while maintaining the glass's quality and performance characteristics.

Lastly, there is a growing emphasis on sustainability and environmental considerations in glass production. The challenge lies in developing borosilicate glass formulations that incorporate recycled materials or alternative raw materials with lower environmental impact, without compromising the glass's essential properties. This includes efforts to reduce the use of potentially harmful elements and explore more eco-friendly production methods.

Another challenge lies in enhancing the chemical durability of borosilicate glass. Although it already possesses superior resistance to chemical attacks compared to soda-lime glass, certain aggressive environments still pose threats to its longevity. Researchers are striving to develop formulations that can withstand exposure to strong acids, bases, and corrosive substances for extended periods without compromising the glass's structural integrity or optical properties.

The optical clarity and transmission properties of borosilicate glass also present ongoing challenges. While it offers good transparency, there is a constant push for formulations that can provide even higher light transmission across a broader spectrum, especially in the ultraviolet and infrared ranges. This is particularly crucial for applications in optics, photonics, and solar energy technologies.

Mechanical strength is another area where improvements are sought. Despite its relatively good strength-to-weight ratio, there is a need for borosilicate glass formulations that offer enhanced impact resistance and flexural strength without sacrificing other desirable properties. This is especially important in applications where the glass is subjected to mechanical stress or potential impacts.

The manufacturing process of borosilicate glass also presents challenges. The high melting temperature required for its production leads to increased energy consumption and production costs. Researchers are exploring ways to optimize the melting and forming processes to reduce energy requirements and improve production efficiency while maintaining the glass's quality and performance characteristics.

Lastly, there is a growing emphasis on sustainability and environmental considerations in glass production. The challenge lies in developing borosilicate glass formulations that incorporate recycled materials or alternative raw materials with lower environmental impact, without compromising the glass's essential properties. This includes efforts to reduce the use of potentially harmful elements and explore more eco-friendly production methods.

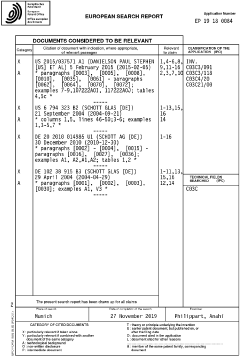

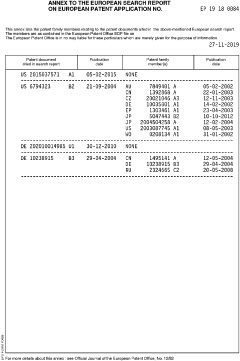

Existing Borosilicate Glass Formulation Techniques

01 Composition of borosilicate glass

Borosilicate glass formulations typically consist of silica, boron oxide, and other oxides such as sodium oxide and aluminum oxide. The specific proportions of these components can be adjusted to achieve desired properties such as thermal resistance, chemical durability, and optical clarity.- Composition of borosilicate glass: Borosilicate glass formulations typically consist of silica, boron oxide, and other oxides such as sodium oxide and aluminum oxide. The specific proportions of these components can be adjusted to achieve desired properties such as thermal resistance, chemical durability, and optical clarity.

- Alkali-free borosilicate glass: Alkali-free borosilicate glass formulations are developed for applications requiring high electrical insulation and chemical resistance. These compositions often include higher percentages of alumina and may incorporate other oxides like calcium oxide or magnesium oxide to maintain desired properties without alkali content.

- Low expansion borosilicate glass: Formulations for low expansion borosilicate glass focus on achieving a low coefficient of thermal expansion. This is typically accomplished by increasing the silica and boron oxide content while carefully balancing other components to maintain workability and other essential properties.

- Borosilicate glass for pharmaceutical packaging: Specialized borosilicate glass formulations for pharmaceutical packaging emphasize chemical inertness and hydrolytic resistance. These compositions may include additional components to enhance durability and minimize ion leaching, ensuring the integrity of stored medications.

- High-strength borosilicate glass: Formulations for high-strength borosilicate glass focus on improving mechanical properties through composition adjustments and surface treatments. These may include the incorporation of strengthening agents or the development of engineered stress profiles to enhance impact and scratch resistance.

