Examining the Patent Landscape of Vehicle-to-Grid Innovations

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

V2G Technology Background and Objectives

Vehicle-to-Grid (V2G) technology represents a transformative approach to energy management that has evolved significantly over the past decade. The concept emerged in the late 1990s but gained substantial momentum after 2010 as electric vehicle (EV) adoption increased globally. V2G enables bidirectional power flow between electric vehicles and the electricity grid, allowing EVs to serve not merely as transportation assets but as distributed energy resources capable of providing grid services.

The evolution of V2G technology has been driven by three converging trends: the proliferation of electric vehicles, advancements in battery technology, and the growing need for grid flexibility amid renewable energy integration. Early V2G implementations focused primarily on unidirectional charging control (V1G), where grid operators could modulate EV charging rates. Modern V2G systems now enable full bidirectional power exchange, transforming vehicles into mobile power plants.

Technical objectives in the V2G domain center on overcoming several critical challenges. Primary among these is minimizing battery degradation during bidirectional power flows, as frequent charging and discharging cycles can accelerate capacity loss. Researchers aim to develop advanced battery management systems that can optimize V2G operations while preserving battery longevity.

Another key objective involves standardizing communication protocols between vehicles, charging infrastructure, and grid operators. Current fragmentation in communication standards presents significant barriers to widespread V2G deployment. The industry is working toward unified protocols that enable seamless integration across different vehicle models, charging equipment, and utility systems.

Efficiency improvements represent another crucial goal, with current V2G systems experiencing energy losses during AC-DC-AC conversion processes. Technical innovations aim to reduce these losses through advanced power electronics and improved system architectures.

Grid integration presents perhaps the most complex challenge, requiring sophisticated algorithms for predicting vehicle availability, optimizing dispatch, and ensuring grid stability. Research efforts focus on developing predictive models that can forecast EV connection patterns and energy needs while balancing grid requirements.

The patent landscape in V2G technology reflects these technical objectives, with significant intellectual property development around bidirectional chargers, communication protocols, battery management systems, and grid integration software. Leading automotive manufacturers, charging infrastructure providers, and energy technology companies have established substantial patent portfolios, indicating the strategic importance of V2G technology to future energy systems.

The evolution of V2G technology has been driven by three converging trends: the proliferation of electric vehicles, advancements in battery technology, and the growing need for grid flexibility amid renewable energy integration. Early V2G implementations focused primarily on unidirectional charging control (V1G), where grid operators could modulate EV charging rates. Modern V2G systems now enable full bidirectional power exchange, transforming vehicles into mobile power plants.

Technical objectives in the V2G domain center on overcoming several critical challenges. Primary among these is minimizing battery degradation during bidirectional power flows, as frequent charging and discharging cycles can accelerate capacity loss. Researchers aim to develop advanced battery management systems that can optimize V2G operations while preserving battery longevity.

Another key objective involves standardizing communication protocols between vehicles, charging infrastructure, and grid operators. Current fragmentation in communication standards presents significant barriers to widespread V2G deployment. The industry is working toward unified protocols that enable seamless integration across different vehicle models, charging equipment, and utility systems.

Efficiency improvements represent another crucial goal, with current V2G systems experiencing energy losses during AC-DC-AC conversion processes. Technical innovations aim to reduce these losses through advanced power electronics and improved system architectures.

Grid integration presents perhaps the most complex challenge, requiring sophisticated algorithms for predicting vehicle availability, optimizing dispatch, and ensuring grid stability. Research efforts focus on developing predictive models that can forecast EV connection patterns and energy needs while balancing grid requirements.

The patent landscape in V2G technology reflects these technical objectives, with significant intellectual property development around bidirectional chargers, communication protocols, battery management systems, and grid integration software. Leading automotive manufacturers, charging infrastructure providers, and energy technology companies have established substantial patent portfolios, indicating the strategic importance of V2G technology to future energy systems.

