Grid Economics: The Value Proposition of Vehicle-to-Grid

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

V2G Technology Background and Objectives

Vehicle-to-Grid (V2G) technology represents a paradigm shift in how we conceptualize the relationship between electric vehicles (EVs) and power grids. The concept emerged in the late 1990s when researchers began exploring the potential of using EV batteries not just for transportation but as distributed energy resources. Over the past two decades, V2G has evolved from a theoretical concept to a practical technology with pilot implementations across various markets.

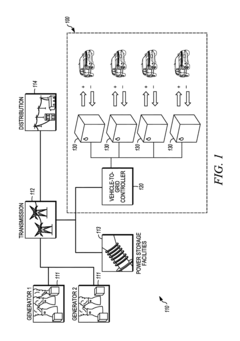

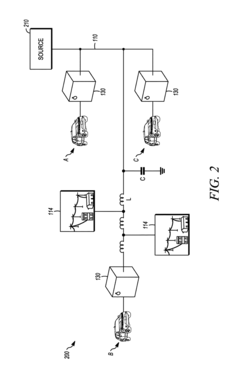

The fundamental principle of V2G technology involves bidirectional power flow between EVs and the electrical grid. When connected to charging infrastructure, EVs can not only draw power from the grid but also discharge stored energy back to the grid when needed. This bidirectional capability transforms EVs from mere consumers of electricity into flexible grid assets capable of providing various grid services.

The evolution of V2G technology has been closely tied to advancements in battery technology, power electronics, and grid management systems. Early V2G concepts faced significant barriers including battery degradation concerns, limited charging infrastructure, and regulatory challenges. However, recent technological breakthroughs in battery chemistry, smart charging algorithms, and power conversion efficiency have substantially improved the technical feasibility of V2G implementations.

The primary objective of V2G technology is to create value through the integration of transportation and energy systems. This integration aims to enhance grid stability, increase renewable energy integration, reduce peak demand, and provide economic benefits to various stakeholders including vehicle owners, utilities, and grid operators. By leveraging the storage capacity of EV batteries when vehicles are parked (which is approximately 95% of the time), V2G technology offers a potentially massive distributed energy resource.

Current technological trends indicate a growing convergence between V2G and other emerging technologies such as smart grids, renewable energy systems, and advanced energy management platforms. The development of international standards like ISO 15118 and CHAdeMO 2.0 has been crucial in establishing protocols for V2G communication and operation.

The technical goals for V2G development include minimizing battery degradation from bidirectional charging, optimizing charging/discharging algorithms, developing more efficient power electronics, creating seamless user interfaces, and ensuring cybersecurity in V2G operations. Additionally, there is significant focus on reducing the cost of bidirectional charging equipment and improving the economic models that determine the value proposition for all stakeholders.

As the global EV market continues to expand rapidly, with projections indicating tens of millions of EVs on roads by 2030, the potential scale and impact of V2G technology are becoming increasingly significant, positioning it as a critical component in the transition toward more sustainable and resilient energy systems.

The fundamental principle of V2G technology involves bidirectional power flow between EVs and the electrical grid. When connected to charging infrastructure, EVs can not only draw power from the grid but also discharge stored energy back to the grid when needed. This bidirectional capability transforms EVs from mere consumers of electricity into flexible grid assets capable of providing various grid services.

The evolution of V2G technology has been closely tied to advancements in battery technology, power electronics, and grid management systems. Early V2G concepts faced significant barriers including battery degradation concerns, limited charging infrastructure, and regulatory challenges. However, recent technological breakthroughs in battery chemistry, smart charging algorithms, and power conversion efficiency have substantially improved the technical feasibility of V2G implementations.

The primary objective of V2G technology is to create value through the integration of transportation and energy systems. This integration aims to enhance grid stability, increase renewable energy integration, reduce peak demand, and provide economic benefits to various stakeholders including vehicle owners, utilities, and grid operators. By leveraging the storage capacity of EV batteries when vehicles are parked (which is approximately 95% of the time), V2G technology offers a potentially massive distributed energy resource.

Current technological trends indicate a growing convergence between V2G and other emerging technologies such as smart grids, renewable energy systems, and advanced energy management platforms. The development of international standards like ISO 15118 and CHAdeMO 2.0 has been crucial in establishing protocols for V2G communication and operation.