02 Alkali-free borosilicate glass

Alkali-free borosilicate glass formulations are developed for applications requiring high electrical insulation and chemical resistance. These compositions often include higher percentages of alumina and may incorporate other oxides like calcium oxide or magnesium oxide to maintain desired properties without alkali content.Expand Specific Solutions03 Low expansion borosilicate glass

Formulations for low expansion borosilicate glass focus on achieving a low coefficient of thermal expansion. This is typically accomplished by increasing the silica and boron oxide content while carefully balancing other components to maintain workability and other essential properties.Expand Specific Solutions04 Borosilicate glass for pharmaceutical packaging

Specialized borosilicate glass formulations for pharmaceutical packaging emphasize chemical durability and resistance to delamination. These compositions may include specific ratios of alkali and alkaline earth oxides, as well as carefully controlled amounts of other elements to enhance stability and reduce ion exchange with drug products.Expand Specific Solutions05 High-strength borosilicate glass

Formulations for high-strength borosilicate glass often incorporate additional components or treatments to enhance mechanical properties. This may include the addition of zirconia or titania, or the use of ion-exchange processes to create compressive stress layers on the glass surface, resulting in improved impact and scratch resistance.Expand Specific Solutions

Key Players in Borosilicate Glass Industry

The research on innovative borosilicate glass formulations in industry is currently in a mature development stage, with a growing market driven by increasing demand across various sectors. The global borosilicate glass market size was valued at USD 1.55 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2021 to 2028. Key players like SCHOTT AG, Corning, Inc., and Nippon Electric Glass Co., Ltd. are at the forefront of technological advancements, focusing on improving thermal and chemical resistance properties. These companies, along with emerging players such as Hunan Kibing Pharmaceutical Material Technology Co., Ltd., are investing heavily in R&D to develop innovative formulations tailored for specific applications in pharmaceuticals, laboratory equipment, and high-tech industries.

SCHOTT AG

Technical Solution: SCHOTT AG has developed innovative borosilicate glass formulations with enhanced chemical durability and thermal shock resistance. Their DURAN® borosilicate glass 3.3 exhibits superior resistance to acids, alkalis, and organic substances[1]. SCHOTT has also introduced NEXTREMA®, a high-performance glass-ceramic that combines the properties of glass and ceramics, offering exceptional temperature resistance up to 950°C[2]. In the pharmaceutical sector, SCHOTT's Type I plus® glass vials feature an inner surface treatment that reduces interaction between the glass and drug formulations, enhancing drug stability and shelf life[3]. The company has also developed specialized borosilicate glass tubing for pharmaceutical packaging, which demonstrates improved strength and reduced delamination risk[4].

Strengths: Wide range of specialized formulations for various industries, strong focus on pharmaceutical and technical applications. Weaknesses: Higher production costs compared to standard glass formulations, potential limitations in large-scale manufacturing of highly specialized products.

Corning, Inc.

Technical Solution: Corning has made significant advancements in borosilicate glass formulations, particularly in the development of Valor® Glass for pharmaceutical packaging. This aluminosilicate glass is engineered to be chemically durable, reducing particulate contamination and breakage[5]. Corning's innovative ion-exchange process strengthens the glass surface, making it up to 50 times stronger than conventional borosilicate glass[6]. For laboratory applications, Corning has developed PYREX® Plus, an enhanced borosilicate glass with improved thermal shock resistance and mechanical strength[7]. In the field of optical communications, Corning's borosilicate-based specialty glass fibers offer high-performance solutions for data transmission and sensing applications[8].

Strengths: Strong focus on pharmaceutical packaging innovations, diverse applications across multiple industries. Weaknesses: High research and development costs, potential challenges in scaling up production for highly specialized glass formulations.

Innovative Approaches in Borosilicate Glass Composition

Aluminum-free borosilicate glass and applications thereof

PatentInactiveUS20040113237A1

Innovation

- Development of an aluminum-free borosilicate glass with a composition ranging from 60-78% SiO2, 7-20% B2O3, and varying amounts of Li2O, Na2O, K2O, MgO, CaO, BaO, ZnO, ZrO2, TiO2, and CeO2, which reduces thermal expansion, melting point, and improves chemical resistance while avoiding aluminum oxide.

Borosilicate glass article with low boron content

PatentActiveEP3584228A3

Innovation

- Development of a chemically temperable borosilicate glass with low boron content and optimized Na2O content, resulting in improved diffusivity and hydrolytical resistance.

