Adoption Patterns of Vehicle-to-Grid Globally

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

V2G Technology Background and Objectives

Vehicle-to-Grid (V2G) technology represents a transformative approach to energy management that has evolved significantly over the past decade. The concept emerged in the late 1990s but gained substantial momentum after 2010 as electric vehicle (EV) adoption increased globally. V2G technology enables bidirectional power flow between electric vehicles and the electricity grid, allowing EVs to not only consume energy but also discharge stored energy back to the grid when needed.

The evolution of V2G technology has been closely tied to advancements in battery technology, power electronics, and smart grid infrastructure. Early implementations focused primarily on unidirectional vehicle-to-grid communication, while modern systems enable fully bidirectional energy exchange with sophisticated control mechanisms that optimize for grid stability, renewable energy integration, and economic benefits.

Current technological trends indicate a move toward more standardized V2G protocols, improved efficiency in bidirectional inverters, and enhanced battery management systems that minimize degradation during V2G operations. The integration of artificial intelligence and machine learning algorithms is increasingly enabling predictive capabilities for optimal charging and discharging cycles based on grid demands, electricity prices, and user behavior patterns.

The primary technical objectives of V2G technology deployment include grid stabilization through frequency regulation and peak shaving, increased renewable energy integration by providing storage capacity for intermittent sources, reduced infrastructure costs by utilizing existing EV batteries as distributed energy resources, and creation of new revenue streams for EV owners through participation in energy markets.

Global adoption patterns reveal significant regional variations in V2G implementation, with pioneering projects in Denmark, the Netherlands, and Japan demonstrating technical feasibility and economic viability. North America has focused on utility-led pilot programs, while the European Union has developed more comprehensive regulatory frameworks to support V2G integration.

The technology aims to address critical challenges in modern energy systems, including grid resilience during peak demand periods, integration of variable renewable energy sources, and reduction of carbon emissions from the transportation and energy sectors. As electric vehicle fleets continue to grow worldwide, V2G technology represents a crucial bridge between transportation electrification and power system transformation.

Looking forward, V2G technology is expected to evolve toward more seamless integration with smart city infrastructure, enhanced cybersecurity protocols, and improved user interfaces that simplify participation for vehicle owners while maximizing system-wide benefits.

The evolution of V2G technology has been closely tied to advancements in battery technology, power electronics, and smart grid infrastructure. Early implementations focused primarily on unidirectional vehicle-to-grid communication, while modern systems enable fully bidirectional energy exchange with sophisticated control mechanisms that optimize for grid stability, renewable energy integration, and economic benefits.

Current technological trends indicate a move toward more standardized V2G protocols, improved efficiency in bidirectional inverters, and enhanced battery management systems that minimize degradation during V2G operations. The integration of artificial intelligence and machine learning algorithms is increasingly enabling predictive capabilities for optimal charging and discharging cycles based on grid demands, electricity prices, and user behavior patterns.

The primary technical objectives of V2G technology deployment include grid stabilization through frequency regulation and peak shaving, increased renewable energy integration by providing storage capacity for intermittent sources, reduced infrastructure costs by utilizing existing EV batteries as distributed energy resources, and creation of new revenue streams for EV owners through participation in energy markets.

Global adoption patterns reveal significant regional variations in V2G implementation, with pioneering projects in Denmark, the Netherlands, and Japan demonstrating technical feasibility and economic viability. North America has focused on utility-led pilot programs, while the European Union has developed more comprehensive regulatory frameworks to support V2G integration.

The technology aims to address critical challenges in modern energy systems, including grid resilience during peak demand periods, integration of variable renewable energy sources, and reduction of carbon emissions from the transportation and energy sectors. As electric vehicle fleets continue to grow worldwide, V2G technology represents a crucial bridge between transportation electrification and power system transformation.

Looking forward, V2G technology is expected to evolve toward more seamless integration with smart city infrastructure, enhanced cybersecurity protocols, and improved user interfaces that simplify participation for vehicle owners while maximizing system-wide benefits.

Global Market Demand for V2G Solutions

The global market for Vehicle-to-Grid (V2G) solutions is experiencing significant growth driven by the convergence of renewable energy integration, grid modernization initiatives, and the rapid expansion of electric vehicle (EV) adoption worldwide. Current market assessments indicate that the global V2G market is valued at approximately $1.5 billion in 2023, with projections suggesting a compound annual growth rate of 30% through 2030.

Regional analysis reveals distinct adoption patterns across major markets. Europe leads in V2G implementation, particularly in countries like Denmark, the Netherlands, and the UK, where regulatory frameworks actively encourage bidirectional charging technologies. The European market demand is primarily driven by grid stability concerns and ambitious renewable energy targets, with utility companies increasingly viewing EVs as distributed energy resources.

North America represents the second-largest market for V2G solutions, with demand concentrated in California, New York, and select Canadian provinces. Market growth in this region is fueled by utility-led pilot programs and emerging regulatory incentives that compensate EV owners for grid services. Commercial fleet operators have emerged as early adopters, recognizing the potential for additional revenue streams through participation in demand response programs.