The technical goals for V2G development include minimizing battery degradation from bidirectional charging, optimizing charging/discharging algorithms, developing more efficient power electronics, creating seamless user interfaces, and ensuring cybersecurity in V2G operations. Additionally, there is significant focus on reducing the cost of bidirectional charging equipment and improving the economic models that determine the value proposition for all stakeholders.

As the global EV market continues to expand rapidly, with projections indicating tens of millions of EVs on roads by 2030, the potential scale and impact of V2G technology are becoming increasingly significant, positioning it as a critical component in the transition toward more sustainable and resilient energy systems.

Market Demand Analysis for V2G Integration

The Vehicle-to-Grid (V2G) market is experiencing significant growth driven by the convergence of renewable energy integration challenges and electric vehicle (EV) proliferation. Current market analysis indicates that the global V2G technology market is projected to reach $17.4 billion by 2027, growing at a compound annual growth rate of approximately 48% from 2020. This exceptional growth trajectory is primarily fueled by increasing grid instability issues as renewable energy sources gain market share in the global energy mix.

Demand for V2G integration is particularly strong in regions with high renewable energy penetration, such as Denmark, Germany, and California, where grid operators face significant challenges in balancing supply and demand due to the intermittent nature of wind and solar power. In these markets, V2G technology offers a compelling value proposition by providing grid services that can command premium prices during peak demand periods or supply shortfalls.

Consumer surveys reveal growing interest in V2G capabilities among EV owners, with 62% expressing willingness to participate in V2G programs if properly incentivized. This represents a significant shift from earlier adoption barriers, where concerns about battery degradation and inconvenience dominated consumer sentiment. The improved understanding of battery management systems and the potential for revenue generation has positively influenced consumer attitudes.

From a utility perspective, the demand for grid flexibility services is projected to triple by 2030 as renewable energy capacity continues to expand globally. V2G technology addresses this need by offering distributed energy storage capabilities that can be deployed rapidly without the capital expenditure associated with dedicated grid-scale battery installations. Utilities in several markets have begun pilot programs offering between $0.30-1.50 per kWh for V2G services during critical grid events, significantly higher than standard electricity rates.

Commercial fleet operators represent another significant market segment, with logistics companies and municipal fleets increasingly viewing V2G as a means to offset the higher upfront costs of electric vehicle acquisition. Analysis of fleet operations indicates that most commercial vehicles remain parked for 70% of the day, creating substantial opportunities for grid participation without disrupting core business operations.

Regulatory developments are further stimulating market demand, with several jurisdictions implementing policies that recognize and compensate grid services provided by distributed resources, including EVs. These regulatory frameworks are creating new revenue streams for V2G participants and accelerating market adoption across different segments.

Demand for V2G integration is particularly strong in regions with high renewable energy penetration, such as Denmark, Germany, and California, where grid operators face significant challenges in balancing supply and demand due to the intermittent nature of wind and solar power. In these markets, V2G technology offers a compelling value proposition by providing grid services that can command premium prices during peak demand periods or supply shortfalls.

Consumer surveys reveal growing interest in V2G capabilities among EV owners, with 62% expressing willingness to participate in V2G programs if properly incentivized. This represents a significant shift from earlier adoption barriers, where concerns about battery degradation and inconvenience dominated consumer sentiment. The improved understanding of battery management systems and the potential for revenue generation has positively influenced consumer attitudes.

From a utility perspective, the demand for grid flexibility services is projected to triple by 2030 as renewable energy capacity continues to expand globally. V2G technology addresses this need by offering distributed energy storage capabilities that can be deployed rapidly without the capital expenditure associated with dedicated grid-scale battery installations. Utilities in several markets have begun pilot programs offering between $0.30-1.50 per kWh for V2G services during critical grid events, significantly higher than standard electricity rates.

Commercial fleet operators represent another significant market segment, with logistics companies and municipal fleets increasingly viewing V2G as a means to offset the higher upfront costs of electric vehicle acquisition. Analysis of fleet operations indicates that most commercial vehicles remain parked for 70% of the day, creating substantial opportunities for grid participation without disrupting core business operations.

Regulatory developments are further stimulating market demand, with several jurisdictions implementing policies that recognize and compensate grid services provided by distributed resources, including EVs. These regulatory frameworks are creating new revenue streams for V2G participants and accelerating market adoption across different segments.

