Vehicle-to-Grid Market Competition and Strategic Alliances

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

V2G Technology Background and Objectives

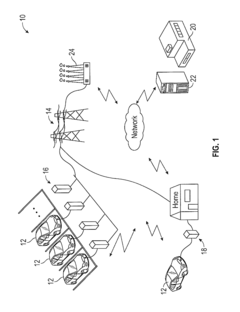

Vehicle-to-Grid (V2G) technology represents a transformative approach to energy management that has evolved significantly over the past decade. The concept emerged in the late 1990s but gained substantial momentum after 2010 as electric vehicle (EV) adoption increased globally. V2G enables bidirectional power flow between EVs and the electrical grid, allowing vehicles to not only consume electricity but also return it to the grid when needed, effectively turning EVs into mobile energy storage units.

The evolution of V2G technology has been closely tied to advancements in battery technology, power electronics, and smart grid infrastructure. Early V2G implementations faced significant challenges related to battery degradation, communication protocols, and grid integration. However, recent technological breakthroughs have addressed many of these limitations, making V2G increasingly viable for commercial deployment.

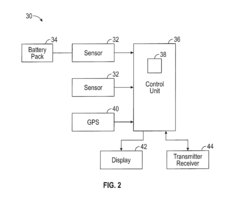

Current V2G systems typically consist of bidirectional chargers, communication interfaces, energy management systems, and grid integration components. The technology has progressed from simple unidirectional controlled charging (V1G) to sophisticated bidirectional power exchange capabilities that can provide multiple grid services including frequency regulation, peak shaving, and renewable energy integration.

The primary objective of V2G technology development is to create a seamless integration between transportation and energy sectors, maximizing the utility of EV batteries beyond their primary mobility function. This integration aims to enhance grid stability, increase renewable energy penetration, reduce electricity costs, and provide additional revenue streams for EV owners.

From a market perspective, V2G technology seeks to establish new business models and value chains that benefit multiple stakeholders including utilities, grid operators, EV manufacturers, charging infrastructure providers, and end users. The technology is expected to play a crucial role in supporting the transition to renewable energy by providing flexible storage capacity to mitigate the intermittency of solar and wind power generation.

Looking forward, V2G technology development is trending toward enhanced interoperability standards, improved user interfaces, reduced system costs, and minimized battery degradation effects. The convergence of V2G with other emerging technologies such as artificial intelligence, blockchain, and Internet of Things (IoT) is expected to further accelerate innovation in this space, creating more sophisticated energy management ecosystems.

As global markets increasingly focus on decarbonization and energy security, V2G represents a strategic technology that bridges transportation electrification with smart grid development, potentially unlocking significant economic and environmental benefits across multiple sectors.

The evolution of V2G technology has been closely tied to advancements in battery technology, power electronics, and smart grid infrastructure. Early V2G implementations faced significant challenges related to battery degradation, communication protocols, and grid integration. However, recent technological breakthroughs have addressed many of these limitations, making V2G increasingly viable for commercial deployment.

Current V2G systems typically consist of bidirectional chargers, communication interfaces, energy management systems, and grid integration components. The technology has progressed from simple unidirectional controlled charging (V1G) to sophisticated bidirectional power exchange capabilities that can provide multiple grid services including frequency regulation, peak shaving, and renewable energy integration.

The primary objective of V2G technology development is to create a seamless integration between transportation and energy sectors, maximizing the utility of EV batteries beyond their primary mobility function. This integration aims to enhance grid stability, increase renewable energy penetration, reduce electricity costs, and provide additional revenue streams for EV owners.

From a market perspective, V2G technology seeks to establish new business models and value chains that benefit multiple stakeholders including utilities, grid operators, EV manufacturers, charging infrastructure providers, and end users. The technology is expected to play a crucial role in supporting the transition to renewable energy by providing flexible storage capacity to mitigate the intermittency of solar and wind power generation.

Looking forward, V2G technology development is trending toward enhanced interoperability standards, improved user interfaces, reduced system costs, and minimized battery degradation effects. The convergence of V2G with other emerging technologies such as artificial intelligence, blockchain, and Internet of Things (IoT) is expected to further accelerate innovation in this space, creating more sophisticated energy management ecosystems.

