Vehicle-to-Grid Impact on Energy Infrastructure Modernization

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

V2G Technology Background and Objectives

Vehicle-to-Grid (V2G) technology represents a paradigm shift in how we conceptualize the relationship between electric vehicles and the power grid. Emerging in the early 2000s through pioneering work at the University of Delaware, V2G has evolved from theoretical concept to practical implementation over the past two decades. The fundamental premise involves bidirectional energy flow between electric vehicles and the electrical grid, transforming vehicles from mere consumers to potential energy storage and supply units.

The evolution of V2G technology has been closely tied to advancements in battery technology, power electronics, and grid management systems. Early V2G systems faced significant limitations in terms of battery degradation concerns and limited communication protocols. However, recent technological breakthroughs in battery chemistry, particularly with lithium-ion and emerging solid-state batteries, have substantially mitigated degradation issues while extending cycle life.

Current V2G development focuses on three primary technological trajectories: unidirectional V1G (managed charging), bidirectional V2G (full power exchange), and V2X applications (including Vehicle-to-Home and Vehicle-to-Building). Each pathway represents increasing levels of integration complexity but also expanded functionality and grid service potential.

The primary technical objectives of V2G implementation center around enhancing grid stability, optimizing renewable energy integration, and creating new value streams for EV owners. Specifically, V2G aims to provide frequency regulation, peak shaving, and load balancing services to grid operators while offering financial incentives to vehicle owners through participation in energy markets.

Looking forward, V2G technology development is trending toward standardization of communication protocols (such as ISO 15118), enhanced cybersecurity frameworks, and seamless integration with smart grid infrastructure. The ultimate goal is to create a distributed energy resource network where millions of electric vehicles can collectively function as a massive, flexible battery system for the grid.

The technical challenges being addressed include minimizing battery degradation from bidirectional charging, reducing round-trip efficiency losses, developing sophisticated aggregation software platforms, and creating regulatory frameworks that properly value grid services. Recent pilot projects across North America, Europe, and East Asia have demonstrated promising results, with some showing frequency regulation response times superior to traditional power plants.

As renewable energy penetration increases globally, V2G technology is positioned to become a critical enabler of grid modernization by providing the flexibility and storage capacity needed to accommodate intermittent generation sources like wind and solar power.

The evolution of V2G technology has been closely tied to advancements in battery technology, power electronics, and grid management systems. Early V2G systems faced significant limitations in terms of battery degradation concerns and limited communication protocols. However, recent technological breakthroughs in battery chemistry, particularly with lithium-ion and emerging solid-state batteries, have substantially mitigated degradation issues while extending cycle life.

Current V2G development focuses on three primary technological trajectories: unidirectional V1G (managed charging), bidirectional V2G (full power exchange), and V2X applications (including Vehicle-to-Home and Vehicle-to-Building). Each pathway represents increasing levels of integration complexity but also expanded functionality and grid service potential.

The primary technical objectives of V2G implementation center around enhancing grid stability, optimizing renewable energy integration, and creating new value streams for EV owners. Specifically, V2G aims to provide frequency regulation, peak shaving, and load balancing services to grid operators while offering financial incentives to vehicle owners through participation in energy markets.

Looking forward, V2G technology development is trending toward standardization of communication protocols (such as ISO 15118), enhanced cybersecurity frameworks, and seamless integration with smart grid infrastructure. The ultimate goal is to create a distributed energy resource network where millions of electric vehicles can collectively function as a massive, flexible battery system for the grid.

The technical challenges being addressed include minimizing battery degradation from bidirectional charging, reducing round-trip efficiency losses, developing sophisticated aggregation software platforms, and creating regulatory frameworks that properly value grid services. Recent pilot projects across North America, Europe, and East Asia have demonstrated promising results, with some showing frequency regulation response times superior to traditional power plants.

As renewable energy penetration increases globally, V2G technology is positioned to become a critical enabler of grid modernization by providing the flexibility and storage capacity needed to accommodate intermittent generation sources like wind and solar power.

