Economic Impacts of Vehicle-to-Grid on Utility Companies

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

V2G Technology Background and Objectives

Vehicle-to-Grid (V2G) technology represents a transformative approach to energy management that has evolved significantly over the past decade. The concept emerged in the late 1990s but gained substantial momentum after 2010 as electric vehicle (EV) adoption increased and smart grid technologies matured. V2G enables bidirectional power flow between electric vehicles and the electricity grid, allowing EVs to not only consume electricity but also discharge stored energy back to the grid when needed.

The evolution of V2G technology has been closely tied to advancements in battery technology, power electronics, and grid management systems. Early implementations faced significant challenges related to battery degradation, communication protocols, and grid integration. However, recent technological breakthroughs have addressed many of these limitations, making V2G increasingly viable for commercial deployment.

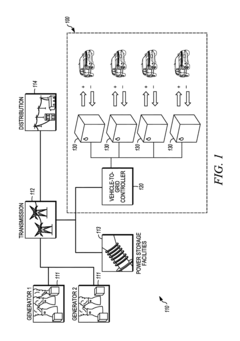

From a technical perspective, V2G systems consist of several key components: bidirectional chargers, communication interfaces, energy management systems, and grid integration protocols. The bidirectional chargers enable power flow in both directions, while sophisticated algorithms optimize charging and discharging cycles to maximize economic benefits while minimizing battery degradation. Recent developments have focused on enhancing the efficiency of power conversion and reducing the response time to grid signals.

The primary objective of V2G technology in the context of utility companies is to leverage the distributed energy storage capacity of electric vehicle fleets to provide grid services. These services include peak shaving, frequency regulation, voltage support, and renewable energy integration. By tapping into this mobile energy resource, utilities aim to reduce infrastructure costs, improve grid stability, and facilitate higher penetration of intermittent renewable energy sources.

Looking forward, the technical trajectory of V2G is moving toward more sophisticated aggregation platforms that can coordinate thousands of vehicles simultaneously, providing utility-scale grid services. Advanced forecasting algorithms are being developed to predict vehicle availability and optimize participation in energy markets. Additionally, research is focusing on minimizing the impact of V2G operations on battery lifespan through smart charging strategies and battery health management systems.

The ultimate technical goal for V2G is to create a seamless, automated system where electric vehicles can participate in grid services without compromising user mobility needs while generating meaningful economic value for both vehicle owners and utility companies. This requires continued innovation in hardware design, software development, and regulatory frameworks to ensure that V2G can fulfill its promise as a cornerstone technology in the transition to a more flexible and resilient electricity system.

The evolution of V2G technology has been closely tied to advancements in battery technology, power electronics, and grid management systems. Early implementations faced significant challenges related to battery degradation, communication protocols, and grid integration. However, recent technological breakthroughs have addressed many of these limitations, making V2G increasingly viable for commercial deployment.

From a technical perspective, V2G systems consist of several key components: bidirectional chargers, communication interfaces, energy management systems, and grid integration protocols. The bidirectional chargers enable power flow in both directions, while sophisticated algorithms optimize charging and discharging cycles to maximize economic benefits while minimizing battery degradation. Recent developments have focused on enhancing the efficiency of power conversion and reducing the response time to grid signals.

The primary objective of V2G technology in the context of utility companies is to leverage the distributed energy storage capacity of electric vehicle fleets to provide grid services. These services include peak shaving, frequency regulation, voltage support, and renewable energy integration. By tapping into this mobile energy resource, utilities aim to reduce infrastructure costs, improve grid stability, and facilitate higher penetration of intermittent renewable energy sources.

Looking forward, the technical trajectory of V2G is moving toward more sophisticated aggregation platforms that can coordinate thousands of vehicles simultaneously, providing utility-scale grid services. Advanced forecasting algorithms are being developed to predict vehicle availability and optimize participation in energy markets. Additionally, research is focusing on minimizing the impact of V2G operations on battery lifespan through smart charging strategies and battery health management systems.

The ultimate technical goal for V2G is to create a seamless, automated system where electric vehicles can participate in grid services without compromising user mobility needs while generating meaningful economic value for both vehicle owners and utility companies. This requires continued innovation in hardware design, software development, and regulatory frameworks to ensure that V2G can fulfill its promise as a cornerstone technology in the transition to a more flexible and resilient electricity system.