As global markets increasingly focus on decarbonization and energy security, V2G represents a strategic technology that bridges transportation electrification with smart grid development, potentially unlocking significant economic and environmental benefits across multiple sectors.

V2G Market Demand Analysis

The Vehicle-to-Grid (V2G) market is experiencing significant growth driven by the convergence of renewable energy integration, grid stability concerns, and the rapid expansion of electric vehicle (EV) adoption worldwide. Current market analysis indicates that the global V2G technology market is projected to grow at a compound annual growth rate of 48% between 2023 and 2030, reaching a market valuation of approximately 17.4 billion USD by 2030.

Primary demand drivers for V2G technology stem from multiple stakeholders across the energy ecosystem. Utility companies are increasingly seeking flexible grid management solutions to address intermittency issues associated with renewable energy sources. V2G technology offers these utilities a distributed energy resource that can provide frequency regulation, peak shaving, and load balancing services without requiring massive infrastructure investments in traditional power plants.

From the consumer perspective, V2G represents a potential revenue stream for EV owners, with studies suggesting that participants could generate between 1,000-2,500 USD annually through grid services, depending on market conditions and participation levels. This economic incentive is becoming a significant factor in consumer purchasing decisions, particularly in regions with dynamic electricity pricing models.

Commercial fleet operators constitute another major demand segment, with logistics companies, ride-sharing services, and municipal vehicle fleets exploring V2G as a means to offset operational costs and achieve sustainability targets. Market research indicates that fleet operators can reduce total cost of ownership by 15-20% through strategic V2G implementation.

Geographically, demand patterns show notable regional variations. European markets, particularly the UK, Netherlands, and Denmark, are currently leading V2G adoption due to favorable regulatory frameworks and high renewable energy penetration. North America follows with growing interest, while Asia-Pacific markets are expected to demonstrate the highest growth rates over the next five years as countries like China, Japan, and South Korea accelerate their EV infrastructure development.

Regulatory developments are significantly influencing market demand trajectories. Countries implementing carbon reduction policies, renewable energy mandates, and grid modernization initiatives are creating favorable conditions for V2G technology adoption. Additionally, the establishment of standardized protocols for vehicle-grid communication and energy trading platforms is reducing market entry barriers and expanding the potential customer base.

Industry forecasts suggest that by 2025, approximately 11 million vehicles worldwide will be V2G-capable, representing a critical mass that will enable meaningful grid services and market liquidity. This growth is expected to accelerate as automotive manufacturers increasingly incorporate bidirectional charging capabilities as standard features in new EV models.

Primary demand drivers for V2G technology stem from multiple stakeholders across the energy ecosystem. Utility companies are increasingly seeking flexible grid management solutions to address intermittency issues associated with renewable energy sources. V2G technology offers these utilities a distributed energy resource that can provide frequency regulation, peak shaving, and load balancing services without requiring massive infrastructure investments in traditional power plants.

From the consumer perspective, V2G represents a potential revenue stream for EV owners, with studies suggesting that participants could generate between 1,000-2,500 USD annually through grid services, depending on market conditions and participation levels. This economic incentive is becoming a significant factor in consumer purchasing decisions, particularly in regions with dynamic electricity pricing models.

Commercial fleet operators constitute another major demand segment, with logistics companies, ride-sharing services, and municipal vehicle fleets exploring V2G as a means to offset operational costs and achieve sustainability targets. Market research indicates that fleet operators can reduce total cost of ownership by 15-20% through strategic V2G implementation.

Geographically, demand patterns show notable regional variations. European markets, particularly the UK, Netherlands, and Denmark, are currently leading V2G adoption due to favorable regulatory frameworks and high renewable energy penetration. North America follows with growing interest, while Asia-Pacific markets are expected to demonstrate the highest growth rates over the next five years as countries like China, Japan, and South Korea accelerate their EV infrastructure development.

Regulatory developments are significantly influencing market demand trajectories. Countries implementing carbon reduction policies, renewable energy mandates, and grid modernization initiatives are creating favorable conditions for V2G technology adoption. Additionally, the establishment of standardized protocols for vehicle-grid communication and energy trading platforms is reducing market entry barriers and expanding the potential customer base.

