Examining Vehicle-to-Grid's Influence on Energy Bills

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

V2G Technology Background and Objectives

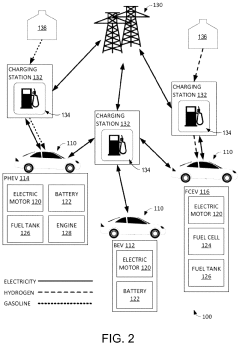

Vehicle-to-Grid (V2G) technology represents a transformative approach in the energy sector, enabling bidirectional power flow between electric vehicles (EVs) and the electricity grid. This concept emerged in the late 1990s when Professor Willett Kempton and his team at the University of Delaware first proposed using EV batteries as distributed energy resources. Over the past two decades, V2G has evolved from theoretical concept to practical implementation, with significant advancements in bidirectional charging hardware, communication protocols, and grid integration strategies.

The technological evolution of V2G has been closely tied to the broader development of electric mobility and smart grid infrastructure. Early V2G systems focused primarily on frequency regulation services, while contemporary solutions encompass a wider range of applications including peak shaving, renewable energy integration, and emergency backup power. This progression reflects the increasing sophistication of power electronics, battery management systems, and grid communication technologies.

The primary objective of V2G technology is to transform electric vehicles from mere transportation assets into dynamic grid resources that can provide valuable services while parked. This dual functionality aims to create economic value for vehicle owners through reduced energy bills and potential revenue streams from grid services, while simultaneously enhancing grid stability and resilience. By enabling EVs to discharge stored energy back to the grid during peak demand periods, V2G can help flatten load curves and reduce the need for expensive peaking power plants.

Current technological trends indicate a move toward more seamless integration of V2G capabilities into charging infrastructure and vehicle design. Advanced inverters with higher efficiency ratings, sophisticated battery management systems that preserve battery health during bidirectional power flows, and standardized communication protocols are emerging as key enablers. The development of ISO 15118 and related standards has been particularly important in establishing interoperability across different vehicle models and charging equipment.

Looking forward, V2G technology is expected to play a crucial role in supporting the transition to renewable energy by providing flexible storage capacity that can help balance intermittent generation sources. The convergence of V2G with other emerging technologies such as blockchain-based energy trading platforms and artificial intelligence for predictive energy management suggests a future where EVs become integral components of a decentralized, resilient energy ecosystem.

The ultimate goal of V2G research and implementation is to create a win-win scenario where vehicle owners can significantly reduce their energy costs while contributing to a more efficient, sustainable, and reliable electricity grid. This alignment of individual economic benefits with broader system advantages represents the core value proposition driving continued investment and innovation in V2G technology.

The technological evolution of V2G has been closely tied to the broader development of electric mobility and smart grid infrastructure. Early V2G systems focused primarily on frequency regulation services, while contemporary solutions encompass a wider range of applications including peak shaving, renewable energy integration, and emergency backup power. This progression reflects the increasing sophistication of power electronics, battery management systems, and grid communication technologies.

The primary objective of V2G technology is to transform electric vehicles from mere transportation assets into dynamic grid resources that can provide valuable services while parked. This dual functionality aims to create economic value for vehicle owners through reduced energy bills and potential revenue streams from grid services, while simultaneously enhancing grid stability and resilience. By enabling EVs to discharge stored energy back to the grid during peak demand periods, V2G can help flatten load curves and reduce the need for expensive peaking power plants.

Current technological trends indicate a move toward more seamless integration of V2G capabilities into charging infrastructure and vehicle design. Advanced inverters with higher efficiency ratings, sophisticated battery management systems that preserve battery health during bidirectional power flows, and standardized communication protocols are emerging as key enablers. The development of ISO 15118 and related standards has been particularly important in establishing interoperability across different vehicle models and charging equipment.

Looking forward, V2G technology is expected to play a crucial role in supporting the transition to renewable energy by providing flexible storage capacity that can help balance intermittent generation sources. The convergence of V2G with other emerging technologies such as blockchain-based energy trading platforms and artificial intelligence for predictive energy management suggests a future where EVs become integral components of a decentralized, resilient energy ecosystem.

The ultimate goal of V2G research and implementation is to create a win-win scenario where vehicle owners can significantly reduce their energy costs while contributing to a more efficient, sustainable, and reliable electricity grid. This alignment of individual economic benefits with broader system advantages represents the core value proposition driving continued investment and innovation in V2G technology.