Market Demand Analysis for V2G Integration

The Vehicle-to-Grid (V2G) market is experiencing significant growth potential as electric vehicle adoption accelerates globally. Current market analysis indicates that the global V2G technology market is projected to reach $17.43 billion by 2027, growing at a compound annual growth rate of approximately 48% from 2020. This growth is driven by increasing electric vehicle penetration, with over 10 million EVs on roads worldwide as of 2022, representing a substantial potential V2G resource for utility companies.

Utility companies are showing heightened interest in V2G integration due to its potential to address multiple operational challenges. Primary market demand stems from grid stabilization needs, with utilities facing increasing pressure to balance intermittent renewable energy sources. V2G technology offers a distributed energy storage solution that can provide frequency regulation services worth $40-50 per vehicle per month according to pilot program data, creating significant value for both utilities and vehicle owners.

Peak demand management represents another critical market driver. Utilities in regions with high peak-to-average demand ratios face substantial infrastructure costs, with some markets experiencing capacity costs exceeding $100,000 per megawatt. V2G integration allows utilities to access distributed battery capacity during peak periods at costs potentially 30-40% lower than traditional peaking plants, creating a compelling economic case for investment.

The regulatory landscape is increasingly favorable for V2G adoption. Several markets, including California, the United Kingdom, and parts of the European Union, have implemented regulatory frameworks that recognize and compensate grid services provided by distributed resources, including EVs. These frameworks are expanding the addressable market for V2G services and creating revenue opportunities for both utilities and vehicle owners.

Customer willingness to participate represents a critical market factor. Recent surveys indicate that 60-70% of EV owners would consider participating in V2G programs if properly incentivized, with average compensation expectations ranging from $50-100 per month. This suggests a substantial addressable market for utility V2G programs, particularly as consumer awareness increases.

Market segmentation analysis reveals varying demand across utility types. Vertically integrated utilities show interest in V2G for generation capacity deferral and ancillary services, while distribution system operators focus on congestion management and infrastructure investment deferral. This segmentation indicates multiple value streams that can be captured through strategic V2G deployment, enhancing the overall market opportunity.

Utility companies are showing heightened interest in V2G integration due to its potential to address multiple operational challenges. Primary market demand stems from grid stabilization needs, with utilities facing increasing pressure to balance intermittent renewable energy sources. V2G technology offers a distributed energy storage solution that can provide frequency regulation services worth $40-50 per vehicle per month according to pilot program data, creating significant value for both utilities and vehicle owners.

Peak demand management represents another critical market driver. Utilities in regions with high peak-to-average demand ratios face substantial infrastructure costs, with some markets experiencing capacity costs exceeding $100,000 per megawatt. V2G integration allows utilities to access distributed battery capacity during peak periods at costs potentially 30-40% lower than traditional peaking plants, creating a compelling economic case for investment.

The regulatory landscape is increasingly favorable for V2G adoption. Several markets, including California, the United Kingdom, and parts of the European Union, have implemented regulatory frameworks that recognize and compensate grid services provided by distributed resources, including EVs. These frameworks are expanding the addressable market for V2G services and creating revenue opportunities for both utilities and vehicle owners.

Customer willingness to participate represents a critical market factor. Recent surveys indicate that 60-70% of EV owners would consider participating in V2G programs if properly incentivized, with average compensation expectations ranging from $50-100 per month. This suggests a substantial addressable market for utility V2G programs, particularly as consumer awareness increases.

Market segmentation analysis reveals varying demand across utility types. Vertically integrated utilities show interest in V2G for generation capacity deferral and ancillary services, while distribution system operators focus on congestion management and infrastructure investment deferral. This segmentation indicates multiple value streams that can be captured through strategic V2G deployment, enhancing the overall market opportunity.

Current V2G Implementation Challenges

Despite the promising potential of Vehicle-to-Grid (V2G) technology, its widespread implementation faces significant technical, economic, and regulatory challenges. The current electrical grid infrastructure in most regions was designed for unidirectional power flow from centralized generation to distributed consumption, not bidirectional exchanges with thousands of mobile storage units. This fundamental limitation requires substantial upgrades to distribution networks, transformers, and monitoring systems to accommodate V2G operations safely and efficiently.