Industry forecasts suggest that by 2025, approximately 11 million vehicles worldwide will be V2G-capable, representing a critical mass that will enable meaningful grid services and market liquidity. This growth is expected to accelerate as automotive manufacturers increasingly incorporate bidirectional charging capabilities as standard features in new EV models.

V2G Technical Status and Challenges

The global Vehicle-to-Grid (V2G) technology landscape is currently characterized by significant advancements but faces several critical challenges. Current V2G systems have achieved bidirectional power flow capabilities between electric vehicles and the grid, with commercial-scale demonstrations operating in Europe, North America, and parts of Asia. These systems typically deliver 10-15 kW of power per vehicle with round-trip efficiencies ranging from 70-85%, depending on the implementation architecture and hardware specifications.

Technical standardization remains a major obstacle in the V2G ecosystem. Despite efforts from organizations like ISO, IEC, and SAE, the industry still lacks universally adopted communication protocols between vehicles, charging infrastructure, and grid operators. This fragmentation creates interoperability issues that significantly hinder widespread deployment and increases implementation costs for stakeholders across the value chain.

Battery degradation concerns continue to present a substantial technical barrier. Current research indicates that frequent bidirectional charging cycles may accelerate battery capacity loss by 5-15% over the vehicle's lifetime, depending on battery chemistry and V2G usage patterns. This degradation risk creates hesitancy among both vehicle manufacturers and consumers to fully embrace V2G technology without adequate compensation mechanisms or technical solutions.

Grid integration challenges persist as existing power infrastructure was not designed for distributed, bidirectional energy flows. Many regional grids lack the necessary monitoring systems, control algorithms, and protection mechanisms to safely accommodate large-scale V2G participation. Cybersecurity vulnerabilities in V2G systems present additional risks, as the increased connectivity between vehicles and grid infrastructure expands potential attack surfaces for malicious actors.

Geographically, V2G technology development shows distinct regional characteristics. European markets lead in regulatory frameworks and pilot deployments, with countries like Denmark, Netherlands, and the UK hosting multiple commercial V2G projects. North America demonstrates strong research capabilities but faces regulatory fragmentation across different states and provinces. Asian markets, particularly Japan and South Korea, excel in hardware development but lag in deployment scale compared to European counterparts.

Economic viability remains challenging as current V2G hardware costs ($2,000-5,000 per bidirectional charger) and software integration expenses often outweigh the revenue potential from grid services in many markets. Without technological breakthroughs to reduce these costs or regulatory frameworks that properly value grid flexibility services, widespread commercial adoption faces significant economic barriers.

Technical standardization remains a major obstacle in the V2G ecosystem. Despite efforts from organizations like ISO, IEC, and SAE, the industry still lacks universally adopted communication protocols between vehicles, charging infrastructure, and grid operators. This fragmentation creates interoperability issues that significantly hinder widespread deployment and increases implementation costs for stakeholders across the value chain.

Battery degradation concerns continue to present a substantial technical barrier. Current research indicates that frequent bidirectional charging cycles may accelerate battery capacity loss by 5-15% over the vehicle's lifetime, depending on battery chemistry and V2G usage patterns. This degradation risk creates hesitancy among both vehicle manufacturers and consumers to fully embrace V2G technology without adequate compensation mechanisms or technical solutions.

Grid integration challenges persist as existing power infrastructure was not designed for distributed, bidirectional energy flows. Many regional grids lack the necessary monitoring systems, control algorithms, and protection mechanisms to safely accommodate large-scale V2G participation. Cybersecurity vulnerabilities in V2G systems present additional risks, as the increased connectivity between vehicles and grid infrastructure expands potential attack surfaces for malicious actors.

Geographically, V2G technology development shows distinct regional characteristics. European markets lead in regulatory frameworks and pilot deployments, with countries like Denmark, Netherlands, and the UK hosting multiple commercial V2G projects. North America demonstrates strong research capabilities but faces regulatory fragmentation across different states and provinces. Asian markets, particularly Japan and South Korea, excel in hardware development but lag in deployment scale compared to European counterparts.