Energy Market Demand Analysis

The Vehicle-to-Grid (V2G) technology market is experiencing significant growth driven by the convergence of renewable energy integration and electric vehicle adoption. Current market analysis indicates that the global V2G market is projected to reach $17.43 billion by 2027, growing at a compound annual growth rate of 48% from 2020. This exceptional growth trajectory is primarily fueled by increasing concerns about grid stability and the need for efficient energy management systems.

Consumer demand for V2G technology is closely linked to the rising adoption of electric vehicles (EVs), which reached 10.5 million units globally in 2022. Market research shows that approximately 71% of EV owners express interest in V2G capabilities when presented with potential energy bill savings. This consumer interest is particularly strong in regions with high electricity costs and variable time-of-use pricing structures.

From a utility perspective, the demand for V2G solutions stems from the growing challenges of grid management amid increasing renewable energy penetration. Power companies in markets with high solar and wind generation face significant peak demand challenges, with some experiencing up to 25% variability in daily load profiles. V2G technology offers a compelling solution by providing distributed energy storage capacity that can be leveraged during peak demand periods.

Regional analysis reveals varying market dynamics. European markets show the highest immediate demand for V2G solutions, driven by aggressive renewable energy targets and supportive regulatory frameworks. The North American market demonstrates strong growth potential, particularly in states with advanced net metering policies and high renewable penetration. The Asia-Pacific region, while currently less developed in V2G implementation, shows the highest long-term growth potential due to rapid EV adoption rates and significant grid modernization investments.

Commercial fleet operators represent a particularly promising market segment, with 63% indicating willingness to invest in V2G-capable vehicles when presented with clear return-on-investment models. These operators value the potential for reduced operational costs through strategic charging and discharging cycles that capitalize on electricity price differentials.

The market demand is further strengthened by emerging energy market structures that increasingly value flexibility services. Capacity markets, frequency regulation services, and demand response programs are creating new revenue streams for V2G participants, with some markets offering payments of up to $0.30 per kWh for grid services during critical periods. This economic incentive structure is critical for driving consumer adoption and maximizing the impact of V2G technology on energy bills.

Consumer demand for V2G technology is closely linked to the rising adoption of electric vehicles (EVs), which reached 10.5 million units globally in 2022. Market research shows that approximately 71% of EV owners express interest in V2G capabilities when presented with potential energy bill savings. This consumer interest is particularly strong in regions with high electricity costs and variable time-of-use pricing structures.

From a utility perspective, the demand for V2G solutions stems from the growing challenges of grid management amid increasing renewable energy penetration. Power companies in markets with high solar and wind generation face significant peak demand challenges, with some experiencing up to 25% variability in daily load profiles. V2G technology offers a compelling solution by providing distributed energy storage capacity that can be leveraged during peak demand periods.

Regional analysis reveals varying market dynamics. European markets show the highest immediate demand for V2G solutions, driven by aggressive renewable energy targets and supportive regulatory frameworks. The North American market demonstrates strong growth potential, particularly in states with advanced net metering policies and high renewable penetration. The Asia-Pacific region, while currently less developed in V2G implementation, shows the highest long-term growth potential due to rapid EV adoption rates and significant grid modernization investments.

Commercial fleet operators represent a particularly promising market segment, with 63% indicating willingness to invest in V2G-capable vehicles when presented with clear return-on-investment models. These operators value the potential for reduced operational costs through strategic charging and discharging cycles that capitalize on electricity price differentials.

The market demand is further strengthened by emerging energy market structures that increasingly value flexibility services. Capacity markets, frequency regulation services, and demand response programs are creating new revenue streams for V2G participants, with some markets offering payments of up to $0.30 per kWh for grid services during critical periods. This economic incentive structure is critical for driving consumer adoption and maximizing the impact of V2G technology on energy bills.

V2G Implementation Status and Challenges

Vehicle-to-Grid (V2G) technology implementation currently exists primarily in pilot projects and limited commercial deployments across North America, Europe, and parts of Asia. Despite its promising potential to transform energy management systems, V2G faces significant technical and market barriers that have hindered widespread adoption.

The most advanced V2G implementations can be found in Denmark, the Netherlands, and the United Kingdom, where regulatory frameworks have been established to support bidirectional charging infrastructure. In the United States, California leads with several utility-sponsored programs that allow electric vehicle owners to participate in grid services. Japan has also made notable progress through initiatives led by major automakers like Nissan in partnership with energy companies.