Market Demand Analysis for V2G Solutions

The Vehicle-to-Grid (V2G) market is experiencing significant growth driven by the convergence of renewable energy integration, grid stability concerns, and electric vehicle (EV) proliferation. Current market analysis indicates that the global V2G technology market is projected to reach $17.4 billion by 2027, growing at a compound annual growth rate of approximately 48% from 2020. This exceptional growth trajectory reflects the increasing recognition of EVs as mobile energy storage units rather than mere transportation assets.

Primary market demand for V2G solutions stems from utility companies seeking to enhance grid resilience and manage peak load challenges. With renewable energy sources contributing an increasingly larger percentage to the energy mix, the intermittent nature of these sources creates substantial grid balancing challenges. V2G technology offers a distributed solution to this problem by enabling bidirectional power flow between vehicles and the grid, effectively creating a network of mobile battery storage systems that can be tapped during peak demand periods.

Fleet operators represent another significant market segment, particularly those managing delivery vehicles, public transportation, and corporate fleets. These entities are attracted to V2G for its potential to generate additional revenue streams through grid services while vehicles are idle. Analysis of fleet operation patterns reveals that commercial vehicles remain parked for 70-80% of their operational life, presenting substantial opportunities for grid participation without disrupting primary transportation functions.

Consumer adoption represents both a challenge and opportunity for V2G market expansion. While individual EV owners could benefit from reduced electricity costs and potential revenue from grid services, concerns regarding battery degradation, convenience, and complex compensation models have limited widespread adoption. Market research indicates that transparent incentive structures and demonstrable battery health assurances are critical factors for consumer market penetration.

Geographically, Europe leads V2G market development, with countries like Denmark, the Netherlands, and the UK implementing progressive regulatory frameworks and pilot projects. North America follows with significant investment in V2G infrastructure, particularly in California and the northeastern states. The Asia-Pacific region, while currently behind in implementation, shows the highest potential growth rate due to rapid EV adoption in China, Japan, and South Korea.

Regulatory environments significantly influence market demand patterns. Regions with favorable policies for distributed energy resources, time-of-use electricity pricing, and grid service compensation mechanisms demonstrate accelerated V2G adoption. Conversely, markets with regulatory barriers or unclear frameworks for bidirectional energy flow show stunted growth despite technological readiness.

Primary market demand for V2G solutions stems from utility companies seeking to enhance grid resilience and manage peak load challenges. With renewable energy sources contributing an increasingly larger percentage to the energy mix, the intermittent nature of these sources creates substantial grid balancing challenges. V2G technology offers a distributed solution to this problem by enabling bidirectional power flow between vehicles and the grid, effectively creating a network of mobile battery storage systems that can be tapped during peak demand periods.

Fleet operators represent another significant market segment, particularly those managing delivery vehicles, public transportation, and corporate fleets. These entities are attracted to V2G for its potential to generate additional revenue streams through grid services while vehicles are idle. Analysis of fleet operation patterns reveals that commercial vehicles remain parked for 70-80% of their operational life, presenting substantial opportunities for grid participation without disrupting primary transportation functions.

Consumer adoption represents both a challenge and opportunity for V2G market expansion. While individual EV owners could benefit from reduced electricity costs and potential revenue from grid services, concerns regarding battery degradation, convenience, and complex compensation models have limited widespread adoption. Market research indicates that transparent incentive structures and demonstrable battery health assurances are critical factors for consumer market penetration.

Geographically, Europe leads V2G market development, with countries like Denmark, the Netherlands, and the UK implementing progressive regulatory frameworks and pilot projects. North America follows with significant investment in V2G infrastructure, particularly in California and the northeastern states. The Asia-Pacific region, while currently behind in implementation, shows the highest potential growth rate due to rapid EV adoption in China, Japan, and South Korea.

Regulatory environments significantly influence market demand patterns. Regions with favorable policies for distributed energy resources, time-of-use electricity pricing, and grid service compensation mechanisms demonstrate accelerated V2G adoption. Conversely, markets with regulatory barriers or unclear frameworks for bidirectional energy flow show stunted growth despite technological readiness.