Market Demand Analysis for V2G Solutions

The Vehicle-to-Grid (V2G) market is experiencing significant growth driven by the convergence of renewable energy integration, grid modernization initiatives, and the rapid expansion of electric vehicle (EV) adoption worldwide. Current market projections indicate that the global V2G technology market is expected to grow from approximately $1.5 billion in 2023 to $17.4 billion by 2030, representing a compound annual growth rate (CAGR) of 41.8% during this forecast period.

Primary demand drivers for V2G solutions stem from multiple stakeholders across the energy ecosystem. Utility companies are increasingly seeking cost-effective alternatives to traditional grid infrastructure investments, with V2G offering potential savings of 30-40% compared to conventional grid upgrades in certain applications. For EV owners, V2G presents an opportunity to monetize their vehicle batteries when idle, with studies suggesting potential annual revenue of $1,000-2,500 per vehicle depending on market conditions and participation levels.

Commercial fleet operators represent another significant market segment, with organizations operating large EV fleets positioned to generate substantial returns through coordinated V2G programs. Early pilot programs with delivery companies have demonstrated energy cost reductions of 15-20% through strategic bidirectional charging implementation.

Geographically, Europe currently leads V2G market development, accounting for approximately 45% of global implementations, followed by North America (30%) and Asia-Pacific (20%). This distribution correlates strongly with supportive regulatory frameworks and grid modernization initiatives. Countries with aggressive renewable energy targets show particularly strong demand for V2G solutions as grid operators seek flexibility mechanisms to manage intermittent generation.

Market research indicates several key customer segments with distinct needs: residential consumers (seeking cost savings and energy independence), commercial/industrial users (focused on demand charge reduction and backup power), and utility/grid operators (requiring grid services and peak management). The residential segment is projected to grow fastest at 48% CAGR through 2030, though commercial applications currently represent the largest market share at 52%.

Demand-side challenges include consumer awareness gaps, concerns about battery degradation, and high initial infrastructure costs. However, these barriers are gradually diminishing as technology advances and successful demonstration projects validate the business case. Recent surveys indicate that 65% of EV owners would consider V2G participation if compensated appropriately, suggesting significant untapped market potential as awareness increases and technology matures.

Primary demand drivers for V2G solutions stem from multiple stakeholders across the energy ecosystem. Utility companies are increasingly seeking cost-effective alternatives to traditional grid infrastructure investments, with V2G offering potential savings of 30-40% compared to conventional grid upgrades in certain applications. For EV owners, V2G presents an opportunity to monetize their vehicle batteries when idle, with studies suggesting potential annual revenue of $1,000-2,500 per vehicle depending on market conditions and participation levels.

Commercial fleet operators represent another significant market segment, with organizations operating large EV fleets positioned to generate substantial returns through coordinated V2G programs. Early pilot programs with delivery companies have demonstrated energy cost reductions of 15-20% through strategic bidirectional charging implementation.

Geographically, Europe currently leads V2G market development, accounting for approximately 45% of global implementations, followed by North America (30%) and Asia-Pacific (20%). This distribution correlates strongly with supportive regulatory frameworks and grid modernization initiatives. Countries with aggressive renewable energy targets show particularly strong demand for V2G solutions as grid operators seek flexibility mechanisms to manage intermittent generation.

Market research indicates several key customer segments with distinct needs: residential consumers (seeking cost savings and energy independence), commercial/industrial users (focused on demand charge reduction and backup power), and utility/grid operators (requiring grid services and peak management). The residential segment is projected to grow fastest at 48% CAGR through 2030, though commercial applications currently represent the largest market share at 52%.

Demand-side challenges include consumer awareness gaps, concerns about battery degradation, and high initial infrastructure costs. However, these barriers are gradually diminishing as technology advances and successful demonstration projects validate the business case. Recent surveys indicate that 65% of EV owners would consider V2G participation if compensated appropriately, suggesting significant untapped market potential as awareness increases and technology matures.

V2G Technical Challenges and Global Development Status

Vehicle-to-Grid (V2G) technology faces several significant technical challenges that have impacted its global adoption rate. One primary challenge is bidirectional charging infrastructure, which requires specialized hardware capable of managing power flow in both directions while maintaining grid stability. Current charging stations predominantly support unidirectional power flow, necessitating substantial infrastructure upgrades to accommodate V2G capabilities.