Technical challenges remain substantial barriers to V2G deployment. Bidirectional charging hardware requires specialized equipment that adds significant cost to both vehicle and charging infrastructure. Current bidirectional chargers typically cost 2-3 times more than standard unidirectional equipment, creating economic hurdles for mass adoption. Additionally, battery degradation concerns persist, as frequent charging and discharging cycles associated with V2G operations may accelerate capacity loss in vehicle batteries, though recent research suggests this impact may be less severe than initially feared.

Communication protocols represent another critical challenge. The lack of standardized protocols between vehicles, charging stations, and grid operators creates interoperability issues that complicate system integration. While standards like ISO 15118, CHAdeMO, and OpenADR provide frameworks for V2G communication, fragmentation across different regions and manufacturers impedes seamless implementation.

Regulatory barriers further complicate V2G deployment. In many jurisdictions, outdated regulations prevent non-utility entities from selling electricity back to the grid, effectively blocking V2G business models. Complex permitting processes and grid interconnection requirements add layers of bureaucracy that slow implementation. Furthermore, rate structures in most markets do not adequately compensate V2G services, limiting economic incentives for participation.

Market awareness presents an additional challenge, as both consumers and utilities demonstrate limited understanding of V2G benefits and operational requirements. Consumer concerns about battery warranty implications and vehicle availability create adoption hesitancy, while utilities often lack experience integrating distributed energy resources at scale.

Despite these challenges, recent technological advancements and policy developments suggest a positive trajectory for V2G implementation. Battery management systems are becoming more sophisticated, enabling more efficient bidirectional energy flows while minimizing battery degradation. Regulatory reforms in several markets are beginning to recognize and compensate grid services provided by distributed resources, including electric vehicles.

The most advanced V2G implementations can be found in Denmark, the Netherlands, and the United Kingdom, where regulatory frameworks have been established to support bidirectional charging infrastructure. In the United States, California leads with several utility-sponsored programs that allow electric vehicle owners to participate in grid services. Japan has also made notable progress through initiatives led by major automakers like Nissan in partnership with energy companies.

Technical challenges remain substantial barriers to V2G deployment. Bidirectional charging hardware requires specialized equipment that adds significant cost to both vehicle and charging infrastructure. Current bidirectional chargers typically cost 2-3 times more than standard unidirectional equipment, creating economic hurdles for mass adoption. Additionally, battery degradation concerns persist, as frequent charging and discharging cycles associated with V2G operations may accelerate capacity loss in vehicle batteries, though recent research suggests this impact may be less severe than initially feared.

Communication protocols represent another critical challenge. The lack of standardized protocols between vehicles, charging stations, and grid operators creates interoperability issues that complicate system integration. While standards like ISO 15118, CHAdeMO, and OpenADR provide frameworks for V2G communication, fragmentation across different regions and manufacturers impedes seamless implementation.

Regulatory barriers further complicate V2G deployment. In many jurisdictions, outdated regulations prevent non-utility entities from selling electricity back to the grid, effectively blocking V2G business models. Complex permitting processes and grid interconnection requirements add layers of bureaucracy that slow implementation. Furthermore, rate structures in most markets do not adequately compensate V2G services, limiting economic incentives for participation.

Market awareness presents an additional challenge, as both consumers and utilities demonstrate limited understanding of V2G benefits and operational requirements. Consumer concerns about battery warranty implications and vehicle availability create adoption hesitancy, while utilities often lack experience integrating distributed energy resources at scale.

Despite these challenges, recent technological advancements and policy developments suggest a positive trajectory for V2G implementation. Battery management systems are becoming more sophisticated, enabling more efficient bidirectional energy flows while minimizing battery degradation. Regulatory reforms in several markets are beginning to recognize and compensate grid services provided by distributed resources, including electric vehicles.

Current V2G Energy Bill Impact Solutions

01 V2G technology for energy cost reduction

Vehicle-to-Grid technology enables electric vehicles to discharge stored energy back to the grid during peak demand periods, helping users reduce their energy bills. This bidirectional energy flow allows EV owners to sell excess electricity back to the grid when prices are high and charge their vehicles when electricity costs are low, creating potential revenue streams and offsetting ownership costs.- V2G technology for energy cost reduction: Vehicle-to-Grid technology enables electric vehicles to discharge stored energy back to the grid during peak demand periods, helping to reduce energy bills. This bidirectional energy flow allows EV owners to sell excess electricity back to utility companies, creating potential revenue streams while supporting grid stability. The system optimizes charging schedules based on electricity prices, charging vehicles when rates are low and selling power when prices are high.