The Asia-Pacific region demonstrates the highest growth potential, particularly in Japan, South Korea, and Australia. These markets are characterized by acute grid resilience challenges and high electricity costs, creating favorable conditions for V2G adoption. China, despite having the world's largest EV fleet, shows more limited V2G market development due to regulatory uncertainties and grid integration challenges.

Market segmentation analysis indicates that fleet applications currently dominate V2G demand, accounting for approximately 65% of implementations. This is attributed to the predictable charging patterns, centralized management, and economies of scale that fleet operations offer. The residential segment, while smaller, is expected to grow substantially as consumer awareness increases and hardware costs decline.

From a demand perspective, primary market drivers include peak shaving capabilities (reducing grid stress during high-demand periods), frequency regulation services, and renewable energy integration. Utilities and grid operators increasingly recognize V2G as a cost-effective alternative to traditional grid infrastructure investments, particularly in regions with aging power systems or high renewable penetration.

Market barriers limiting wider adoption include high initial hardware costs, complex regulatory environments, battery degradation concerns, and limited consumer awareness. The total cost of ownership calculations remain challenging for many potential adopters, though this is gradually improving as technology matures and scale economies emerge.

Regional analysis reveals distinct adoption patterns across major markets. Europe leads in V2G implementation, particularly in countries like Denmark, the Netherlands, and the UK, where regulatory frameworks actively encourage bidirectional charging technologies. The European market demand is primarily driven by grid stability concerns and ambitious renewable energy targets, with utility companies increasingly viewing EVs as distributed energy resources.

North America represents the second-largest market for V2G solutions, with demand concentrated in California, New York, and select Canadian provinces. Market growth in this region is fueled by utility-led pilot programs and emerging regulatory incentives that compensate EV owners for grid services. Commercial fleet operators have emerged as early adopters, recognizing the potential for additional revenue streams through participation in demand response programs.

The Asia-Pacific region demonstrates the highest growth potential, particularly in Japan, South Korea, and Australia. These markets are characterized by acute grid resilience challenges and high electricity costs, creating favorable conditions for V2G adoption. China, despite having the world's largest EV fleet, shows more limited V2G market development due to regulatory uncertainties and grid integration challenges.

Market segmentation analysis indicates that fleet applications currently dominate V2G demand, accounting for approximately 65% of implementations. This is attributed to the predictable charging patterns, centralized management, and economies of scale that fleet operations offer. The residential segment, while smaller, is expected to grow substantially as consumer awareness increases and hardware costs decline.

From a demand perspective, primary market drivers include peak shaving capabilities (reducing grid stress during high-demand periods), frequency regulation services, and renewable energy integration. Utilities and grid operators increasingly recognize V2G as a cost-effective alternative to traditional grid infrastructure investments, particularly in regions with aging power systems or high renewable penetration.

Market barriers limiting wider adoption include high initial hardware costs, complex regulatory environments, battery degradation concerns, and limited consumer awareness. The total cost of ownership calculations remain challenging for many potential adopters, though this is gradually improving as technology matures and scale economies emerge.

V2G Implementation Status and Barriers

Vehicle-to-Grid (V2G) implementation globally exhibits varying degrees of maturity, with significant disparities between regions. Currently, Denmark, the Netherlands, and the United Kingdom lead European V2G deployment with numerous pilot projects and commercial installations. In Asia, Japan stands out with Tokyo Electric Power Company's initiatives, while North America shows promising developments primarily in California and specific utility territories.

Despite growing interest, V2G technology faces substantial implementation barriers. Technical challenges remain prominent, including battery degradation concerns from bidirectional charging cycles. Studies indicate potential capacity loss of 2-5% annually with intensive V2G operations compared to standard EV usage, creating hesitation among vehicle manufacturers to offer comprehensive warranties for V2G-enabled vehicles.

Infrastructure limitations present another significant obstacle. The current charging infrastructure predominantly supports unidirectional power flow, requiring substantial upgrades to enable bidirectional capabilities. The estimated cost for V2G-compatible charging stations ranges from $5,000 to $15,000 per unit, approximately 2-3 times higher than conventional charging stations, creating economic barriers to widespread adoption.

Regulatory frameworks across most jurisdictions remain underdeveloped for V2G integration. Many electricity markets lack clear mechanisms for small-scale distributed energy resources to participate in grid services. Additionally, complex interconnection requirements and lengthy approval processes from utilities create administrative burdens that discourage adoption.

Market structure issues further complicate implementation. The value proposition of V2G remains challenging to quantify due to fragmented revenue streams across multiple stakeholders. Current business models struggle to distribute benefits equitably among vehicle owners, charging infrastructure operators, and utilities, resulting in limited economic incentives for individual participants.

Consumer awareness and acceptance represent another critical barrier. Surveys indicate that less than 30% of EV owners understand V2G technology, with significant concerns about vehicle availability, battery lifespan, and privacy. The complexity of participation requirements and unclear financial benefits further diminish consumer interest in V2G programs.

Standardization gaps across hardware interfaces, communication protocols, and grid integration requirements create interoperability challenges. The lack of unified standards increases implementation costs and creates market fragmentation, with competing proprietary systems limiting the potential for economies of scale in equipment manufacturing and software development.

