Vehicle-to-Grid as a Tool for Energy Trading

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

V2G Technology Background and Objectives

Vehicle-to-Grid (V2G) technology represents a transformative approach to energy management that has evolved significantly over the past decade. The concept emerged in the late 1990s but gained substantial momentum in the 2010s as electric vehicle (EV) adoption increased and smart grid technologies matured. V2G enables bidirectional power flow between electric vehicles and the electricity grid, allowing EVs to not only consume energy but also discharge stored energy back to the grid when needed.

The evolution of V2G technology has been driven by several converging trends: the global push toward renewable energy integration, increasing EV market penetration, advancements in battery technology, and the development of sophisticated grid management systems. Early V2G implementations focused primarily on frequency regulation services, but the technology has since expanded to encompass peak shaving, demand response, and now, energy trading applications.

The primary technical objective of V2G as an energy trading tool is to create a decentralized energy marketplace where EV owners can participate as active prosumers—both consuming and producing electricity. This requires developing robust communication protocols between vehicles, charging infrastructure, and grid operators to enable real-time energy transactions. Additionally, V2G systems must optimize battery usage to balance grid services with vehicle owner needs while minimizing battery degradation.

Current V2G technology aims to address several critical challenges in modern energy systems. These include integrating intermittent renewable energy sources, reducing peak demand pressures, providing grid stability services, and creating new value streams for EV owners. The technology seeks to transform parked EVs—which represent an enormous distributed energy resource—into valuable grid assets that can be monetized through energy trading platforms.

Looking forward, V2G technology development is trending toward more sophisticated aggregation platforms that can manage fleets of vehicles as virtual power plants. These systems incorporate machine learning algorithms to predict both grid needs and vehicle usage patterns, optimizing energy trading opportunities. The ultimate goal is to establish a seamless, automated ecosystem where energy can flow bidirectionally between vehicles and the grid based on market signals, creating economic value for all stakeholders while supporting grid resilience and renewable energy integration.

The evolution of V2G technology has been driven by several converging trends: the global push toward renewable energy integration, increasing EV market penetration, advancements in battery technology, and the development of sophisticated grid management systems. Early V2G implementations focused primarily on frequency regulation services, but the technology has since expanded to encompass peak shaving, demand response, and now, energy trading applications.

The primary technical objective of V2G as an energy trading tool is to create a decentralized energy marketplace where EV owners can participate as active prosumers—both consuming and producing electricity. This requires developing robust communication protocols between vehicles, charging infrastructure, and grid operators to enable real-time energy transactions. Additionally, V2G systems must optimize battery usage to balance grid services with vehicle owner needs while minimizing battery degradation.

Current V2G technology aims to address several critical challenges in modern energy systems. These include integrating intermittent renewable energy sources, reducing peak demand pressures, providing grid stability services, and creating new value streams for EV owners. The technology seeks to transform parked EVs—which represent an enormous distributed energy resource—into valuable grid assets that can be monetized through energy trading platforms.

Looking forward, V2G technology development is trending toward more sophisticated aggregation platforms that can manage fleets of vehicles as virtual power plants. These systems incorporate machine learning algorithms to predict both grid needs and vehicle usage patterns, optimizing energy trading opportunities. The ultimate goal is to establish a seamless, automated ecosystem where energy can flow bidirectionally between vehicles and the grid based on market signals, creating economic value for all stakeholders while supporting grid resilience and renewable energy integration.

Market Demand Analysis for V2G Energy Trading

The Vehicle-to-Grid (V2G) energy trading market is experiencing significant growth driven by the convergence of electric vehicle adoption and renewable energy integration. Current market analysis indicates that the global V2G technology market is projected to reach $17.4 billion by 2027, growing at a compound annual growth rate of approximately 48% from 2020. This exceptional growth trajectory is primarily fueled by increasing electric vehicle penetration rates across major automotive markets worldwide.

Consumer demand for V2G solutions is emerging from multiple segments. Fleet operators represent a particularly promising market, as they can leverage V2G technology to optimize charging schedules and generate revenue during vehicle downtime. Residential EV owners constitute another significant segment, with surveys indicating that 65% of current EV owners express interest in V2G capabilities when presented with potential electricity bill savings of 10-15%.

Utility companies are increasingly recognizing V2G as a valuable grid management tool. The demand for grid flexibility services is projected to triple by 2030 as renewable energy penetration increases, creating intermittency challenges that V2G can help address. Several major utilities have launched pilot programs offering financial incentives ranging from $0.30 to $2.00 per kWh for V2G services during peak demand periods.

Regulatory developments are substantially influencing market demand. Countries with progressive energy policies like Denmark, Netherlands, and the UK have implemented regulatory frameworks that enable V2G participation in energy markets. These frameworks include mechanisms for aggregating distributed energy resources and compensating vehicle owners for grid services, which has accelerated market adoption in these regions.