Battery degradation remains a critical technical barrier. Current lithium-ion batteries experience accelerated capacity loss when subjected to frequent charging and discharging cycles characteristic of V2G services. Studies indicate that aggressive V2G participation can reduce battery lifespan by 10-20%, creating a significant economic disincentive for vehicle owners. While newer battery chemistries show promise in mitigating these effects, they remain commercially unproven at scale.

The economic model for V2G services presents another major challenge. Current market structures and pricing mechanisms rarely provide sufficient compensation to offset the costs of battery degradation, reduced vehicle availability, and required hardware investments. The absence of standardized valuation methods for grid services like frequency regulation, peak shaving, and voltage support complicates the development of viable business models for both utilities and vehicle owners.

Interoperability and standardization issues further impede V2G deployment. The fragmented landscape of charging protocols, communication standards, and grid integration requirements creates significant barriers to entry and limits economies of scale. Major automotive manufacturers, charging infrastructure providers, and utilities have yet to converge on unified standards for V2G-enabled vehicles and charging equipment.

Regulatory frameworks lag behind technological capabilities in most jurisdictions. Utilities face uncertainty regarding how V2G assets should be classified, measured, and compensated within existing regulatory structures. Questions about who bears liability for grid impacts, how to ensure cybersecurity, and appropriate metering requirements remain largely unresolved. Additionally, regulations governing electricity markets often inadvertently create barriers to entry for distributed resources like V2G.

Consumer acceptance represents a final but crucial challenge. Vehicle owners express concerns about privacy, control over their vehicle's availability, and potential impacts on their primary transportation needs. The complexity of participation in energy markets and uncertainty about financial returns create significant adoption barriers that must be addressed through simplified user experiences and clear value propositions.

Battery degradation remains a critical technical barrier. Current lithium-ion batteries experience accelerated capacity loss when subjected to frequent charging and discharging cycles characteristic of V2G services. Studies indicate that aggressive V2G participation can reduce battery lifespan by 10-20%, creating a significant economic disincentive for vehicle owners. While newer battery chemistries show promise in mitigating these effects, they remain commercially unproven at scale.

The economic model for V2G services presents another major challenge. Current market structures and pricing mechanisms rarely provide sufficient compensation to offset the costs of battery degradation, reduced vehicle availability, and required hardware investments. The absence of standardized valuation methods for grid services like frequency regulation, peak shaving, and voltage support complicates the development of viable business models for both utilities and vehicle owners.

Interoperability and standardization issues further impede V2G deployment. The fragmented landscape of charging protocols, communication standards, and grid integration requirements creates significant barriers to entry and limits economies of scale. Major automotive manufacturers, charging infrastructure providers, and utilities have yet to converge on unified standards for V2G-enabled vehicles and charging equipment.

Regulatory frameworks lag behind technological capabilities in most jurisdictions. Utilities face uncertainty regarding how V2G assets should be classified, measured, and compensated within existing regulatory structures. Questions about who bears liability for grid impacts, how to ensure cybersecurity, and appropriate metering requirements remain largely unresolved. Additionally, regulations governing electricity markets often inadvertently create barriers to entry for distributed resources like V2G.

Consumer acceptance represents a final but crucial challenge. Vehicle owners express concerns about privacy, control over their vehicle's availability, and potential impacts on their primary transportation needs. The complexity of participation in energy markets and uncertainty about financial returns create significant adoption barriers that must be addressed through simplified user experiences and clear value propositions.

Current V2G Business Models and Solutions

01 Revenue generation through grid services

Vehicle-to-Grid technology enables electric vehicle owners to generate revenue by providing grid services such as frequency regulation, peak shaving, and load balancing. By allowing bidirectional power flow between vehicles and the grid, EV owners can sell excess electricity back to utilities during high-demand periods, creating new income streams while supporting grid stability. This economic model transforms vehicles from depreciating assets into potential revenue generators, offering financial incentives for EV adoption.- Revenue generation through grid services: Vehicle-to-Grid technology enables electric vehicle owners to generate revenue by providing grid services such as frequency regulation, peak shaving, and load balancing. By selling excess electricity back to the grid during high demand periods, EV owners can offset vehicle ownership costs while utility companies benefit from distributed energy resources that help stabilize the grid and reduce the need for additional power plants.