V2G Technical Challenges and Global Development Status

Vehicle-to-Grid (V2G) technology faces several significant technical challenges that have influenced its global development trajectory. The primary technical hurdle remains bidirectional charging infrastructure, which requires sophisticated power electronics capable of managing electricity flow in both directions while maintaining grid stability. Current charging systems predominantly support unidirectional power flow, making widespread V2G implementation technically complex and costly.

Battery degradation presents another critical challenge. The additional charge-discharge cycles imposed by V2G operations can potentially accelerate battery wear, reducing the overall lifespan of electric vehicle (EV) batteries. Research indicates that without proper management algorithms, V2G participation could decrease battery life by 10-15%, creating a significant barrier to consumer adoption.

Communication protocols and standardization issues further complicate V2G deployment. The lack of universally accepted standards for vehicle-to-grid communication creates interoperability problems between different vehicle manufacturers, charging infrastructure providers, and grid operators. This fragmentation has led to isolated pilot projects rather than cohesive market development.

Globally, V2G development status varies significantly by region. Japan leads in commercial V2G implementation, with Nissan's CHAdeMO protocol supporting bidirectional charging since 2013. The European market shows promising growth, particularly in the UK, Denmark, and the Netherlands, where regulatory frameworks increasingly support V2G integration through pilot projects and incentive programs.

North America presents a mixed landscape, with California and New York leading regional development through utility-sponsored programs and regulatory support. However, widespread adoption remains limited by regulatory complexity and market structure barriers.

China, despite its dominant position in EV manufacturing, has focused more on unidirectional smart charging than bidirectional V2G technology, though recent policy shifts indicate growing interest in V2G capabilities.

Patent activity reflects these regional differences, with Japanese companies holding the largest share of V2G-related patents (approximately 35%), followed by European entities (25%), North American companies (20%), and Chinese firms (15%). The remaining patents are distributed among various global players.

Recent technological advancements show promise in addressing these challenges, particularly in battery management systems that minimize degradation effects and more efficient power conversion systems that reduce energy losses during bidirectional transfers. These innovations, reflected in patent filings since 2018, suggest a maturing technological landscape that may accelerate global V2G adoption in the coming years.

Battery degradation presents another critical challenge. The additional charge-discharge cycles imposed by V2G operations can potentially accelerate battery wear, reducing the overall lifespan of electric vehicle (EV) batteries. Research indicates that without proper management algorithms, V2G participation could decrease battery life by 10-15%, creating a significant barrier to consumer adoption.

Communication protocols and standardization issues further complicate V2G deployment. The lack of universally accepted standards for vehicle-to-grid communication creates interoperability problems between different vehicle manufacturers, charging infrastructure providers, and grid operators. This fragmentation has led to isolated pilot projects rather than cohesive market development.

Globally, V2G development status varies significantly by region. Japan leads in commercial V2G implementation, with Nissan's CHAdeMO protocol supporting bidirectional charging since 2013. The European market shows promising growth, particularly in the UK, Denmark, and the Netherlands, where regulatory frameworks increasingly support V2G integration through pilot projects and incentive programs.

North America presents a mixed landscape, with California and New York leading regional development through utility-sponsored programs and regulatory support. However, widespread adoption remains limited by regulatory complexity and market structure barriers.

China, despite its dominant position in EV manufacturing, has focused more on unidirectional smart charging than bidirectional V2G technology, though recent policy shifts indicate growing interest in V2G capabilities.

Patent activity reflects these regional differences, with Japanese companies holding the largest share of V2G-related patents (approximately 35%), followed by European entities (25%), North American companies (20%), and Chinese firms (15%). The remaining patents are distributed among various global players.

Recent technological advancements show promise in addressing these challenges, particularly in battery management systems that minimize degradation effects and more efficient power conversion systems that reduce energy losses during bidirectional transfers. These innovations, reflected in patent filings since 2018, suggest a maturing technological landscape that may accelerate global V2G adoption in the coming years.