V2G Technical Challenges and Global Development Status

Vehicle-to-Grid (V2G) technology faces several significant technical challenges that have impacted its global adoption. One primary challenge is bidirectional charging infrastructure, which requires specialized hardware capable of managing power flow in both directions. Current charging systems predominantly support unidirectional flow, necessitating substantial upgrades to existing infrastructure. This limitation has slowed V2G deployment in many regions.

Battery degradation presents another critical concern. The additional charging and discharging cycles associated with V2G operations can potentially accelerate battery wear, reducing the overall lifespan of electric vehicle batteries. Research indicates that certain battery chemistries may experience up to 10% additional degradation under intensive V2G usage patterns, creating hesitation among vehicle manufacturers and consumers alike.

Communication protocols and grid integration pose substantial technical hurdles. The lack of standardized communication interfaces between vehicles, charging stations, and grid operators complicates seamless integration. Various competing standards such as ISO 15118, CHAdeMO, and proprietary protocols have created market fragmentation, hindering interoperability across different systems and regions.

Globally, V2G development status varies significantly. Japan leads in commercial V2G implementation, with the CHAdeMO association actively promoting V2G-compatible charging standards. Several pilot projects utilizing Nissan LEAF vehicles have demonstrated successful grid services provision. In Europe, Denmark, the Netherlands, and the UK have emerged as frontrunners, with regulatory frameworks increasingly supporting V2G integration through market mechanisms and incentive structures.

North America shows a mixed landscape, with California pioneering V2G demonstrations and regulatory support, while other states lag in implementation. The Department of Energy has funded multiple research initiatives, yet widespread commercial deployment remains limited. China, despite its dominant position in electric vehicle manufacturing, has focused more on unidirectional smart charging than bidirectional V2G capabilities.

Regulatory barriers persist across most regions, with electricity market rules often failing to accommodate the unique characteristics of distributed mobile energy resources like electric vehicles. Grid codes, interconnection standards, and market participation requirements typically favor traditional generation assets, creating administrative and technical barriers for V2G participation.

Recent technological advancements show promise in addressing these challenges, particularly in battery management systems that can optimize V2G operations while minimizing battery degradation. Smart inverter technologies have also evolved to support more efficient bidirectional power conversion, reducing energy losses during grid interactions.

Battery degradation presents another critical concern. The additional charging and discharging cycles associated with V2G operations can potentially accelerate battery wear, reducing the overall lifespan of electric vehicle batteries. Research indicates that certain battery chemistries may experience up to 10% additional degradation under intensive V2G usage patterns, creating hesitation among vehicle manufacturers and consumers alike.

Communication protocols and grid integration pose substantial technical hurdles. The lack of standardized communication interfaces between vehicles, charging stations, and grid operators complicates seamless integration. Various competing standards such as ISO 15118, CHAdeMO, and proprietary protocols have created market fragmentation, hindering interoperability across different systems and regions.

Globally, V2G development status varies significantly. Japan leads in commercial V2G implementation, with the CHAdeMO association actively promoting V2G-compatible charging standards. Several pilot projects utilizing Nissan LEAF vehicles have demonstrated successful grid services provision. In Europe, Denmark, the Netherlands, and the UK have emerged as frontrunners, with regulatory frameworks increasingly supporting V2G integration through market mechanisms and incentive structures.

North America shows a mixed landscape, with California pioneering V2G demonstrations and regulatory support, while other states lag in implementation. The Department of Energy has funded multiple research initiatives, yet widespread commercial deployment remains limited. China, despite its dominant position in electric vehicle manufacturing, has focused more on unidirectional smart charging than bidirectional V2G capabilities.

Regulatory barriers persist across most regions, with electricity market rules often failing to accommodate the unique characteristics of distributed mobile energy resources like electric vehicles. Grid codes, interconnection standards, and market participation requirements typically favor traditional generation assets, creating administrative and technical barriers for V2G participation.

Recent technological advancements show promise in addressing these challenges, particularly in battery management systems that can optimize V2G operations while minimizing battery degradation. Smart inverter technologies have also evolved to support more efficient bidirectional power conversion, reducing energy losses during grid interactions.