- Achievement of high compressive stress (CS > 400 MPa) and deep penetration depth (DoL > 20 µm) through chemical tempering, surpassing the performance of comparable state-of-the-art borosilicate glasses.

- Tailored glass composition specifically designed for pharmaceutical primary packaging applications, balancing mechanical resistance, sterilizability, and low permeability.

Environmental Impact of Borosilicate Glass Production

The production of borosilicate glass, while offering numerous advantages in terms of durability and chemical resistance, also carries significant environmental implications. The manufacturing process involves high-temperature melting of raw materials, which consumes substantial amounts of energy and contributes to greenhouse gas emissions. Typically, natural gas or electric furnaces are used, with temperatures reaching up to 1,600°C. This energy-intensive process results in considerable CO2 emissions, contributing to the industry's carbon footprint.

Furthermore, the extraction and processing of raw materials for borosilicate glass production, such as silica sand, boric oxide, and other additives, can lead to habitat disruption and soil erosion. Mining activities associated with these materials may also result in water pollution and increased dust emissions in surrounding areas. The transportation of raw materials and finished products adds to the overall environmental impact through vehicle emissions and fuel consumption.

Water usage is another environmental concern in borosilicate glass production. Significant quantities of water are required for cooling processes and cleaning equipment. While many facilities implement water recycling systems, there is still a net consumption that can strain local water resources, particularly in water-scarce regions.

The production process also generates air pollutants, including particulate matter, nitrogen oxides, and sulfur dioxide. These emissions can contribute to local air quality issues and potentially impact human health in surrounding communities. Advanced filtration systems and scrubbers are often employed to mitigate these emissions, but they do not eliminate them entirely.

Waste management is a critical aspect of the environmental impact of borosilicate glass production. While glass itself is recyclable, the specialized composition of borosilicate glass can complicate recycling efforts. Cullet (broken glass) from production can often be reused in the manufacturing process, reducing waste and energy consumption. However, end-of-life disposal of borosilicate glass products remains a challenge, as they are not typically accepted in standard glass recycling streams due to their different melting properties.

Innovative approaches to borosilicate glass formulations are being explored to address these environmental concerns. Research is focusing on developing lower-melting temperature compositions, which could significantly reduce energy consumption and associated emissions. Additionally, efforts are being made to incorporate more recycled content and alternative raw materials to decrease the reliance on virgin resources and minimize the environmental impact of extraction processes.

Furthermore, the extraction and processing of raw materials for borosilicate glass production, such as silica sand, boric oxide, and other additives, can lead to habitat disruption and soil erosion. Mining activities associated with these materials may also result in water pollution and increased dust emissions in surrounding areas. The transportation of raw materials and finished products adds to the overall environmental impact through vehicle emissions and fuel consumption.

Water usage is another environmental concern in borosilicate glass production. Significant quantities of water are required for cooling processes and cleaning equipment. While many facilities implement water recycling systems, there is still a net consumption that can strain local water resources, particularly in water-scarce regions.

The production process also generates air pollutants, including particulate matter, nitrogen oxides, and sulfur dioxide. These emissions can contribute to local air quality issues and potentially impact human health in surrounding communities. Advanced filtration systems and scrubbers are often employed to mitigate these emissions, but they do not eliminate them entirely.

Waste management is a critical aspect of the environmental impact of borosilicate glass production. While glass itself is recyclable, the specialized composition of borosilicate glass can complicate recycling efforts. Cullet (broken glass) from production can often be reused in the manufacturing process, reducing waste and energy consumption. However, end-of-life disposal of borosilicate glass products remains a challenge, as they are not typically accepted in standard glass recycling streams due to their different melting properties.

Innovative approaches to borosilicate glass formulations are being explored to address these environmental concerns. Research is focusing on developing lower-melting temperature compositions, which could significantly reduce energy consumption and associated emissions. Additionally, efforts are being made to incorporate more recycled content and alternative raw materials to decrease the reliance on virgin resources and minimize the environmental impact of extraction processes.

Regulatory Framework for Glass Manufacturing

The regulatory framework for glass manufacturing, particularly in the context of innovative borosilicate glass formulations, is a complex and evolving landscape. Governments and international organizations have established various regulations and standards to ensure the safety, quality, and environmental sustainability of glass production processes and products.