Regional market analysis reveals varying adoption patterns. Europe leads in V2G implementation due to supportive policies and high electricity prices, while North America shows strong growth potential driven by utility interest in demand response programs. The Asia-Pacific region, particularly Japan and South Korea, demonstrates increasing demand based on energy security concerns and government-backed demonstration projects.

Market barriers affecting demand include high initial infrastructure costs, with bi-directional chargers currently priced 2-3 times higher than standard EV chargers. Technical standardization remains fragmented, with competing protocols limiting interoperability. Consumer concerns about battery degradation persist, though recent studies indicate minimal impact when V2G operations are properly managed.

The market shows clear segmentation between residential, commercial, and industrial applications, with commercial applications currently representing the largest market share at approximately 45%. This is attributed to the more favorable economics of fleet-based implementations and the ability to aggregate multiple vehicles for more significant grid impact.

Consumer demand for V2G solutions is emerging from multiple segments. Fleet operators represent a particularly promising market, as they can leverage V2G technology to optimize charging schedules and generate revenue during vehicle downtime. Residential EV owners constitute another significant segment, with surveys indicating that 65% of current EV owners express interest in V2G capabilities when presented with potential electricity bill savings of 10-15%.

Utility companies are increasingly recognizing V2G as a valuable grid management tool. The demand for grid flexibility services is projected to triple by 2030 as renewable energy penetration increases, creating intermittency challenges that V2G can help address. Several major utilities have launched pilot programs offering financial incentives ranging from $0.30 to $2.00 per kWh for V2G services during peak demand periods.

Regulatory developments are substantially influencing market demand. Countries with progressive energy policies like Denmark, Netherlands, and the UK have implemented regulatory frameworks that enable V2G participation in energy markets. These frameworks include mechanisms for aggregating distributed energy resources and compensating vehicle owners for grid services, which has accelerated market adoption in these regions.

Regional market analysis reveals varying adoption patterns. Europe leads in V2G implementation due to supportive policies and high electricity prices, while North America shows strong growth potential driven by utility interest in demand response programs. The Asia-Pacific region, particularly Japan and South Korea, demonstrates increasing demand based on energy security concerns and government-backed demonstration projects.

Market barriers affecting demand include high initial infrastructure costs, with bi-directional chargers currently priced 2-3 times higher than standard EV chargers. Technical standardization remains fragmented, with competing protocols limiting interoperability. Consumer concerns about battery degradation persist, though recent studies indicate minimal impact when V2G operations are properly managed.

The market shows clear segmentation between residential, commercial, and industrial applications, with commercial applications currently representing the largest market share at approximately 45%. This is attributed to the more favorable economics of fleet-based implementations and the ability to aggregate multiple vehicles for more significant grid impact.

V2G Technical Status and Challenges

Vehicle-to-Grid (V2G) technology has reached a significant level of technical maturity globally, with numerous pilot projects demonstrating its feasibility. Current V2G systems typically achieve bidirectional power flows of 10-20 kW for residential applications and up to 50-100 kW for commercial settings. Communication protocols have evolved substantially, with ISO 15118, CHAdeMO, and OpenADR emerging as leading standards that enable secure and reliable grid-vehicle interactions.

Despite this progress, V2G implementation faces substantial technical challenges. Battery degradation remains a primary concern, with studies indicating that frequent bidirectional charging cycles can reduce battery lifespan by 5-15% depending on usage patterns and battery chemistry. This degradation represents a significant barrier to widespread adoption as it directly impacts the total cost of ownership for electric vehicle users participating in V2G programs.

Grid integration presents another major challenge. Most existing power grids were designed for unidirectional power flow and lack the necessary infrastructure for managing distributed energy resources at scale. Advanced inverter technologies capable of maintaining power quality while facilitating bidirectional energy flow are still evolving, with current solutions often struggling to meet stringent grid codes during rapid transitions between charging and discharging modes.

Cybersecurity vulnerabilities constitute a growing concern as V2G systems create new attack vectors within critical infrastructure. The complex ecosystem of stakeholders—including utilities, charging station operators, vehicle manufacturers, and aggregators—complicates the implementation of comprehensive security frameworks. Current security protocols often fail to address the unique challenges of mobile energy resources that connect to multiple grid points.

Geographically, V2G technology development shows distinct regional characteristics. Europe leads in regulatory frameworks and standardization efforts, with countries like Denmark, the Netherlands, and the UK hosting the most advanced commercial V2G projects. North America focuses on market mechanism development and utility integration, while Japan and South Korea emphasize vehicle-side technology development through manufacturers like Nissan and Hyundai.

Interoperability between different vehicle models, charging equipment, and grid management systems remains limited. The fragmentation of standards and proprietary systems creates significant barriers to scaling V2G beyond pilot projects. Current efforts by organizations such as CharIN and the Open Charge Alliance aim to address these issues but have yet to achieve universal adoption across the industry.