Current V2G Implementation Solutions

01 Revenue generation through grid services

Vehicle-to-Grid technology enables electric vehicles to provide valuable grid services such as frequency regulation, peak shaving, and load balancing. EV owners can generate revenue by selling excess electricity back to the grid during high demand periods or participating in demand response programs. This creates a new economic value stream for EV owners, potentially offsetting some of the vehicle ownership costs while helping utilities manage grid stability and reduce the need for additional power plants.- Revenue generation through grid services: Vehicle-to-Grid (V2G) technology enables electric vehicles to provide valuable grid services such as frequency regulation, peak shaving, and load balancing, creating revenue streams for EV owners. By allowing bidirectional power flow, EVs can sell excess electricity back to the grid during high demand periods, providing economic benefits to vehicle owners while supporting grid stability. This creates a new value proposition for electric vehicle ownership beyond transportation.

- Cost optimization and energy arbitrage: V2G systems enable economic optimization through energy arbitrage, allowing users to charge vehicles when electricity prices are low and discharge to the grid when prices are high. This price differential creates financial incentives for EV owners while reducing overall energy costs. Advanced algorithms and smart charging systems can automatically determine optimal charging/discharging schedules based on electricity market conditions, maximizing economic returns while ensuring vehicle readiness for transportation needs.

- Infrastructure investment and market models: The economic value of V2G technology depends significantly on infrastructure investments and market models that facilitate bidirectional energy exchange. This includes charging stations capable of bidirectional power flow, communication systems for grid integration, and regulatory frameworks that enable fair compensation for grid services. Various business models are emerging, including aggregator services that pool multiple EVs to provide larger-scale grid services, subscription-based models, and utility-managed programs that share economic benefits with participants.

- Battery degradation economics and lifecycle costs: A critical economic consideration for V2G implementation is the potential impact on battery degradation and lifecycle costs. Additional charging and discharging cycles from grid services may accelerate battery wear, affecting the economic equation. However, advanced battery management systems can minimize degradation while maximizing economic returns. Economic models must balance immediate revenue from grid services against long-term battery replacement costs, with some systems incorporating battery health monitoring to optimize this tradeoff.

- Grid resilience and renewable energy integration: V2G technology provides significant economic value through enhanced grid resilience and renewable energy integration. By serving as distributed energy storage, electric vehicles can help balance intermittent renewable generation, reducing the need for fossil fuel peaker plants and associated costs. During grid emergencies or outages, V2G-enabled vehicles can provide backup power to critical infrastructure or homes, creating economic value through avoided outage costs and increased energy security. This integration capability supports higher renewable energy penetration while maintaining grid stability.

02 Smart charging and energy arbitrage

V2G systems can be programmed to charge vehicles during low-cost electricity periods and discharge during high-cost periods, creating opportunities for energy arbitrage. This intelligent charging strategy maximizes economic benefits for vehicle owners while reducing overall grid costs. Advanced algorithms can optimize charging schedules based on electricity price forecasts, user preferences, and grid conditions, creating significant economic value through price differential exploitation.Expand Specific Solutions03 Integration with renewable energy systems

V2G technology provides economic value by supporting renewable energy integration into the grid. Electric vehicles can store excess renewable energy during high production periods and feed it back during low production times, reducing curtailment and improving the economic viability of renewable investments. This bidirectional energy flow helps balance intermittent renewable generation, creating value for both the grid operators and clean energy producers while reducing dependency on fossil fuel-based peaker plants.Expand Specific Solutions04 Market mechanisms and business models

Various business models are emerging to capture the economic value of V2G technology, including aggregator services that pool multiple vehicles to participate in electricity markets, utility-managed programs offering incentives for grid support, and third-party service providers creating platforms for V2G transactions. These market mechanisms establish frameworks for compensating EV owners for their battery capacity and energy services while ensuring grid reliability and creating new revenue streams in the energy ecosystem.Expand Specific Solutions05 Battery lifecycle and depreciation considerations

The economic value of V2G must account for potential battery degradation from additional charge-discharge cycles. Advanced battery management systems can minimize degradation while maximizing revenue from grid services. Economic models that balance the revenue from grid services against the cost of battery wear are essential for determining the true value proposition of V2G technology. Some systems incorporate battery health monitoring to optimize operations and extend useful life while participating in grid services.Expand Specific Solutions

Key Industry Players in V2G Ecosystem

Vehicle-to-Grid (V2G) technology is emerging as a transformative solution in the energy-grid ecosystem, currently in its early growth phase. The global V2G market is projected to expand significantly, driven by increasing electric vehicle adoption and grid modernization initiatives. While the technology is still evolving, major automotive manufacturers including Toyota, Honda, Hyundai, BMW, and Porsche are making substantial investments in V2G capabilities. Technology maturity varies across players, with companies like Qualcomm and NEC developing advanced bidirectional charging solutions, while traditional automakers are integrating V2G functionality into their EV platforms. Academic institutions such as the University of Delaware and Northwestern University are contributing significant research to advance grid economics and integration challenges, positioning V2G as a critical component of future smart grid infrastructure.