Current V2G Patent Solutions and Implementations

01 V2G Energy Management Systems

Energy management systems for Vehicle-to-Grid (V2G) technology that optimize the flow of electricity between electric vehicles and the power grid. These systems include algorithms for determining when to charge or discharge vehicles based on grid demand, electricity pricing, and user preferences. They enable efficient integration of electric vehicles into the grid infrastructure while maximizing economic benefits for vehicle owners and grid stability.- V2G charging infrastructure and management systems: Patents in this category focus on the physical infrastructure and management systems needed for Vehicle-to-Grid technology. These include charging stations, grid connection hardware, and systems for managing the flow of electricity between vehicles and the power grid. These technologies enable efficient bidirectional power transfer and ensure compatibility between electric vehicles and existing grid infrastructure.

- V2G energy trading and market platforms: This category encompasses technologies for facilitating energy trading between electric vehicle owners and grid operators. These patents cover market platforms, pricing mechanisms, and transaction systems that enable EV owners to sell excess energy back to the grid. The innovations include automated bidding systems, real-time pricing algorithms, and blockchain-based trading platforms that create economic incentives for V2G participation.

- V2G control algorithms and optimization techniques: Patents in this category focus on sophisticated algorithms and optimization techniques for managing V2G operations. These include predictive analytics for energy demand, machine learning approaches for optimizing charging/discharging cycles, and algorithms that balance grid stability with vehicle battery health. These technologies aim to maximize the economic and environmental benefits of V2G while minimizing negative impacts on battery lifespan.

- V2G integration with renewable energy systems: This category covers technologies that specifically integrate V2G systems with renewable energy sources such as solar and wind power. These patents address the challenge of intermittent renewable generation by using electric vehicle batteries as distributed storage. The innovations include smart systems that prioritize charging from renewable sources and technologies that enable EVs to help balance grid loads during periods of high renewable generation.

- V2G communication protocols and security systems: Patents in this category focus on the communication protocols and security systems essential for V2G operations. These include secure data exchange between vehicles and grid infrastructure, authentication mechanisms to prevent unauthorized access, and standardized protocols for interoperability across different vehicle models and grid systems. These technologies ensure reliable, secure, and efficient information exchange in V2G networks.

02 V2G Communication Protocols and Infrastructure

Communication protocols and infrastructure that facilitate the exchange of information between electric vehicles, charging stations, and the grid. These technologies enable real-time data transmission regarding battery status, grid conditions, and pricing signals. The infrastructure includes hardware and software components that ensure secure, reliable communication for coordinating V2G operations across multiple stakeholders in the energy ecosystem.Expand Specific Solutions03 V2G Payment and Incentive Systems

Financial systems and methods for V2G transactions that enable vehicle owners to be compensated for providing grid services. These innovations include billing mechanisms, market participation frameworks, and incentive structures that encourage V2G participation. The technologies address challenges in measuring, verifying, and settling payments for energy and ancillary services provided by electric vehicles to the grid.Expand Specific Solutions04 V2G Battery Management and Protection

Technologies that optimize battery performance and longevity in V2G applications. These innovations address the additional stress placed on vehicle batteries from bidirectional power flow by implementing advanced battery management systems. They include methods for monitoring battery health, predicting degradation, and controlling charging/discharging cycles to minimize negative impacts while maximizing the value of grid services provided.Expand Specific Solutions05 V2G Grid Integration and Stability Solutions

Technologies that enable electric vehicles to provide grid support services such as frequency regulation, voltage support, and demand response. These innovations help maintain grid stability and reliability while accommodating increasing penetration of renewable energy sources. They include control systems that aggregate multiple vehicles to provide meaningful grid services and methods for coordinating V2G operations with other distributed energy resources.Expand Specific Solutions

Key Players in Vehicle-to-Grid Patent Ecosystem

The vehicle-to-grid (V2G) patent landscape reflects an evolving market currently in its growth phase. Major automotive manufacturers including Ford, Toyota, Honda, and Volkswagen are leading innovation, with technology companies like Huawei, Intel, and Qualcomm increasingly entering this space. The market is projected to expand significantly as electric vehicle adoption increases, though commercial deployment remains limited. Technology maturity varies across applications, with bidirectional charging patents from Ford and Toyota showing greater development, while integration with renewable energy systems from companies like Bosch and Denso represents emerging opportunities. Telecommunications players such as Nokia and NEC are focusing on communication protocols essential for grid integration, indicating cross-industry convergence in this technology domain.