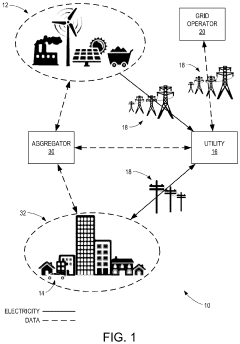

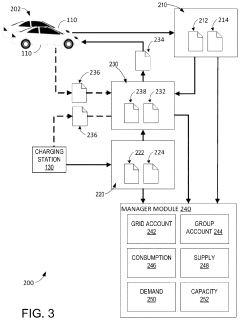

- Smart grid integration and management systems: Smart grid integration systems coordinate V2G operations by managing the communication between vehicles, charging stations, and the power grid. These systems utilize advanced algorithms to predict energy demand, optimize power flow, and balance grid loads. They incorporate real-time pricing data and user preferences to make intelligent decisions about when to charge or discharge vehicle batteries, maximizing economic benefits while maintaining grid stability.

- V2G charging infrastructure and hardware solutions: Specialized charging infrastructure enables bidirectional power flow between electric vehicles and the grid. These systems include bidirectional inverters, smart meters, and communication modules that facilitate secure and efficient energy transfer. The hardware is designed to protect both vehicle batteries and grid integrity while providing seamless integration with existing electrical systems. Advanced features include remote monitoring, authentication protocols, and safety mechanisms to prevent system overloads.

- V2G energy management for residential applications: Residential V2G systems allow homeowners to use their electric vehicles as backup power sources or to participate in energy arbitrage. These systems can integrate with home energy management systems to optimize household electricity consumption, reduce dependency on the grid during peak hours, and provide emergency power during outages. By coordinating vehicle charging with home energy needs and renewable energy generation, these systems can significantly reduce household energy bills.

- V2G business models and incentive structures: Various business models have been developed to incentivize V2G participation, including time-of-use pricing, demand response programs, and grid service payments. These models compensate EV owners for making their battery capacity available to support grid operations. Utility companies benefit from reduced infrastructure costs and improved grid stability, while consumers receive financial incentives that offset their energy bills. Innovative payment structures include subscription services, aggregator models, and direct utility partnerships.

02 Smart charging and grid integration systems

Smart charging systems optimize when and how electric vehicles charge based on electricity rates, grid demand, and user preferences. These systems incorporate intelligent algorithms that can schedule charging during off-peak hours when electricity is cheaper, integrate with renewable energy sources, and provide grid services while minimizing energy costs for vehicle owners.Expand Specific Solutions03 Energy management platforms for V2G applications

Comprehensive energy management platforms coordinate V2G operations by monitoring grid conditions, electricity prices, and vehicle availability. These systems enable automated decision-making about when to charge or discharge vehicles, aggregate multiple EVs to provide significant grid services, and optimize financial returns for participants while maintaining vehicle readiness for transportation needs.Expand Specific Solutions04 Renewable energy integration with V2G systems

V2G technology can be integrated with renewable energy sources like solar and wind to store excess renewable energy in vehicle batteries when generation is high and supply it back to the grid when needed. This integration helps balance intermittent renewable generation, reduces reliance on fossil fuels during peak demand, and can provide additional cost savings through renewable energy incentives.Expand Specific Solutions05 Billing and incentive mechanisms for V2G participation

Specialized billing systems and financial incentive structures are being developed to compensate EV owners for grid services provided through V2G technology. These mechanisms include time-of-use pricing, grid service payments, demand response incentives, and automated settlement systems that track energy flows and calculate appropriate compensation, making V2G participation financially attractive.Expand Specific Solutions

Key Industry Players and Stakeholders

Vehicle-to-Grid (V2G) technology is emerging as a transformative solution in the energy sector, currently in its early growth phase. The global V2G market is projected to expand significantly, with major automotive manufacturers like Toyota, Hyundai, BMW, Honda, and Volkswagen investing heavily in this technology. Energy and grid companies such as State Grid Corporation of China and ChargePoint are developing the necessary infrastructure. The technology's maturity varies across regions, with companies like Qualcomm and ABB E-mobility advancing bidirectional charging capabilities. While V2G shows promise for reducing energy bills through peak shaving and grid services, widespread commercial deployment remains limited as stakeholders work to overcome technical challenges, standardization issues, and regulatory barriers.