Despite growing interest, V2G technology faces substantial implementation barriers. Technical challenges remain prominent, including battery degradation concerns from bidirectional charging cycles. Studies indicate potential capacity loss of 2-5% annually with intensive V2G operations compared to standard EV usage, creating hesitation among vehicle manufacturers to offer comprehensive warranties for V2G-enabled vehicles.

Infrastructure limitations present another significant obstacle. The current charging infrastructure predominantly supports unidirectional power flow, requiring substantial upgrades to enable bidirectional capabilities. The estimated cost for V2G-compatible charging stations ranges from $5,000 to $15,000 per unit, approximately 2-3 times higher than conventional charging stations, creating economic barriers to widespread adoption.

Regulatory frameworks across most jurisdictions remain underdeveloped for V2G integration. Many electricity markets lack clear mechanisms for small-scale distributed energy resources to participate in grid services. Additionally, complex interconnection requirements and lengthy approval processes from utilities create administrative burdens that discourage adoption.

Market structure issues further complicate implementation. The value proposition of V2G remains challenging to quantify due to fragmented revenue streams across multiple stakeholders. Current business models struggle to distribute benefits equitably among vehicle owners, charging infrastructure operators, and utilities, resulting in limited economic incentives for individual participants.

Consumer awareness and acceptance represent another critical barrier. Surveys indicate that less than 30% of EV owners understand V2G technology, with significant concerns about vehicle availability, battery lifespan, and privacy. The complexity of participation requirements and unclear financial benefits further diminish consumer interest in V2G programs.

Standardization gaps across hardware interfaces, communication protocols, and grid integration requirements create interoperability challenges. The lack of unified standards increases implementation costs and creates market fragmentation, with competing proprietary systems limiting the potential for economies of scale in equipment manufacturing and software development.

Current V2G Deployment Models

01 Consumer adoption patterns and incentives for V2G technology

Consumer adoption of Vehicle-to-Grid (V2G) technology is influenced by various incentives and behavioral patterns. Financial benefits, such as reduced electricity costs and grid service payments, are primary drivers for adoption. Consumer education about the environmental benefits and grid stability advantages of V2G technology also plays a crucial role in increasing adoption rates. Implementation of government incentives, rebates, and tax benefits can significantly accelerate the adoption of V2G technology among private vehicle owners.- Consumer adoption patterns and incentives for V2G technology: Consumer adoption of Vehicle-to-Grid (V2G) technology is influenced by various incentives and behavioral patterns. Financial benefits, such as reduced electricity costs and grid service payments, are primary drivers for adoption. Consumer education about the environmental benefits and grid stability advantages of V2G technology also plays a crucial role in increasing adoption rates. Implementation of reward systems and clear demonstration of return on investment can significantly accelerate consumer acceptance of this technology.

- Infrastructure development for V2G implementation: The successful adoption of V2G technology depends heavily on the development of supporting infrastructure. This includes charging stations with bidirectional capabilities, grid connection points, and communication systems that enable seamless interaction between vehicles and the power grid. Smart grid integration is essential for managing the complex power flows between vehicles and the grid. The development of standardized protocols and interfaces for V2G systems is also critical to ensure interoperability across different vehicle models and grid systems.

- Business models and market strategies for V2G technology: Various business models are emerging to support V2G technology adoption. These include aggregator models where third parties manage fleets of electric vehicles to provide grid services, utility-led programs that offer incentives to EV owners for grid participation, and peer-to-peer energy trading platforms. Subscription-based services and revenue-sharing arrangements between vehicle owners, charging infrastructure operators, and utilities are being developed to distribute the financial benefits of V2G technology. Market strategies focus on targeting early adopters and gradually expanding to mainstream consumers as the technology matures.

- Technological innovations enhancing V2G adoption: Technological advancements are accelerating the adoption of V2G systems. Improvements in battery technology are addressing concerns about battery degradation from bidirectional charging. Advanced power electronics and control systems are enhancing the efficiency and reliability of V2G operations. Smart charging algorithms that optimize charging and discharging cycles based on grid needs, electricity prices, and user preferences are making V2G more attractive to consumers. Mobile applications and user interfaces are simplifying the management of V2G participation for vehicle owners.

- Policy frameworks and regulatory considerations for V2G deployment: Government policies and regulations significantly influence V2G technology adoption. Supportive regulatory frameworks include electricity market rules that allow for vehicle participation in grid services, standardization of V2G protocols, and incentives such as tax credits or rebates for V2G-capable vehicles and equipment. Environmental regulations promoting renewable energy integration and carbon reduction also drive V2G adoption. Policies addressing data privacy, cybersecurity, and grid reliability concerns are essential for building trust in V2G systems among consumers and utilities.