Despite this progress, V2G implementation faces substantial technical challenges. Battery degradation remains a primary concern, with studies indicating that frequent bidirectional charging cycles can reduce battery lifespan by 5-15% depending on usage patterns and battery chemistry. This degradation represents a significant barrier to widespread adoption as it directly impacts the total cost of ownership for electric vehicle users participating in V2G programs.

Grid integration presents another major challenge. Most existing power grids were designed for unidirectional power flow and lack the necessary infrastructure for managing distributed energy resources at scale. Advanced inverter technologies capable of maintaining power quality while facilitating bidirectional energy flow are still evolving, with current solutions often struggling to meet stringent grid codes during rapid transitions between charging and discharging modes.

Cybersecurity vulnerabilities constitute a growing concern as V2G systems create new attack vectors within critical infrastructure. The complex ecosystem of stakeholders—including utilities, charging station operators, vehicle manufacturers, and aggregators—complicates the implementation of comprehensive security frameworks. Current security protocols often fail to address the unique challenges of mobile energy resources that connect to multiple grid points.

Geographically, V2G technology development shows distinct regional characteristics. Europe leads in regulatory frameworks and standardization efforts, with countries like Denmark, the Netherlands, and the UK hosting the most advanced commercial V2G projects. North America focuses on market mechanism development and utility integration, while Japan and South Korea emphasize vehicle-side technology development through manufacturers like Nissan and Hyundai.

Interoperability between different vehicle models, charging equipment, and grid management systems remains limited. The fragmentation of standards and proprietary systems creates significant barriers to scaling V2G beyond pilot projects. Current efforts by organizations such as CharIN and the Open Charge Alliance aim to address these issues but have yet to achieve universal adoption across the industry.

Current V2G Implementation Solutions

01 V2G Energy Trading Platforms and Marketplaces

Vehicle-to-Grid technology enables the creation of energy trading platforms where electric vehicle owners can participate in energy markets. These platforms facilitate the buying and selling of electricity between EV owners and the grid, allowing for bidirectional energy flow. The systems include transaction management, pricing mechanisms, and settlement processes that enable EV owners to monetize their vehicle's battery capacity when not in use.- V2G Energy Trading Platforms and Marketplaces: Vehicle-to-Grid technology enables the creation of energy trading platforms where electric vehicle owners can participate in energy markets. These platforms facilitate the buying and selling of electricity between EV owners and the grid, allowing for bidirectional energy flow. The systems include transaction management, pricing mechanisms, and settlement processes that enable EV owners to monetize their vehicle's battery capacity when not in use.

- Smart Grid Integration and Management Systems: Integration of V2G technology with smart grid infrastructure allows for efficient management of energy resources. These systems coordinate the charging and discharging of electric vehicles based on grid demands, renewable energy availability, and electricity prices. Advanced algorithms optimize the flow of electricity between vehicles and the grid, helping to balance load, reduce peak demand, and improve grid stability while maximizing economic benefits for participants.

- Blockchain-Based V2G Energy Trading: Blockchain technology is being applied to V2G energy trading to create secure, transparent, and decentralized marketplaces. These systems use smart contracts to automate energy transactions between electric vehicles and the grid without intermediaries. The distributed ledger technology ensures tamper-proof records of energy exchanges, enables microtransactions, and provides a trustworthy framework for peer-to-peer energy trading in V2G ecosystems.

- Dynamic Pricing and Incentive Mechanisms: Advanced pricing models and incentive structures are developed to encourage participation in V2G energy trading. These systems implement real-time pricing based on grid conditions, time-of-use rates, and demand-response events. Various incentive mechanisms, including monetary rewards, credits, and gamification elements, motivate electric vehicle owners to make their battery capacity available to the grid when needed, thereby creating a more responsive and flexible energy ecosystem.

- V2G Communication Protocols and Security Systems: Specialized communication protocols and security systems are essential for reliable and secure V2G energy trading. These technologies enable seamless communication between electric vehicles, charging infrastructure, and grid operators. Advanced encryption, authentication mechanisms, and data protection measures safeguard the V2G ecosystem against cyber threats and unauthorized access, ensuring the integrity of energy transactions and protecting user privacy in the connected vehicle-grid environment.

02 Smart Charging and Grid Integration Systems

Smart charging systems optimize the charging and discharging of electric vehicles based on grid conditions, electricity prices, and user preferences. These systems incorporate algorithms that determine the optimal times to charge vehicles when electricity prices are low and discharge to the grid when prices are high. The integration with grid infrastructure allows for load balancing, frequency regulation, and other grid services that can increase grid stability while providing financial benefits to EV owners.Expand Specific Solutions03 Blockchain-based V2G Energy Trading

Blockchain technology is being applied to V2G energy trading to create secure, transparent, and decentralized transaction systems. These solutions use smart contracts to automate energy trading agreements between EV owners and energy buyers, ensuring tamper-proof records of all transactions. The blockchain infrastructure enables peer-to-peer energy trading without intermediaries, reducing transaction costs and increasing market efficiency while ensuring data security and privacy.Expand Specific Solutions04 V2G Aggregation and Fleet Management