Economic viability remains challenging as current V2G hardware costs ($2,000-5,000 per bidirectional charger) and software integration expenses often outweigh the revenue potential from grid services in many markets. Without technological breakthroughs to reduce these costs or regulatory frameworks that properly value grid flexibility services, widespread commercial adoption faces significant economic barriers.

Current V2G Implementation Solutions

01 Strategic alliances in V2G technology market

Strategic partnerships and alliances between automotive manufacturers, energy providers, and technology companies are forming to accelerate the development and deployment of Vehicle-to-Grid (V2G) technology. These collaborations aim to combine expertise in vehicle manufacturing, grid management, and software development to create integrated V2G solutions. Such alliances help companies share development costs, reduce market entry barriers, and establish industry standards for V2G implementation.- Strategic alliances in V2G technology market: Strategic partnerships and alliances between automotive manufacturers, energy providers, and technology companies are forming to accelerate the development and deployment of Vehicle-to-Grid (V2G) technology. These collaborations aim to combine expertise in vehicle manufacturing, grid management, and software development to create integrated V2G solutions. Such alliances help companies share development costs, reduce market entry barriers, and establish industry standards for V2G implementation.

- Market competition dynamics in V2G ecosystem: The V2G technology market is experiencing increasing competition as both established energy companies and new entrants vie for market share. Competition focuses on developing more efficient bidirectional charging systems, user-friendly interfaces, and attractive pricing models for consumers. Market players are differentiating themselves through proprietary algorithms that optimize energy flow between vehicles and the grid, enhanced battery management systems that minimize degradation during V2G operations, and value-added services for fleet operators and individual EV owners.

- Business models and revenue sharing frameworks: Various business models are emerging in the V2G market, including subscription services, revenue-sharing arrangements between vehicle owners and grid operators, and aggregator-based models. These frameworks define how value is distributed among stakeholders when electric vehicles provide grid services. Companies are developing platforms that facilitate transactions between EV owners willing to provide battery capacity and utilities needing grid stabilization services, with compensation mechanisms based on energy contributed, availability periods, and grid service quality.

- Intellectual property strategies and patent landscapes: Companies are actively building patent portfolios around V2G technologies to secure competitive advantages and create barriers to entry. Patent activities focus on communication protocols between vehicles and grid infrastructure, energy management algorithms, and hardware components for bidirectional power flow. The intellectual property landscape reveals strategic positioning by automotive OEMs, charging infrastructure providers, and software developers, with some companies pursuing aggressive patenting strategies while others focus on open standards to accelerate market adoption.

- Regulatory influences on market competition: Government policies and regulatory frameworks significantly impact the competitive landscape of the V2G technology market. Regulations regarding grid interconnection standards, electricity market participation rules, and incentive programs for V2G adoption create both opportunities and challenges for market participants. Companies are adapting their strategies to navigate varying regulatory environments across different regions, with some focusing on markets with favorable policies for distributed energy resources and others working with regulators to shape emerging frameworks for V2G integration.

02 Market competition dynamics in V2G ecosystem

The V2G technology market is experiencing increasing competition as companies vie for market share in this emerging sector. Competition exists between traditional automotive manufacturers integrating V2G capabilities into electric vehicles, utility companies developing grid integration solutions, and technology startups offering innovative V2G platforms. Market players are differentiating themselves through proprietary technologies, service offerings, and business models to gain competitive advantage in various segments of the V2G value chain.Expand Specific Solutions03 Business models and revenue sharing frameworks

Various business models are emerging in the V2G market, including service-based approaches, energy trading platforms, and infrastructure-as-a-service offerings. These models define how value is created and distributed among stakeholders in the V2G ecosystem. Revenue sharing frameworks establish how profits from grid services, energy arbitrage, and ancillary services are allocated between vehicle owners, charging infrastructure operators, and utility companies. The development of sustainable business models is critical for widespread V2G adoption.Expand Specific Solutions04 Intellectual property strategies and patent landscapes

Companies in the V2G technology space are actively developing intellectual property portfolios to protect their innovations and strengthen their competitive positions. Patent activities focus on charging technologies, grid integration methods, communication protocols, and energy management algorithms. The evolving patent landscape reflects the technological development trajectory of V2G systems and indicates areas of intense competition. Strategic patent filings and licensing agreements are becoming increasingly important as the market matures.Expand Specific Solutions05 Standardization efforts and regulatory frameworks