02 Integration of V2G technology with smart grid infrastructure

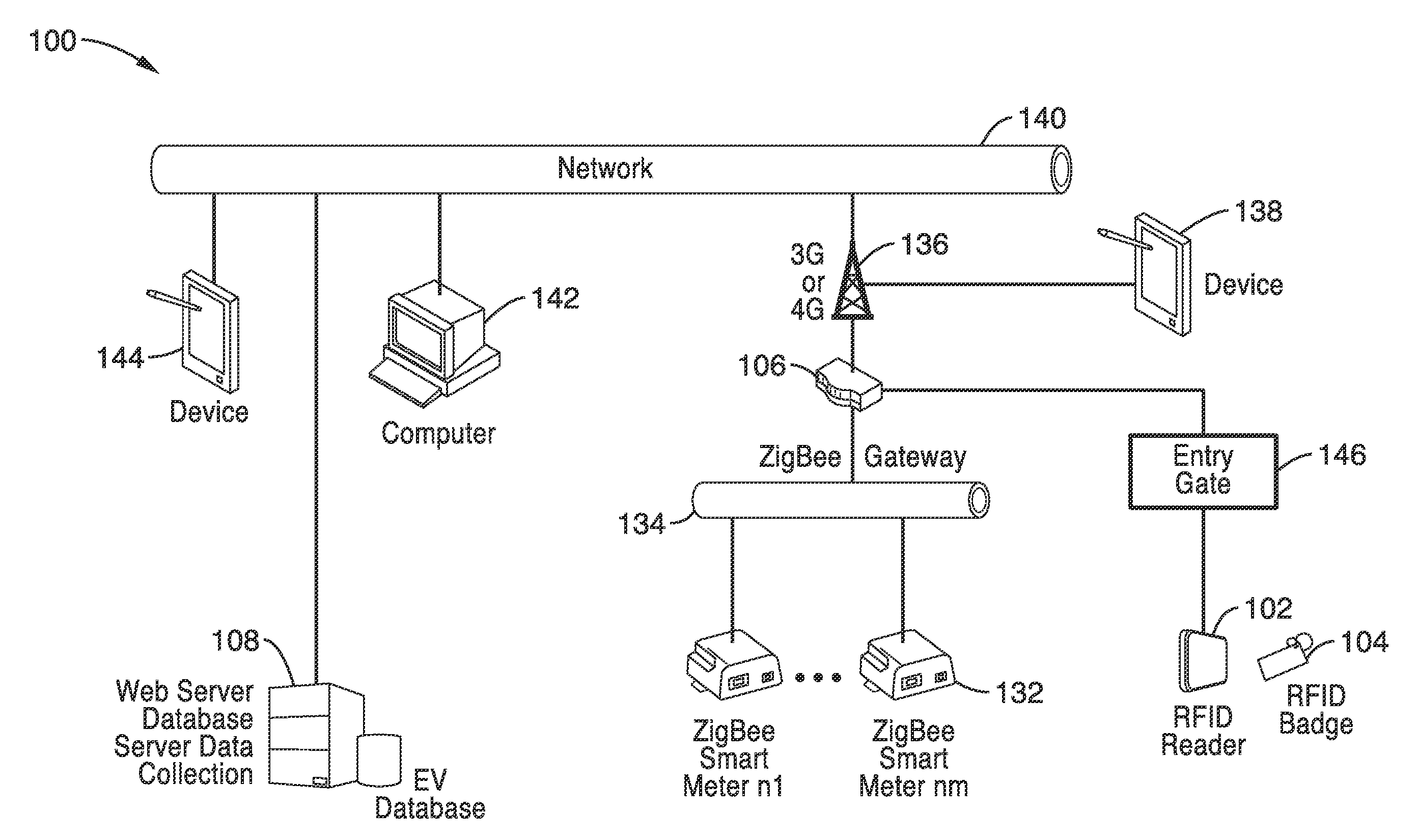

The successful adoption of V2G technology depends heavily on its integration with existing smart grid infrastructure. This includes the development of bidirectional charging stations, communication protocols between vehicles and grid operators, and grid management systems capable of handling distributed energy resources. Smart metering systems and IoT connectivity enable real-time monitoring and control of energy flow between electric vehicles and the power grid, optimizing the benefits of V2G technology and improving grid stability during peak demand periods.Expand Specific Solutions03 Commercial fleet implementation of V2G technology

Commercial fleets represent a significant opportunity for V2G technology adoption due to their predictable usage patterns and centralized management. Fleet operators can leverage V2G to reduce operational costs through energy arbitrage and providing grid services during vehicle downtime. Implementation strategies include scheduled charging during off-peak hours and discharging during peak demand periods. Fleet management systems can be optimized to balance vehicle availability requirements with grid service opportunities, maximizing the economic benefits of V2G technology.Expand Specific Solutions04 Technical challenges and solutions in V2G adoption

Several technical challenges affect the widespread adoption of V2G technology, including battery degradation concerns, standardization issues, and grid integration complexities. Solutions being developed include advanced battery management systems that minimize degradation during bidirectional power flow, universal communication protocols for seamless vehicle-grid interaction, and enhanced power electronics for efficient energy conversion. Addressing these technical barriers is crucial for increasing consumer confidence and accelerating the adoption of V2G technology across different markets.Expand Specific Solutions05 Regulatory frameworks and policy impacts on V2G adoption

Regulatory frameworks and energy policies significantly influence the adoption trajectory of V2G technology. Policies that enable compensation for grid services provided by electric vehicles, standardize interconnection requirements, and address electricity market participation barriers are critical for V2G market development. Regulatory innovations such as dynamic pricing mechanisms, aggregator business models, and streamlined permitting processes can accelerate V2G adoption. The development of supportive policy environments across different regions shows varying impacts on adoption rates and implementation strategies.Expand Specific Solutions

Key Industry Players in V2G Ecosystem

Vehicle-to-Grid (V2G) technology is currently in the early growth phase of its industry lifecycle, with global market size estimated at $1.5 billion in 2023 and projected to reach $17.4 billion by 2032. The competitive landscape features automotive giants (Toyota, Hyundai, Honda, Kia) leading implementation through EV fleets with bidirectional charging capabilities, while technology companies (Qualcomm, IBM, Huawei) focus on developing communication protocols and grid integration solutions. Energy storage specialists like CATL are advancing battery technologies to support V2G requirements. Regional adoption patterns vary significantly, with Europe leading in policy support, North America focusing on utility partnerships, and Asia showing rapid growth through government initiatives. Technical maturity remains moderate, with interoperability standards and battery degradation concerns representing key challenges for widespread adoption.