Aggregation systems combine multiple electric vehicles into virtual power plants that can provide significant energy capacity to the grid. These systems manage fleets of EVs to coordinate their charging and discharging activities, maximizing the collective value they can provide to the grid. Fleet management solutions include scheduling algorithms, communication protocols, and control systems that enable coordinated participation in energy markets while ensuring that individual vehicle owners' mobility needs are met.Expand Specific Solutions05 V2G Economic Models and Incentive Structures

Various economic models and incentive structures have been developed to encourage participation in V2G energy trading. These include dynamic pricing mechanisms, reward systems for grid services, and compensation frameworks for battery degradation. The models account for factors such as time-of-use rates, demand response events, and ancillary service markets to maximize the financial benefits for EV owners while providing valuable services to the electrical grid.Expand Specific Solutions

Key Players in V2G Energy Trading Ecosystem

Vehicle-to-Grid (V2G) technology is emerging as a transformative tool for energy trading, currently in the early growth phase of market development. The global V2G market is projected to expand significantly, driven by increasing electric vehicle adoption and grid modernization initiatives. Technologically, V2G systems are advancing toward commercial viability, with automotive leaders like Toyota, Ford, Hyundai, and BMW developing bidirectional charging capabilities. Academic institutions such as the University of Delaware are pioneering research, while technology companies including IBM and Qualcomm are enhancing communication protocols. Energy sector players like NTT and Hitachi are developing integrated grid management solutions. The competitive landscape features collaboration between automotive manufacturers, technology providers, and utilities to establish interoperable standards and scalable business models.

Toyota Motor Corp.

Technical Solution: Toyota has developed an advanced Vehicle-to-Grid (V2G) system that integrates their hybrid and electric vehicles into the power grid ecosystem. Their technology enables bidirectional power flow between vehicles and the grid, allowing vehicles to serve as mobile energy storage units. Toyota's V2G platform includes sophisticated power electronics for DC/AC conversion with minimal energy loss and intelligent energy management systems that optimize charging and discharging based on grid demands, electricity prices, and user preferences. The company has implemented smart scheduling algorithms that predict optimal times for energy trading based on historical usage patterns and real-time grid conditions. Toyota has also developed specialized V2G-compatible charging stations that facilitate seamless energy transfer while maintaining battery health through advanced battery management systems that monitor cell conditions during V2G operations to prevent degradation.

Strengths: Toyota's extensive experience with hybrid technology provides a strong foundation for V2G implementation. Their system offers excellent battery longevity protection and seamless integration with existing power infrastructure. Weaknesses: The system requires significant investment in specialized charging infrastructure and may face regulatory hurdles in certain markets.

Ford Global Technologies LLC

Technical Solution: Ford has engineered a comprehensive V2G energy trading platform called "Ford Intelligent Power" that transforms their electric vehicles into versatile grid assets. The system features bidirectional charging capabilities that allow Ford EVs to both draw power from and return it to the grid. Their technology incorporates advanced power electronics with high-efficiency inverters that minimize conversion losses during energy exchange. Ford's platform includes a sophisticated energy management system that analyzes grid conditions, electricity pricing, and user preferences to optimize when to charge and when to sell power back to the grid. The company has developed a user-friendly mobile application that gives vehicle owners control over their energy trading parameters, including minimum battery reserves and profit thresholds. Ford has also implemented blockchain-based smart contracts to facilitate secure, transparent, and automated financial settlements for energy transactions between vehicle owners and utilities.

Strengths: Ford's system offers exceptional user control through intuitive interfaces and provides transparent financial tracking through blockchain integration. Their platform is designed for scalability across diverse grid environments. Weaknesses: The technology requires significant consumer education and may face challenges with battery warranty implications when frequently using vehicles for grid services.

Core V2G Communication Protocols and Standards

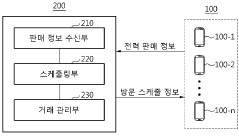

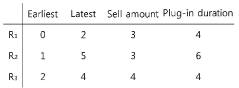

Power brokering system for electricity trades from electric vehicle to grid

PatentActiveKR1020160064563A

Innovation

- A power brokering system is introduced, comprising a purchaser terminal, seller terminal, and intermediary terminal, which facilitate two-way message exchange and scheduling to manage power transactions between electric vehicles and smart grids, ensuring efficient power supply and demand balancing.