Ford Global Technologies LLC

Technical Solution: Ford has developed an integrated Vehicle-to-Grid (V2G) system that enables bidirectional power flow between electric vehicles and the power grid. Their solution incorporates intelligent charging management that optimizes charging based on grid demand, electricity prices, and user preferences. Ford's V2G technology includes advanced power electronics with silicon carbide inverters that achieve over 95% efficiency in bidirectional energy transfer. The system features a proprietary Battery Management System (BMS) that monitors cell health during V2G operations to minimize battery degradation while maximizing grid services. Ford has also implemented a cloud-based platform that aggregates multiple vehicles into virtual power plants, enabling participation in grid services markets while providing vehicle owners with financial incentives for energy sharing.

Strengths: Strong integration with existing vehicle platforms and robust battery management to minimize degradation during V2G operations. Weaknesses: Limited deployment scale compared to dedicated energy companies and potential compatibility issues with regional grid standards.

Toyota Motor Corp.

Technical Solution: Toyota has pioneered a comprehensive V2G ecosystem called "Toyota V2G Connect" that leverages their hybrid and battery electric vehicle platforms. Their technical approach focuses on extending battery longevity during bidirectional power transfer through advanced algorithms that monitor and control depth of discharge, charging rates, and thermal management. Toyota's V2G solution incorporates predictive analytics that forecast both grid demands and driver behavior patterns to optimize when vehicles should charge or discharge. Their system includes specialized power conditioning equipment with high-frequency switching capabilities that minimize conversion losses. Toyota has also developed a standardized communication protocol that enables their vehicles to interact with various grid operators and energy markets, supporting multiple use cases including peak shaving, frequency regulation, and emergency backup power for homes and businesses.

Strengths: Extensive experience with battery management systems and hybrid powertrains provides robust technical foundation for V2G applications. Weaknesses: Conservative approach to battery warranty coverage for V2G operations may limit customer adoption and market penetration.

Core V2G Patent Analysis and Technical Innovations

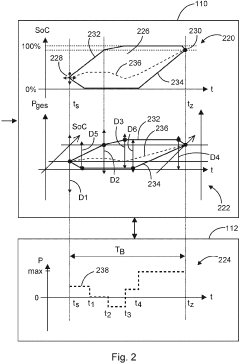

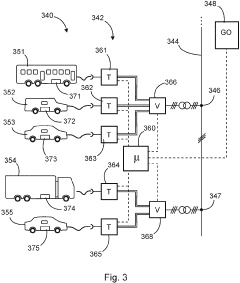

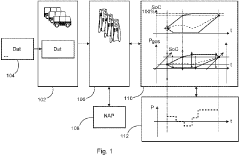

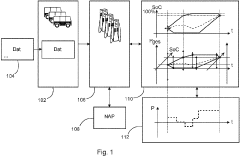

Charge control for a vehicle fleet

PatentPendingEP3904152A1

Innovation

- A method involving a charging infrastructure that coordinates multiple charging points to manage a fleet of electric vehicles, determining a state of charge range and controlling exchange power to maintain the total state of charge within this range, allowing for reliable provision of electrical energy to or from the grid, even when vehicles are not in use.

Vehicle-to-grid optimization control method for balancing battery aging cost and electricity market income

PatentWO2024192972A1

Innovation

- By obtaining relevant status data of electric vehicles, predicting frequency modulation signal distribution, and constructing the objective function of the optimal bidding problem, combined with battery aging costs and market profit constraints, stochastic optimization methods are used to solve the power allocation problem of electric vehicle clusters and optimize charging management strategies.