Toyota Motor Corp.

Technical Solution: Toyota has developed a comprehensive Vehicle-to-Grid (V2G) ecosystem centered around their CHAdeMO-compatible EVs. Their approach integrates bidirectional charging capabilities into vehicles like the Prius Prime and RAV4 Prime, allowing them to both draw power from and feed it back to the grid. Toyota's V2G technology implementation includes smart charging algorithms that optimize charging based on grid demand, electricity prices, and user preferences. The company has deployed significant V2G pilot programs across Japan, demonstrating up to 10kW power return capacity per vehicle. Toyota's V2G strategy also incorporates their home energy management systems (HEMS) that coordinate between vehicle batteries, home energy storage, and solar generation to maximize efficiency and grid support. Their Virtual Power Plant (VPP) initiatives aggregate multiple EVs to provide substantial grid services, with trials showing successful demand response capabilities during peak load periods.

Strengths: Extensive integration with existing energy management systems; proven technology with real-world deployments; strong compatibility with established CHAdeMO standard. Weaknesses: Limited global deployment outside Japan; current solutions primarily focused on hybrid rather than full EV models; requires specialized charging infrastructure.

Hyundai Motor Co., Ltd.

Technical Solution: Hyundai has pioneered V2G technology through its Integrated Charging Control Unit (ICCU) that enables bidirectional power flow between EVs and the grid. Their system, implemented in models like the IONIQ 5 and IONIQ 6, supports both V2G and Vehicle-to-Load (V2L) functionalities, allowing vehicles to serve as mobile power sources. Hyundai's V2G approach incorporates advanced power electronics that achieve over 90% efficiency in bidirectional energy transfer. The company has established partnerships with major utilities across Europe and North America to develop V2G ecosystems that provide grid services including frequency regulation and peak shaving. Their proprietary Energy Management System (EMS) optimizes charging/discharging cycles to minimize battery degradation while maximizing grid support value. Hyundai has also developed a smartphone application that allows users to set preferences for grid participation, including minimum battery levels and time-of-use priorities, giving consumers control over how their vehicle interacts with the grid.

Strengths: High-efficiency bidirectional charging technology; comprehensive user control systems; strong utility partnerships for implementation. Weaknesses: Limited deployment scale compared to market potential; concerns about battery warranty implications; requires specialized charging infrastructure not yet widely available.

Critical V2G Standards and Protocols

Vehicle-to-grid system with power loss compensation

PatentInactiveUS9630511B2

Innovation

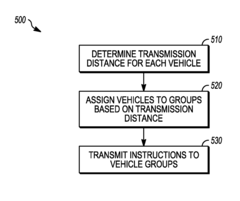

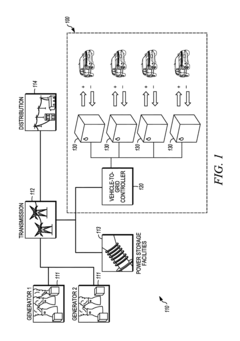

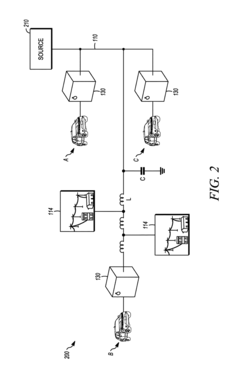

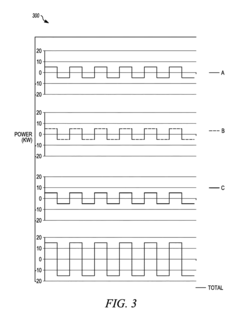

- A vehicle-to-grid system with a controller that assigns vehicles to different groups based on transmission distance, instructing the first group to supply power at a nominal frequency and adjusted amplitude, and the second group to supply power at an adjusted frequency different from the nominal frequency and nominal amplitude, thereby optimizing power delivery and reducing losses.