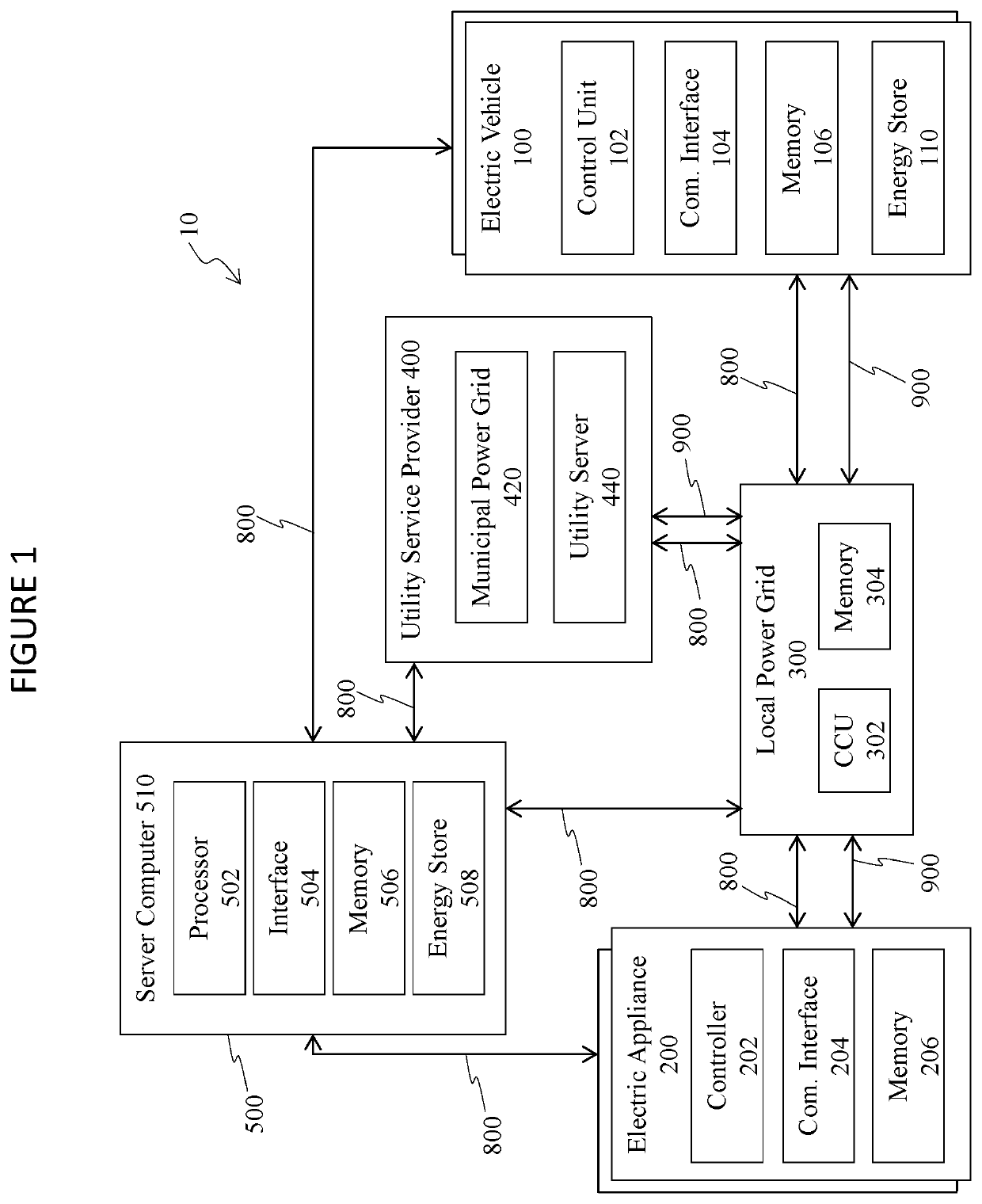

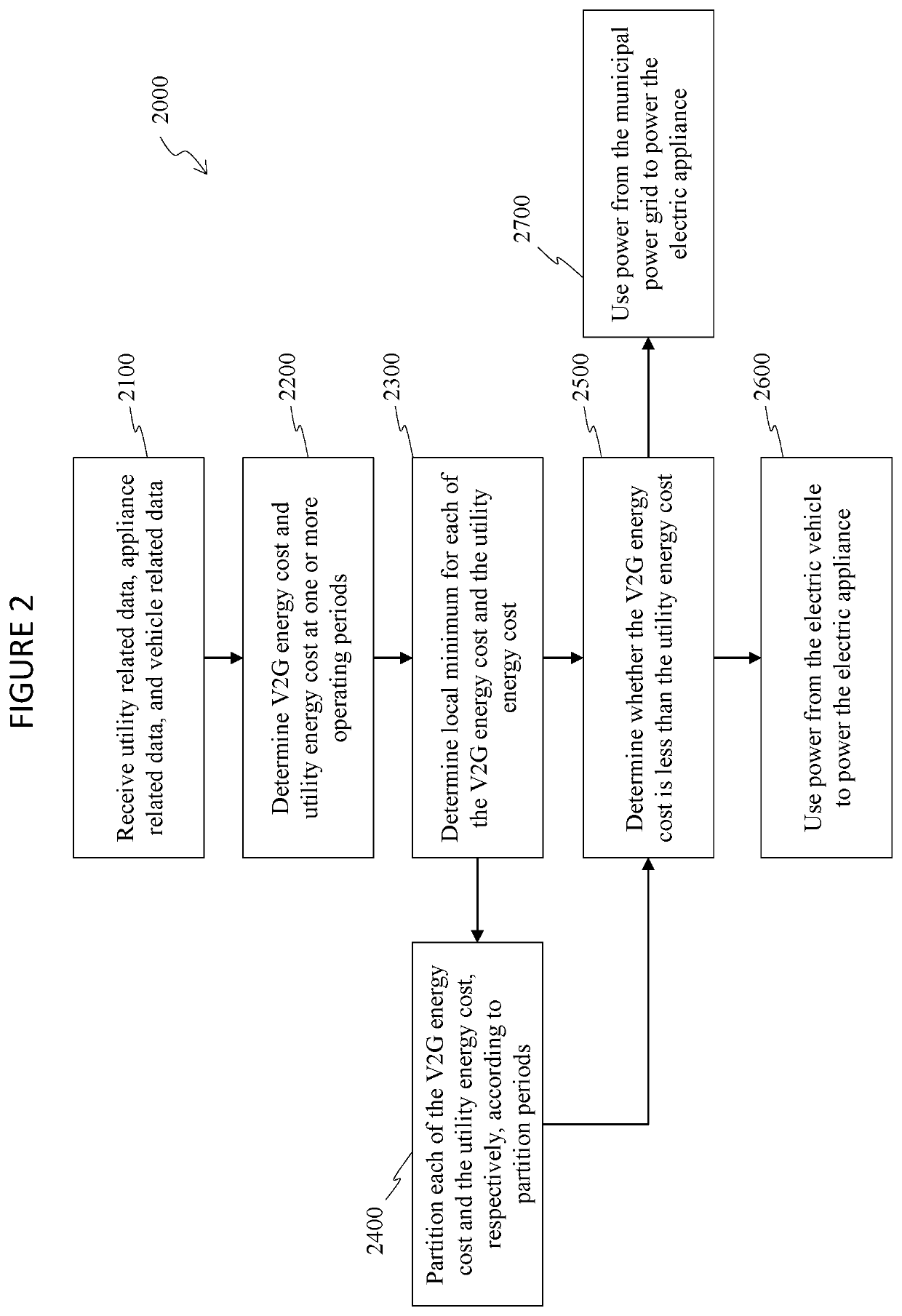

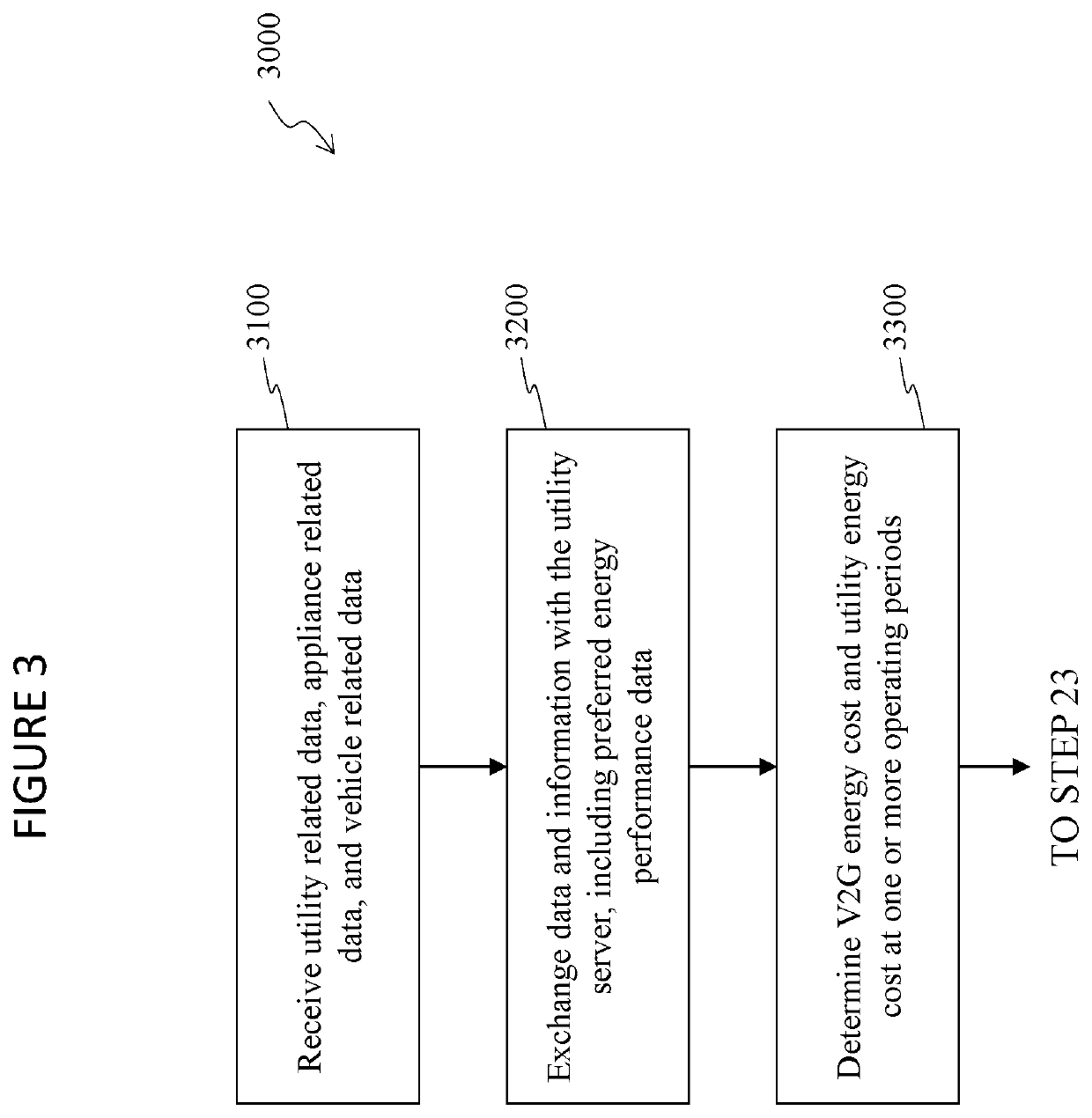

Systems and Methods for Integrating On-Premises Electric Appliances with Vehicle-To-Grid Electric Vehicles

PatentActiveUS20200406778A1

Innovation

- An energy management system that integrates on-premises electric appliances with vehicle-to-grid (V2G) electric vehicles, using a system server to receive and analyze utility, appliance, and vehicle data to determine optimal energy usage, controlling the electric vehicle to discharge energy to the local power grid for operating appliances based on cost comparisons between V2G and utility energy costs.

Regulatory Framework for V2G Energy Markets

The regulatory landscape for Vehicle-to-Grid (V2G) energy markets remains fragmented globally, presenting significant challenges for widespread implementation. Current regulatory frameworks primarily focus on traditional unidirectional power flows, leaving bidirectional energy exchanges largely unaddressed. This regulatory gap creates uncertainty for market participants and inhibits investment in V2G infrastructure.

In the United States, the Federal Energy Regulatory Commission (FERC) Order 841 represents a milestone by requiring wholesale electricity markets to establish rules allowing energy storage resources, including electric vehicles, to participate. However, implementation varies significantly across regional transmission organizations. California leads with its Rule 21, which establishes technical standards for grid-connected devices, while other states lag in developing comprehensive V2G regulations.