Honda Motor Co., Ltd.

Technical Solution: Honda has developed a comprehensive V2G platform called "Honda Energy Management System" that enables bidirectional power flow between their EVs and the electrical grid. Their system incorporates both hardware and software components, including specialized inverters that can convert DC power from vehicle batteries to AC power for grid use with over 90% efficiency[9]. Honda's approach focuses on maximizing economic value through participation in multiple grid service markets, including frequency regulation, demand response, and energy arbitrage. Their platform includes predictive algorithms that optimize charging and discharging schedules based on electricity price forecasts, grid needs, and driver mobility patterns. Honda has conducted extensive field trials in partnership with utilities, demonstrating that their EVs can provide grid services with response times under 2 seconds while maintaining battery health through sophisticated battery management systems that monitor cell-level conditions[10]. Their economic analysis shows potential annual returns of $800-1,500 per vehicle through grid services, with additional value created through resilience benefits during grid outages and integration with home solar systems.

Strengths: Highly efficient bidirectional power conversion systems; comprehensive approach that addresses multiple value streams; integration with Honda's broader energy ecosystem including home power management. Weaknesses: Limited deployment scale compared to some competitors; economic models still heavily dependent on regional market structures and regulations; requires specialized charging equipment that increases implementation costs.

Toyota Motor Corp.

Technical Solution: Toyota has developed a comprehensive V2G ecosystem centered around their CHAdeMO-compatible EVs and PHEVs. Their approach integrates vehicle battery management systems with home energy management systems (HEMS) and utility grid operations through their "Toyota Connected" platform. The system enables dynamic participation in energy markets, allowing vehicles to charge during low-demand periods and discharge during peak demand, creating arbitrage opportunities. Toyota's V2G technology includes predictive analytics that forecast both grid conditions and vehicle usage patterns, optimizing the economic value while preserving battery life. Field trials in Japan have demonstrated that Toyota's PHEVs can provide approximately 9kWh of usable energy to homes or the grid[5], while their dedicated BEVs can provide substantially more. Their economic analysis shows that V2G participation can reduce total cost of ownership for EVs by 8-12% through a combination of energy arbitrage, demand charge reduction, and grid service payments[6]. Toyota has also pioneered "virtual power plant" concepts where fleets of vehicles are aggregated to provide grid services at scale.

Strengths: Integration with established CHAdeMO standard enables immediate deployment; comprehensive ecosystem approach connecting vehicles, homes and grid; extensive real-world testing in Japanese market. Weaknesses: Limited battery capacity in PHEV models constrains V2G potential; North American and European markets use different charging standards requiring adaptation; economic models heavily dependent on regional electricity market structures.

Core V2G Value Proposition Technologies

Vehicle-to-grid system with power loss compensation

PatentInactiveUS9630511B2

Innovation

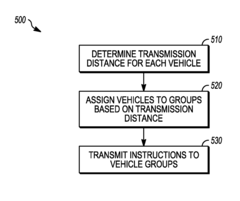

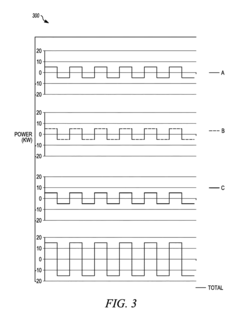

- A vehicle-to-grid system with a controller that assigns vehicles to different groups based on transmission distance, instructing the first group to supply power at a nominal frequency and adjusted amplitude, and the second group to supply power at an adjusted frequency different from the nominal frequency and nominal amplitude, thereby optimizing power delivery and reducing losses.