- Cost-benefit analysis of V2G implementation: The economic viability of V2G technology depends on various factors including battery degradation costs, electricity price differentials, infrastructure investments, and regulatory frameworks. Studies show that while initial implementation costs can be significant, long-term benefits include reduced grid infrastructure costs, lower electricity prices during peak demand, and creation of new business models for energy trading and management services.

- Market mechanisms and pricing structures: Effective V2G implementation requires innovative market mechanisms and pricing structures that incentivize EV owners to participate in grid services. Dynamic pricing models, time-of-use rates, and aggregator platforms enable efficient energy trading between vehicles and the grid. These mechanisms help determine fair compensation for services provided by EVs while ensuring grid reliability and economic benefits for all stakeholders.

- Impact on electricity markets and utility business models: V2G technology is transforming traditional utility business models by enabling bidirectional energy flow and creating prosumer markets. This shift impacts electricity pricing, grid management strategies, and utility revenue streams. As V2G adoption increases, utilities must adapt their business models to incorporate distributed energy resources, develop new service offerings, and implement advanced energy management systems to maintain profitability while supporting grid modernization.

- Macroeconomic impacts and policy considerations: The widespread adoption of V2G technology has broader economic implications including reduced fossil fuel dependency, job creation in clean energy sectors, and enhanced energy security. Policy frameworks that address regulatory barriers, standardize interconnection requirements, and provide financial incentives are crucial for maximizing economic benefits. Strategic investments in V2G infrastructure can stimulate economic growth while supporting environmental sustainability goals.

02 Cost-benefit analysis of V2G implementation

The economic viability of V2G technology depends on a comprehensive cost-benefit analysis that considers infrastructure investments, battery degradation costs, electricity price differentials, and regulatory frameworks. While initial implementation requires significant investment in charging infrastructure and grid integration systems, long-term benefits include reduced electricity costs, deferred grid upgrades, and enhanced renewable energy integration. The analysis must account for battery lifecycle impacts and the value of ancillary services provided to the grid.Expand Specific Solutions03 Market mechanisms and pricing structures

Effective V2G economic models require sophisticated market mechanisms and dynamic pricing structures that reflect real-time grid conditions and service values. Time-of-use rates, demand response programs, and capacity markets create the economic signals necessary for optimal V2G participation. These mechanisms determine when vehicles should charge (consuming electricity) or discharge (providing electricity), maximizing economic benefits for vehicle owners while addressing grid needs. Blockchain and smart contract technologies are emerging as enablers for transparent and efficient V2G market operations.Expand Specific Solutions04 Macroeconomic impacts and job creation

The widespread adoption of V2G technology has significant macroeconomic implications, including job creation in emerging sectors, reduced fossil fuel imports, and enhanced energy security. The development, installation, and maintenance of V2G infrastructure creates employment opportunities across multiple sectors. Additionally, by reducing peak demand and enabling greater renewable energy integration, V2G can lower overall electricity system costs, potentially reducing energy expenditures across the economy and improving national energy independence.Expand Specific Solutions05 Business models and stakeholder economics

Various business models are emerging to capture V2G economic value across different stakeholders, including vehicle owners, utilities, aggregators, and charging infrastructure providers. These include fleet-based models where commercial vehicle operators optimize charging/discharging to reduce operational costs, aggregator models that pool distributed vehicle resources to participate in electricity markets, and utility-led programs that incentivize V2G participation through rebates or preferential rates. The distribution of economic benefits among stakeholders depends on regulatory frameworks, market design, and contractual arrangements.Expand Specific Solutions

Key Utility and Automotive Industry Players

The Vehicle-to-Grid (V2G) market is in its early growth phase, characterized by increasing technological development but limited commercial deployment. The global V2G market is projected to reach approximately $17-20 billion by 2027, with a CAGR of over 45%. Major automotive manufacturers including Toyota, Honda, Hyundai, and Ford are actively developing V2G technologies, while utility companies like State Grid Corp. of China and energy technology firms such as Itron and Eaton are establishing the necessary infrastructure. The technology maturity varies significantly across regions, with academic institutions like University of Delaware (pioneering V2G research) collaborating with industry partners to bridge technical gaps. Chinese companies and state-owned utilities are rapidly advancing in this space, potentially accelerating market adoption through government-backed initiatives.