The European Union has made substantial progress through its Clean Energy Package, particularly with Electricity Directive 2019/944, which explicitly recognizes aggregators and energy storage as distinct market participants. Countries like Denmark, the Netherlands, and the United Kingdom have pioneered regulatory sandboxes to test V2G business models under controlled conditions before full-scale implementation.

Market access rules present another critical regulatory consideration. Current electricity markets often impose minimum capacity requirements that individual electric vehicles cannot meet. Aggregation frameworks allowing multiple vehicles to participate collectively are essential but remain underdeveloped in most jurisdictions. Additionally, complex registration procedures and high entry costs create barriers for small-scale participants.

Tariff structures and taxation policies significantly impact V2G economic viability. Double taxation—where energy is taxed both when drawn from and returned to the grid—remains a persistent barrier in many regions. Progressive regulatory frameworks like those in Denmark have eliminated this double taxation, creating more favorable economics for V2G participation.

Standardization of communication protocols and hardware interfaces represents another regulatory challenge. While standards like ISO 15118 and IEC 63110 provide technical frameworks for V2G communication, their adoption remains inconsistent across markets, creating interoperability issues that hinder scalability.

Data privacy and cybersecurity regulations also require careful consideration as V2G systems involve sensitive information about energy usage patterns and vehicle availability. Regulations like the EU's General Data Protection Regulation provide some guidance, but V2G-specific data protection frameworks remain underdeveloped in most jurisdictions.

In the United States, the Federal Energy Regulatory Commission (FERC) Order 841 represents a milestone by requiring wholesale electricity markets to establish rules allowing energy storage resources, including electric vehicles, to participate. However, implementation varies significantly across regional transmission organizations. California leads with its Rule 21, which establishes technical standards for grid-connected devices, while other states lag in developing comprehensive V2G regulations.

The European Union has made substantial progress through its Clean Energy Package, particularly with Electricity Directive 2019/944, which explicitly recognizes aggregators and energy storage as distinct market participants. Countries like Denmark, the Netherlands, and the United Kingdom have pioneered regulatory sandboxes to test V2G business models under controlled conditions before full-scale implementation.