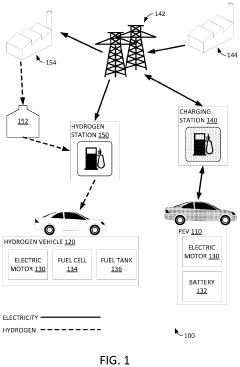

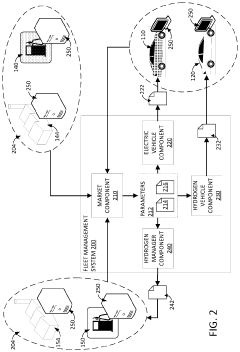

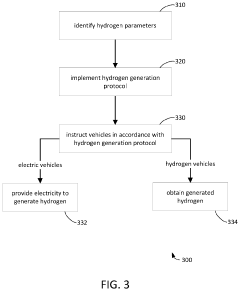

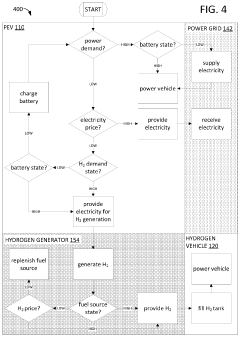

Vehicle-to-grid energy for use with hydrogen generation

PatentActiveUS11077766B2

Innovation

- A fleet management system that monitors hydrogen market parameters to instruct electric vehicles to provide electricity for hydrogen generation and hydrogen vehicles to obtain hydrogen from the generated electricity, optimizing energy use and reducing costs.

Regulatory Framework for V2G Deployment

The regulatory landscape for Vehicle-to-Grid (V2G) technology varies significantly across regions, creating a complex environment for stakeholders. In the United States, the Federal Energy Regulatory Commission (FERC) has established Order 841 and 2222, which remove barriers for distributed energy resources, including electric vehicles, to participate in wholesale electricity markets. These orders mandate that grid operators develop mechanisms to incorporate aggregated distributed resources, creating pathways for V2G integration. However, implementation remains inconsistent across different Independent System Operators (ISOs) and Regional Transmission Organizations (RTOs).

The European Union has developed a more comprehensive framework through its Clean Energy Package, which explicitly recognizes energy storage as a distinct market activity. The EU Electricity Directive 2019/944 establishes rights for consumers to participate in flexibility markets and receive compensation for grid services. Countries like Denmark, the Netherlands, and the UK have pioneered regulatory sandboxes to test V2G business models under controlled regulatory conditions, accelerating the development of practical implementation guidelines.

In Asia, Japan's strategic energy plan specifically identifies V2G as a critical component of its resilience strategy, with the Ministry of Economy, Trade and Industry (METI) developing technical standards for grid integration. China has incorporated V2G into its New Energy Vehicle (NEV) policies, focusing on standardization of communication protocols between vehicles and grid infrastructure.

Key regulatory challenges persist across all markets. Metering and billing frameworks designed for unidirectional power flow require significant modification to accommodate bidirectional exchanges. Double taxation issues—where consumers pay grid fees and taxes when charging and again when discharging—create economic barriers to V2G adoption. Additionally, unclear definitions of market roles and responsibilities between utilities, aggregators, and vehicle owners complicate contractual relationships.

Technical standards harmonization represents another critical regulatory challenge. While standards like ISO 15118, CHAdeMO, and OpenADR provide foundations for V2G communication, regulatory bodies must establish certification processes to ensure interoperability and cybersecurity. The International Electrotechnical Commission (IEC) and Society of Automotive Engineers (SAE) are working to develop unified standards, but regulatory adoption remains fragmented.

Privacy and data protection regulations also significantly impact V2G deployment, as the technology necessitates continuous exchange of vehicle usage, location, and energy consumption data. Regulations like GDPR in Europe establish strict requirements for data handling that V2G systems must accommodate, adding complexity to system design and implementation.

The European Union has developed a more comprehensive framework through its Clean Energy Package, which explicitly recognizes energy storage as a distinct market activity. The EU Electricity Directive 2019/944 establishes rights for consumers to participate in flexibility markets and receive compensation for grid services. Countries like Denmark, the Netherlands, and the UK have pioneered regulatory sandboxes to test V2G business models under controlled regulatory conditions, accelerating the development of practical implementation guidelines.

In Asia, Japan's strategic energy plan specifically identifies V2G as a critical component of its resilience strategy, with the Ministry of Economy, Trade and Industry (METI) developing technical standards for grid integration. China has incorporated V2G into its New Energy Vehicle (NEV) policies, focusing on standardization of communication protocols between vehicles and grid infrastructure.