Battery degradation presents another critical concern. The additional charging and discharging cycles imposed by V2G operations can potentially accelerate battery wear, reducing the overall lifespan of electric vehicle (EV) batteries. This creates hesitation among vehicle manufacturers and owners regarding participation in V2G programs without adequate compensation mechanisms for battery depreciation.

Communication protocols and standardization remain fragmented globally. Different regions have developed varying technical standards for V2G integration, creating interoperability challenges across international markets. The lack of unified protocols hampers seamless integration between vehicles, charging infrastructure, and grid management systems.

From a development perspective, V2G technology has seen uneven global adoption. Europe leads implementation efforts, with Denmark, the Netherlands, and the UK pioneering commercial V2G projects. The European Union has established regulatory frameworks specifically addressing V2G integration, facilitating market development. These countries have moved beyond pilot projects to limited commercial deployments, particularly in fleet applications.

North America shows strong research activity but more limited commercial deployment. California and New York have implemented regulatory incentives for V2G, while utilities in these regions conduct demonstration projects to evaluate grid benefits. However, widespread commercial adoption remains constrained by regulatory complexity and market structure challenges.

In Asia, Japan stands as an early V2G pioneer through Nissan's initiatives with the LEAF model. China has incorporated V2G into its national electrification strategy, leveraging its manufacturing capabilities to develop compatible hardware. South Korea has focused on integrating V2G with renewable energy systems, particularly solar installations.

Globally, V2G development correlates strongly with regions experiencing high renewable energy penetration, as these areas benefit most from the grid-balancing capabilities V2G provides. Island nations and regions with isolated grids, such as Hawaii and parts of Australia, have shown particular interest in V2G as a solution for grid stability challenges associated with intermittent renewable generation.

Battery degradation presents another critical concern. The additional charging and discharging cycles imposed by V2G operations can potentially accelerate battery wear, reducing the overall lifespan of electric vehicle (EV) batteries. This creates hesitation among vehicle manufacturers and owners regarding participation in V2G programs without adequate compensation mechanisms for battery depreciation.

Communication protocols and standardization remain fragmented globally. Different regions have developed varying technical standards for V2G integration, creating interoperability challenges across international markets. The lack of unified protocols hampers seamless integration between vehicles, charging infrastructure, and grid management systems.

From a development perspective, V2G technology has seen uneven global adoption. Europe leads implementation efforts, with Denmark, the Netherlands, and the UK pioneering commercial V2G projects. The European Union has established regulatory frameworks specifically addressing V2G integration, facilitating market development. These countries have moved beyond pilot projects to limited commercial deployments, particularly in fleet applications.

North America shows strong research activity but more limited commercial deployment. California and New York have implemented regulatory incentives for V2G, while utilities in these regions conduct demonstration projects to evaluate grid benefits. However, widespread commercial adoption remains constrained by regulatory complexity and market structure challenges.

In Asia, Japan stands as an early V2G pioneer through Nissan's initiatives with the LEAF model. China has incorporated V2G into its national electrification strategy, leveraging its manufacturing capabilities to develop compatible hardware. South Korea has focused on integrating V2G with renewable energy systems, particularly solar installations.

Globally, V2G development correlates strongly with regions experiencing high renewable energy penetration, as these areas benefit most from the grid-balancing capabilities V2G provides. Island nations and regions with isolated grids, such as Hawaii and parts of Australia, have shown particular interest in V2G as a solution for grid stability challenges associated with intermittent renewable generation.

Current V2G Implementation Approaches

01 V2G Integration with Power Grid Infrastructure

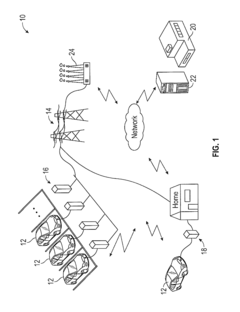

Vehicle-to-Grid technology enables bidirectional power flow between electric vehicles and the power grid, allowing EVs to serve as distributed energy resources. This integration requires modernized grid infrastructure with advanced communication systems to manage power flow, optimize grid stability, and balance supply and demand. The technology helps utilities manage peak loads, provide ancillary services, and improve overall grid resilience through coordinated charging and discharging of connected vehicles.- V2G Integration with Power Grid Infrastructure: Vehicle-to-Grid technology enables bidirectional power flow between electric vehicles and the power grid, allowing EVs to serve as distributed energy resources. This integration requires modernized grid infrastructure with advanced communication systems, smart meters, and grid management software to coordinate charging and discharging operations. The technology helps balance grid loads, provide ancillary services, and improve overall grid stability during peak demand periods.