State Grid Corp. of China

Technical Solution: State Grid Corporation of China has implemented a large-scale V2G integration platform called "Grid-Vehicle Harmony" that coordinates thousands of electric vehicles across urban centers to support grid stability while reducing consumer energy costs. Their system employs hierarchical control architecture that aggregates distributed vehicle resources into virtual power plants capable of providing grid services at utility scale. State Grid's platform incorporates sophisticated forecasting algorithms that predict grid demand patterns, renewable generation fluctuations, and vehicle availability to optimize bidirectional energy flows. The technology includes tiered incentive structures that reward vehicle owners based on their flexibility and responsiveness to grid needs, with higher compensation for critical peak periods. Their implementation includes specialized tariff designs that eliminate demand charges for V2G participants and provide time-varying rates that reflect actual grid conditions. Pilot programs across multiple Chinese provinces have demonstrated average monthly bill reductions of 200-300 yuan per vehicle, with additional grid services compensation adding 100-150 yuan in monthly revenue for participants. The system includes grid-edge intelligence that enables continued operation during communication disruptions, ensuring resilience during challenging grid conditions.

Strengths: Massive scale deployment provides unparalleled operational data; vertical integration with utility operations ensures seamless grid coordination; government backing facilitates regulatory alignment. Weaknesses: Centralized approach may limit applicability in markets with decentralized grid structures; less focus on consumer experience compared to commercial providers; potential privacy concerns with extensive data collection.

ChargePoint, Inc.

Technical Solution: ChargePoint has developed an advanced Vehicle-to-Grid (V2G) integration platform that enables bidirectional energy flow between electric vehicles and the power grid. Their system incorporates smart charging stations equipped with real-time monitoring capabilities that analyze grid conditions, electricity prices, and vehicle usage patterns to optimize charging and discharging cycles. The platform includes a sophisticated energy management system that allows vehicle owners to set preferences for when their vehicles can participate in grid services while ensuring sufficient charge for their transportation needs. ChargePoint's solution integrates with utility demand response programs, enabling automatic participation in grid stabilization events and providing financial incentives to vehicle owners. Their mobile application gives users transparency into their energy transactions, showing real-time savings and grid contributions while allowing remote control of V2G functionality.

Strengths: Extensive charging network infrastructure provides significant market reach; sophisticated user interface enhances consumer adoption; established relationships with utilities facilitate implementation. Weaknesses: Requires compatible vehicles with bidirectional charging capability; dependent on regional utility regulations and rate structures; initial installation costs may be prohibitive for some consumers.

Critical V2G-Grid Integration Technologies

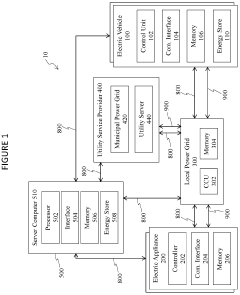

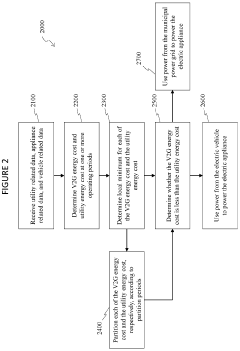

Systems and methods for integrating on-premises electric appliances with vehicle-to-grid electric vehicles

PatentActiveUS11407325B2

Innovation

- An energy management system that includes a local power grid, an electric vehicle capable of bi-directional energy exchange, and a system server that receives and analyzes utility, appliance, and vehicle data to determine optimal energy usage states, controlling the electric vehicle to discharge energy to the grid when it is cheaper or greener, thereby optimizing energy costs and reducing peak loads.

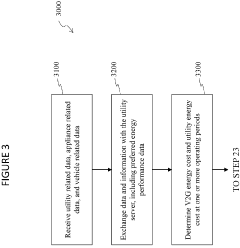

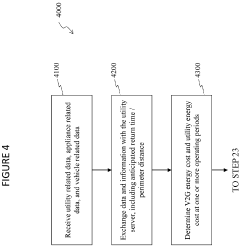

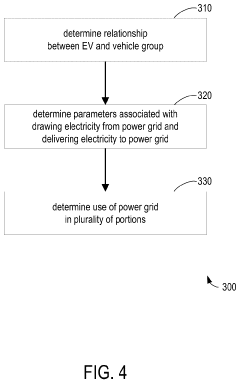

Methods and systems for managing vehicle-grid integration

PatentActiveUS12038726B2

Innovation

- A vehicle-grid integration (VGI) management system that includes computer storage media and processors to determine the use of the power grid by EVs in a dual multi-part rate structure, allowing for organized and controllable participation of EVs in power and energy management, enabling strategic dispatching to balance supply and demand, and equitably attribute costs and benefits.