Key regulatory challenges persist across all markets. Metering and billing frameworks designed for unidirectional power flow require significant modification to accommodate bidirectional exchanges. Double taxation issues—where consumers pay grid fees and taxes when charging and again when discharging—create economic barriers to V2G adoption. Additionally, unclear definitions of market roles and responsibilities between utilities, aggregators, and vehicle owners complicate contractual relationships.

Technical standards harmonization represents another critical regulatory challenge. While standards like ISO 15118, CHAdeMO, and OpenADR provide foundations for V2G communication, regulatory bodies must establish certification processes to ensure interoperability and cybersecurity. The International Electrotechnical Commission (IEC) and Society of Automotive Engineers (SAE) are working to develop unified standards, but regulatory adoption remains fragmented.

Privacy and data protection regulations also significantly impact V2G deployment, as the technology necessitates continuous exchange of vehicle usage, location, and energy consumption data. Regulations like GDPR in Europe establish strict requirements for data handling that V2G systems must accommodate, adding complexity to system design and implementation.

Economic Models and ROI Analysis for V2G Systems

The economic viability of Vehicle-to-Grid (V2G) systems depends on sophisticated modeling approaches that capture both direct and indirect value streams. Traditional cost-benefit analyses often underestimate V2G potential by focusing solely on energy arbitrage, while comprehensive models reveal multiple revenue sources that collectively enhance the business case.

Primary V2G economic models include the Aggregator Model, where third-party entities manage fleets of EVs to provide grid services; the Utility-Integrated Model, where power companies directly incorporate V2G into their operations; and the Prosumer Model, enabling individual EV owners to participate in energy markets. Each model distributes risks and rewards differently among stakeholders, affecting adoption incentives and implementation pathways.

Return on Investment (ROI) calculations for V2G systems must account for battery degradation costs, infrastructure investments, and regulatory compliance expenses against revenue streams from frequency regulation, demand response, and energy arbitrage. Current analyses indicate payback periods ranging from 3-7 years depending on market conditions, with frequency regulation services typically offering the highest value proposition at $30-50/kW-month in mature markets.

Sensitivity analyses reveal that regulatory frameworks significantly impact V2G economics. Markets with capacity payments and ancillary service mechanisms show substantially higher ROI potential than energy-only markets. Additionally, time-of-use rate structures can increase arbitrage opportunities by up to 40%, enhancing the economic case for residential V2G participation.

Emerging value stacking approaches combine multiple revenue streams to improve overall economics. For instance, pairing frequency regulation with demand charge management can increase annual returns by 25-35% compared to single-service models. This approach requires sophisticated algorithms to optimize across competing objectives while respecting battery constraints.

Long-term economic projections suggest V2G systems will reach grid parity in most markets by 2027-2030 as battery costs decline and market mechanisms mature. Early adopters in favorable regulatory environments are already achieving positive ROI, particularly in commercial fleet applications where vehicle availability patterns align well with grid needs.

Primary V2G economic models include the Aggregator Model, where third-party entities manage fleets of EVs to provide grid services; the Utility-Integrated Model, where power companies directly incorporate V2G into their operations; and the Prosumer Model, enabling individual EV owners to participate in energy markets. Each model distributes risks and rewards differently among stakeholders, affecting adoption incentives and implementation pathways.

Return on Investment (ROI) calculations for V2G systems must account for battery degradation costs, infrastructure investments, and regulatory compliance expenses against revenue streams from frequency regulation, demand response, and energy arbitrage. Current analyses indicate payback periods ranging from 3-7 years depending on market conditions, with frequency regulation services typically offering the highest value proposition at $30-50/kW-month in mature markets.

Sensitivity analyses reveal that regulatory frameworks significantly impact V2G economics. Markets with capacity payments and ancillary service mechanisms show substantially higher ROI potential than energy-only markets. Additionally, time-of-use rate structures can increase arbitrage opportunities by up to 40%, enhancing the economic case for residential V2G participation.

Emerging value stacking approaches combine multiple revenue streams to improve overall economics. For instance, pairing frequency regulation with demand charge management can increase annual returns by 25-35% compared to single-service models. This approach requires sophisticated algorithms to optimize across competing objectives while respecting battery constraints.

Long-term economic projections suggest V2G systems will reach grid parity in most markets by 2027-2030 as battery costs decline and market mechanisms mature. Early adopters in favorable regulatory environments are already achieving positive ROI, particularly in commercial fleet applications where vehicle availability patterns align well with grid needs.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!