Regulatory Framework and Standards for V2G Technology

The regulatory landscape for Vehicle-to-Grid (V2G) technology remains fragmented globally, with significant variations across regions. In the United States, the Federal Energy Regulatory Commission (FERC) Order 2222 represents a milestone by enabling distributed energy resources, including electric vehicles (EVs), to participate in wholesale electricity markets. This regulatory framework has created opportunities for V2G integration, though implementation varies by regional transmission organization.

The European Union has established more comprehensive regulations through its Clean Energy Package, which explicitly recognizes EVs as potential grid assets. The EU's 2019/944 Directive specifically addresses V2G by mandating non-discriminatory access to electricity markets for storage facilities, including EVs. Additionally, the European Green Deal further strengthens the regulatory foundation for V2G deployment across member states.

In Asia, Japan leads with its Vehicle-to-Grid aggregation program, supported by the Ministry of Economy, Trade and Industry (METI). China has incorporated V2G into its New Energy Vehicle (NEV) policies, though specific regulatory frameworks remain under development. South Korea has implemented demonstration projects under its K-EV100 initiative, gradually building regulatory structures.

Technical standards development has progressed significantly, with ISO 15118 emerging as the cornerstone for V2G communication protocols. This standard defines the communication interface between EVs and charging infrastructure, enabling bidirectional power flow. The CHAdeMO association has developed complementary protocols specifically for DC charging with V2G capabilities, while the Combined Charging System (CCS) consortium has recently incorporated V2G functionality into its specifications.

Grid interconnection standards vary regionally, with IEEE 1547 in the United States and IEC 61851 in Europe providing frameworks for safely connecting distributed resources to the grid. These standards address critical aspects including power quality, islanding detection, and synchronization requirements for V2G systems.

Cybersecurity and data privacy regulations present significant challenges for V2G deployment. The EU's General Data Protection Regulation (GDPR) imposes strict requirements on handling EV user data, while the U.S. National Institute of Standards and Technology (NIST) has developed specific guidelines for securing V2G communications through its Cybersecurity Framework.

Harmonization efforts are underway through organizations like the International Electrotechnical Commission (IEC) and the Society of Automotive Engineers (SAE), which are working to develop unified standards that can facilitate global V2G deployment. These efforts aim to address the current regulatory fragmentation that represents a significant barrier to widespread V2G adoption.

The European Union has established more comprehensive regulations through its Clean Energy Package, which explicitly recognizes EVs as potential grid assets. The EU's 2019/944 Directive specifically addresses V2G by mandating non-discriminatory access to electricity markets for storage facilities, including EVs. Additionally, the European Green Deal further strengthens the regulatory foundation for V2G deployment across member states.

In Asia, Japan leads with its Vehicle-to-Grid aggregation program, supported by the Ministry of Economy, Trade and Industry (METI). China has incorporated V2G into its New Energy Vehicle (NEV) policies, though specific regulatory frameworks remain under development. South Korea has implemented demonstration projects under its K-EV100 initiative, gradually building regulatory structures.

Technical standards development has progressed significantly, with ISO 15118 emerging as the cornerstone for V2G communication protocols. This standard defines the communication interface between EVs and charging infrastructure, enabling bidirectional power flow. The CHAdeMO association has developed complementary protocols specifically for DC charging with V2G capabilities, while the Combined Charging System (CCS) consortium has recently incorporated V2G functionality into its specifications.

Grid interconnection standards vary regionally, with IEEE 1547 in the United States and IEC 61851 in Europe providing frameworks for safely connecting distributed resources to the grid. These standards address critical aspects including power quality, islanding detection, and synchronization requirements for V2G systems.

Cybersecurity and data privacy regulations present significant challenges for V2G deployment. The EU's General Data Protection Regulation (GDPR) imposes strict requirements on handling EV user data, while the U.S. National Institute of Standards and Technology (NIST) has developed specific guidelines for securing V2G communications through its Cybersecurity Framework.

Harmonization efforts are underway through organizations like the International Electrotechnical Commission (IEC) and the Society of Automotive Engineers (SAE), which are working to develop unified standards that can facilitate global V2G deployment. These efforts aim to address the current regulatory fragmentation that represents a significant barrier to widespread V2G adoption.