- Smart Charging and Energy Management Systems: Advanced energy management systems optimize V2G operations by determining when to charge vehicles and when to feed power back to the grid based on electricity prices, grid demand, and user preferences. These systems incorporate machine learning algorithms to predict energy needs, grid conditions, and vehicle availability patterns. Smart charging infrastructure includes intelligent charging stations that can communicate with both vehicles and grid operators to execute optimal charging/discharging strategies.

- V2G Market Mechanisms and Economic Models: Economic frameworks and market mechanisms enable V2G participants to monetize their vehicle battery capacity by providing grid services. These include dynamic pricing models, aggregator business models that pool multiple vehicles into virtual power plants, and blockchain-based peer-to-peer energy trading platforms. Regulatory frameworks and incentive structures are being developed to compensate EV owners for battery degradation and encourage participation in V2G programs.

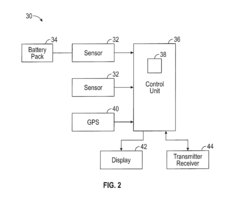

- V2G Hardware and Battery Management Technology: Specialized hardware components enable safe and efficient bidirectional power flow between vehicles and the grid. These include bidirectional inverters, advanced battery management systems that monitor state of charge and health, and communication interfaces that comply with grid interoperability standards. Technologies to minimize battery degradation during V2G operations are critical, including thermal management systems and sophisticated charging algorithms that optimize battery longevity while providing grid services.

- Renewable Energy Integration with V2G Systems: V2G technology facilitates greater integration of intermittent renewable energy sources like solar and wind into the power grid. Electric vehicles can store excess renewable energy during high production periods and discharge it during low production periods, effectively serving as mobile energy storage units. This integration requires sophisticated forecasting tools for renewable generation, coordinated charging infrastructure at renewable generation sites, and grid-aware energy management systems that optimize the flow between renewables, vehicles, and the grid.

02 Smart Charging and Energy Management Systems

Advanced energy management systems are essential for effective V2G implementation, incorporating AI and machine learning algorithms to optimize charging schedules, predict energy demand, and manage power flow. These systems enable dynamic pricing models, automated demand response, and real-time grid support services. Smart charging infrastructure coordinates multiple vehicle connections while ensuring grid stability and maximizing renewable energy utilization through intelligent load balancing and forecasting capabilities.Expand Specific Solutions03 Renewable Energy Integration with V2G Systems

V2G technology facilitates greater integration of intermittent renewable energy sources by using electric vehicle batteries as flexible storage assets. This approach helps mitigate the variability of solar and wind generation by storing excess renewable energy during high production periods and feeding it back to the grid during peak demand. The synergy between V2G systems and renewable energy sources enhances grid stability, reduces carbon emissions, and supports the transition to a more sustainable energy infrastructure.Expand Specific Solutions04 V2G Market Mechanisms and Business Models

Innovative business models and market mechanisms are emerging to incentivize V2G participation and create value for stakeholders. These include aggregator services that pool multiple vehicles to provide grid services, peer-to-peer energy trading platforms, and utility programs offering financial incentives for grid support. New regulatory frameworks and pricing structures are being developed to compensate EV owners for battery degradation, energy provision, and grid services, making V2G economically viable for consumers while supporting grid modernization efforts.Expand Specific Solutions05 V2G Communication Protocols and Cybersecurity

Secure and standardized communication protocols are critical for V2G implementation, enabling seamless interaction between vehicles, charging infrastructure, and grid operators. These protocols support authentication, authorization, and encryption to protect against cyber threats and ensure data privacy. Advanced cybersecurity measures safeguard the V2G ecosystem from potential attacks that could compromise grid stability or vehicle functionality. The development of interoperable standards facilitates widespread adoption while maintaining system security and reliability across diverse hardware and software platforms.Expand Specific Solutions