Regulatory Framework for V2G Implementation

The regulatory landscape for Vehicle-to-Grid (V2G) technology remains fragmented globally, presenting significant challenges for widespread implementation. In the United States, the Federal Energy Regulatory Commission (FERC) Order 2222 represents a milestone by allowing distributed energy resources, including electric vehicles (EVs), to participate in wholesale electricity markets. However, state-level regulations vary considerably, with California leading through its Rule 21 that establishes interconnection standards for distributed generation resources.

The European Union has made substantial progress with its Clean Energy Package, which recognizes energy storage as a distinct asset class and promotes consumer participation in energy markets. Countries like Denmark and the Netherlands have pioneered regulatory sandboxes specifically for V2G pilots, allowing temporary exemptions from certain regulatory requirements to facilitate innovation and testing.

Compensation mechanisms represent a critical regulatory consideration. Net metering policies, time-of-use tariffs, and capacity payments must be adapted to accommodate bidirectional energy flows characteristic of V2G systems. Currently, most jurisdictions lack specific rate structures that adequately value grid services provided by EVs, creating economic barriers to adoption.

Grid interconnection standards present another regulatory hurdle. Technical requirements for safety, power quality, and communication protocols must be standardized to ensure seamless integration of V2G-enabled vehicles with existing grid infrastructure. IEEE 1547 and IEC 61851 standards provide foundational frameworks, but V2G-specific amendments are still evolving in many regions.

Data privacy and cybersecurity regulations also require significant attention. The bidirectional flow of both energy and data in V2G systems creates potential vulnerabilities that must be addressed through comprehensive regulatory frameworks. The EU's General Data Protection Regulation (GDPR) offers some guidance, but V2G-specific provisions remain underdeveloped globally.

Market structure regulations present perhaps the most complex challenge. Traditional electricity markets were not designed with distributed, mobile energy resources in mind. Regulations must evolve to allow aggregation of multiple EVs into virtual power plants capable of providing meaningful grid services. Additionally, regulations governing who can sell electricity (traditionally limited to utilities) must adapt to accommodate prosumer participation through V2G technology.

Moving forward, regulatory harmonization across jurisdictions will be essential to enable scalable V2G business models. Stakeholders must advocate for technology-neutral regulations that focus on desired outcomes rather than prescribing specific technical approaches, allowing innovation to flourish while maintaining system reliability and consumer protection.

The European Union has made substantial progress with its Clean Energy Package, which recognizes energy storage as a distinct asset class and promotes consumer participation in energy markets. Countries like Denmark and the Netherlands have pioneered regulatory sandboxes specifically for V2G pilots, allowing temporary exemptions from certain regulatory requirements to facilitate innovation and testing.

Compensation mechanisms represent a critical regulatory consideration. Net metering policies, time-of-use tariffs, and capacity payments must be adapted to accommodate bidirectional energy flows characteristic of V2G systems. Currently, most jurisdictions lack specific rate structures that adequately value grid services provided by EVs, creating economic barriers to adoption.

Grid interconnection standards present another regulatory hurdle. Technical requirements for safety, power quality, and communication protocols must be standardized to ensure seamless integration of V2G-enabled vehicles with existing grid infrastructure. IEEE 1547 and IEC 61851 standards provide foundational frameworks, but V2G-specific amendments are still evolving in many regions.

Data privacy and cybersecurity regulations also require significant attention. The bidirectional flow of both energy and data in V2G systems creates potential vulnerabilities that must be addressed through comprehensive regulatory frameworks. The EU's General Data Protection Regulation (GDPR) offers some guidance, but V2G-specific provisions remain underdeveloped globally.

Market structure regulations present perhaps the most complex challenge. Traditional electricity markets were not designed with distributed, mobile energy resources in mind. Regulations must evolve to allow aggregation of multiple EVs into virtual power plants capable of providing meaningful grid services. Additionally, regulations governing who can sell electricity (traditionally limited to utilities) must adapt to accommodate prosumer participation through V2G technology.