Industry consortia and standards organizations are working to develop common protocols and interfaces for V2G technology to ensure interoperability between different systems and components. These standardization efforts are crucial for market growth as they reduce integration challenges and enable broader adoption. Simultaneously, regulatory frameworks are evolving to address grid connection requirements, energy market participation rules, and compensation mechanisms for V2G services. Companies are forming alliances to influence these standards and regulations in ways that align with their strategic interests.Expand Specific Solutions

Key V2G Industry Players

The Vehicle-to-Grid (V2G) market is currently in an early growth phase, characterized by increasing strategic alliances among key players to overcome technological barriers and establish market presence. The global V2G market is projected to expand significantly, with estimates suggesting a compound annual growth rate of 15-20% over the next five years. Technologically, the sector is transitioning from pilot projects to commercial deployment, with automotive manufacturers like Hyundai Mobis, Honda, Audi, and Volkswagen leading integration efforts. Technology companies such as Huawei and Qualcomm are advancing communication protocols, while energy specialists like Contemporary Amperex Technology are developing bidirectional charging solutions. Academic institutions including the University of Delaware and University of Luxembourg are contributing fundamental research, creating a competitive landscape where cross-industry partnerships are becoming essential for market leadership.

Volkswagen AG

Technical Solution: Volkswagen AG has developed a comprehensive Vehicle-to-Grid (V2G) ecosystem centered around their ID. family of electric vehicles. Their technical approach integrates bidirectional charging capabilities into their MEB platform, allowing vehicles to not only consume electricity but also feed it back to the grid when needed. Volkswagen's V2G solution includes smart energy management systems that optimize charging based on grid demands, electricity prices, and user preferences. The company has implemented ISO 15118 communication protocols to enable seamless interaction between vehicles and charging infrastructure[1]. Volkswagen has also partnered with energy providers across Europe to create a unified V2G network, deploying pilot programs in Germany, Netherlands, and the UK to demonstrate real-world applications. Their system incorporates predictive algorithms that analyze driving patterns, grid conditions, and energy markets to maximize both grid stability benefits and financial returns for vehicle owners.

Strengths: Volkswagen's extensive vehicle production capacity allows for rapid scaling of V2G technology across multiple markets. Their established partnerships with energy providers create a ready ecosystem for deployment. Weaknesses: The company faces challenges in standardization across different regional energy markets and must overcome consumer hesitation about battery degradation concerns related to bidirectional charging.

Robert Bosch GmbH

Technical Solution: Robert Bosch GmbH has engineered a sophisticated V2G technical solution that centers on their intelligent charging controller systems. Their approach integrates hardware and software components to enable bidirectional power flow between electric vehicles and the electrical grid. Bosch's system features advanced power electronics with silicon carbide semiconductors that achieve over 95% efficiency in bidirectional energy conversion[2]. Their charging infrastructure incorporates real-time communication protocols that comply with both CHAdeMO and CCS standards, allowing compatibility across multiple vehicle brands. The company has developed specialized Battery Management Systems (BMS) that monitor cell health during V2G operations to minimize degradation effects. Bosch's energy management platform uses machine learning algorithms to predict grid demand patterns and optimize vehicle charging/discharging schedules accordingly, creating value for both grid operators and vehicle owners through frequency regulation services and peak shaving capabilities.

Strengths: Bosch's extensive experience in automotive electronics and power systems provides them with superior integration capabilities across multiple vehicle platforms. Their technology achieves high efficiency in bidirectional power conversion. Weaknesses: Their solutions require significant infrastructure investment and face challenges in achieving cost-effectiveness for mass-market adoption in the short term.

Core V2G Technical Innovations

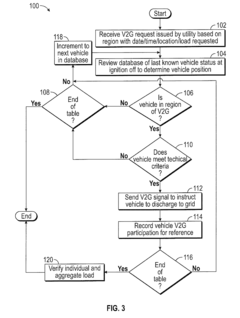

Priority based vehicle control strategy

PatentActiveUS20160075247A1

Innovation

- A method and system that prioritize V2G requests by determining which vehicles in a specific geographic region meet criteria established to reduce battery degradation, using historical and current data to select vehicles for participation, thereby limiting the number of charge and discharge cycles and extending the battery life.