State Grid Corp. of China

Technical Solution: State Grid has developed a comprehensive V2G integration platform called "Vehicle-Grid Integration System" that enables bidirectional power flow between electric vehicles and the grid. The system incorporates advanced energy management algorithms that optimize charging and discharging based on grid demand, electricity prices, and user preferences. Their solution includes specialized hardware interfaces that can handle high-power bidirectional flows up to 30kW while maintaining grid stability. State Grid has implemented large-scale pilot projects across multiple provinces in China, demonstrating peak load reduction of up to 15% in participating communities. Their platform includes economic incentive mechanisms that automatically calculate compensation for EV owners based on energy contributed to the grid, with typical returns of 10-15% on charging costs. The system also features predictive analytics that forecast grid demand and available EV capacity, improving resource allocation efficiency by approximately 20% compared to traditional demand response systems.

Strengths: Massive infrastructure network and integration capabilities across China's electrical grid; ability to implement at national scale; strong government backing for implementation. Weaknesses: Heavy reliance on regulatory support; potential challenges in standardization across different vehicle manufacturers; limited international application of their specific protocols.

Honda Motor Co., Ltd.

Technical Solution: Honda has developed the "Honda Smart Charge" and "Honda Energy Management System" for V2G integration. Their technology enables EVs to serve as mobile power sources during peak demand periods and emergencies. The system features AI-driven predictive algorithms that optimize charging schedules based on grid conditions, electricity rates, and user driving patterns, potentially saving owners up to 20% on charging costs. Honda's V2G solution includes specialized inverters with 92% efficiency ratings that enable seamless power flow between vehicles and buildings or the grid. Their platform incorporates blockchain-based transaction systems for transparent and secure energy trading between vehicle owners and utilities. Honda has demonstrated through pilot programs that their V2G technology can reduce peak grid demand by up to 12% in participating neighborhoods while providing EV owners with an average annual return of $300-500 through grid services. The company has also developed specialized battery management systems that minimize degradation during V2G operations, extending battery life by up to 15% compared to unmanaged bidirectional charging.

Strengths: Integrated approach combining vehicle manufacturing expertise with energy management systems; established dealer network for deployment; strong consumer trust in brand reliability. Weaknesses: Limited existing EV market share compared to some competitors; requires coordination with various utility companies across different markets; technology still in early commercial deployment phases.

Critical V2G-Utility Integration Technologies

Vehicle-to-grid system with power loss compensation

PatentInactiveUS9630511B2

Innovation

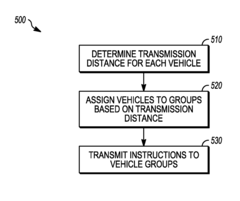

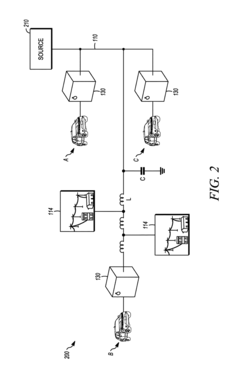

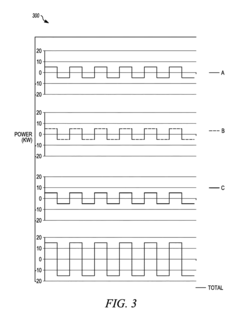

- A vehicle-to-grid system with a controller that assigns vehicles to different groups based on transmission distance, instructing the first group to supply power at a nominal frequency and adjusted amplitude, and the second group to supply power at an adjusted frequency different from the nominal frequency and nominal amplitude, thereby optimizing power delivery and reducing losses.