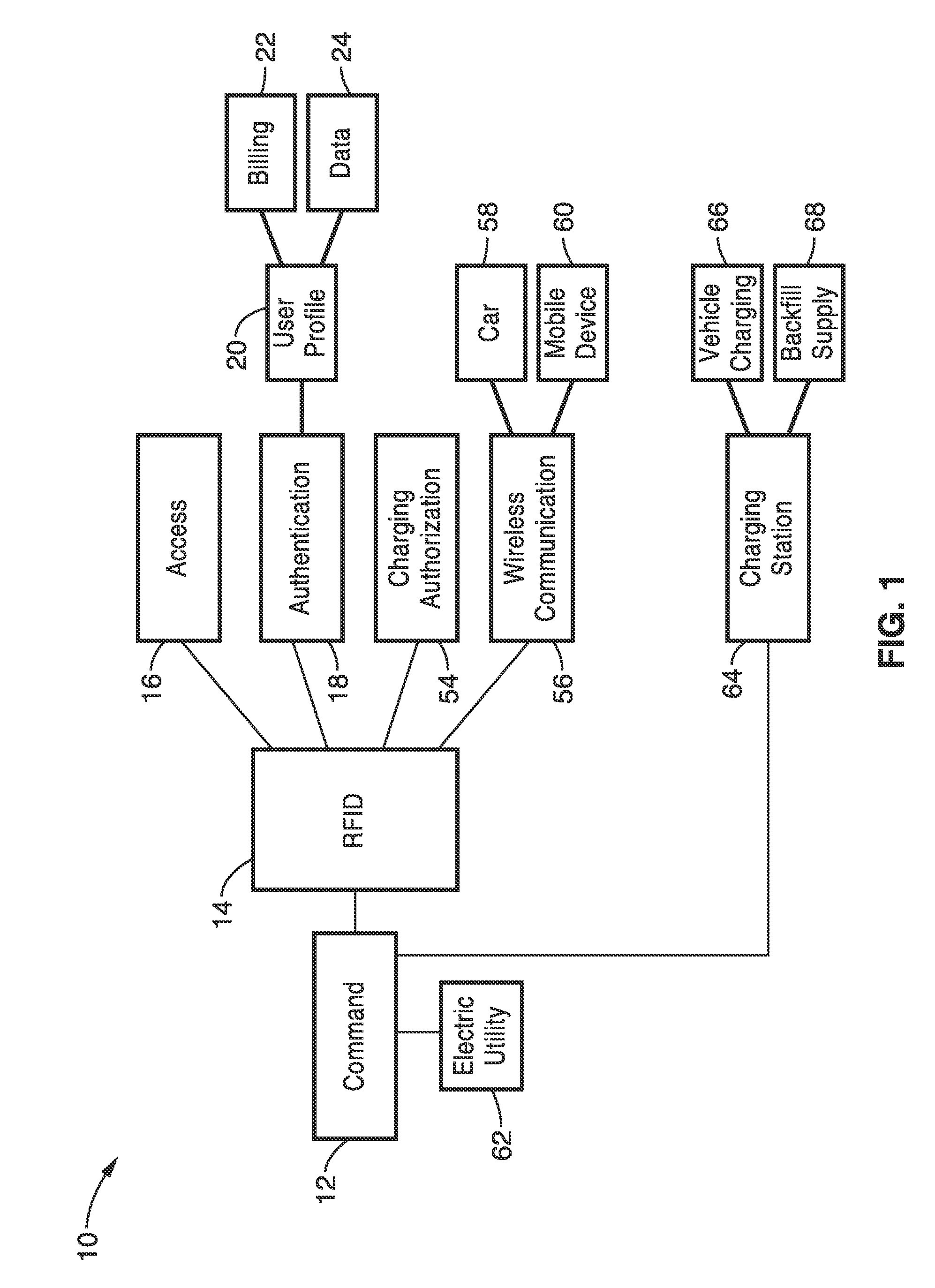

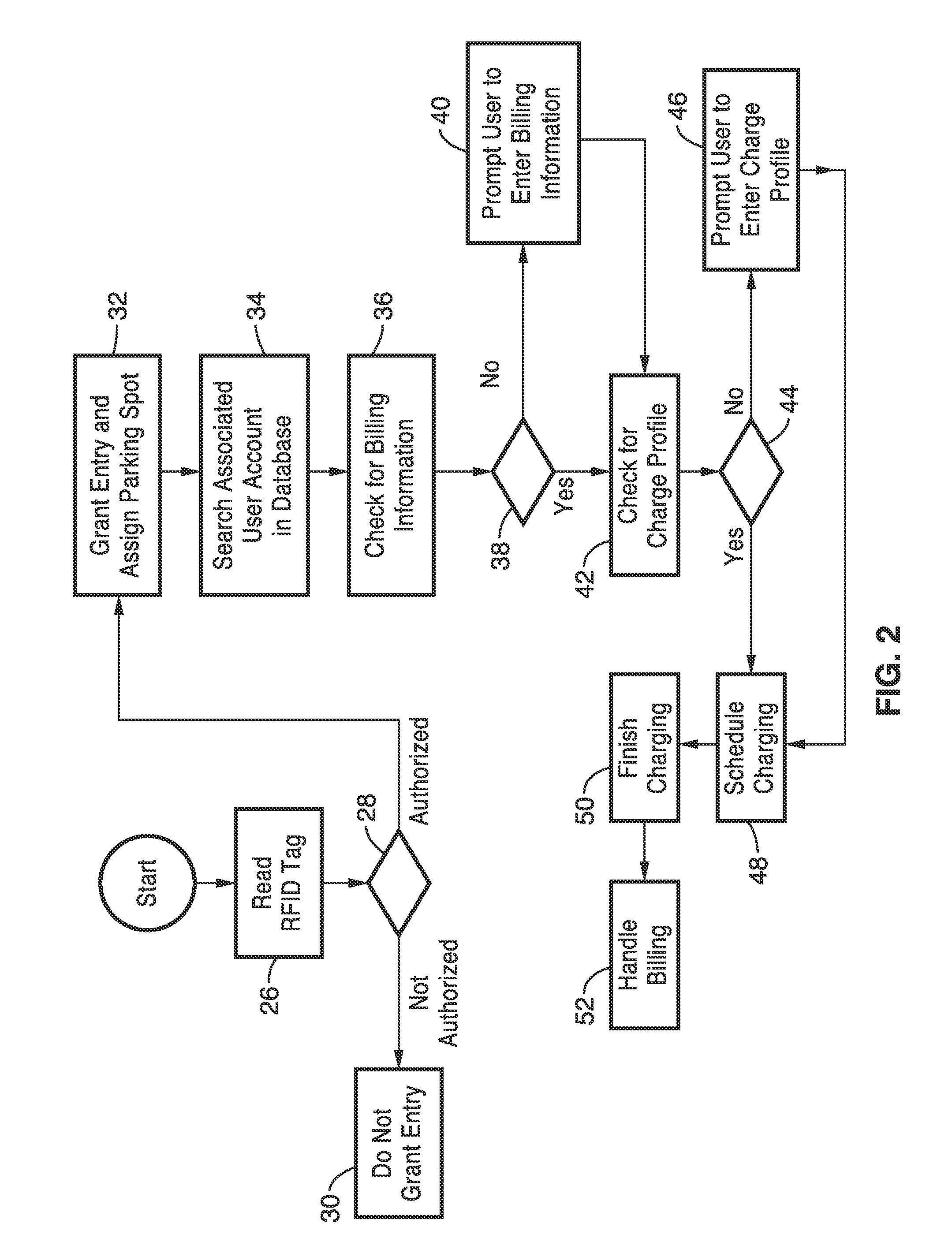

Intelligent electric vehicle charging system

PatentInactiveUS20140203077A1

Innovation

- An intelligent automated electric vehicle charging system using RFID technology for identification, intelligent charge/discharge management, and grid integration, allowing for aggregation of EVs to act as a controllable load and energy buffer, optimizing charging schedules based on user input, grid demand, and utility needs.

Regulatory Frameworks Across Regions

The regulatory landscape for Vehicle-to-Grid (V2G) technology varies significantly across global regions, creating a complex environment for adoption and implementation. In North America, the United States has developed a patchwork approach where individual states like California and New York lead with progressive policies that incentivize V2G integration. FERC Order 2222, implemented in 2020, represents a significant milestone by allowing distributed energy resources, including electric vehicles, to participate in wholesale electricity markets, thereby creating economic opportunities for V2G applications.

The European Union demonstrates the most comprehensive regulatory framework globally, with the Clean Energy Package and subsequent directives explicitly recognizing EVs as potential grid assets. Countries like Denmark, the Netherlands, and the UK have pioneered regulatory sandboxes that allow for controlled testing of V2G business models without full regulatory constraints. The EU's standardization efforts through bodies like CEN-CENELEC have also established technical protocols that facilitate interoperability across member states.

In Asia-Pacific, Japan stands out with its strategic V2G roadmap following the 2011 Fukushima disaster, which accelerated interest in distributed energy resources. The Japanese approach integrates V2G within broader energy resilience policies, with METI (Ministry of Economy, Trade and Industry) providing clear guidelines for grid connection. China, despite having the world's largest EV market, maintains a centralized regulatory approach that has been slower to accommodate bidirectional charging technologies, though recent five-year plans indicate growing interest.