Key Industry Players in V2G Ecosystem

Vehicle-to-Grid (V2G) technology is currently in the early growth phase of market development, with an estimated global market size of $1.5-2 billion, projected to expand significantly as electric vehicle adoption increases. The competitive landscape features diverse players across multiple sectors: traditional utilities (State Grid Corp. of China), automotive manufacturers (Hyundai, Toyota, Ford, Kia), technology providers (QUALCOMM, GlobalFoundries), and specialized V2G companies (ChargeX, PlugShare). Technical maturity varies considerably, with established companies like Bosch and Siemens offering more developed solutions, while university research partnerships (University of Delaware, UC Regents) continue to advance fundamental technologies. The integration of V2G systems with existing grid infrastructure represents the primary technical challenge that market leaders are addressing through strategic partnerships and increased R&D investment.

State Grid Corp. of China

Technical Solution: State Grid has developed an integrated V2G system that leverages their massive electrical infrastructure to create bidirectional energy flow between electric vehicles and the power grid. Their solution incorporates smart charging stations with real-time monitoring capabilities and advanced power electronics that enable precise control of energy transfer. The system utilizes AI algorithms to predict grid demand patterns and optimize vehicle charging/discharging schedules accordingly. State Grid has implemented large-scale pilot projects across multiple provinces, demonstrating how V2G technology can effectively balance load during peak hours, integrate renewable energy sources, and provide emergency backup power. Their platform includes a comprehensive management system that handles billing, user authentication, and grid stability maintenance while ensuring compatibility with various EV models through standardized protocols.

Strengths: Massive existing infrastructure provides unparalleled scale for V2G implementation; Strong government backing enables rapid deployment and standardization. Weaknesses: Heavily centralized approach may limit flexibility; International expansion constrained by geopolitical considerations.

Hyundai Motor Co., Ltd.

Technical Solution: Hyundai has developed a comprehensive V2G ecosystem centered around their E-GMP (Electric-Global Modular Platform) architecture. This platform features bidirectional charging capabilities that allow their EVs to not only consume electricity but also return it to the grid when needed. Hyundai's V2G solution incorporates advanced Battery Management Systems (BMS) that optimize battery health during bidirectional energy flows, extending battery life while maximizing grid services. Their system includes smart charging algorithms that respond to grid signals and electricity pricing, enabling vehicles to charge during low-demand periods and discharge during peak hours. Hyundai has partnered with utilities across multiple markets to develop standardized communication protocols between vehicles and grid operators, ensuring seamless integration. Their V2G platform also includes user-friendly mobile applications that give vehicle owners control over their participation in grid services and visibility into their energy contribution and compensation.

Strengths: Purpose-built EV platforms designed specifically with V2G capabilities; Strong global market presence provides scale for widespread adoption. Weaknesses: Dependent on utility partnerships for full implementation; Battery warranty concerns may limit customer participation in V2G programs.

Critical V2G Patents and Technical Innovations

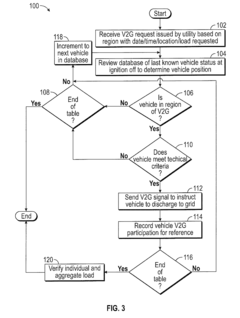

Priority based vehicle control strategy

PatentActiveUS20160075247A1

Innovation

- A method and system that prioritize V2G requests by determining which vehicles in a specific geographic region meet criteria established to reduce battery degradation, using historical and current data to select vehicles for participation, thereby limiting the number of charge and discharge cycles and extending the battery life.