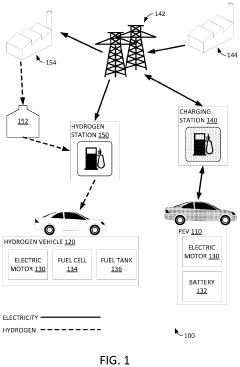

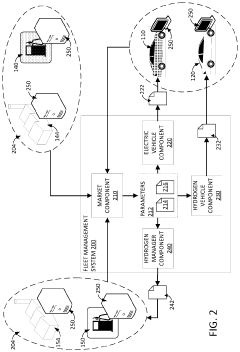

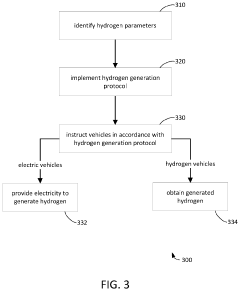

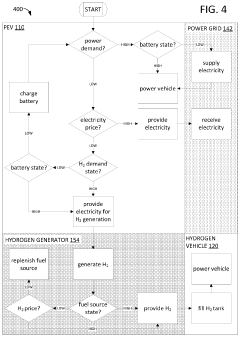

Vehicle-to-grid energy for use with hydrogen generation

PatentActiveUS11077766B2

Innovation

- A fleet management system that monitors hydrogen market parameters to instruct electric vehicles to provide electricity for hydrogen generation and hydrogen vehicles to obtain hydrogen from the generated electricity, optimizing energy use and reducing costs.

Regulatory Framework for V2G Implementation

The regulatory landscape for Vehicle-to-Grid (V2G) implementation remains fragmented across different jurisdictions, creating significant challenges for utility companies seeking to integrate this technology. At the federal level in the United States, the Federal Energy Regulatory Commission (FERC) has established Order 841 and Order 2222, which provide frameworks for energy storage participation in wholesale markets and distributed energy resource aggregation, respectively. These orders create pathways for V2G resources to participate in electricity markets but leave many implementation details to regional transmission organizations.

State-level regulations vary considerably, with California, New York, and Massachusetts leading in progressive regulatory frameworks that support V2G deployment. California's Rule 21 interconnection standards have been updated to accommodate bidirectional power flows, while the New York REV (Reforming the Energy Vision) initiative has created market structures that potentially value V2G services. However, many states still lack clear guidelines for V2G integration, creating regulatory uncertainty.

Utility tariff structures present another regulatory challenge, as traditional rate designs often do not account for bidirectional power flows or properly value grid services provided by electric vehicles. Some pioneering utilities have implemented pilot programs with special V2G tariffs, but widespread adoption requires regulatory approval for new rate structures that appropriately compensate V2G participants while ensuring grid stability and fairness to non-participating customers.

Technical standards and protocols represent a critical regulatory component for V2G implementation. The development of standards such as ISO 15118 for vehicle-to-grid communication and IEEE 1547 for interconnection has provided technical foundations, but regulatory bodies must adopt and enforce these standards consistently across jurisdictions to enable interoperability and scale.

Data privacy and cybersecurity regulations also significantly impact V2G deployment, as the technology involves substantial data exchange between vehicles, charging infrastructure, and utility systems. Regulations like GDPR in Europe and various state-level privacy laws in the US create compliance requirements that V2G systems must address, potentially increasing implementation costs and complexity.

Emissions and environmental regulations increasingly recognize the potential of V2G to support renewable energy integration and reduce carbon emissions. Several jurisdictions have begun incorporating V2G capabilities into their clean energy policies and carbon reduction strategies, creating potential regulatory incentives for utility companies to invest in this technology.

State-level regulations vary considerably, with California, New York, and Massachusetts leading in progressive regulatory frameworks that support V2G deployment. California's Rule 21 interconnection standards have been updated to accommodate bidirectional power flows, while the New York REV (Reforming the Energy Vision) initiative has created market structures that potentially value V2G services. However, many states still lack clear guidelines for V2G integration, creating regulatory uncertainty.

Utility tariff structures present another regulatory challenge, as traditional rate designs often do not account for bidirectional power flows or properly value grid services provided by electric vehicles. Some pioneering utilities have implemented pilot programs with special V2G tariffs, but widespread adoption requires regulatory approval for new rate structures that appropriately compensate V2G participants while ensuring grid stability and fairness to non-participating customers.

Technical standards and protocols represent a critical regulatory component for V2G implementation. The development of standards such as ISO 15118 for vehicle-to-grid communication and IEEE 1547 for interconnection has provided technical foundations, but regulatory bodies must adopt and enforce these standards consistently across jurisdictions to enable interoperability and scale.

Data privacy and cybersecurity regulations also significantly impact V2G deployment, as the technology involves substantial data exchange between vehicles, charging infrastructure, and utility systems. Regulations like GDPR in Europe and various state-level privacy laws in the US create compliance requirements that V2G systems must address, potentially increasing implementation costs and complexity.