Emerging markets present a different regulatory picture, with countries like India and Brazil developing frameworks that often leapfrog traditional regulatory stages. India's FAME II scheme, while primarily focused on EV adoption, includes provisions for exploring V2G integration within smart city initiatives. However, these regions frequently face challenges related to grid stability and reliability that must be addressed before widespread V2G implementation.

A critical cross-regional observation is the varying approaches to compensation mechanisms for V2G services. While some jurisdictions have established clear price signals and market structures for grid services provided by EVs, others lack transparent valuation methods, creating uncertainty for potential investors and users. Additionally, data privacy and cybersecurity regulations significantly impact V2G adoption, with the EU's GDPR setting stringent requirements for handling vehicle and energy consumption data.

The harmonization of technical standards represents another regulatory challenge, with competing protocols like CHAdeMO, CCS, and China's GB/T creating potential interoperability issues across markets. International coordination bodies are increasingly working to address these disparities, though progress remains uneven across regions.

The European Union demonstrates the most comprehensive regulatory framework globally, with the Clean Energy Package and subsequent directives explicitly recognizing EVs as potential grid assets. Countries like Denmark, the Netherlands, and the UK have pioneered regulatory sandboxes that allow for controlled testing of V2G business models without full regulatory constraints. The EU's standardization efforts through bodies like CEN-CENELEC have also established technical protocols that facilitate interoperability across member states.