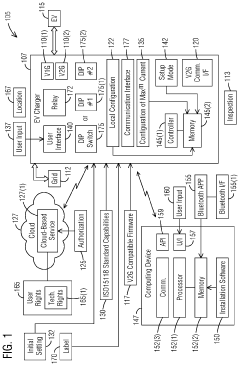

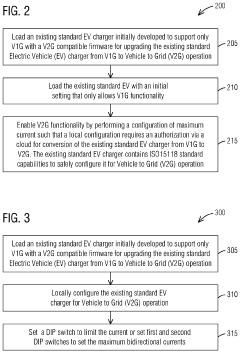

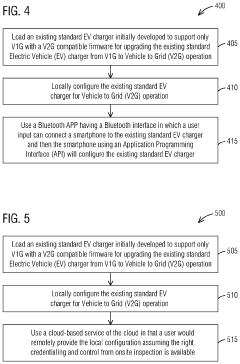

Upgrading an existing standard electric vehicle (EV) charger from grid to vehicle (V1G) to v1g plus vehicle to grid (V2G) operation

PatentPendingUS20240201974A1

Innovation

- A method to locally configure existing standard AC EV chargers with ISO15118 capabilities for V2G operation by loading V2G compatible firmware, authorizing via the cloud, and configuring maximum current, allowing bi-directional charging/discharging through a communication interface.

Grid Integration Standards and Protocols

The standardization of Vehicle-to-Grid (V2G) integration represents a critical foundation for successful energy infrastructure modernization. Currently, several key standards govern V2G communications and interoperability, including ISO 15118, which establishes the communication protocol between electric vehicles and charging stations, enabling bidirectional power flow control. This standard has evolved through multiple iterations, with ISO 15118-20 specifically addressing V2G functionality requirements and security considerations.

SAE J3072 provides complementary standards for interconnection requirements, ensuring electric vehicles can safely function as distributed energy resources when connected to the utility grid. Meanwhile, IEEE 1547 establishes technical specifications for interconnecting distributed resources with electric power systems, creating a framework that accommodates V2G integration within broader distributed energy resource management.

IEC 61850 extends these capabilities by standardizing communication protocols for power utility automation systems, facilitating seamless integration of V2G resources into grid management systems. OpenADR (Automated Demand Response) standards further enable automated load management and demand response capabilities essential for V2G market participation.

Significant protocol challenges persist despite these advancements. Interoperability issues between different vehicle manufacturers, charging infrastructure providers, and utility systems create implementation barriers. Security protocols require continuous enhancement to protect against cyber threats while maintaining system performance. Additionally, regional variations in grid codes and regulatory frameworks necessitate flexible protocol implementations that can adapt to diverse requirements.

The development of unified communication frameworks represents a promising direction for future standardization efforts. These frameworks would establish common data models and messaging formats across the V2G ecosystem, reducing integration complexity. Real-time communication protocols with minimal latency are particularly crucial for grid services requiring rapid response, such as frequency regulation.

Emerging standards like OCPP 2.0 (Open Charge Point Protocol) are extending capabilities to support V2G operations, while efforts to harmonize international standards aim to create globally compatible V2G systems. The evolution toward "plug-and-play" V2G integration protocols would significantly reduce implementation barriers and accelerate market adoption.

Regulatory alignment with technical standards remains essential, requiring coordination between standards organizations, industry stakeholders, and regulatory bodies to ensure technical protocols align with market rules and grid requirements. This collaborative approach will be vital for establishing a robust standards ecosystem that enables widespread V2G deployment.

SAE J3072 provides complementary standards for interconnection requirements, ensuring electric vehicles can safely function as distributed energy resources when connected to the utility grid. Meanwhile, IEEE 1547 establishes technical specifications for interconnecting distributed resources with electric power systems, creating a framework that accommodates V2G integration within broader distributed energy resource management.

IEC 61850 extends these capabilities by standardizing communication protocols for power utility automation systems, facilitating seamless integration of V2G resources into grid management systems. OpenADR (Automated Demand Response) standards further enable automated load management and demand response capabilities essential for V2G market participation.

Significant protocol challenges persist despite these advancements. Interoperability issues between different vehicle manufacturers, charging infrastructure providers, and utility systems create implementation barriers. Security protocols require continuous enhancement to protect against cyber threats while maintaining system performance. Additionally, regional variations in grid codes and regulatory frameworks necessitate flexible protocol implementations that can adapt to diverse requirements.

The development of unified communication frameworks represents a promising direction for future standardization efforts. These frameworks would establish common data models and messaging formats across the V2G ecosystem, reducing integration complexity. Real-time communication protocols with minimal latency are particularly crucial for grid services requiring rapid response, such as frequency regulation.