Network-controlled charging system for electric vehicles

PatentInactiveEP2243060A1

Innovation

- A network-controlled charging system using Smartlets, which connect electric vehicles to a data control unit via a local area network and a server over a wide area network, enabling real-time communication for charge transfer, taxation, and Demand Response management, while allowing vehicle operators to pay for recharging and parking through mobile communication devices or payment stations.

V2G Business Models and Revenue Streams

The V2G market presents diverse business models that enable stakeholders to monetize bidirectional energy flow capabilities. The primary revenue model revolves around grid services, where EV owners receive compensation for providing ancillary services such as frequency regulation, demand response, and voltage support. Utility companies typically offer these payments based on availability (capacity payments) and actual energy transfer (energy payments), with rates varying by market conditions and regulatory frameworks.

Fleet operators represent another significant business model, aggregating multiple EVs to achieve scale economies and negotiate more favorable terms with grid operators. This aggregator model allows for the pooling of resources to meet minimum capacity requirements that individual vehicle owners cannot achieve independently. Companies like Nuvve and The Mobility House have pioneered this approach, managing fleets of school buses or corporate vehicles to provide grid services during idle periods.

Energy arbitrage presents an additional revenue stream, allowing EV owners to charge during low-price periods and discharge during peak demand when electricity prices are higher. This price differential creates profit opportunities, though the viability depends on regional electricity market structures and the presence of time-of-use pricing mechanisms.

Emerging subscription-based models are gaining traction, where EV owners pay a monthly fee for V2G equipment while receiving guaranteed returns from grid participation. This reduces upfront costs and provides predictable revenue streams for participants. Some innovative companies are exploring "V2G-as-a-Service" offerings that handle all technical aspects while sharing benefits with vehicle owners.

The integration with renewable energy generation creates additional value streams through self-consumption optimization and virtual power plant participation. EV batteries can store excess solar or wind production for later use or grid export, enhancing the economic proposition of distributed energy resources.

Regulatory frameworks significantly impact business model viability, with markets featuring capacity payments and clear participation rules showing faster V2G adoption. Countries like Denmark, the UK, and parts of the US with favorable regulatory environments have witnessed more robust business model innovation and commercial deployment.

As the market matures, hybrid models combining multiple revenue streams are emerging as the most sustainable approach, diversifying income sources and mitigating risks associated with any single market mechanism. The most successful implementations typically stack multiple value streams, combining grid services with energy arbitrage and renewable integration benefits.

Fleet operators represent another significant business model, aggregating multiple EVs to achieve scale economies and negotiate more favorable terms with grid operators. This aggregator model allows for the pooling of resources to meet minimum capacity requirements that individual vehicle owners cannot achieve independently. Companies like Nuvve and The Mobility House have pioneered this approach, managing fleets of school buses or corporate vehicles to provide grid services during idle periods.

Energy arbitrage presents an additional revenue stream, allowing EV owners to charge during low-price periods and discharge during peak demand when electricity prices are higher. This price differential creates profit opportunities, though the viability depends on regional electricity market structures and the presence of time-of-use pricing mechanisms.

Emerging subscription-based models are gaining traction, where EV owners pay a monthly fee for V2G equipment while receiving guaranteed returns from grid participation. This reduces upfront costs and provides predictable revenue streams for participants. Some innovative companies are exploring "V2G-as-a-Service" offerings that handle all technical aspects while sharing benefits with vehicle owners.

The integration with renewable energy generation creates additional value streams through self-consumption optimization and virtual power plant participation. EV batteries can store excess solar or wind production for later use or grid export, enhancing the economic proposition of distributed energy resources.

Regulatory frameworks significantly impact business model viability, with markets featuring capacity payments and clear participation rules showing faster V2G adoption. Countries like Denmark, the UK, and parts of the US with favorable regulatory environments have witnessed more robust business model innovation and commercial deployment.

As the market matures, hybrid models combining multiple revenue streams are emerging as the most sustainable approach, diversifying income sources and mitigating risks associated with any single market mechanism. The most successful implementations typically stack multiple value streams, combining grid services with energy arbitrage and renewable integration benefits.