In Asia-Pacific, Japan stands out with its strategic V2G roadmap following the 2011 Fukushima disaster, which accelerated interest in distributed energy resources. The Japanese approach integrates V2G within broader energy resilience policies, with METI (Ministry of Economy, Trade and Industry) providing clear guidelines for grid connection. China, despite having the world's largest EV market, maintains a centralized regulatory approach that has been slower to accommodate bidirectional charging technologies, though recent five-year plans indicate growing interest.

Emerging markets present a different regulatory picture, with countries like India and Brazil developing frameworks that often leapfrog traditional regulatory stages. India's FAME II scheme, while primarily focused on EV adoption, includes provisions for exploring V2G integration within smart city initiatives. However, these regions frequently face challenges related to grid stability and reliability that must be addressed before widespread V2G implementation.

A critical cross-regional observation is the varying approaches to compensation mechanisms for V2G services. While some jurisdictions have established clear price signals and market structures for grid services provided by EVs, others lack transparent valuation methods, creating uncertainty for potential investors and users. Additionally, data privacy and cybersecurity regulations significantly impact V2G adoption, with the EU's GDPR setting stringent requirements for handling vehicle and energy consumption data.

The harmonization of technical standards represents another regulatory challenge, with competing protocols like CHAdeMO, CCS, and China's GB/T creating potential interoperability issues across markets. International coordination bodies are increasingly working to address these disparities, though progress remains uneven across regions.

Grid Integration Challenges

The integration of Vehicle-to-Grid (V2G) technology into existing power infrastructures presents significant technical and operational challenges globally. Power grids were traditionally designed for unidirectional energy flow from centralized generation facilities to end consumers. The bidirectional energy exchange required by V2G systems necessitates substantial modifications to grid architecture, control systems, and regulatory frameworks.

Grid stability emerges as a primary concern when integrating large numbers of electric vehicles with V2G capabilities. The unpredictable nature of vehicle connectivity patterns can introduce voltage fluctuations and frequency deviations if not properly managed. Advanced grid management systems utilizing artificial intelligence and predictive analytics are being developed to forecast vehicle availability and optimize grid balancing operations.

Communication protocols represent another critical challenge in V2G implementation. Different regions have adopted varying standards for vehicle-to-grid communication, creating interoperability issues across international markets. While Europe has largely embraced the ISO 15118 standard, North America and parts of Asia utilize alternative protocols, complicating global V2G deployment strategies.

Grid capacity constraints further impede widespread V2G adoption. In densely populated urban areas, simultaneous charging of multiple vehicles already strains local distribution networks. Adding bidirectional power flow capabilities compounds this challenge, requiring substantial investments in grid infrastructure upgrades. Countries with aging power infrastructures face particularly severe limitations in this regard.

Cybersecurity vulnerabilities present growing concerns as V2G systems create new attack vectors for power grids. The increased number of digital access points through connected vehicles expands the potential surface for malicious interventions. Robust encryption standards and secure authentication mechanisms are being developed, though implementation varies significantly across different markets.

Regulatory frameworks governing grid operations often lag behind technological capabilities of V2G systems. Many jurisdictions maintain regulations that implicitly assume unidirectional power flow, creating legal ambiguities for prosumers who both consume and produce electricity through their vehicles. Progressive regulatory environments in Denmark, Netherlands, and parts of California have established clearer frameworks, serving as models for other regions.

Technical standardization remains fragmented globally, with different charging standards, communication protocols, and grid codes creating barriers to seamless V2G integration. This fragmentation increases implementation costs and slows adoption rates, particularly for vehicle manufacturers designing for global markets.

Grid stability emerges as a primary concern when integrating large numbers of electric vehicles with V2G capabilities. The unpredictable nature of vehicle connectivity patterns can introduce voltage fluctuations and frequency deviations if not properly managed. Advanced grid management systems utilizing artificial intelligence and predictive analytics are being developed to forecast vehicle availability and optimize grid balancing operations.

Communication protocols represent another critical challenge in V2G implementation. Different regions have adopted varying standards for vehicle-to-grid communication, creating interoperability issues across international markets. While Europe has largely embraced the ISO 15118 standard, North America and parts of Asia utilize alternative protocols, complicating global V2G deployment strategies.

Grid capacity constraints further impede widespread V2G adoption. In densely populated urban areas, simultaneous charging of multiple vehicles already strains local distribution networks. Adding bidirectional power flow capabilities compounds this challenge, requiring substantial investments in grid infrastructure upgrades. Countries with aging power infrastructures face particularly severe limitations in this regard.

Cybersecurity vulnerabilities present growing concerns as V2G systems create new attack vectors for power grids. The increased number of digital access points through connected vehicles expands the potential surface for malicious interventions. Robust encryption standards and secure authentication mechanisms are being developed, though implementation varies significantly across different markets.

Regulatory frameworks governing grid operations often lag behind technological capabilities of V2G systems. Many jurisdictions maintain regulations that implicitly assume unidirectional power flow, creating legal ambiguities for prosumers who both consume and produce electricity through their vehicles. Progressive regulatory environments in Denmark, Netherlands, and parts of California have established clearer frameworks, serving as models for other regions.

Technical standardization remains fragmented globally, with different charging standards, communication protocols, and grid codes creating barriers to seamless V2G integration. This fragmentation increases implementation costs and slows adoption rates, particularly for vehicle manufacturers designing for global markets.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!