Economic Impact and Business Models of V2G Implementation

The economic implications of Vehicle-to-Grid (V2G) technology extend far beyond the technical innovations revealed in patent landscapes. V2G systems create multi-directional value streams that fundamentally alter traditional energy market dynamics. Primary revenue opportunities include grid services such as frequency regulation, demand response, and peak shaving, which collectively can generate between $1,000-$2,500 annually per vehicle according to recent pilot programs.

Energy arbitrage represents another significant economic opportunity, allowing EV owners to purchase electricity during low-cost periods and sell back during peak demand, potentially yielding 15-20% returns on electricity costs. This model becomes particularly lucrative in markets with dynamic pricing structures and high peak-to-off-peak differentials.

The business ecosystem surrounding V2G implementation has evolved into several distinct models. The Aggregator Model involves third-party companies that pool thousands of EVs into virtual power plants, negotiating with grid operators and distributing revenues to participants while retaining a service fee typically ranging from 10-30%. This model has gained traction in European markets where regulatory frameworks support aggregation services.

The Utility-Led Model positions power companies as direct managers of V2G programs, offering customers reduced electricity rates or direct payments for grid access to their vehicles. This approach simplifies integration with existing grid infrastructure but may limit consumer choice and competition.

The OEM-Integrated Model involves vehicle manufacturers embedding V2G capabilities directly into their products and partnering with energy companies to create seamless customer experiences. Tesla, Nissan, and Volkswagen have pioneered this approach, leveraging their technological ecosystems to capture additional revenue streams beyond vehicle sales.

Financial analyses indicate that V2G implementation requires significant initial investment in bidirectional charging infrastructure, with current costs ranging from $2,000-$5,000 per charging point. However, these costs are projected to decrease by approximately 60% by 2030 as manufacturing scales and technologies mature. The return on investment period currently averages 3-5 years for fleet operators but can extend to 7-8 years for individual consumers without subsidies.

Regulatory frameworks significantly impact V2G economics, with successful implementations requiring clear rules for grid participation, standardized compensation mechanisms, and reduced barriers to entry. Countries with progressive energy policies like Denmark, Netherlands, and the UK have demonstrated accelerated V2G adoption through targeted incentives and regulatory clarity.

Energy arbitrage represents another significant economic opportunity, allowing EV owners to purchase electricity during low-cost periods and sell back during peak demand, potentially yielding 15-20% returns on electricity costs. This model becomes particularly lucrative in markets with dynamic pricing structures and high peak-to-off-peak differentials.

The business ecosystem surrounding V2G implementation has evolved into several distinct models. The Aggregator Model involves third-party companies that pool thousands of EVs into virtual power plants, negotiating with grid operators and distributing revenues to participants while retaining a service fee typically ranging from 10-30%. This model has gained traction in European markets where regulatory frameworks support aggregation services.

The Utility-Led Model positions power companies as direct managers of V2G programs, offering customers reduced electricity rates or direct payments for grid access to their vehicles. This approach simplifies integration with existing grid infrastructure but may limit consumer choice and competition.

The OEM-Integrated Model involves vehicle manufacturers embedding V2G capabilities directly into their products and partnering with energy companies to create seamless customer experiences. Tesla, Nissan, and Volkswagen have pioneered this approach, leveraging their technological ecosystems to capture additional revenue streams beyond vehicle sales.

Financial analyses indicate that V2G implementation requires significant initial investment in bidirectional charging infrastructure, with current costs ranging from $2,000-$5,000 per charging point. However, these costs are projected to decrease by approximately 60% by 2030 as manufacturing scales and technologies mature. The return on investment period currently averages 3-5 years for fleet operators but can extend to 7-8 years for individual consumers without subsidies.

Regulatory frameworks significantly impact V2G economics, with successful implementations requiring clear rules for grid participation, standardized compensation mechanisms, and reduced barriers to entry. Countries with progressive energy policies like Denmark, Netherlands, and the UK have demonstrated accelerated V2G adoption through targeted incentives and regulatory clarity.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!