Regulatory Framework and Grid Integration Standards

The regulatory landscape for Vehicle-to-Grid (V2G) technology remains fragmented globally, creating significant barriers to market development and strategic partnerships. In the United States, the Federal Energy Regulatory Commission (FERC) Order 2222 represents a watershed moment, enabling distributed energy resources, including electric vehicles, to participate in wholesale electricity markets. However, implementation varies considerably across regional transmission organizations, with PJM and CAISO leading in establishing frameworks that accommodate V2G services.

The European Union has developed more comprehensive standards through its Clean Energy Package, which explicitly recognizes energy storage as a distinct market activity. The European Committee for Electrotechnical Standardization (CENELEC) has established technical standards for grid connection requirements (EN 50549), creating a foundation for V2G integration. These standards have facilitated strategic alliances between automotive manufacturers and utility companies, particularly in markets like Denmark, the Netherlands, and the UK.

Grid integration standards present another critical dimension, with IEEE 1547-2018 serving as the primary technical standard for interconnecting distributed resources with electric power systems. This standard has been supplemented by SAE J3072, which specifically addresses the interconnection requirements for V2G-capable electric vehicles. The ISO 15118 standard further enables seamless communication between vehicles and charging infrastructure, supporting bidirectional power flow essential for V2G services.

Competitive dynamics in the V2G market are significantly influenced by these regulatory frameworks. Companies operating across multiple jurisdictions face compliance challenges that smaller, regionally-focused entities may avoid. This regulatory complexity has driven strategic alliances between automotive OEMs and energy market participants, as evidenced by partnerships between Nissan-Enel, BMW-PG&E, and Tesla-Octopus Energy.

Emerging markets present unique regulatory challenges. China's dual-credit policy for automotive manufacturers indirectly supports V2G development by incentivizing electric vehicle production, while its recent power market reforms create opportunities for V2G participation. However, the lack of specific V2G regulations creates uncertainty for market entrants and potential strategic partners.

The competitive landscape is further complicated by varying approaches to metering, settlement, and compensation mechanisms. California's Rule 21 and the UK's Balancing and Settlement Code modifications represent contrasting approaches to addressing these issues, with significant implications for market competition and alliance formation. Companies that can navigate these regulatory differences gain substantial competitive advantages in the evolving V2G marketplace.

The European Union has developed more comprehensive standards through its Clean Energy Package, which explicitly recognizes energy storage as a distinct market activity. The European Committee for Electrotechnical Standardization (CENELEC) has established technical standards for grid connection requirements (EN 50549), creating a foundation for V2G integration. These standards have facilitated strategic alliances between automotive manufacturers and utility companies, particularly in markets like Denmark, the Netherlands, and the UK.

Grid integration standards present another critical dimension, with IEEE 1547-2018 serving as the primary technical standard for interconnecting distributed resources with electric power systems. This standard has been supplemented by SAE J3072, which specifically addresses the interconnection requirements for V2G-capable electric vehicles. The ISO 15118 standard further enables seamless communication between vehicles and charging infrastructure, supporting bidirectional power flow essential for V2G services.

Competitive dynamics in the V2G market are significantly influenced by these regulatory frameworks. Companies operating across multiple jurisdictions face compliance challenges that smaller, regionally-focused entities may avoid. This regulatory complexity has driven strategic alliances between automotive OEMs and energy market participants, as evidenced by partnerships between Nissan-Enel, BMW-PG&E, and Tesla-Octopus Energy.

Emerging markets present unique regulatory challenges. China's dual-credit policy for automotive manufacturers indirectly supports V2G development by incentivizing electric vehicle production, while its recent power market reforms create opportunities for V2G participation. However, the lack of specific V2G regulations creates uncertainty for market entrants and potential strategic partners.

The competitive landscape is further complicated by varying approaches to metering, settlement, and compensation mechanisms. California's Rule 21 and the UK's Balancing and Settlement Code modifications represent contrasting approaches to addressing these issues, with significant implications for market competition and alliance formation. Companies that can navigate these regulatory differences gain substantial competitive advantages in the evolving V2G marketplace.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!