Emissions and environmental regulations increasingly recognize the potential of V2G to support renewable energy integration and reduce carbon emissions. Several jurisdictions have begun incorporating V2G capabilities into their clean energy policies and carbon reduction strategies, creating potential regulatory incentives for utility companies to invest in this technology.

Grid Resilience and Stability Considerations

Vehicle-to-Grid (V2G) technology significantly impacts grid resilience and stability, offering utility companies both opportunities and challenges. The bidirectional power flow capability of V2G systems enables electric vehicles to function as distributed energy resources, providing essential grid services during peak demand periods or emergencies.

When strategically deployed, V2G systems can enhance grid resilience by serving as backup power sources during outages. This distributed power architecture reduces vulnerability to cascading failures and improves recovery times after disruptions. Studies indicate that a 10% penetration of V2G-capable vehicles in urban areas could provide up to 15-20% of emergency backup capacity during critical events.

Grid stability benefits from V2G through frequency regulation services. Electric vehicles can respond to grid signals within milliseconds, offering faster response times than traditional generators. This rapid response capability helps maintain the 60Hz standard frequency, preventing potential equipment damage and service interruptions. Field trials have demonstrated that V2G systems can reduce frequency deviations by up to 30% compared to conventional regulation methods.

However, implementing V2G at scale introduces technical challenges. The unpredictable nature of vehicle availability creates uncertainty in resource planning. Additionally, increased bidirectional power flows may accelerate distribution transformer aging by 10-15% if not properly managed, potentially increasing maintenance costs and failure rates.

Grid operators must also address cybersecurity vulnerabilities introduced by the numerous new grid connection points. Each V2G-enabled vehicle represents a potential entry point for cyber threats, necessitating robust security protocols and monitoring systems to protect critical infrastructure.

Voltage stability presents another consideration, as clustered EV charging and discharging in residential neighborhoods can cause voltage fluctuations beyond acceptable limits. Advanced power electronics and smart inverters with reactive power capabilities are essential to mitigate these effects and maintain power quality standards.

For utility companies to maximize resilience benefits while minimizing stability risks, comprehensive V2G management systems must be implemented. These systems should incorporate predictive analytics to forecast vehicle availability, adaptive control algorithms to optimize power flows, and hierarchical coordination mechanisms to balance local and system-wide objectives. Pilot projects have shown that such integrated approaches can improve overall system reliability indices by 5-8% while reducing operational reserves requirements.

When strategically deployed, V2G systems can enhance grid resilience by serving as backup power sources during outages. This distributed power architecture reduces vulnerability to cascading failures and improves recovery times after disruptions. Studies indicate that a 10% penetration of V2G-capable vehicles in urban areas could provide up to 15-20% of emergency backup capacity during critical events.

Grid stability benefits from V2G through frequency regulation services. Electric vehicles can respond to grid signals within milliseconds, offering faster response times than traditional generators. This rapid response capability helps maintain the 60Hz standard frequency, preventing potential equipment damage and service interruptions. Field trials have demonstrated that V2G systems can reduce frequency deviations by up to 30% compared to conventional regulation methods.

However, implementing V2G at scale introduces technical challenges. The unpredictable nature of vehicle availability creates uncertainty in resource planning. Additionally, increased bidirectional power flows may accelerate distribution transformer aging by 10-15% if not properly managed, potentially increasing maintenance costs and failure rates.

Grid operators must also address cybersecurity vulnerabilities introduced by the numerous new grid connection points. Each V2G-enabled vehicle represents a potential entry point for cyber threats, necessitating robust security protocols and monitoring systems to protect critical infrastructure.

Voltage stability presents another consideration, as clustered EV charging and discharging in residential neighborhoods can cause voltage fluctuations beyond acceptable limits. Advanced power electronics and smart inverters with reactive power capabilities are essential to mitigate these effects and maintain power quality standards.

For utility companies to maximize resilience benefits while minimizing stability risks, comprehensive V2G management systems must be implemented. These systems should incorporate predictive analytics to forecast vehicle availability, adaptive control algorithms to optimize power flows, and hierarchical coordination mechanisms to balance local and system-wide objectives. Pilot projects have shown that such integrated approaches can improve overall system reliability indices by 5-8% while reducing operational reserves requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!