Market access rules present another critical regulatory consideration. Current electricity markets often impose minimum capacity requirements that individual electric vehicles cannot meet. Aggregation frameworks allowing multiple vehicles to participate collectively are essential but remain underdeveloped in most jurisdictions. Additionally, complex registration procedures and high entry costs create barriers for small-scale participants.

Tariff structures and taxation policies significantly impact V2G economic viability. Double taxation—where energy is taxed both when drawn from and returned to the grid—remains a persistent barrier in many regions. Progressive regulatory frameworks like those in Denmark have eliminated this double taxation, creating more favorable economics for V2G participation.

Standardization of communication protocols and hardware interfaces represents another regulatory challenge. While standards like ISO 15118 and IEC 63110 provide technical frameworks for V2G communication, their adoption remains inconsistent across markets, creating interoperability issues that hinder scalability.

Data privacy and cybersecurity regulations also require careful consideration as V2G systems involve sensitive information about energy usage patterns and vehicle availability. Regulations like the EU's General Data Protection Regulation provide some guidance, but V2G-specific data protection frameworks remain underdeveloped in most jurisdictions.

Economic Viability and ROI Analysis

The economic viability of Vehicle-to-Grid (V2G) technology as an energy trading tool depends on multiple interconnected factors that influence return on investment. Current cost-benefit analyses indicate that V2G systems require significant initial capital expenditure, including bidirectional charging infrastructure, grid connection upgrades, and vehicle modifications. These investments typically range from $2,000 to $10,000 per charging point, depending on scale and location.

Revenue generation potential stems primarily from three streams: energy arbitrage (buying electricity at low prices and selling at peak rates), grid services provision (frequency regulation, voltage support), and capacity market participation. Studies from pilot projects in Denmark and the Netherlands demonstrate that frequency regulation services offer the highest revenue potential, with annual returns of $1,000-$3,500 per vehicle.

Battery degradation remains a critical factor affecting ROI calculations. Recent research from the University of Warwick suggests that smart V2G algorithms can actually extend battery life by 8-10% compared to standard charging, challenging earlier concerns about accelerated degradation. However, this requires sophisticated battery management systems and optimal cycling patterns.

Payback periods vary significantly based on usage patterns and regulatory environments. In favorable markets with time-of-use electricity pricing and supportive grid service compensation, ROI periods of 3-5 years are achievable. Less favorable regulatory environments may extend this to 7-10 years, potentially exceeding the ownership period of individual vehicles.

Sensitivity analysis reveals that economic viability is particularly dependent on regulatory frameworks and market design. Regions with capacity markets and ancillary service markets that recognize and compensate distributed energy resources show substantially improved economics. For instance, PJM's frequency regulation market in the United States has demonstrated V2G value streams 2-3 times higher than energy arbitrage alone.

Fleet applications currently present the most promising economic cases, with predictable usage patterns and economies of scale reducing per-vehicle implementation costs by 30-40%. Private consumer applications face greater challenges, though emerging aggregator business models are beginning to address these by pooling resources and distributing benefits.

Future economic viability will be enhanced by declining battery costs (projected at 8% annually through 2030), improving bidirectional charging efficiency, and evolving market mechanisms that better value grid flexibility. Regulatory recognition of V2G as both a generation and consumption resource remains crucial for unlocking its full economic potential.

Revenue generation potential stems primarily from three streams: energy arbitrage (buying electricity at low prices and selling at peak rates), grid services provision (frequency regulation, voltage support), and capacity market participation. Studies from pilot projects in Denmark and the Netherlands demonstrate that frequency regulation services offer the highest revenue potential, with annual returns of $1,000-$3,500 per vehicle.

Battery degradation remains a critical factor affecting ROI calculations. Recent research from the University of Warwick suggests that smart V2G algorithms can actually extend battery life by 8-10% compared to standard charging, challenging earlier concerns about accelerated degradation. However, this requires sophisticated battery management systems and optimal cycling patterns.

Payback periods vary significantly based on usage patterns and regulatory environments. In favorable markets with time-of-use electricity pricing and supportive grid service compensation, ROI periods of 3-5 years are achievable. Less favorable regulatory environments may extend this to 7-10 years, potentially exceeding the ownership period of individual vehicles.

Sensitivity analysis reveals that economic viability is particularly dependent on regulatory frameworks and market design. Regions with capacity markets and ancillary service markets that recognize and compensate distributed energy resources show substantially improved economics. For instance, PJM's frequency regulation market in the United States has demonstrated V2G value streams 2-3 times higher than energy arbitrage alone.

Fleet applications currently present the most promising economic cases, with predictable usage patterns and economies of scale reducing per-vehicle implementation costs by 30-40%. Private consumer applications face greater challenges, though emerging aggregator business models are beginning to address these by pooling resources and distributing benefits.

Future economic viability will be enhanced by declining battery costs (projected at 8% annually through 2030), improving bidirectional charging efficiency, and evolving market mechanisms that better value grid flexibility. Regulatory recognition of V2G as both a generation and consumption resource remains crucial for unlocking its full economic potential.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!