At the forefront of these regulations are environmental protection measures. Glass manufacturing, especially borosilicate glass production, often involves high-temperature processes that can release pollutants into the atmosphere. Regulatory bodies have implemented strict emission control standards, requiring manufacturers to adopt advanced filtration systems and monitoring technologies to minimize air pollution.

Energy efficiency is another key focus area in the regulatory framework. Given the energy-intensive nature of glass production, many jurisdictions have introduced energy consumption limits and incentives for adopting energy-efficient technologies. This has led to innovations in furnace design and heat recovery systems, particularly relevant for borosilicate glass manufacturing due to its higher melting point.

Worker safety regulations play a crucial role in shaping the industry's practices. The handling of raw materials, exposure to high temperatures, and potential chemical hazards associated with borosilicate glass production are subject to stringent occupational health and safety standards. These regulations mandate the use of personal protective equipment, implementation of safety protocols, and regular health monitoring for workers.

Product safety and quality standards form a significant part of the regulatory landscape. For borosilicate glass, which is often used in laboratory equipment, pharmaceutical packaging, and cookware, there are specific requirements regarding chemical resistance, thermal shock resistance, and overall durability. Regulatory bodies such as the FDA in the United States and the European Medicines Agency have established guidelines for glass used in pharmaceutical packaging, influencing the development of new borosilicate formulations.

Waste management and recycling regulations have become increasingly important in recent years. The glass industry, including the borosilicate sector, is encouraged to adopt circular economy principles. Regulations often mandate recycling targets and promote the use of cullet (recycled glass) in production processes, although this can be challenging for specialized glasses like borosilicate.

International trade regulations also impact the borosilicate glass industry. Tariffs, import/export restrictions, and quality certification requirements can influence the global market for innovative glass formulations. Compliance with these regulations is essential for manufacturers looking to expand their market reach.

As research into innovative borosilicate glass formulations progresses, regulatory frameworks are likely to evolve. Emerging technologies and novel applications may necessitate the development of new standards and regulations. Industry stakeholders must stay informed about these changes and actively participate in shaping future regulatory landscapes to ensure both innovation and compliance.

At the forefront of these regulations are environmental protection measures. Glass manufacturing, especially borosilicate glass production, often involves high-temperature processes that can release pollutants into the atmosphere. Regulatory bodies have implemented strict emission control standards, requiring manufacturers to adopt advanced filtration systems and monitoring technologies to minimize air pollution.

Energy efficiency is another key focus area in the regulatory framework. Given the energy-intensive nature of glass production, many jurisdictions have introduced energy consumption limits and incentives for adopting energy-efficient technologies. This has led to innovations in furnace design and heat recovery systems, particularly relevant for borosilicate glass manufacturing due to its higher melting point.

Worker safety regulations play a crucial role in shaping the industry's practices. The handling of raw materials, exposure to high temperatures, and potential chemical hazards associated with borosilicate glass production are subject to stringent occupational health and safety standards. These regulations mandate the use of personal protective equipment, implementation of safety protocols, and regular health monitoring for workers.

Product safety and quality standards form a significant part of the regulatory landscape. For borosilicate glass, which is often used in laboratory equipment, pharmaceutical packaging, and cookware, there are specific requirements regarding chemical resistance, thermal shock resistance, and overall durability. Regulatory bodies such as the FDA in the United States and the European Medicines Agency have established guidelines for glass used in pharmaceutical packaging, influencing the development of new borosilicate formulations.

Waste management and recycling regulations have become increasingly important in recent years. The glass industry, including the borosilicate sector, is encouraged to adopt circular economy principles. Regulations often mandate recycling targets and promote the use of cullet (recycled glass) in production processes, although this can be challenging for specialized glasses like borosilicate.

International trade regulations also impact the borosilicate glass industry. Tariffs, import/export restrictions, and quality certification requirements can influence the global market for innovative glass formulations. Compliance with these regulations is essential for manufacturers looking to expand their market reach.

As research into innovative borosilicate glass formulations progresses, regulatory frameworks are likely to evolve. Emerging technologies and novel applications may necessitate the development of new standards and regulations. Industry stakeholders must stay informed about these changes and actively participate in shaping future regulatory landscapes to ensure both innovation and compliance.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!