Emerging standards like OCPP 2.0 (Open Charge Point Protocol) are extending capabilities to support V2G operations, while efforts to harmonize international standards aim to create globally compatible V2G systems. The evolution toward "plug-and-play" V2G integration protocols would significantly reduce implementation barriers and accelerate market adoption.

Regulatory alignment with technical standards remains essential, requiring coordination between standards organizations, industry stakeholders, and regulatory bodies to ensure technical protocols align with market rules and grid requirements. This collaborative approach will be vital for establishing a robust standards ecosystem that enables widespread V2G deployment.

Economic Models for V2G Adoption

The economic viability of Vehicle-to-Grid (V2G) technology represents a critical factor in its widespread adoption. Current economic models for V2G implementation typically revolve around four primary revenue streams: energy arbitrage, frequency regulation, spinning reserves, and capacity markets. Energy arbitrage allows EV owners to charge during low-price periods and discharge during peak demand, creating price differential profits. Frequency regulation services, which help stabilize grid frequency, offer the most lucrative compensation structure, with payments ranging from $30-45 per MW per hour in mature markets.

Financial incentive structures vary significantly across regions, with some utilities offering upfront subsidies for V2G-capable equipment while others implement dynamic pricing models that reward grid-supportive behavior. The Delaware V2G pilot program demonstrated annual revenues of $1,000-5,000 per vehicle, establishing a benchmark for potential returns. However, these figures must be balanced against increased battery degradation costs, estimated at 2-5% additional wear depending on cycling patterns and battery chemistry.

Cost-benefit analyses reveal that payback periods for V2G investments currently range from 3-7 years for fleet operators, with longer horizons for individual consumers. This timeline presents a significant barrier to adoption without additional incentives or regulatory support. The total cost of ownership (TCO) models indicate that V2G capability adds approximately $2,000-3,500 to initial vehicle or charging infrastructure costs, necessitating sufficient revenue generation to offset this premium.

Emerging subscription-based models are gaining traction, where aggregators manage V2G operations and share revenues with vehicle owners, reducing individual investment requirements. These models typically offer 60-70% revenue share to vehicle owners while absorbing technical complexity and market interface responsibilities. Simultaneously, regulatory frameworks are evolving to recognize V2G as a distributed energy resource, enabling participation in capacity markets previously restricted to traditional generators.

The most promising economic pathway appears to be fleet-based implementations, where predictable usage patterns, economies of scale, and professional management reduce operational uncertainties. Corporate fleets with defined operational schedules can participate in V2G programs without compromising primary transportation functions, optimizing revenue potential while minimizing disruption to core business activities.

Financial incentive structures vary significantly across regions, with some utilities offering upfront subsidies for V2G-capable equipment while others implement dynamic pricing models that reward grid-supportive behavior. The Delaware V2G pilot program demonstrated annual revenues of $1,000-5,000 per vehicle, establishing a benchmark for potential returns. However, these figures must be balanced against increased battery degradation costs, estimated at 2-5% additional wear depending on cycling patterns and battery chemistry.

Cost-benefit analyses reveal that payback periods for V2G investments currently range from 3-7 years for fleet operators, with longer horizons for individual consumers. This timeline presents a significant barrier to adoption without additional incentives or regulatory support. The total cost of ownership (TCO) models indicate that V2G capability adds approximately $2,000-3,500 to initial vehicle or charging infrastructure costs, necessitating sufficient revenue generation to offset this premium.

Emerging subscription-based models are gaining traction, where aggregators manage V2G operations and share revenues with vehicle owners, reducing individual investment requirements. These models typically offer 60-70% revenue share to vehicle owners while absorbing technical complexity and market interface responsibilities. Simultaneously, regulatory frameworks are evolving to recognize V2G as a distributed energy resource, enabling participation in capacity markets previously restricted to traditional generators.

The most promising economic pathway appears to be fleet-based implementations, where predictable usage patterns, economies of scale, and professional management reduce operational uncertainties. Corporate fleets with defined operational schedules can participate in V2G programs without compromising primary transportation functions, optimizing revenue potential while minimizing disruption to core business activities.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!