Moving forward, regulatory harmonization across jurisdictions will be essential to enable scalable V2G business models. Stakeholders must advocate for technology-neutral regulations that focus on desired outcomes rather than prescribing specific technical approaches, allowing innovation to flourish while maintaining system reliability and consumer protection.

Consumer Adoption Barriers and Incentives

Despite the promising potential of Vehicle-to-Grid (V2G) technology to transform energy management and reduce electricity bills, several significant barriers impede widespread consumer adoption. The primary obstacle remains the high initial investment cost for V2G-compatible electric vehicles and necessary charging infrastructure. Current V2G-enabled vehicles typically command a premium of $3,000-$5,000 over standard EVs, while bidirectional chargers cost between $2,000-$10,000 depending on capacity and features.

Technical complexity presents another substantial barrier, as consumers often lack understanding of how V2G systems operate and the potential benefits they offer. The technology requires sophisticated energy management systems that many find intimidating, creating hesitation among potential adopters who prefer simpler solutions.

Battery degradation concerns significantly influence consumer decisions, with studies indicating that frequent charging and discharging cycles associated with V2G operations may accelerate battery wear by 5-15% depending on usage patterns. This perception directly impacts the perceived value proposition of V2G technology.

Regulatory uncertainty further complicates adoption, as inconsistent policies regarding grid integration, compensation mechanisms, and interconnection standards vary widely across regions. Many potential users remain hesitant to invest in technology that operates in an evolving regulatory landscape.

To overcome these barriers, several incentive mechanisms have proven effective. Financial incentives, including tax credits ranging from $1,000-$7,500, rebates on equipment purchases, and preferential electricity rates for V2G participants, have demonstrated success in early adoption markets. Some utilities offer reduced demand charges or time-of-use optimization benefits that can save participants $300-$950 annually.

Educational programs focused on demonstrating real-world benefits through pilot projects and case studies help address knowledge gaps. These initiatives typically show potential bill reductions of 15-30% for participating households, creating compelling evidence for skeptical consumers.

Streamlined regulatory frameworks that establish clear compensation mechanisms for grid services and standardized interconnection procedures significantly reduce adoption friction. Regions with well-defined V2G policies have seen adoption rates 2-3 times higher than those with ambiguous regulations.

Warranty protections specifically addressing battery concerns have emerged as crucial adoption drivers. Manufacturers offering extended battery warranties for V2G participants have reported 40% higher conversion rates compared to those without such guarantees, effectively neutralizing one of the most significant psychological barriers to adoption.

Technical complexity presents another substantial barrier, as consumers often lack understanding of how V2G systems operate and the potential benefits they offer. The technology requires sophisticated energy management systems that many find intimidating, creating hesitation among potential adopters who prefer simpler solutions.

Battery degradation concerns significantly influence consumer decisions, with studies indicating that frequent charging and discharging cycles associated with V2G operations may accelerate battery wear by 5-15% depending on usage patterns. This perception directly impacts the perceived value proposition of V2G technology.

Regulatory uncertainty further complicates adoption, as inconsistent policies regarding grid integration, compensation mechanisms, and interconnection standards vary widely across regions. Many potential users remain hesitant to invest in technology that operates in an evolving regulatory landscape.

To overcome these barriers, several incentive mechanisms have proven effective. Financial incentives, including tax credits ranging from $1,000-$7,500, rebates on equipment purchases, and preferential electricity rates for V2G participants, have demonstrated success in early adoption markets. Some utilities offer reduced demand charges or time-of-use optimization benefits that can save participants $300-$950 annually.

Educational programs focused on demonstrating real-world benefits through pilot projects and case studies help address knowledge gaps. These initiatives typically show potential bill reductions of 15-30% for participating households, creating compelling evidence for skeptical consumers.

Streamlined regulatory frameworks that establish clear compensation mechanisms for grid services and standardized interconnection procedures significantly reduce adoption friction. Regions with well-defined V2G policies have seen adoption rates 2-3 times higher than those with ambiguous regulations.

Warranty protections specifically addressing battery concerns have emerged as crucial adoption drivers. Manufacturers offering extended battery warranties for V2G participants have reported 40% higher conversion rates compared to those without such guarantees, effectively neutralizing one of the most significant psychological barriers to adoption.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!